Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Estudios fronterizos

versión On-line ISSN 2395-9134versión impresa ISSN 0187-6961

Estud. front vol.11 no.22 Mexicali jul./dic. 2010

Artículos

Cross Border Business Cycle Impacts on the El Paso Housing Market

Gokce Kincal*, Thomas M. Fullerton, Jr.,** James H. Holcomb** y Martha Patricia Barraza de Anda***

* Harvey Economics.

** Department of Economics & Finance, University of Texas at El Paso. Correo electrónico: tomf@utep.edu

*** Departamento de Economía, Universidad Autónoma de Ciudad Juárez, Ciudad Juárez, Chihuahua, México. Correo electrónico: mbarraza@uacj.mx

Artículo recibido en octubre de 2009

Segunda versión recibida en abril de 2010

Artículo aceptado en mayo de 2010

Abstract

There is comparatively little empirical evidence regarding the impacts of cross border business cycle fluctuations on metropolitan housing markets located near international boundaries. This study examines the impacts of economic conditions in Mexico on sales of existing single–family houses in El Paso, Texas. Anecdotal evidence suggests that these impacts are fairly notable. Annual frequency data from the University of Texas at El Paso Border Region Modeling Project are used to test this possibility. Results indicate that solid empirical evidence of such a linkage is elusive.

Keywords: border, business cycles, border housing markets.

Resumen

Existe relativamente poca evidencia empírica sobre el impacto de las fluctuaciones económicas transfronterizas en mercados de vivienda metropolitanas ubicadas en límites internacionales. Este estudio considera los impactos potenciales de condiciones económicas en México sobre ventas de casas mono–estructurales previamente construidas en El Paso, Texas. La evidencia sugiere que estos efectos suelen ser importantes. Para poner a prueba esta hipótesis, se emplean datos de frecuencia anual del University of Texas at El Paso Border Region Modeling. Los resultados econométricos indican que la evidencia empírica sólida de tales vínculos económicos transfronterizos es mínima.

Palabras clave: frontera, fluctuaciones económicas, mercados de vivienda fronterizas.

Introduction1

Housing plays a major role in the El Paso economy. A house purchase is the largest single consumer transaction that the majority of El Pasoans make and it represents the greatest portion of non–human wealth for most of these households. New residential construction expenditures in 2002 in El Paso totaled approximately $380 million. Collectively, the nearly 183 thousand existing single–family housing units in El Paso were worth more than $16 billion in 2002 (Fullerton and Tinajero, 2003).

These figures underscore the importance of the housing market for the El Paso economy. Analysis of the possible wealth effects associated with changes in financial variables on housing can deepen our understanding of the fundamentals of the El Paso economy. Such knowledge may be helpful in forecasting future sales and contribute to a better understanding of the relationships among financial variables, home prices, and local economic performance. Housing is an expensive, durable, and heterogeneous good, whose purchase requires a considerable down payment. Its heterogeneity prevents the development of an organized commodity market in the sense of a quoted price for a homogenous unit such as wheat or sugar.

Not surprisingly, accurate price information is almost always costly (Smith, Rosen, and Fallis, 1988). Prior research indicates that variables such as mortgage rates, real personal disposable income, unemployment, prior period home sales, and migration may play important roles in explaining behavior the of the El Paso real estate market (Fullerton, 2001). Changes in the returns on financial instruments in both the United States and Mexico may also affect market conditions in this border economy.

Such factors can affect activity as well as prices in the housing market. Given the potential wealth effects from both countries on the El Paso housing market, empirical research on the possible linkages between them may prove useful.

The major purpose of this study is to examine the effects of changes in financial variables on the El Paso residential real estate market. The analysis utilizes a data set that includes prices for new and existing houses, plus sales of existing single–family units. Several statistical and econometric testing methods are employed. Section two provides an overview of related studies. Section three outlines data and methods. Empirical results are reported in Section four. Section five provides concluding comments and suggestions for future research.

Literature Review

Studies conducted to evaluate the relationship between financial variables and housing market conditions have been primarily carried out at the national level with fewer studies at the regional level. Variables such as mortgage rates, household income, unemployment levels, and demographics have been found to play important roles in housing markets. Studies that analyze wealth effects of financial variables on housing demand and prices have concentrated on the equity market returns more than other variables (Ullah and Zhou, 2003; Jud and Winkler, 2002).

Reichert (1990) suggests that housing policy and research should take into consideration both national factors as well as regional trends in income, employment and key demographic characteristics by dividing the United States into at least four broad regions. Hence, once a general forecast of the national macroeconomy is established, then trends in the level and composition of population shifts, the general direction of employment rates, and likely changes in permanent income should be considered on a regional basis.

Consistent with that approach, Bonnie (1998) argues that macroeconomic factors such as monetary and fiscal policies are important determinants of national and regional housing prices. Of course, economic theory predicts that housing prices and stocks of houses are positively related to economic cycles. Individual housing markets are first influenced, therefore, by general developments and tendencies in the national economy. Both contractionary and expansionary phases of national economic cycles have profound effects on regional housing markets because they affect personal incomes and mortgage rates. Schwab (1983) states that the purchase of most owner–occupied housing in the United States is financed by conventional mortgages, annuities that specify terms, principal amounts, nominal interest rates, and constant nominal payments such that the present values of the stream of real payments is equal to the amounts loaned.

McGibany and Nourzad (2004) analyze long– and short–run relationships between prices of newly constructed houses and mortgage rates. Results in that study indicate that housing prices and mortgage rates are non–stationary, but co–integrated. Contrary to earlier studies, the estimates uncover virtually no short–term relationship between mortgage rates and housing prices. Over the long–run, however, the study finds a mortgage rate elasticity of housing prices of –0.0789.

Harris (1989) conducts an empirical study in an effort to examine the role of appreciation expectations in overcoming the negative effects of nominal mortgage interest rates. That paper finds that real rate of interest is the primary mechanism affecting the changes in housing price levels. It further states that if nominal rates and inflationary expectations rise by an identical amount, leaving the real rate constant, real prices are unaffected. Schwab (1983) also finds that effect of changes in expected inflation is small relative to changes in real rates and concludes that demand for housing is not a function of the nominal rate.

Carliner (1973) examines the income elasticity of housing demand in the United States for homeowners and renters. Results indicate that using permanent income rather than current income leads to higher elasticity estimates. Moreover, the income elasticity of housing demand is less than unity. Similarly Follain (1979) analyzes the income elasticites of housing demand by low– and high–income households. Income elasticities are found to be less than unity for almost all groups included in the sample. In addition, housing demand of high–income households is found to be more sensitive to changes in permanent income than it is for low–income households.

Reichert (1990) includes measures of both transitory and permanent income in housing demand functions. Results indicate that, at the national level, a 1 percent change in permanent income results in a 3.78 percent change in the general level of housing prices. Regional data in the study also confirm the relationship between permanent income and housing prices. Haurin and Gill (1987) analyze the effects of uncertain future income on the demand for owner occupied housing. Consistent with the permanent income hypothesis, increased uncertainty about future income reduces housing expenditures. The estimated income elasticity of housing demand is 0.75, less then unity and consistent with earlier estimates.

Hendershott and Abraham (1992) focus on the patterns and determinants of metropolitan house prices between 1977 and 1991 in 29 cities across the United States. Real income growth and employment rates are identified as the major forces that drive hosing prices. Hendershott and Abraham (1996) defines two groups of variables, one that accounts for changes in equilibrium price level and another that explains deviations from the equilibrium price. The former group includes real income growth, real construction costs, and real after–tax financing costs. The latter group consists of lagged real appreciation and the difference between the actual and equilibrium real house price levels. Results indicate that deviation from the equilibrium exercises a small effect on housing prices, reflective of the durable nature of dwelling structures.

Chen (2004) interprets the findings of an econometric model developed by Economy.com based on Abraham and Hendershott (1996). The model includes both an equilibrium price and a cyclical price. The cyclical equation is utilized to explain deviations from the equilibrium price and these deviations are driven by factors such as joblessness and changing mortgage rates. The most important explanatory variable in the equilibrium price equation is real per capita disposable income. A higher jobless rate is found to put downward pressure on housing demand and results in slower price growth.

Numerous research efforts also highlight the influence of demographic factors on housing demand and prices. According to Reichert (1990), population growth puts direct pressure on the demand for housing services. That effect becomes more pronounced when the majority of population growth is in the home buying age group with significant income. Copazza, Hendershott, Mack and, Mayer (2002) examine the single–family house price dynamics in 62 U.S. metropolitan areas during the 1979–1995 period. That study estimates a population elasticity of real house prices of 0.15.

Mankiw and Weil (1989) also evaluate the effects of population changes on housing demand and prices by focusing on baby boom and bust periods observed in the United States. Although population changes caused by high and low birth rates may not have immediate effects on housing demand and prices, they can have lagged effects. A 1 percent increase in housing demand is found to generate a 5.3 percent increase in the real price of housing at the national level. Large demographic changes are thus found to induce potentially large swings in housing prices.

The degree to which demographic factors can affect housing demand and real housing prices has been the subject of much debate. Accurate housing price forecasts are difficult to develop due to at least three important factors. First, the long–run supply of housing is fairly elastic. Second, while occasionally subject to persistent disequilibria, housing markets are in some ways relatively efficient. Third, simulation outcomes can be very sensitive to model specifications (Woodward, 1991). Hendershott (1991) states that historical model fits are not always good enough to explain housing market behavior over extended periods. Holland (1991) also points out that while demographic changes frequently affect housing investment, housing prices are also influenced by numerous other variables that cause variations in overall market conditions.

Goetzmann (1993) analyzes the behavior of returns on single–family homes as assets in investment portfolios. The return on a single–family home investment is defined as the difference between purchase and sales prices. One finding of the study is that correlations among returns on home investment and other financial assets such as stocks, bonds, and treasury bills vary from region to region and are negative for almost all regions. For example, in Dallas, the correlation between the S&P500 index and single–family dwelling units is found to be 0.01 while it is –0.18, –0.11, and –0.04 for Atlanta, Chicago, and San Francisco respectively.

He (2002) examines the effects of real stock returns on home sales segmented into existing and new home markets. Because potential homeowners are constrained by down payment and mortgage loan qualification requirements, increases in current wealth should facilitate house purchasing process. Consistent with earlier studies, results are not identical across regions. At the national level, regression coefficients on mortgage rates, real disposable personal income, and unemployment level are statistically significant for sales of both new and existing homes. Changes in real stock returns are found to affect home sales and also increase the explanatory power of the model. Moreover, they are also found to exercise a lagged effect on sales of existing homes via changes in the level of consumer confidence.

Green (2002) focuses on California in a study of the wealth effects of variations in stock prices on housing prices. Empirical findings indicate that for changes in equity values to have measurable impacts on consumption, stock holdings must be widespread, variations in stock prices must be unanticipated, and fluctuations in stock prices must be the result of something other than a change in the discount rate. In Northern California, where it is reasonable to expect all three conditions to hold, evidence is uncovered that house prices are affected by changes in stock returns. More specifically, for the San Jose area, where the wealth effect is expected to be relatively stronger, it is estimated that a 1 percent increase in the value of the Russell 2000 Index would lead to 0.88 percent increase in house prices after 1 year. For San Francisco, the housing price response is only 0.22 percent. In Southern California, where the three conditions are not met, the wealth effect in question is found to be relatively unimportant.

Ullah and Zhou (2003) investigate the dynamic relationships among three housing market variables (median sales prices of existing single family units, 30–year effective mortgage rates, and sales) and the general stock market. A strong and positive relationship between New York Stock Exchange (nyse) value–weighted portfolio returns and housing sales is reported. Consistent with the wealth effect hypothesis, the nyse value–weighted portfolio returns are further reported to have a significant effect on prices. Jud and Winkler (2002) examine housing price growth dynamics in metropolitan areas across the United States. Housing price appreciation is found to be strongly influenced by population, income, construction costs, interest rates, and real stock market appreciation. Real wealth accumulation also exhibits strong current and lagged wealth effects on housing prices in that sample.

According to macroeconomic theory, consumption is an increasing function of labor income and wealth. A considerable body of literature has been devoted to investigating the relationship between wealth and demand for consumption. Mankiw and Zeldes (1991) for example, focus on the consumption patterns of stockholders and non–stockholders. That study uncovers the evidence that stockholders' consumption is more volatile and more highly correlated with the stock market. Similarly Poterba (2000) investigates the effects of increased stock market wealth on household consumption behavior. In that study the evidence suggests that rising stock market surely leads to higher levels of consumer spending. Nevertheless, studies that concentrate on the linkages between financial wealth and housing demand, consumption, and prices have not been numerous.

In this sense, this study aims to contribute to a better understanding of the linkages between regional housing markets and financial wealth. It also includes an international dimension by examining the potential effects of Mexican financial conditions on the housing market in the border metropolitan economy of El Paso, Texas. It well known that cross–border economic conditions affect many sectors within metropolitan economies in the United States (Fullerton, 2001; Adkisson and Zimmerman, 2004; Fullerton, Molina, and Pisani, 2009). Documenting empirical evidence of those linkages sometimes proves to be a difficult task (Fullerton, 1998; Fullerton, Molina, and Ibarreche, 2007). Whether that is the case for border region housing markets has not previously been examined.

Data and Methodology

In many previous studies, econometric models of the dynamics of regional housing demand and prices have included factors such as mortgage interest rates, income levels, and employment rates as important explanatory variables (Reichert, 1990; Hendershott and Abraham, 1992). Also expressing housing demand and prices as functions of changes in financial wealth is a relatively newer approach (Green, 2002; He, 2002; Jud and Winkler, 2002; Ullah and Zhou 2003). To date, an analysis of wealth effects on the El Paso housing market has not been completed. To do so accurately probably requires inclusion of economic variables from Mexico. It should be pointed out that real estate investment flows in this market are commonly assumed to go from south to north. That assumption does not hold for other border regions such as Baja California, where substantial real estate investment flows are attracted from San Diego and other cities in Southern California.

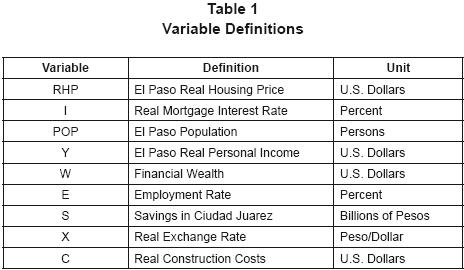

The following two–equation model describes the behavior of El Paso housing market. It is based on Jud and Winkler (2002) and Reichert (1990). Variables employed in it are defined in Table 1. The sample bounds are determined by data availability. The variables are from the University of Texas at El Paso Border Region Modeling Project (Fullerton and Tinajero, 2003).

Equations 1 and 2 represent housing demand and supply in El Paso. QD is the demand for housing during time period t, QS is the supply of housing during time period t. Except where noted, all data are from the United States. P is the real price of housing, Y is real personal income, pop is population, I is the real mortgage interest rate, W is real financial wealth in El Paso measured by the S&P 500 metropolitan index, E is the employment rate, S is annual private savings in Ciudad Juarez, Mexico, X is a real exchange rate index for Mexico, and C is real construction costs. Random error terms are represented by u and v.

The savings variable (S) is included in the model in order to measure the direct effects of changes in private wealth in Ciudad Juarez on housing prices in El Paso. The inclusion of savings variable in the model as a wealth indicator recognizes that direct changes in private wealth are caused by the changes in private savings (Kennedy, 1978). The approach utilized to calculate changes in private savings in Ciudad Juarez involves subtracting national private consumption expenditures from national disposable income (Dagenais, 1992) and multiplying this figure by the Ciudad Juarez share of total population of Mexico. Changes in wealth in Ciudad Juarez will affect the volume of assets available for meeting down payment requirements on housing units that are to be purchased on the north side of the river in El Paso (Smith, Rosen, and Fallis, 1988; Klein and Rosengren, 1994).

The real exchange rate variable (X) is included in the model in order to account for the potential effects of variations in the purchasing power of Mexican nationals on housing prices and the volume of home sales in El Paso. The rationale for the use of this variable is that fluctuations in Mexican purchasing power affect retail and economic activity in El Paso (Fullerton, 2001). By extension, real exchange rate changes will also affect the ability of Mexican housing investors to meet mortgage payment obligations in El Paso.

Because all variables in the model are logarithmically transformed prior to parameter estimation, regression coefficients in the supply and demand equations measure the elasticities of supply and demand with respect to the various explanatory variables employed. For instance, b1 represents the price elasticity of housing demand and b2 measures mortgage interest rate elasticity of housing demand. Similar housing market models have been employed in several other empirical studies of the demand for residential real estate (Jud and Winkler, 2002; Reichert, 1990).

When the housing market is in equilibrium,

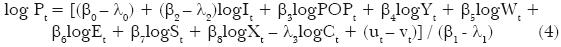

Substitution of Equation 1 and Equation 2 into Equation 3 yields a reduced form equation:

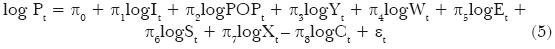

Equation 4 provides a more succinct expression for the housing price equation to be estimated:

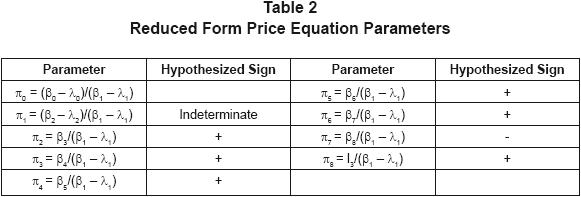

As summarized in Table 2, most of the explanatory variables in Equation 5 are assumed to have positive coefficients associated with them. The expected sign of the parameter for the real mortgage rate variable is indeterminate. When interest rates increase, the housing demand curve shifts downward and to the left, but the housing supply curve shifts upward and to the left. The net impact on housing prices depends on the relative shifts of the demand and supply curves (Jud and Winkler, 2002). The coefficient for the real exchange rate variable has a negative hypothesized sign due to the fact that depreciation of the Mexican peso weakens the purchasing power of Mexican nationals and this is expected to cause a decline in housing demand in El Paso.

In addition to the housing price model, a complementary econometric model for single–family housing sales in El Paso is defined in Equation 6. It is based on He (2002) and employs same independent variables as the variables shown in Equation 1, exclusive of the population and employment rate regressors. The dependent variable (hs), represents the number of existing housing units sold annually in El Paso. Analogous to Equations 1 and 2, variables employed in Equation 6 are also logarithmically transformed. Its estimated regression coefficients, therefore, measure the elasticity of housing sales with respect to the various explanatory variables included in the model.

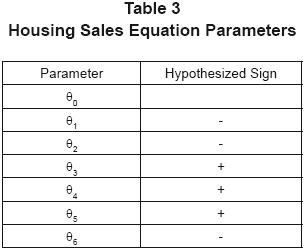

As highlighted in Table 3, three of the eight slope parameters in Equation 6, namely the coefficients for the real price, real mortgage interest rate, and real exchange rate variables are hypothesized to be negative. Increasing house prices imply higher costs for home buyers, which are very likely to cause declines in housing sales. This effect becomes even more pronounced when increasing house prices lead to higher down payment requirements (He, 2002). Thus, the expected sign of the regression coefficient for the real price variable is negative.

Mortgage rate movements significantly influence housing market activity by altering the qualifying levels of incomes for home buyers (Dua, Miller and Smyth, 1999). Therefore, an inverse relationship between housing sales and mortgage interest rates is expected as well. The real exchange rate variable (X) is also assumed to have a negative sign due to the adverse effects of depreciations on the abilities of Mexican home buyers to meet mortgage and down payment requirements in El Paso or other cities on the north side of the border (Fullerton, 2001).

Annual savings in Ciudad Juarez (S) and the S&P 500 metropolitan index for El Paso (EPW) are utilized in the house sales equation as wealth indicators in order to determine the extent to which housing sales in El Paso are sensitive to wealth fluctuations in both metropolitan economies. The S&P metropolitan index is the S&P 500 stock index, adjusted by the dividend, interest, and rent to total income ratio for El Paso relative to that of the United States (Chen, 2004). The slope parameter associated with the S&P 500 metropolitan index variable is expected to be positive. This assumption is consistent with the hypothesis that higher stock returns help potential home buyers accumulate savings for down payments (He, 2002). Similarly, the expected sign of the savings variable (S) is positive since annual savings represent additions to the wealth stock and increasing wealth in Ciudad Juarez is expected to stimulate housing sales in El Paso.

Empirical Results

The central hypothesis being tested is that housing sales and prices in El Paso are affected by fluctuations in the wealth of El Paso and Ciudad Juarez residents in a manner similar to that of other metropolitan residential real estate markets as reported in earlier studies (He, 2002; Green, 2002; Jud and Winkler, 2002). To analyze that possibility, several different regression equations are estimated using least squares regression techniques. Since stock and price adjustments may take more than a year, autoregressive (AR) and moving average (MA) terms with more than one lag are employed in some of the equation specifications.

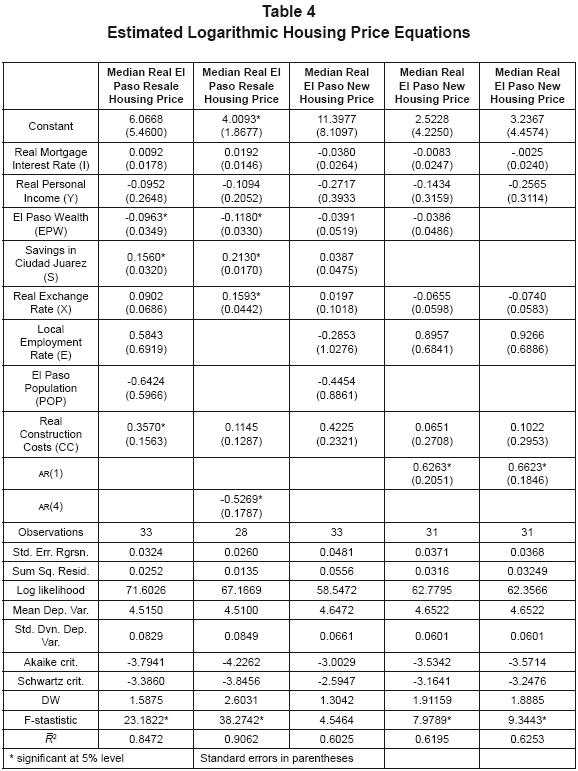

The vast majority of the single–family housing stock in any metropolitan economy is comprised by previously built structures. In Table 4, parameter estimates for equations in which the dependent variable is the median price for resale houses are shown in Columns 2 and 3. Both specifications are based upon the framework shown in Equation 6. The first model includes real mortgage rate, real personal income, wealth in El Paso, savings in Ciudad Juarez, population, the real exchange rate, and the construction cost index as independent variables. The model explains 88.5 percent of the variation in the dependent variable, real El Paso resale housing price. The F–statistic suggests that variables employed in the model are jointly significant at the 1–percent confidence level. Although not shown in Column 2 of Table 4, the autocorrelation function for the residuals has a low Q–statistic associated with it. That indicates that the model successfully accounts for the systematic variations in real housing prices in El Paso.

Four of the eight independent variables, namely real personal income, wealth in El Paso, population, and the real exchange rate have coefficients whose signs are counterintuitive. Moreover only the savings, El Paso wealth, and construction cost variables have statistically significant coefficients. The wealth elasticity of new houses in El Paso is negative 0.0963 and this coefficient is significant at the 1–percent level. The unexpected negative sign for the coefficient attached to the El Paso wealth variable may suggest that, as the returns on stock investments increase, housing investments decline. That is consistent with the findings of Goetzman, (1993). The coefficient for the savings variable shows that a 1–percent change in annual wealth accumulation in Ciudad Juarez brings about a positive 0.156 percent change in the resale prices of existing single–family houses in El Paso. Not unexpectedly, the results from the different models exhibit sensitivity to specification changes. Still, the international variable, Ciudad, Juarez savings, is shown to exercise a statistically significant impact on El Paso house prices. Column 2 of Table 4 further indicates that a one percent change in construction costs generates a 0.356 percent change in single–family housing prices.

The second specification for median resale unit prices in El Paso includes a real mortgage rate, real personal income, wealth in El Paso and Ciudad Juarez, the real exchange rate, and the construction cost index as explanatory variables. This version is estimated in order to observe the changes in model parameters in the absence of two insignificant explanatory variables as well as a correction for autocorrelated residuals. When the population and employment rate variables are dropped from the model, the explanatory power of the model slightly decreases and an F–test rejects the hypothesis that these explanatory variables are jointly equal to zero. Results for this specification are shown in Column 3 of Table 4.

Following the exclusion of the population and employment rate variables, the general nature of the relationship between the dependent variable and independent variables stays the same. Real mortgage rate, real personal income, and construction cost parameters are insignificant. Moreover, the real personal income parameter estimate maintains its counterintuitive negative sign. The variable representing wealth in El Paso and the real exchange rate variable have significant coefficients at the 1–percent level, but also with algebraic signs that run counter to those hypothesized. The estimated coefficients for the two international variables, S and X, when both included in the model, again fail to satisfy the 5–percent significance criterion with respect to housing price movements in El Paso.

Columns 2 and 3 of Table 4 indicate that the mortgage rate, personal income, and population variables do not affect the prices of existing houses in El Paso in statistically reliable manners. These results are at odds with previous studies investigating the behavior of existing house prices (Jud and Winkler, 2002; Ullah and Zhou, 2003). Column 2 reports a coefficient for the construction cost variable is positive and significant. This result is consistent with Jud and Winkler (2002), but the coefficient in Column 2 is large relative to coefficient reported in that study.

Previous studies (Jud and Winkler, 2002; Green, 2002; Ullah and Zhou, 2003) report that current or lagged financial wealth have a positive and statistically significant, albeit modest, effect on the prices of existing houses. Contrary to those studies, a negative relationship between the financial wealth of El Paso residents and prices of existing houses is reported in Columns 2 and 3 of Table 4. Goetzman (1993) reports a negative correlation between equity market and housing investments and states that housing provides a hedge against fluctuations in the financial markets. The negative coefficient for the El Paso wealth variable may reflect such a relationship.

In order to explore which factors affect the prices of newly built houses in El Paso, three different model specifications are utilized. The first equation employs real mortgage rate, real personal income, real exchange rate, savings in Juarez, wealth in El Paso, local employment rate, population, and construction cost variables. Results for the first specification are shown in Column 4 of Table 4. The equation explains sixty percent of the variation in the prices of new houses and the F–statistic indicates that the variables included in the model are jointly significant. Low t–statistics and high standard errors associated with almost all of the independent variables suggest that multicollinearity is present. A correlogram of residuals and a low Q–statistic value indicate that the model successfully accounts for systematic movements in the residuals.

None of the parameters shown in Column 4, including that for construction costs, satisfy the 5–percent criterion. Beyond that, the real personal income, real exchange rate, El Paso wealth, population, and employment rate coefficients exhibit counterintuitive signs. While not significant at the 5–percent level, coefficients for the variables representing wealth in El Paso and Ciudad Juarez have the hypothesized arithmetic signs. Because of these results, two additional specifications are estimated with subsets of the variables utilized in Column 4.

An important difference between the equations estimated for the prices of new and resale units is that the coefficients for the real mortgage rate variable display opposite algebraic signs. Negative coefficients for the real mortgage rate variable appear in Columns 4, 5, and 6. Those outcomes indicate that, for new houses in El Paso, shifts in the housing demand curve in response to changes in the real mortgage rate are larger than those of the housing supply curve. In the equations for the prices of existing houses, that movement is in the opposite direction (Jud and Winkler, 2002). That is, changes in the real mortgage rate causes larger shifts in the housing supply curve than in the housing demand curve. However, it should be noted that, for both sets of equations, estimated coefficients for the real mortgage rate variable are insignificant and undermine the reliability of these interpretations.

A second specification for the price of new structures is estimated in order to see whether the effects of multicollinearity can be isolated when the insignificant El Paso population and Ciudad Juarez savings variables are excluded. Not surprisingly, it also includes an autoregressive term. Explanatory variables in Column 5 model account for seventy percent of the variation in the dependent variable. Coefficients for all of the independent variables in Column 5 are also statistically indistinguishable from zero. Furthermore, the real personal income and wealth in El Paso parameters have counter intuitive signs. It is seems clear that significant multicollinearity remains in this specification. Remaining independent variables yield the hypothesized arithmetic signs. The results for the third specification are shown in Column 6.

The third equation estimated for the median new price employs all the independent variables included in the previous specification except for the wealth in El Paso variable. This model specification is estimated in order to see whether the El Paso wealth variable affects the degree of multicollinearity observed in the prior specifications. With the exclusion of El Paso wealth, the explanatory power of the model is almost unchanged. The reported F–statistic indicates that variables included are jointly significant at the 1–percent confidence level. None of the explanatory variables included are statistically significant, but they yield the hypothesized algebraic signs except for the real personal income variable. From a border perspective, a ten percent loss in the real currency value of the peso results in a 0.7 percent decline in the inflation adjusted price of new single–family dwellings in El Paso.

To summarize, some of the housing price results in Table 4 corroborate subsets of the outcomes from earlier housing market studies, but many do not or are simply insignificant. In both equations for the median prices of existing structures, increases in real wealth in Ciudad Juarez are associated with higher residential real estate values in El Paso. Given all of the institutional impediments that affect cross–border economic interactions, the relationships shown in both equations are inelastic, as expected. Elasticity estimates for the real peso index are either counter intuitive or insignificant.

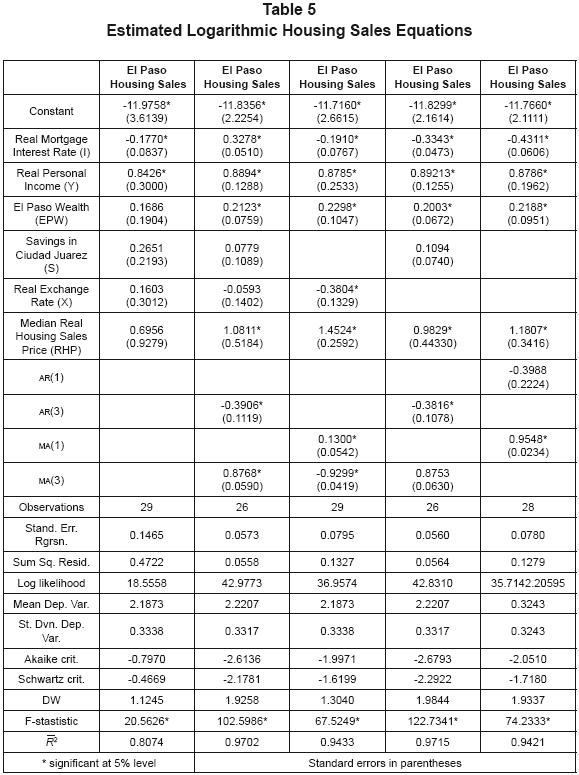

Five different model specifications are also employed to determine which variables, including the cross–border measures, exercise significant effects on housing sales in El Paso. The first specification includes the real mortgage rate, real personal income, the real exchange rate, real wealth estimates for El Paso, real savings in Ciudad Juarez, and the median sales price to explain changes in home sales. Parameter estimates and measures of model fit for the first specification are shown in Column 2 of Table 5.

As expected, the real mortgage rate has a negative impact on housing sales. The real mortgage rate elasticity of housing sales is estimated as negative 0.177 and this estimate is statistically significant at the 5–percent level. In addition, it is found that a one percent change in real personal income generates a 0.84 percent change in housing sales in the same direction. This coefficient is also significant at the 5–percent level. Results in Column 5 further suggest that changes in the real exchange rate, real wealth from the both sides of the border, and the real sales price do not exert statistically significant effects on the sales of existing houses in El Paso. However, the F–statistic suggests that variables included in the model are jointly significant, so multicollinearity may be present. That problem may account for the insignificance of the two international variables (S and X), as well as the unexpected sign on sales price (RHP). The Durbin–Watson test generates inconclusive results for the presence of first order serial correlation, but a residuals correlogram points to higher order autocorrelation.

The second specification for El Paso housing sales includes an AR(3) and an MA(3) serial correlation correction terms in addition to the explanatory variables included in the first specification. With the inclusion of the AR(3) and MA(3) terms, the coefficient of determination, adjusted for degrees of freedom, increases substantially, indicating that the explanatory power of the second specification is higher. The F–statistic and log–likelihood values corroborate this statement. Regression results for the second equation are shown in Column 3 of Table 5.

In the second model, the real mortgage rate elasticity of housing sales in El Paso changes from –0.177 to –0.3278 and the latter coefficient is significant at the 5–percent level. A one percent change in real personal income yields a 0.889 percent change in housing sales in the same direction. That parameter is also significant at the 5–percent level. The estimated parameter for real wealth in El Paso also satisfies the 5–percent significance criterion with the hypothesized arithmetic sign. Both of the international variables, real savings in Ciudad Juarez and the real exchange rate index, exhibit the expected signs, but are significant. The elasticities for both of the latter coefficients are inelastic, as should be the case for each.

The coefficient for the sales price in column 3 of Table 5 is also significant, but does not have the expected sign. The price elasticity of sales of existing houses is found to be positive 1.081. This implies that more units will sell when residential real estate prices appreciate in el Paso (He, 2002). A possible explanation is that investors seeking potential capital gains, plus favorable tax treatment of those gains, enter the real estate market when they observe higher housing prices (Ullah and Zhou, 2003). In addition, there may be a simultaneity issue with regard to the price variable (Reichert, 1990).

In the specification shown in Column 4, the variable (S) for annual changes in the aggregate wealth of Ciudad Juarez residents, is removed and MA(1) and an MA(3) terms are included. This specification is estimated in order to examine whether multicollinearity is reduced when the savings variable is excluded. The explanatory power of the model still exceeds 94.3 percent of the variation in the dependent variable. The F–statistic indicates that the remaining variables are jointly significant at the 1–percent confidence level. An autocorrelation function indicates that the equation does not fail to explain any systematic movement in the dependent variable.

The results in Column 4 are broadly similar to those of Column 3, but the coefficient for the real exchange rate variable becomes significant at the 5–percent confidence level and exhibits the hypothesized sign. This result lends support to the possibility that multicollinearity exists between real savings in Ciudad Juarez and the inflation adjusted exchange rate for Mexico. The real exchange rate elasticity of housing sales is estimated as –0.38, implying that housing sales in El Paso are fairly sensitive to currency market fluctuations. Column 4 indicates that the real exchange rate does play a role in determining the number of houses sold in El Paso in the manner suggested as possible by standard economic theory. The real price coefficient is still positive and significant at the 5–percent level. The estimated parameter for wealth in El Paso has the expected sign and satisfies the 5–percent significance criterion. The real mortgage rate and real personal income variables also exhibit the respective signs hypothesized and are statistically different from zero.

To further examine the question of multicollinearity, a fourth specification is developed in order to observe the changes in the model parameters when the real exchange rate variable (X) is excluded. As regressors, this specification includes real mortgage rate (I), real personal income in El Paso (Y), savings in Ciudad Juarez (S), wealth in El Paso (W), and real price of housing (rhp) variables to account for variations in sales of single–family homes in El Paso. Also, AR(3) and MA(3) terms are included to correct for serially correlated residuals. Again, the coefficient of determination, adjusted for degrees of freedom, exceeds 97.1 percent. The F–statistic indicates that explanatory variables are jointly significant at the 1–percent level. Results for the fourth housing sales equation are shown in Column 5 of Table 5.

The real mortgage rate and real personal income parameters have the expected signs and also satisfy the 5–percent significance criterion. The coefficient for the variable representing wealth fluctuations in El Paso is also significant at the 5–percent confidence level and has the hypothesized algebraic sign. The savings variable for Ciudad Juarez (S) again has a coefficient that does not quite reach the 5–percent confidence level, but its algebraic sign is positive as expected and its magnitude is inelastic as should be the case for real estate market that is truncated by an international boundary. Consistent with the results for the first three equations in Table 5, the coefficient for the real price variable is also positive and significantly different from zero.

The last equation developed to examine the behavior of housing sales in El Paso excludes both the savings and the real exchange rate variables and includes AR(1) and MA(1) autocorrelation correction terms. This specification is estimated in order to see what happens to model parameters when both international variables are removed. As shown in Column 6, the adjusted coefficient of determination associated with this model exceeds 0.942. Given the high F–statistic, independent variables included in the model are jointly significant. While the different specifications are not completely comparable due to the different forms of serial correlation correction, the overall fit of the model does not suffer too severely with exclusion of the international variables. Although there does appear to be significant multicollinearity between savings in Ciudad, Juarez and the real exchange rate, a model specification including only the real exchange rate provides, arguably, the best fit. This result provides at least partial, if not conclusive, evidence that economic fluctuations in Mexico impact sales of existing single–family houses in El Paso.

Consistent with the earlier specifications, the real mortgage rate and real personal income coefficients are significant at the 5–percent confidence level and they exhibit the hypothesized signs. Once again, the real price coefficient maintains its unexpected positive sign and, in line with other model specifications, this effect is significant. The magnitudes of the various parameters shown in Column 6 are comparable to those in the other specifications.

In general, model specifications developed to explain the sales of exis ting houses in El Paso suggest that personal income and housing price positively affect the sales and these effects are statistically significant. There is a negative relationship between housing sales and the real mortgage rate. The effect of the financial wealth on housing sales is positive and statistically significant. Those results, in a border housing market context, are consistent with the findings of He (2002). Inclusion of the cross–border Ciudad Juarez savings and real peso exchange rate variables appear warranted by the evidence shown in Table 5. Exclusion of these international variables would likely reduce the simulation reliability of such an equation for a border housing market.

Conclusion

The study at hand attempts to explain and quantify the effects of fluctuations in the wealth of El Paso and Ciudad Juarez residents on the prices and sales of houses in El Paso. To date, various studies have analyzed the relationships between financial wealth and housing markets for other regions. None of the earlier studies involve international components such as those included in this effort.

For El Paso, a data set that includes prices for new and existing houses, plus sales of existing single–family units, is employed to determine how wealth fluctuations affect the housing market. Real financial wealth of El Paso residents is measured by the S&P 500 metropolitan index. In order to measure the direct effects of changes in private wealth in Ciudad Juarez, Mexico on housing prices in El Paso, the annual changes of private savings in Mexico is utilized. In addition, a real peso–dollar exchange rate index is used to account for changes in the purchasing power of Mexican nationals in the border region.

To account for movements in real prices of new and resale units, a reduced form equation is developed. Parameter estimation is carried out using generalized least squares regression. Empirical results are mixed and frequently deviate from those reported in other studies. Limited evidence of a linkage between real savings in Ciudad Juarez and median resale unit housing prices in El Paso is uncovered. Equations are also estimated for sales of existing single–family structures. Results for these equations more closely match those reported for other markets. Similar to the price models, only limited evidence of cross–border links to the El Paso housing market is obtained.

Although the empirical results for El Paso differ from those reported in previous studies, they may be representative for other border economies with similar socio–economic characteristics. Additional research regarding wealth effects from both sides of the border for other areas as Laredo or McAllen may prove beneficial. Also, if better and more detailed measures of regional wealth become available in the future, border housing market wealth effects may eventually be quantified with better accuracy. Finally, the employment of alternative estimation strategies such as least absolute deviations might prove useful for border metropolitan economies characterized by relatively high degrees of volatility. The limited evidence reported in this study indicates that firm evidence of cross–border housing market linkages may be difficult to track down. Given the highly regulated nature of mortgage markets, that may be a logical outcome in other border residential real estate sectors, as well.

Bibliografía

Adkisson, R.V., and L. Zimmerman (2004), "Retail Trade on the US–Mexico Border during the NAFTA Implementation Era," Growth and Change, 35, 77–89. [ Links ]

Bonnie, J.B. (1998), "The Dynamic Impact of Macroeconomic Aggregates on Housing Prices and Stock of Houses: A National and Regional Analysis," Journal of Real Estate Finance and Economics 17, 179–197. [ Links ]

Carliner, G. (1973), "Income Elasticity of Housing Demand," Review of Economics and Statistics, 55, 528–532. [ Links ]

Chen, C. (2004), "House Price Taxonomy," Economy.com Regional Financial Review, 15, 20–27. [ Links ]

Copazza, D.R., P.H. Hendershott, C. Mack, and C.J. Mayer (1992), "Determinants of Real House Price Dynamics," NBER Working Paper, 9262. [ Links ]

Dagenais, M.C. (1992), "Measuring Personal Savings, Consumption, and Disposable Income in Canada," Canadian Journal of Economics, 25, 681–707. [ Links ]

Dua, P., S.M. Miller, and D.J. Smyth (1999), "Using Leading Indicators to Forecast U.S. Home Sales in a Bayesian Vector Autoregressive Framework," Journal of Real Estate Finance and Economics, 18, 191–205. [ Links ]

Follain, J.R., Jr. (1979), "A Study of the Demand for Housing by Low Versus High Income Households," Journal of Financial and Quantitative Analysis, 14, 769–782. [ Links ]

Fullerton, T.M., Jr. (1998), "Cross Border Business Cycle Impacts on Commercial Electricity Demand," Frontera Norte, 10, 53–66. [ Links ]

Fullerton, T.M., Jr. (2001), "Specification of a Borderplex Econometric Forecasting Model," International Regional Science Review, 24, 245–260. [ Links ]

––––––––––, A.L. Molina, Jr., and S. Ibarreche (2007), "Borderplex Economic Growth: Chicken, Egg, or Scrambled?" International Journal of Business & Economics Perspectives, 2, 124–143. [ Links ]

––––––––––, A.L. Molina, Jr. and M.J. Pisani (2009), "Peso Acceptance Patterns in El Paso," Pennsylvania Geographer (Special Issue on Borders & Boundaries), 47, 91–102. [ Links ]

–––––––––– and Tinajero, R. (2003), "Borderplex Economic Outlook: 2003–2005," Business Report SR03–2, El Paso, TX: University of Texas at El Paso Border Region Modeling Project. [ Links ]

Goetzmann, W.N. (1993), "The Single Family Home in the Investment Portfolio," Journal of Real Estate Finance and Economics, 6, 201–222. [ Links ]

Green, R.K. (2002), "Stock Prices and House Prices in California," Regional Science and Urban Economics, 21, 775–783. [ Links ]

Harris, J.C. (1989), "The Effects of Real Rates of Interest on Housing Prices," Journal of Real Estate Finance and Economics, 2, 47–60. [ Links ]

Haurin, D.R.; Gill, H.L. (1987), "Effects of Income Variability on the Demand for Owner–Occupied Housing," Journal of Urban Economics, 22, 136–150. [ Links ]

He, L.T. (2002), "The Effects of Real Stock Returns on Sales of New and Existing Homes," Journal of Housing Research, 13, 199–217. [ Links ]

Hendershott, P.H. (1991), "Are Real House Prices Likely to Decline By 47%?" Regional Science and Urban Economics, 21, 553–563. [ Links ]

Hendershott, P.H., Abraham, J.M. (1992), "Patterns and Determinants of Metropolitan House Prices, 1977–1991," NBER Working Paper, 4196. [ Links ]

–––––––––– and Abraham, J.M. (1996), "Bubbles in Metropolitan Housing Markets," Journal of Housing Research, 7, 191–207. [ Links ]

Holland, A.S. (1991), "The Baby Boom and The Housing Market," Regional Science and Urban Economics, 21, 565–571. [ Links ]

Jud, G.D. and Winkler, D.T. (2002), "The Dynamics of Metropolitan Housing Prices," Journal of Real Estate Research, 21, 29–45. [ Links ]

Kennedy, P.E. (1978), "Direct Wealth Effects in Macroeconomic Models: The Saving versus the Definitional Approach," Journal of Money, Credit and Banking, 10, 94–98. [ Links ]

Klein, M.W. and Rosengren, E. (1994), "The Real Exchange Rate and Foreign Direct Investment in the United States: Relative Wealth versus Relative Wage Effects," Journal of International Economics 36, 373–389. [ Links ]

Mankiw, N.G. and Weil, D.N. (1989), "The Baby Boom, The Baby Bust and The Housing Market," Regional Science and Urban Economics, 19, 235–258. [ Links ]

Mankiw, N.G. and Zeldes, S.P. (1991), "The Consumption of Stockholders and Nonstockholders," Journal of Financial Economics, 29, 97–112. [ Links ]

McGibany, J.M. and F. Nourzad (2004), "Do Lower Mortgage Rates Mean Higher Housing Prices?" Applied Economics, 36, 305–313. [ Links ]

Poterba, J.M. (2000), "Stock Market Wealth and Consumption," Journal of Economic Perspectives, 14, 99–118. [ Links ]

Reichert, A.K. (1990), "The Impact of Interest Rates, Income, and Employment upon Regional Housing Prices," Journal of Real Estate Finance and Economics, 3, 199–217. [ Links ]

Schwab, R.M. (1983), "Real and Nominal Interest Rates and Demand for Housing," Journal of Urban Economics, 13, 181–195. [ Links ]

Smith, L.B. and Rosen, K.T., Fallis, G. (1988), "Recent Developments in Economic Models of Housing Market," Journal of Economic Literature, 26, 29–64. [ Links ]

Ullah, A. and Zhou, Z. (2003), "Real Estate and Stock Returns a Multivariate varec Model," Property Management, 21, 8–23. [ Links ]

Woodward, S.E. (1991), "Economists' Prejudices: Why the Mankiw–Weil Story is not Credible," Regional Science and Urban Economics, 21, 531–537. [ Links ]

1 Acknowledgements: Financial support for this research was provided by El Paso Electric Company, Hunt Communities LLC, Hunt Building Corporation, Wells Fargo Bank of El Paso, JPMorgan Chase Bank, and the James Foundation Scholarship Fund. Helpful comments and suggestions were provided by Roberto Tinajero, Brian Kelley, Pat Eason, Angel Molina, and Dave Schauer. Econometric research assistance was provided by Karen Fierro and Emmanuel Villalobos.