Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Problemas del desarrollo

versión impresa ISSN 0301-7036

Prob. Des vol.48 no.191 Ciudad de México oct./dic. 2017

Articles

Innovation and Development: A Program to Stimulate Regional Innovation in Mexico

1 Autonomous University of Baja California, Mexico. E-mail addresses: moctezuma@uabc.edu.mx: slopez56@uabc.edu.mx; and munagaray@uabc.edu.mx, respectively.

This paper evaluates the Innovation stimulus Program (PEI) in Mexico through its contribution to the Baja California Regional Innovation System (SRI) between 2009 and 2013. Using additional behavior methodologies, we analyzed the within-company effect and the network effect, as well as the degree of connectivity and number of interactions between stakeholders from the worlds of business, science, and government involved in the SRI. The results reveal that by making funding for innovative projects subject to connections between actors from the realms of business and science, the PEI is helping fortify the SRI by incentivizing 15% of its interactions.

Keywords: Regional Innovation System; regional development; companies; Baja California

El presente artículo evalúa el Programa Estímulos a la Innovación (PEI) en México, a partir de su contribución al Sistema Regional de Innovación (SRI) de Baja California, entre los años 2009-2013. Mediante las metodologías del comportamiento adicional, se analizan los efectos al interior de las empresas, y de redes, se analiza el nivel de vinculación e interacciones entre los actores empresariales, científicos y gubernamentales del SRI. Los resultados muestran que al condicionar el financiamiento de los proyectos de innovación a la vinculación de los actores empresariales y científicos, el PEI está contribuyendo a fortalecer el SRI incentivando el 15% de sus interacciones.

Palabras clave: Sistema Regional de Innovación; desarrollo regional; empresas; Baja California

Clasificación JEL: F23; H32; O31; O38; R11

Cet article évalue le programme des stimulations à l’innovation (PEI) au Mexique, en fonction de sa contribution au système régional d’innovation (SRI) de Baja California entre 2009-2013. Grâce aux méthodologies du comportement supplémentaire les effets sont analysés au sein des entreprises, et celui des réseaux analyse le niveau de connexion et des interactions entre les acteurs entrepreneuriaux, scientifiques et gouvernementaux de l’SRI. Les résultats révèlent qu’en conditionnent le financement des projets d’innovation à la liaison entre les acteurs commerciaux et scientifiques, le PEI contribue à renforcer l’SRI avec 15% de ses interactions.

Mots clés: Système régional d’innovation; développement régional; entreprises; Baja California

Este artigo avalia o Programa Estímulo à Inovação (PEI) no México, com base em sua contribuição para o Sistema Regional de Inovação (SRI) da Baja Califórnia, entre 2009-2013. Através das metodologias do comportamento adicional, os efeitos são analisados dentro das empresas, e da redes, analisando o nível de conexão e as interações entre os atores empresariais, científicos e governamentais do SRI. Os resultados mostram que, ao condicionar o financiamento dos projetos de inovação à vinculação de atores empresariais e científicos, o PEI está ajudando a fortalecer a SRI incentivando 15% de suas interações.

Palavras-chave: Sistema Regional de Inovação; desenvolvimento regional; empresas; Baja Califórnia

本文通过分析2009-2013年期间北下加州地区创新系统,评估了墨西哥创新激励项目的贡献。根据附加行为方法,研究了对企业内部所产生的效应;根据网络方法,探讨了创新系统中企业家、科研人员和政府部门人员之间的联系与互动。结果显示,通过对创新项目相关联企业家和科研人员的金融资助,创新激励计划(PEI)有助于促进地区创新系统(SRI)发展,使得人员之间的互动增加15%。

关键词 地区创新系统; 区域发展; 企业; 北下加州

INTRODUCTION

The policies enacted through science and technology (S&T) stimulus programs impact corporate competitiveness and productivity in accordance with the regional structures in place to support science. They are mainly designed to foster innovation and get innovation into the productive system, although they have a wide array of effects, because each region is unique.

In 2009, Mexico launched the Innovation stimulus Program (PEI, in Spanish), encouraging companies that want to be more competitive and improve their processes and products to interact with Institutes of Higher Education (IHE). This undertaking has driven learning and prompted major changes within the companies that have taken part, not to mention had an impact on the Regional Innovation System (SRI, in Spanish).

In 2009, Á. Calderón (2009) evaluated the aggregate results of the first PEI, with an emphasis on design, but without considering the regional aspect. In 2013, the National Social Development Policy Assessment Council (Coneval, 2013) evaluated the PEI at the nationwide level between 2011 and 2013, although the results were not wholly attributable to the PEI intervention, because although the approved projects were scientifically and technologically far-reaching, for only 48% of them was it possible to conclude that the support from the National Science and Technology Council (Conacyt) had been decisive to their success.

In order to take a closer look at region-wide impacts, in this paper, we will analyze the PEI in the time period 2009-2013 in the Mexican state of Baja California. The idea is to learn about the impacts on companies that participated in the program and how they reflect back on the SRI, through the creation of knowledge networks between the companies benefiting from the program and the science and technology structure underlying innovation. The PEI's centralized funding structure means that each region tries to obtain the highest allocations possible to shore up specific aspects of their development, such as: productive specializations, innovative vocations, support for clusters, and human resource training for the disciplines in highest demand (FCCYT, 2006).

Aiming to demonstrate that the PEI does indeed help strengthen the SRI, by incentivizing projects that boost interaction, in the first section, we review the background of the program, followed by a literature review of the nature of SRIs and the economic advantages of interacting within a network that give rise to innovative dynamics. In the third section, we introduce the methodologies to analyze additionally and social networks, which are relevant to studying the conduct and interactions of companies and the IHEs, and, in the fourth section, we analyze the results, stressing interactions and connectivity across the network. Finally, we discuss the results and offer our conclusions, underscoring the degree to which the PEI has truly contributed to the connections in the system.

BACKGROUND

On the Mexican Fiscal Stimulus (EF) Program for Technology Development and Innovation (DTI) to the Innovation Stimulus Program (PEI)

The Fiscal Stimulus (EF) program in Mexico was born of an initiative from the Mexican Association of Applied Research and Technology Development Executives (ADIAT) in an effort to increase private investment in domestic research and development (R+D) spending and tie it to the IHEs (Sánchez, 2008). To do so, they proposed a tax credit of 20% on annual R+D investment for large companies and 35% for small- and medium-sized enterprises. Nevertheless, the program did not lead to the expected results, and from the beginning it ended up benefiting large companies, mainly multinational, in an outsized fashion, as in 2005 they received 60% of the stimulus associated with the program. Its greatest weakness was its lax rules for which projects could be considered R+D, meaning that on many occasions, marginal innovations or innovations developed in other countries received support (OCDE, 2010).

Between 2001 and 2006, the number of participating companies grew from 193 to 1,045; the number of projects went from 679 to 1,616, and the stimulus money granted increased from 416 million to 4 billion pesos, with mainly large and foreign-capital-funded companies in the automotive, chemical, information technology, pharmaceutical, metal-mechanics, food, electronics and electrical sectors benefiting, altogether accounting for a little over 80% of the stimulus money approved in 2006 (Cámara de Diputados, 2011). The diagnosis found that Mexican companies were reinvesting little in research and lacked the human resources needed to do so, so their products were low-productivity and did not have a direct impact on their international competition. When companies fail to consolidate in the education-science-technology-innovation chain, their demand for technological innovation and scientific knowledge is very low. This is rooted in systemic failures of coordination, and the high costs of the innovation system prevent strategic networks and alliances between companies and IHEs from emerging

The key recommendations made were to add in new tax credits, but also to set more rules to prevent large and multinational companies from behaving opportunistically. To do so, the system to evaluate the projects companies submitted underwent changes, with new methods to validate the information companies provided and give preferential treatment to MSMEs, further encouraging ties between them and the IHEs, to make the formation of partnerships more efficient and rapid.

In 2009, the PEI was implemented with the supplementary economic stimuli. The beneficiaries were all of the Mexican companies enrolled in the National Registrar of Science and Technology Companies and Institutions (RENIECYT), which are companies that work on Research, Technology Development, and Innovation (RTDI) on their own, in partnership with an IES, and/or in partnership with national research centers and institutes (СІ).

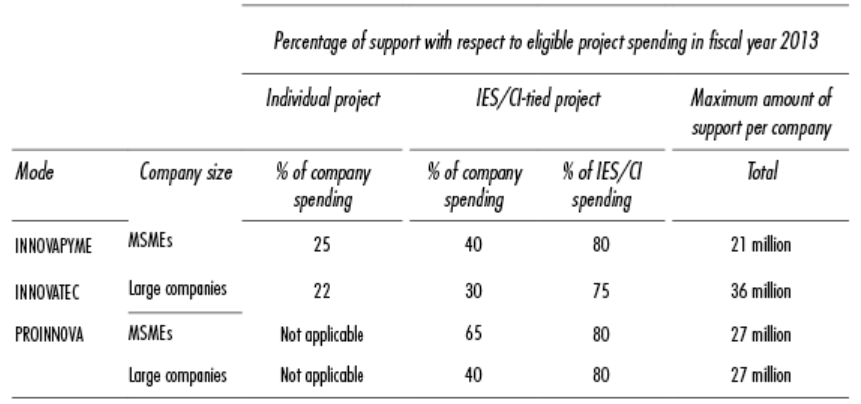

The PEI is composed of three sub-programs: INNOVAPYME, which supplements investments by micro-, small-, and medium-sized enterprises with public money;2 and INNOVATEC, which incentivizes investment in RTDI for large companies. Both help companies obtain patents, products, processes, or novel services that will improve their competitiveness and in so doing foster the competitive advantages of each region or state in the country. And, third, PROINNOVA, which drives the flow of knowledge across corporate entities of all sizes and IHEs and CIS, and fuels the creation and maintenance of innovation networks or strategic alliances to develop projects, in knowledge precursor fields that translate into high-added-value products, processes, or services with a regional, sectoral, and social impact.

The PEI is centrally managed by Conacyt, with support from the Secretariats of Economic Development (SEDECOS) and the State Science and Technology Councils, which are in charge of releasing the calls for applications, providing guidance to companies, and organizing and checking up on the assessment process.

LITERATURE REVIEW

The innovation-systems approach recognizes that innovation no longer exists in isolation, but is rather now part of a social construct with visible economic effects, in which the knowledge-creating institutions that were heretofore not recognized in the market in reality facilitate the movement of innovations into the companies that use them (Nauwelaers, 1995).

The constant interaction between supply and demand leads to a feedback process, as part of the supply is influenced on a daily basis by the demand for knowledge, to incorporate it into different realms of the economy, leading to interactive learning among the different players involved in the production and exchange of knowledge.

Both approaches aim to involve the actors to participate in the knowledge-creation dynamics. Although the channels of exchange are open, they are limited because the agents choose how and with whom to relate, based on trust and on their needs, taking into account risks, costs, and benefits. A networks-vision makes it possible to understand the forms, channels, and means by which the different members of the system engage in exchanges in the regions, based on social capital and existing institutional capabilities (Méndez, 2002).

In recent years, regions and the companies based in them have undergone a reconceptualization, because due to the effects of globalization and market openness, mounting competition has revamped their roles. The debate is open on two fronts: the first is centered on a company's internal capacity to adapt to new changes, aiming to improve its ability to innovate in the production process, or its ability to access new markets in unconventional ways, and/or produce new, improved, and redesigned goods (Maskeli and Malmberg, 1999). The latter pays attention to the economic success of some regions and their increased specialization in international trade, so rather than focusing on companies individually, the stress is placed on the productive systems in which the companies operate with external bonds and relationships (Lawson, 1999). The concepts of smart regions or territories that learn are linked to the role of knowledge and collective learning as strategic resources, where proximity is the relevant factor to generate these dynamics (Audretsch and Feldman, 1996).

An innovative territory becomes a primary source of resources thanks to decisions and actions that make this possible (Rozga, 2006); and is characterized by the presence of a specialized productive system, where a good portion of companies are working on technological innovation. Territories that learn reflect the potential capacity of local actors to creatively mobilize existing resources, a the result of the knowledge accumulated in private and public, educational, and research institutions, to foster specialized business and regional partnerships.

In 1979, Z. Grilinches evaluated the contribution of R+D to the total productivity of factors in the economy of the United States. This study permitted A. Jaffe (1989) to modify the production function to analyze the importance of geographical proximity in the capture and harnessing of technological externalities, concluding that the existence of research at universities does indeed have significant effects on dispersion. This, in turn, allowed L. Anselin et al. (1997) to review the degree of spatial spillover between university research and high-tech innovations in the United states, finding that large companies are less innovative than those that are not.

Analyzing the drivers of innovative capacity in the regional Spanish R+D system, Baumert and Heijs (2002) concluded that innovation-generation in a region is positively dependent on the innovative efforts made over the size of technology businesses, the degree of innovative culture, and existing cooperation. Nevertheless, estimating the connectivity between Spanish SRIs with a factor and cluster analysis, X. Alberdi et al. (2014) concluded that asymmetric behavior generates different system failures and justifies the design of tailored corrective measures in each region observed.

In Mexico, E. Santos (2006) evaluated to what degree the fiscal stimulus program generated an additionally effect on corporations' behavior in R+D activities and collaboration with other enterprises and educational and research institutions. Their results signal that at the first level, companies exhibited additionally when they developed significant organizational capabilities; at a second level, it led to lessons learned for selecting projects and better organizing them to diminish time and costs.

Meanwhile, Calderon (2009) evaluated the first call for applications by the innovation stimulus program on the immediate additionally effects on spending on technology research and development at companies, with an emphasis on the impact of the program on number patent registrations as the indicator of innovation. To do so, the study draws a comparison between two results for a single company: 1) when the company is exposed to intervention, and 2) when the company is not. It also compares the performance of participating companies with a similar group of companies that were eligible to take part in the program but chose not to. These results point to a positive and significant impact on the additionally of Technology Research and Development Spending (TRDS) in companies with 250 or fewer employees, but with no additionally on the likelihood of patent filings.

Ruiz (2008) analyzed the creation of innovative environments through productive capacity-building thanks to state efforts, linking regional environments to international innovation networks built through foreign investment. Thus, the study concluded that the companies with the greatest capacity to innovate were those with economies of agglomeration, where the State had contributed to shaping innovative inputs, meaning that a network development scheme would make it possible to implement them on a wider scale.

G. Ahuja's (2000) pioneering work performed an evaluation of the effect of network relationships on innovative activities at 97 leading companies in the Western European chemicals industry, and concluded that although both indirect and direct ties have a positive impact on innovation, the indirect ties are an efficient and effective way to maximize network benefits, because they represent benefits without the cost of maintenance for companies.

U. Canter et al. (2010) evaluated the influence of geographical and cognoscitive proximity on knowledge trickle-down effects in three SRIs over a three-year time period, finding that an ample regional knowledge base augments knowledge flows and the incentives for actors to interact with each other.

In Mexico, R. Casas and M. Luna (2001) reviewed the process by which potentially favorable knowledge networks are built for regional innovation, beginning with public stratégies and actions designed to foster collaboration with IHEs. They conclude that although spaces for innovation are built in geographical proximity to the stakeholders, they can grow to regional, national, and international dimensions, depending on their degree of connectivity.

METHODOLOGY

Impact Approach

First, we look at the effect of the PEI inside of companies using the additional behavior methodology, and then conduct a social network analysis to specify the degree of interaction between companies and IHEs and CIS in the regional space (Lundvall, 2005).

The concept of additionality justifies state intervention in order to furnish sufficient investment to incentivize innovation projects (Busom, 1991), in light of market failures that inhibit investment due to imperfections in the capital market; the difficulty involved in appropriating the benefits of innovation because of how easy it is for other companies to copy innovations; and the high cost of learning facing companies that want to develop new products (Grossman, 1990).

Interaction and coordination across agents within an SRI happens in recognition of the market failings that are inherent obstacles to the innovation process itself (Heijs, 2012). However, governmental leverage can go beyond merely offsetting low private-sector investment in R+D (Griffiths, 2012) and can actually seek to change the behavior of the agents so that they interact more and better (Larosse, 2011).

Stimulating the SRI generates regional social capital that helps forge bonds and shared rules that facilitate interaction within and across groups (Schuller, 2005). As a consequence, the most significant additionality effect in an SRI is the fostering of collaboration across companies, governmental agencies, IHEs and eis (Falk, 2006), via effects on investment, engagement, and competitiveness (Mungaray et al, 2013).

Data Sources

The minutes of the State Evaluation Subcommittee (SEE, in Spanish) of the PEI in Baja California, Mexico were used to construct a database for the time period 2009-2013, looking at the projects that were approved in each round of calls for applications. Only those that had some type of partnership pursuant to the network methodology described here were considered, leading to a total of 157 projects. The SEE is charged with reviewing the project applications to see if they are relevant and meet the criteria for quality, Implementation, and Impact. If they pass, they are sent for evaluation by three experts chosen from Conacyt's Registry of Accredited Evaluators (RCEA). These minutes summarize the information related to the allocation of funds to finance the program, the scores given by the evaluators, and the amounts approved per project.

To identify the level of additionality, information was gathered from a sample of 63 beneficiaries (designed with a confidence level of 95%), to which an electronic survey was administered for each project. To analyze the networks, an adjacency matrix was constructed to identify the relations between the actors, processed in the UCINET 6 program to find where networks exist via a graphic construction. This made it possible to identify levels of connectivity and centrality in the relations, interactions, choices, and structures built by the individuals and organizations to which they belong, making social capital prevail over human or individual capital (Wasserman and Faust, 1994; Velazquez and Gallegos, 2005, Souza and Villavicencio, 2011 ).

ANALYSIS OF RESULTS

Local Research Support Infrastructure

Increasingly, state support for research in Mexico has become centralized in Conacyt's federal governmental money management system. In order to access this money, everyone from state and municipal authorities to universities, corporations, and individuals must enroll in the RENIECYT.

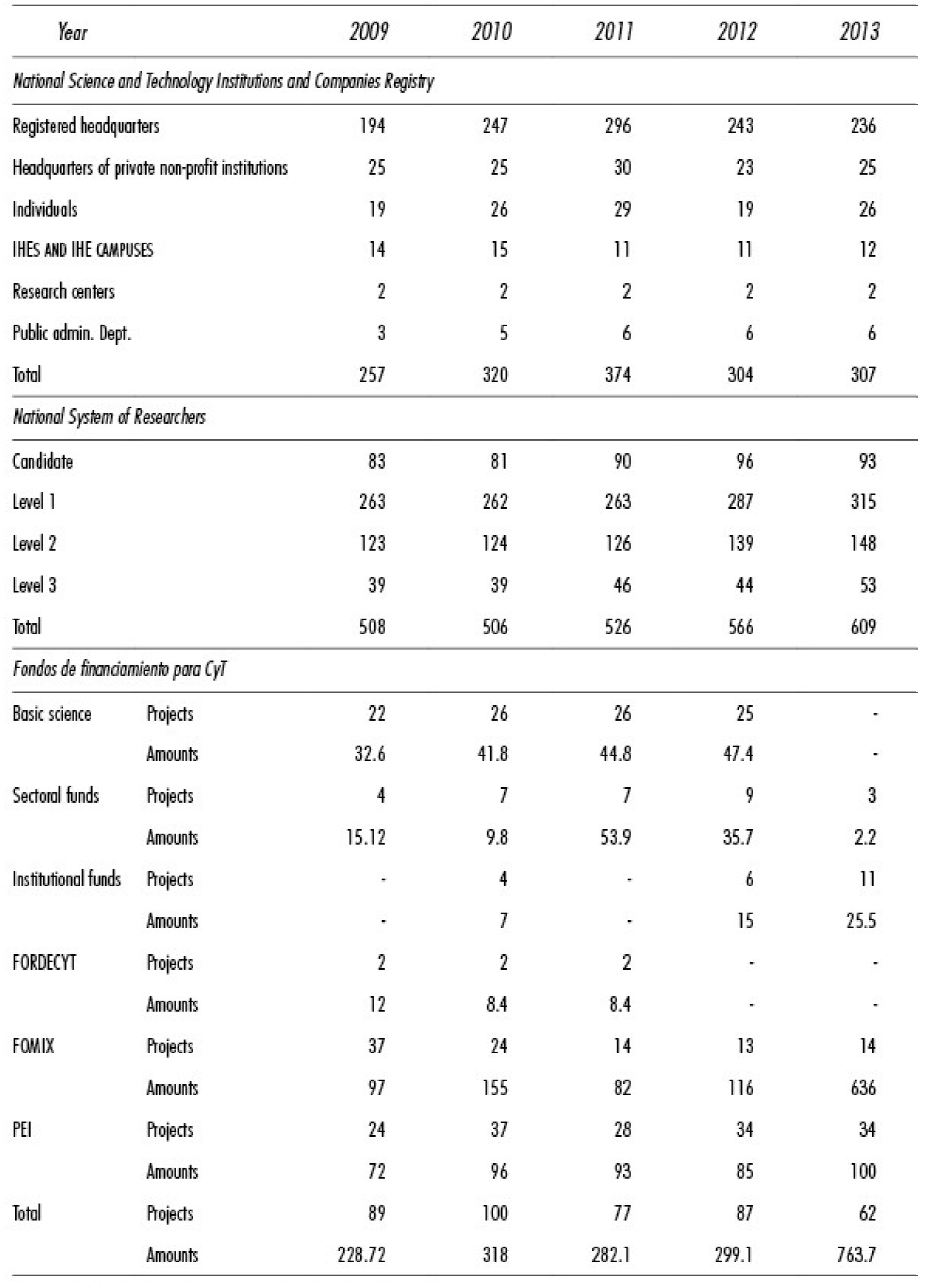

Research capacity to find innovative solutions to the challenges and problems facing society and corporations is measured by the number of professional scientists belonging to the National System of Researchers (SNI, in Spanish), whose quality of productivity is evaluated by their peers. In Baja California, the number of scientists enrolled in the SNI grew in the time period 2009-2013 by 17%, going from 508 to 609 researchers, and propelling Baja California to eighth on the national ranking, home to 3.1% of the country's researchers. Level 3 and the field of physical mathematics grew the most, with growth rates of 17% and 46%, respectively.3

In 2013, there were 28 IHEs in Baja California offering 194 graduate school programs. Of them, only 82 were recognized in the National Quality Graduate Program Registry (PNPC): 34 are federal programs run by public research centers and technology institutes; 45 are housed at the Autonomous University of Baja California (UABC), and only two are private institutions. As a result, the number of Conacyt grants for quality programs in Baja California grew from 56% to 81% for master's degrees and fell 13% for doctoral degrees, placing Baja California fifth on the list of number of grants nationwide.

Between 2009 and 2013, 157 PEI projects were funded in Baja California for a total cumulative amount of 446 million pesos, putting Baja California in seventh place in Mexico. Of these, 57 projects were in INNOVAPYME, 45 in PROINNOVA, and 36 in INNOVATEC. The cumulative approval rate was 45% of the proposals, with standout performance among micro- and small enterprises in the telecommunications, information technology, food and beverage, agroindustry, and pharmaceutical industries, and among large companies in the aerospace and food and beverage sectors, with 49%.

Additionality Indicators

Investment

The factor known as known as project additionality elucidates whether a public policy is truly acting as an incentive for companies to engage in science and technology activities. The fact that 61 % of the projects would have been carried out anyway with or without governmental support indicates that the public policy was décisive for 39% of the innovation and development projects. To access the grants, 100% of the companies had to change their original protocols to adapt to the criteria and rules for technology content, degree of engagement with others, outputs, and project users. Some companies submitted applications for more than one project, and many would have been performed anyway even without governmental support, merely as these companies' response to their priorities and growth strategies, market diversification, or short-term production problems' Projects that did not end up being carried out were related to long-term needs that could be postponed.

Networking

The companies with the most projects approved include Honeywell, in aeronautics and the automotive sector, with 20 projects; Argus, Hielo Cachanilla, and Fevisa, with 8 projects each; Skyworks with 7; and SBL Pharmaceutical with 6. Altogether, there are 157 projects with 189 partnerships, not least because in order to win a grant from PROINNOVA, applicants are required to present at least one or more partnership with an IHE or СІ, which did push 72% of the projects to improve their engagement with others. This led to the forging of lasting relationships; the facilitation of knowledge exchange; the creation of more innovative and higher-quality outputs; and the rethinking of processes that help to make production more efficient. By creating an environment of endogenous innovation born of entrepreneurial initiative and networking across different agents and the environment in which the innovation process takes place, the SRI is made ever stronger (Mungaray and Palacio, 2000). Several companies went even further, and opted to invite researchers from different IHEs or CIS for summer research stays, or even to develop other projects outside of the project grants they received, as was the case of Skyworks.

Interaction with researchers and students

Seventy-two percent of the projects received support from an outside researcher and the rest were performed using the company's own staff. On average, three researchers took part in each project, with a range of between 1 and 12 researchers per project, and a total of 111 researchers participating in performing studies, conducting specific analysis, or using laboratories. Fifty-eight percent of the projects involved students: 18 undergraduate students in 7 projects, 17 master's degree students in 11 projects, and 5 doctoral students in 3 projects. This participation comes with a dual benefit: the immediate, because they are able to put their knowledge and training into action. And the medium-term, because people received training in specialized profiles for the future. It is interesting to note that 35% of the projects were performed by the public state university, the UABC, while the top-performing private institution was behind 21% of the projects.

Dissemination

Local or regional conferences were the most frequently-used method of disseminating researcher, either to share project results or to give updates on how they were developing. These sorts of opportunities are essential to the SRI, because the flow of information motivates other companies to engage in similar business endeavors and triggers innovation. Interviews or media reports reach a much wider audience, and help to create a perception among the citizenry as to the benefits of science and technology for corporate innovation.

Competitiveness

A new product directly boosts corporate revenue in the medium term, after it is launched to market, and helps the company attain a better market position, whether the product is entirely novel or an improvement over an already-existing one. Fifty-one percent of the projects resulted in at least one new product thanks to the research, with a range of between 1 and 23 products per project; the spillover effect within the company into new ideas or improvements in other products leads to synergies that can have even more far-reaching effects.

A new process within a company can prompt at least two effects: 1) raise the level of productivity by changing or improving how things are done, or 2) lead to savings on man-hours or reduce the amount of inputs used. In both cases, the cost of the final product is decreased and the products attain a better market position. The survey shows that 114 new products resulted from the projects. Most companies only obtained 1 new product, but in the most extreme case, one company developed 23. In 74% of the projects, employment rose or is expected to rise in the future.

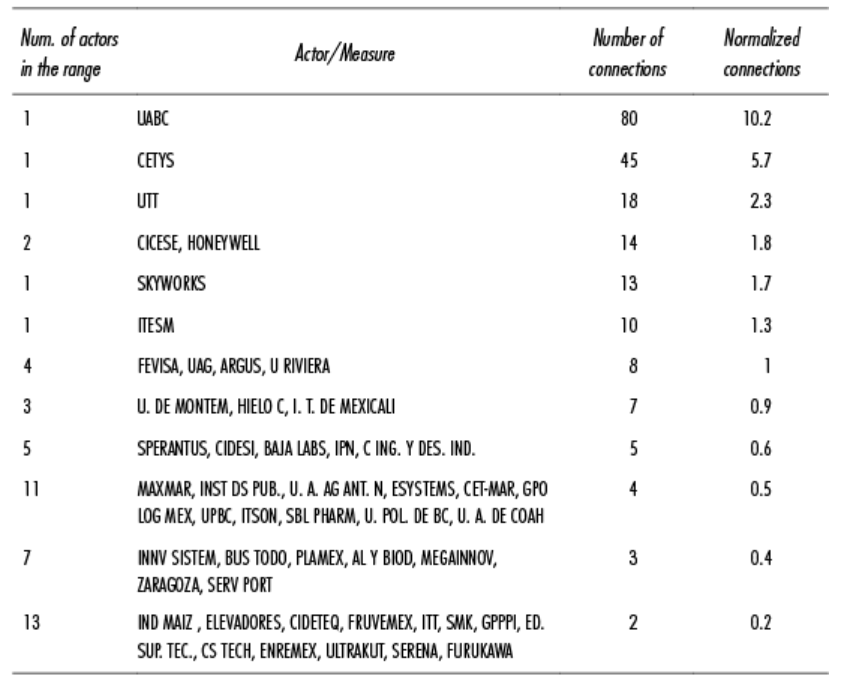

Network Indicators

The system is composed of 62 companies, 18 universities, and 6 research centers (14 local and 10 foreign), for a total of 82 actors. The group of companies can be broken down into three categories: 35 micro- and small enterprises, 15 medium-sized, and 12 large. Most of the relationships in the network are two-way, because there are reciprocal connections between companies and IHEs in the projects with more than one partnership. By making the company the project coordinator, the projects become centralized in a way that does not encourage IHE-IHE relations, because the relations only exist separately between IHEs and companies. This corporate weight fragments projects where each university plays its own role, because each university will only know about a small piece of the larger project they are working on. This mechanism serves to protect information on the companies' strategies and projects, because even when they sign confidentiality agreements with the IHEs, there is a natural tendency to put protections in place in light of scholars' propensity for disseminating knowledge through publication.

Network connectivity

The total number of connections that the PEI could possibly have generated in the time period 2009-2013 was 7,656. Of them, 65% are between companies, 10% between IHEs, and 25% between companies and IHEs. Given the rules of the PEI game, which do not incentivize company-to-company connections, the total number of possible connections falls to 2,679, and as such, in the 382 connections made between players taking part in the PEI, the SRI connectivity index in Baja California amounts to 15%.

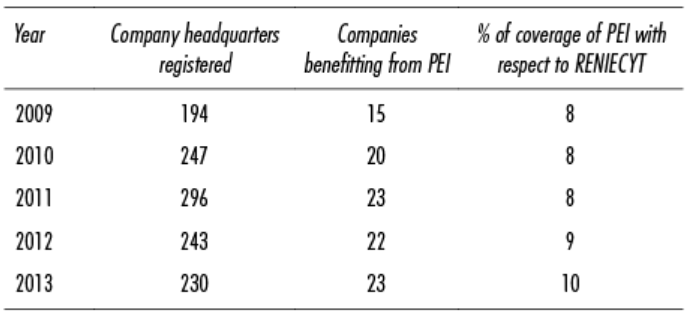

The analysis of the coverage of PEI projects approved with respect to the companies enrolled in the RENIECYT produces a network coverage index of around 8% and 10% per year. Some of the reasons that companies choose a partnership with an educational institution in particular include trust, reputation, specialization, and the speed of forming the relationship. A network with many connections means that individuals are highly connected and exposed to more diverse information (Hanneman, 2002). By having more resources and different prospects for problem-solving, they are able to mobilize their resources faster.

Table 3 Percentage of Coverage of Companies in Baja California for the PEI 2009-2013.

Source: Created by the outtrars with doto from PEI ond Conacyt.

The actor with the most connections in the network is the state public university UABC, with 80 connections, which places it at the center of the innovation system. The other standout case is that of Honeywell, with 14, and Syworks, with 13. More connections mean more trust and better potential for future relationships with new actors in the network.

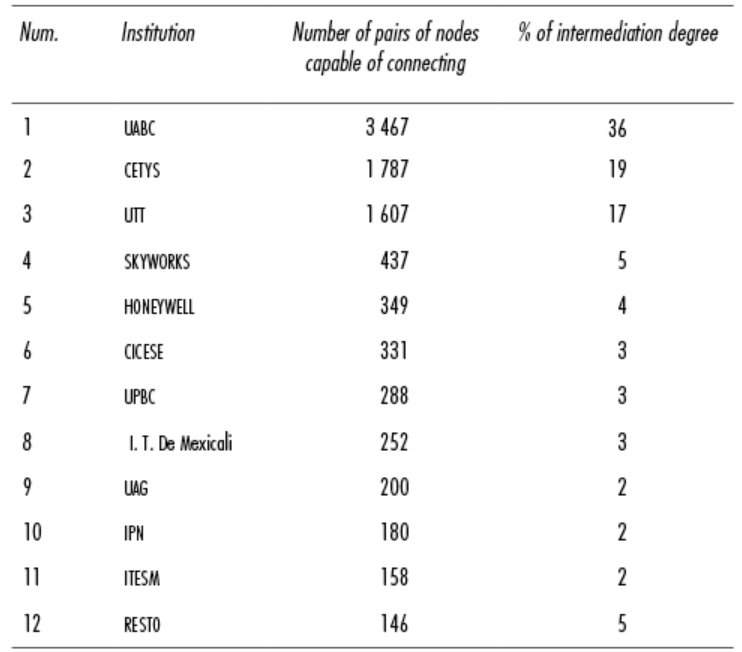

Intermediation

The most connected actors have a positional advantage and more options to meet their needs and access more resources from the network. The fact that UABC has such a high degree of intermediation (36%) makes it a bridge actor, with more control over information, communication, and the relations between other actors. With the right strategy, this could continue to grow in the short term.

For a country like Mexico, it is very meaningful for a public state university (UABC) to have such a high degree of intermediation within an SRI. in the absence of connections between companies, the university can serve as a strategic bridge for networking among companies, as it is the largest gathering space for the demand for innovation on the part of corporations. This has made way for graduate projects focused on industry, widely disseminated in developing economies, where different companies agree to collaborate on training personnel by taking part in joint graduate school programs, which further raises the level of intermediation (McWilliam et al., 2002). Such is the case of UABC and Skyworks.

Degree of closeness

The high degree of closeness indicates that the nodes were very much able to connect with the rest of the actors in the network with little effort, which is an indicator of learning, help, or influence within an SRI (Hanemman, 2002). This is because IHEs are the group that foster the most nodes with other actors in the network, with 14 nodes, while companies were located in the middle category, mainly.

It is well known that spatial concentration stimulates both formal and informal communication, facilitating the rapid spread of information and collective learning as the factors behind the success of regional competitiveness predicated on continuous innovation. Proximity emphasizes the importance of the agglomeration effect and helps foster shared practices and facilitate the flow of different types of knowledge as a central aspect of the SRI. IHEs and CIS with a high degree of closeness create better access to companies in exchange processes and spearhead innovation business, because they are the biggest promoters of the dynamics of proximity and exchange with companies or IHEs outside of the SRI.

DISCUSSING THE FORMATION OF A REGIONAL INNOVATION SYSTEM (SRI) IN BAJA CALIFORNIA

The proximity term elucidates the innovation process through the links between science and industry and the relationships between users and producers in the innovation system. This interest in proximity is tied to burgeoning evidence that technological learning at corporations is a function of the existing conditions in the education system, their capacity to develop technology, and their ability to network with the local environment (Cimoli, 2000); but above all, their potential to forge frequent and regular interactions with inhabitants in the area (Nardi and Pereira, 2006). Proximity makes it possible to form bonds between institutions or individuals that share common spaces, generates dynamics and relationships with specific interests, and improves actors' local capacity to take initiative in response to events. These dynamics help actors develop the capacity to learn and, when induced by a catalyst agency, which may or may not be governmental, make this learning lasting and help it grow over time.

Both J. Ramos (2011) and A. Mungaray et al. (2011) observed that the engagement between institutions of higher education and the business community are underpinned by greater interaction around useful knowledge that fosters better connectivity in R+D and augments competitiveness. Although it is not possible to speak of a fully organized SRI in Baja California yet, in the time period 2009-2013, there was indeed a public policy framework with short-, medium-, and long-term goals. The state Science and Technology Program (РЕСуТ ВС, 2010) is one manifestation of that, and the Research, Innovation, and Technological Developnient System of the state of Baja California (SIIDEBAJA) is another, a mechanism to strengthen intra- and inter-agent connections via economic incentives such as Conacyt's PEI and, to a lesser extent, local resources. However, the strengths of the region in terms of CIS, IHEs, researchers, the business sector, and regional science policy act as such because the PEI fosters greater linkages for collaboration among actors through the research and innovation projects it supports.

Although it would be important to understand total connectivity in all of the ways through which companies, IHEs, and CIS undertake relationships and exchanges, the results show that the PEI contributes to 15% of the relationships in the SRI. They can be divided into those that are newly arisen and those that the program is merely reinforcing, where there was already prior contact, because in some cases, universities and companies are constantly collaborating to present joint projects in more than one call for applications. What is important about the PEI is that it allows networks to emerge horizontally in the system, without any one actor being dominant over another, which is beneficial in terms of its objectives, and keeps negotiation processes open. The foregoing is also very important because it stimulates companies to access science and technology products through the market without upsetting university autonomy and research freedom. Due to the prestige of the regional institutions and because they have the staff, infrastructure, and study program that are pertinent to corporations' needs, most of the links companies forge are with IHEs or CIS located in the region, and only a very small percentage with external actors.

CONCLUSIONS

Although a good percentage of the projects would have been carried out even without governmental support, compared to the results of Mungaray et al. (2013), the results of the program have improved, as the percentage of projects that would have been canceled if they had not received governmental support rose from 18 to 39%. Likewise, the subsidies awarded to companies changed the perception of ties and the diversification of these ties, encouraging projects to invest more and pushing them to be more productive. The annual evaluation process drives companies to obtain better results, either by changing their projects or accepting suggestions for them to improve, or by tracking and evaluating overall results. Although social arbitrage is a practical way for knowledge to become support for corporate competitiveness, business sectors unaccustomed to arbitrating their decisions have been slow to accepted it, but they have started to, thanks to links with the academic sector, which has for a long time arbitrated its projects and outputs.

From the perspective of the SRI in Baja California, the PEI helped companies stay on a technology track in the long run, because it is well known that it is the first projects that get sacrificed to market or investment uncertainties, while those that are only short-term would continue anyway without governmental support. A second immediate impact is seen in improved human capital capabilities thanks to the growth of cooperation networks with other companies and with IHEs and CIS, which undoubtedly prompt long-term synergies. Being chosen as a company to receive government support for R+D has a positive impact on a company's corporate image, raises the perception of reliability, and sends signals that a company is solid and innovative.

The PEI provides the same opportunities to access the network for both large and small companies, leveling the playing field in terms of the opportunities and benefits of belonging to them. The network structure is open, because new relationships emerge with every call for applicants, although relationships may repeat if new collaborations arise. In reality, this policy is solving one of the coordination problems inherent to an SRI, because the network incentivizes the demand side for companies and the supply side for IHEs, helping both avoid the natural aversion to cost and risk involved in forging these partnerships.

The relationships that the PEI fosters between companies and IHEs are becoming the most important institutional means of connectivity for research, because the rules of operation are clear, the objectives are concrete, and the deadlines do not go beyond the end of the fiscal year. This makes it a fund that is simple to manage in administrative terms and motivates all parties involved to keep up their ends of the bargain. On the part of the IHEs, researchers make sure they meet their commitments on time and work hard to make sure that they keep up good relationships with the companies; stay up-to-date in how to solve problems; create expectations of even higher income for future projects; and make sure they have a good reputation with Conacyt, which is the main funder of the research. On the part of corporations, they live up to their roles as project coordinators and want to make sure they have a good reputation with the fund, hoping to benefit from future calls for applications and to access more funding to innovate in their products and processes.

The PEI has made strides forward in recent years in tracking and overseeing projects, thanks to the implementation of a platform that manages the information of everyone involved, from the time the project applies for the grant to when it wraps up, with calendars listing submission deadlines. By keeping strict control over the ways in which and the volume of resources allocated the PEI makes it possible to grow with more resources. In the future, it will be important to evaluate and listen to feedback from the first wave of corporate and university beneficiaries to look at the weighted long-term impact as a function of success attained.

Some topics upon which to reflect, both for the PEI and for the different institutions involved, include company engagement, as of the 67 that have gone through the program, only 26 (38%) have done so more than once. Why are the rest not applying to the program a second or third time? Another topic is what is going on internally at the IHEs and CIs: how is the PEI changing the incentives for research activities and what effect is it having on graduate students?

Observations in the field point to a situation in which innovations are developed without patents or innovations with expired patents for products meant for new traditional markets; also, that there are entrepreneurial scientists at the corporations and at the IHEs who have different concepts than the students (Etzkowitz et al., 2000). A third observation is that there are more interactions than can be measured, because the number of researchers doing business ventures as individuals at the IHEs is on the rise, and these practices are frequently kept out of sight. As a result, as the number of PEI projects rises, it creates a positive impact on linkages and technology transfer, but a negative impact on the competitiveness of some of the graduate students, because in response to higher income from the PEI, some entrepreneurial scientists do not sustain the SNI; it keeps students around longer who are working for non-academic reasons, and puts pressure on the length of graduate programs, affecting institutional objectives.

This sort of business venture among entrepreneurial scientists and the burgeoning number of master's degree and doctoral degree holders in the sciences working at corporations does help generate closer relationships, but in the near future it could lead to a new competitive relationship between members of the SRI in Baja California. On another note, the fact that companies are able to engage in dialogue on partnerships through innovation will make the PEI necessary to support projects between companies that nowadays are not considered. Both processes will forge new synergies that will drive the SRI to evolve to new levels. For the time being, the evidence of growing collaboration between corporations and IHEs and CIS in information exchange, service provision, use of infrastructure, research development, or technology transfer via the PEI indicates that the program has had a positive effect on generating lasting ties and interactions that will allow the SRI to continue evolving.

REFERENCES

Ahuja, G. (2000), “Collaboration Networks, Structural Holes, and Innovation: A Longitudinal Study”, Administrative Science Quaterly, vol. 45, núm. 3, US, SAGE, September. [ Links ]

Alberdi, X., Gibaja, J. y Parrilli, M. (2014), “Evaluación de la fragmentación en los Sistemas Regionales de Innovación: Una tipología para el caso de España”, Investigaciones Regionales, núm. 28, España, Asociación Española de Ciencia Regional. [ Links ]

Anselin, L., Varga, A. y Zoltan, A. (1997), “Local Geographic Spillovers between University Research and High Technology Innovations”, Journal of Urban Economics, vol. 42, issue 3, US, Elsevier, November. [ Links ]

Audretsch, D. y Feldman, M. (1996), “R&D Spillover and The Geography of Innovation and Production”, The American Economic Review, vol. 86, núm. 3, US, American Economic Association, June. [ Links ]

Baumert, T. y Heijs, J. (2002), “Los determinantes de la capacidad innovadora regional: Una aproximación econométrica al caso español: recopilación de estudios y primeros resultados”, Madrid, UCM, Instituto de Análisis Industrial y Financiero, núm. 33, Documento de trabajo. [ Links ]

Busom, I. (1991), “Innovación Tecnológica e Intervención Pública: Panorama y Evidencia Empírica”, tesis Doctoral, Facultad de Ciencias Económicas y Empresariales Departamento de Economía Aplicada, España, Universidad Autónoma de Barcelona. [ Links ]

Calderón, Á. (2009), INNOVATEC, INNOVAPYME, PROINNOVA. Evaluación externa en materia de diseño, México, Conacyt. [ Links ]

Cámara de Diputados (2011), Iniciativa con proyecto de decreto que reforma el artículo 219 de la Ley del Impuesto sobre la Renta. [ Links ]

Canter, U., Meder, A. y Wal, A. (2010), “Innovator Networks and Regional Knowledge Base”, Technovation, núm. 30, UK, Elsevier. [ Links ]

Casas, R. y Luna, M. (coord.) (2001), La formación de redes de conocimiento. Una perspectiva regional desde México, México, Anthropos. [ Links ]

Cimoli, M. (2000), Developing Innovation System. Mexico in a Global Context (Science, Technology, and the International Political Economy Series), London and New York, Routledge Taylor & Francis Group. [ Links ]

Consejo Nacional de Evaluación de la Política de Desarrollo Social (Coneval) (2013), Informe de Evaluación Específica de Desempeño 2012-2013. Innovación Tecnológica para Negocios de Alto Valor Agregado, Tecnologías Precursoras y Competitividad de las Empresas, México, Conacyt . [ Links ]

Etzkowitz, H., Webster, A., Gebhardt, C. y Cantisano, R. (2000), “The Future of The University and The University of The Future: Evolution of Ivory Tower to Entrepreneurial Paradigm”, Research Policy, vol. 29, núm. 2, Netherlands, Elsevier. [ Links ]

Falk, R. (2006), “Behavioural Additionality of Austria’s Industrial Research Promotion Fund (FFF)”, in R. Falk, Government R&D Funding and Company Behaviour OCDE, Paris, OCDE. [ Links ]

FCCYT (2006), Diagnóstico de la política científica, tecnológica y de fomento a la innovación en México (2000-2006), México, Foro Consultivo Científico y Tecnológico, A.C. [ Links ]

Griffiths, J. (2012), Leveraging Private Sector Finance. How does It Work and What are The Risks, UK, Bretton Woods Project. [ Links ]

Grilinches, Z. (1979), “Issues in Assessing the Contribution of Research and Development to Productivity Growth”, Bell Journal of Economics, vol. 10, núm.1, UK, Spring. [ Links ]

Grossman, G. (1990), Promoting New Industrial Activities: a Survey of Recent Arguments and Evidence. Economics and Statistics Department, OCDE Economic Studies, 14, New Jersey, US. Princeton University. [ Links ]

Hanneman, R. (2000), Introducción a los métodos de análisis de redes sociales. Departamento de Sociología de la Universidad de California Riverside. Recuperado de <http://redes-sociales.wikidot.com/materiales> [ Links ]

Heijs, J. (2012), “Fallos sistémicos y de mercado en el Sistema Español de Innovación”, Información Comercial Española, núm. 869, España, ICE. [ Links ]

Jaffe, A. (1989), “Real Effects of Academic Research”, The American Ecomic Review, vol. 79, núm. 5, US, American Economic Association . [ Links ]

Larosse, J. (2011), “Conceptual and Empirical Challenges of Evaluating the Effectiveness of Innovation Policies with Behavioural Additionality (The Case of IWT R&D Subsidies)”, IWT, Flanders, Working Paper. [ Links ]

Lawson, C. (1999), “Toward Competence Theory of the Region”, Cambridge Journal of Economics, vol. 23, UK, Cambridge University Press. [ Links ]

Lundvall, B. (2005), “National Innovation Systems-Analytical Concept and Development Tool. Dynamics of Industry and Innovation: Organizations, Networks and Systems”, Conference Document. Copenhagen, Denmark, Aalborg University. [ Links ]

Maskell, P. y Malmberg, A. (1999), “Localized Learning and Industrial Competitiveness”, Cambridge Journal of Economics , vol. 23, UK, Cambridge University Press . [ Links ]

McWilliam, E., Taylor, P., Thomon, P., Green, B., Maxwell, T., Wildy, H. y Simons, D. (2002), “Research training Doctoral Progress. What can be Learned from Professional Doctorates?”, Common Wealth, Department of Education, Science and Training, Commonwealth of Australia, Working Paper. [ Links ]

Mungaray, A. y Palacio, J. (2000), “Schumpeter, la Innovación y la Política Industrial”, Revista de Comercio Exterior, vol. 50, núm. 12, México, Bancomext. [ Links ]

______, Ramos, J., Plasencia, I. y Moctezuma, P. (2011), “Las instituciones de Educación Superior en el Sistema Regional de Innovación de Baja California”, Revista de Educación Superior, vol. XL(2), núm. 158, México, Anuies. [ Links ]

______, López, S. y Moctezuma, P. (2013), “La adicionalidad de los fondos públicos en la innovación empresarial mexicana. El caso de Baja California, 2001-2010”, Revista de Educación Superior, vol. 3, núm. 167. [ Links ]

Méndez, R. (2002), “Innovación y Desarrollo territorial: Algunos debates teóricos recientes”, Revista de Estudios Urbanos Regionales, vol. 28, núm. 84, Pontificia Universidad de Chile, Santiago de Chile. [ Links ]

Nardi, A. y Pereira, G. (2006), “Proximidad territorial y desarrollo local-rural: Las ferias francas de La Provincia de Misiones-Noreste argentino”, Revista Internacional de Desenvolvimiento Local, vol. 8, núm. 13, Argentina, MIAR. [ Links ]

Nauwelaers, C. (1995), “Methodologies for The Evaluation of Regional Innovation Potential”, Scientometrics, vol. 34, núm. 3, Netherlands, Akademiai Kiado. [ Links ]

Organización para la Cooperación y el Desarrollo Económicos (OCDE) (2010), Perspectivas OCDE: México políticas clave para un desarrollo sostenible, México, OCDE, octubre. [ Links ]

______ (2008), OCDE Reviews of Innovation Policy. Overall Assessment and Recommendations, Paris, OCDE. [ Links ]

PECYTBC (2010), Programa Especial de Ciencia e Innovación Tecnológica de Baja California, COCyT BC, México, COCyT BC. [ Links ]

Ramos, J. (2011), Elementos básicos y propuesta metodológica para la conformación de un Sistema Regional de Innovación en Baja California, México, Universidad Autónoma de Baja California. [ Links ]

Rozga, R. (2006), “La importancia dimensión local y regional de los procesos de innovación tecnológica”, Aportes , vol. VII, núm. 20, México, Universidad Benemérita de Puebla. [ Links ]

Ruiz, C. (2008), “México: Geografía Económica de la Innovación”, Revista de Comercio Exterior , vol. 58, núm.11, México, Bancomext . [ Links ]

Sánchez, J. M. (2008), “Los Estímulos Fiscales en México: Investigando la construcción de un Sistema de Incentivos para la Innovación”, 29 de agosto de 2008, Congreso: “Sistemas de Innovación para la Competitividad SINNCO 2008” CONCYTEG - IBERO, Guanajuato, México. [ Links ]

Santos, E. (2006), Adicionalidad de comportamiento asociada a los estímulos fiscales en México: 2001-2005, México, tesis de Maestría, Universidad Autónoma Metropolitana. [ Links ]

Schuller, T. (2005), “Social Capital, Networks and Communities of Knowledge”, NSF/OECD Conference on Advancing Knowledge and the Knowledge Economy, Washington, January. [ Links ]

Secretaría de Economía (2013), Reglas de Operación de Fondos PYME. Recuperado de http://www.segob.mx , septiembre 15 de 2016. [ Links ]

Sistema Nacional de Investigadores (SNI) (2017), Reglamento del SNI, México, Conacyt . [ Links ]

Souza, L. y Villavicencio, D. (2011), “Redes de innovación, una perspectiva desde la construcción de indicadores CTI”, en A. Villavicencio y D. Villavicencio, Dinámicas institucionales y políticas de innovación, México, CONCYTEG-UAMX-Plaza y Valdés. [ Links ]

Velázquez, A. y Gallegos, N. (2005), Manual introductorio al análisis de redes sociales. Medidas de Centralidad. Recuperado de < http://revista-redes.rediris.es/wedredes/talleres/manual> [ Links ]

Wasserman, S. y Faust, K. (1994), Social Network Analysis. Methods and Applications, New York, USA, Cambridge University Press. [ Links ]

2To define industrial-sector companies, the PEI uses the definition from the Secretariat of the Economy, which in Mexico, says that micro-companies have up to 10 workers and up to 4 million pesos in annual turnover: small companies have between 11 and 50 employees and annual turnover of up to 100 million pesos: and medium-sized enterprises have between 51 and 250 employees and up to 250 million in annual turnover (Secretaría de Economía, 2013).

3The National System of Researchers (SNI) distinguishes those scientists and technologists who perform especially quality work, train new researchers, or shore up their research lines. Depending on the quality and maturity of a researcher's contributions, the distinctions are divided into candidate and researcher, level 1, 2, and 3 (SNI, 2017).

Received: October 18, 2016; Accepted: March 28, 2017

texto en

texto en