Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Frontera norte

On-line version ISSN 2594-0260Print version ISSN 0187-7372

Frontera norte vol.18 n.36 México Jul./Dec. 2006

Artículos

LNG in the Northwestern Coast of Mexico. Impact on Natural Gas on Both Sides of the U. S.-Mexico Border

Sophie Meritet*, Juan Rosellón**, Alberto Elizalde***

* Associated Professor, Centre of Geopolitics of Energy and Row Materials, Dauphine University. E-mail: Sophie.MERITET@dauphine.fr.

** Professor-Researcher, Centro de Investigación y Docencia Económicas (CIDE). E-mail: juan.rosellon@cide.edu.

*** Interorganisms price analysis supervisor, Petróleos Mexicanos (Pemex). E-mail: aelizalde@dco.pemex.com.

Date of receipt: February 14, 2006.

Date of acceptance: May 22, 2006.

Abstract

This paper studies the possible impacts of liquefied natural gas (LNG) projects on natural gas prices on both sides of the U. S.-Mexico border in California. In that state gas prices are high and demand is expected to grow. Several projects for LNG facilities have been proposed and have to cope with public opinions against them. In Baja California, four LNG projects are under development given the rising demand forecasted for the next years. After a detailed study of the opportunity for LNG projects, we conclude with an analysis of the fundamentals of the current and future price formation in both sides of the U. S.Mexico border.

Keywords: liquefied natural gas (LNG), price formation, LNG projects, Mexico-U. S. border, natural gas market.

Resumen

Este artículo estudia los posibles impactos de los proyectos de gas natural licuado (GNL) sobre los precios del gas natural en ambos lados de la frontera Estados Unidos-México en el área de California. En California, los precios son altos y la demanda se espera que crezca. Varios proyectos de instalaciones de GNL han sido propuestos y tienen que lidiar con opiniones públicas en su contra. En Baja California, cuatro proyectos de GNL están en desarrollo, dada la alta demanda pronosticada para los años siguientes. Después de un estudio detallado de las oportunidades para proyectos de GNL, concluimos con un análisis de los fundamentos de la formación actual y futura de precios en ambos lados de la frontera.

Palabras clave: gas natural licuado (GNL), formación de precios, proyectos GNL, frontera México-Estados Unidos, mercado de gas natural.

INTRODUCTION

Canada, Mexico and the United States recognize the fact that they have important interrelationships in the natural gas sector. Based on data from the three countries' energy ministries, natural gas demand in North America will continue to increase significantly. The maturity of conventional natural gas supply areas and sources in the United States and Canada, and the lack of capital to develop gas supplies in Mexico, will mean that increasing supply to meet this North American demand growth will be challenging. The United States are progressively feeling upward gas price pressure with an increasing number of projected natural gas-fired electricity generation capacity, relatively small amount of natural gas storage, increasing demand from users, demand-driven transportation capacity constraints, and higher marginal cost of obtaining reliable natural gas supply. This will also create a significant opportunity for unconventional gas supplies and sources, such as gas from shale, from Alaska and Arctic Canada, and via liquefied natural gas. Increasing demand for natural gas and slowly declining natural gas production are causing analysts, including Federal Reserve Bank chairman A. Greenspan, to look to LNG imports as the answer to North America's supply issues. Records levels have been noticed for 2004 in terms of us LNG imports with 22% increase (Energy Information Administration, 2004). Liquefied Natural Gas (LNG) is supposed to induce major changes in the North American gas market.

LNG would no longer be just a peaking fuel. It could become an increasingly important part of natural gas consumption. cera notes "The incoming tide of LNG in the North American market". There are at least two dozen proposals to build new LNG terminals in North America over the next few years. Many see the expansion of U. S. LNG imports as a means to lessen U. S. dependence on foreign oil and welcome expansion plans, while other groups oppose any new LNG import terminal developments, citing potential threats by terror groups and environmental disruption. One concern the industry has expressed is that companies active in the market are running the risk of overbuilding import terminal capacity—creating a potential oversupply in the market that will depress gas prices and impede operating profitability. While there is some social opposition, key issues in the development of this new natural gas supply in the U. S. include recent market changes that increase LNG flexibility, decreasing LNG costs along the value chain, and access to new markets with the diversity of natural gas suppliers from all over the world. Thanks to LNG development, some analysts predict a new, more flexible natural gas market could appear with more links between regions. The role of LNG is usually misunderstood...

This paper focuses on the possible impacts of development of LNG on natural gas prices on both sides of the U. S.-Mexico border. In California, gas prices are high and demand is expected to grow. Several projects for LNG facilities have been proposed and have to cope with public opinions against them. In Mexico, some LNG projects are under development or revision in order to complete the domestic gas production, given the rising demand forecasted for the next years. The Mexican Energy Regulatory Commission (cre) has approved the construction of five LNG terminal projects in Mexico, four of which would be built in Baja California. However, one of the projects, to be developed by Marathon Oil Corp., was rescinded in March 2004 after the State of Baja California seized the land.

The U. S.-Mexico border in California is a good example to study the impact of LNG supply on regional natural gas prices. This paper is divided in three parts:

• Section 1 presents the opportunities for LNG development within the natural gas market in California.

• Section 2 shows the fundamentals of the natural gas market and LNG developments in Mexico, and Baja California.

• The concluding remarks section presents insights on price formation for both sides of the U. S.-Mexico border.

NATURAL GAS AND LNG MARKETS IN CALIFORNIA

During the 1980s and 1990s, North American natural gas supply exceeded demand and, as a result, prices were stable and low. Today, the situation is different. Natural gas imported to California from the Western states and Canada is more expensive. California's large and increasing demand for natural gas and its dependence on interstate pipelines for imported sources of natural gas supply has been the subject of broad public policy debate. The California Energy Commission is concerned about the impact of recent increases in natural gas prices, which in 2004 were double what they were in 2002 and earlier, on consumers and the state's economy. This section will focus on the state of California1 with the natural gas market fundamentals, LNG projects and a price analysis.

Natural Gas Market Fundamentals

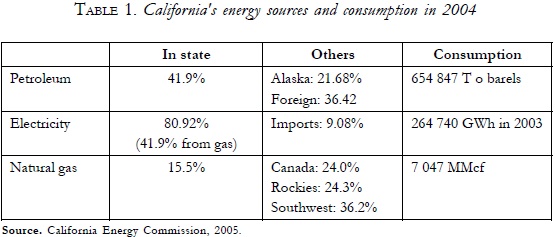

California's energy system is characterised by two fuels: petroleum and natural gas. In 2004, the state produced about 16% of the natural gas it used, 42% of the petroleum and 81% of the electricity (Table 1). California is the second state in its use of energy after Texas.

In 2004, the gas demand in California was around 2.0 Tcf (MMMMcf) with an in state production of 0.25 Tcf: 85% of natural gas consumed in California is imported. Over the next two decades, natural gas is expected to play a key role in California's energy system (Figure 1). Around 42% of the electricity produced in the state is from gas, a figure that is expected to rise. Natural gas-fired power plants are preferred, because they emit less air pollution and are more cost effective compared to other fossil-fuelled generation technology (with lower capital and operating costs). The state has environmental objectives were achieved thanks to natural gas. Public debates are numerous in California where public concern about environment protection is taken seriously.

Even if the population is growing,2 total residential natural gas consumption, however, has remained relatively flat at about 500 bcf per year. The average household's natural gas consumption (most new homes and buildings have air conditioning and natural gas heating) is less than half what it was thirty-five years ago even with the state's larger homes and more natural gas appliances. California's residential consumers use approximately one-third less natural gas per customer annually than residential customers, nationwide. The natural gas demand is increasing thanks to the two biggest consumers of natural gas, namely electricity generators (33%) and industrial use (32%).

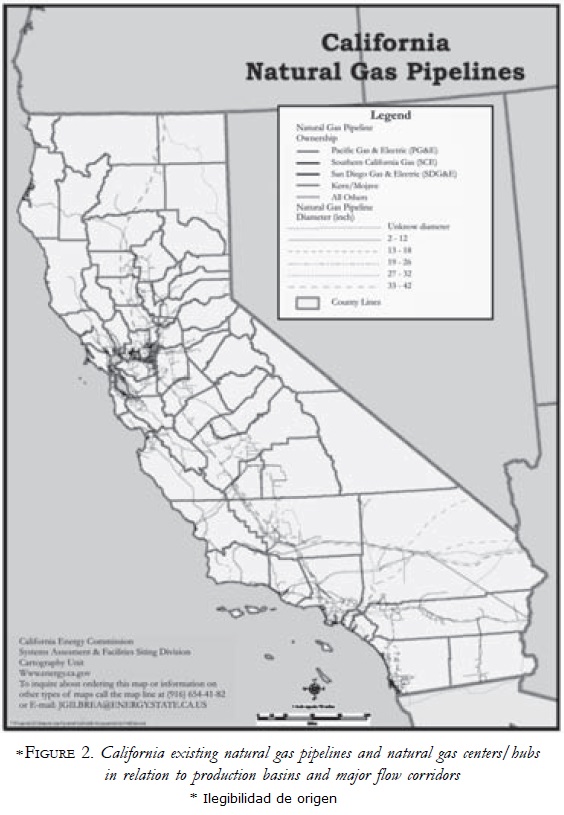

The authorities are worried about the dependence of California on natural gas and are focusing on improving the situation. California is not the only state with a increasing demand: the demand of its neighbors affects the delivery capacity to California. At the same time, this state appeared to be at the end of pipelines networks. In the last decade, three new interstate gas pipelines were built to serve California (expanding the over one million miles of existing pipelines connecting the state with gas-producing areas) (Figure 2).

The growing gap between U. S. gas production and demand suggests that the natural gas industry could be on the threshold of entering the rank of major long term natural gas importers. The tight natural gas supply situation impacts prices. With 85% of its consumption imported, the state is looking at prices that are higher than before. North American market interrelation has not helped to reduce the price volatility that has emerged since the mid-nineties. This volatility, caused by a tightening between supply and demand, has seen prices surge to as high as $10 per MMBtu and fall back to below $2 per MMBtu. Wholesale natural gas prices in California have doubled since 2002 and have, periodically, been as much as four times the national average (Figures 3 and 4).

In 2003, to satisfactorily meet existing and future energy demands, the Energy Report established five options:

1. Energy efficiency strategies.

2. Replace natural gas-fired power plants with renewable energy.

3. Deploy small-scale, "distributed" generation.

4. Increase domestic supplies of natural gas from unconventional and remote sources.

5. Import natural gas supplies from overseas.

One of the options is to develop natural gas supplies. With a tight market, volatility and high prices, news sources of natural gas could be a solution. With the decrease of LNG costs along the value chain, LNG imports could help meet demand. In the Integrated Energy Policy Report, LNG is recognized as a potential supply source for California and a means of serving its energy needs.

LNG in California

Historically, LNG imports represented a small amount of natural gas imports in the U. S. - about 1%. LNG imports more than doubled in 2003 from the previous year and now represent 3% of the total gas imports (naew, 2005). The possibility that LNG might play an important role in meeting U. S. energy needs has arisen only recently. Three year ago, in its Annual Energy Outlook 2002, the eia indicated that LNG imports were "not expected to become a major source of U. S. energy supply".

In California, residential demand for natural gas is relatively flat, due to the success of energy conservation programs. Demand is expected to rise especially because of electricity generation. The state is heavily dependant on natural gas with 85% of its consumption being imported. Authorities are looking at different ways to diversify their supplies. The real driver, however, is price. An LNG terminal would allow the state to import foreign gas to compete with high-priced domestic gas. The most economical way to transport natural gas over long distances that cannot be served by a pipeline, is in liquid form. California has an interest in South America and Mexico, which are two of its closest sources. If these countries could provide LNG, they would be cost-competitive suppliers. A ship will take 25 days to come to California from Oman, 18 days from Australia, 16-17 days from Malaysia and Indonesia, 11 days from Russia and 5 days from Alaska (one way at 18.5 knots). The costs of LNG depend on projects, and differ from country to country.

Currently, there are no LNG facilities on the Pacific Coast of the U. S. The early Paclndonesia project that was supposed to deliver LNG from Indonesia to California in 1980 was cancelled for several reasons, one of which was powerful popular resistance. Thus, many of the new West Coast LNG proposals are based on deliveries into Baja California and transmission across the U. S.-Mexico border by pipeline (see next section). Three LNG import terminals are proposed for the California coast (one in Long Beach and two off the coast of Oxnard) and one close to Oregon (Table 2).

The projects in Baja California are getting serious scrutiny. Developers of these projects face a number of hurdles, ranging from funding for project investment to technological advances to development of appropriate policy and regulatory regimes and coordination for new transportation corridors. Developments upstream appear to be the key point in the development of LNG. At the same time, there is strong public opposition to new pipeline projects that cross through states. The nimby (not in my back yard) position is still present and accentuated by the terrorist threat: citizen fear that liquefied natural gas ship could be targets. Terminals in Baja California would be of great interest for the state. It would increase the source of supplies and it would reduce risks of supply disruptions for this area. Nevertheless, concerned citizen in Vallejo and Tijuana have already rejected attempts to site LNG terminals in their neighborhood. There are also concerns regarding ferc certificate delays. In addition, necessary infrastructure enhancements downstream from LNG terminals will be needed which are likely to raise landowner and cost allocation issues. Will firms take the risk of building a large number of LNG terminals only for some of them to become uneconomic to run? LNG facilities still represent mayor capital investments. While developing new pipeline capacity in these markets is more and more difficult, the decline in delivered LNG costs makes LNG an attractive, cost competitive in these gas consuming markets. The question is until which point it will be attractive.

Price Analysis

The future of LNG imports in California depends on various elements. The firsts are natural gas prices and cost of the LNG value chain. Gas prices will have to be consistent and high enough to make LNG imports profitable to its producers. Shipping costs, which vary with distance, add to the cost of LNG. Tankers must offload their cargo within a certain period of time, which means that imports form closed countries are preferable.

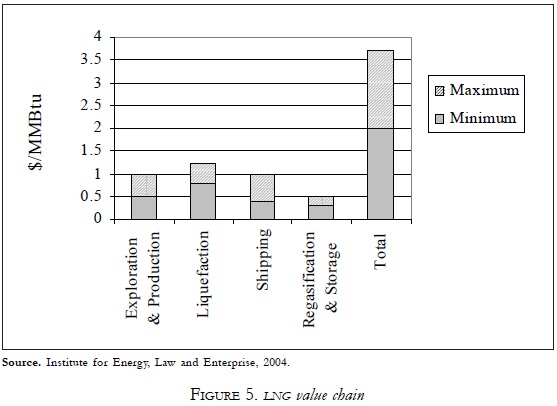

Thanks to technical innovations, costs along the LNG value chain have been significantly reduced over the past 20 years. All the technological improvements have allowed a decrease of around 30%, meaning that more and more projects are becoming economically viable.

In 2003, the cost of liquefaction, shipping and regasification pushed the cost of LNG up to between 2.75 and $4.00 per MMBtu. There are very large disparities in individual costs between projects, depending on the projects and countries involved.

Current prices are about 3.00 to $4.00 per MMBtu depending on the costs of natural gas liquefaction, transportation and regasification (Figure 5). Natural gas can be economically produced and delivered to the U. S. as LNG in a price range of about 3.00 to $4.00 per MMBtu (depending on shipping costs). As the distance over which natural gas must be transported increases, LNG usage has economic advantages over pipelines. The total cost of LNG production has been quite streamlined and reduced thanks to competition and technological progress. According to the iele, the LNG value chain "now incorporate technology improvements for cost reductions and economies of scale, as well as enhancements and protections for health, safety and the environment".

NATURAL GAS AND LNG MARKETS IN MEXICO

Prospects for the Mexican Market and LNG Role

In the early 1990's, the Mexican government adopted a policy encouraging natural gas use thanks to its environmental qualities (clean combustion), its suitability for use in more efficient technologies such as combined cycle plants and the presence of relatively abundant gas sources. As a result, the program to replace fuel oil by natural gas in power plants, investment plans for building new combined cycle plants, and the environmental regulations that went into effect in 1998 for all industries, ensure a heavy demand for this hydrocarbon in Mexico over the next few years.

On the supply side, approximately 64 Tcf of natural gas resources remain in Mexico, 15 Tcf of which are proven reserves (Petróleos Mexicanos, 2004). Producing 1.6 Tcf per year, Petróleos Mexicanos (Pemex-the National Oil Company) maintains a monopoly on domestic gas exploration and production and a strong market power in transport systems (National Gas Pipelines System, ngps). Private companies have been allowed to participate in downstream projects since 1995.

Every year, the Mexican Secretary of Energy publishes a study that analyses the future of the natural gas market for the next ten years. The most recent version for the period 2004-2013 (Secretary of Energy, 2004a) considers six scenarios that combine three demand cases and two supply cases, as follows:

E1. Base Demand—Average Supply (Reference case); E2. Base Demand-High Supply; E3. High Demand—Average Supply; E4. Low Demand—Average Supply; E5. High Demand—High Supply and E6. Low Demand—High Supply.

Table 3 presents the results of the reference scenario (E1). This picture forecasts an increase in gas demand from 5 309 MMcfd in 2003 to 9 303 MMcfd in 2013 (average annual growth of 5.8%). Power generation will be the most dynamic and biggest consumer sector and its participation in total demand would rise from 34% to 51% in 2013. However, national supply is expected to be unable to satisfy all consumption demands because Pemex's powerful budgetary constraints limit the adequate development of gas fields. Imports would therefore increase from 983 MMcfd in 2003 to 3 784 MMcfd in 2013. These imports vary from 2 045 MMcfd under scenario E6 to 4 076 MMcfd under E3 in 2013 (Figure 6). LNG imports in 2013 are estimated to range from 555 MMcfd (E4 and E6) to 814 MMcfd (E1 and E2) (15-25% of total imports), in addition to imports coming by pipeline from the U. S.

Five LNG terminal projects have received approval to be built in Mexico from the Comisión Reguladora de Energía (CRE-the Mexican Energy Regulatory Commission). Four of them would be installed in Baja California, and one in Altamira, in the State of Tamaulipas (Table 4). However, one of them, scheduled to be developed by Marathon Oil Corp. (Gas Natural Baja California) has been called off in March 2004 after the State of Baja California seized land the company had planned to buy. Additionally, two proposals respectively in Manzanillo and Lázaro Cárdenas (central-Pacific area of the country) are under revision by the cre. For LNG imports to 2013, Sener's study (2004a) only considers the Altamira LNG Project because the Altamira Terminal and the Federal Electricity Commission (CFE) have already signed a long-term supply contract. The other three proposals are still negotiating a supply contract.

Dependency on foreign supply will increase since the rate of imports/demand would reach 42% for E3 and 41% for the reference case in 2013. Showing another panorama, the E6 scenario considers exports to be 1 613 MMcfd and imports 2 045 MMcfd (Figure 6). These forecasts clearly underline the uncertainties as to whether the indigenous production can be sufficiently increased to satisfy rising demand and eventually export gas to the U. S.

Baja California: Gas Supply and Demand, Import Points and Gas Power Plants

The States of Baja California Sur, Sinaloa, Sonora and Baja California comprise the Northwest region, but natural gas is only supplied and commercialized in the two last ones. Gas consumption has rapidly increased in recent years from 5 MMcfd in 1993 to 250 MMcfd in 2003 (annual growth of 48%), which now represents about 5% of the national figures (Table 5). The power generation sector has mostly contributed to this evolution by rising from 7 MMcfd in 1999 to 233 MMcfd four years later (90% which is regional production).

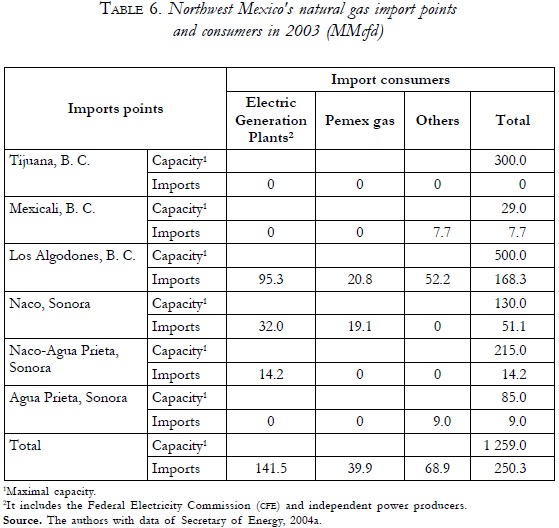

As far as supply is concerned, all demand is satisfied by U. S. imports since there is neither production in the zone nor pipelines from the south of the country. These imports are carried by means of six transborder pipelines (Table 6).

According to the Secretary of Energy's projections (Secretary of Energy, 2004a), gas demand in the zone will continue to grow at an annual rate of 10.7% to reach 693 MMcfd in 2013. The installation of 3 245 MW of gas fired, combined cycle power plants will be responsible for the increase. Almost 450 MMcfd of additional imported gas will thus be required from 2003 to 2013.

CONCLUDING REMARKS

The development of gas resources within North America will be a lengthy process that will require the discovery of new gas fields, and the more efficiently exploitation of already existing fields. The development of large new pipeline systems will be a natural consequence of this process; such a process will mature over many years. In the meantime, the timely construction of LNG infrastructure will be vital. LNG will thus have a very important role in the natural gas supply all over North America.

In 2004 LNG imports from the U. S. were 1.8 MMMcfd, and are expected to increase to around 7 MMMcfd by 2010. The increase of LNG imports is regarded as so important that by 2012 such imports will be higher than pipeline imports from Canada (Lajous, 2005). These calculations are carried out under the assumption of gas imports from Baja California that—in turn—originate from LNG imports into the Baja peninsula.

General natural gas price formation in the United States is very much linked to an interval whose boundaries are determined by low-sulfur heavy fuel oil and heating oil (Lajous, 2005). The price differential between these two liquid fuels has increased, which implies that the price interval for natural gas has widened, implying more uncertainty and price volatility. This is a crucial element to understand forward prices for the 2005 winter of around USD8 per MMBtu. In the longer run, marginal supply sources (such as LNG) establish a floor for the price of pipeline gas.

Price formation for LNG imports into the U. S. is basically determined by short run conditions. More specifically, LNG prices are linked to internal pipeline gas prices such as the ones in Henry Hub. The U. S. market is primarily characterized by non regulated gas-to-gas competition, as opposed to other gas regions in the world (e.g., Europe) where gas competes with oil and substitute fuels in a long-run framework. So, for example, the LNG price in Lake Charles, Louisiana (one of the most important LNG terminals), is highly correlated to the price at Henry Hub.3

Rising LNG imports are going to have an impact on natural prices in the area. Most likely, LNG will have an impact on natural gas prices in California because it will be part of the energy mix: natural gas supply will increase, therefore prices should decrease. Its influence on price will be largely determined by how many suppliers will effectively compete and how quick they will be able to supply. However, LNG will not be able to set prices at its level of costs. It will remain a "price taker" and not become a "price maker". To have an influence on natural prices, LNG should present costs below price levels and be able to reduce prices to its cost level. As described by Jensen (2004), many misunderstanding about LNG impacts are linked to the difference between "net-back pricing" and "cost of services" pricing. LNG will moderate gas prices but is likely to retain its netback pricing. LNG suppliers operate with the idea that U. S. price levels will determine their netbacks (rathed than their costs determining U. S. price levels). Jensen emphasized that in the past, American the U. S. Congress recognized the difficulty of trying to apply cost-of-service regulation to individual producers with very different costs when their product was an exchangeable commodity in the marketplace. The same also applies to the possible development of LNG supplies in the U. S.

At the same time, LNG supplies in California could have an influence on basis differentials in the natural gas market in the U. S. The current price reference point used for trading is at Henry Hub. Prices at the end of pipeline networks are among the highest. Now the impact of LNG is also going to depend on transportation costs... The global price arbitrage system should evolve if LNG facilities are built in Baja California.

In Mexico, the LNG price contracts that cfe has agreed on, use internal U. S. prices as a reference. While the LNG price in the Altamira project (in the northeast of Mexico) is linked to Henry Hub, the LNG price in Baja California is determined by the Southern California Border Average (Socal). In 2004, the price in Altamira was USD0.36 per MMBtu higher than the Baja California price. However, as Lajous (2005) argues, the arranged contract LNG prices seems odd. cfe agreed to pay the Henry Hub price plus USD0.17 in Altamira and Socal, minus USD0.03 in Ensenada. In the first case, there is no reason for paying a higher price than the Lake Charles one (which is very similar to the Henry Hub one), while in the second case, it appears to be too high.

Apparently, cfe arranged LNG contract prices for what it would pay for pipeline gas imports. However, in the specific case of Ensenada, Baja California, the LNG contract price is higher than the gas price associated with bringing gas all the way from Texas to the California-Arizona borderline. This means that cfe is granting (artificial) rents to LNG companies. From an analytical point of view, this cfe policy is inconsistent with an efficient result derived from nodal price theory applied to natural gas regulation (Brito and Rosellon 2002 and 2005). The new LNG supply sources should simply be considered as new supply nodes in a netback system. LNG pricing should be determined by following the natural gas opportunity cost (netback rule) and reflect as well congestion in gas distribution. However, the cfe contracts seem to be generating additional rents with adverse distributional effects.

LNG's entry into the Mexican natural gas network (in both the Gulf of Mexico, and the Pacific Ocean) will then increase the number of arbitrage points as well as their location. This will of course imply a more complex price system. However, this should not constitute a major problem for Mexican gas regulators since similar programs have been devised in other infrastructure areas fairly easily, even for much more complex industries such as the electricity industry. The adequate design of a price program in accordance with nodal price theory would provide an efficient reference for gas trading and contracting, in both the natural gas and electricity sectors. Likewise, the regulator should develop programs that evaluate the impacts on welfare and pricing of the location, dimension, ownership and sequencing in the construction of LNG terminals.

REFERENCES

Bazán, Gerardo, A. Elizalde and J. Puente, 2004, Real Options Valuation Modeling: A Vivid Application in Eiquefied Natural Gas Facilities and Electric Power Generation in the Northwestern Coast of Mexico, Proceedings of the 19th World Energy Congress & Exhibition, Sydney, Australia, September 2004. [ Links ]

Brito, D. L. and J. Rosellón, 2002, "Pricing Natural Gas in Mexico: An Application of the Little Mirrlees Rule," The Energy Journal, 24 (3). [ Links ]

----------, and J. Rosellón, 2005, Liquid Natural Gas and a New Policy for Pricing Natural Gas in Mexico, Working Paper, Centro de Investigación y Docencia Económicas (forthcoming). [ Links ]

----------, and J. Rosellón, 2005, "Price Regulation in a Vertically Integrated Natural Gas Industry: The Case of Mexico," The Review of Network Economics, 4 (1), March. [ Links ]

California Energy Commission (2005), California's Major Sources of Energy, California, U.S.A. [ Links ]

Comisión Reguladora de Energía (2005), www.cre.gob.mx , Mexico, June.

Energy Information Administration, 2003, The Global Liquefied Natural Gas Markets: Status and Outlook, Washington, D. C.: EIA, U. S. Department of Energy. [ Links ]

----------, 2004, Annual Energy Outlook 2004, Washington, D. C: Energy Information Administration, U. S. Department of Energy. [ Links ]

Federal Energy Regulatory Commission (2005), Existing and Proposed North American LNG Terminals, Office of Energy Projects, Washington, D. C., U.S.A. [ Links ]

Ferguson, R., 2003, Natural Gas: The Next Energy Crisis, Center for Energy Efficiency and Renewable Technologies, September. [ Links ]

Hartley Peter and Medlock III Kenneth, 2005, Russian Natural Gas Supply: Some Implications for Japan, Rice University. [ Links ]

Institute for Energy, Law and Enterprise, 2004, The Role of LNG in North American Natural Gas Supply and Demand, IELE, September. [ Links ]

Jensen T., 2004, US Reliance on International Liquefied Natural Gas Supply, policy paper prepared for the National Commission on Energy Policy, February. [ Links ]

Lajous, A., 2005, "El mercado de gas natural y su regulación," paper presented at the seminar Las Alternativas Energéticas México-Estados Unidos para el Siglo XXI, Mexico City: Universidad Nacional Autónoma de México, May. [ Links ]

Meritet Sophie and A. Elizalde, 2004, Developing LNG in North America: Impact on Prices of Natural Gas, Proceedings of the 25th Annual North American Conference of the USAEE/IAEE, Washington, D. C., U.S.A., July. [ Links ]

NAEW, 2005, North American Natural Gas Vision, North American Energy Working Group Experts' Group on Natural Gas Trade and Interconnections, January. [ Links ]

Petróleos Mexicanos, 2004, Las reservas de hidrocarburos de México, 2004, Pemex Exploration and Production. [ Links ]

Secretary of Energy, 2004a, Prospectiva del mercado de gas natural 2004-2013, Mexico: Sener. [ Links ]

----------, 2004b, Prospectiva del sector eléctrico 2004-2013, Mexico: Sener. [ Links ]

Wolak, 2004, Liquefied Natural Gas (LNG) Is Essential to California's Energy Future, Stanford Institute for Economic Policy Research Policy Brief, December. [ Links ]

1 We do not present the situation of the U. S. market; we focus on the Californian situation.

2 Since 1967 the number of households in California has nearly doubled from 5 million to more than 9 million

3 In 2004, the average import price of pipeline gas in the U. S. was USD5.81 per MMMBtu, while the importing price was USD5.82, and the one registered at Henry Hub was USD5.85 (Lajous, 2005).