Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Problemas del desarrollo

versão impressa ISSN 0301-7036

Prob. Des vol.49 no.193 Ciudad de México Abr./Jun. 2018

https://doi.org/10.22201/iiec.20078951e.2018.193.60235

Articles

Managing Pemex as a State Productive Enterprise

1Benemérita Universidad Autónoma de Puebla (BUAP), Mexico. E-mail addresses: angysan_t@hotmail.com and augusto_mx@hotmail.com, respectively.

Three years out from the 2014 Energy Reform, this study explores how Petróleos Mexicanos (Pemex) has performed as a State Productive Enterprise (SPE). The analysis consists of two parts: the first is an overview of the assumptions underlying the reform, a diagnosis of the hydrocarbon sector, and the solutions and instruments set in motion as a result of the legal changes made and Pemex's new operating model. The second provides an assessment of the progress or contradictions involved in Pemex's track record as an SPE with respect to the reform's original premises. The findings point to a lot of unfinished work in the spheres of corporative governance, tax structure, and partnerships and contracts in the oil and oil products sectors.

Key Words: Energy reform; hydrocarbons; state-owned enterprise; private investment; tax structure

A tres años de la reforma energética de 2014, se realiza el presente estudio exploratorio del desempeño de Petróleos Mexicanos (Pemex) como Empresa Productiva del Estado (EPE). El análisis consta de dos partes: en la primera se hace una revisión de los supuestos de la reforma, del diagnóstico realizado al sector hidrocarburos y de las soluciones e instrumentos puestos en marcha a partir de los cambios legales y del nuevo modelo operativo de Pemex. Mientras que, en la segunda, se realiza una valoración de los avances o las contradicciones en la gestión de Pemex EPE, con relación a las premisas originales de la reforma. Los hallazgos ubican importantes pendientes en el área de Gobierno Corporativo, régimen fiscal y asociaciones y contratos en los sectores de petróleo y petrolíferos.

Palabras clave: reforma energética; hidrocarburos; empresa paraestatal; inversión privada; régimen fiscal

Clasificación JEL: L32; O13; Q42; Q43; Q48

Trois ans après la réforme en matière d'énergie de l'année 2014, cette étude exploratoire de la performance de Petróleos Mexicanos (Pemex), en tant qu'entreprise productive de l'État (EPE), est effectuée. L'analyse se compose toujours de deux parties: la première est un examen des hypothèses de la réforme, du diagnostic fait le secteur des hydrocarbures, des solutions et des instruments lancés par des changements juridiques et du nouveau modèle d'exploitation de Pemex. Le second est une évaluation des progrès ou des contradictions dans la gestion de Pemex EPE, par rapport aux prémisses originales de la réforme. Les conclusions placent des dossiers importants en suspens dans le domaine de la gouvernance d'entreprise, du régime fiscal, des associations et des contrats dans les secteurs du pétrole et du pétrole.

Mots clés: réforme de l'énergie; les hydrocarbures; semi-publique; l'investissement privé; la fiscalité

Três anos após a Reforma Energética de 2014, é realizado o presente estudo exploratório sobre o desempenho de Petróleos Mexicanos (Pemex) como Empresa Produtiva do Estado (EPE). A análise consiste em duas partes: a primeira é uma revisão dos pressupostos da reforma, do diagnóstico feito no setor de hidrocarbonetos e as soluções e instrumentos implantados com base nas mudanças legais e no novo modelo operacional da Pemex. Enquanto, no segundo, é feita uma avaliação do progresso ou das contradições na gestão da Pemex EPE, em relação às premissas originais da reforma. Os resultados sinalizam importantes pendencias na área de Governança Corporativa, regime fiscal e associações e contratos no setor petrolífero.

Palavras-chave: reforma energética; hidrocarbonetos; empresa paraestatal; investimento privado; regime tributário

2014年能源改革三年之后,我们对墨西哥国家石油公司作为国家生产性公司的运营进行了探索性的研究。研究分为两部分:第一部分是对改革假想、碳氢化合物行业的诊断以及基于法律改革和墨西哥国家石油公司运营新型运营模式的解决方案和方法的回顾。第二部分对墨西哥国家石油公司管理方面的进展或矛盾进行了评估。研究发现在石油和石油部门的公司治理中,财政制度和协会及合同制度有着重要的地位。

关键词 能源改革; 碳氢化合物; 准国有公司; 私人投资; 财政制度

INTRODUCTION

This paper is designed to follow up on Pemex as a State Productive Enterprise (EPE) three years after the energy reform that designated it as such. It is also meant to explore the changes it has undergone as compared to its former status as a parastatal enterprise and, specifically, point out those factors which, since the very beginning, have turned out to be contradictory to what was originally formulated. The idea is to inspire lines of research and policy measures to help better understand Pemex's new role.

The first section describes the challenges facing the hydrocarbon sector, which the energy reform sought to resolve, as well as the instruments and suppositions put into place. Context is provided for Pemex as part of the Mexican state enterprise sector, economic liberalization, and Latin American indicators on production and reserves.

The outcome of the government’s diagnosis can be summarized in two points: 1) the company has fallen behind in deepwater drilling technologies and carry out industrial transformation, including refining, petrochemicals, and fertilizer production, which the reform sought to reactivate by ramping up extraction of non-associated gas and its byproducts (ammonia, acetic anhydride) and curbing imports from the United States; 2) financial deficit in terms of the ability to cover desired investments; the solution here was to allow private capital a seat at the table by amending the constitution and its bylaws; likewise, three policy measures were defined for Pemex as an EPE: i) internal management based on Corporate Governance (CG); ii) adapt the tax regime to the new contracting scheme; iii) partner with private enterprises to attract capital and technology.

The second section analyzes the three measures described above, and the steps forward and backward taken during Pemex's first years as an EPE. The exercise is deemed necessary for a company, which, under the arguments of efficiency and competitiveness, was opened up to the private sector in all of its linkages, previously the exclusive purview of the nation: exploration, extraction, industrial activities, and service provision.

1. CONCEPTUAL AND POLICY FRAMEWORK

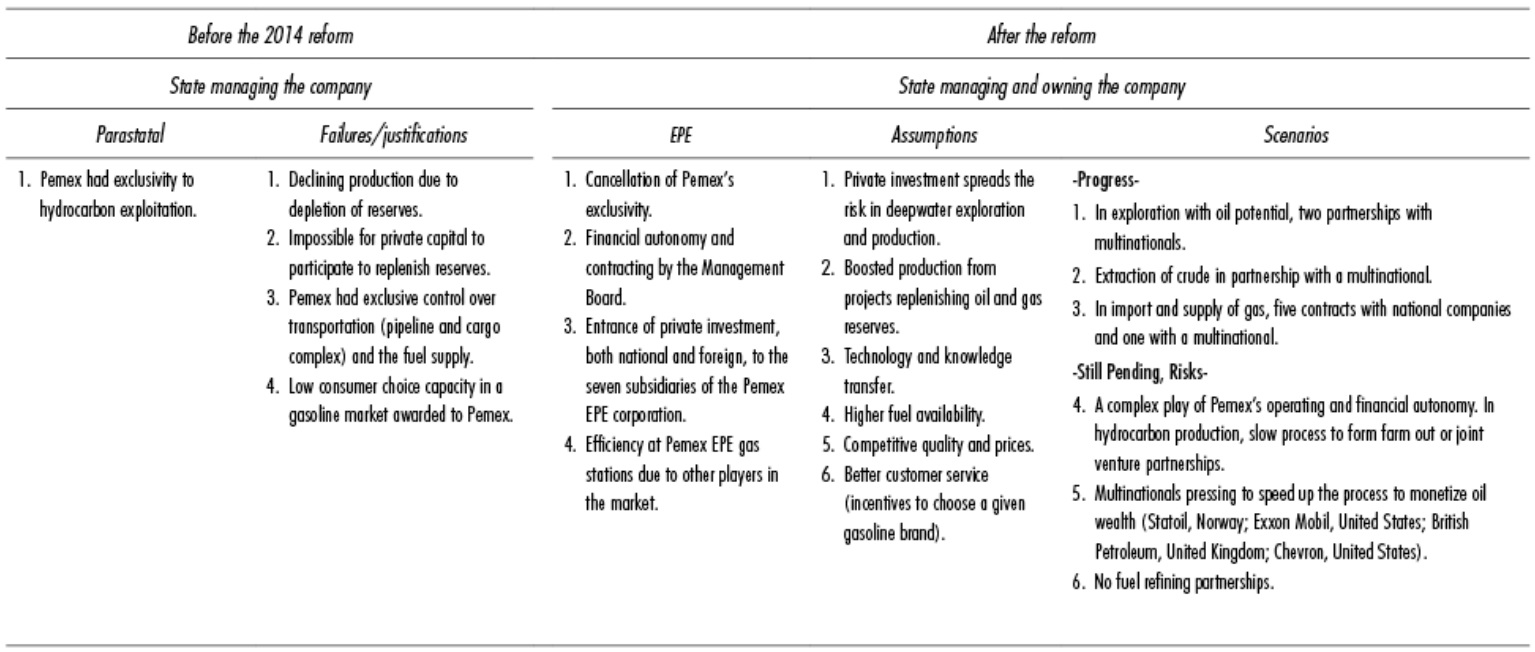

Assumptions in the 2014 Energy Reform: What was the reform meant to resolve for Pemex?

The 2014 energy reform entailed a profound chain in the way the Mexican power and hydrocarbon sector is run- In the case of Pemex, specifically, the idea was to overhaul the legal framework governing the parastatal enterprise, modernizing it to strengthen the industry and boost oil revenues (Presidencia de la República, 2015). The official diagnosis underscored the deficit in the realms of financial, human, and technological capital, reflected in three aspects: 1) lack of technology and resources to drill deepwater oil (500-meter sea floor) and ultra-deepwater oil (more than 2,000 meters),2 to restore the reserves before Cantarell, the largest oil field accounting for 63% of Pemex's total production, is depleted; 2) outdated technology for extracting shale gas-rock that needs to be fractured to obtain the gas-and under-use of production potential; 3) a fuel market cornered by Pemex-especially gasoline-and the risk of running out of the national supply (Presidencia de la República, 2014, 2015; Pemex, 2013, 2014a).

The response of the reform was to change Pemex's legal regime, transforming it from a parastatal enterprise into an EPE, which is a figure that grants not only administration but also ownership to the State, by modifying Articles 25, 27, and 28 of the constitution, enabling complete autonomy via CG, and empowering it to partner with other oil companies (Pemex, 2015). The objective was emphatically financial, setting Pemex's goal as maximizing profits (H. Congreso de la Unión, 2014b). With the legal adjustments, the oil reserves were monetized, becoming a business plan that could be harnessed by the public and private sector (Pemex, June 10, 2017).3 The partnership with private investment-at the corporate and subsidiary level-4 came from a new paradigm to manage natural resources, turning them from means to development into financial usufructs. The Hydrocarbons Law established the primacy of drilling for oil and gas over any other activity in the Mexican surface or subsurface, even refining (H. Congreso de la Unión, 2014c, pp. 38-39; Pemex, 2014a), a model that failed to consider the business approach of the transnational companies, whose main strength is end-to-end exploitation of the chain, and many of which had already made partnerships with Pemex.

The regulatory framework set in the strategic farming out and joint venture associations the public-private co-participation method to identify priority fields that are highly technically complex and require lots of capital (deepwater oil and gas, mature fields, extra-heavy oil fields), to accelerate production and restore reserves (Pemex, 2014a). Pemex EPE ended up being subject to the Mercantile Law, which opens it up to sanctions if it violations the rules of competition (Pemex, June 12, 2017).

Efficiency and Competitiveness: The New Parameters of the Hydrocarbon Sector

Pemex, parastatal enterprises, and economic liberalization

Via parastatal entities in a mixed-economy system, the State could facilitate the constitutional mandate of serving as the backbone of development; however, in addition to this ownership, the State itself was subject to the challenges derived from choosing the means, policies, and techniques to carry it out (Martínez, 1983). With the nationalization of Pemex in 1938, the State consolidated its dominion over the energy sector (Campodónico, 2007). In 1982, the economic crisis led to solutions revolving around liberalization, the ideological core of which was categorical in its treatment of the State: the role would be limited to resolving the failings of the market, the most efficient resource allocation method (Smith, 2002; Friedman and Friedman, 1980). With the exception of Pemex and the Federal Electricity Commission (CFE), which ended up as decentralized State bodies, the deregulation immediately hit public enterprises in the midst of a high fiscal deficit, debt, and a dense bureaucratic apparatus supporting the parastatal enterprises; efficiency and competitiveness became the premises of the public sector (Casar and Peres, 1988; OCDE, 2012; Buchanan, 2006). Through privatization and liquidation, the number of parastatal enterprises went from 1,255 in 1982 to 213 in 1990 (INEGI, 1994; Peñaloza, 2005, p. 50).

The hydrocarbons sector in Latin American indicators on production and reserves

Given its strategic nature, reflected in global production and income share indicators, Pemex’s existence in the in the parastatal sector since 1982 did not exempt it from the liberalization of later years and the State's loss of exclusivity over hydrocarbons. In oil production by country, Mexico is ranked 11th on a list of 119 nations’ generating an average of 2.5 million barrels a day (mbd). In Latin America, it is outranked only by Brazil at 9th with 3.2 mbd, coming in ahead of Venezuela (11th with 2.4 mbd) and Colombia (23rd with 924 mbd) (EIA, 2017a). In proven reserves, Mexico is 17th on a list of 69 countries with reserves amounting to up to 9.7 billion barrels. Number one in the world is Venezuela, with a capacity of 300 billion barrels; Brazil is 15th with 16 billion; Argentina, 33rd, with 2.4 billion; and Colombia, 34th, with 2.3 billion (EIA, 2017a). Between 1980 and 2016, oil revenues accounted for on average 34% of the federal government’s total income, climbing as high as 38% in high-price moments. As a percentage of gross domestic product (GDP), 8%.

Opening Pemex and the instruments of the 2014 energy reform

Efficiency and competitiveness were the arguments made along the entire path to liberalization, advocating for better use of available resources (natural, human, financial), modernization to response to technical constraints, and the ability to stay in the market while boosting production. They can be distilled into the solution to two major problems:

Outdated technology needed to explore non-conventional oil and gas sources (deepwater and shale), as well as for refining, and petrochemical and fertilizer production;

Financial shortfalls in terms of covering investment in these realms.

The response was to do away with Pemex’s exclusive right to the entire hydrocarbon chain. The policy instruments enacted range across three broad operating areas at the company:

1. Internal management based on Corporate Governance (CG) (Presidencia de la República, 2014). Conceptually, CG delimits the functions of the state to reduce its involvement in productive activities and ease access to private enterprises. The model is the brainchild of the Organization for Economic Cooperation and Development (OECD). It is pro-market and uses the Guidelines on Corporate Governance Principles, which are adapted on an ongoing basis to global trends in competition, providing non-binding standards and best practices (OCDE, 2004). At public enterprises, embedding this system is recommended as decisive to guarantee they can fuel a country's competitiveness; it is a requirement for privatization or partial openness, because it offers investors legal certainty as to the equality of conditions in which they will be competing, mitigating the regulatory powers of the State (OCDE, 2011). As a practical tool, CG demarcates the responsibilities among the directors (Board of Directors, Management Council, or Executive Board), managers (executives, managers), and the owners or shareholders at a company (OCDE, 2012). Before implementation, as was the case in the Mexican energy sector, the primary and secondary standards are amended. Then, a new form of management emerged, dividing the role of the State across the administrator, owner, regulatory, and operator. Thus, at Pemex EPE, the distribution of functions ended up as follows: the Estado Propietario (Owner State) (Energy Secretariat-Sener-and Secretary of Finance and Public Credit-SHCP); the Estado Regulador (Regulatory State) (National Hydrocarbons Commission, Energy Regulating Commission, the National Industrial Safety and Environmental Protection Agency for the Hydrocarbons Sector); the Estado Operador (Operating State) (National Natural Gas Control Center, National Energy Control Center); and the Compañías Operadoras (Operating Companies) (Pemex EPE, Federal Electricity Commission) (Pemex, 2014a). For its part, internal CG (Management Council) was designated with a chairman (energy secretary); a representative of the SHCP; three members of the federal government; and five independent members (Pemex, April 12, 2017). This model is enforced through a resolution that is emphatic as to the State’s business skills, as in its role as a public subject with social purposes, as Tello (1989) argues, it is taken for granted that it is inefficient and corrupt; on the contrary, to the private sector, merely for being private, are attributed efficiency and productivity. In the parastatal phase, Pemex did operate financially (pre-tax profits) and logistically (no documented cases of running out of oil and fuel nationally or locally) efficiently, so this premise is not really a satisfactory explanation for the management change.

2. Adapting the tax regime to the new contracting scheme (H. Congreso de la Unión, 2014a and 2014b). Pemex's taxes, duties, and contributions adapt to the different types of contracts emanating from partnerships with other companies: licenses, shared production deals, profit-sharing arrangements, and service contracts (FMP, 2015). Nevertheless, the fiscal treatment has remained unchanged despite the greater autonomy granted. The cost has been the abandonment of significant investment plans needed to balance out oil exploitation (Ibarra, 2008; Campodónico, 2007). The current regime, as it is designed (CEFP, 2015) further entrenches primary specialization (82% of total investment goes to this link of the chain and 10.4% to industrial transformation), affecting the degree of financial freedom. In the time period 1993-2016, as a percentage of the company's profits, investment spending was 19.5%; taxes, duties, and contributions paid were 94%.

3. Strategic partnerships with other companies (Pemex, 2014b, pp. 6-11). Partnerships are meant to reduce risk, boost oil and gas production, release Pemex from its capital requirements, and help it access technology, the costs of which rise in line with complexity (Schlumberger, 1998, p. 5). Prior to the reform, in the 2007-2012 Sectoral Energy Program, Pemex set a term of no more than 20 years (Pemex, 2013, p. 9) to develop its own technological and human resources, producing alongside other specialized companies and acquiring mature technologies. The plan began with the first two Pemex EPE exploration licenses (the Pemex Exploración y Producción subsidiary) in the deep waters of Norte Plegado in the "Lost Belt" of the Gulf of Mexico (Pemex, February 28, 2017), with Chevron and INPEX Corporation, an American and a Japanese oil company, respectively. In the farming out model, a partnership was entered into with the Australian company BHP Billiton to drill deepwater oil in the Trion Block (Pemex, March 3, 2017). For auxiliary services, the partnership was with the local unit of the French company Air Liquide Mexico S.A. de R.L. de C.V., to supply hydrogen to the Tula refinery expansion project in Hidalgo for 20 years, designed to increase gasoline production (Pemex, February 23, 2017). Generally speaking, the idea behind these partnerships is to furnish the funding, training, technology, and services to boost production in an extremely uncertain scenario. For example, the experience of Pemex with service contracts with third parties since 2001 in non-associated gas, designed to raise the execution capacity of Pemex Exploración y Extracción and reduce imports, was not entirely successful (Rodríguez, 2010). The 2014 reform operated the Comprehensive Exploration and Production Contract version, returning to the project to raise production of non-associated gas (input for fertilizers) and curb imports. Nevertheless, it has not been simple. The National Refining System is working at a capacity of only 61% as compared to 90% in the United States and a 72% average across Latin America (EIA, 2017b, p. 6). From 2013 to 2017, natural gas production went from 6,300 cubic feet to 5,300. At the same time, the United States boosted its exports of gas and fuel to Mexico (EIA, 2017b, pp. 8-9).

2. ANALYSIS OF THE ASSUMPTIONS, POLICIES, AND INSTRUMENTS OF THE REFORM AND HOW THEY ARE EXPRESSED IN PEMEX EPE

Corporate Governance (CG): Autonomy and Minimal Regulation

In the context of globalization (Rivas, 2002), management of public companies for the purposes of greater autonomy, such as the CG for Pemex EPE, finds its roots in the nineteen-nineties. The first version is in the Organic Law for Petróleos Mexicanos and Subsidiary Bodies, from 1992, which established a general Management Board and, for each subsidiary, another board, signaling the main failure as the subordination to the Executive and to unions (Presidencia de la República, 2014, p. 4). As part of its parastatal classification, Pemex was a Director Budgetary Control Body (known as ODCPD); that is to say, its investment spending was exclusively defrayed by the government (SHCP, 2014). The new form of organization partially removed the centralized system under the command of the Federal Executive, which was entitled o name 6 of the 11 members of the Management and remove them, too. The second change is rooted in the 2008 energy reform and is an administrative change, which only affected the service link of the chain for the company (cargo transport). Its purpose was to strengthen the duties of the Management Board to better manage the budget. Up until that point, in an attempt to give strategic management to an important sector, he management bodies were endowed with best decision-making practices without affecting the matter of state ownership. Pemex continued to be a parastatal enterprise. The third is that the 2014 energy reform designed a company beyond the reach of excessive state intervention, creating for this reason an autonomous governance, charged with maximizing the company's profits and State revenue (Presidencia de la República, 2014, p. 16; H. Congreso de la Unión, 2014a and 2014b; Pemex, 2014a). CG, through the Management Board, assumed, finally, the prerogative of enforcing the laws of a sector of such magnitude as the hydrocarbon sector, now with the powers to dispose of allocate the company's immovable assets by virtue of market needs, as well as to divest and seize them (Pemex, 2014a, p. 34; Presidencia de la República, 2015, p. 3). Legally, the involvement of the Executive was slowed down, leaving its sole responsibility the appointment of five of the 10 members of the board (Secretary of Energy, Secretary of Finance, and three members from the federal government), and delegated to the Senate the designation of five other independent members (Pemex, 2014a; Presidencia de la República, 2014, pp. 24-28).

Pemex needed better forms of management far before the 2014 reform. It was a parastatal enterprise for over 70 years; for 54 years, it was governed by bylaws that conferred complete control to the State (1938-1992); and 22 years under laws that made this control more flexible to varying degrees (1992-2014) (Presidencia de la República, 2014). But resorting to Buchanan's (2006, pp. 23-33) critique of state interventionism and the consequent defense of the market, the freedom given to the Board can play against both the management of finance and assets, as well as incentives for transparency and corruption, areas in which there have been inefficiencies over the past 23 years and especially from 2000 to date (Pérez, 2012; Morales and Dávalos, 2015).

Economic policy management, influenced by any interest other than welfare and development, is a deviation from its nature, which is amply backed by economic and political theory (Meny and Thoenig, 1992; Serrano, 2001) and by studies that measure corruption in Mexico (Casar, 2015 and 2016). However, it would be mistaken to categorically concede ineptitude to the State and efficiency to private management. Nothing is exempt from the games of interests; for example, following in the footsteps of Palazuelos and Vara (2008), the experience of energy liberalization in the European Union led not to a common policy but rather to the predominance of multinationals and weakened governmental regulatory capacity. Also noteworthy is the fact that Pemex EPE requires technically and geo-strategically qualified boards; a less political and more professional Management Board. The involvement of the federal executive continues to be a possibility because although the five independent board members (the counterweight) are ratified by the Senate, it is the executive who must nominate them (Presidencia de la República, 2014). In turn, the chair of the Management Board, the head of the CG, according to OECD guidelines, ought to have a highly competent profile (OCDE, 2012, pp. 13-17). At Pemex EPE, inconsistency in the profiles of the board members5 is explained by the preponderance of partisanship and the lack of experts in management strategy able to neutrally mediate between the State and private shareholders in order to prevent problems of information asymmetry and moral risk. Moreover, someone who can reconcile the role of the Sener and that of the SHCP to turn Pemex into a competitive firm with greater independence, under the condition of reducing the fiscal debt, which is no easy task. Additionally, sensitivity to global market movements limits the scope of the reform in terms of the true capacity of CG to work in favor of the company. Pemex is a price-taking company and playing the game entails having organizational models with specialized profiles, an integrated chain, and good competition tactics (Rivas, 2002, p. 15).

The OECD monitoring (2012) in Latin America concluded that the combination of CG principles with the political activity of the State tends to foment boards composed mainly of career civil servants, rather than people with qualified profiles. The discretionary designations continue to be reproduced in those public companies that have adopted the scheme and Pemex EPE is no exception.

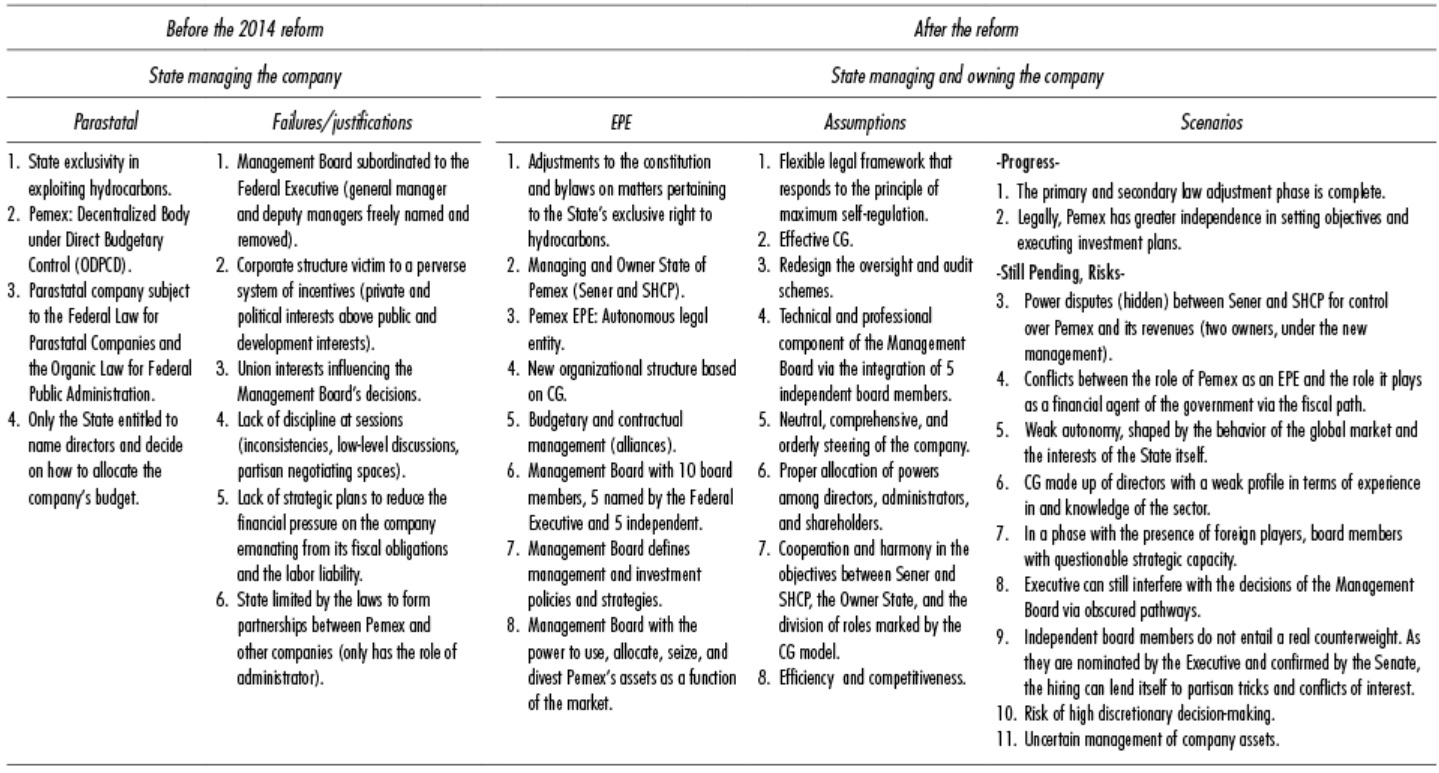

Table 1 Evaluation of EPE´s* Corporate Governance*

*EPE: State Productive Enterprise.

Source: Created by the authors based on: (OCDE, 2004) (OCDE, 2011) (OCDE, 2012) (Presidencia de la república, 2014) (Pemex, 2014a and b) (Pemex, 2015).

Fiscal Regime: Between the Budgetary Autonomy of Pemex EPE and its Role as a Financial Agent of the Government

The management model given to Pemex EPE thanks to its CG entailed better used of its finances, fundamentally where payment of taxes, duties, and contributions are concerned, which depends on the difference between available and committed profits. Diverse studies (Tello, 2015; Caballero and Tello, 2008; Morales et al., 2013; Cornejo et al., 2012) analyze the company's fiscal regime. Caballero and Tello (2008) examine in detail the fiscal obligations and make a proposal to adjust them to reduce the company's tax burden. Cornejo et al. (2012) and Morales et al. (2013) use the accounting method and draw conclusions about Pemex's profitability before the taxes, duties, and contributions and its ability to finance its investments. Castañeda and Kessel (2003, pp. 81-82) furnish arguments to support the budgetary autonomy of public enterprises.

In Mexico, Pemex is the most fiscally penalized company; in the time period 1990-2016, taxes, duties, and contributions represented 93% of profits; in 2014-2016, they exceeded 100%. As a percentage of total revenue, they represented 61%; in the case of Petrobras, by contrast, this figure was just 33% (Huerta and Ruíz, 2012, pp. 129-131), Ecopetrol is at 11%, and Petróleos de Venezuela is at 40% (OCDE, 2014). Pemex's fiscal treatment has been directly related to the low tax burden; Mexico collects 17.4% of GDP, while Brazil collects 32$, Colombia 20.8%, and Venezuela 20.9% (OCDE, 2017, pp. 23-24; OCDE, 2016). Unlike the 2015 statistics, they show an increase of 2.3% in collections with respect to GDP (17.4%). In 2015, the figure reached 15.1%, but Mexico continues to be below the OECD average (34.3%) and the Latin American average (22.8%) (OCDE, 2017, p. 25).

In accounting terms, the strong tie between the public budget (and to a certain point, development) and Pemex's revenues as a parastatal and an EPE, the proportion that the taxes, duties, and contributions payment represents in the primary balance sheet can be seen (revenue less total expenses, without including amortization for interests) (see Figure 1).

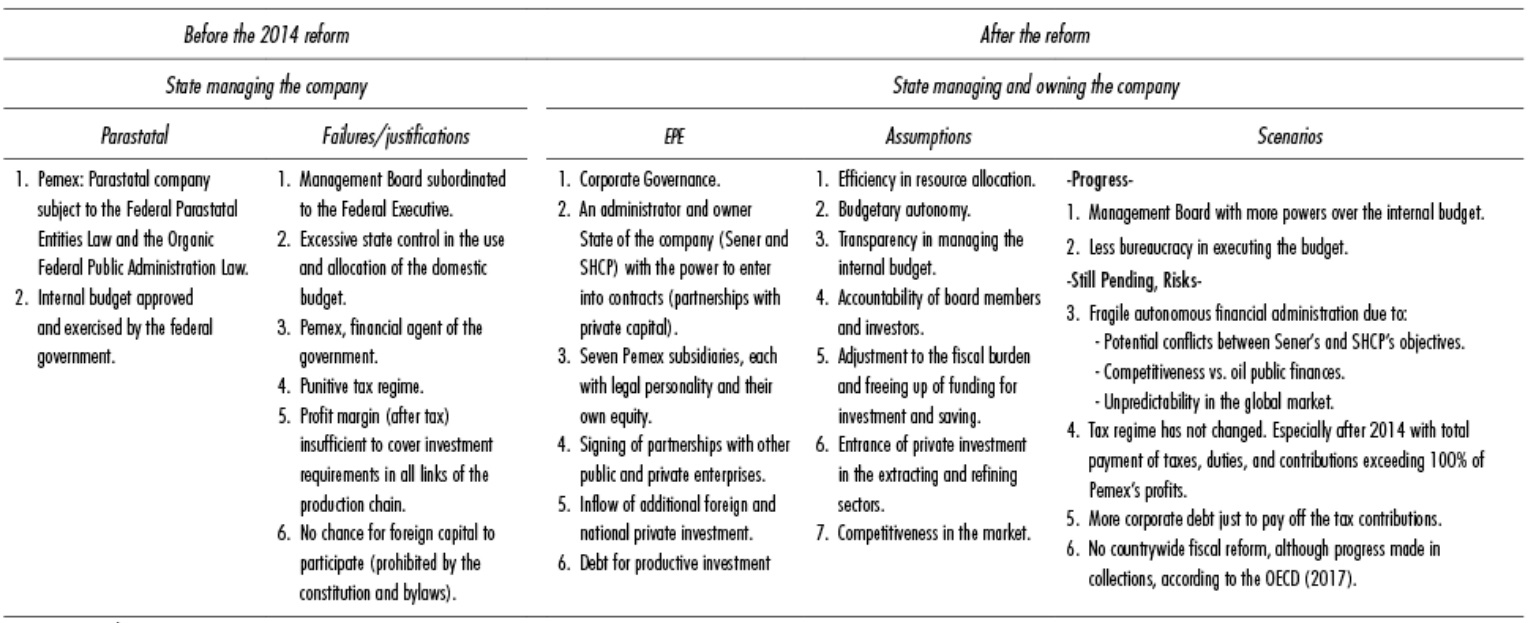

Table 2 Pemex EPE* Fiscal Regime

*EPE: State Productive Enterprise.

Source: Created based on (Pemex, 2014a)

*EPE: State Productive Enterprise

Source: Created by the authors based on the budgetary monitoring section of <http://www.pemex.com>

Figure 1 Percentage Share of Taxes, Duties, and Contributions Payments in the Pemex Primary Balance Sheet (before and after 2014; parastatal and EPE)*

There is a contradictory relationship between prices and fiscal obligations when 2008-2013 and 2014-2016 are compared. These two time periods correspond to the two energy reforms (2008 and 2014) and it is clear, on the one hand, the propensity to tax 98.7% of Pemex's profits in a high-price period in the first case (86 dollars per barrel [dpb] on average). But also the tendency to continue doing it at 107.5%, in a time period when prices fell precipitously in the latter time (55 dpb on average). This reflects Pemex EPE's vulnerability to being governed by its new management model; it challenges the competency of the CG to autonomously manage finances in light of market instability and with the owners of the company being Sener and SHCP; that is o say, it goes against the principle of maximum self-regulation of public companies open to private capital. There is no denying that taxes, duties, and contributions account for more than 90% of hte primary balance in the entire period 1993-2016 and more than 100% in the time period 2014-2016. Pemex bears the fiscal, market, and corporate pressure with a debt of 100 billion dollars (Fitch Ratings, 2016) and a labor liability (pensions and other employment benefits) that amounts to 8.3% of GDP (ASF, 2015, pp. 22-24).

When it comes to debt, the Fitch Ratings sensitivity analysis (2016) underscores the likelihood of financial insolvency due to the high fiscal burden and the lack of containment policies. As a result of low oil prices in 2014-2016, much of Pemex's profits were taken for the federal budget, and debt grew to cover taxes; in 2017, the debt amounted to 125 billion USD, 25% more than it was in 2016 (Fitch Ratings, 2016). The costs to produce crude and gas are competitive; savings from there are not the way out. The problem with the debt is that it is being used to cover productive and operating expenses, including fiscal obligations. The biggest debt lines up with the time period 2008-2016, when taxes, duties, and contributions exceeded 100% of the primary balance, a situation which was backed by the federal government, given that financing proposals are examined by the SHCP to be included in the Financial Program for the General Public Debt Law, which is subject to the annual overall debt ceiling approved by the Congress (2014a and 2014b).

Pemex EPE needs fiscal treatment that is consistent with the purposes of competitiveness and efficiency (Terrazas, 2009, pp. 55-56), which prevents subordination to private capital. Fiscal pressure and the external market play the biggest role in influencing autonomy. Lightening the fiscal burden is a prerequisite for efficiency, but it will mean aligning the objectives and balancing powers within the Owner State, personified in the form of Sener and SHCP.

Table 3 Evaluation of Pemex EPE´S* Fiscal Treatment

*EPE: State Productive Enterprise.

Source: Crated by the authors based on: (OCDE, 2004) (OCDE, 2011) (OCDE, 2012) (Presidencia de la República, 2014) (Pemex, 2014a and b) (Pemex, 2015)

Strategic Partnerships with Other Oil and Petroleum Companies

The first Pemex EPE Business Plan (Pemex, 2015) set out to free the company from financial and capital restraints and get up and running a system of licensing, production contracts, and shared profits, as well as service contracts (FMP, 2015) in the crude and petroleum sectors (Pemex, 2014a and 2014b; Schlumberger, 2001, p. 22) (see Figures 2 and 3).

*Petroleum products: liquefied gas, propane, gasoline, naphtha, diesel, turbosine, gasoil.

Source: Created by the authors based on <http://www.pemex.com>

Figure 2 Oil Exports. Petroleum Product Exports and Imports*

Source: Created by the authors based on http://www.pemex.com

Figure 3 Value of Foreign Trade in Crude Oil, Petroleum Products, and Natural Gas

When it comes to petroleum products, the official argument about the risk of a national shortage ended up opening the gasoline market (freight forwarding, pipelines, new brands), now the fuel that accounts for 52% of total imports in the sector and the demand for which is burgeoning (Pemex, April 29, 2017), alongside increased production (assembly) of cars in Mexico and more vehicles on the road (INEGI, April 29, 2017) (see Figure 4).6

Source: Created by the authors based on information from http://www.pemex.com>

Figure 4 Gasoline Exports and Imports

In crude oil, via the subsidiary Pemex Exploración y Extracción the reform foresaw for the short term a scheme of partnerships centered around foreign companies; in petroleum products, via Pemex Logística, with national companies, in the form of commercialization service contracts based on the import of fuels. In crude oil, of the first three contracts signed with transnational companies, awarded in Round One, two were deepwater exploration projects. Investment in the first four years amounted to 100 million pesos, used to conduct exploratory studies that will define the commercial potential in the Norte Plegado of the "Lost Belt" of the Gulf of Mexico (Pemex, February 28, 2017). From Round Zero, there was the field development project, the first in the farming out model, between Pemex EPE and BHP Billiton, the Australian oil company that will drill the Trion Block in the Gulf of Mexico. The total project cost is 11 billion dollars, and first production is expected to be obtained in six years with over 100,000 bdp equivalent crude (Pemex, March 3, 2017). There is certain commercial viability, given that the Trion Block was discovered back in 2012 by Pemex and has 3P reserves (Possible, Probable, and Proven) worth 485 million barrels (see Table 4).

Table 4 Pemex EPE´S* Strategic Partnerships and Service Contracts

*EPE: Empresa Productiva del Estado.

Fuente: elaboración propia con base en la información de <http://www.pemex.com>

In petroleum products, the first six contracts are for gasoline supply (Pemex, March 6, 2017); in this case, Pemex Logística shall continue importing fuel and distributing it through the pipeline system, while private parties may use their own cargo transport. The opening of the pipelines is in process, and given the demand for construction and maintenance, it is expected that multinationals will come in to compete with Pemex. In refining, the impacts are premature. The transition is happening pursuant to sectoral performance; private parties move within the confines of importation, not transformation, a capital-intensive activity in which environmental regulations are a key factor for it to be viable (Romo, 2016, p. 141). Nevertheless, partnerships are needed to reactivate the National Refining System. In the immediate term, under the transportation, storage, and distribution permit model (not tied to pipelines), companies shall resell Pemex Logística gasoline, and they will not incur infrastructure expenses for facilities, as they will refurbish Pemex stations to their own brands (Pemex, March 12, 2017).

Table 5 Evaluation of Pemex EPE´s Strategic Partnerships and Contracts

*EPE: Empresa Productiva del Estado.

Fuente: elaboración propia con base en: (OCDE, 2004) (OCDE, 2011) (OCDE, 2012) (Presidencia de la República, 2014) (Pemex, 2014a y b).

CONCLUSIONS

Analyzing Pemex in its first years as an EPE reveals the aspects the State should consider to make it efficient and competitive, as oil continues to be a strategic resource for Mexico. However, at the management level, having monetized the oil wealth in the current Business Plan, one of the greatest risks resides in the gestation of concealed conflicts between the Sener's and the SHCP's objectives, institutions, which, as part of the division of roles determined by the CG model, personify the Owner State. The high and latent public dependency on oil revenue and Pemex's goal of autonomy could give rise to internal power struggles. The purpose of the reform to modernize without privatizing may, in practice, take on a complex political meaning, as the only way for Pemex EPE to self-govern is to reduce the fiscal burden, which is a far-off scenario, looking at the percentage of its profits the burden represents, especially in the wake of the 2014 reform. Everything indicates that the SHCP has a preponderant role, and not the Sener. For a sector considered to be strategic, practices are inferred from the parastatal stage, condemned by the government itself, with respect to the quality of the Management Board and fiscal treatment.

Looking at the partnerships with multinational companies, they tend to be concentrated on deepwater oil and gas exploration and extraction. In refining, there are no planned alliances; those that do exist are with national companies and remain within the scope of importing and supplying gasoline, which foretells and increase in foreign purchases as well as the presence of new players in the pipeline complex to transport fuel, a sector also opened up by the reform and previously exclusively the realm of Pemex. Time will tell whether the new gasoline brands guarantee better quality at lower prices, as expected. Likewise, whether the strategic partnerships will fulfill the objective of transferring knowledge and technology in the exploration and extraction links of the chain.

REFERENCES

Auditoría Superior de la Federación (ASF) (2015), Pemex. Informe del resultado de la auditoría practicada al pasivo laboral, México. [ Links ]

Buchanan, J. (2006), "Las presuposiciones normativas de la democracia", Isonomía. Revista de Teoría y Filosofía del Derecho, núm. 25, México, ITAM, 25 de octubre. [ Links ]

Caballero, E. y Tello, C. (2008), "Régimen fiscal de Pemex. Situación actual y propuesta de reforma", Economía Informa, núm. 354, México, UNAM-Facultad de Economía, septiembre-octubre. [ Links ]

Campodónico, H. (2007), La gestión de la industria de hidrocarburos con predominio del Estado, Santiago de Chile, Cepal, Serie Recursos Naturales e Infraestructura, núm. 147. Recuperado de <http://repositorio.cepal.org/bitstream/handle/11362/6351/S0900832_es.pdf;jsessionid=581E10093FD1FC6EC31B037EF442D961?sequence=1> [ Links ]

Casar, A. (2015), Anatomía de la corrupción en México, México, Centro de Investigación y Docencia Económica (CIDE), Instituro Mexicano para la Competitividad (IMCO). [ Links ]

______ (2016), Anatomía de la corrupción en México, México, Mexicanos Contra la Corrupción y la Impunidad (MCCI). [ Links ]

Casar, A. y Peres, W. (1988), El Estado empresario en México: ¿agotamiento o renovación?, Primera edición, México, Siglo XXI Editores. [ Links ]

Castañeda, A. y Kessel, G. (2003), "Autonomía de gestión de Pemex y CFE", Gestión y Política Pública, vol. 12, núm. 1, México, CIDE, enero-junio. [ Links ]

Centro de Estudios de las Finanzas Públicas (CEFP) (2014), Reforma Energética. Principales Modificaciones al Régimen Fiscal en Materia de Hidrocarburos. Recuperado de <http://www.cefp.gob.mx/publicaciones/nota/2012/julio/notacefp0462012.pdf> [ Links ]

______ (2017), Nota informativa 10 de marzo. Recuperado de <www.cefp.gob.mx> [ Links ]

Cornejo, R., Ortega, R. et al (2012), Pemex desde el punto de vista financiero en el entorno internacional, México, XVII Congreso Internacional de Contaduría, Administración e Informática, Ciudad Universitaria, México, 3, 4 y 5 de octubre de 2012. [ Links ]

Energy Information Administration (EIA) (2017a), International Geography. Recuperado de <http://www.eia.gov> [ Links ]

______(2017b), U.S. Refined Product Exports. Developments, Prospects and Challenges, Washington DC. [ Links ]

Fitch Rating (2016), Carga fiscal elevada empuja a Pemex hacia la insolvencia, México. [ Links ]

Fondo Mexicano del Petróleo (FMP) (2015), El FMP y la administración de los ingresos petroleros, México. [ Links ]

Friedman, M. y Friedman, R. (1980), Libertad de elegir, Madrid, Grijalbo. [ Links ]

H. Congreso de la Unión (2014a), Ley de Ingresos sobre Hidrocarburos, México, Cámara de Diputados. [ Links ]

______(2014b), Ley de Petróleos Mexicanos, México, Cámara de Diputados. [ Links ]

______(2014c), Ley de Hidrocarburos, México, Cámara de Diputados. [ Links ]

Huerta, C. y Ruíz, F. (2012), "Petrobrás: petróleo, finanzas públicas y desarrollo", Ola Financiera, vol. 5, núm. 12, México, UNAM-IIEC-FE, mayo-agosto. [ Links ]

Ibarra, D. (2008), El desmantelamiento de Pemex, México, Colección Economía UNAM Conciencia. [ Links ]

Instituto Nacional de Estadística Geografía e Informática (INEGI) (1994), Una visión de la modernización de México, México. [ Links ]

______ (2017) (29 de abril de 2017), Banco de Información Económica. Recuperado de <www.INEGI.org.mx/> [ Links ]

Meny, I. y Thoenig, J. (1992), Las políticas públicas, Madrid, Ariel. [ Links ]

Martínez, R. (1983), "Las empresas paraestatales", Problemas del Desarrollo, vol. 15, núm. 56, México, UNAM-IIEC. [ Links ]

Morales, E. y Dávalos, J. J. (2015), Reforma para el saqueo. Foro Petróleo y Nación, México, Ediciones Proceso. [ Links ]

Morales, R., López, F. y Cornejo, R. (2013), Análisis de la rentabilidad de las principales empresas petroleras en América: mito y realidad sobre la viabilidad financiera de Pemex, México, Asociación Nacional de Facultades y Escuelas de Contaduría y Administración. [ Links ]

Organización para la Cooperación y el Desarrollo Económicos (OCDE) (2004), Principios de Gobierno Corporativo, París. [ Links ]

______ (2011), Directrices de la OCDE sobre el Gobierno Corporativo de las Empresas Públicas, París. [ Links ]

______(2012), Gobierno Corporativo en América Latina. Importancia para las Empresas de Propiedad Estatal, París. [ Links ]

______(2014), Economic Survey: Canada 2014, Canada. [ Links ]

______(2016), Panorama Fiscal de América Latina y el Caribe 2016, Santiago de Chile. [ Links ]

______(2017), Revenue Statistics in Latin American and the Caribbean 1990-2015, París. [ Links ]

Palazuelos, E. y Vara, M. (2008), "Las reformas liberalizadoras del sector energético en la Unión Europea", Revista de Economía Mundial, núm. 18, Huelva, España. [ Links ]

Peñaloza, M. (2005), "Competitividad: ¿nuevo paradigma económico?", Fórum Empresarial, vol. 10, núm. 1, San Pedro, Puerto Rico. [ Links ]

Pérez, A. (2012), Camisas azules, manos negras. El saqueo de Pemex desde Los Pinos, México, Grijalbo. [ Links ]

Petróleos Mexicanos (Pemex) (2013), Programa Estratégico Tecnológico 2013-2027, México. [ Links ]

______(2014a), Reforma Energética en México y Pemex como Empresa Productiva del Estado, México. [ Links ]

______ (2014b), Migración de asignaciones a contratos y esquema de asociaciones (farm outs), México. [ Links ]

______(2015), Principales elementos del Plan de Negocios de Petróleos Mexicanos y sus empresas productivas subusidiarias 2016-2020, México. [ Links ]

______(2017) (15, 23 y 28 de febrero de 2017; 3, 6 y 12 de marzo de 2017; 7, 12 y 29 de abril de 2017; 10 y 12 de junio de 2017). Sala de prensa. Recuperado de <www.pemex.com.mx> [ Links ]

Presidencia de la República (2014), Proyecto de Decreto para la expedición de la Ley de Petróleos Mexicanos , México. [ Links ]

______(2015), Reforma Energética, México. [ Links ]

Rivas, L. (2002), "Nuevas formas de organización", Estudios Gerenciales, núm. 82, Cali, Colombia, Universidad ICESI, enero-marzo. [ Links ]

Rodríguez, V. (2010), "Contratos de servicios múltiples en Pemex: eficacia, eficiencia y rentabilidad", Problemas del Desarrollo , vol. 41, núm. 163, México, UNAM-IIEC , octubre-diciembre. [ Links ]

Romo, D. (2016), "Refinación de petróleo en México y perspectiva de la reforma energética", Problemas del Desarrollo , vol. 47, núm. 187, México, UNAM-IIEC , octubre-diciembre. [ Links ]

Schlumberger (1998), Soluciones submarinas. Recuperado de <https://www.slb.com/~/media/Files/resources/oilfield_review/spanish00/spr00/p2_19.pdf> [ Links ]

______(2000), Soluciones para los problemas de la construcción de pozos en aguas profundas. Recuperado de <https://www.slb.com/~/media/Files/re-sources/oilfield_review/spanish00/sum00/p2_19.pdf> [ Links ]

______(2001), Riesgos medidos. Recuperado de <https://www.slb.com/~/media/Files/resources/oilfield_review/spanish00/win00/p20_35.pdf> [ Links ]

Secretaría de Hacienda y Crédito Público (SHCP) (2014), Manual de Contabilidad Gubernamental para el Sector Paraestatal, México. [ Links ]

Serrano, J. (2001), La naturaleza ética de las políticas públicas, Santiago, Universidad Pontificia de Chile. [ Links ]

Smith, A. (2002), La riqueza de las naciones, Madrid, Alianza Editorial. [ Links ]

Tello, C. (1989), "La participación del Estado y la empresa pública", en A. Cervantes Delgado (coord.), Ensayos sobre la modernidad nacional. La empresa pública en la modernización económica de México, Primera edición, México, Diana. [ Links ]

______(2015), Sobre la baja y estable carga fiscal en México, México, Cepal, Serie Estudios y Perspectivas. [ Links ]

Terrazas, R. (2009), "Modelo de gestión financiera para una organización", Perspectivas, núm. 23, Cochabamba, Bolivia, Universidad Católica Boliviana San Pablo, enero-junio. [ Links ]

2The water depth parameters were taken from Schlumberger (2000, 2001).

3In total, there were nine laws enacted and 12 existing laws amended for the oil and electricity sectors. New for the hydrocarbon sector: 1) Hydrocarbon Law; 2) Petróleos Mexicanos Law; 3) Energy Matters Coordinating Regulatory Bodies Law; 4) Hydrocarbons Revenue Law; 5) Mexican Oil Fund Law for Stabilization and Development (Pemex, 2014a).

4Subsidiaries of the corporate Pemex EPE: 1) Pemex Exploración y Producción; 2) Pemex Transformación Industrial; 3) Pemex Perforación y Servicios; 4) Pemex Logística; 5) Pemex Cogeneración y Servicios; 6) Pemex Fertilizantes; 7) Pemex Etileno (Pemex, 2015, p. 30).

5The chair of the Management Board of the corporation Pemex EPE is the lawyer Pedro Joaquín Coldwell (since 2012), member of the Institutional Revolutionary Party (PRI). His professional track record prior to this appointment includes serving as a local and federal representative, local secretary of state (Secretary of Government in Quintana Roo), federal secretary of state (Tourism), and local congressional representative and senator. The role of general manager is held by Dr. José Antonio González Anaya, who is an economist who graduated from the Massachusetts Institute of Technology (MIT), former general director of the IMSS, and who previously held several jobs at the SHCP (Pemex, April 7, 2017).

6In the year 2000, total car production was 1,000,889 thousand units; in 2014, it was 3,000,219 thousand units. In 1980, the total number of vehicles on the roads was 5,758,330; in 2012, it was 34,874,655 (INEGI, April 29, 2017).

*The authors would like to acknowledge the Conacyt Sectoral Fund - Secretariat of Energy - Hydrocarbons, from the National Science and Technology Council (Conacyt), Mexico, for supporting the project. Likewise, the BUAP Doctoral Program in Development Policy Economics for providing all of the facilities to carry out the research.

Received: June 14, 2017; Accepted: October 31, 2017

texto em

texto em