Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Problemas del desarrollo

versión impresa ISSN 0301-7036

Prob. Des vol.48 no.191 Ciudad de México oct./dic. 2017

Articles

Strategic Regionalisms and Domestic and Transnational Hydrocarbon Companies in the United States and Latin America

1 University of Puerto Rico. E-mail address: maribel.apontel@upr.edu

This study analyzes how different regionalisms in Latin America are tied to the restructuring of the upstream American oil chain and the private transnational company (PTC)/domestic oil company (DOC) dichotomy. This research is situated in the theoretical framework of new strategic regionalism and value chains, seeking to forge connections between chains and companies through data mining. This research was designed as a quantitative-descriptive study. The analysis of concepts (regionalistil, natural resources, and transnational companies) is operationalized by linking together the construct with the information available in the databases.

Keywords: Hydrocarbons; oil; value chain; Pacific Alliance; Bolivarian Alliance - Peoples' Trade Treaty; NAFTA

En el estudio se analiza cómo los distintos regionalismos de América Latina se relacionan con la reestructuración de la cadena del petróleo de Estados Unidos aguas arriba y con la dicotomía empresas privadas transnacionales (EPTN)/empresas nacionales de petróleo (ENP). La investigación se localiza en el marco teórico del nuevo regionalismo estratégico y el de las cadenas de valor que intentan articular conexiones entre cadenas y empresas a través de la minería de datos (data mining). El diseño de la investigación es cuantitativo descriptivo. El análisis de los conceptos (regionalismo, recursos naturales, y empresas transnacionales) se operacionaliza vinculando el constructo con la información disponible en las bases de datos.

Palabras clave: hidrocarburos; petróleo; cadena de valor; Alianza del Pacífico; Alianza Bolivariana-Tratado Comercial de los Pueblos; TLCAN

Clasificación JEL: B41; R11; R58; L71; N96

L’étude analyse comment les différents régionalismes en Amérique Latine sont liés à la restructuration de la chaîne pétrolière américaine plus au nord et à la dichotomie des entreprises privées transnationales (EPTN) / entreprises pétrolières nationales (ENP). La recherche se situe dans le cadre théorique du nouveau régionalisme stratégique et celui des chaînes de valeur qui tentent d’articuler les liens entre les chaînes et les entreprises grâce à l’exploration de données (data mining). Le plan de recherche est quantitatif descriptif. L’analyse des concepts (régionalisme, ressources naturelles et sociétés transnationales) est opérationnelle en liant la construction aux informations disponibles dans les bases de données.

Mots clés: hydrocarbures; pétrole; chaîne de valeur; Alliance du Pacifique; Alliance bolivarienne- Traité sur le commerce des peuples; NAFTA

O estudo analisa a forma como os diferentes regionalismos da América Latina estão relacionados com a reestruturação da cadeia de petróleo dos EUA águas acima e com a dicotomia empresas privadas transnacionais (EPTN) / empresas petrolíferas nacionais (EPN). A pesquisa se dá dentro do quadro teórico do novo regionalismo estratégico e das cadeias de valor que tentam articular conexões entre cadeias e empresas através da mineração de dados (data mining). O desenho da pesquisa é quantitativo- descritivo. A análise dos conceitos (regionalismo, recursos naturais e empresas transnacionais) é operacionalizado vinculando a construção com a informação disponível nos bancos de dados.

Palavras-chave: hidrocarbonetos; petróleo; cadeia de valor; Aliança do Pacífico; Aliança Bolivariana-Tratado Comercial dos Povos; NAFTA

本文分别研究了拉美各类区域战略主义同美国石油产业链上游重组、以及与石油产业跨国私人和国家两类公司之间的联系。研究重点在于新区域战略主义理论框架和产业链,并通过对数据的挖掘,将产业链和企业连在一起。研究方法是描述性定量分析,利用数据库现有信息对一些基本概念(地区主义、自然资源、跨国公司)进行分析。

关键词 碳氢化合物; 石油; 产业链; 太平洋联盟; 玻利瓦尔人民贸易协定联盟; 北美自由贸易区协定

INTRODUCTION2

The objective of this research is to use data mining to introduce a methodology to analyze the relations between international trade data, value chain components, and corporations. The methodology is applied to the case of the hydrocarbons industry in three regional agreements in Latin America and the Caribbean: the Pacific Alliance (PA), the North American Free Trade Agreement (NAFTA), and the Bolivarian Alliance - Peoples' Trade Treaty (ALBA-TCP). Through these agreements, I analyze how these regionalisms are related to: 1) several upstream components of the oil value chain in the United States; and 2) the presence of private transnational companies (PTC) and national or domestic oil companies (DOC) in the member countries in these regions.

Two divergent models for regionalism and development have emerged in Latin America, although they are not always mutually exclusive. The first is the more radical of the two, epitomized by the Bolivarian Alliance - Peoples' Trade treaty, which stresses multi-dimensional, inclusive regional development and the role of the state and the public sector as important, and has been referred to as a new strategic regionalism (Aponte Garda, 2014; Aponte Garda and Amézquita Puntiel, 2015), a post-hegemonic or counter-hegemonic regionalism, or a socialist or third-generation regionalism (Muhr, 2013). The second is the open regionalism model, exemplified by the Pacific Alliance and NAFTA, which do not prioritize inclusive development, and rather emphasize free trade, the private sector, and foreign direct investment.

To the extent that the territories in which natural resources reside belong to different countries, which in turn belong to regional agreements, then the logic of regionalism has an influence on the components of the value chain. In the region of Latin America, hydrocarbon mining exists in both countries subjected to open regionalism and in countries governed by progressive or leftist administrations associated with post-hegemonic regionalism or the new strategic regionalism.

Natural resource extradivism has been typical of Latin American growth for centuries. Extradivism as an accumulation model is characterized by corporate-owned enclaves that extract non-renewable resources to export to the international market without any significant prior processing; they overexploit natural resources and the commons (Composto and Navarro, 2012), harming the environment. Hydrocarbons (oil and gas), minerals, and metals are the non-agricultural primary exports tied to foreign investment. Extractive activities force territories and multinational companies into joining international commodities chains (Machado Aráoz, 2011 ; Compost and Navarro, 2012). Local populations must therefore bear the impact of environmental degradation, poverty, and exclusion.

Since the year 2000, primary product exports have continued to climb thanks to high raw materials prices; so too has investor interest in key industries, alongside changes in demand unleashed by the big players, in particular, China, and the desire on the part of national governments to harness this boom and channel it into development. Altogether, the process has come to be known as neo-extractivism and under it, environmental land conflicts and corporation-led mineral and fuel extraction have all increased considerably. In Latin America, neo-extractivism appears in countries practicing both open regionalism and alternative regionalism models.

In countries with open regionalism, neo-extractivism is characterized by an emphasis on reprimarization, and the spread and intensity of extradivist activity that under capitalism seeks to take advantage of the commodities boom in the international market. In countries that lean toward the new regionalism, capitalist practices may be similar to those of the other group of nations, but the emphasis is placed on the nationalization or renationalization of natural resources, preventing capital flight abroad, changing the royalties or profit margins imposed on foreign investment, and redistributing profit into social spending that stresses education and healthcare.

So, why is it worth it to focus on the relationships between regionalisms, value chains, and hydrocarbon companies? First, to the extent that natural resources are located in countries that belong to regional agreements, regionalisms are intrinsically linked to natural resources. The United States is one of the countries that absorbs (imports) a large volume of natural resources from the Latin American and Caribbean region, which is known for its rich biodiversity and natural resource endowment, so there is interest in finding new ways to analyze the data to advance along the path to coordinating a natural resource sovereignty tied to regional integration/regionalisms.

At present, under the Donald Trump administration, there are big changes in the pipeline that will have an impact on both regional agreements and the value chains that operate within them. President Trump has announced that he will renegotiate NAFTA and has pulled out of the Trans-Pacific Partnership (ТРР). The United States' withdrawal from the ТРР affected the Pacific Alliance countries, at least for those that also belong to the ТРР, and certainly had a negative impact on their economies. ALBA-TCP has also come under fire. Former President Barack Obama's administration may have taken somewhat of a meddling stance toward Venezuela, but at present, the Trump administration has threatened direct intervention in the country, which is home to the planet's largest hydrocarbon reserves, obliging various member countries belonging to these regional agreements to rethink their strategies.

Likewise, there are sanctions against Venezuela at play (Aponte Garda et al., 2016, p. 118). The United States imposed a package of sanctions on Venezuela on March 9, 2015 when former President Obama proclaimed a "national emergency," saying that the South American country represented an unusual and extraordinary threat to U.S. interests, and banned seven senior Venezuelan civil servants linked to corruption and human rights violations from entering the country. The then-president of the United States extended the sanctions against Venezuela for another year, due to the "extraordinary risk' the country posed to U.S. security. ALBA-TCP countries rejected the extension of the American sanctions against Venezuela.3 At present, Venezuela is facing a complex internal and external situation, further exacerbated by falling oil prices worldwide.

This scenario is even more complicated considering that the United States is now an exporter of natural gas, gasoline, and their byproducts thanks to shale production. In addition, in light of U.S. President Donald Trump's new policies, the outlook for the oil-exporting countries of Latin America, especially Venezuela, home to the world's largest oil reserves, is up in the air.

Second, the situation is complicated by struggles over the remaining hydrocarbon reserves (oil and gas), which have marked the twenty-first century. As these nonrenewable resources begin to run out, at current consumption rates, the planet may have enough oil for 40 years4 and enough gas for 55 years.5 These conflicts exist in the midst of two contradictions in the international political economy of hydrocarbons. The first is that the biggest consumers (the United States consumes 19 million barrels of oil a day) do not have enough reserves to keep up this level of consumption for a very long time. The United States has proven reserves of 22 billion barrels. The second is that in many of the 10 countries with the largest proven oil reserves as of 2015, measured in billions of barrels ENT#091;Venezuela (298), Saudi Arabia (268), Canada (172), Iran (158), Iraq (144), Kuwait (104), united Arab Emirates (98), Russia (80), Libya (48), Nigeria (37)ENT#093;, the resources are in the hands of state-owned oil companies that belong to the Organization of Petroleum-Exporting Countries (OPEC); while the biggest consumers, generally speaking, do not own state oil companies and depend on private transnational companies.

Third, the data available to study oil do shed light on aspects related to international trade and the corporations and countries involved. However, these data are not available for many other goods or commodities. Data availability provides a special opportunity to study the chains linked to information on companies, studying oil map patterns is crucial, because what happens with the oil maps may shape appropriation patterns and conflicts/wars/environmental damage in other countries.

Fourth, it is important to consider public policy implications: academic and regional institutional bodies linked to the new strategic regionalism or the counter-hegemonic regionalism-such as the Southern Observatory on Transnational Corporations and Investment, the Union of South American Nations, the Bolivarian Alliance - Peoples' Trade Treaty, and the Community of Latin American and Caribbean states (CELAC), to name a few-could apply the methodology suggested here and conduct sectoral studies by natural resource (hydrocarbons, oil and gas, minerals, and water). Doing so could spur region-wide actions to bolster natural resource sovereignty in a way that supports policymaking.

The idea is to assemble integrated databases and identify the relations between international trade and value chains to help the new regionalisms develop strategic trade policies and to fuel efforts to articulate a common platform for state oil companies to ad in response to multinational companies, promoting sustainable development, rather than growth predicated solely on extraction.

FORMULATING THE RESEARCH PROBLEM

This analysis revolves around two research questions. What do the data on regionalisms and international trade have to say about how certain upstream components of the oil value chains have been reshaped, specifically, the primary hydrocarbon goods that the United States imports from ALBA-TCP, the Pacific Alliance, and NAFTA? What do the data on multinational companies show us about how foreign investment has been restructured in Pacific Alliance, ALBA-TCP, and NAFTA member countries?

The expectation is that the United States has started to import more primary goods from countries that follow an open regionalism model (Pacific Alliance and NAFTA), and has moved away from importing from ALBA-TCP countries, above all" from Venezuela, as a result of the founding of ALBA-TCP in 2005 and the sanctions imposed in 2015. Another expectation is that private international companies have expanded in Pacific Alliance countries, while state oil companies have gotten a better foothold in ALBA-TCP countries.

THEORETICAL FRAMEWORK AND LITERATURE REVIEW6

Conceptually speaking, this research is located in the theoretical framework of the new strategic regionalism and of value chains! seeking to draw connections between value chains and companies using data mining The most important conceptual notions in this paper are related to a comparative analysis of the regionalisms characteristic of the Pacific Alliance versus of ALBA-TCP (Aponte Garda, 2014; Bernal Meza, 2015; Briceño Ruiz, 2013), as well as the concepts used to describe the new strategic regionalism or post-regionalism model (Muhr, 2013), and research by Bruckmann (2012) and Regueiro (2008, 2014), who offer reviews of regionalisms and critical aspects of natural resource geopolitics. In methodological terms, the most important papers to this study were published by Sturgeon and Gereffi (2009) and Sturgeon and Memedovic (2010), as will be explained below.

Aponte Garda (2014) proposed the concept of the new strategic regionalism (NSR), characterized by three components: an emphasis on the building blocks of a strategic regionalism, especially, on the emergence of strategic companies, products, and sectors, and the existence of trade and industrial alliances where the state is a major strategic player; the concept of multidimensional^, going beyond the economic, and certain aspects that characterize the socioeconomic model; and economic policies modeled on the concept of sovereignty, as well as regional actions surrounding these policies.

Sovereignty is conceptualized in terms of the PTC/DOC dichotomy to create a new governance of strategic resources tied to inclusive development. The concept of sovereignty has sprouted around the ^nationalization of hydrocarbons, the prevention of capital flight, and the sharing of hydrocarbon profits, redistributing them into social projects nationwide, as well as the creation of mixed state-owned regional enterprises and regional energy integration initiatives.

In the Pacific Alliance, the idea of development has been supplanted by the notion of "competitiveness." The state no longer plays an important role, and the ideal of autonomy from the United States has been cast aside (Bernal Meza, 2015) . Lourdes Regueiro (2014) took a "look at the Pacific Alliance from the geopolitical interests of the United States, in an attempt to show the emergence of the entity as part of a global project designed to bolster the geostrategic project of the current administration in the United States" (Regueiro, 2014, p. 150).

Regueiro (2008) described Free Trade Agreements (FTA) as part of the logic of capitalist accumulation worldwide, referring to the role of strategic resources in the accumulation process. The author sought to explain how it is through the Free Trade Area of the Americas (ҒТАА) and the FTAs that the process to expropriate resources located outside the borders of the United States comes to life; the work also explains the features of the process by which integration spaces have been reshaped (Regueiro, 2008, p. 12). It provides important information and analysis on how far the United States has gone to hoard mineral and water resources, but it does not suggest a specific typology of integration processes, nor does It furnish any new methodology to systematically analyze these relations.

Bruckmann (2012) analyzed the geopolitics of natural resources in the region using data from the United States Geological Survey (USGS). The author details the importance of the different strategic minerals, and which countries are home to significant reserves of each, and also reports on aquifers. Bruckann's research is seen by some as "anti imperialist and integrationist geopolitics" that advocates for what progressive governments are doing and their regional integration efforts to get a strategic agenda going within some regionalist bodies, such as the Union of South American Nations (UNASUR) (Fornillo, 2015, p. 137), which aims for natural resource sovereignties to be coordinated.

Although the focus of that analysis is more on the international stage and less on the logic of accumulation in the United States, it does not include information on corporate exploitation facilities by country, does not work with hydrocarbons (oil and gas), and does not establish a relationship between the presence of minerals and diverse notions of regionalism. Nor does It analyze value chains and how they tie into international trade.

Looking at the literature dealing with methodological aspects, the experts concur that quantitative measures and database-analysis methods are few and far between when it comes to global value chains (GVC). The consequence of this is that GVC analysis tends to be grounded in surveys, case studies, or data that are not gathered on an annual basis. Accordingly, the information collected is primarily descriptive and it is not possible to come up with data for analyzing trade and production patterns within regions. On another note, generally speaking, GVC analyses do not try to study a set of multinational companies tied to export and import data at the industry level worldwide.

Of the existing GVC literature, information on the corporations responsible for trade flows is not available, because it is confidential, or because it is handled by customs agencies around the world. That is why researchers have to use case studies, surveys, or data at the corporation or company level to try to close the gap. The challenge is still very much out there: how to obtain information on companies and how to tie it conceptually to these trade flows.

One group of researchers tackled the first gap by introducing an argument in favor of compiling new statistics, reworking existing statistics, performing data mining, and drawing connections across existing data sets (Sturgeon and Gereffi, 2009, p. 5).

Although at the region-wide level there have been good initiatives to map out the chains, and many of them have even earned the notice of the Economic Commission for Latin America and the Caribbean (ECLAC) (2013), what is still lacking is an interconnected system of data that would make it possible to conduct integrated analysis at the production and corporation level with international (export and import) trade data. In light of that, value chain analyses are very much reliant on case studies with qualitative methodologies or micro-databases that are not easily accessible.

As a result of the literature review conducted to devise this methodology, the most important papers turned out to be those published by Sturgeon and Gereffi (2009); Sturgeon and Memedovic (2010); and Aponte Garda (2011, 2014, 2016) , because they contribute conceptualizations that link together international trade data with global value chain concepts using existing an statistical database, specifically, the United Nations Commodity Trade (UN Comtrade) database (Aponte García, 2014, p. 203).

Sturgeon and Gereffi (2003) argued in favor of gathering economic data at the company or corporation level pursuant to the business functions that emerge from mapping the value chain, Sturgeon and Memedovic (2010) classified goods according to the Broad Economic Categories (ВЕС) of consumption, capital goods, and intermediate goods, and calculated that the global trade of intermediate goods has now surpassed that of the other categories. They present this result as proof of the appearance of GVCs.

Nevertheless, broadly speaking, although these contributions did advance the research about how to use existing data to analyze value chains, none of these investigations applied any method to analyze the trade-production relations within a regional integration agreement, nor did any of them tie together data with the activities of multinational corporations (Aponte Garcia, 2015, p. 203).

Aponte Garda (2011) used the UN Comtrade database and qualitative data on regional companies. She converted the data on intra-regional exports from the Bolivarian Alliance (ALBA-TCP) from standard industrial classifications to broad economic category (ВЕС) codes, and later classified the data for 10 categories belonging to a new concept, the Grandnational Enterprise (GNE). The GNE arose in the context of the ALBA-TCP, referring to those regional mixed-type state-owned enterprises. In this regard, the data on exports are tied to the full suite of activities contained in a specific business category, that of the GNE.

Aponte Garda (2016) also analyzed how the interventions carried out and the sanctions imposed by the United States in and on five of the wealthiest oil-producing countries on the planet (Iraq, Iran, Libya, Russia, and Venezuela) have restructured the oil value chain through the appropriation of natural resources and the arrival of multinational oil companies in those countries. On another note, the Latin American countries that are reclaiming their oil sovereignty have also helped shake up the oil value chain.

As far as Aponte Garda was able to ascertain, analysis of this sort has never been performed before for trade with the United States in oil and for national and international oil companies in the regionalist agreements in Latin America and the Caribbean.

CHARACTERIZING THE UNITED STATES HYDROCARBON CHAIN

Understanding the United States hydrocarbon chain provides context for the analysis, even though the real objective of this study is focused on the black rectangle in Diagram 1, which will be discussed in greater detail below.

Diagram 1 is an illustration of a conceptualization of the oil chain, as well as how the supply in the United States comes from both imported and domestically-produced oil. The countries from which the United States imports oil can be classified pursuant to the regionalism criterion: the Pacific Alliance, ALBA-TCP, and NAFTA. Together with oil production located in the United States Itself and shale obtained from hydraulic tracking, the United States also gets the raw material through processing at refineries. Processing involves a raft of industries, including those directly associated with hydrocarbons (like gasoline) and the petrochemical and plastics byproducts industries, among others. The products these industries make are both locally consumed and exported. This paper only analyzes the rectangle related to imports from Pacific Alliance, NAFTA, and ALBA-TCP countries in detail.

Source: Created by the author based on the United States Geological Survey, 2015:5f Mineral Commodity Summaries, available at http://dx.doi.org/10.3133/7014009t

Diagram 1 Components of the Oil Chain

The supply from local and foreign sources is fed by both production in the United States production and oil imported from other countries. American crude production began in the mid-nineteenth century. As shown in Figure 1, production increased at the dawn of the twentieth century, reaching peak barrel production in the early nineteen-seventies, followed by a period of contraction extending into the end of the aughts, and then an abrupt increase.

Source: Created by the author based on <http://www.eia.gov>

Figure 1 United States: Crude Oil Production, Imports, and Exports (in Thousands of Barrels)

The objective of this paper specifically deals with the time period between 1994 and 2016, characterized by a sharp increase in imports and then a decrease starting in 2005. Even through imports shrunk, as shown in Figure 1, for most of the years in the study period, the amount of crude the United States imports still far exceeds its own domestic crude production levels. This behavioral pattern lasts into 2013, when crude production in the United States, which had already been on the rise since 2007, finally surpasses imported crude.

Until this point in the paper, the idea has been to detail the role played by NAFTA, Pacific Alliance, and ALBA-TCP member countries in this restructuring, which affected the upstream components of the hydrocarbon chain in the United States.

The data on shale production only date back to 2007. By 2008, shale production amounted to approximately 2 trillion cubic feet, and this quantity would quintuple over an eight-year period (see Figure 1). The data show how the oil chain in the United States has also been impacted by other factors, like domestic shale exploitation. There is a relationship between increased production in the United States and the advent of shale tracking. To include the impact of shale, the unit of billions of cubic feet of shale was converted and included in the Figure 1 data starting in 2007.

Strong dependency on crude oil marked by the need to import oil to meet the country's consumption needs led the United States to go out in search of international and domestic supply sources. Internationally, there have been invasions, interventions, and sanctions placed against major producers that are not close allies of the United States (see Aponte García, 2016). Nationally, attempts to exploit large shale deposits have multiplied.

According to the USGS, potential breakdowns in the supply chain are a longstanding concern of the United States government and industry (USGS, 2016). In 2013, the Energy Intelligence Agency (EIA) wrote the following: "Crude oil imports from the top five foreign suppliers to the United States-which in 2012 were Canada, Saudi Arabia, Mexico, Venezuela, and Iraq, in that order-accounted for almost 72% of total U.S. net crude oil imports, the highest proportion since 1997" (EIA, 2013). Reliance on net natural gas imports was estimated at 12% as of 2009, a much lower percentage (EIA/Office of Oil and Gas, 2009).

Although at present the government of the United States does not work with a unified definition, in general terms, a mineral (or hydrocarbon) can be defined as strategic if it is deemed important to the economy of the nation; if it does not have many replacements; if it comes mainly from foreign countries; and/or if its supply can potentially be interrupted (due to natural disasters, civil war, or strikes) that threaten the nation (United States) (USGS, 2016). Whether or not it is considered critical is determined by the industrial and commercial uses of the raw material.

Later on, this paper will examine other external factors, like access to international markets in the region, to elucidate whether the United States has started to import more from the Pacific Alliance and NAFTA member countries and less from the ALBA-TCP countries. This study is focused on these three agreements and the countries party to them, because in the rest of Latin America, with the exception to some degree of Colombia, Peru and Brazil, the volume of hydrocarbons the U.S. imports from these countries is negligible. After that, this paper introduces a parallel analysis considering only the three countries in these agreements that export the most oil to the United States: Venezuela, Mexico, and Canada.

In the value chain laid out in Diagram 1, processing covers a range of industries, including those for products directly associated with hydrocarbons (like gasoline) and byproduct industries, like petrochemicals and plastics, to name a few. The products these industries manufacture are channeled into local consumption and exports.

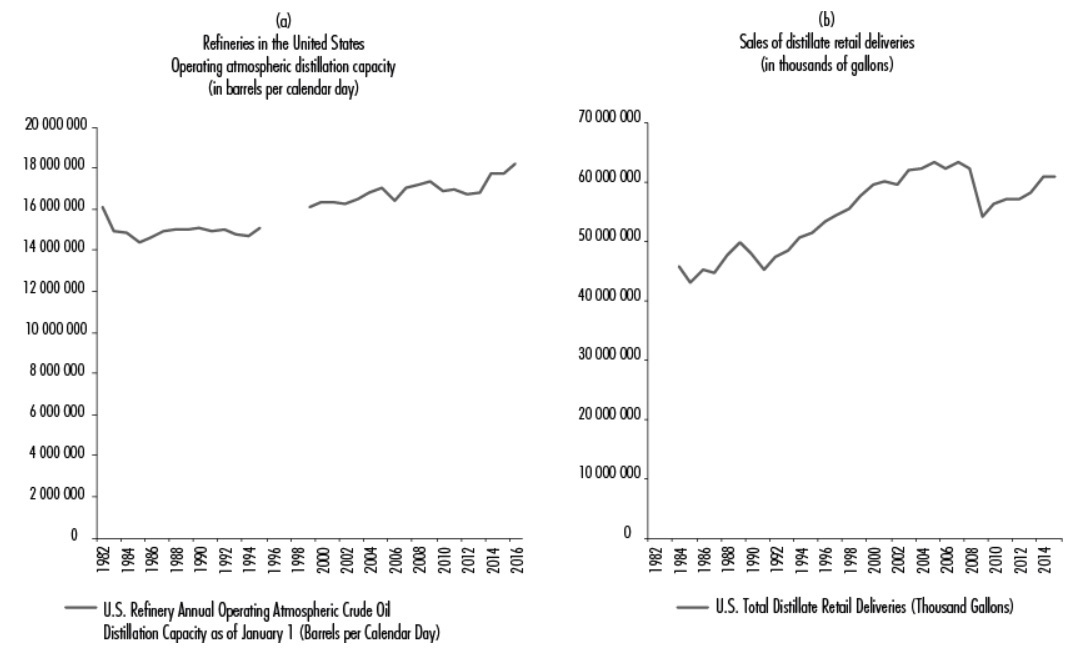

In the United States, the number of operating refineries fell from 254 in 1982 to 139 in 2016, according to EIA data. However, distillation capacity and retail deliveries that feed consumption have risen, as seen in Figures 2a and 2b.

These data encompass the different types of consumers, including residential, commercial, industrial, corporate, agricultural, electrical power consumers, railways, and more.

Since 2007, the United States has begun to export more to the rest of the world. Figure 1 shows that this increase is related to the boxes in the value chain labeled in Diagram 1 as global exports. The next section of this paper is focused on the regionalisms and their relationship to several value chain components.

In terms of the objectives of this paper and the data introduced in this section, there are two processes to note: 1) the change or restructuring of crude oil imports; 2) the rise in crude production in the United States potentially related to hydraulic tracking, but also to the rise in the volume of imported primary oil goods, followed by the manufacture of products up and down the chain in the United States, and an increase in exports. This next section deals with these matters through the lens of the regionalisms: the Pacific Alliance, ALBA-TCP, and NAFTA, and examines the three top oil-producing countries in each space: Mexico, Venezuela, and Canada.

REGIONALISMS AND HYDROCARBONS7

For purposes of the analysis in this paper, the countries have been divided into three groups: the Pacific Alliance, NAFTA, and ALBA-TCP.

Table 1 introduces a typology to establish the links between the regions, regionalisms, and natural resources; it contains a summary of the information for all three aspects, too.

The member nations of each of the regional agreements included in this research are detailed below. The countries were chosen based on three criteria: being active members (not observers) in the agreements, located in the Latin America and Caribbean region; having national oil companies; and appearing in the USGS database of companies located in those countries. The member countries of the Pacific Alliance and the years they joined are as follows: Colombia (2012), Chile (2012), Peru (2012), and Mexico (2012).8 The member nations of ALBA-TCP chosen for the study, and the years they joined, are as follows: Venezuela (2004), Bolivia (2006), Ecuador (2009), and Nicaragua (2007). The NAFTA member nations are Canada, Mexico, and the United States, but for purposes of this research, only data from Mexico and Canada are used, because the idea is to analyze the restructuring of the chain in the United States.9

For the purposes of Table 1, the diverse manifestations of the regionalisms are classified into six categories, as specified in Columns 1-6. This classification helps set the stage to depict the relationships between region, regionalism, and natural resources. The concept of old regionalism is tied to the analysis of the data pointing to the open regionalism with an economic model centered on free trade treaties, openness to foreign investment, and export-led growth (see Aponte Garda, 2014, chapter 2, for a detailed analysis). All of the definitions that apply to the categories of the old regionalisms and the agreements with extra-regional actors are taken from the World Trade Organization (WTO) database. To this typology, other initiatives belonging to the new regionalism (ALBA-TCP) have been added, which is neither recognized nor recorded by the WTO. Participation in the new regionalisms was analyzed pursuant to the information published on the ALBA web portals.

Table1. Regionalism by Type of Agreement and by Country

Note: ND means no data available

Source: Created by the author based on <http://www.wto.org> and <http://minerals.usgs.gov>

The terms old and new do not refer to a temporal construct, but rather to models of regionalism. In this sense, the old is associated with free trade agreements and open regionalism. The new is associated with models that go beyond free trade agreements.

NAFTA and Pacific Alliance member countries follow a model of open regionalism that boosts free trade, foreign investment in many industries, and export-led growth with strong partnerships with the United States. ALBA-TCP member countries are pursuing a new strategic regionalism (Aponte Garcia, 2014, 2015), which rejects open regionalism, fosters oil sovereignty, and has brought these countries closer to China. The old regionalism is predominant in the Pacific Alliance category, both in bilateral and multilateral agreements, while the new regionalism is predominant in the ALBA-TCP category.

Columns 5 and 6 compile information on extra-regional actors and mega actors. Agreements with extra-regional actors include those made with Europe and Asia. At present, the United States has four bilateral free trade agreements with the countries that have open regionalism (Colombia-2012; Panama-2012; Chile-2004; and Peru-2009) and two multilateral free trade agreements, NAFTA-1994 and the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) -2006.

Меgа-regions are meant to create wide-ranging integrated economic spaces and deal with an ample array of topics, including diverse areas not addressed in the WTO agreements or in other standing agreements (Cepal, 2013, p. 5). Of these mega-regions, the ТРР includes countries from Latin America, North America, Asia, and Oceania. In 2017, American President Donald Trump withdrew the United States from the ТРР.

With these categories of regionalisms, this paper now looks at a partial typology of the natural resources that characterize the region. Table 1 also shows, in columns 7-8, the number of hydrocarbon facilities and oil reserves per country. The information on the hydrocarbons is taken from the USGS database and EIA. The USGS keeps data on reserves and the productive capacity of mining and hydrocarbon facilities in the region. Namely, Latin America and the Caribbean do not gather their own data and rely on the data from the United States to understand the status of their natural resources.

Accordingly, it is necessary to specify how many hydrocarbon facilities are in each region to determine whether these natural resources would fall under a certain type of regionalism in particular. Looking at the case of the Pacific Alliance as an example, it can be asserted that this region has the most bilateral agreements associated with the old regionalism. Thus, there are 19 hydrocarbon facilities that would be affected by the old or open regionalism. It is with these cases that it is possible to obsewe the convergence of neo-extractivism with the old or open regionalism.

The concept of the transnational private enterprises is operationalized by compiling and organizing the information in the USGS database.

The research design is descriptive quantitative. The analysis of each of the concepts (regionalism, natural resources, private transnational companies and domestic oil companies) is operationalized by linking the construct with the information available in a database.

In this research, Aponte Garda applied a methodology that was already developed to classify and organize data on exports from the Pacific Alliance and the ALBA-TCP to the United States using the Harmonized Tariff Schedule (HS). Table 2 specifies the concepts, steps used in the method to compile and organize the data, and the sources from which the data were obtained.

Step 6 establishes the components of the oil distribution and production chain. Moreover, for it pairs some of the links of the chain with foreign trade categories. The second column of Table 2 lists the sources and databases from which the information was obtained to map out the oil chain.

The research maps and analyzes the following information in the time period 1994-2016 for the three regionalisms (Pacific Alliance, NAFTA, and ALBA-TCP): oil companies operating in each country; and changes in the volume of primary oil products exported from these countries to the United States. The data were compiled from different databases, including: the Energy Intelligence Agency, the United Nations, the United Nations Comtrade database, and the U.S. Investment Map.

RESULTS AND DISCUSSION

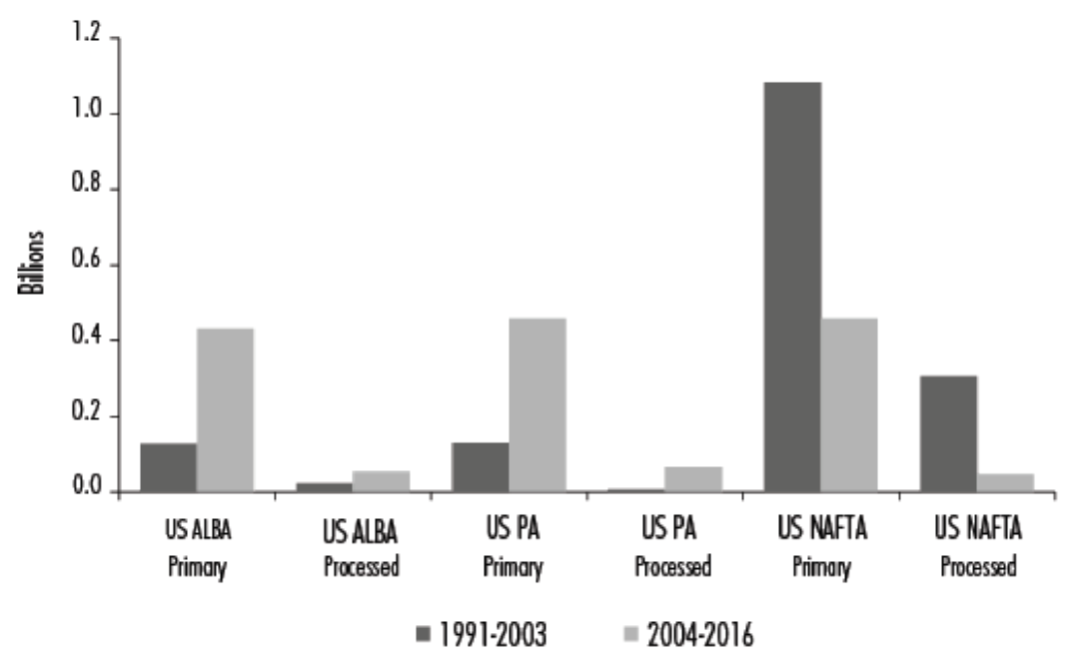

As shown in Figure 3, in both time periods, the United States imports more or less the same volume of hydrocarbons from the Pacific Alliance as from ALBA-TCP, when analyzed in thousands of dollars. In the first two cases-the Pacific Alliance and ALBA-TCP-the volumes both increase by the second time period. Imports from NAFTA fall for the second period, down to a level nearly equal to that of the ALBA-TCP and the Pacific Alliance countries.

Source: Created by the author based on data from UN Comtrade.

Figure 3 The United States' Imports of Hydrocarbons by Regionalism Category (in Hundreds of Thousands of USD at Current Prices)

Source: Created by the author based on <www.eia.gov>

Figure 4 The United States' Imports of Crude Oil and Oil Products (in Thousands of Barrels)

As shown in Table 4, when analyzed in thousands of barrels and not in dollars (to isolate the price effect), the United States imported significantly more from Canada starting in 2007, and less from Mexico and Venezuela. The case of Venezuela is understandable because the United States is not supportive of the socialist government in the country with the largest oil reserves on the planet, which has moreover enacted a full-on oil sovereignty policy. However, the case of Mexico is different. Imports begin to taper despite the fact that Mexico is an important trading partner for the United States. Nor should this decrease be attributed to the Mexican Oil Reform that began in 2013 and made the market more flexible for foreign investment, because the decline dates all the way back to 2006.

Although the data point to a restructuring that benefits Canada, it is important to understand whether this increase is attributable more to primary or processed goods. To do so, one must look at the main products that are traded.

Figure 5 displays the composition of hydrocarbon imports by broad economic category and by regionalism category. In all three regionalisms, primary goods predominate. Nevertheless, the United States began to import more primary goods from ALBA-TCP and the Pacific Alliance in the time period 2004-2016, while importing a lower volume of primary goods from NAFTA.

Source: Created by the authors based on UN Comtrade data.

Figure 5 The United States' Imports of Hydrocarbons by Broad Economic Category (in Hundreds of Thousands of USD at Current Prices)

As seen in Figure 1, the United States has ramped up its own domestic oil production and started to import less from other countries, leading to an overhaul of the components of the oil chain.

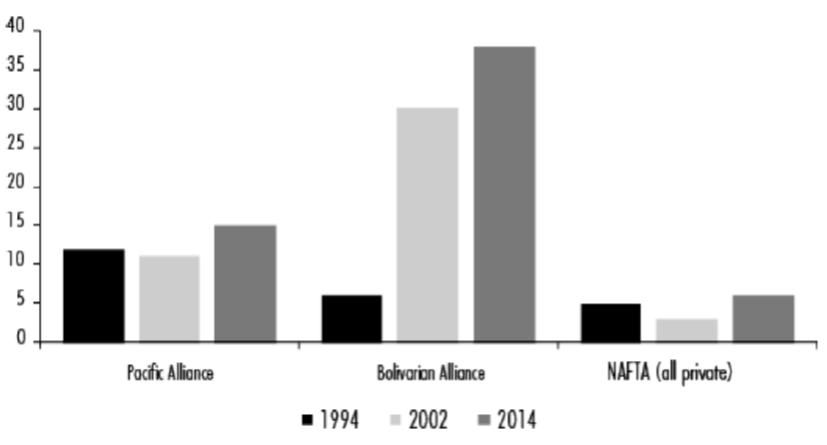

THE PRESENCE OF PRIVATE INTERNATIONAL OIL COMPANIES

The presence of international private oil companies took off in the time period 2000-2014 in the Pacific Alliance and waned in ALBA-TCP, as illustrated in Figure 6. This result is consistent with how the different types of regionalism approach foreign investment. Pursuant to what was described above, the Pacific Alliance is more favorable to foreign investment and the ALBA-TCP more favorable to domestic oil companies. NAFTA, in the case of Mexican oil, was not favorable to upstream foreign investment until the Energy Reform was implemented starting in 2013. However, the USGS data included in the analysis does not cover the years after 2013. Thus, the result for NAFTA would have to be explained by the data from Canada! because the data from Mexico are not going to reflect differences related to private international corporations in the three years considered. In the case of Canada, the number of private international companies fell.

After 1994, the number of national oil companies starts to rise in ALBA-TCP and in the Pacific Alliance, as shown in Figure 7.

Source: Created by the author based on data from the United States Geological Survey (http://minerals.usgs.gov/minerals/pubs/country/sa.html).

Figure 6 Number of Private International Oil Companies in the Pacific Alliance, ALBA-TCP, and NAFTA

Source: Created by the author based on data from the USGS (http://minerals.usgs.gov/minerals/pubs/country/sa.html).

Figure 7 Number of National Oil Companies in Member Countries of the Pacific Alliance and ALBA-TCP

The case of NAFTA is different, because Canada does not have its own state oil company. For purposes of this analysis, the Canadian companies were included in the figure for private national Canadian companies. They are meant for purposes of comparison.

CONCLUSIONS

This project generated a new integrated database that makes it possible to analyze the components of the oil chains in relation to regionalist processes, international trade data, and companies. This, in turn, allows for an examination of the relationships that explain how international trade is connected to the hydrocarbon chains. It also makes it possible to analyze the behavior of private multinational and national oil companies in the wake of diverse regionalist processes, all of which are important factors in the reshaping of the chains.

Both academic and regional institutional bodies can benefit from applying the methodology described here to conduct sectoral studies by natural resource. This may lead to regional actions that benefit the sovereignty of natural resources and contribute to public policymaking.

REFERENCES

Aponte García, M. (2011), “Intra-regional Trade and Grandnational Enterprises in The Bolivarian Alliance: Conceptual Framework, Methodology and Preliminary Analysis”, International Journal of Cuban Studies, vol. 3, núm. 2, 3, Londres, IISC, Summer-Fall. [ Links ]

______ (2014), El nuevo regionalismo estratégico. Los primeros diez años del ALBA-TCP, Argentina, Consejo Latinoamericano de las Ciencias Sociales (CLACSO)-Agencia Sueca de Desarrollo Internacional. Recuperado de <http://biblioteca.clacso.edu.ar/clacso/becas/20141117115005/nuevo.pdf.2014> [ Links ]

______ (2016), Integración, geopolítica y mapeo de cadenas: un desafío metodológico para promover la soberanía de los recursos naturales frente a las empresas transnacionales, Argentina, Consejo Latinoamericano de las Ciencias Sociales (CLACSO). Recuperado de <http://biblioteca.clacso.edu.ar/gsdl/collect/clacso/index/assoc/D11194.dir/MaribelAponteGarcia.pdf> [ Links ]

______, Allende Karam, I. y Suárez Salazar, L. (2016), Cuba: empresas y economía. Memorias del Primer Viaje de Estudios de la Universidad de Puerto Rico, Facultad de Administración de Empresas, Argentina, Consejo Latinoamericano de las Ciencias Sociales. Recuperado de <http://www.clacso.org.ar/librerialatinoamericana/contador/sumar_pdf.php?id_libro=1204> [ Links ]

______ y Amézquita Puntiel, G. (comps.) (2015), A diez años del ALBA-TCP. Origen y fruto del nuevo regionalismo latinoamericano y caribeño, Argentina, Consejo Latinoamericano de las Ciencias Sociales (CLACSO). Recuperado de <http://biblioteca.clacso.edu.ar/clacso/gt/20150521020240/EL-albatcp.pdf> [ Links ]

Bernal-Meza, R. (2015), “Alianza del Pacífico versus Alba y Mercosur: Entre el desafío de la convergencia y el riesgo de la fragmentación de Sudamérica”, Pesquisa & Debate, vol. 26, núm. 1 (47), Sao Paulo, PUCSP, enero-marzo. [ Links ]

Briceño Ruiz, J. (2013), “Ejes y modelos en la etapa actual de la integración económica regional en América Latina”, Estudios Internacionales, Santiago, Universidad de Chile, vol. 45, núm. 175. [ Links ]

Bruckmann, M. (2012), Recursos naturales y la geopolítica de la integración sudamericana, Lima, Instituto de Investigaciones Sociales Perumundo-Fondo Editorial José Carlos Mariátegui. [ Links ]

Cepal. División de Comercio Internacional e Integración (2013), Panorama de la inserción internacional de América Latina y el Caribe. Lenta poscrisis, meganegociaciones comerciales y cadenas de valor: el espacio de acción regional, México, Cepal. [ Links ]

Composto, C. y Navarro, M. L. (2012), “Estados, transnacionales extractivas y comunidades movilizadas: dominación y resistencias en torno de la minería a gran escala en América Latina”, Revista Theomai, vol. 25, Buenos Aires, Red de Estudios sobre Sociedad, Naturaleza y Desarrollo, primer semestre. Recuperado de <http://www.revistatheomai.unq.edu.ar/numero25/Composto.pdf> [ Links ]

EIA (2013), Concentration of U.S. crude oil imports among top five suppliers highest since 1997, abril 19 de 2013, Today in Energy. Recuperado de <https://www.eia.gov/todayinenergy/detail.php?id=10911 > [ Links ]

EIA/Office of Oil and Gas (2009), U.S. Natural Gas Imports and Exports: 2007, January 2009, p. 1. Recuperado de <https://www.eia.gov/naturalgas/importsexports/annual/archives/2009/ngimpexp07.pdf> [ Links ]

Fornillo, B. (2015), “Centralidad y permanencia del pensamiento geopolítico en la historia reciente de Sudamérica (1944-2015)”, Estudios Sociales del Estado, vol. 1, núm. 2, Buenos Aires, ESE, segundo semestre. [ Links ]

Machado Aráoz, H. (2011), “El auge de la minería transnacional en América Latina. De la ecología política del neoliberalismo a la anatomía política del colonialismo”, en H. Alimonda (coord.), La naturaleza colonizada. Ecología política y minería en América Latina, Buenos Aires, CLACSO. [ Links ]

Muhr, T. (ed.) (2013), Counter-globalization and Socialism in the 21st Century: The Bolivarian Alliance for the Peoples of our America, New York, Routledge. [ Links ]

Regueiro Bello, L. M. (2008), Los TLC en la perspectiva de la acumulación estadounidense: visiones desde el Mercosur y el alba, Argentina, CLACSO. [ Links ]

______ (2014), “La Alianza del Pacífico: un pilar para el apuntalamiento del liderazgo global de Estados Unidos”, Revista de Estudios Estratégicos, núm. 1, La Habana, Centro de Investigaciones de Política Internacional, primer semestre. [ Links ]

Sturgeon, T. y Gereffi, G. (2009), “Measuring Success in The Global Economy: International Trade, Industrial upgrading, and Business Function Outsourcing in Global Value Chains. An Essay in Memory of Sanjaya Lall”, Transnational Corporations, vol. 18, núm. 2, Geneva, UNCTAD, August. [ Links ]

Sturgeon, T. y Memedovic, O. (2010), Measuring Global Value Chains: Intermediate Goods Trade, Structural Change and Compressed Development, Vienna, UNIDO, Working Paper. [ Links ]

USGS (2016), Going Critical: Being Strategic with Our Mineral Resources. Recuperado de <http://www.USGS.gov/blogs/features/USGS_top_story/going-critical-being-strategic-with-our-mineral-resources/> [ Links ]

Van Langenhove, L. (2011), Building Regions: The International Political Economy of New Regionalisms Series, Nueva York, Ashgate. [ Links ]

2This research was sponsored by a grant from the Research Initiative Program of the Faculty of Business Administration at the University of Puerto Rico, Rio Piedras campus.

6 Some of the information in this section is taken verbatim from Aponte García (2016).

7This section applies the typology developed in Aponte García (2016) to the cases of ALBA-TCP (including several members), the Pacific Alliance, and NAFTA.

8Costa Rica is an observer (2013). The extra-regional observer countries are: Australia, Spain, New Zealand, Japan, France, Portugal, Turkey, Italy, Germany, Switzerland, and the United Kingdom. Also, the United States.

9Although Dominica (2008), Antigua and Barbuda (2009), St. Vincent and the Grenadines (2009), Saint Lucia (2013), Granada (2014), and Saint Kitts and Nevis (2014) are ALBA-TCP member countries, they could not be included in this research because the USGS does not keep information on the companies located in these nations. Cuba, which has belonged to ALBA-TCP since 2004, could not be included because although the USGS does record information on the companies located in the country, UN Comtrade has not kept data on the island since 2006.

Received: October 12, 2016; Accepted: April 24, 2017

texto en

texto en