INTRODUCTION

Since 1980 there have been a growing number of Foreign Direct Investment (FDI) studies, but why is it so important? The answer to this question lies in economic science (or macroeconomic science) logic. It poses that investment for large periods of time determines size of capital stock, which is useful to generate economic growth in the long term (Dornbusch, Fischer & Startz, 2008). In this sense, FDI is a flow of resources that came from other countries and is used in the purchase of physical capital, which can support economic growth in the long term.

The attractive idea behind these studies is economic growth concept, which in time generates employments and also a rise in wages average. Above this idea, importance of developing countries FDI is major, since resources for investment are scarce, and these kind of resources are augmenting supply of investment funds (Bellumi, 2014). In fact, FDI in developing countries has increased 12-fold since 1980 to the present, but also represents 60% of the private capital (Herzer, Klasen & Norwak-Lehmann, 2008). From these arguments, FDI constitutes a real option of development for millions of workers, families and communities in the developing world (Dutta & Osei-Yeboah, 2013).

From the previous idea, policy for creating a better investment climate is a priority, since this growth caused by FDI is contributing to poverty reduction, and also in the best of the cases is contributing to economic development (Ríos-Morales & O’Donovan, 2006). Despite of this priority, strategy for attracting FDI inflows must center on attraction of quality FDI, since this kind of investment can be categorized in three different strategies according to Dunning’s model (1988); a) access to natural resources, b) market expansion, c) efficiency seeking, which will be described in forthcoming sections.

A more important fact is that Inward Foreign Direct Investment (IFDI1) in developing countries is rising on average 23% every year since 1990 (Dutta & Osei-Yeboah, 2013). But, also some countries attract more IFDI than this average. So, another question must be stated, what some developing countries would do to attract more IFDI than others? To address it, we need to describe IFDI determinants, specifically human capital (HC) formation. Pioneering work on HC was launched by Schultz (1961) and Becker (1964) works, pointing that the performance of workers is determined by the skills and knowledge developed by the same workers. In particular it was noted that the more skilled was the worker, the greater the performance shown. A few years later, Lucas (1990) and Easterlin (1981) did a research on HC effects on IFDI in developing countries, where low skills corresponded to a less rate of IFDI, and countries with higher levels of HC attract more FDI.

In Mexico, there are some studies documenting FDI-HC relationship. Ahmed (2012) found that IFDI increases productivity if is established in financial developed regions. Villegas-Sánchez (2009) stated that the major part of IFDI is attracted to manufacturing sectors, where the main benefit of FDI is given by intangible assets transferred like knowledge, skills and training, in which the major proportion of this IFDI benefits is captured by the larger firms. Nelson, Wolff & Baumol (1994) found increases in total factor productivity due to IFDI, and Kokko (1994) shows that technological spillovers given by FDI is positively related to absorptive capacities.

From last paragraphs, it is clear that there is a relationship between FDI-HC, and the causal relationship explained is that FDI determines HC level, despite this situation, productivity and technological spillovers are not always a consequence of FDI, instead, HC and FDI (specifically IFDI) interact in another more complex way. HC level in the host country, in most cases is a necessary condition to attract FDI in developing countries, but only if the model is not supposing that home country is seeking natural resources or a market-seeking logic on FDI, where the home country is looking for natural resources and cheap labor force, many of these cases are well documented by Ahmed (2012) and Bellumi (2014). The model in this document is supposing the opposite case, where FDI is following an efficiency-seeking logic, in which the home country is looking for skilled labor force and the necessary technological infrastructure of knowledge given by HC.

The present study aims to determine HC impact on IFDI, specifically in the Mexican context, where there is a lack of these kind studies to make a clarification on this relationship. The main contribution is to test nonlinear relationship between HC-FDI with use of a panel data. A panel was constructed for each of the 32 federal states on the 2007-2012 period, and test consists in a nonlinear relationship concept of tertiary education level (as a proxy variable for HC) over IFDI, which in time was proposed by Dutta & Osei-Yeboah (2013), and theoretically supported by Blomström & Kokko (2002). Despite of the last, there are little (almost null) empirical results supporting this idea, in a general manner, it is tested a causal relationship of HC formation that determines the FDI inflows. In fact Heyuan & Teixeira (2010), and Miyamoto (2003), point out that these kind of studies are scarce due to lack of information, but also due to difficulties for constructing and/or finding a proxy variable for HC.

In this study, a dummy variable was generated, which distinguishes the US border and developed states that generally receive the major resources of FDI, from the other states. After segmenting, it was applied a panel data regression looking for random effects, which prove to be significant for testing HC-IFDI relationship in a nonlinear fashion for tertiary education. After regression, it was tested a co-integration analysis for proving relationship in the long term with also significant results.

The work is structured as follows, in the next section it is studied FDI importance for developing countries, specifically in the Mexican context. Subsequent section has a discussion of the HC formation as FDI attraction mechanism, as well as the necessary conditions for the HC to become such an attraction mechanism. Section 4 describes the interrelation between the geographic distribution of FDI and the HC formation. Section 5 is a description of the variables used in the econometric model, explaining the proxy variables for HC formation and the control variables in the model. Section 6 describes the method from which dummy variable for US border states and developed states were created, also it is presented the equation that is going to be estimated by random effects, and it is presented the test for cointegration in the panel context. By last, empirical results of random effects are presented, where it is concluded existence of a nonlinear relationship in FDI-HC relation, followed by concluding comments.

The importance of the IFDI in developing countries

As noted in the previous section, IFDI plays an important role by increasing supply of investment funds, which in time is important for host firms to accumulate capital, and by these means to increase the production through increase total factor productivity (TFP). Nevertheless, there are two main lines for studying of FDI, the neoclassical economic growth theory and the new economic growth theory (endogenous growth), which in turn lead to different kind of results in terms of increasing the gross domestic product (GDP) in any country.

Neoclassical theory of growth proposes that, IFDI does not affect the growth of GDP in the long term, since it is affecting only the percapita income and capital, but reaching a steady state in the long term (Bellumi, 2014; Herzer et al., 2008). By the other side, new growth theory states that increase in GDP is due to technological change, which in time is given by FDI influence in HC and R&D activities in the host country (Ahmed, 2012; Bellumi, 2014; Herzer et al., 2008; Miyamoto, 2003). Endogenous growth theory states that these spillovers generated by IFDI are driving technological change, which increases productivity of labor force and allows economic growth in the long term. In this manner, IFDI is constantly transforming HC in the host country, by means of technical change.

Despite of well documented effects of IFDI in developing countries predicted by the new theory of economic growth (Blomström & Kokko, 2002), empirical results supporting these studies are not concluding. Since results in studies applied in Latin-American, African and Asian countries have shown ambiguous effects of IFDI on economic growth (Blomström & Kokko, 2002). Particularly, Bellumi (2014) found negative and null effects of FDI in African countries, as well as Herzer et al. (2008), and Ahmed (2012) described the same effects of FDI in Latin-American countries. Heyuan & Teixeira (2010) found negative effects in Asian countries. It seems that there is a lack of convincing evidence supporting the endogenous growth theory in developing countries. Some of the main explanations supporting this theory are related with limitations in databases (Bellumi, 2014), as lack of tests on causal relationship (tests for unit root and co-integration), small samples without concluding cointegration tests, or that panel data used does not take into account for specific problems in the countries.

Alternative explanations have been rising in the last ten years, due to these lack of evidence of FDI on economic growth. At a micro level, Herzer et al. (2008) pose that economic growth generated by FDI is not reached, mainly because of technology protection of multinational corporations; in second place qualification of labor force in the host country is too low and does not allow imitation activities; and by last host firms lack of financial resources to invest in absorptive capacities. At a macro level, explanations are given by Miyamoto (2003), that proposes to divide history in two periods for interpreting opposite results. Which in time are the first period 1960-1980, and the second period 1980-2000. Main contributions are that in the first period multinational corporations and in general IFDI were looking for natural resources and cheap labor force, this explains negative effects of FDI on economic growth, since multinationals inhibited competence in host countries, implementing a market-seeking strategy to expand at international level. On the other side, in 1980-2000 period, IFDI was looking for developing countries with infrastructure and qualified labor force, which in time could be interpreted as HC formation mechanism for attracting FDI, which at the same time constitutes an efficiency-seeking strategy for firm expansion.

In Mexico, in addition to spillover generated by FDI, other beneficial effect is increase in firm competition given by presence of foreign firms (Bellumi, 2014; Ha & Giroud, 2014; Villegas-Sánchez, 2009; Herzer et al., 2008). Villegas-Sánchez (2009) found that evidence must be taken with care, since beneficial effect of IFDI was located in large firm size over smaller strata of firms. On the contrary, Nelson et al. (1994), Waldkirch (2010) and Escobar-Gamboa (2013), show that beneficial effects are given by TFP increasing due to IFDI. This Idea is supported by Ahmed (2012), who signals that TFP increase only if IFDI is located in regions where financial institutions are developed. Other limitation on IFDI effect is that most beneficial effects are focused on export oriented sectors, having little contact with national activities (Escobar-Gamboa, 2013). Beyond of this evidence, IFDI have doubled size since 1989 reaching a level of FDI/GDP of 4.75% ratio in 2001, with a US share of 60% (Escobar-Gamboa, 2013; Waldkirch, 2010).

The question that came again is: What determines the attraction of FDI?, to answer this question there is little evidence. By one side IFDI depends on factors like low wages, proximity to Unite States borders and size of market (Jordaan, 2012), contrasting with other studies where the same author points to factors like regional demand, schooling and infrastructure (Jordaan, 2008). Waldkirch (2010) points to geographic conditions as a determinant factor, but it seems that an emerging important factor is related with HC formation (Blomström & Kokko, 2002; Dutta & Osei-Yeboah, 2013; Heyuan & Teixeira, 2010; Kokko, 1994; Miyamoto, 2003). Since it constitutes a more complex relationship affecting absorptive capabilities of a country that in time attracts a higher volume of FDI. According to Nunnenkamp, Alatorre & Waldkirch (2007), in Mexico IFDI is generating an increase in manufacturing employment in skilled personal rather than in unskilled staff.

The HC formation as a mechanism of attraction of FDI

To explain effect of HC formation in attracting FDI, first one have to look at economics of education history as emerging area that began to influence economic thinking related to FDI in recent years. A key idea was the HC paradigm stated by Becker (1964), when he publish his research on human capital, formalizing a cost-benefit model for individuals to invest in education and training to accumulate knowledge, and by this means increase their productivity as a production input. Nevertheless, economics of education and HC theory began to lose power in the period of 1970-1980, especially in the US, resurging in the last 15 to 20 years with approaches that have gone beyond the Mincer equation for wages (Mincer, 1974). Which explains impacts of education in other areas like health, well-being and crime (Lochner, 2011), or impact of HC in economic growth (Barro, 1991; Krueger & Lindahl, 2001), and what is more important for this research, spillovers of education and HC formation on FDI attraction (Blomström & Kokko, 2002; Chitrao, 2014; Dutta & Osei-Yeboah, 2013; Heyuan & Teixeira, 2010; Miyamoto, 2003). This means to think in HC formation as a resource needed by multinational corporations in the new knowledge economy.

One of the key factors to attract FDI is having an attractive investment climate, which includes quality factors of production, market size, logistic costs and political environment for doing business with minimal risk. Among the most important production factors in countries with successful experience in attracting FDI, is HC, that has played an important role, especially in technology-based multinational corporations that generates high amounts of added value, seeking for skilled labor force in technology, engineering, organizational skills and business administration (Miyamoto, 2003). Which in time helps the multinational firm to introduce new technologies embodied in machinery and equipment (Blomström & Kokko, 2002). Nevertheless, there is a lack of evidence for this type of education, that is more effective in attracting FDI, but also, there is a lack of studies comparing different levels or types of HC to identify the most effective (Miyamoto, 2003). This kind of studies gave rise to a significant number of surveys which includes among others: “The World Business Environment Survey” by the World Bank in 2000, and the “Foreign Direct Investment Survey” by the multilateral Investment Guarranty Agency in 2001.

However, HC formation is insufficient to explain the inward FDI flows (Dutta & Osei-Yeboah, 2013). Although there is a literature´s recognition on HC impact over FDI, there may be a more complex relation. One of the first steps is to recognize that HC capital formation must be accompanied with a mass of HC already formed to support an investment climate. Thus HC formation could be recognized and divided into tertiary and postgraduate, where the tertiary is recognized as a minimum in knowledge economy, and the last as an optimal in terms of efficiency for multinational corporations’ requirements. On the other hand, HC already formed must be registered as total researchers in the host country, that are capable to absorb, imitate and also generate their own technology, which in time act as leaders of HC in formation.

From last, it arises a new problem, since it is needed a critical mass of HC in formation to have an attractive climate for multinational firms, which will lead to a nonlinear relationship between the HC formation and FDI inflows, this idea has been proposed by Dutta & Osei-Yeboah (2013), Blomström & Kokko (2002), which in time has been not tested. This idea of a nonlinear relationship could lead research in many ways; one of them is the simplest nonlinear relationship as a quadratic relationship that could be an ∩ shaped curve. The ∩ shaped curve case means that a few students enrolled in tertiary and postgraduate are not attractive for multinational firms to invest and/or introduce new technologies, because there are no sufficient skilled personal or HC in formation to manage new machinery and equipment. This also suppose that the opposite is true, but it is not clear how a huge number of students enrolled in tertiary and postgraduate can affect multinational technology management, as the more HC in formation seems to be a signal of a good investment climate. The only suspect in the long term is that a huge number of HC in formation could lead to a high rate of unemployment, which in time will lead to a less attractive climate for multinationals because of manifestations, but still this remains into hypothetical terrain. In general, as it was explained ∩ shaped curve example is just one of multiple cases in a nonlinear relationship.

Furthermore, there is a mass of HC already formed, as scientists and technologists that can give support to HC in formation process. In the case of Mexico, HC already formed is given by members of National System of Researchers (SNI for its acronym in Spanish) of the National Consul of Science and Technology (Conacyt for its acronym in Spanish), these people are qualified to do scientific research refereed by other peers. In addition, there is other kind of researchers called technologists, given by the National Register of Science and Technology Institutions and Firms (Reniecyt for its acronym in Spanish) personnel, which is the institution that look for organizations that make research activities. Those types of HC already formed are Scientists that teach HC in formation as tertiary and postgraduate students. Here it is not stated a nonlinear relationship since HC formation must be proportional to HC already formed volume. Thus, there is only a nonlinear relationship between HC in formation and IFDI, but not in HC already formed and IFDI.

The HC formation and the geographical distribution of IFDI

Other related factors in FDI and HC relationship, are geographical distribution of HC and its effect on attracting FDI inflows. These points are treated by separate in the literature, as effects of HC on IFDI (Blomström & Kokko, 2002; Dutta & Osei-Yeboah, 2013; Heyuan & Teixeira, 2010; Kokko, 1994; Miyamoto, 2003), and effects of geographical distribution on IFDI (Escobar-Gamboa, 2013; Jordaan, 2012). Here it is proposed an interaction between HC formation and geographical distribution of FDI inflows, taking into account differential effect of HC formation performance of the border and developed poles with respect to the rest of entities of Mexico.

According to Nunnenkamp et al. (2007), in Mexico relative demand for skilled labor has increased only in regions where FDI is concentrated. Additionally, Escobar-Gamboa (2013) states that the Federal District (Mexico City), accumulated more that 60% of the FDI inflows in the 1994-2001 period, but also proposes that there is a disproportional distribution between the federal states in the US border and the rest of the states. Mollick, Ramos-Durán & Silva-Ochoa (2006), determined that there is a relation between geographical regions, like the US border or the big cities and the attraction of FDI, but despite their literature review, where it was recognized the HC formation importance, as they quote the work of Deichmann, Karidis & Sayek (2003), it was not taken into account for the study, and either was the relation between HC and geographical distribution. Jordaan (2011, 2012), proposes that schooling, training personnel and geographical distribution of the US border and Mexico City are important factors to attract the FDI inflows, but in his study HC and geographical distribution relationship was not described, taken them as separate effects on IFDI. In general, studies about IFDI determinants, treat infrastructure, geographic distribution and HC as possible explanations on FDI inflows, but the interaction between geographic distribution and HC formation and its effect over FDI is not taken into account.

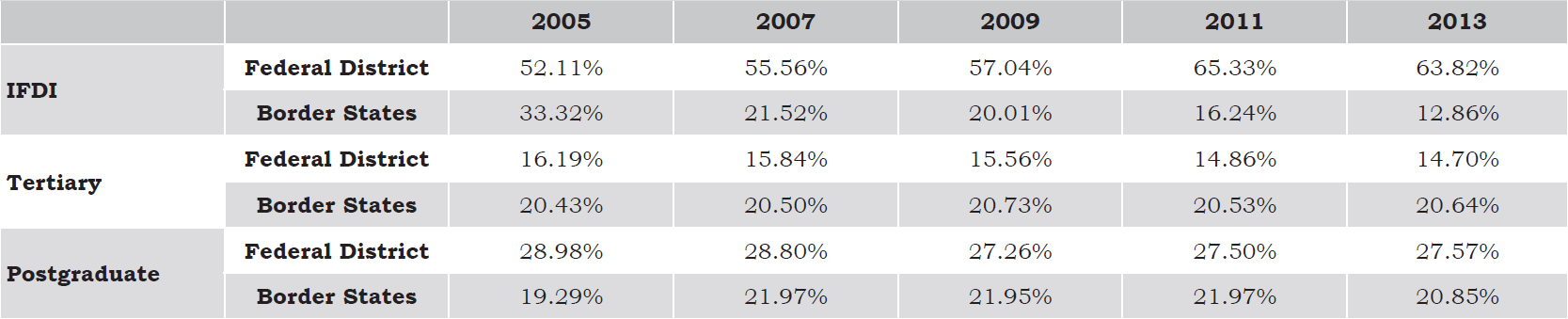

As it is shown in table 1, in the last ten years main hosts for FDI inflows have follow a strong strategy of tertiary and postgraduate enrolment uptaking, with at least 75% of FDI inflows, 35% of tertiary enrolment and 45% of postgraduate enrolment. This table describes HC formation and geographic distribution of FDI, but also a relationship between these variables, as tertiary and postgraduate enrolments constitutes part of an appropriate climate for attracting IFDI. Moreover, these results are also enhanced maybe due to trade agreements beneficiating principally Border States (Ríos-Morales & O’Donovan, 2006), and following a territorial proximity strategy path in educational policies.

METHODS

Tertiary education as a proxy for HC and control variables

Literature describes a large amount of variables taken as proxy for HC, as can be health, life expectancy, schooling, training, medical expenditures, education expenditures, patents per inhabitant and education enrolments among others (Barguellil, Zaiem & Zmami, 2013; Khan, 2014; Neycheva, 2014; Ocegueda-Hernández, Meza-Fregoso & Coronado-García, 2013; Popov, 2014; Poças, 2014; Whiteley, 2012). But the number of proxies for “HC formation” can be reduced, taking into account the kind of capital that is not already formed like trainings, educational expenditures and education enrolments. Since this kind of capital is closed related to tertiary education, and thus is theory based, which means to qualify people to accede to advanced programs or to get enrolled in a job that requires high skills (Reisz & Stock, 2012).

Also, to control for the larger states and/or developed states, it is taken into account the number of scholarships given by Consejo Nacional de Ciencia y Tecnología (Conacyt) to students enrolled in tertiary and postgraduate level.

Although the last is related to HC formation, the central idea of HC is to be closed related to a major economic growth (Barguellil et al., 2013; Khan, 2014; Neycheva, 2014; Ocegueda-Hernández et al., 2013; Popov, 2014; Poças, 2014; Whiteley, 2012). Which in time is related to IFDI, since a climate with a positive macroeconomic indicator is desirable for the home countries to bring inflows of FDI to a host country. In this manner, economic growth is one of key control variables to be taken into account for attracting more IFDI. At the time, another relevant variable for creating a good climate for investment is population growth, since from neoclassical theory, a major population means to reduce the capital per worker, and thus a decreasing performance in labor productivity.

One of key variables controlling for infrastructure in the host countries, is given by absorptive capabilities developed by local firms (Mollick et al., 2006). Since absorptive capabilities facilitate the technology transfer process, but also make easier technical progress in host regions by means of spillovers. Given importance of last argument, it is taken in this research, number of firms with “ISO certification” in each entity for controlling local infrastructure. Also, a control variable for education level, but also for infrastructure level is given by patenting level per million of inhabitants (Poças, 2014), which reflects tertiary education level, but also infrastructure of innovativeness in local region.

Also to take into account HC already formed, as was pointed above, there is a mass of HC already formed, as scientists and technologists that can give support to HC in formation process. In Mexico case, HC already formed is given by members of SNI of Conacyt, for accounting them it is taken SNI people per million inhabitants. In addition, there is other kind of researchers called technician, given by Reniecyt staff, for accounting them it is taken the Reniecyt people per million inhabitant.

To take into account geographical distribution, it was performed a “cluster analysis” taken variables of FDI and GDP to account for developed states, but also for the US border states, analysis was made using STATA software. Cluster analysis gave as a result, that the states with more FDI attraction are also developed states like Nuevo Leon, Jalisco, Mexico State and DF (Mexico City), as it is shown in the figure 1.

Regression model specification and testing of cointegration

A panel data for the states of Mexico in the period 2007-2012 was generated. The panel contains data on FDI from the Ministry of Economy, GDP at 2008 prices data from the National Institute of Statistics, Geography and Informatics (INEGI for its acronym in Spanish), population data from the National Population Council (Conapo for its acronym in Spanish) and other variables such as scholarships to students of Conacyt, tertiary and postgraduate enrollment from statistical Yearbook of the National Association of Universities and Higher Education Institutions (ANUIES for its acronym in Spanish), scientific and technological personnel of Reniecyt, Researchers members of the SNI, and finally the number of firms with ISO certification by state.

A dual strategy was followed, first it was used a multivariate analysis technique called “cluster analysis”, which is a statistical technique used to divide observations into two or more parts. This division of observations, draws on a set of variables that divide by common factors. In this case, it was took into account variables of GDP and FDI, where two different groups of states were obtained, those by GDP are poles of development and attract FDI and those that have historically attracted FDI (Baja California, Chihuahua, Nuevo León, Jalisco, Mexico State and Federal District), and a separate group are the entities that are not characterized by having large volumes of GDP or FDI. Groups of entities are shown in figure 1.

Additionally, due to geographical, institutional, cultural and political differences, which cannot be captured by appropriate controls, it was established a regression analysis with random effects2 (Wooldridge, 2009). This type of econometric models opposed to fixed effects (like effects estimated by De Mello [1999]), implies that there is no serial correlation between the explanatory variables and terms of idiosyncratic error. However, this relationship is mitigated due to inclusion of many controls as deemed appropriate. In the case of this study, controls are the level of patenting, GDP, population, the dummy group and level of certification, as a whole are enough variables that take into account technological culture, economic performance, the size of the entity, processes infrastructure (ISO).

Regression model that arises is:

Where subscript i represents federal entity and t represents the year in question. FDI is given in millions of dollars. Reniecyt variable measures the number of network staff of scientists and technologists per million population as a proxy for HC. SNI measures the number of members of the national research system as a proxy for HC, the scholarships awarded per million inhabitants per federative by the Conacyt as a control for the largest states on HC formation. Patents measures the number of patents per million inhabitants per entity as necessary conditions to attract investment technology transfer. ISO is the number of companies that have such certification approximating part the infrastructure needed to attract investment. DGDP is the first difference of GDP as a control variable that measures growth. Dpopulation measures the first difference of the population of each entity as a control variable. Group is a dummy variable that takes value 1 if these entities listed in figure 1 and zero otherwise. Tertiary is the total enrollment of undergraduate and technology as a proxy for HC formation. Postgraduate is the total enrollment of postgraduate as a proxy for HC formation.

It is expected that proxy variables of HC as Reniecyt, SNI, tertiary and postgraduate have a positive impact on attracting FDI as they represent human capital capable of handling the new technology, and secondly this study is assuming that Mexico attracts FDI intention of obtaining technology transfer and resource-seeking or market-seeking of primary resources as cheap labor or natural resources. Another aim is to test Tertiary and Postgraduate impact enrollment broken down by area of studies such as Agriculture, Natural Sciences, Engineering, Health Sciences and Social Sciences (Agro, CNE, ING, SAL and SOC, respectively). Moreover, it is intended to test interaction of group variable with Tertiary and Postgraduate variables, as this would prove whether there is a structural difference of returns to education in the group indicated in figure 1. Additionally, it will be included in model squared values of tertiary and postgraduate to test on particular nonlinear relationship between HC formation and IFDI attraction.

Usually cointegration test is applied to determine if it exist a long term relationship between variables. The most common method applied on a single equation is the Engle-Granger, and it determines existence of a long term relationship, which in turn implies to determine existence of causality. These kind of method, assume that variables have the same order of integration, for the purpose of this research the panel unit root test is performed. But as Idrees & Siddiqi (2013) point, the panel unit root test differ from the standard (DF and ADF approach) time series unit root tests as: i) the panel data allows for different degree of heterogeneity between cross sections; ii) In panel data unit root analysis, one cannot be sure of validity of rejecting a unit root; iii) The power of panel unit root test increases with the increase in panel series; iv) The additional component of cross-sections in panel data provides better information as compared to the standard ADF in time series. From the previous, it is proposed to employ the LL (Levin and Lin test) where the null hypothesis is a unit root existence, and also is performed the IPS (Im, Pesaran and Shin test) panel unit root tests, where also the hypothesis is a unit root existence. The main difference between these tests, is that the first does not allow to any unit root in the cross-section, and the second test allows this condition to verify the cointegration, and by these means the long-term relation between variables. Finally, a Granger causality test is shown to test for endogenous variables or reverse causation in variables.

RESULTS

As noted in the literature review, results of the returns to education as a means of attracting FDI have been ambiguous, partly because the panel data constructed have not taken appropriate control variables that catch the idiosyncratic errors, and therefore have not been a mitigation strategy. Results presented here are divided into four different models, one that takes into account the above equation, and three other models that take into account interaction of the group variable with school enrollments, a third model that takes into account breakdown of tertiary and postgraduate enrollments, and finally a model that takes into account nonlinear effects of tertiary and postgraduate education on FDI attraction. All these models were implemented taking into account random effects described in methodology, and they all yield significant results of education and human capital on FDI.

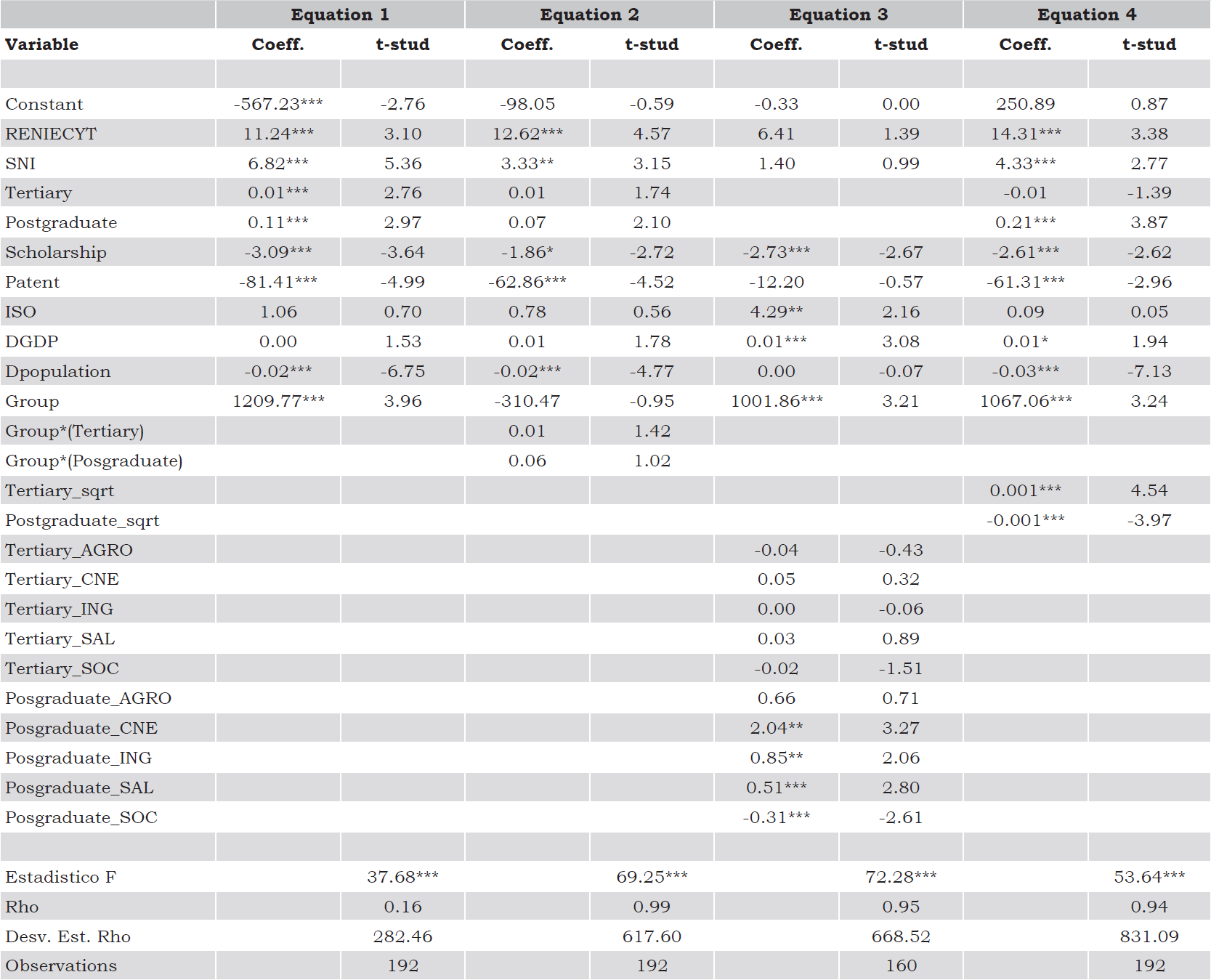

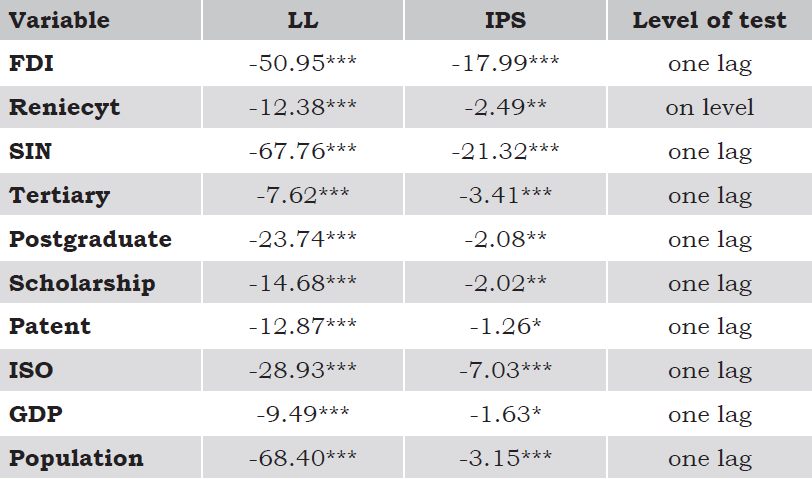

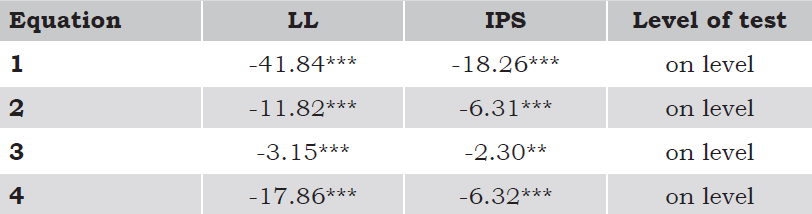

As shown in Table 2, in model 1 almost all variables were significant individually and in all models variables are globally significant, in which can be inferred that there is a causal relationship between the two variables (HC and FDI). Specifically in model 2, it can be seen that nonlinear relationship between tertiary and postgraduate education against FDI is significant, confirming main research hypothesis. On the far side, taking into account the long-term relationship, cointegration tests LL and IPS show the next results in table 3.

Table 2 Results of the random effects model.

In the table, the results of the original model as Equation 1, the model with interaction variables in equation 2, and the model with a breakdown of enrollment in Equation 3. Significance levels are shown as * to 10%, ** for 5%, and *** for 1%. For Equation 3 it is excluded the year 2012 due to lack of data on school enrollment in this period.

Source: Own elaboration using E-Views.

Table 3 Unit root test for the variables.

The test are taking into account trend and intercept, Significance levels are shown as * to 10%, ** for 5%, and *** for 1%.

Source: Own elaboration using E-Views.

Results shown in table 3, confirm cointegration level of variables, which corroborate relationship between variables in the long-term. This is a test for time series variables, which allows us to infer that there is not a spurious relationship, and that results of the models are valid asymptotically. Nevertheless, results of cointegration test for the model, are shown in table 4.

Table 4 Results of the cointegration test for the error term in the four models presented in table 2

Significance levels are shown as * to 10%, ** for 5%, and *** for 1%.

Source: Own elaboration using E-Views.

Cointegration tests shown in Table 4 are very important, because they validate the long-term relationship between dependent and independent variables. Otherwise, data might show some relationship that is only due to tendency to increase or decrease in the time of different variables. Panel Granger causality test results are reported in table 5, this is a specification test that considers possible reverse causality relationship.

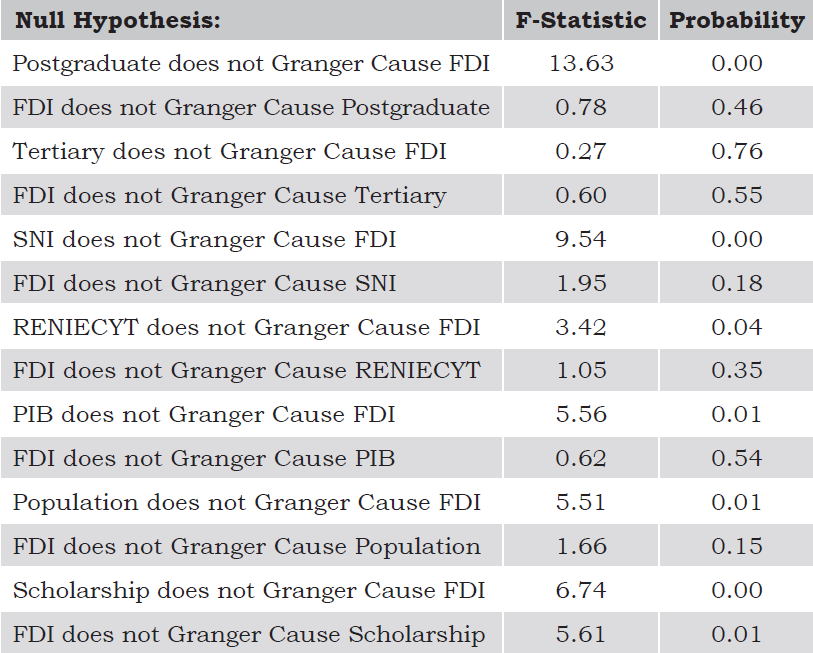

As it can be seen from table 5, causality test results are alike for the models. In the long-run equilibrium, FDI is Granger caused by Postgraduate, SNI, RENIECYT, PIB, Population and Scholarship, and also FDI is Granger causing Scholarship. From these results, it can be said that the model is correctly specified.

DISCUSSION

Equation 1 in table 2, shows that proxies of human capital as enrollment and number of scientists and technologists (Reniecyt, SNI, and Scholarships) are significant variables that largely explain returns to education on FDI. Where two things are noticed, the first is that is greater the impact of scientists and technologists in FDI, than tertiary and postgraduate enrollments, where care must be taken in interpreting values, because enrollments are not negligible, since there are states with tertiary and postgraduate enrollment that generate very high impacts, which could overtake the training of scientists and technologists. The second aspect is that the group variable was significant, so that on average entities indicated attract more FDI than other entities with significant results.

In addition to above results, control variables such as changes in GDP and population are significant in all three models. So, foreign capital take into account the size of the entities measured with these variables. Some variables that take into account infrastructure and conditions, as total number of firms with ISO certification were not significant individually. But taking the statistical F, it is necessary to include these variables in the model, and moreover, the positive sign on coefficient has the expected impact. Other conditions such as number of scholarships per million population was negative and significant impact. Therefore, a possible interpretation is that the crowding out of investment in HC by government on foreign capital, as well as patents per million population has the same interpretation, because most patents or effort in R&D is the largest private expulsion effect of FDI (at least in the first two equations of table 2).

With respect to equation 2, the fact that performance in tertiary and postgraduate education, has a positive sign in interaction variables, which means that there is a differential in the group of figure 1, with respect to other states. However, it is difficult to sustain this statement, since coefficients of these variables are not statistically significant. So according to results, there is no difference in education performance on FDI in the group described and other federal entities.

Taking into account equation 3, it can be said that breakdown of school enrollments by field of study, proved to be no significant individually in most cases of tertiary enrollment, and only highlight the significance of postgraduate. However, results of F statistic in this model are significant even at 1%, so it is recommended to introduce all this detail in the explanatory model. Interpretation may be that foreign capital does not take into account a study area in particular to settle in one state, but take into account the whole school enrollment, but giving special importance to postgraduate enrollments, however these results should be taken with caution, because interpretation is based only on statistical F and individual t-statistic.

Finally, in equation 4, it can be seen that there exist a nonlinear relationship between HC formation and FDI attraction. Since coefficients of squared tertiary and postgraduate are significant even at 1%. In this case it is highlighted ∩ shaped curve on tertiary education, which represents a critical mass that is necessary for the optimal FDI attraction (as explained in the above sections), but also there is a U shaped pattern in postgraduate enrollment, which could be interpreted as inverse necessity of postgraduate students with respect on tertiary enrollment. This means a necessity to combine or configure an optimal combination of tertiary and postgraduate HC formation to attract a major volume of FDI inflows.

Based on results shown in table 4, cointegration test demonstrate a relationship in the long-term between the FDI inflows and the HC (researchers and enrollment). Which is important in terms of public policy, since it became necessary to generate a strategy for a configuration of a critical mass of HC in formation (tertiary and postgraduate enrollments) to attract a major volume of FDI inflows in each of the Federal States. Specifically in model 3, it is shown that postgraduate enrollments in natural sciences, engineering and health sciences are more profitable in terms of attracting FDI.

CONCLUSIONS

As explained in literature review, FDI is an important factor for development of regions, employment and economic growth. Therefore a strategy for attracting FDI inflows must be applied in developing countries. On a regional level, one of the most common strategies to attract IFDI is through HC formation, which for Mexico case is concentrated in a little number of Federal States, as they were detected by a cluster analysis (Baja California, Chihuahua, Nuevo León, Jalisco, Estado de Mexico and the Federal District), taking also into account GDP and FDI of each of the States in the 2007-2012 period.

Analyzing these States, one of the highlights points to the strategy of accumulating human capital, is through the tertiary and postgraduate enrollment (35% and 45% of the country total enrollment respectively). Thus, from literature review, it is proposed that there exists a nonlinear relationship between HC formation and FDI, and in this way it is necessary to achieve a critical mass of HC capable to attract FDI or least to contribute on the IFDI necessary climate. This kind of relationship was corroborated in empirical results, since it was shown that there exist a ∩ shaped relationship on tertiary enrollment and a U shaped relationship on postgraduate enrollment over the FDI inflows, where postgraduate enrollment showed greater significance than tertiary enrollment. This nonlinear relationship must to be taken into account for local economies to establish an adequate strategy to achieve a critical mass of HC, which will be the correct configuration of tertiary and postgraduate enrollment. Subsequently, taking into account the result, it would be advisable to make a harder effort to create a critical mass with more emphasis in postgraduate enrollment than in tertiary, mainly due to the results shown in model 3.

An important fact is that the returns of HC over IFDI are not changing between federal States, but relevance of being a US border State or a big State in terms of GDP is an important factor to attract in average a major volume of FDI inflows. It is also important, to point out that tertiary and postgraduate breakdown is not taking into account by Multinational Corporations that make foreign investment, since they need the total HC formation as a whole, and no only one aspect of the HC formation.

One interesting result that deserves to be studied in future research, is that patents by millions of inhabitants and scholarships perform in all equations as a crowding out mechanism for foreign investment. Since scholarships could be seen as a necessary condition to generate HC resources, as well as patents are an important condition to generate a climate where there is innovative business and where multinational corporation could learn and benefit from local spillovers. Another opportunity for future research will be, how to find the correct configuration for HC formation between tertiary and postgraduate enrollment, or the configuration between higher levels of education with lower levels as secondary or primary.

The main limitations of the study, are related to time period which is of six years (even five years for equation 3), but instead of limitation necessary controls were included in the analysis, as well as necessary test for cointegration, that corroborate the long term relationship between variables. Another limitation is related to the shaped form of the relationship, since here was tested the quadratic relationship, but other nonlinear relationships need an accurate numerical method, that are out of the range of this article, for testing the correct specification.

text new page (beta)

text new page (beta)