Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Problemas del desarrollo

versão impressa ISSN 0301-7036

Prob. Des vol.49 no.194 Ciudad de México Jul./Set. 2018

https://doi.org/10.22201/iiec.20078951e.2018.194.61588

Articles

Foreign Exchange Deregulation, Capital Flight, and Debt: The Recent Experience in Argentina

1 University of Buenos Aires and Institute for Higher Social Studies-UNSAM, Argentina, respectively. E-mail addresses: magdalenarua@hotmail.com and nicolaszeolla@gmail.com, respectively.

In 2011, Argentina began to implement a series of foreign exchange controls, going so far as to prohibit the acquisition of foreign currency for non- productive purposes. In December 2015, after the change of administration, all of the foreign exchange regulations were eliminated and returned to their pre-2001-2002 crisis levels. These reforms were implemented under the mainstreaming vision, with the expectation that capital out flows would be reversed. Nevertheless, after the controls were lifted, according to information from the foreign exchange balance kept by the Central Bank of Argentina (BCRA) on Foreign Asset Formation (FAF), one year later, capital flight abroad had doubled. is increased currency outflow was financed by rising foreign debt.

Keywords: Foreign exchange market; banking regulations; capital flight; foreign debt; accumulation pattern

A partir de 2011, Argentina implementó una serie de controles cambiarios que llegaron a incluir la prohibición de adquisición de moneda extranjera para fines no productivos. En diciembre de 2015, tras el cambio de gobierno, se eliminaron todas las regulaciones cambiarias hasta niveles previos a la crisis de 2001-2002. La implementación de estas reformas estuvo basada en la visión mainstream, con la expectativa de que se revertiría la salida de fondos al exterior. Sin embargo, tras el levantamiento de los controles, según la información del balance cambiario del Banco Central de la República Argentina (BCRA) sobre la Formación de Activos Externos (FAE) se observa que, para el primer año, el monto fugado al exterior se duplicó. El financiamiento de la mayor salida de divisas fue posible mediante el incremento del endeudamiento externo.

Palabras clave: mercado cambiario; regulación bancaria; fuga de capitales; deuda externa; patrón de acumulación

Clasificación JEL: F31; F34; G12; L43; O24

En 2011, l'Argentine mit en place une série de contrôles des changes qui incluaient l'interdiction d'acquérir des devises étrangères à des fins non productives. En décembre 2015, après le changement de gouvernement, toutes les réglementations sur les changes ont été éliminées avant la crise de 2001-2002. La mise en œuvre de ces réformes était basée sur la vision dominante, avec l'espoir que les sorties de fonds seraient annulées à l'étranger. Toutefois, après la levée des contrôles, selon les informations du solde d'échange de la Banque centrale de la République argentine (BCRA) sur la formation des actifs externes (FAE), il est observé que pour la première année le montant échappé à l'étranger avait doublé. Ainsi le financement de la plus grande sortie de devises fut possible à cause de l'augmentation de l'endettement extérieur.

Mots clés: marché des changes; régulation bancaire; fuite des capitaux; dette extérieure; modèle d'accumulation

A partir de 2011, a Argentina implementou uma série de controles cambiais que chegaram a incluir a proibição de aquisição de moeda estrangeira para fins não produtivos. Em dezembro de 2015, após a mudança de governo, todas as regulamentações cambiais foram eliminadas para níveis até anteriores à crise de 2001-2002. A implementação dessas reformas foi baseada na visão mainstream, com a expectativa de que a saída de recursos para o exterior fosse revertida. No entanto, após a suspensão dos controles, de acordo com as informações da balança de câmbio do Banco Central da República Argentina (BCRA) sobre a Formação de Ativos Externos (FAE), se observa que, para o primeiro ano, o montante que "escapou" para o exterior duplicou. O financiamento da maior saída de divisas foi possível por meio do aumento do endividamento externo.

Palavras-chave: mercado de câmbio; regulação bancária; fuga de capitais; dívida externa; padrão de acumulação

1. INTRODUCTION

From 2011 to 2015, a series of currency regulations were implemented in Argentina, primarily targeting the use and purpose of foreign currency acquired by the private sector for non-productive ends. Regulations peaked in mid-2012 with a full ban on the acquisition of foreign currency for non-productive purposes, spurring serious challenges in certain sectors of the economy, like the real estate sector,2 and causing real problems for the middle and upper classes of society in Argentina, accustomed to accumulating their savings in dollars. Starting in 2014, access to foreign currency was partially eased, in an attempt to loosen controls on business transactions, although strict regulations on the use of foreign currency remained in place.

After the change of administration (December 2015), a more liberal economic plan came into action, leading to, as one of the first measures, the elimination of all foreign exchange and capital controls, with the expectation that this deregulation would foster a new cycle of economic growth. Nevertheless, this did not happen. Spiraling inflation depressed the purchasing power of wages, shrinking consumption and economic activity, while the outflow of currency, rather than being reversed, took off. As a counterweight, external debt began to rise once again, after a 15-year break.

This paper aims to analyze the major causes and aspects underlying recent transformations in the way the Argentine currency market functions, as a historical event challenging the presuppositions made in the mainstream literature as to the nature of capital outflows, as a result of misguided macroeconomic policy decisions, weak fundamentals, and the risks of expropriation (Khan and Haque, 1985). A year out from the change of administration, it is now feasible to evaluate whether the key points of the initial objectives of the measures taken have been met or not.

The conceptual framework for this analysis rests on the notion of accumulation regimes (Basualdo, 2006, 2013). In this paper, the Argentine foreign exchange market and its regulations are understood as a realm in which the transfer and valuation of the surplus are in dispute. The hypothesis posited here is that in the wake of the recent currency deregulation in Argentina, a set of large local and foreign companies-previously unable to access the single exchange market to send profits abroad via ordinary mechanisms-can now do so free of constraints.

This paper is divided into five sections and an introduction. First, we examine some relevant conceptual aspects of the conventional view of the nature of capital flight and how they differ from the accumulation pattern-based approach. Second, we examine debt and capital flight in Chile. Third, we analyze the process in historical terms, quantifying flight and characterizing its stages. Fourth, we look at the major changes the currency market has undergone and size up capital flight in recent months. Finally, we share our conclusions.

2. CAPITAL FLIGHT AND FOREIGN DEBT

2.1 The Mainstream Approach

In the traditional strain, not all capital flight from a country is concerning. On the one hand, there is "normal" flight, referring to outflows of currency from non-residents or residents aiming to diversify their investment portfolios in the daily course of their activities. Considering covered interest rate parity and the single-price law, in the long term, the balance of payments should even out, cancelling out any imbalances, such that currency outflows recorded in the present should be offset by future inflows.

From that standpoint, a bigger volume-temporarily-of currency outflows is nothing more than a reflection of better integration with the global market, in an age of globalization characterized by expanding capital flows and the globalization of investment portfolios (Banco Mundial, 2013). Even this augmented financial integration is understood as a boon to development. With savings scant, the increased availability of foreign and domestic savings, which generates the end of financial repression, is channeled into more resources for investment (McKinnon, 1973; Shaw, 1973).

On another note, there could also be "abnormal" capital outflows, which have come to be known as capital flight.3 The conventional explanation for these financial flows revolves around decisions made by residents-who are primarily inclined to invest in the national economy-when some state intervention policy throws off the balance; this could be raising the tax burden or enacting stricter controls or regulations that limit the handling of assets, among others, engendering political and economic uncertainty (Schneider, 2003; Cuddington, 1986; Rojas-Suarez, 1990; Baba and Kokenyny, 2011).

Especially when it comes to currency regulation, there is a critique to be had of state controls in terms of microeconomic efficiency. Following along these lines, regulations on the purchase of foreign currency give rise to myriad changes (financial, import trade, export trade, etc.), which in turn push economic actors to exploit the benefits of arbitrage across markets, in an attempt to avoid the regulatory. This leads to the postponement of investment plans, driving the economy into stagnation (Forbes, 2007).

Accordingly, against a backdrop of uncertainty, agents seek to safeguard their main capital or returns by investing abroad, because they will not be subject to the same risks as they would be in the domestic environment (Khan and Haque, 1985; Alesina, Tabellini, and Franco, 1989).

From the traditional standpoint, capital flight is explained principally by domestic uncertainty. Once regulations are gone in an endeavor to free up the acquisition of foreign currencies and trust has been restored in institutions, capital flight should be reversed.

However, experiences in other countries, and recently in Argentina, run counter to these ideas. The empirical evidence backs the idea that deregulating the capital account does not produce any significant effect on growth. In fact, it's entirely to the contrary. The Asian crises showed that sharp currency deregulation in early stages of development can give rise to balance of payments crises due to contagion (sudden stops), etc. (Rodrik, 1998; Rodrik and Subramanian, 2009).

It is therefore necessary to try out alternative explanations to elucidate this phenomenon, which displays a sharply historical component, tied to productive patterns and the ways in which countries are involved in international economic relations.

2.2 Capital Flight and the Exchange Market from the Accumulation Regime Standpoint

The accumulation regime or pattern approach entails a specific analysis combining economic, political, and social variables, beginning with an economic structure in transformation. This institutional arrangement is dynamic and is disputed by the various power blocs looking for hegemony. This analysis includes the form of international insertion, the specific model running the State, priorities in income distribution, and other factors (Basualdo, 2011).

From this viewpoint, regulations on the exchange market can be understood as a space in which appropriation of the surplus is in dispute. Moreover, currency management, albeit not a sufficient condition, has served as a powerful instrument to supplement national industrial development policies at different times throughout the history of Argentina and other countries around the world.4

Along these lines of ideas, capital flight is not an isolated and exogenous phenomenon, like those related to investment diversification or adverse economic and/or political junctures, but rather is part of an endogenous structural phenomenon in a given mode of capital accumulation (Basualdo and Kulfas, 2002; Gaggero et al., 2013).

Capital flight shall be understood as the mechanism by which residents in a country, either companies or people, licitly or illicitly send a portion of the surplus produced in the domestic economy outside of the local economic circuit, including foreign currency kept in individual homes or safe deposit boxes (Gaggero et al., 2013). Note that unlike in conventional theory, this approach considers not only currency outflows through the capital and financial account on the balance of payments, but also current account concepts.

The profile of international insertion, the weight of revenue from natural resources as a share of total national income, the concentration and participation of foreign capital in the business sector, the history of banking (DEBT) crises, hyper-inflation, and the absence of a sufficiently developed capital market lay the structural groundwork for currency outflows, regardless of a country's economic and political stability cycles. Although at critical economic stages and times of political instability outflows may be exacerbated, the phenomenon has been consistently present throughout the past 40 years of Argentine history (Rua, 2017). Furthermore, once economic or political crises have been overcome, the currency that left the country does not return (Kulfas, 2007).

In macroeconomic terms, the consequences of capital flight are numerous and have been studied in other papers (Gaggero et al., 2013). The most widely-known is related to the aggravation of the external restriction. The persistence of capital flight affects economic development, as a significant portion of the currency supply furnished by exports must finance this demand for dollars, which is taken away from the surplus available and destined toward importing capital and inputs for industry (Diamand, 1972).

It is even worse when the dollars funding this flight do not come from export surpluses, but are rather financed with foreign debt. This builds up a two-way flow between cycles of outgoing money and foreign debt, because the the currency continues to flow out as long as there are resources to finance it. This dual causality between capital flight and foreign debt has been extremely important in both Argentina and other developing countries (Boyce, 1992; Demir, 2004).

Accordingly, when currency leaves the country, it curbs domestic investment, as domestic savings are diverted into financial projects abroad, rather than used for local productive investments, and come back in the form of foreign loans. With that said, burgeoning capital flight serves as a severe restraint on capital formation and on economic development (Basualdo and Kulfas, 2002).

In the current conditions in the international economy, in which multinational capital flows have taken off and the number of financial actors and assets involved has skyrocketed as compared to 40 years ago, developing economies with lax financial regulatory frameworks are exposed to rising foreign vulnerability as a result of volatility in the international capital markets (Epstein, 2005; Bastourre and Zeolla, 2016).

2.3 Quantifying Capital Flight

There are several methods to measure or estimate outgoing money (Gaggero et al., 2013; Gaggero et al., 2010; Basualdo and Kulfas, 2002). The most commonly-used methods in Argentina are summarized below (see Table 1).

Table 1 Argentina. Common Methods for Estimating Capital Flight.

| Method | Estimate | Limitations |

| Residual balance-of-payments method | Indirect estimate, based on balance-of-payment data, adding up foreign investment, foreign debt, and the current account balance, and subtracting the change in international reserves | This method fails to reflect capital flight done through the manipulation of transfer pricing, under-invoicing, and over-invoicing. Moreover, it depends on the quality of the balance-of payment data. |

| Foreign Asset Formation by Non-Financial Private Sector (FAF-NFPS) ·Central Bank o/ the Republic of Argentina's (BCRA) Foreign Exchange Balance | Direct estimate, based on recorded soles and purchases of foreign currency in the foreign exchange market from 2002 to the present day. | This method only records foreign currency purchase and sale transactions authorized by the BCRA and does not permit the stock to be calculated, as this measurement only began in 2002. |

| lnternational lnvestment Position (IIP) - INDEC | Direct estimate, calculated via surveys and data gathering abroad, used to find the NFPS' s stock of foreign assets. | This method may underestimate the stock of capital flight, as the sources queried or surveyed may underreport the amounts invested. |

| Trode or country-partner method | Estimate of capital flight done through the manipulation of transfer pricing, over-invoicing on imports,. and under-invoicing on exports, by comparing foreign trade figures reported in Argentina against those reported by the country' s main trade partners (Basualdo and Kulfas, 2002). | There may be classification, reporting, and/ or discrepancy issues in the estimates against othe, countries (Grondona and Burgos, 2015), which could lead to over or underestimates. |

Source: Created by authors based on the works cited.

All of these methods have their limitations and different degrees of difficulty involved in gathering the information. This paper shall use the first and second of the methods. The residual balance-of-payments method draws on statistical information from the balance of payments developed by the National Institute for Statistics and Censuses (INDEC), making it possible to analyze long time series. On another note, the Foreign Asset Formation by the Non-Financial Private Sector (FAF-NFPS) method, found in the Central Bank of the Republic of Argentina's (BCRA) foreign exchange balance, as it is published more frequently, on a monthly basis, and is widely used to study recent experience. The limitation is that both methods exclude other forms of capital flight, such as under-invoicing exports, over-invoicing imports, and the manipulation of transfer pricing. Other studies have pointed to the importance of these forms of capital flight in Argentina (Basualdo and Kulfas, 2002; Gaggero et al., 2013; Grondona and Burgos, 2015).

3. FOREIGN DEBT AND CAPITAL FLIGHT THROUGHOUT ARGENTINA'S HISTORY

The phenomenon of capital flight skyrocketed around the globe with the advent of the neoliberal order and financial globalization. In Argentina, capital flight began to become notoriously persistent starting in the nineteen-seventies, the other side of the rising foreign debt coin.

Over the years of financial valorization (1976-2001), capital flight turned out to be closely intertwined with foreign debt, as it is part of the same process by which financial rents are valorized, which entails taking out foreign debt in order to invest in financial assets in the domestic market and valorize these assets thanks to the existence of a positive differential between the domestic and international interest rates, followed, subsequently, by taking the capital abroad. Throughout this time period, foreign debt ended up being used not to finance productive investment or working capital, but rather primarily to underwrite capital flight, as a way to obtain higher financial yields (Basualdo, 2013).

From that standpoint, the first stage in which a link emerged between capital flight and foreign debt emerged with the military-civilian dictatorship in 1976, which is when the economic regime shifted from an import-substitution industrialization model to a model revolving around financial valorization (Basualdo, 2011). Two central aspects of this accumulation regime were, on the one hand, the dismantling of the productive apparatus, and, on the other, financial deregulation. The Ministry of Economy at the time, Martínez Hoz, adopted an orthodox scheme predicated on the monetarist balance-of-payments vision pushed by the central economies, which involved lowering inflation by a virtual setting of the exchange rate in a context of pre-announced devaluations, curtailing the monetary supply, foreign debt, and high interest rates.

Another key aspect of the program was the 1977 financial reform. The new regulation sidelined the State from determining the destination of deposits.5 The main measures included allowing foreign banks to freely open up branches, deregulating the conditions for private financial entities to accept deposits, and a free-floating interest rate, to name just a few (Cibils and Allami, 2008).

In this context, foreign debt guaranteed the financial bicycle could keep rolling, the rents from which were sent abroad (Díaz Alejandro, 1984). Between 1975 and 1983, annual average capital flight amounted to around 7.9 billion dollars, the counterweight to which was spiraling foreign debt, with an annual average of over 9.5 billion dollars.

Starting in 1982, the Mexican crisis cut off the flow of debt to Latin America, and as a result, capital flight waned in Argentina. After the failure of the Austral Plan-between 1987 and 1989-, capital flight gained momentum again, with over 9 billion dollars leaking out in just three years, which in a context of a total dollar drought, culminated in hyperinflation.

A third phase of capital flight began in 1991 with the implementation of the convertibility plan, an exchange rate regime predicated on fixed parity with the dollar. One of the features of this phase was a record high amount of capital flight and the expansion of foreign debt, to such an extent that it can only be compared to the period of the military dictatorship (Basualdo and Kulfas, 2002). Two periods stand out here: the first, in the onset of the decade, the country managed to offload some of the debt, thanks to privatizations, and also to ebbing capital flight, as the principal local economic groups actively participated in the privatization process, in conjunction with multinational operators and investment banks. The second, when this regime started to show signs of losing steam, capital flight picked up speed. Among other things, numerous local business people sold national enterprises into foreign hands and siphoned the profits from these sales out of the country. Annual capital flight from 1990 to 2001 averaged 9.1 billion dollars against an average of 8.6 billion dollars in foreign debt.

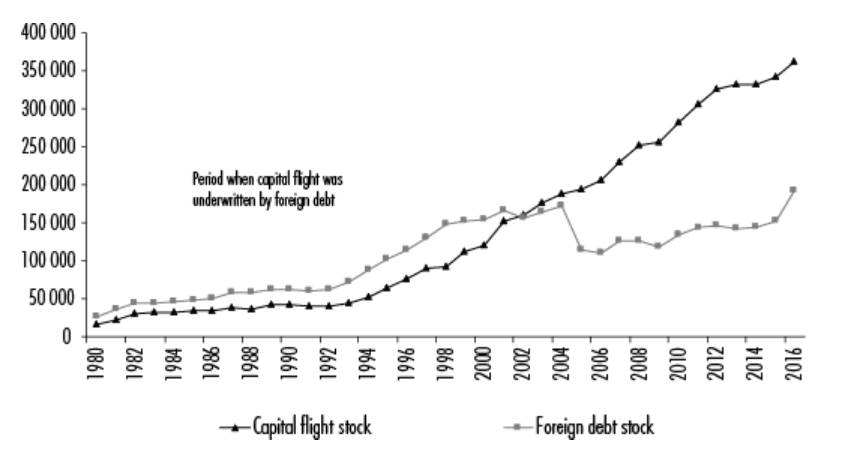

As the financial valorization model was exhausted, a new capital accumulation pattern emerged in 2002, substantially different than the model predating it (Basualdo, 2011). From that point forward, Argentina began to settle its debt with international bodies and private owners of government bonds, interrupting that intrinsic link between currency outflows and foreign debt. Thus, capital flight was no longer underwritten by foreign loans, and began to rest instead on the trade balance surplus. Figure 1 shows how the stock of capital flight and foreign debt evolved over different phases of history in Argentina. It shows the clear and close link between capital flight and foreign debt in the run-up to 2002, the interruption of this relationship-starting that same year and lasting throughout 2002-2015-, a time of significant debt reduction, when outgoing currency was essentially fed by the positive trade balance.

Source: Created by the authors based on estimates made with information from INDEC, BCRA, and ECLAC, and theBasualdo and Kulfas (2002)residual method estimate.

Figure 1 Argentina. Total Foreign Debt Stock vs. Capital Flight Stock from 1980 to 2016. In millions of current dollars.

Looking at the most recent stage, Figure 2 shows that from 2003 to 2015, capital flight was predominantly underwritten by the trade balance surplus, with the exception of the years 2008, 2011, 2013, and 2015, when the trade balance was not enough to fund the massive amount of capital outflows, so the BCRA's international reserves felt the impact. Along other lines, by 2016, the trade balance continued to be negative and capital flight began to be financed by foreign debt again, as it was in the nineteen-nineties. Later on, we will go into greater detail about this latter time period.

4. CURRENCY REGULATION AND DEREGULATION: ARGENTINA'S RECENT EXPERIENCE

4.1 Currency Regulations in 2011-2015

In broad strokes, the recent history of currency regulations in Argentina reflects a nearly exclusive focus on demand, and, in a few one-off cases, on supply. Currency controls were implemented in a context in which there was a lot of pressure on the foreign exchange market. In the months running from July to October 2011-when Cristina Fernández de Kirchner was re-elected-, a total of 11.420 billion dollars, equivalent to 25% of the BCRA's reserves at the time, left the country under the concept of Foreign Asset Formation (FAF), which is the statistic recording the acquisition of foreign currency. Beginning at that time, the government launched a series of measures designed to target the demand for dollars. The main measures are listed below (see Table 2).

Table 2 Argentina. Principal Control Measures on the Buying Dollars in the Foreing Exchange Market.

Source: Created by the authors based on information from BCRA, AFIP, and the IMF (2016).

On October 28, 2011, a rule requiring individuals who wanted to buy dollars without any specific productive purpose to obtain special authorization from AFIP took effect, giving rise to the dollar-purchase regulation policy. On February 8, 2012, regulations on companies who wanted to buy dollars for any type of transaction were implemented, requiring them to get approval from the BCRA. At the same time, the Sworn Affidavit of Intent to Import (DJAI) system was launched, requiring the Secretariat of Commerce to issue advance approval in order to import (or not) certain products. Both measures effectively regulated importers.

On June 15, 2012, the savings option was removed from the AFIP form, placing a full ban on the purchase of dollars for FAF in the official market. On November 1, 2012, the purchase of dollars for real estate transactions with approved mortgage loans was prohibited. From then on, the regulations would alternate between AFIP regulations and more or less strict authorizations from the BCRA.

The first big shift happened on January 24, 2014, in the wake of a major currency devaluation, setting up a more flexible system to access foreign currency just to amass it, with purchase limits reliant on income level, and an additional tax of 35%, which could later be booked as a tax on earnings. This measure was the first step toward opening up the foreign exchange market for retail buyers. This new flexibility entailed the outflow of 3.248 billion dollars in 2014 and 6.495 billion between January and November 2015. These purchases were essentially made by retail savers who were using the dollar as a way to preserve the purchasing power of their savings, in a context lacking any sort of sufficiently clear and widespread savings instrument (reference stabilization coefficient (CER)-indexed fixed-term, dollarized bonds, etc.). But the official dollar market was closed to the "big players" throughout this entire time period, forcing them to resort to the financial dollar window ("contado con liquidación"-a sort of blue chip swap), operating on the stock market and abroad. Bear in mind that this was in a legal market, whose exchange rate was higher than the official rate, and in which there was no limit on the acquisition of dollars. The price was set freely by the operators and the BCRA did not directly intervene.6

On the foreign currency supply side, there were hardly any regulatory or intervention measures. On April 26, 2012, the term for the settlement of dollars from exports was reduced to 15 days for over 800 tariff codes. After the 2014 devaluation, the number of maximum dollars that certain banks could have in their portfolio came under stronger scrutiny. Anyone who wanted to sell dollars at a higher price did so in a market in which the BCRA did not participate. Nevertheless, one of the big problems was that the BCRA was the only party willing to sell dollars at the official rate, responding solely with international reserves.

4.2 2015-2016 Period

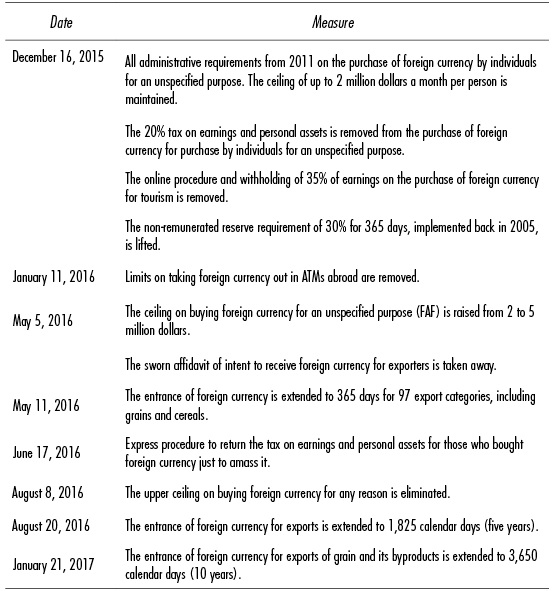

After the change of administration, the new government lifted all of the controls that had been implemented since 2011, not to mention the maximum term for settling foreign currency, which had been in place since 2001, and the minimum non-remunerated reserve requirement on portfolio investment flows from abroad, which had been in place since 2005 (see Table 3).

Table 3 Argentina. Elimination of Measures Regulating the Purchase of Dollars and Financial Flows from Abroad.

Source: Created by the authors based on information from BCRA, AFIP, and the IMF (2016).

On December 16, 2015, Argentina did away with its regulations on the acquisition of foreign currency to amass it and for tourism. The exchange rate unification was done with a devaluation of 40% of the official exchange rate in only a few days, bringing it to the financial exchange rate level.

Generally speaking, the removal of controls on the purchase of dollars was done with three objectives in mind. The first of them was foreign exchange unification: since the ideological conception of the administration, the existence of multiple windows for the purchase of dollars led to inefficient sectoral income detrimental to the allocation of resources guaranteed by the free market. The second was to eliminate controls on the purchase of dollars regardless of their purpose: the management of the official dollar restricted the remittance of profits and dividends, and the purchase of dollars for imports by companies that did not export and could not keep their investment plans, and individuals, whether for savings or for an unspecified purpose (FAF). The third was to facilitate the entrance of financial flows from abroad: this speculative capital came with the condition of short-term valorization, such that the capital could enter fast as long as it could be withdrawn equally quickly. Accordingly, the obligation of non-remunerated temporary reserves was lifted.

This total deregulation of the foreign exchange market saw no correlation in the amount of capital flight. It was rather to the contrary. As shall be shown below, capital flight took off significantly in the last year.

4.3 Prospects for a New Cycle of Capital Flight and Debt?

After the currency controls were lifted, the main outcome was that capital flight accelerated and persisted. Figure 3 shows the monthly breakdown of net FAF-NFPS published in the BCRA exchange rate balance.

Source: Created by the authors based on information from BCRA.

Figure 3 Argentina. Foreign Asset Formation by the Non-Financial Private Sector. With and Without Currency Controls. December 2014 - April 2017. In millions of current dollars.

After the controls were lifted, from December 2015 to April 2017, FAF-NFPS was 17.658 million dollars.7 If extraordinary income from the month of December due to money laundering is excluded, the amount would be, in just one year and five months, 21.750 billion dollars.8

In order to compare against a 12-month period during the exchange rate restriction phase, between December 2014 and November 2015, FAF amounted to 6.466 billion dollars; by contrast, between December 2015 and November 2016, it was 13.972 billion dollars, more than double. That means that after the exchange rate restrictions were lifted, net FAF doubled. And far from being the result of repressed demand in the wake of a period of strict regulations, the dollar outflow continued.

In terms of the types of actors involved in FAF, breaking out dollar purchasers by transaction type, it appears that the "big players" returned to the market. At present, the purchase of dollar notes is done by around 703,000 people who account for 45% of the total volume of purchase transactions worth less than 10,000 dollars. That is to say, they are retail buyers, and although they mobilize a significant volume in purchasing dollars, they use dollarization as a form of savings. Per month, this net outflow amounts to approximately 1 billion dollars. Others make gross transfers abroad, accounting for 950 clients, 82% of which are doing currency transactions worth more than 2 million dollars each. As shown in Figure 4, up until last year, the existence of controls virtually excluded these actors from the official dollar market (dark area).

Source: Created by the authors based on information from BCRA.

Figure 4 Argentina. Buyers of Dollars by Transaction Type in Notes and Foreign Currency. January 2015 - April 2017. In millions of current dollars.

Since the currency controls were lifted, the volumes done by the "big players" have run up a gross tab of over 7.530 billion dollars. In net terms, the amounts sent abroad exceed 2.9 billion dollars.

Additionally, analyzing the components of capital flight, it emerges that the holders of foreign assets favor those high-liquidity and low-risk assets over longer-term investments. This means that when it comes time to get their capital out, individuals prefer to do so in the form of liquid assets, typically dollar notes and other equivalent financial instruments.

Figure 5 shows the composition of FAF, revealing that the purchase of dollar bill notes (cash) stands out above any other form. In turn, the high-liquidity assets altogether-notes plus other investments (shares, government bonds, negotiable obligations, etc.)-, reflect practically the entirety of local residents' foreign assets, leaving the purchase of foreign money for direct investment insignificant for all intents and purposes (stock shares above 10% and real estate investments).

Source: Created by the authors based on information from the BCRA.

Figure 5 Argentina. Breakdown of Foreign Asset Formation from the BCRA, 2009-2016. In millions of current dollars.

On top of that, net currency outflows in the form of remitting profits and dividends abroad accounted for 1.752 billion dollars between December 2015 and November 2016, in contrast with just 242 million dollars between December 2014 and November 2015, meaning there was an inter-annual increase of 1037% (see Figure 6). The average monthly outflow in this category between January and November 2015 was 22 million dollars, which jumped to 213 million dollars between December 2015 and April 2017. The trend held steady into the first months of 2017; between January and April 2017, 466 million dollars were sent abroad.

Source: Created by the authors base don information from the BCRA.

Figure 6 Argentina. Remittance of Profits, Dividends, and other Income in 2015 - April 2017. In millions of current dollars.

The flipside of this significant amount of foreign currency drained abroad in the first year of the administration was a substantial foreign debt flow, which provided the currency to underwrite these outflows. The key to accessing the international market in search of foreign credit was payment to the "vulture funds" (holdouts).

In 2016, the national government took out foreign debt worth 25.118 billion dollars, of which 12.119 billion were directly channeled into paying out the ruling in favor of the holdouts. On the other side, the provinces and the private sector issued debt worth 12.643 billion dollars. The process continued on into the first three months of 2017, when a total of 15.747 billion was issued.

Table 4 Argentina. Foreign Debt Issuance by the National Government, Provinces, and Companies, 2015-2017. In millions of current dollars

**First three months of 2017.

Source: Created by the authors based on information from the BCRA.

However, this is nothing new in the machinations of the Argentine economy. As displayed in Figure 7, there has long been a close relationship between foreign debt and capital flight throughout different eras in the history of Argentina. In this case, the capital flight estimate was done using the residual method. As can be observed, the two variables tend to rise and fall very similarly throughout the different economic and political cycles the country has experienced since the nineteen-seventies, with the exception of the time period 2002-2015, when the government unloaded a significant amount of debt. In 2016, there is a return to the foreign debt and capital flight cycle, in which currency outflows are once again being underwritten by loans from abroad. More specifically, using the balance-of-payments residual method, in 2017, capital flight amounted to an estimated 18.956 billion dollars. On the other side of the coin, in the same time period, there is a remarkable amount of foreign currency flowing in thanks to foreign debt, worth 39.830 million dollars. This phenomenon is very much in line with the literature, which points to a two-way causal relationship between debt and capital flight (Boyce, 1992; Demir, 2004).

Source: Created by the authors based on estimates using information from INDEC, BCRA, and ECLAC, and theBasualdo and Kulfas (2002)residual method of estimation.

Figure 7 Argentina. Annual Average Capital Flight and Total Foreign Debt, 1975-2016. In millions of current dollars.

CONCLUSIONS

In the time period 2016-2017, Argentina gradually loosened its currency regulations. Contrary to what the orthodox vision would foretell, Argentina experienced indiscriminate currency outflows in the wake of liberalizing the currency and capital controls. Using the BCRA's foreign exchange balance measurement of FAF, which records purchases of foreign currency by the private sector, in the first year without currency controls, the amount of capital flight doubled.

Looking at the 12 months prior to when the controls were lifted, December 2014 to November 2015, against an equivalent subsequent period, December 2015 to November 2016, capital flight spiked from 6.466 billion dollars to 13.971 billion dollars. Far from the pace reversing, as it would have if it had been the result of repressed demand after the controls were lifted, in the first four months of 2017, the phenomenon grew even worse, with a total of 5.650 billion dollars in just that first third of the year, nearly equivalent to the entire amount recorded between January and November 2015 (87%).

The flipside was unprecedented foreign debt, guaranteeing the supply of foreign currency. In 2016, the national government, the provinces, and the private sector issued total debt worth 26.150 billion dollars, net of the payments to the holdouts, which further underpins the stance that sees capital flight as a structural component, given that currency deregulation failed to reverse currency outflows, and in fact accelerated them, made possible due to the expanding pool of foreign currency underwritten by foreign debt.

Other phases of Argentine history and experiences in other developing country demonstrate that this capital flight track-predicated on debt-is a short-term financial accumulation circuit, which exposes the domestic economy to greater vulnerability from abroad. During the stages when funds are flowing in, when foreign debt is available, the economy grows and the perception of domestic risk declines. Nevertheless, as soon as the local or international situation evolves adversely, there is a latent risk of a financial, currency, and debt crisis just waiting to happen.

That is why it is essential to undertake an analysis with an eye to the history of Argentina, calling into question which economic policy tools are really necessary to manage capital flight as an unavoidable component of the "external restriction" and the challenge of development.

REFERENCES

Alesina, A., Tabellini, G. y Franco, Ó. (1989), "Deuda externa, fuga de capitales y riesgo político", Estudios Económicos, vol. 4, núm. 2. [ Links ]

Baba, C. y Kokenyne, A. (2011), "Effectiveness of Capital Controls in Selected Emerging Markets in the 2000's", International Monetary Fund, núm. 11/281. [ Links ]

Banco Mundial (BM) (2013), "Capital for the Future: Saving and Investment in an Interdependent World", World Bank Publications. [ Links ]

Bastourre, D. y Zeolla, N. (2016), "¿Hacia un nuevo ciclo de fragilidad financiera?", Entrelineas de la Política Económica, 9. [ Links ]

Basualdo, E. M. (2011), Sistema político y modelo de acumulación: tres ensayos sobre la Argentina actual, 1a ed., Buenos Aires, Atuel. [ Links ]

______(2013), Estudios de Historia Económica Argentina: Desde mediados del siglo XX a la actualidad, 2a ed. [1a reimpresión], Buenos Aires, Siglo XXI Editores. [ Links ]

Basualdo, E. M. y Kulfas, M. (2002), "La fuga de capitales en la Argentina; en La Globalización Económico Financiera. Su impacto en América Latina", CLACSO, Consejo Latinoamericano de Ciencias Sociales Editorial, Buenos Aires. [ Links ]

Boyce, J. K. (1992), "The Revolving Door? External Debt and Capital Flight: A Philippine Case Study", World Development, 20(3). [ Links ]

Cibils, A. y Allami, C. (2008), "Desde la reforma de 1977 hasta la actualidad", Realidad Económica, 249, IADE, 1 de enero/15 de febrero de 2010. [ Links ]

Cuddington, J. T. (1986), "Capital Flight: Estimates, Issues, and Explanations", Princeton Studies on International Finance. ISSN 0081-8070, núm. 58, December. [ Links ]

Demir, F. (2004), "A Failure Story: Politics and Financial Liberalization in Turkey, Revisiting the Revolving Door Hypothesis", World Development , vol. 32, núm. 5, Elsevier Ltd. [ Links ]

Diamand, M. (1972), "La estructura productiva desequilibrada argentina y el tipo de cambio", Desarrollo Económico, vol. 12, núm. 45. [ Links ]

Díaz Alejandro, C. F. (1984), "Good-bye Financial Repression, Hello Financial Crash", Working Paper, 24, Kellogg Institute, August. [ Links ]

Epstein, G. (2005), Financialization and the World Economy, Northampton, Massachusets, Edward Elgar Publishing. [ Links ]

Fernández, A., Klein, M. W., Rebucci, A. S. y Uribe, M. (2015), "Capital Control Measures: A New Dataset" (No. w20970), National Bureau of Economic Research. [ Links ]

FMI (2016), "Argentina: 2016 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Argentina", November. Washington, DC, IMF. Recuperado de <http://www.imf.org/external/ pubs/cat/longres.aspx?sk=44386.0> [ Links ]

Forbes, K. J. (2007), "The Microeconomic Evidence on Capital Controls: No Free Lunch", Capital Controls and Capital Flows in Emerging Economies: Policies, Practices and Consequences, Chicago, University of Chicago Press. [ Links ]

Gaggero, J., Kupelian, R. y Zelada, M. A. (2010), "La fuga de capitales II. Argentina en el escenario global (2002-2009)", CEFID-AR. Documento de Trabajo núm. 29, Buenos Aires, julio. [ Links ]

______ Rua, M. y Gaggero, A. (2013), "Fuga de capitales III. Argentina (2002-2012). Magnitudes, evolución, políticas públicas y cuestiones fiscales relevantes", CEFID-AR. Documento de Trabajo núm. 52, Buenos Aires, diciembre. [ Links ]

Grondona, V. y Burgos, M. (2015), "Fuga de capitales VI. Argentina 2015. Estimación de los precios de transferencia. El caso del Complejo Sojero", Jorge Gaggero (coord.), CEFID-AR. Documento de Trabajo núm. 71, julio. [ Links ]

Khan, M. S. y Haque, N. U. (1985), "Foreign Borrowing and Capital Flight: A Formal Analysis", Staff Papers (International Monetary Fund ), vol. 32, núm. 4, December. [ Links ]

Kose, M. A., Prasad, E., Rogoff, K. y Wei, S. J. (2009), "Financial Globalization: A Reappraisal", IMF Staff Papers, 56. [ Links ]

Kulfas, M. (2007), Internalización financiera y fuga de capitales en América Latina: Argentina, Brasil, Chile y México en los años '90, 1a ed., Buenos Aires, FLACSO, Facultad Latinoamericana de Ciencias Sociales. [ Links ]

Ley N° 27260 (2016), Programa Nacional de Reparación Histórica para Jubilados y Pensionados, Congreso de la Nación Argentina, Buenos Aires, Argentina, 2016, 22 de Junio. Disponibe en <http://servicios.infoleg.gob.ar/infolegInternet/anexos/260000-264999/263691/norma.htm> [ Links ]

Manzanelli, P, Barrera, M., Wainer, A. y Bona, L. (2015), "Deuda externa, fuga de capitales y restricción externa. Desde la última dictadura militar hasta la actualidad", E. Basualdo (coord.), Documento de Trabajo N° 68, CEFID-AR, abril. [ Links ]

McKinnon, R. I. (1973), "Money and Capital in Economic Development", Brookings Institution Press. [ Links ]

Noland, M. (2007), "South Korea's Experience with International Capital Flows", en S. Edwars, Capital Controls and Capital Flows in Emerging Economies: Policies, Practices and Consequences, Chicago, University of Chicago Press . [ Links ]

Reinhart, C. M. y Rogoff, K. (2009), This Time is Different: Eight Centuries of Financial Folly, New Jersey, Princeton University Press. [ Links ]

Rodrik, D. (1998), "Who Needs Capital-account Convertibility?", Essays in International Finance 55. [ Links ]

Rodrik, D. y Subramanian, A. (2009), "Why did Financial Globalization Disappoint?", IMF Staff Papers, 56(1). [ Links ]

Rojas-Suarez, L. (1990), "Risk and Capital Flight in Developing Countries", Unpublished Manuscript of the International Monetary Fund , Research Department. [ Links ]

Rua, M. (2017), Fuga de capitales IX: el rol de los bancos internacionales y el caso HSBC, Buenos Aires, ediciones Z/Fundación SES. [ Links ]

Schneider, B. (2003), "Measuring Capital Flight: Estimates and Interpretations", Working Paper 194, London, Overseas Development Institute. [ Links ]

Shaw, E. (1973), Financial Deepening in Economic Development, New York, Oxford University Press. [ Links ]

4According to statistics published in Reinhart and Rogoff (2009), in Argentina, during the most successful stage of industrialization, in 43% of the months running from 1943 to 1976 (150 months), there was an exchange rat split with a gap higher than 50%. Up until 1996, South Korea had a ban on companies taking on debt in foreign currency, but it was subsequently lifted. Up until 2002, there were still controls on foreign payments made in foreign currency by individuals (scholarships, tourism, buying properties abroad, etc.) (Noland, 2007). China had administrative measures in place, ranging from reporting to prohibitions, on transactions for 90% of the total capital account positions subject to regulation, including a limit of 50,000 dollars per individual and a mandatory declaration of the origin of the funds (Fernández et al., 2015).

5The regulatory frameworks were as follows: Decree-Law 21,495, decentralizing deposits, enacted January 17, 1977; and Decree-Law 21,526 for financial entities, enacted February 14, 1977.

6Even though the government did indeed intervene indirectly, through National Social Security Administration (ANSES) transactions, as did the official banks, selling positions in dollars, or the National Securities Commission (CNV) regulations on maximum holdings of public bonds in dollars, as a way to operate on the "contado con liquidación"—a sort of blue chip swap—market.

7Seven business days in the month of December belong to the previous administration, during which time the single and free exchange market operated with restrictions. Accordingly, for greater precision as to the amount given, the equivalent of 250 million dollars ought to be subtracted, although it is such a low amount that it really is not very meaningful to make this distinction.

Received: June 27, 2017; Accepted: November 03, 2017

texto em

texto em