1. Introduction

During the last two decades, debates on the effects of economic growth on the environment continue to be a clear source of concern, both to trade economists and to environmental economists, since it directly links differences in environmental regulation across countries with trade flows.1

On the one hand, it is clear that the economic growth that drives trade, either because countries have gradually gained more market access through ongoing negotiations on preferential and regional trade agreements, or because the global economic and financial conditions have sometimes been cyclically favourable, serious concerns have arisen regarding the effects of the gradual increase of trade on the environment. Taylor (2005) and Copeland and Taylor (2004) claim that in the absence of suitable property rights, or pollution taxes appropriately designed and applied, second-best policy choices must be implemented to partially offset direct and indirect effects of the economic expansion on the environment. These concerns have strengthened the well-known pollution haven hypothesis, where environmental standards and regulations play a key role in the reallocation of polluting industries with poor environmental regulation.

However, making trade responsible for the environmental damage, covers up the impact that economic growth and a lack of appropriate environmental standards and regulations have on the environment. Generally speaking, three key elements are under consideration: i) economic growth, ii) international trade as a result of the economic growth, and iii) poor environmental standards and/or property right regulations. Considering that environmental standards are not part of the toolbox of every policy maker, papers written on this topic are framed and constrained to an analysis of second best choice of analysis.2

This paper aims to explore this trade and environmental link by considering a perfectly competitive structure where the interaction between optimal trade and environmental policies for an open economy are a natural extension of the first and second-best approaches followed by Gallegos (2006), and Copeland (1994). Both authors obtain trade and pollution taxes set at their optimal level -as a bench-mark case-, and further explore some specific cases where policies, though optimally chosen as well, respond to constraints on the number of available instruments, resulting in second or even third best instruments. However, unlike Gallegos (2006) and Copeland (1994), I extend the analysis to include the terms of trade effect and multilateral reforms to improve the domestic economy’s welfare.3

Next, I consider both trade and environmental reforms, chosen together towards first best levels, to further explore the terms of trade effect and the sign of the multilateral externalities on the choice of optimal policies.

Generally speaking, most studies on trade reforms analyse welfare effects within three broad strategies: unilateral, second best, and multilateral reforms.4 In the first case, self-imposed trade restrictions are unilaterally reduced. In the second, policy makers use second-best policies to minimise the welfare effects caused by some other externalities or institutional self-imposed-restrictions on the availability of instruments by partially correcting trade distortions. The third case involves the multilateral negotiations that have played a central role in the World Trade Organization (WTO) for the past twenty years.

With this paper, I take up the main concern regarding the expansion of trade and its effect on the environment, and I further explore this theoretical relationship. In doing so, I follow an approach of a combined first and second best trade and environmental policies, assessing welfare effects in a domestic polluted open economy. Next, I consider a multilateral reform towards free trade, blended with the implementation of an environmental tax, aiming at improving the domestic economy’s welfare when it is implicitly trading with a similar foreign country, and therefore, both endogenously determining international prices. Unlike Turunen-Red and Woodland (2004), and Copeland and Taylor (2001), I model the mechanism by which pollution is generated through the industrial consumption of an intermediate pollutant input, in other words, as a by-product of the production process. Terms of trade effects are key to finding that moving from optimal trade and pollution taxes to free trade and non-zero pollution taxes, are the directions for multilateral welfare-improving reforms.

In so doing, I consider a model à la Heckscher-Ohlin where three productive sectors and four productive factors are considered. Three of these factors are primary factors of production, i.e., capital, labour and a third factor assumed as necessary for the production of the intermediate input, which is used for the production of two final goods. This is particularly realistic if one considers that international trade is mainly driven by intermediate inputs, which may generate production or consumption externalities depending on the productive processes and the intensity with which these inputs are used to produce final goods.

Unlike Turunen-Red and Woodland (2004), where environmental reforms are undertaken in the presence of international transfers, in this paper I focus on the way trade and environmental taxes are gradually adjusted towards their first-best levels instead of considering second-best arrangements per se, and the likely special case where the multilateral trade reforms of a subgroup of goods are implemented, with trade reforms being considered as a substitute of the international transfers.5

With this paper I contribute to the existing literature on the design of optimal trade and environmental policies in a domestic economy facing trade and pollution distortions: I examine sufficient welfare improving conditions, in order to propose some directions for gradual multilateral trade and environmental reforms within a theoretical framework consisting of an open economy trading on a non-numeraire good and an intermediate input.

This paper is organised as follows. Section 2 presents a general trade equilibrium model with no transboundary pollution. Section 3 obtains the first-best trade and environmental policies for the domestic economy. Here, it is assumed that prices are endogenously determined and that the domestic country is a net importer of the non-numeraire and intermediate input,6 while the foreign country is a net exporter of both products. These assumptions determine the type of trade instruments that policy makers can implement in each country. Sections 4 to 6 analyse the world welfare function and identify conditions under which trade and environmental reforms improve global welfare. Section 7 proposes directions for trade and environmental reforms finding sufficient welfare-improving conditions. Small equiproportional changes are considered in tariffs, export taxes and pollution taxes, towards a second-best vector. Finally, Section 8 presents some conclusions and suggests further areas for research.

2. The Model

Following Dixit and Norman (1980), Copeland (1994), and Hatta (1977), I develop a standard model of a perfectly competitive open economy facing endogenous world prices. Final goods are produced with labour, capital and the intermediate input. Naturally, both sectors are modelled using with different intensity the intermediate input, tradable in the international market, as the final goods are.

Pollution is generated as a by-product of the production process. The first final good is the numeraire, so its price will, as usual, be considered as p 1 = 1. The second final good will be the non-numeraire, its price p will be the relative price of the non-numeraire good in terms of the numeraire, and the third product, an intermediate input, will also have its price q as the relative price of the intermediate input in terms of the numeraire.

The economy is assumed to be endowed with three primary factors of production, offered in an inelastic, non-tradeable manner in international markets. The economy has three subsectors, each producing a single product. Sectors one and two produce the numeraire and non-numeraire, with two primary factors, and the intermediate input, which is produced by a third sector, using the complete set of primary production factors. The two final goods and the intermediate input are produced with a constant-returns to scale technology.

To keep things simple, I have assumed that although pollution harms consumers, it does not affect productivity in neighbouring firms. Similarly, the possibility of transboundary pollution is not considered, nor is any pollution created through consumption activities taken into account.7 The open economy has trade and pollution taxes: t for the non-numeraire and τ for the intermediate, as trade instruments, and ρ for pollution tax.8

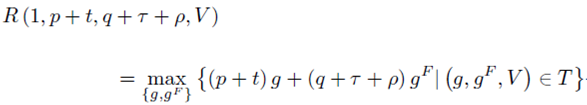

To characterise the production side of the domestic economy, I use the gross GDP or revenue function:

where p and q are the international prices for the non-numeraire and the intermediate input, while g and g F are the gross supply of the non-numeraire and the intermediate input (F stands for the intermediate input for the rest of the paper), V is the aggregate vector of net inputs, x the vector of total net outputs of goods while T stands for convex technology.9

Hotelling’s Lemma allows us to obtain: R p = g, being the gross supply of the non-numeraire product; R q = g F the gross supply of the intermediate input; R V 0w the vector of primary factor prices, and R F = q + ρ + τ the industrial consumer’s price of the intermediate input.

Since the revenue function is convex in prices, output supplies are upward-sloping, so: R pp ≥ 0 and R qq ≥ 0. On the other hand, the sign of the intermediate input cross price effect on the non-numeraire good intensively uses the intermediate input (R pq < 0), or not (R pq = 0).

Being concave in the factor market prices, the second derivatives of the revenue function are: R VV ≤ 0 and ∂R F /∂F = R FF ≤ 0, in other words, the inverse demands for all factors are downward-sloping.10 Conversely, the Rybczynski coefficients are: R pV = R Vp , and R pF = R F p > < 0, depending on whether the non-numeraire good uses the intermediate input intensively (R pF > 0), or not (R pF < 0).

The demand side is modelled using the dual of the indirect utility function. The expenditure function now includes the amount of the intermediate input used by the non-numeraire sector. This emerges from the following maximisation program:

where F is the amount of the intermediate input used in the production of final goods as mentioned above. The utility function is additively separable into goods and the intermediate input, which means that U (c, F) = ϕ (c) + φ (F).11 Since pollution adversely affects consumers’ utility, we have φ ’ (F) < 0. From the consumer’s perspective, the consumption of the numeraire and the non-numeraire goods is totally independent of the intermediate input’s industrial demand. Moreover, consumers do not choose to consume final goods on the basis of the amount of intermediate inputs needed. Besides, in the utility function, consumption of goods is a choice variable for the consumer, but pollution is generated through the industrial consumption of the intermediate input, which means that F is not controlled by the representative consumer. Therefore, equivalently, consumer preferences may be represented by the expenditure function E (1, p + t, U, F), which is concave in p, and increasing in U and F. An increase in the level of F is assumed to harm consumers, so that the minimum cost of attaining a given utility level increases with F.

The application of the envelope theorem (Shephard’s lemma) leads to the following: E p , the Hicksian demand function for the non-numeraire final good; E U , the reciprocal of the marginal utility of income; and E F , the marginal damage caused by the use of the intermediate input. Moreover, due to the concavity of the expenditure function on p, the second derivatives of the expenditure function are E pp ≤ 0, which is the slope of the compensated demand function. Likewise, E pU > 0 with the prices given is the increase in utility leading to an increase in the level of consumption. Further-more, E pF ≥ 0 so that the increase in the level of pollution affects the compensated demand for final goods: if compensation comes from the non-numeraire good, E pF > 0, if it comes from the numeraire good, E pF = 0 .

3. Equilibrium

Equilibrium can be characterised by the following set of equations:

where R

F

= q + ρ + τ is the price faced by the industrial consumers of the intermediate input in the home country,

In equilibrium, in order to achieve utility level U in the home country or U ∗ in the foreign country, the expenditure of the representative consumer must be equal to the total income represented by the net revenue from production plus the tax revenue, broken down into the trade tax revenue and the pollution emissions revenue. On the other hand, m = E p − R p , and m F = F − R q are the imports of the non-numeraire good and the intermediate input respectively, and likewise for the foreign country. In addition, it is assumed that the tax revenue is rebated to the representative consumer in a lump-sum fashion.

4. Optimal trade and environmental policies: first best

Defining the trade expenditure function as the difference between expenditure and the net revenue function for the domestic and foreign countries, where j = 1, 2 stands for domestic and foreign countries respectively:

The equilibrium of the model can be characterised by the following conditions:

where:

In accordance with Walras’ law, I will only consider the markets of the non-numeraire final good and intermediate input when totally differentiating Eq. (7) for the domestic country.

Then, we obtain:

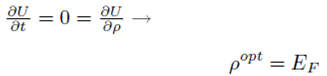

Since Equation (10) measures the domestic welfare change in terms of the trade instruments and the pollution tax, we obtain the first-best policies performing:12

and

In other words, the optimal trade and environmental policies are the reciprocal of the elasticity of the foreign country’s offer curve, and the Pigouvian tax.13

5. Trade and environmental reforms

After each country has optimally determined its trade and environmental policies, the next step is to identify the sign of the multilateral externalities affecting the domestic country. In order to do so, I substitute the optimal trade and environmental policies found in the home country in its own welfare equation.14

Therefore, it is only the change in domestic welfare that depends on the optimal trade and environmental policies of the foreign country,15 which are known as multilateral externalities, in other words,

A similar procedure is performed to obtain the foreign country’s welfare equation, which in this model depends solely on the same two instruments in the home country.

6. Welfare-improving conditions

6.1. Home country

Equation (14) measures the welfare of the home country in terms of changes in the instruments of the foreign country. As already mentioned, I assume that the home country is a net importer of both the non-numeraire and the intermediate input, intermediate input-intensive in the non-numeraire good’s sector, and that compensation to consumers comes from the numeraire good.16 In terms of optimization of welfare, these assumptions imply that both trade instruments are import tariffs for the home country.17

I also assume that in the foreign country the non-numeraire sector is intermediate input-intensive and that it is a net exporter of both the non-numeraire good and intermediate input, and that compensation to consumers is coming from the numeraire good.18 Assuming that welfare is optimized, these assumptions imply trade instruments that both are export taxes for the foreign country.19

Looking at Equation (7), we can observe that if the expenditure and revenue functions E(•) and R(•) are twice differentiable, S(•) = E(•) − R(•) must be negative semidefinite.20

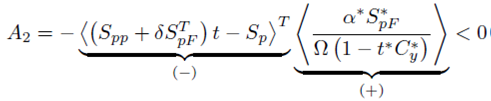

Thus, a necessary welfare-improving condition is that the matrix

and the coefficient A 2 is negative:

6.2. Foreign country

Except that because the foreign country is a net exporter of the non-numeraire and the intermediate input, the symmetry in the structure of the trade balance equation shows an almost identical welfare equation corresponding to the foreign country:

Equation (15) allows us to establish that the sources of change in foreign welfare depend on changes in the three instruments available to the home country, namely trade taxes and the pollution tax multiplied by the direct and indirect effects on consumption and production of the non-numeraire and intermediate inputs in both countries.

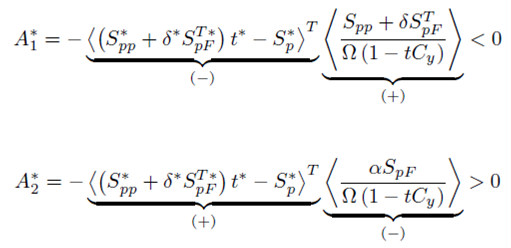

Thus, provided that the vector of exports

In the foreign country, welfare-improving conditions depend on the definiteness of the matrix of indirect effects on production and consumption δ

∗

S

pF

T∗

, which is negative semidefinite due to the assumptions previously made. Therefore, for the foreign country coefficients

7. Global welfare and multilateral reforms

If we add the welfare equations from both countries, we obtain an expression that shows directions for trade and environmental reforms that will not decrease global welfare. Thus, global welfare depends on the changes in trade and pollution taxes for both countries together.

Provided the negative semidefiniteness (necessary) conditions on δ * S pF T∗ and δS pF T hold, this expression shows that global welfare will improve if the import tariffs applied in the home country decrease and the export taxes applied in the foreign country increase.23 Regarding the directions of the environmental reform, an increase in the pollution tax levied by the home country and a decrease in the pollution tax levied by the foreign country, will further improve global welfare, according to the assumptions made.

From the point of view of the domestic country, an increase in foreign export taxes will improve the home country’s welfare via the terms of trade effect.24 When export taxes increase, the direct effect will gradually drive foreign prices up closer to their free trade level. As a result, the supply (demand) for both commodities will increase (decrease), exports will also increase, driving down international prices, and then improving domestic country’s terms of trade. The home country will not be worse off.25

With respect to the foreign country, a decrease in import tariffs will also improve the foreign country’s welfare through the terms of trade effect. The direct effect of a decrease in home country’s import tariffs is that the demand (supply) for both the non-numeraire good and intermediate input will increase (decrease). Since the domestic country is large, an increase in demand will drive up international prices, improving the foreign country’s terms of trade. The direct effect of tariff reduction on domestic production will be a decrease in the supply of both commodities. The indirect effect will be a decrease in the use of intermediate input as a result of the fall in the domestic supply of both commodities. Consequently, the foreign country’s welfare will improve and it will be better off.

The direct effect of decreasing the foreign pollution tax will be a reduction in the price that the industrial consumers pays for the intermediate input (R F∗ = q + ρ ∗ + τ ∗ ), to produce the non-numeraire final good.26 As a result, intermediate input will have a lower price (for foreign industrial consumers), foreign demand for intermediate input will increase and the supply of the non-numeraire good will increase. However, the international price for the non-numeraire will also decrease as a result of the increased export tax of the non-numeraire good in the foreign country. Eventually, that will contract industrial demand for intermediate input, reducing the production externality. Consequently, a lower pollution tax will be levied.

The price that the producer pays for the intermediate input (R F∗ = q + ρ ∗ + τ ∗ ) will increase as a result of the increase in the export tax τ ∗ , therefore increasing the foreign supply of the intermediate input, lowering its international price and, eventually, improving the home country’s welfare.

The resulting increase in domestic pollution tax will directly increase the price that the domestic producer pays for the intermediate input (R F = q + ρ + τ), and will subsequently increase the demand for the imported intermediate input. As a result, this increase in demand will improve the foreign country’s terms of trade effect.27 The foreign country will be better off.

In the end, the direct and indirect effects on the home country’s terms of trade as increasing foreign export taxes and decreasing the pollution tax, will improve the home country’s welfare. Similarly, for the foreign country, reductions in import tariffs plus a higher pollution tax will improve the foreign country’s terms of trade.

7.1. Tariff reform without pollution reform

I am now in a position to give a condition where a small equiproportionate reduction in protection of the home and foreign countries can improve welfare when pollution taxes are exogenous. In this case, the global welfare equation becomes:

I propose two sufficient conditions to improve global welfare with tariff reforms performed at the same time by both home and foreign countries.28

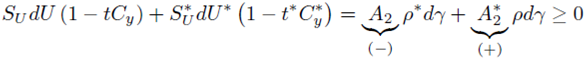

PROPOSITION 1 Assume stability in both countries, i.e., 1 − tC y > 0 and 1 − t ∗ C y∗ > 0. Assume that the only trade distortions are export taxes in the foreign country, and import tariffs in the home country. Assume that in the home and foreign countries the non-numeraire sector is intermediate input-intensive. Thus, a small equiproportionate reduction in trade taxes will reduce neither the domestic nor the foreign country’s welfare.

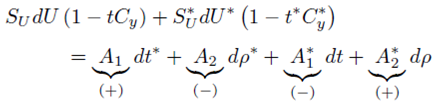

PROOF: Let dt/t = −dσ and, dt ∗ /t ∗ = −dκ with dσ, dκ > 0. Equation (17) can be written as:

Our instruments are t ∗ < 0 and t ∗ > 0. So, provided the matrices of indirect effects on production and consumption to the home country δS pF T and δ ∗ S pF T∗ to the foreign country are negative semidefinite, I have the result.

The intuition behind this result is that import taxes reallocate productive resources to the non-numeraire and intermediate protected sectors at the expense of the rest of the domestic economy. If the non-numeraire sector is intermediate input-intensive, the small reduction in tariffs will cause the sector to contract, indirectly reducing demand for the pollutant intermediate input, as well as pollution effects. This will lessen the trade distortion and will have a positive spillover effect on the environment, as well as improving welfare. On the other hand, a small increase in export taxes will expand the contracted sectors, which will diminish the trade distortion. However, the non-numeraire sector is intermediate input-intensive as well, and thus the expanded non-numeraire sector will demand more pollutant intermediate input, therefore increasing pollution in the foreign country. Although the global welfare effect derived from the spillover effects appears to be ambiguous, welfare improvements due to reductions in trade distortions will not reduce global welfare. With optimal (exogenous) pollution taxes applied in both economies, global welfare will unam-biguously be better.

If instead of intermediate input-intensive non-numeraire sectors, the protected sectors were not pollution intensive, a small reduction in trade taxes could encourage the numeraire sector to demand more pollutant input, so that with suboptimal pollution taxes, the spillover effects of lessening trade distortions would have an ambiguous effect on global welfare. To find a sufficient welfare-improvement rule, consider a uniform movement toward a second-best vector.

PROPOSITION 2 Assume stability in both countries, i.e., 1 − tC y > 0 and 1 − t ∗ C y∗ > 0. Let µ(t) = (S pp + δS pF T )−1 S p and µ ∗ (t ∗ ) = (S pp ∗ + δ ∗ S pF T∗ )−1 S p ∗ , be the second-best tariff vectors. Thus, a small equiproportionate movement of trade taxes toward the vector μ(t) and µ ∗ (t ∗ ) will not reduce welfare .

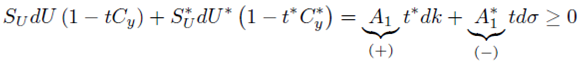

PROOF: Let dt = [t − µ (t)] dλ, and, dt = [t ∗ − µ ∗ (t ∗ )] dλ, where dλ > 0. Equation (17) can be reexpressed as:

Provided the matrices of indirect effects on production and consumption to the home country δS pF T and δ ∗ S pF T∗ to the foreign country are negative semidefinite, I have the result.

7.2. Environmental reform without tariff reform

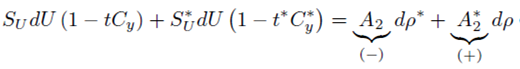

I now consider a global environmental reform with exogenous trade taxes. In this a case, the global welfare Eq. (16) becomes:

The simplest mean of proposing an environmental reform would be a proportional reduction in the foreign pollution tax and an increase in the home pollution tax.

PROPOSITION 3 Assume Walrasian stability in both countries, i.e., 1 − tC y > 0 and t ∗ C y∗ > 0. The only trade distortions are export taxes in the foreign country. Suppose that in the home and foreign countries the non-numeraire sector is intermediate input-intensive and protected by import and export tariffs, respectively. A small proportionate increase in the pollution tax of the home country combined with a small proportionate decrease in the pollution tax of the foreign country will therefore neither reduce the home nor the foreign country’s welfare.

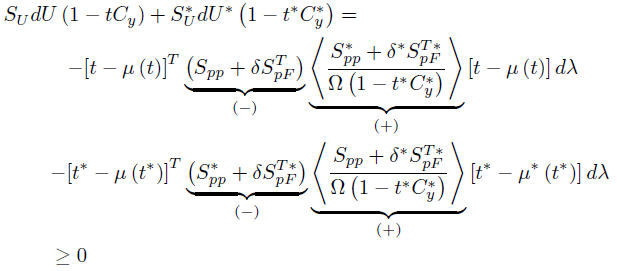

PROOF: Let dρ ∗ = −ρ ∗ dγ and dρ = ρdγ, where dγ > 0. Equation (18) may be reexpressed as follows:

Since the matrices of the indirect effects of the demand for intermediate input on the production of the non-numeraire in the home country δS pF T and the foreign country δ ∗ S pF T∗ are negative semidefinite, I have the result.

The intuition for this result is that in the presence of trade distortions (exogenous), a reduction in the pollution tax in the foreign country would make the intermediate input less expensive. Since it is an input for the production of the non-numeraire good, the amount of the non-numeraire good produced in the foreign country would increase as a result, and subsequently causing its international price to fall, improving the home country’s terms of trade by displacing intermediate input-intensive domestic production, leaving the home country better off.

On the other hand, an increase in pollution tax in the home country would make the intermediate input costlier for the domestic production of the non-numeraire good. That sector will contract, so the demand for the domestically produced intermediate input would decline, increasing the demand for the foreign intermediate input. As a result, the international price of intermediate input will rise, improving the foreign country’s terms of trade, and therefore and leaving the foreign country better off. Therefore, simultaneous changes in the policy instruments made by home and foreign countries would not reduce global welfare.

However, there are spillover effects on production. Whether these effects are positive or negative depends on the volume of production of each sector. If the non-numeraire sector in the home country is highly protected and the amount of production too high, an increase in pollution tax partially offsets the effects of the trade distortion on pollution. Likewise, if export taxes are too high in the foreign country, a reduction in pollution tax would partially correct the trade distortion. The contracted sector will not create too much pollution, therefore, the spillover effect of the environmental reform would be positive.

8. Conclusions

I have found that the optimal environmental and trade policies for both domestic and foreign countries are in the first best case, the Pigouvian tax, and the reciprocal of the elasticities of the foreign offer curves for the non-numeraire final good and intermediate input, i.e., ρ = E F , and the percentage import tariffs (for both countries) t opt /p = 1/ε ∗ and τ opt /q = 1/ε ∗ , provided the domestic (foreign) country is a net importer (exporter) of both goods, i.e., m > 0 (m ∗ < 0), m F > 0 (m F∗ < 0) . The imposed symmetry for the foreign country allows us to obtain export taxes rather than import tariffs, provided the foreign country is a net exporter of both commodities, using the same instruments.

When determining optimal policies, it is clear that externalities must be taken into account when proposing trade and environmental reforms in a global context. Those additional externalities are called multilateral because they are generated through international trade and affect the welfare of both the home and the foreign country through terms of trade. Therefore, from a real perspective, policy-makers must consider a number of circumstances before designing optimal policies. One of them involves the intensity with which final goods are produced. In this particular matter, whether second or first-best cases, the production externality must be offset by a pollution tax equal to the marginal damage in the first best cases, and must consider the indirect effects on production and consumption, in the second-best cases. Secondly, regarding pollution intensity, trade taxes produce spillover effects which may exacerbate production externalities. It is easy to prove that there are second best trade taxes that take into account production externalities when a suboptimal pollution tax is in place. In those cases, trade policies can turn into trade subsidies when commodities are pollution-intensive or can involve trade taxes when commodities, still being intensive on pollutant inputs, have a pollution tax close to marginal damage.

However, when the interaction between foreign and home countries endogenously determines international prices, first-best policies optimally tackle all potential externalities: trade and production externalities. When this is the case, if countries engage in welfare improvement reforms at the same time, each country’s welfare depends on the actions taken by the trading partner. Effects are transmitted via prices through the terms of trade effect. In practice, policy makers should take this into account when after trade openness, countries engage in multilateral trade and environmental reforms, if the countries in question have an influence on determining international prices.

nueva página del texto (beta)

nueva página del texto (beta)