Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Problemas del desarrollo

versión impresa ISSN 0301-7036

Prob. Des vol.48 no.189 Ciudad de México abr./jun. 2017

Articles

Unemployment in Latin America: Labor Market Flexibility or Capital Accumulation?

1 Instituto de Investigaciones Económicas, Universidad Nacional Autónoma de México (UNAM), México. Correos electrónicos: luis_gacov@hotmail.com y aleph398@gmail.com, respectivamente.

Unemployment in Latin America fell substantially in 2000-2013, which, from the standpoint of conventional theory, would be the outcome of reforms designed to make the labor market more flexible. On the other hand, a post-Keynesian perspective would maintain that a dropping unemployment rate is due to rising capital accumulation. This paper aims to determine which of these theoretical visions is supported by the empirical evidence. The panel data results suggest that capital accumulation is the variable that explains the majority of the behavior of unemployment. The policy recommendation based on this evidence is to keep investment growing via instruments that stimulate effective demand.

Keywords: Unemployment; labor market; panel data; post-Keynesian theory; neoclassical theory

El desempleo en América Latina ha tenido una disminución sustancial durante el periodo 2000-2013. Desde el punto de vista teórico convencional, lo anterior sería consecuencia de las reformas orientadas a flexibilizar el mercado de trabajo. Por otro lado, la visión post-keynesiana sustentaría que la caída de la tasa de desempleo se debe al aumento de la acumulación de capital. El presente documento intenta conocer cuál de estas visiones teóricas es apoyada por la evidencia empírica. Los resultados del panel de datos sugieren que la acumulación de capital es la variable que explica mayormente el desempeño del desempleo. La recomendación de política de esta evidencia es mantener en crecimiento la inversión a través de instrumentos que estimulen la demanda efectiva.

Palabras clave: desempleo; mercado de trabajo; datos de panel; teoría post-keynesiana; teoría neoclásica

Clasificación JEL: E12; E13; E24; J64; N36

Le chômage en Amérique Latine a subit une diminution substantielle durant la période 2000-2013. Du point de vue théorique conventionnel, ce qui précède serait le résultat des reformes orientés vers l’assouplissement du marché du travail. En revanche, le point de vue post-keynésien soutiendrait l’idée que la baisse du taux de chômage est due à une augmentation de l’accumulation du capital. Le présent document cherche à savoir lequel de ces points de vue théoriques est soutenue par des preuves empiriques. Les résultats du panneau de données suggèrent que l’accumulation du capital est la variable qui explique largement la performance du chômage. La recommandation de politique de cette preuve est de garder le même rythme de croissance de l’investissement à travers des instruments qui stimulent la demande effective.

Mots clés: chômage; marché du travail; panneau de données; théorie post-keynésienne; théorie néoclassique

O desemprego na América Latina teve uma diminuição substancial durante o período 2000-2013. Desde o ponto de vista teórico convencional, o anterior seria consequência das reformas orientadas a flexibilizar do mercado de trabalho. Por outro lado, a visão pós-keynesiana sustentaria que a queda da taxa de desemprego se deve ao aumento da acumulação de capital. O presente documento tenta conhecer qual destas visões teóricas é apoiada pela evidência empírica. Os resultados do panel de dados sugerem que a acumulação de capital é a variável que explica em maior medida o desempenho do desemprego. A recomendação de política desta evidência é manter em crescimento o investimento através de instrumentos que estimulem a demanda efetiva.

Palavras-chave: desemprego; mercado de trabalho; dados de painel; teoria pós-keynesiana; teoria neoclássica

摘要2000-2013年期间拉丁美洲的失业率显著下降。从传统的理论角度来看,失业率下降是旨在调节劳动市场的一系列改革的结果。另一方面,后凯恩斯主义观点认为失业率的下降归功于资本积累的增加。本文旨在研究哪种理论观点有经验证据的支撑。研究数据表明资本的积累是能够最大限度阐释失业率下降的变量。因此我们推荐采取刺激实际需求措施以保证投资增长。

关键词 失业 劳动市场 数据板 后凯恩斯理论 新古典理论

1. INTRODUCTION

In 2000-2013, unemployment in Latin America declined slowly but sustainably, moving from 9.3% in 2003 to 6.2% in 2013. A remarkable decrease of this sort had never before occurred in recent history. Interestingly, such behavior was marked by two stylized facts that could potentially explain it, by linking each of them with a theory about the roots of unemployment.

On the one hand, in the nineteen-nineties, labor reforms were implemented across the region to make the employment market more flexible (Vega, 2005). Namely, the recent past has been characterized by amendments made to diverse employment laws to help labor supply and demand reach an equilibrium point, understood as the natural, potential rate, or the non-inflationary unemployment rate. Easing some of the rigidity of the labor market, pursuant to the neoclassical school or the so-called new Keynesian strain of thinking, is essential to reducing unemployment. Accordingly, declining unemployment could be the result of the reforms implemented to make the labor market more flexible.

On the other hand, aggregate demand and capital accumulation alike, understood as the rise in total gross fixed investment, were far more lively in 2000-2013 than in the nineteen-eighties, but similar to levels in the nineties, with aggregate demand and investment enjoying annual average rates of 3.2% and 4.8%, respectively; these numbers include 2009, when the economy shrunk in the aftermath of the Great Recession. As a percentage of gross domestic product (GDP), however, capital accumulation blossomed, rising four percentage points between 2002 and 2008, and moving from 17% to 21% of GDP. In post-Keynesian theory, effective demand, via its impact on employers' investment decisions, is what determines (un)employment levels. Thus, dynamic demand and capital accumulation between 2000 and 2013 would lead to the suggestion that it was these two factors which caused the unemployment rate to subside, lending itself to a post-Keynesian explanation.

Both stylized facts pose the following question: What explains the gradual decline of unemployment in the region: labor flexibility or the vibrant demand and accumulation rate? Finding the right answer, labor flexibility or effective demand, is no trivial matter, as it could signal which types of policies to emphasize to keep unemployment low, whether that be making the labor market even more flexible or keeping demand and, consequently, capital accumulation high. Likewise, let's recall that unemployment is one of the main sources of poverty, and insofar as unemployment can be consistently brought down, the struggle against poverty becomes much easier.

This research therefore aims to answer the question posed in the Latin American reality, which as far as is known, has not been answered to date. In that sense, although the debate about what is really behind employment is certainly longstanding, study of this topic in Latin America is relevant. In pursuit of this objective, estimates of unemployment were made with panel data to empirically prove each of the theoretical arguments conveyed. The data come from a set of 18 Latin American economies in the time period 2000-2013.

This paper is structured as follows: the second section briefly describes the conventional and post-Keynesian theoretical underpinnings of determining (un)employment levels; the third section introduces and discusses the empirical results of the econometric exercise; and the final section offers some conclusions.

2. (Un)employment in the Neoclassical and Post-Keynesian Schools

This section describes how the neoclassical and post-Keynesian schools of thought would argue about the determination of the (un)employment rate. The intention here is twofold. First, to theoretically associate falling unemployment in Latin America in the aughts with each school's explanation of (un)employment; second, to elucidate the differences between the two approaches in understanding the policy recommendations that emanate from each of them.

(Un)employment through the lens of neoclassical theory

The conventional theoretical stance, whether called neoclassical or new Keynesian (Hicks, 1937; Samuelson and Solow, 1960; Phelps, 1972; Blanchard, 1997, to name a few), postulates that unemployment in the labor market is determined by independent but interrelated maximizing choices made by, on the one hand, employers, regarding their profits and, on the other, consumers, regarding their utility (in terms of consumption capacity). Thus, business owners will demand a workforce until such point at which the cost of labor is equal to its marginal productivity, while the workforce will be supplied until the marginal disutility of idleness is equal to the benefit of working. Assuming perfect flexibility in the labor market, wages will take care of equalizing labor supply and demand, cleaning up the market. This assumes full employment and is associated with the potential or natural product, or with its counterpart, the so-called non-accelerating inflation rate of unemployment.

As a result of the above, when an attempt is made to increase aggregate demand to reduce unemployment below said rate, the result will be: “…price growth. The reason for this is the growing power of unions to bargain for better wages as employment rises” (Blanchard, 1997: 279). At the natural product or rate, the economy inexorably converges and although there may be deviations from said point, it will return to the same due to the very forces that led it there: agents' attempt to maximize benefits and wage flexibility. This carries with it the idea that once unemployment reaches its natural rate, given by structural factors and the characteristics of the labor market, it makes no sense to try to lower it again through alternative policies to the market, because if this attempt is made, unemployment will try to return to the same rate, but with adverse effects on the economy, like an inflationary spiral.

Because market forces secure the level of full employment, the model suggests that there is no chance for involuntary unemployment. Everyone who is unemployed must be in this position due to either frictional, structural, or cyclical reasons, or of their own volition. All of these workers are the people who comprise the non-inflationary unemployment rate.

However, the theory asserts that when the labor market confronts institutional rigidities, employment will fall below the natural equilibrium rate, or said another way, the unemployment rate will rise above the non-accelerating inflation rate of unemployment. This would imply that the cost of the labor factor is above that consistent with its productivity, impeding other workers from being employed.1 It thus follows that the portion of unemployment that is not frictional, structural, or cyclical is principally (and nearly exclusively) explained by labor market inflexibility (Bernal-Verdugo, 2012, 2013; Layard et al., 1991). In this way, the more rigid the institutional structure of the labor market (reflected, among other ways, in the existence of unemployment benefits, restrictions on dismissals, minimum wages, unions, taxes), the more difficult it is for employers to increase labor demand, even if workers have incentives to stay in or join the formal labor market. Both factors prompt higher unemployment than what there would be in fully flexible conditions.

Along these lines of reasoning it emerges that even exogenous shocks that raise the natural or non-accelerating inflation rate of unemployment, leading to even higher (and persistent or permanent) unemployment rates, are also ultimately grounded in the rigidity of the labor market. In other words, the principal explanation for the recognized phenomenon of unemployment hysteresis is employment inflexibility. In this case, the logic of the most common argument is centered on the power of a group of the employed called insiders to negotiate and establish, besides other benefits, real wages above market wages, preventing the unemployed, known as outsiders, from joining (even if they want to) the labor market (Blanchard, 1997; Carlin and Soskice, 2006).

From this perspective, the solution to the problem of growing and persistent unemployment consists of implementing mechanisms to make the labor market more flexible, read: eliminating any barrier that prevents employers from raising their demand for labor. In other words, the following should be removed or reduced: benefits for unemployment, restrictions on dismissals, minimum wages, unions, and more. This generally entails reforming labor laws in this direction.

It bears noting that making the labor market more flexible is no novel idea and has been embraced by advanced and developing countries alike. In this sense, there is ample empirical literature about the results, pointing to ambiguous conclusions as to the effectiveness of labor flexibility to bring down unemployment, to the extent that certain studies support it while others refute it. As it were, much of the empirical literature focused on explaining the high unemployment rate in Europe beginning in the nineteen-seventies (Layard et al., 1991; Siebert, 1997, among others) has not been able to consistently demonstrate that labor market inflexibility is the main cause behind it (Arestis et al., 2007: 126; and works cited therein). In particular, Nickell et al. (2005) asserted that 50% of the high unemployment in Europe from the nineteen-seventies to the mid-nineties can be attributed to institutional changes in the labor market and the other 50% to insufficient effective demand.

More recent literature, studying diverse countries, both advanced and developing, affirms that there is robust evidence as to the existence of an inverse relationship between labor market flexibility and unemployment rates. In addition, said literature emphasizes that higher labor market flexibility is positively correlated with employment elasticity (Bernal-Verdugo et al., 2012, 2013, and citations contained therein; Crivelli et al., 2012; Furceri, 2012). Aleksynska (2014) challenged all of this literature, mainly coming out of the International Monetary Fund (IMF), on methodological grounds related to the time series used, signaling that using these methodologies, the results cannot be replicated, calling into doubt the robustness of the work.

There are, on the other hand, studies that maintain a rather more cautious posture towards the benefits and costs of some labor regulations, like the minimum wage or employment laws, because they are beneficial in some regards, like improving income distribution, but have minimum or no impact on others, like productivity (Betcherman, 2014). In the context of a monetary union, it has been found that employment flexibility reduces economic welfare (Galí and Monacelli, 2016). In short, as underscored, the empirical evidence in the literature does not point to a uniform conclusion as to the benefits of making employment more flexible on (un)employment.

Finally, the literature on hysteresis also points to ambiguous results about the effectiveness or ineffectiveness of labor market flexibility on bringing down unemployment (Cross et al., 1990; Maurer and Nivia, 1994; Dias, 1995; León-Ledesma and McAdam, 2004; Cheng-Hsun et al., 2008; Mednik et al., 2012; Ayala et al., 2012; Dritsaki and Dritsaki, 2013). This is because these works do not always confirm that the unemployment rate is not stationary (by rejecting the unit root hypotheses of the series in question). In other words, if it were to turn out that unemployment were stationary, then against the backdrop of a shock, the series would revert to its mean (let’s say the non-accelerating inflation unemployment rate), prompting a situation in which potential labor market rigidities are not a factor preventing it from returning to its mean.

(Un)employment through the lens of post-Keynesian theory

Counterpoised against the neoclassical and new Keynesian vision of how (un)employment is determined in an economy is the post-Keynesian creed, one of whose pillars submits that wage flexibility (nominal or real)2 does not play any role in shedding light on (un)employment rates in capitalist economies (Keynes, 2000; Davidson, 2007).3 More specifically, it contends that the labor supply is not a function of real wages. With the explanation of unemployment on the side of the neoclassical labor market out of the way, this persuasion postures that the dynamics of effective demand, domestic and foreign alike, in the market of goods is what determines (un)employment (Kaldor, 1988; Kalecki, 1995; López and Assous, 2010). Namely, it is the growth of effective demand (or profits earned)4 that determines investment. Profits provide the financial resources that companies need and in turn indicate how profitable an investment has been in the recent past.

In this sense, the evolution of effective demand (meaning sales and profit) determines whether investors follow through on their investment decisions, which will have an impact on (un)employment rates. A more Kaleckian argument, but undoubtedly related to the evolution of effective demand, claims that the degree to which installed capacity is harnessed is also an important driver of investment decisions (Kalecki, 1995; López and Assous, 2010). With that said, changes in effective demand will affect the degree to which installed productive capacity is used, which will in turn have an influence on the decisions made by employers as to whether or not to hire more workers or expand or replace their machinery.

Thus, for example, in a pessimistic context, with effective demand falling short of expectations, and with an unwelcome accumulation of stock, employers will be discouraged from using their productive capacity in its totality and will at the same time postpone making investment decisions, to the extent that profits will have declined, and unemployment will rise as a consequence. If this trend holds steady, meaning there are no interventions to reverse it, unemployment will continue to increase.

The opposite scenario, namely, with effective demand above expectations, an unwanted depletion of stock, and burgeoning profits, will encourage employers to satisfy the growing demand by increasing production and commissioning previously idle machinery to start operating, in so doing employing more labor, and expanding their productive capacity, which also entails higher demand for labor as soon as said investments materialize. As this cycle is perpetuated, unemployment levels decline until, if possible, the entire workforce is employed.

Unemployment in the post-Keynesian camp is primarily involuntary, because regardless of nominal or real wage levels, employers, on the one hand, with poor effective demand prevailing and therefore low profits, will have no incentive to demand more labor, with a consequent increase in idle capacity, and workers, on the other, despite being willing to work at the current nominal wages, will not find open vacancies.

In short, effective demand determines employment rates by coming into play when employers make decisions about future production levels, which they will either cover or not through more/less employment (by employment or dismissing existing productive capacity) and/or by speeding up/putting off capital accumulation. This logic can be synthesized into an equation where induced investment (II), which expands productive capacity, given the capital-product technical coefficient (α) and the degree of employed productive capacity (μ), is a positive function of the growth of the product observed (ΔY), meaning effective demand, and negative of the capital depreciation rate (d). In other words:

From the equation it is clear that if the product does not grow, there will be no induced investment, and only obsolete capital will be replaced. But if the product does grow, investment will rise both to employ the unemployed productive capacity and to expand said capacity.

In the post-Keynesian proposal, the economic policy recommendation to diminish unemployment resides in encouraging employers to make investment decisions by incentivizing and ensuring the stability of effective demand. As is known, the most effective mechanism available to the authorities in this vision to achieve such an effect is to brandish fiscal policy, in particular by continuing to boost public spending (in particular investment). Public investment (understood as money used in the purchase of goods and services from the private sector allocated for infrastructure projects that complement or substitute private investment, like ports, roads, prisons, schools, healthcare centers, research and development centers, etc.) was in fact recommended by Keynes over public consumption (understood as money transferred to households through wages or purchases of goods and services from companies, but as part of current spending) for such effect (Smithin, 1989; Pressman, 1994; Davidson, 2007). In this sense, public investment not only directly invigorates effective demand but also adds to capital accumulation (and other variables like productivity), engendering short- and long-term effects.

The empirical proof for the post-Keynesian perspective does not, as far as these authors know, abound, and what does exist mainly deals with advanced economies. Some of the studies in this regard include those by Alexiou and Pitelis (2003), Arestis et al. (2007), and Karanassou et al. (2008). Likewise, research studying cases or groups of developing economies are few and far between (one exception is the study by Salazar and Azamar (2014) addressing the Mexican economy). The results of these studies, in both advanced economies and Mexico, are uniform in the sense that they have found evidence as to the inverse relationship between capital accumulation and unemployment.

3. (Un)employment in latin america: labor market flexibility or capital accumulation?

The advent of the twenty-first century in Latin America was marked by the end of the new wave of financial crises unleashed in the mid-nineteen-nineties.5 Since then, namely, since the beginning of Argentina’s economic recovery in 2003, the region experienced a relatively long and uninterrupted period of economic growth and stability, at least until 2009, when GDP shrunk 1.6%, a result this time of exogenous factors, in particular, the Global Recession set off in 2007. In spite of this crash, recovery came rapidly, and growth has remained positive since 2010, although tending towards a slowdown.

Parallel to that, and contrary to what happened in the nineteen-nineties, unemployment in the region has fallen slowly but consistently. Thus, although the unemployment rate hovered around 9% at the turn of the century, starting in 2004, it declined to 8.5%, and continued to wane until reaching nearly 6% in 2014 (see Figure 1). It is important to note that among the countries where the unemployment rate fell significantly, the following stand out: Argentina, whose unemployment rate plummeted from 18.3% in 2001 to 8.2% in 2014; Colombia, whose rate dropped from 16.2% in 2000 to 10.1% in 2014; Brazil, which saw its unemployment rate fall from 9.5% to 6.8% between 2000 and 2014; and Panama, where unemployment decreased from 14% in 2001 to 4.3% in 2014. Other countries, like Mexico, Ecuador, El Salvador, Jamaica, Honduras, Paraguay, and Peru experienced rather more stable behavior. Altogether, we reiterate, unlike what has been happening in the recent past (the nineties, for example), in the aughts, the unemployment rate declined in a sustained fashion in Latin America.

Source: World Development Indicators, World Bank (http://databank.worldbank.org/data/home.aspx)

Figure 1 Open Unemployment Rate in Latin America (%), 1991-2014

In light of this evolution, the question that arises is: What could explain this behavior? Pursuant to the descriptions of theory in the section prior, there are two potential responses: a more flexible labor market or thriving effective demand and capital accumulation. Curiously, the region experienced both phenomena, although certainly, as will be shown, the increased flexibility of the labor market was in large measure set in motion in the nineties. The next step is to offer a description of the two events.

Labor market flexibility

The aughts ushered in the ramping up of the labor law reforms launched in the nineties in the vast majority of countries throughout the region, aiming to deregulate the labor market.6 Many of these reforms, it bears mentioning, like in the case of the Mexican economy, merely formalized what in practice was already happening, in other words, de facto labor market flexibility (Cook, 2007). According to Vega (2005), on the other hand, the aspects of labor laws that were amended the most, with a deregulatory bent, included contracts, causes for dismissal, the workday, wages, and severance when employment relationships are terminated.7

Table 1 shows the economies and years in which said reforms took place. As can be observed, this regulatory process weighed heavily in the nineties. In the aughts, however, several more changes were enacted to labor laws, although of course in fewer economies. Of the amendments made since 2003:

"...the fact that in 11 of the 17 countries considered more or less profound labor reforms have taken place with an inclination to flexibility, and that these countries account for 70% of wage-earning employment in the region, would seem to call into doubt the oft-made statements that labor reform in Latin America has been neither widespread nor profound..." (Vega, 2005: 13).

As a result of the changes made to labor laws, labor market flexibility expanded relatively rapidly in Latin America in the nineties. This was reflected in the evolution of the employment regulation index in the region, an indicator published by the Fraser Institute (www.fraserinstitute.org). Accordingly, said index rose from 4.54 in 1990 to 5.31 in 1995, to settle in at 5.24 in 2000 (the index is scored on a range of 1 to 10, where 10 is total freedom, no regulations). In the aughts, the index rose more slowly, peaking at 5.78 in 2009.8 In other words, the index moved in step with the changes made, but the rise, measured in terms of its value, does not seem to reflect the magnitude of the labor reforms in the region. This is the case even when considering that the index is composed of variables, which, as we are pointing out, have changed significantly, such as regulations on hiring and firing and the minimum wage.

We should mention, however, that pursuant to said index, labor regulations in Latin America are not so far off from countries or groups of countries that are much further along in development. For example, the rigidity of employment index in 2013 for the European Union countries and the 20 OECD economies was 6.7. The rate was similar in Germany, with 6.5, but far below the United States, at 9. Remarkable in this context are the rates of employment flexibility in economies such as those of Belize, Jamaica, and Nicaragua, which lag behind in economic development, but also enjoy the highest levels of labor market flexibility in the region, at 8.9, 8.4, and 7.3, respectively.

In short, it is evident that since the 1990s, the region as a whole has witnessed labor law changes, moving towards deregulation in concordance with the recommendations emerging from neoclassical theory to reduce unemployment.

Capital accumulation

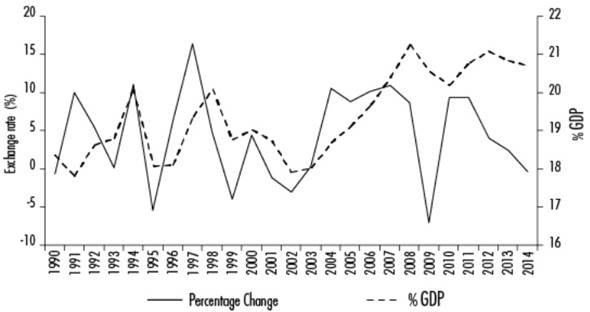

As signaled already, the labor reform was not the only relevant stylized fact that the region has experienced recently. In effect, since the early aughts, Latin America has been characterized by an outstanding increase in capital accumulation. Accordingly, both the investment growth rate and its share in GDP have grown vibrantly in a sustained fashion, far above what ensued in decades prior. Investment grew on average 4.8% between 2000 and 2013, including 2009, when investment collapsed 7%; likewise, it is striking that said growth held strong at a spectacular 11% between 2004 and 2007. For its part, investment as a percentage of GDP increased by four percentage points, going from 17% to 21% of GDP between 2002 and 2008, the latter unprecedented since the eighties (see Figure 2). The rising share of investment in GDP is especially momentous to the extent it has begun to approach the threshold recommended by international bodies to achieve significant sustained economic growth, which is between 20% and 25% (UNCTAD, 2003).

Source: World Development Indicators, World Bank (http://www.databank.worldbank.org/data/home.aspx)

Figure 2 Gross Capital Formation in Latin America, 1990-2014

On the other hand, as can be seen in Figure 2, rising investment since the early aughts was interrupted with the onset of the Great Recession around the world in 2007, remaining depressed up through 2009. Even so, the recovery was almost immediate, picking up again in 2010. It is worth noting that in this context of brisk capital accumulation, public investment played an important role starting in 2006, when it began to climb from 3.5% of GDP that year to 4.7% in 2013. Finally, we must recall that dynamic investment is essential to the evolution of the GDP, such that its stability and growth helped the product grow on average 3.2% in the time period 2000-2013. Although this growth is far from spectacular, it is nothing to scoff at either, especially in a region marked by instability and slow growth in decades past.

Although outside the scope of this work, it is important to note that the principal, although far from only, factor responsible for the great economic moment the region experienced was the global economic upturn, driven by the vigor of developing economies like China. This, in a region that is predominantly an exporter of primary goods (nearly 50% of the total) entailed a significant increase in the demand for said goods, undoubtedly a relevant factor involved in the economic growth observed. The global economy capitalized on this momentum until its collapse in 2007. To date, it has not managed to rebound to pre-recession growth levels.

The tremendous rise in gross capital formation in the region would, pursuant to the post-Keynesian school, be the main element underwriting the sustained decrease in unemployment.

The econometric exercise

Against the backdrop of the quandary posed by the stylized facts, we proceeded to conduct an econometric exercise with data from a sample of 18 Latin American economies in the period 2000-2013, which, we reiterate, saw the unemployment rate fall in a sustained fashion. The economies in the sample are: Argentina, Belize, Bolivia, Brazil, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, Jamaica, Mexico, Nicaragua, Panama, Paraguay, Peru, Dominican Republic, and Venezuela, which were selected primarily based on the availability of data, aiming to empirically identify the cause behind declining unemployment in Latin America in the period of study. The idea, accordingly, is to estimate the following specification through panel data techniques:

where u it is the urban open unemployment rate of country i in period t, 2000-2013, αi represents the fixed effect that captures the drivers not observed in the unemployment of each country, and x it is the vector that contains the explanatory variables, where on the one side is the labor regulation index (b) and on the other, the components of aggregate demand; namely, private consumption (cp), exports (x), government spending (gg), and gross capital formation (k). The demand variables are expressed as a percentage of GDP and were transformed into logs, the same as for the unemployment rate. The variables associated with labor regulation were maintained in levels. The expectation was that the explanatory variables would have a negative sign, indicating an inverse relationship between each variable and the unemployment rate. The labor regulation index data were gathered from the Fraser Institute Economic Freedom database (www.fraserinstitute.org), while the components of aggregate demand were drawn from the World Development Indicators released by the World Bank (www.databank.worldbank.org).

It is important to note that we chose to conduct the estimate through the fixed effects technique in order to, as is usual in this type of exercise, include the heterogeneity of the economies in the sample. Likewise, because the basis comprises an imbalanced panel, we used robust standard errors to correct for the possible heteroscedasticity that could affect the outcome of the regression (Asteriou and Hall, 2011).

Table 2, column 1, reports the results of the basic estimate that explains unemployment as a function of the compound labor regulation index and capital accumulation. The idea is to try to capture the effect of the two variables in the evolution of employment to the extent that, as noted, the labor reforms were already under way in said period, although in some cases, there were already de facto changes to the labor market even before proper reforms were enacted. At the same time, capital accumulation grew significantly.

Table 2 Drivers of the Unemployment Rate (u), 2000-2013

Notas: Robust standard errors in parentheses, * and ** denote statistical significance at 1 and 5 percent, respectively.

Source Created by the authors.

As we can see, both variables have the expected sign. Nevertheless, capital accumulation is statistically significant. This result is maintained throughout the subsequent estimates (columns II and III). It is important to note, in fact, that the response of unemployment to capital accumulation is large, indicating that for each percent that capital accumulation increases as a percentage of GDP, the unemployment rate decreases by 1%.

In column II we find the results after adding in the remaining components of aggregate demand, meaning public (gg) and private consumption (cp), and exports (x). The intention here is to elucidate whether another of these components has been crucial in explaining unemployment. As is evident, none of these variables is able to explain unemployment as none is statistically significant, although private consumption and exports do possess the expected sign. Interestingly, public spending displays a positive sign, something unexpected in the post-Keynesian context. The compound labor regulation index maintains its negative sign and continues to be statistically insignificant.

Now, as we have pointed out, the aspects where labor laws changed most radically in Latin America included contracts, causes for dismissal, the workday, wages, and severance packages. In order to look at whether through any of these variables labor market flexibility had an impact on unemployment, we set aside the compound labor market flexibility rate and introduce in its place the components that comprise it. There are five components, and they measure the following: bi, hiring and minimum wage regulations; bii, hiring and firing regulations; biii, centralized bargaining in collective contracts; biv, regulations per hour and cost of hiring per worker; and, finally, bv, the mandatory cost of dismissal.

Column III shows the results of each estimate. As can be seen, capital accumulation maintains its sign, size, and statistical significance. In other words, the measures focused on making hiring and minimum wages more flexible have had a positive effect on the unemployment rate. All of the other measures have a positive sign and are statistically insignificant.

Finally, given the relevance of capital accumulation in explaining unemployment, as underscored in the post-Keynesian argument, investment responds principally to the evolution of effective demand. Namely, if investment varies as a function of effective demand, then (un)employment will do so, too. Column IV includes explanatory variables for the log of per capita income in real terms (ypc) and the compound labor market regulation index. In other words, for each percentage increase in income, the unemployment rate falls by the same measure. For its part, compound labor regulation continues to be irrelevant to unemployment.

In short, our results indicate that capital accumulation has been the main driver responsible for dwindling unemployment in Latin America between 2000 and 2013. In this sense, the post-Keynesian school is backed by the empirical evidence. Labor market flexibility has also had an impact through changes made to hiring and minimum wage regulations, although the impact seems to wane in periods of high economic growth.

These empirical findings have significant policy implications. First, they suggest that the degree of employment deregulation is of little importance when employers are deciding how much more labor to employ, because it shrinks or disappears against the relevance of effective demand. In fact, if the objective of employment flexibility is to reduce the cost of labor, then emphasizing said strategy could be counterproductive to stimulate employment to the extent that lower wages will drive down effective demand and, consequently, capital accumulation. Let's not forget that wages are both a cost of production and a fundamental component of demand. The evolution of wages in demand in this sense is crucial in developing economies, like those in Latin America, because they have not yet moved to permanent dependence on external demand, via the production and exportation of goods with high income elasticity of demand. But even in economies where the external sector does play a significant role in demand and economic growth, wages are very important, because they drive domestic demand.

Second, if Latin American economies want to move closer to full employment, they will need policies that incentivize the growth of demand, which will in turn positively fuel capital accumulation. One of the few immediate alternatives in the hands of policymakers, especially in a context of contracting external demand, is to use public investment, as the region has been doing since 2006. As noted here, public investment not only has immediate effects on demand levels, but also produces medium- and long-term effects, by expanding productive capacity, and having a positive impact on all levels of productivity (Pressman, 1994; Galstyan and Lane, 2009). In fact, an expansionary public investment strategy, as part of a well-defined industrial strategy, would help countries leap into producing sophisticated goods. This process would undoubtedly boost employment.

4. CONCLUSIONS

In 2000-2013, Latin America bore witness to the sustained decline of the unemployment rate accompanied by two phenomena that rarely happen at the same time: labor reforms bent on greater flexibility in the nineties, doubled down on in the aughts, and a significant rise in capital accumulation. Each of these phenomena on its own could account for falling unemployment, through two opposing theoretical schools of thought. The neoclassical posits labor market flexibility as a mechanism to resolve unemployment problems. The post-Keynesian current sustains that it is rising capital accumulation, as a result of growing effective demand, that is the path to diminishing unemployment.

Beginning at this point of departure, this paper, drawing on data from 18 economies throughout the region and panel data techniques, investigated which variable, and therefore which theory, more feasibly supports the observations. The results suggest that it is demand and capital accumulation which primarily explain the performance of unemployment in the period of study. Namely, it is the post-Keynesian lens that provides the right theoretical framework to explain falling unemployment. Measures designed to make hiring and minimum wages more flexible have also had a positive effect on the unemployment rate, but this effect is seemingly minimized in a context of economic growth like that seen in this study.

Based on these results, it could be suggested that in order to reduce unemployment, it is necessary to ensure that capital accumulation continues to grow, as it is the main path to breathing new life into effective demand. To that end, the post-Keynesian vision recommends, in a context of contracting external demand and slow productivity growth and, therefore slow wage growth, boosting public investment. The region has been doing so tremendously since 2006. Accordingly, the idea would be to maintain and even continue to increase public investment, tied to an industrial policy strategy to move towards the manufacture of high-added-value goods, which are in high demand in the foreign market. In a context of this sort, it would be viable for unemployment to continue on a downward trend.

REFERENCES

Aleksynska, M. (2014), “Deregulating Labour Markets: How Robust is the Analysis of Recent imf Working Papers?”, Conditions of Work and Employment Series núm. 47, International Labour Office, Geneva. [ Links ]

Alexiou, C. y C. Pitelis (2003), “On Capital Shortages and European Unemployment: A Panel Data Investigation”, Journal of Post Keynesian Economics, vol. 25, núm. 4, pp. 613-640. [ Links ]

Arestis, P., M. Baddeley y M. Sawyer (2007), “The Relationship between Capital Stock, Employment and Wages in Nine emu Countries”, Bulletin of Economic Research, vol. 59, núm. 2, pp. 125-148. [ Links ]

Asteriou, D. y S. Hall (2011), Applied Econometrics (2nd ed.), Reino Unido, Palgrave-MacMillan. [ Links ]

Ayala, A., J. Cuñado y L. Gil-Alana (2012), “Histéresis del desempleo: evidencia empírica para América Latina”, Revista de Economía Aplicada, vol. 15, núm. 2, pp. 213-233. [ Links ]

Bernal-Verdugo, L., D. Furceri y D. Guillaume (2013), “Banking Crises, Labour Reforms, and Unemployment”, Journal of Comparative Economics, vol. 41, núm. 4, pp. 1202-1219. [ Links ]

______, D. Furceri y D. Guillaume (2012), “Labour Market Flexibility and Unemployment: New Empirical Evidence of Static and Dynamic Effects”, imf Working Paper, 12/64. [ Links ]

Betcherman, G. (2014), “Labor Market Regulations. What do We know about Their Impacts in Developing Countries?”, Policy Research Working Paper no. 6819, The World Bank. [ Links ]

Bhaduri, A. (1990), Macroeconomía: la dinámica de la producción de mercancías, México, Fondo de Cultura Económica. [ Links ]

Bhaduri, A. y S. Marglin (1990), “Unemployment and The Real Wage: The Economic Basis for Contesting Political Ideologies”, Cambridge Journal of Economics, vol. 4, núm 4, pp. 375-93. [ Links ]

Blanchard, O. (1997), Macroeocnomía, Reino Unido, Prenctice-Hall. [ Links ]

Carlin, W. y D. Soskice (2006), Macroeconomics: Imperfections, Institutions and Policies, Reino Unido, Oxford University Press. [ Links ]

Cheng-Hsun, L., K. Nai-Fong y Y. Cheng-Da (2008), “Nonlinear vs. Nonstationary of Hysteresis in Unemployment: Evidence from oecd economies”, Applied Economics Letters, núm. 15, pp. 905-909. [ Links ]

Cook, M. (2007), The Politics of Labor Reform in Latin America. Between Flexibility and Rights, Estados Unidos, The Pennsylvania State University Press. [ Links ]

Cross, R., H. Hutchinson y S. Yeoward (1990), “The Natural Rate, Hysteresis, and The Duration Composition of Unemployment in the U. S.”, Quarterly Journal of Business and Economics, vol. 29, núm. 2, pp. 89-116. [ Links ]

Crivelli, E., D. Furceri y J. Toujas-Bernaté (2012), “Can Policies Affect Employment Intensity of Growth? A Cross-Country Analysis”, imf Working Paper núm. 12/218. [ Links ]

Hicks, J. (1937), “Mr. Keynes and the ‘Classics’. A suggested Interpretation”, Econometrica, vol. 5, núm. 2, pp. 147-159. [ Links ]

Davidson, P. (2007), John Maynard Keynes, Reino Unido, Palgrave Macmillan. [ Links ]

Dias, N. (1995), “Paradox of Hysteresis and Real-wage Flexibility in Australia”, Journal of Post-Keynesian Economics, vol.17, núm. 4, pp. 503-514. [ Links ]

Dritsaki, C. y M. Dritsaki (2013), “Hysteresis in Unemployment: An Empirical Research for Three member States of European Union”, Theoretical and Applied Economics, vol. 20, núm. 4, pp. 35-46. [ Links ]

Furceri, D. (2012), “Unemployment and Labour Market issues in Algeria”, IMF Working Paper no. 12/99. [ Links ]

Galí, J. y T. Monacelli (2016), “Understanding the Gains of Wage Flexibility: The Exchange Rate Connection”, American Economic Review, vol. 106, núm. 12, pp. 3829-3868. [ Links ]

Galstyan, V. y P. Lane (2009), “The Composition of Government spending and The Real Exchange Rate”, Journal of Money, Credit and Banking, vol. 41, núm. 6, pp. 1233-1249. [ Links ]

González, J. (2013), Reforma laboral: algunos apuntes para el análisis legislativo, Documento de Trabajo no. 148, Centro de Estudios Sociales y de Opinión Pública de la Cámara de Diputados (México).. [ Links ]

Kalecki, M. (1995), Teoría de la dinámica económica, México, FCE. [ Links ]

Kaldor, N. (1988), “The Role of Effective Demand in the Short and Long Run”, en A. Barrère (ed.), The Fundations of Keynesian Analysis, London, Macmillan Press. [ Links ]

Karanassou, M., H. Sala y P. Salvador (2008), “Capital Accumulation and Unemployment: New Insights on the Nordic Experience”, Cambridge Journal of Economics, vol. 32, pp. 977-1001. [ Links ]

Keynes, J. (2000), La teoría general de la ocupación, el interés y el dinero, México, FCE. [ Links ]

Lavoie, M. (2014), Post-keynesian Economics. New Fundations, Reino Unido, Cheltenham Edward Elgard. [ Links ]

Layard, R., R. Jackman y S. Nickell (1991), Unemployment: Macroeconomic Performance and the Labour Market, Oxford, Oxford University Press. [ Links ]

León-Ledesma, M. y P. McAdam (2004), “Unemployment, Hysteresis and Transition”, Scottish Journal of Politycal Economy, vol. 51, núm. 2, pp. 377-401. [ Links ]

López, J. y M. Assous (2010), Michal Kalecki, New York, Palgrave-Macmillan. [ Links ]

Maurer, M. y D. Nivia (1994), “La histéresis en el desempleo colombiano”, Cuadernos de Economía, vol. 14, núm. 21, pp. 223 - 239. [ Links ]

Mednik, M., C. Rodríguez y I. Ruprah (2012), “Hysteresis in Unemployment: Evidence from Latin America”, Journal of International Development, vol. 24, núm. 4, pp. 448-466. [ Links ]

Nickell, S., L. Nunziata y W. Ochel (2005), “Unemployment on the oecd since the 1960s. What do We Know?”, Economic Journal, vol. 115, pp. 1-27. [ Links ]

Phelps, E. (1972), Inflation Policy and Unemployment Theory: The Cost-Benefit Approach to Monetary Planning, primera edición, The MacMillan Press, London. [ Links ]

Pressman, S. (1994), “The Composition of Government spending: Does It Make any Difference”, Review of Political Economy, vol. 6, núm. 2, pp. 221-239. [ Links ]

Salazar, C. y A. Azamar (2014), “Flexibilidad y precarización del mercado de trabajo en México”, Política y Cultura, núm. 42, pp. 185-207. [ Links ]

Samuelson, P. y R. Solow (1960), “Analytical Aspects of Anti-inflation Policy”, American Economic Review, vol. 50, núm. 2, pp. 174-194. [ Links ]

Siebert, H. (1997), “Labour Market Rigidities: at the Root of Unemployment in Europe”, Journal of Economic Perspectives, vol. 11, núm. 3, pp. 37-54. [ Links ]

Smithin, J. (1989), “The Composition of Government Expenditures and the Effectiviness of Fiscal Policy”, en J. Pheby (ed.), New Directions in Post-keyensian Economics, Inglaterra, Edward Elgar, pp. 209-227. [ Links ]

Tokman, V. (2008), “From the Concensus Reforms to Reforms for the Protected and Inclusive Employment”, ids Bulletin, vol. 39, núm. 2, pp. 69-78. [ Links ]

UNCTAD (2003), Trade Development Report. Capital Accumulation, Growth and Structural Change, United Nations, New York and Geneva. [ Links ]

Vega Ruíz, M. (2005), La reforma laboral en América Latina: 15 años después. Un análisis comparado, Organización Internacional del Trabajo, Lima. [ Links ]

1The higher cost of the labor factor is also seen as a loss of competitiveness in the international markets in this perspective. Therefrom employment flexibility is seen as a mechanism to recover said competitiveness.

2In fact, according to Lavoie (2014), the post-Keynesian vision does not consider the existence of the labor market.

3In the post-Keynesian vision, unemployment rates determine wages, setting aside the possibility that wages are able to alter labor supply and demand (Badhuri, 1990; Lavoie, 2014). In this context, assuming constant or growing yields, employment and wages move together.

4Profit is measured as the rate or share of income (Badhuri and Marglin, 1990).

5Latin America suffered major financial crises in the nineties, like the Mexican crisis of 1994-95 and the Brazilian of 1997-98. In 2001, Argentina endured a major crisis, too. In 2003, the Dominican Republic went through the latest crisis in the region.

6 Tokman (2008) highlighted that the labor reforms of the nineties were in reality part of a second package of structural reforms introduced in Latin America starting in the early eighties, geared towards globalization, privatization, and liberalization (also, see Cook, 2007). In the particular case of the labor reforms, the aim was to reduce the costs of firing and loosen up other rigidities so that low labor costs would attract foreign direct investment, buttressing the basis of the region's competitive advantage.

7Before the reforms, most of the contracts for jobs in the formal sector were permanent employment contracts, which compelled employers to give advance notice before dismissal and to provide other severance compensations (like one month of wages per year worked up to a ceiling of 11 months). Thus, the cost of firing under these conditions in Latin America became double that of other Organization for Cooperation and Economic development (OECD) member countries (Tokman, 2008: 69).

Received: October 19, 2016; Accepted: January 13, 2017

texto en

texto en