Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Problemas del desarrollo

versão impressa ISSN 0301-7036

Prob. Des vol.48 no.188 Ciudad de México Jan./Mar. 2017

Articles

The Transparency of Subnational Debt a Mechanism to Limit its Growth

1Institute for Economic Research at the National Autonomous University of Mexico (UNAM), Mexico. E-mail addresses: marcelaa@unam.mx and neria@unam.mx, respectively.

2Faculty of Economics at the National Autonomous University of Mexico (UNAM), Mexico. E-mail address: thureos@hotmail.com

The aim of this paper is to demonstrate the lack of an explicit transparency obligation in terms of disclosing the amount of subnational public debt and limiting it in relevant legislation, which effectively allow subnational debt to balloon. To analyze this matter, we estimate two econometric models that combine panel data and time series to determine the impact of transparency requirements and regulatory constraints on the behavior of state debt. It was found that on average, debt tended to be 28% higher in states where it was not mandatory to disclose debt levels; likewise, it was observed that on average, debt was 43% lower in states with explicit debt limits.

Key Words: Subnational debt; corruption; transparency; public finance; econometric models; states

El objetivo de este artículo es demostrar que la ausencia de una obligación explícita de transparentar las cantidades de la deuda pública subnacional y de limitarla en la legislación correspondiente, propician su incremento acelerado. Para su análisis, se realizan estimaciones de dos modelos econométricos que combinan datos panel y series de tiempo, para determinar el impacto de la transparencia y de los límites normativos en el comportamiento de la deuda estatal. Se encontró que en promedio la deuda tendía a ser 28% mayor en las entidades federativas, donde no era obligatorio transparentar el nivel de endeudamiento; asimismo, se observó que en promedio la deuda fue menor en un 43% en las entidades que tenían límites explícitos de endeudamiento.

Palabras clave: deuda subnacional; corrupción; transparencia; finanzas públicas; modelos econométricos; entidades federativas

Le but de cet article est démontrer que l’absence d’une obligation explicite de fournir les chiffres transparentes de la dette publique sous-national et d’en limiter avec la législation pertinente, conduisent à sáugmentation rapide. Dans le dessein de l’analyser, se réalisent des estimations avec des deux modèles économétriques qui combinent des données de panel et de séries chronologiques afin de déterminer l’impact de la transparence et de réglamentation des limites sur le comportement de la dette de l’Etat. On a constaté que, en moyenne, la dette avait tendance à être 28% plus élevé dans les entités fédératives où il n’a pas les niveau de transparence obligatoire de l’endettement; également on â noté que la dette moyenne était 43% inférieure dans les entités qui ont des limites explicite de la dette.

Mots clés: la dette sous-national; la corruption; la transparence; les finances publiques; les modêles économétriques; entités fédératives

O objetivo deste artigo é demonstrar que a ausência de uma obrigação explícita de transparência nas quantidades da dívida dos governos sub-nacionais e de limitá-la na legislação pertinente proporcionam o seu rápido crescimento. Para analisar este processo, realizamos estimativas dos dois modelos econométricos que combinam dados de painel e dados de séries de tempo para determinar o impacto da transparência e dos limites dados pela regulamentação sobre o comportamento da dívida estatal. Verificou-se que, em média, a dívida tende a ser 28% maior em estados onde não foi obrigatório ter transparência do nível de endividamento; também se verificou que a dívida foi em média um 43% inferior nos estados que tinham limites de endividamento explícitos.

Palavras-chave: dívida sub-nacional; corrupção; transparência; finanças públicas; modelos econométricos; estados

本论文旨在证明如果不对地方政府债务做出明确的规定并予以立法,将导 致债务快速增长。本文采用结合了面板和时间序列数据的两种计量模型进 行分析以确定透明度和法规限制对国债的影响。分析发现没有强制债务透 明的联邦政府机构的平均债务要比其他地区高28%。研究同时发现:对债 务限制做出明确规定的机构,平均债务水平比其他机构低43%。

关键词: 地方政府债务; 腐败; 透明; 公共财政; 经济计量模型; 联邦机构

Introduction3

Transparency is gaining ground on the agendas of public and private bodies, both national and international. Its relevance is neither coincidental nor occasional, because it is due to the disillusionment that citizens are feeling as a result of government performance, which has in many cases led to economic and social crises that have had a negative impact on life in society. Likewise, there have been countless corruption scandals that foment further rancor among the citizenry.

In recent years, Mexican subnational public debt has surged as a result of the absence of institutional control. Fundamental questions whose responses are extremely salient to society in exercising its right to know include: How does an explicit mandatory requirement to transparently disclose debt levels affect the growth of subnational public debt? Is there any relationship between rising debt and a legal framework that limits it?

It ought to be kept in mind that the choice to opt for public debt only resolves problems in the short term, because sooner or later, the debt will have to be repaid and the debt service covered to the detriment of potential funding for public services essential to the welfare of the population, which is the ultimate purpose of any governmental administration.

This research aims to contribute to solving this problem. It was found that both transparency and the regulatory framework play a role of vital importance in controlling subnational debt and ensuring healthy public finances.

The topic is addressed, in the first two sections, by considering the role of corruption and transparency in the evolution of public finances and, particularly, of subnational debt. The third section highlights the legal framework of transparency in Mexico. The fourth analyzes the behavior of subnational debt, as well as the states that have set a limit on debt following the 2015 constitutional reform in matters of financial discipline. The fifth section presents the arguments, results, and assessment of a panel data and time series econometric exercise that measures the relationship among subnational debt, transparency, and corruption. The final section underscores a few final considerations as the conclusions.

1. Corruption and Public Finances

In Latin American countries, despite the spotlight recently shone on transparency and accountability, the weakness of these mechanisms and the rule of law have prompted acts of corruption to persist in public administration, derived in large part from weak accountability mechanisms and debilitated rule of law (Monsiváis, 2005). With opacity, corruption becomes an everyday practice that harms the economy and, in the case of public finances, causes deficits that need to be covered by debt in the short term, but sooner or later, taxpayers end up paying the bill.

For Tanzi (2008), corruption means an absence of fair treatment towards all by public servants. As the author asserted, the problem of corruption is very complex; first, its definition is ambiguous, which makes it hard to identify. The topic is extremely sensitive because it affects the credibility and prestige of people and institutions. Moreover, corruption is frequently protected by the very people or institutions that hold economic and/or political power. To control and prevent corruption, it is necessary to increase both the likelihood of getting caught and enforcement. Otherwise, the rules are not mandatory, and it becomes a matter of mere political will (Merino, 2006).

The relationship between the State and corruption is fundamental. Now, over time, our understanding of corruption has changed. For Weber (2005), corruption delegitimizes the people and institutions perceived to be involved in these practices. Neoliberal theorists, such as Buchanan and Musgrave (1999) conceive of the State as a source of rents, privileges, and favors. For them, it is a normal economic tradeoff that entails a calculation of the costs versus the benefits. Other authors have written that corruption is inevitable and even useful to overcome the resistance of national bureaucracies. Leff (1964) and Huntington (1968) consider that corruption in developing societies is helpful in activating the economic life. Even during the Cold War period, wealthy countries preferred to deal with corrupt, but submissive, governments rather than incorruptible, but also independent, rulers (Alonso and Garciamartín, 2011).

Because corruption affects the composition of public spending and distorts the tax system, it makes room for more severe imbalances in public finances, which are conventionally covered by taking on public debt. Easterly (2002) found evidence that in countries with higher corruption, the public deficit with respect to the Gross Domestic Product (GDP) was higher than in less corrupt nations.

Myrdal (1990) was one of the first to study the costs of tolerating corruption on countries' progress. Nowadays, corruption is considered to distort the ability to alter the efficient allocation mechanisms of the market, concentrate income by increasing the cost to access social services for the poorest, and is also used by organized crime (Alonso, 2011).

Public finances are fertile ground for corruption, especially when there is neither transparency nor accountability. When it comes to tax collecting, it turns out that the State earns less than what it potentially could; this happens when, in exchange for an illegal payment, taxes are reduced or reimbursed or tax exemptions are granted, because these practices lead to tax evasion. Similar cases also arise in concessions to exploit natural resources or the assets belonging to a nation. Payments for these rights could generate numerous resources for the State, but when there is corruption, entitlements are granted at low costs.

On the other hand, corruption discourages investment and makes the tax system regressive, because it is large taxpayers who have the highest likelihood of seeing their tax burdens eased.

From the income perspective, factors conducive to corruption include: the complexity of the tax system and the inordinate discretion of some tax administrators. When the tax burden is high and civil servants’ wages are low, or when bureaucracy is excessive (Alonso and Garciamartín, 2011), the likelihood of corruption is higher. Among the indices mentioned by the Superior Audit Body of the Federation (ASF) is the Indicator on the Ease of Tax Payments 2014-2015 (ASF, 2015), where Mexico is ranked 105th out of 189 economies.

When it comes to the exercise of public spending, just like in the case of income, if there is no transparency in how resources are managed, corruption mechanisms frequently appear, for example, in tenders. Public investment is especially influenced by this phenomenon, as fewer benefits than expected are frequently the norm.

One example of that can be found in works built at high prices that barely benefit the population. Moreover, investments are often made alongside bribe payments (Tanzi, 2008). In this way, it appears that public spending is rising due to the commissions that corrupt civil servants receive to favor a certain supplier in the acquisition of goods for the public sector.

According to Tanzi (2008), corruption has adverse effects on countries, which are reflected in the quality of public investment, the costs of transaction to start a business, and levels of public debt. Corruption also pushes up the cost of certain economic operations (Alonso and Garciamartín, 2011).

Underspending of the budget is another bastion of corruption. In this case, banks receive large amounts of funds from transfers they do not carry out, depositing them in interest-free accounts where the interest ends up in the hands of some civil servant.

On the other hand, Alt and Lassen (2006) found that the deficit and cumulative debt rise insofar as political parties become more polarized, as they try to look more efficient in the provision of public services without tax hikes, under the motto of "buy now, pay later."

It is impossible to quantify corruption based on objective data, because these data simply do not exist. That is why this paper has attempted to measure it through the perceptions of different actors about the frequency of corrupt acts (Del Solar, 2008). Thus, there are currently diverse indices that measure corruption indirectly. Based on these indices, the perception of corruption among the populations of different countries can be compared, as well as how these perceptions have evolved over time (Del Solar, 2008).

The most well-known corruption perception index is the Transparency International Index developed by the eponymous international non-governmental organization. Pursuant to that index, Mexico is ranked 95th out of 168 countries and 11th among the 22 Latin American countries. According to the index, the closer countries are rated to 100, the less corrupt they are. In 2016, Mexico scored a mere 35.

2. Transparency: A Mechanism to Confront Corruption

Transparency plays a key role in controlling corruption (Solimano, 2008), as it can limit abuses of power; by contrast, in its absence, corruption can flourish because these practices will remain hidden and will not be known to the public. Piñar (2014: 3) cited Judge Louis B. Brandeis, who once asserted, metaphorically speaking, "Sunlight is said to be the best of disinfectants." By contrast, opacity is a denial of the public (Uvalle, 2008) and its result is to foster corruption (Del Solar, 2008).

But what is transparency? It is the fluid and timely access to reliable, relevant, and verifiable information (Del Solar, 2008). Transparency is a way to bolster publicity for public affairs and therefore prevent power from being exercised in such a way that favors private interests and deviates from public objectives. Since Kant (2013), transparency has been considered an essential element of public law. As long ago as 1948, the Universal Declaration of Human Rights had already recognized the right to information.

What is the utility of transparency for a society? Transparency can make the distribution of resources more efficient and at the same time serve as a barrier to prevent the benefits of growth from being appropriated by the elite (Bellver, 2007). Transparency can improve control of corruption, make use of public resources more efficient, and afford citizens stronger tools for control and oversight (Del Solar, 2008).

When it comes to the effect of transparency on the trust that citizens place in their governments, champions of transparency do not concur. From an optimistic perspective, transparency can create an open culture in governmental organizations, which increases the confidence felt by citizens (Hollyer, Rosendorff, and Vreeland, 2011). According to Grimmelikhuijsen et al. (2013), transparency is considered to be a key value in the trust that citizens place in their governments; however, the way in which people perceive and appreciate governmental transparency varies depending on a country’s cultural values. To skeptics, transparency can produce some confusion among citizens; to others, it has no effect at all because there are other determinants of trust in governments that are more important. Recent empirical studies have concluded that transparency has a limited effect (Grimmelikhuijsen et al., 2013; Héritier, 2003).

It should be noted that transparency alone is not enough. What is desirable is to generate real change and not just have transparency as a means of controlling governmental decisions (Arellano, 2007). As Fox and Haight (2007) wrote of transparency, on its own, it cannot resolve the imperfections of the rule of law. Rather, it needs to be used strategically to become an instrument of change. Merely making information available will not prevent corruption. Other conditions, such as accountability, education, an independent media, and free and fair elections, are required. Moreover, it is a good idea for transparency requirements to be enforced by external institutions, such as a free press, as they are more effective than when applied by the institutions themselves.

If the idea is to obtain positive effects in the fight against corruption (Lindstedt and Naurin, 2010), it is important for reforms that increase transparency to be accompanied by the following measures: a) strengthen the ability of citizens to act on the information available; b) establish penalties when an abuse or breach occurs; c) citizen participation must become a reality and citizens need to actively participate in public affairs (Uvalle, 2008); d) according to Cunill (2006), in order for information to be transparent, it must be accessible so that citizens can easily use it; it must moreover be relevant and respond to the varied interests of inhabitants, such as potholes in the streets or the amount of public spending allocated to education or the destination of foreign public debt, topics that do not interest all citizens equally.

Although it may seem difficult to estimate the level of public spending efficiency associated with greater transparency, some work has been done in this regard. For example, Ohashi (2009) found, in an empirical case study conducted in a Japanese municipality, that improving transparency is an effective method of reducing the cost of acquisition of goods and services for the public sector, which can be explained because it limits discretionary abuses by the civil servant in charge of purchasing and weakens collusion among bidders. Opaque and discretionary purchasing practices reduce the incentives for companies to join the market and give rise to a perverse relationship between those in charge of government buying and contractors.

Transparency promotes competition in bidding and public contracting processes (Del Solar, 2008). It is a way to evaluate the accountability of a government in decision-making related to income and spending; it is also a necessary input for citizens to participate in drafting the budget (Bellver, 2007). A paper by Benito and Bastida (2009), drawing on a comparative approach among 41 countries, demonstrated a positive relationship between the fiscal balance and transparency, because the more budgetary information is known, the less of a chance that rulers have to use the fiscal deficit to their own advantage. Likewise, Alt and Lassen (2006) demonstrated that the effects of fiscal transparency are positive on diminishing public debt.

3. The Legal Framework of Transparency in Mexico

In the Political Constitution of the United Mexican States (CPEUM), currently in effect, we find a first antecedent in the introduction, in 1977, of the principle that the right to information shall be guaranteed by the State (Art. 6 of the Constitution). Transparency, the right to access information, and accountability are all closely-related concepts, although they have different meanings (Luna, 2013: 55).

This paper is focused on transparency as a unilateral act by which public bodies make available to the public information about the exercise of their duties and attributions.

The timid 1977 constitutional reform was well-intended, but it was not until June 2002 that the Federal Transparency and Access to Public Governmental Information Act (LFTAIPG) was enacted, aiming to provide whatever necessary to guarantee all people access to the information in the possession of the powers of the union, autonomous constitutional bodies, or those with legal autonomy, and any other federal entity.

Later on, the Permanent Constituent Assembly approved a reform to Article 6 of the Magna Carta, published July 20, 2007, to establish the principles and conditions at the constitutional level for exercising the right to access information. Subsequently, on February 7, 2014, in the Official Gazette, a new constitutional reform was published, establishing an autonomous body to guarantee transparency, the right to access public information, and the protection of personal data, with competency to demand information about issues related to these matters from any federal public entity.

In the transitory provisions, the Congress of the Union was required to issue a regulatory law on Article 6 of the Constitution. This happened with the publication, on May 4, 2015 of the General Transparency and Access to Public Information Act (LGATIP). In a moment lacking legislative finesse, it was also determined that, in addition to the General Act, the Federal Act on the same matters would be reformed, an unnecessary step, because the General Act itself could have distributed the powers and competencies to each of the realms of government, including those specific to the federation. In the end, Congress issued the new Federal Transparency and Access to Public Information Law far after the constitutional timeframes set out.

The 2002 LFTAIPG established, at the time, in Article 7, Section IX, that the Secretary of Finance shall report "on the economic situation, public finances, and the public debt..." In turn, Article 70 of the new LGTAIP provides that "in the Federal and State law, subjects shall be obliged to make available to the public and update in their respective electronic media ... the information ... on the topics, documents, and policies indicated below...", and Section XXII states explicitly: "Information related to the public debt, in terms of applicable regulations."

This means that state laws on matters of transparency and access to public information, when doing this work, have established public information to include diverse types of financial information (e.g., information related to public accounts and/or financial statements), but in 10 of them, there is no explicit mention of information about public debt. As can be seen in Table 1, of the other 22, in four, this information is only mandatory for disclosure at the municipal, but not the state, level.

Table 1. Explicit Transparency Obligations to Disclose Public Debt*

| Federal Entity | State | Municipality |

| Aguascalientes | No | No |

| Baja California | Yes | Yes |

| Baja California Sur | Yes | Yes |

| Campeche | Yes | Yes |

| Coahuila | Yes | Yes |

| Colima | No | Yes |

| Chiapas | No | No |

| Chihuahua | No | Yes |

| Federal District** | No | No |

| Durango | Yes | Yes |

| Guanajuato | Yes | Yes |

| Guerrero | No | No |

| Hidalgo | No | No |

| Jalisco | Yes | Yes |

| State of Mexico | Yes | Yes |

| Michoacán | No | No |

| Morelos | Yes | Yes |

| Nayarit | Yes | Yes |

| Nuevo León | No | Yes |

| Oaxaca | Yes | Yes |

| Puebla | No | No |

| Querétaro | No | No |

| Quintana Roo | Yes | Yes |

| San Luis Potosí | Yes | Yes |

| Sinaloa | No | Yes |

| Sonora | Yes | Yes |

| Tabasco | Yes | Yes |

| Tamaulipas | No | No |

| Tlaxcala | No | No |

| Veracruz | Yes | Yes |

| Yucatán | Yes | Yes |

| Zacatecas | Yes | Yes |

*Based on information on the page National Legal Order, viewed at: http://www.ordenjuridico.gob.mx/ambest.php [viewed: March 2016];

**Now Mexico City.

Source: Created by the authors.

4. The Public Debt of States and Municipalities

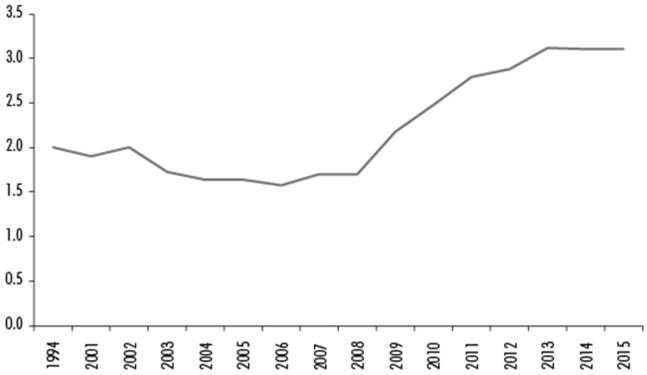

The Constituent Assembly of 1917 established two important provisions in matters of public debt in the Mexican Fundamental Law. The first is found in Article 73, Section VIII, containing the power of the Congress to set the terms by which the Executive may borrow money, approve loans, and recognize and order the payment of the national debt. The second of these provisions is found in the limitations that Article 117 sets for the states: Section VIII prohibits them from taking out foreign debt. Both provisions have undergone changes, and other constitutional reforms and bylaws have been enacted pertaining to public debt, incorporating checks and balances to prevent the state and municipal governments from taking on too much debt. Even with these constitutional and legal limits, subnational debt as a proportion of State Gross Domestic Product (SGDP) over the past two decades has experienced an upswing, as can be observed in Figure 1.

Source: Created by the authors based on data from SHCP.

Figure 1. Total Subnational Debt/SGDP, 1994, 2001-2015 (Percentage)

Recently, an important constitutional reform was passed in matters of financial discipline, published on May 26, 2015. Article 73, Section VIII stipulates that debt refinancing or restructuring must be done pursuant to the best market conditions. Congress is empowered to pass laws setting the terms for states and municipalities to hold debt, including limitations and ways that they can alter their shares of debt payments, as well as the obligation to make transparent borrowings and payment obligations through a single registry. It also provides for a system of alerts regarding debt management and potential penalties for civil servants who fail to comply with regulations on these matters. Moreover, for states that already have high debt levels, Congress is empowered to analyze, through a bicameral legislative commission, an adjustment strategy to firm up the public finances of those that intend to enter into agreements with the federal government to obtain guarantees. In the very same Article 73, Section XXIX-W was added, entitling Congress to pass laws related to financial accountability to ensure the sustainable handling of public finances at all levels of government. Derived from the May 2015 constitutional reform, in April 2016, the decree issuing the Financial Discipline for States and Municipalities Act was published, reforming, adding, and repealing diverse provisions of the Fiscal Coordination, General Public Debt, and General Governmental Accounting laws.

The main regulatory instrument that has shaped the topic of debt in Mexico has been the General Public Debt Act (LGDP), whose named changed, as a result of the aforementioned decree, to the Federal Public Debt Act. The Act, published on December 31, 1976, dates back to an age in which presidentialism de facto subjected all subnational levels through meta-constitutional powers (Carpizo, 2001: 89) and, therefore, limitations in matters of public debt were fixed more by submission to the head of the Federal Executive than by any express rule.

In this way, the LGDP in reality lacks an essential element that characterizes other general laws, which is to distribute competencies among the diverse realms of government (Thesis: P./J. 5/2010, Semanario Judicial de la Federación y su Gaceta, Novena Época, Volume XXXI, February 2010, page. 2322). The LGDP rather establishes provisions for decentralized and state-run public administration, companies with majority state-ownership, trusts in which the trustee is the federal government, and financial entities of a public nature (as shown in Table 2).

Table 2. Explicit Limits on the Debt of States and Municipalities

| State | Constitutional | Legal | States | Municipalities |

| Aguascalientes | No | Yes | Yes | Yes |

| Baja California | No | Yes | Yes | Yes |

| Baja California Sur | No | No | No | No |

| Campeche | No | Yes | No | Yes |

| Coahuila | No | No | No | No |

| Colima | No | No | No | No |

| Chiapas | No | Yes | Yes | Yes |

| Chihuahua | Yes | No | No | Yes |

| Federal District*** | N/A | N/A | N/A | N/A |

| Durango | No | Yes | No | Yes |

| Guanajuato | No | No | No | No |

| Guerrero | Yes | No | Yes | Yes |

| Hidalgo | No | No | No | No |

| Jalisco | No | Yes | Yes | Yes |

| State of Mexico | No | No | No | No |

| Michoacán | No | Yes | Yes | Yes |

| Morelos | No | No | No | No |

| Nayarit | No | No | No | No |

| Nuevo León | No | No | No | No |

| Oaxaca | No | Yes | Yes | Yes |

| Puebla | No | No | No | No |

| Querétaro | No | No | No | No |

| Quintana Roo | No | No | No | No |

| San Luis Potosí | No | Yes | Yes | Yes |

| Sinaloa | No | No | No | No |

| Sonora | No | Yes | Yes | Yes |

| Tabasco | Yes | Yes | Yes | Yes |

| Tamaulipas | No | No | No | No |

| Tlaxcala | Yes | No | Yes | Yes |

| Veracruz | No | No | No | No |

| Yucatán | No | Yes | No | Yes |

| Zacatecas | No | No | No | No |

*Based on information from the National Legal Order page, viewed at: http://www.ordenjuridico.gob.mx/ambest.php [viewed: March 2016]; **2015 Reform;

***Now Mexico City. To date, it does not have a Constitution and its debt is approved by the National Congress.

Source: Created by the authors.

Such is the case that in the legal failings and loopholes of a General Act that in reality never lived up to its name, we can find some of the causes behind the monumental debt held by certain states and municipalities, which made it necessary to create a legal instrument specifically designed to set certain general criteria for financial and treasury accountability in the subnational realm, meaning, the Financial Discipline for States and Municipalities Act.

Another piece of the puzzle can be found, as will be shown later on, in the omissions of state laws of the states themselves, which some governors and mayors, once free from the presidential yoke, have not hesitated to take advantage of to borrow generous amounts.

In an analysis of the constitutions and debt laws in the 32 states, it emerged that less than half provide for explicit debt limits on states and municipalities, understood as predetermined amounts or percentages set forth in a non-periodical legal provision (in other words, excluding income or expenditure laws that are approved annually), whether in the local Constitution or a bylaw, such as debt laws, the fiscal code, or something similar.

When this study was conducted, of the 32 states, only four contained in their constitutions explicit limits, and one had only enacted the limit in 2014. When it came to bylaws, only 12 of the 32 states had these types of limits (one set it just in 2015).

Of the states that do have express limits, whether in the local constitution, the bylaws, or in both (as shown in Table 2), 11 set limits for both the state and municipalities (reiterating that two of them only recently started to do this), while the other four do so only for the municipalities.

It is also common that when local laws do consider debt matters, in many cases and in certain conditions (amounts and terms), they do not consider short-term debt to be public debt, which is a mistake, because at the end of the day, it has to be covered by money from the public coffers.

In this way, we can see how a vast disparity persists among local ordinances regarding debt. Even so, this does not signify that the problem of over-indebtedness is merely a legal structural problem, but rather points to the laxity with which some congresses have acted when approving debt amounts for subnational governments.

5. An Economic Model for Transparency and Explicit Limitations on Subnational Debt

In order to ascertain the impact of transparency and burgeoning subnational public debt, we introduce a couple of models that combine panel data with time series that show the linear relationship of debt in each state of the Republic as a percentage of its federal funds4 with a transparency indicator (if the state in question does or does not have an explicit obligation to disclose debt levels) and a legal framework proxy (whether or not the state in question has a fixed debt limit, under the assumption that not having a limit is an incentive to take on more debt). Both indicators are presented as dummy variables.5

5.1 A Model for Transparency and Subnational Government Debt

The model for transparency and state government debt considers the logarithm of the balance of state government debt in proportion to revenue earned by the states by way of federal funds, as a function of transparency, defined as a dummy variable, and expressed in logarithmic terms:

Where:

As a dummy variable, tra is equal to 1 when the state has an explicit transparency obligation to disclose its public debt and 0 if no such obligation exists, as shown in Table 1.

The result is the estimator β=-0.2833, which means that on average, debt tends to be 28% higher in states where it is not mandatory to disclose debt levels than in states where it is.

In addition, Table 4 presents the fixed effects by state that capture some aspects that the model does not take into account and which only affect each state (constant c).

Table 3. Regression Statistics

| Variable | Coefficient | Standard Error | t-Statistic | Prob. |

| C | 3.767548 | 0.048715 | 77.33828 | 0.0000 |

| TRA | -0.283388 | 0.131053 | -2.162394 | 0.0312 |

| R squared | 0.563365 |

Source: Created by the authors.

Table 4. Value of the Fixed Effect for Every State I (value of the constant c i )

| State | Fixed Effect | State | Fixed Effect |

| National | 0.322989 | National | 0.322989 |

| Aguascalientes | -0.144268 | Morelos | 0.968039 |

| Baja California | 0.206752 | Nayarit | 0.254526 |

| Baja California Sur | 0.711974 | Nuevo León | -0.263349 |

| Campeche | 0.036776 | Oaxaca | 0.810263 |

| Coahuila | -2.767502 | Puebla | 1.196396 |

| Colima | -1.447889 | Querétaro | -0.671052 |

| Chiapas | 0.534783 | Quintana Roo | -0.573745 |

| Chihuahua | -0.182329 | San Luis Potosí | -0.64859 |

| Federal District*** | -0.069839 | Sinaloa | 0.127394 |

| Durango | -0.061676 | Sonora | -0.144444 |

| Guanajuato | 0.605128 | Tabasco | -0.283989 |

| Guerrero | 0.69799 | Tamaulipas | -0.047705 |

| Hidalgo | -0.346426 | Tlaxcala | 0.90121 |

| Jalisco | -0.133082 | Veracruz | 0.939431 |

| State of Mexico | -0.767353 | Yucatán | 0.328508 |

| Michoacán | -0.961271 | Zacatecas | 0.180476 |

Source: Created by the authors.

5.2 The Impact of Explicit Limitations on Subnational Public Debt

The second model considers the same endogenous variable in logarithms from Model 1, represented by the balance of state government debt as a proportion of state income from federal funds, as a function of the increase in the debt balance measured through a proxy of the limits on state debt (1 when there are regulatory limits and 0 when there are not).

Where:

The results of the model are given in Table 5.

Table 5. Regression Statistics

| Variable | Coefficient | Standard Error | t-Statistic | Prob. |

| C | 3.403798 | 0.089725 | 37.93596 | 0.0000 |

| TRA | 0.438751 | 0.12677 | 3.460994 | 0.0006 |

| R squared | 0.585134 |

Source: Created by the authors.

In this case, we obtain a value of β equal to 0.438, indicating that not having debt limits directly affects debt levels, positively. States with debt limitations have, on average, 43% less debt than states without these limits. In this second model, we included the effects of each year (see Table 6), represented by the constant c t in equation (2), that affect debt levels in all states equally, but that the model did not take into account. We have also included the fixed effects of factors not contemplated in the model but which influence the debt in each state and are represented by the constant c i (see Table 7). Temporal effects are independent of the fixed effects in each state.

Table 6. Temporal Fixed Effects

| Year | Temporal Effect |

| 2003 | 0.040825 |

| 2004 | 0.063327 |

| 2005 | 0.168761 |

| 2006 | 0.017697 |

| 2007 | 0.025978 |

| 2008 | 0.128327 |

| 2009 | -0.191585 |

| 2010 | -0.200206 |

| 2011 | -0.053463 |

| 2012 | 0.005505 |

| 2013 | -0.036889 |

| 2014 | 0.031725 |

Source: Created by the authors.

Table 7. Fixed Effects by State (value of the constant c i )

| State | Effect by State | State | Effect by State |

| National | 0.247987 | National | 0.247987 |

| Aguascalientes | 0.109794 | Morelos | 0.970719 |

| Baja California | 0.428808 | Nayarit | 0.296046 |

| Baja California Sur | 0.753495 | Nuevo León | -0.338351 |

| Campeche | -0.038226 | Oaxaca | 0.735261 |

| Coahuila | -2.815435 | Puebla | 1.121394 |

| Colima | -1.52289 | Querétaro | -0.746053 |

| Chiapas | 0.459782 | Quintana Roo | -0.648747 |

| Chihuahua | -0.147643 | San Luis Potosí | -0.64591 |

| Federal District*** | 0.010522 | Sinaloa | 0.168915 |

| Durango | 0.302073 | Sonora | -0.219446 |

| Guanajuato | 0.530127 | Tabasco | -0.358991 |

| Guerrero | 0.622988 | Tamaulipas | -0.122706 |

| Hidalgo | -0.421428 | Tlaxcala | 0.90389 |

| Jalisco | -0.169243 | Veracruz | 1.019793 |

| State of Mexico | -0.686992 | Yucatán | 0.370029 |

| Michoacán | -0.958591 | Zacatecas | 0.105474 |

Source: Created by the authors.

5.3 Normality Tests

The residuals of the first model are distributed normally, with an average very close to zero, skewness also very close to zero (0.10), and kurtosis very close to three, despite the fact that the value of the Jarque-Bera probability test is less than 0.05 (meaning that according to this statistic, the null hypothesis that the errors are distributed normally should not be accepted at a confidence level of 95%) (see Figure 2).

Almost the same thing occurs in the second model. The residuals of the model are distributed normally, with an average close to zero, skewness also close to zero (0.06) and kurtosis close to three (see Figure 3).

6. Final Considerations

Public finances are ripe for corruption when transparency and an institutional framework are nonexistent or insufficient. When it comes to debt, the effect of corruption is indeed relevant, because as was stated earlier, corruption increases the likelihood of deficits that are generally covered by debt, which affects the makeup of public spending and distorts the tax system.

Derived from the legal analysis, it emerged that a disproportionate debt hike occurred in the framework of disarticulated and complex legislation. The quantitative analysis achieved its objective of demonstrating that the absence of an explicit transparency obligation to disclose state government debt, as well as limitations imposed through public debt laws on the states, has direct repercussions on the debt levels held by the states. The model demonstrates with statistically significant estimates, which meet the assumptions of normality, the hypothesis that greater transparency in the handling of public finances and, specifically, a more stringent explicit transparency obligation to disclose subnational public debt, would tend to rein in the amount of debt; on the flipside, the absence of explicit limits on subnational debt ramps up debt uncontrollably.

Based on the results obtained, it was found that on average, debt tends to be 28% higher in states where it is not mandatory to disclose debt levels than in states where it is. Likewise, it was observed that states that do have explicit debt limits have, on average, 43% less debt than states that do not.

If, as has been shown here, the lack of transparency and adequate laws do influence rising debt, it is time for the legal framework to play a fundamental role in preventing, detecting, and penalizing improper handling of debt in order to avoid repeating the same dramatic scenarios of over-indebtedness that have afflicted other countries in recent times and Mexico itself in the last third of the twentieth century. Transparency, fighting corruption, and controlling public debt are tasks for the present that leave behind a legacy of peace of mind and welfare for future generations.

Legislation Consulted

Political Constitution of the United Mexican States. Constitutions and State legislation of the 32 federal states, relating to transparency, public debt, audit, civil servant responsibilities and penal codes in the National Legal Order, available at: <http://www.ordenjuridico.gob.mx/ambest.php> [consulted: March 2016].

Decree of Amendments and Additions to Title Four of the Political Constitution of the United Mexican States (28/12/82).

Decree declaring amendments to articles 73, 74, 78 and 79 of the Political Constitution of the United Mexican States (DOF 30/07/99).

Decree amending and adding various provisions of the Political Constitution of the United Mexican States in the area of transparency (DOF 07/02/14).

Decree amending and adding various provisions of the Political Constitution of the United Mexican States in matters of financial discipline for federative entities and municipalities (DOF 26/05/15).

Decree amending, adding to and repealing various provisions of the Political Constitution of the United Mexican States in the fight against corruption (DOF 27/05/15).

Law of Audit and Accountability of the Federation. Federal Law on Responsibilities of Public Servants. Federal Law on Administrative Responsibilities of Public Servants. Federal Law on Transparency and Access to Governmental Public Information. General Law on Public Debt. General Law on Transparency and Access to Public Information.

Draft decree enacting the Financial Discipline of Federal Entities and Municipalities Act; and amending, adding and repealing various provisions of the Laws of Fiscal Coordination, General Public Debt, and General Government Accounting (Parliamentary Gazette. Chamber of Deputies. March 17, 2016).

Websites

ASF <http://www.asf.gob.mx/Section/46_Informes_y_publicaciones>, date consulted: March 20, 2016.

INEGI <http://sc.inegi.org.mx/cobdem/contenido.jsp?rf=false&solicitud=>, date consulted: March 3, 2016.

SEGOB <http://www.ordenjuridico.gob.mx/>, date consulted: March 20, 2016.

SHCP <http://finanzaspublicas.hacienda.gob.mx/es/Finanzas_Publicas/Estadisticas_Oportunas_de_Finanzas_Publicas>, date consulted: March 20, 2016.

Transparencia Mexicana <http://www.tm.org.mx/wp-content/uploads/2013/05/01-INCBG-2010-Informe-Ejecutivo1.pdf>, date consulted: March 15, 2016.

REFERENCES

Alonso, José Antonio (2011), “Introducción”, en José Antonio Alonso y Carlos Mulas-Granado (eds.), Corrupción, cohesión social y desarrollo: El caso de Iberoamérica, Madrid, Fondo de Cultura Económica, pp. 11-20. [ Links ]

______ y Carlos Garciamartín (2011), “Causas y consecuencias de la corrupción: una revisión de la literatura”, en José Antonio Alonso y Carlos Mulas-Granado (eds.), Corrupción, cohesión social y desarrollo: El caso de Iberoamérica, Madrid, Fondo de Cultura Económica, pp. 43-72. [ Links ]

Alt, James y David Lassen (2006), “Fiscal Transparency, Political Parties, and Debt in OECD Countries”, European Economic Review, 50(6), pp. 1403-1439. [ Links ]

Arellano, David (2007), “Fallas de transparencia: hacia una incorporación efectiva de políticas de transparencia en las organizaciones públicas”, Convergencia, 14(45), pp. 31-46. [ Links ]

Auditoría Superior de la Federación (ASF) (2015), Perfil de México a través de Indicadores Clave, México, Auditoría Superior de la Federación. [ Links ]

Bellver, Ana (2007), “Reformas en materia de transparencia: segunda generación de cambio institucional”, Reforma y Democracia, 38, pp. 5-48. [ Links ]

Benito, Bernardino y Francisco Bastida (2009), “Budget Transparency, Fiscal Performance, and Political Turnout: An International Approach”, Public Administration Review, 69 (3), pp. 403-417. [ Links ]

Buchanan, James y Richard Musgrave (1999), Public Finance and Public Choice: Two Constrasting Visions of the State, Cambridge, Massachusetts, The MIT Press. [ Links ]

Carpizo, Jorge (2001), “Veintidós años de presidencialismo mexicano: 1978-2000. Una Recapitulación”, Boletín Mexicano de Derecho Comparado, nueva serie, año XXXIV, núm. 100, enero-abril, pp. 71-99. [ Links ]

Cunill, Nuria (2006), “La transparencia en la gestión pública: ¿Cómo construirle viabilidad?”, Estado, gobierno, gestión pública: Revista Chilena de Administración Pública (8), pp. 22-44. [ Links ]

Del Solar, Felipe (2008), “Transparencia, corrupción y acceso a información pública en Chile”, en Andrés Solimano, Vito Tanzi y Felipe del Solar (eds.), Las termitas del Estado, Chile, Fondo de Cultura Económica, pp. 89-144. [ Links ]

Easterly, William (2002), The Elusive Quest for Growth, Cambridge, Massachusetts, The MIT Press. [ Links ]

Fox, Jonathan y Libby Haight (2007), “Las reformas a favor de la transparencia: teoría y práctica”, Derecho a saber. Balance y perspectivas cívicas, pp. 29-64. [ Links ]

Grimmelikhuijsen, Stephan, Gregory Porumbescu, Boram Hong y Tobin Im (2013), “The Effect of Transparency on Trust in Government: A Cross‐ National Comparative Experiment”, Public Administration Review, 73(4), pp. 575-586. [ Links ]

Héritier, Adrianne (2003), “Composite Democracy in Europe: the Role of Transparency and Access to Information”, Journal of European Public Policy, 10(5), pp. 814-833. [ Links ]

Hollyer, James, Peter Rosendorff y Raymond Vreeland (2011), “Democracy and Transparency”, The Journal of Politics, 73(04), pp. 1191-1205. [ Links ]

Huntington, Peter (1968), Political Order in Changing Societies, New Haven, Yale University Press. [ Links ]

Kant, Immanuel (2013) [1791], ¿Qué es la ilustración?: y otros escritos de ética, política y filosofía de la historia, Madrid, Alianza Editorial. [ Links ]

Leff, Haupert (1964), “Economic Development through Bureaucratic Corruption”, American Behavioral Scientist, 82(2), pp. 337-341. [ Links ]

Lindstedt, Catherine y Daniel Naurin (2010), “Transparency is not enough: Making Transparency Effective in Reducing Corruption”, International Political Science Review, 31(3), pp. 301-322. [ Links ]

Luna, Issa (2013), Movimiento Social del Derecho de Acceso a la Información en México, Instituto de Investigaciones Jurídicas-UNAM, México. [ Links ]

Merino, Mauricio (2006), “Muchas políticas y un solo derecho”, en S. López Ayllón (ed.), Democracia, transparencia y Constitución: propuestas para un debate necesario, México, IIJ-IFAI, pp. 127-156. [ Links ]

Monsiváis, Alejandro (2005), Políticas de transparencia: ciudadanía y rendición de cuentas, México, Instituto Federal de Acceso a la Información Pública. [ Links ]

Myrdal, Gunnar (1990), The Political Element in the Development of Economic Theory, EU, New Brunswick, New Jersey. [ Links ]

Ohashi, Hiroshi (2009), “Effects of Transparency in Procurement Practices on Government Expenditure: A Case Study of Municipal Public Works”, Review of Industrial Organization, 34(3), pp. 267-285. [ Links ]

Piñar, José Luis (2014), “Transparencia y Derecho de Acceso a la Información pública: algunas reflexiones en torno al derecho de acceso en la Ley 19/2013, de Transparencia, Acceso a la Información y Buen Gobierno”, Revista catalana de dret públic, (49), pp. 1-19. [ Links ]

Solimano, Andrés (2008), La corrupción: Motivaciones individuales, fallas del Estado y desarrollo, en Andrés Solimano, Vito Tanzi y Felipe del Solar (eds.), Las termitas del Estado. Ensayos sobre corrupción, transparencia y desarrollo. Chile, Fondo de Cultura Económica, pp. 57-88. [ Links ]

Tanzi, Vito (2008), “La corrupción y la actividad económica”, en Andrés Solimano, Vito Tanzi y Felipe del Solar (eds.), Las termitas del Estado. Ensayos sobre corrupción, transparencia y desarrollo, Chile, Fondo de Cultura Económica, pp. 23-56. [ Links ]

Uvalle, Ricardo (2008), “Gobernabilidad, transparencia y reconstrucción del Estado”, Revista Mexicana de Ciencias Políticas y Sociales, 50 (203). [ Links ]

Weber, Max (2005) [1905], La ética protestante y el espíritu del capitalismo, México, Colofón. [ Links ]

3We would like to extend our appreciation to the Program to Support Technology Research and Innovation Projects (PAPIME) at the UNBAM, PAPIME project PE309316.

4Federal funds refer to the income from the federal government allocated to each state based on a funding index.

Received: September 08, 2016; Accepted: November 15, 2016

texto em

texto em