Introduction

The economic and financial crisis of 1982 caused the Mexican economy to begin a long transition to a model of export growth with price stability, first by fixing the nominal exchange rate as an inflation anchor (1988-1994) and subsequently (from 2001 to the present) through an inflation-targeting monetary policy framework with the interest rate as a reaction function.

The Mexican government had several objectives in mind when adopting this new growth and development strategy: to resolve the macroeconomic imbalances accumulated during the industrialization period based on import substitution; to increase the share of non-oil exports; to position the manufacturing sector as the engine of economic activity; to strengthen value chains; and to increase the attraction of foreign savings (foreign direct investment). This process required a broad set of economic system reforms, epitomized by trade and financial liberalization.

In the specialized empirical literature, there is no consensus on the effect of trade and financial liberalization on economic performance, especially in semi-industrialized economies such as Mexico. Furthermore, a positive and statistically significant coefficient between openness and economic growth is interpreted, nominally, as evidence in favor of the fact that greater trade and foreign direct investment (FDI) flows promote the strengthening of domestic value chains, capital formation, and productivity gains. However, the specific channels or effects through which trade and financial liberalization act on the economy are not analyzed (Arif-Ur-Rahman & Inaba, 2021; Cruz et al., 2019; Landa, 2019; Moreno & Espinosa, 2018).

Therefore, it is pertinent to ask whether the export growth model has made it possible for a deepening of capital formation and a greater linkage of the sectoral production network. Thus, this article aims to evaluate, using a panel data model, the effect of FDI and exports on the dynamics of the capital stock and the intersectoral dispersion/dragging capacity of the Mexican economy during 1999-2020.

The objective of greater trade openness was to expand exports and facilitate access to foreign capital. In theory, with the presence of transnational companies and their relationship with the national productive apparatus, it is possible to generate a positive synergy to obtain profits resulting from increased productivity, boost capital accumulation, and consolidate intersectoral production linkages.

The original contribution of this paper lies in analyzing the impact, at the economic subsector level, of economic liberalization on capital stock and production linkage indices (backward and forward). This procedure makes it possible to establish the specific contribution of FDI and exports to the evolution of the economic structure in agriculture, mining, manufacturing, and services.

The paper is organized as follows. The first part succinctly presents the theoretical framework based on the endogenous growth model, the McKinnon-Shaw hypothesis of repression and financial liberalization, and the main theories of FDI; the second part comments on the relevant empirical literature on the relationship of foreign investment with some of the variables analyzed in the model. The third part contains the empirical analysis with panel data for Mexico from 1990-2019. The last part is the conclusion.

The effect of economic liberalization: Theoretical issues

The theoretical and empirical literature recognizes that two main channels through which economic openness impacts the economic structure are international trade (IT) and FDI flows. In general, on the one hand, it is considered that IT enables economies, especially those that are far from the global technological frontier: (i) to access new varieties of inputs and outputs (introduction of new technologies); (ii) to reallocate resources from less productive sectors to more dynamic ones; (iii) to expand market size; (iv) to boost learning-by-doing and the accumulation of physical and technological capital through knowledge diffusion; (v) to increase the use of installed capacity and economies of scale; and (iv) to deploy intersectoral technology spillovers (Grossman & Helpman, 1991 ch. 9; Aghion & Howitt, 2009, ch. 15).

On the other hand, it is assumed that the increase in FDI flows constitutes a catalyst for pecuniary and dynamic gains1 for the recipient companies or subsectors due to the effects linked to the operating characteristics of transnational corporations (TNC), such as i) access to global distribution and financing networks; ii) production and competitiveness profile based on product differentiation and economies of scale; and iii) organizational practices (Keller, 2021; Romo, 2004).

Given the above, it is important to delimit conceptually and theoretically the effects that IT and FDI have on the economic growth rate based on their impact on installed capacity, inter-sectoral linkages, and economic structure (specialization patterns).

International trade, capital accumulation, and production linkages

In the model of growth constrained by the balance of payments equilibrium (MCRBP), as in the endogenous growth theory, IT is a determining source of the long-term trajectory of the technological innovation rate and economic growth. The generic conjecture is that through the deepening of trade, economies expand their capacity to accumulate traditional productive factors that generate externalities, thereby boosting productivity and, additionally, structural changes in patterns of production and trade specialization.

The MCRBP argues that economic growth is determined by external demand, and exports are the driving factor of aggregate demand, capital investment, and employment (Thirlwall, 2003). According to Thirlwall, the output expansion rate is constrained by the balance of payments equilibrium. Given a systematic trade deficit and underutilization of installed production capacity, the observed growth rate of output (gY) will be equal to, or slightly higher than, the growth rate consistent with the balance of trade equilibrium (gB). Therefore, if relative prices remain constant, in the long run, the growth rate is given by:

Where ẇt and xṫ represent the growth rates of world income and exports, respectively, while ε and π are the income elasticities of exports and imports, respectively. From Equation (1), it follows that the increase in the long-run economic growth rate depends on structural adjustments aimed at increasing the income elasticity of exports and reducing the income elasticity of imports, whose variations are endogenous to the degree of economic capacity utilization/restriction and non-price competitiveness (Romero & McCombie, 2018; Perrotini & Vázquez, 2018).

On the other hand, the endogenous growth theory (Grossman & Helpman, 1991, ch. 9) gives international trade a fundamental role since it constitutes a channel of access to the world technological frontier and, therefore, a mechanism for the diffusion of knowledge, which generates productivity gains; imitation, learning by doing, and backward reengineering are the activities responsible for the process of technological spillover.

In general terms, the endogenous approach postulates that in the long run, the expansion of aggregate output (gY) is determined by the rate of innovation (gn); the fundamental question is, what factors condition the evolution of innovation? Following the diffusion and convergence model of Aghion and Howitt (2009, ch. 7), this study considers an economy outside the technological frontier whose productivity level (At) is given by:

Where At−1 constitutes the level of domestic productivity achieved in the previous period and μ the capacity to implement the technology of the world technological frontier (ˉAt), which evolves according to:

Where ˉAt-1 and gf represent, respectively, the level of productivity in the previous period and the growth rate of innovation (which in equilibrium expands steadily) within the world technological frontier.

By construction, in the long run, the rate of innovation (solution) would be given by:

According to this expression, in the long run the rate of innovation of a semi-industrialized economy is determined by the degree of imitation (η), productivity in the research and development sector (λ), the rate of frontier innovation (gf), and the proximity coefficient (at−1). Consequently, a country's output growth and investment rate will be higher if technological knowledge is easily diffused globally, i.e., dynamic gains will be greater the higher the degree of economic openness. This condition will be consistent with the extent that international trade reduces the duplication of technological effort, increases the efficiency of the R&D sector, and encourages the capacity of the exporting sectors to drag and disperse over the local production network (Aghion & Howitt, 2009, ch. 7; Grossman & Helpman, 1991, ch. 9).

It is important to note that in endogenous growth models the company constitutes the fundamental node of productivity expansion and output growth. The result of deliberate actions associated with allocating resources in R&D activities, imitation, and technological incorporation translates into a continuous process of technological innovation (Aghion & Howitt, 2009; Grossman & Helpman, 1991).

Some theories of foreign direct investment

The crisis and abandonment of the Bretton Woods international monetary and financial system (in force between 1944 and 1973) were followed by the establishment of flexible exchange rate regimes, trade and financial liberalization, and the deregulation of international capital movements (De Grauwe, 1996). These structural changes profoundly altered the dynamics of markets, global production, and the terms of the debate on economic development policy.

Mckinnon (1973) and Shaw (1973) emphasize the importance of financial liberalization as a strategy to attract foreign savings and channel them to investment. Both argue that financial repression policy hinders the attraction of domestic and foreign savings and that it is necessary to eliminate nominal interest rate controls and ensure a low inflation environment for attracting foreign investment to guarantee a competitive financial market and sustained output expansion2. The McKinnon-Shaw hypothesis argues that financial liberalization facilitates the attraction of FDI and portfolio investment and, therefore, the economy's liquidity (credit expansion), which favors the expectations of export sectors, capital formation, and supply chains.

FDI is the long-term acquisition of ownership and control of a company's assets abroad, while short-term investment confers ownership but not control of the assets involved. The control of a company is exercised over the production, distribution, managerial activities, and returns pertaining to a given activity or economic sector in another country (Moosa, 2002).

Several authors have analyzed the role of FDI in the economy. Based on comparative advantages, Vernon (1966) analyzed North American industries in Europe and developed the production cycle theory comprised of the following four stages: innovation, growth, development, and decline. FDI is explained through the advantages of new technology and innovation in some companies, making it possible for them to produce and export a surplus. This advantage is temporary and remains until local companies imitate and reproduce it. This encourages the multinational company to invest continuously in new technologies to recover those markets and capture others abroad.

Cushman (1985) argues that the exchange rate influences FDI: in non-competitive capital markets, uncertainty can influence FDI since exchange rate appreciation (devaluation) can encourage (discourage) investment. The empirical evidence in Cushman's analysis, for the case of the United States, indicates that appreciation of the real exchange rate encourages FDI and, vice versa, depreciation of the dollar discourages it by approximately twenty-five percent.

Hymer's (1976) theory of internalization--anticipated in 1937 by Ronald Coase--identifies two determinants of FDI: the elimination of competition and the advantages of some companies in certain activities. Later, following similar reasoning, Buckley and Casson (1976) found that, based on the actions and reorganization carried out by transnational companies internally, FDI is a determining aspect in developing competitive advantages. Hymer explains that the company will undertake FDI if the benefits of internal development outweigh the costs of operating abroad. Accordingly, investing in foreign markets results from an internal strategy decided by the company.

Based on the conceptual framework proposed by Hymer and the incorporation of previous theories, Dunning (1979, 1993, 2001) developed the OLI model (Ownership, Location, and Internalization). Three elements can explain the decision to invest abroad: first, based on the ownership of certain monopolistic competencies that the company possesses, it can compete abroad through patents, rights, and technology, among other forms that provide temporary advantages to local companies. Second, the localization advantages (Moosa, 2002) offered by countries that attract FDI refer to economic, political, and social factors. Third, the internal strategy of TNCs weighs costs and (maximization of) profits. In short, by relocating geographically, TNCs obtain advantages in terms of reduced transportation costs and factors of production. Thus, with the increase in sales resulting from internalization, the company has control of operations and obtains benefits from production and profit generation abroad.

FDI can be classified as vertical, horizontal, and conglomerate. Vertical FDI is oriented to the incorporation of raw materials and intermediate products from the host country, which is related to backward and forward linkages through the acquisition of points of sale for their distribution. Horizontal FDI is oriented to the exploitation of differentiated products, monopolistic or oligopolistic advantages and patents, and, finally, the conglomerate type incorporates both types of FDI. Dunning (1993) typifies company incentives to engage in FDI derived from the search for resources, markets, efficiency, and strategic assets.

Guimón and Narula (2010) state that the pattern of domestic investment and attraction of foreign investment depends on the development level of a country and is based on two assumptions. The first refers to the relationship between the economic structure and the type of activities to which FDI is directed, and the second refers to the relationship between local companies' ownership advantages and the locational advantages of multinational companies.

The literature has identified four motivations of multinational companies that determine their localization strategy: i) search for raw materials; ii) export platforms; iii) conquest of the domestic market; iv) exploitation of technological assets (ECLAC, 2006). These driving forces not only determine the type of externality but could also induce biases in the host economies' productive and commercial specialization patterns, especially if the objective is the exploitation of natural resources or the consolidation of export platforms.

Consequences of economic liberalization in economic performance: A review of the empirical literature

The results in the empirical literature suggest the persistence of mixed effects of economic openness on economic growth, especially those associated with FDI inflows. Studies on the impact of FDI on economic performance are multifaceted since they can exert positive and negative synergies on output growth, production linkages, gross capital formation, the innovation process, and employment.

In a company-level study, Arif-Ur-Rahman and Inaba (2021) studied the direct and indirect impact of FDI on total factor productivity (TFP) in Bangladesh and Vietnam between 2005 and 2015. Their estimates find horizontal (intra-industry) spillover effects on output and TFP in Bangladesh. Furthermore, they find the presence of vertical externalities (via backward linkages) on output and productivity only in Vietnam. Their regressions indicate that financial constraint is a key determinant of the economic activity of a company.

With data by state, during 2006-2016, Mühlen and Escobar (2020) analyze whether FDI has contributed to structural change in Mexico. They find that the greater presence of TNCs generates a positive effect on economic growth; however, they highlight three aspects of this result: first, the impact occurs with a significant time lag; second, the effect on structural change is more significant in the more developed states; third, the contribution is more important in the manufacturing sector. They also find that FDI does not cause significant changes in the reallocation of highly skilled labor.

In a paper for Brazil, Russia, India, China, and South Africa over the period 1993-2016, Raghutla (2020) studies the importance of openness for economic growth. He finds that trade deepening generates a positive effect on output dynamics. He finds that technology, financial development, and labor force drove GDP evolution. On the other hand, his estimates confirm unidirectional causality from economic growth to trade openness and the financial system; however, he finds no evidence of a causal relationship between output growth and the rate of innovation.

Cruz et al. (2019) evaluate the contribution of trade openness and FDI to economic growth and domestic investment in 18 Latin American (LA) countries from 1996-2014. In their estimates, they find a negative impact on GDP growth in the face of shocks to trade openness and FDI, especially in the more developed economies. On the other hand, they find a mixed effect on domestic investment in the face of a boost in FDI. For Latin American countries, the response is positive, while for highly developed economies, it negatively impacts the temporal dynamics of investment.

In another study for 17 LA countries from 1990-2012, Moreno and Espinosa (2018) studied the effect of FDI on the evolution of TFP. At the country level, their estimates indicate the persistence of mixed effects derived from the greater presence of TNCs. They observed a positive impact on economic performance only in Argentina, Ecuador, Mexico, and Uruguay, while the panel estimation suggests that FDI generates an expansion of productivity. They also find ambiguous effects associated with the import of intermediate inputs since, while in the regional estimation, the relationship is negative, in some case studies, the link is positive, as in Mexico.

Based on data from 9 industrial aggregations from 53 countries from 2003-2011, Amighini et al. (2017) evaluate the impact of FDI on gross capital formation. Their regressions indicate that the increased presence of TNCs, especially in manufacturing activities, generates a positive effect on total investment; they find that the impact is more robust in advanced economies than in developing countries. They also find that an increase in the participation of TNCs boosts the profitability of domestic investment and strengthens production linkages; however, if it is oriented toward export platforms, it produces reduced effects.

Using a panel model, Lu et al. (2017) analyzed the industry-level impact of FDI on the wage rate, export performance, company survival, and R&D in China from 1993-2008. In their estimations for the agglomeration/competition effect, they find a negative impact on local productivity, exports, and technological effort; likewise, their regressions confirm a positive relationship with the wage rate. The authors conclude that TNCs can generate static or dynamic gains for local companies at the industry level.

Newman et al. (2015) analyze whether FDI generates productivity gains through the intersectoral supply chain in 4,248 companies, aggregated in 23 manufacturing subsectors, during 2009-2012. Their results suggest the presence of indirect spillovers from transnational companies to the maquiladora industries of final products. On the other hand, their estimates find direct spillover effects derived from linkages with domestic input suppliers. At the same time, they observe a negative impact on productivity when transnational companies are input suppliers.

Fetahi-Vehapi et al. (2015) assess the impact of trade openness and FDI on economic growth in 10 southeast European countries from 1996-2012. Overall, increasing international trade, human capital, and fixed capital formation positively affect output development. In contrast, they find that FDI boosts GDP expansion, but the effect is small. Their results also reveal that economies with high fixed capital investment and a greater presence of TNCs benefit more from trade flows. They find that the gains associated with openness are conditional on initial per capita income.

In an industry-level study, Hejazi and Pauly (2003) assess the impact of FDI on gross capital formation (GFCF) in Canada from 1984-1995. In general, in their estimates they find that FDI inflows boost GFCF; however, they find mixed effects associated with the investment decisions of local companies abroad: positive when the destination is the United States and negative when it is directed to the rest of the world. They also find that R&D investment is the main factor impacting GFCF; in contrast, their regressions indicate that GFCF is negatively related to the depreciation rate, taxes, and wages.

Economic openness, productivity, competitiveness, and linkage capacity

Stylized facts

The foreign debt crisis of 1982 marked the end of the import substitution industrialization (ISI) model. Subsequently, the Mexican economy began a process of structural change based on a growth and development strategy driven by trade and financial liberalization.

The objectives of this new model have been price and exchange rate stability, increasing productivity and competitiveness, stimulating non-oil exports, increasing the savings/investment rate, strengthening the capacity to absorb external shocks, and accelerating sustained product growth.

The manufacturing sector and FDI are two drivers of the new growth model in place since the early 1990s, while the key elements of economic policy are fiscal discipline, the interest rate as the sole instrument for achieving price stability, a flexible exchange rate regime, the elimination or reduction of tariff barriers and quotas, the flexibilization of the labor market and the financial system, and the privatization of government assets.

Regarding the financial system, the financial regulation conferred greater management autonomy to commercial banks, expanded credit operations through the participation of non-bank financial entities, facilitated the automatic adjustment of bank interest rates, eliminated guarantee, savings, and capitalization requirements for financial intermediaries, made the law on development banking credit institutions more flexible, and liberalized the capital account. This implied substantive modifications to the regulatory framework for FDI and securities ownership.

The reforms above created the expectation of greater economic liquidity, growing innovation and financial inclusion, diversification of stock market hedging instruments, and an increase in installed production capacity (López & Basilio, 2016; Sánchez & Sánchez, 2000). At the level of the real sector of the economy, the desideratum was an exponential increase in exports and a greater presence of transnational companies that would foster gains derived from productivity and, consequently, a greater accumulation of capital and a significant increase in the production linkages of the national productive apparatus. However, although the Mexican economy has achieved price stability and fiscal consolidation, economic growth has been meager, and the economy has accumulated several decades of stagnation due to the deterioration of productivity and competitiveness (see Table 1).

Table 1 Productivity, capital formation, and trade

| Indicator | 1990-2000 | 2000-2010 | 2010-2020 |

|---|---|---|---|

| Gross Domestic Product /1 | 3.4 | 1.5 | 1.3 |

| Total Factor Productivity /1 | -0.3 | -1.1 | 0.2 |

| Gross Capital Formation /2 | 22.9 | 22.3 | 22.5 |

| Foreign Direct Investment /1 | 18.1 | 1.6 | 0.8 |

| Exports /1 | 8.7 | 3.5 | 3.8 |

| Imports /1 | 11.9 | 2.9 | 2.3 |

| Unit Labor Cost /1 | 0.1 | -2.3 | -4.7 |

| Real exchange rate /1 | -1.9 | 0.7 | 2.6 |

| Average compensation /1 | 0.8 | 1.2 | 0.8 |

(INEGI) and the Organization for Economic Cooperation and Development (OECD)

1/ Average annual growth rate; 2/ Indicator as a proportion of GDP

Source: created by the authors with data from the National Institute of Statistics, Geography, and Informatics

The sectoral impact of economic liberalization has been heterogeneous. There is still a significant loss of industrial dispersion/dragging capacity, a slowdown or contraction of productivity, and a marked bias in competitiveness, the combination of which has limited the creation of value-added and induced clear outward industrialization, especially in the manufacturing sector (see Table 2).

Table 2 Production capacity, productivity, competitiveness, 1990-2020

| Subsector | VA/1 | PTF/1 | PL/1 | FBK/1 | FDI/2 | CLU/1 | X/2 | M/2 | PO/1 | RM/1 |

|---|---|---|---|---|---|---|---|---|---|---|

| Primary and extractive activities | ||||||||||

| Agriculture | 1.8 | 0.9 | 1.2 | -3.3 | 0.3 | -1.1 | 3.2 | 2.6 | 0.6 | 0.8 |

| Mining | -0.4 | -2.4 | -1.6 | 1.1 | 5.3 | 0.4 | 9.0 | 0.6 | 1.1 | -0.6 |

| Manufacturing activities | ||||||||||

| Food | 2.4 | 0.1 | 1.5 | 0.2 | 10.3 | -1.9 | 3.8 | 4.2 | 1.3 | 0.2 |

| Textile | -1.7 | -1.0 | 0.0 | -4.9 | 0.9 | -1.1 | 2.8 | 3.5 | -1.6 | -0.5 |

| Wood and paper | 1.0 | -0.6 | 2.1 | -1.0 | 1.0 | -2.5 | 0.8 | 2.7 | -1.3 | 0.2 |

| Oil | -1.3 | -1.8 | 0.4 | 3.5 | 0.1 | 0.8 | 1.1 | 5.6 | -1.7 | 1.9 |

| Chemistry | 0.3 | -2.0 | 0.8 | 0.4 | 6.0 | -1.7 | 3.4 | 10.5 | -0.9 | -0.2 |

| Plastic | 1.9 | -1.2 | 0.0 | 2.2 | 2.2 | -0.7 | 1.8 | 4.2 | 1.8 | -0.1 |

| Non-metallic products | 1.1 | -0.8 | 0.5 | 1.2 | 1.2 | -3.3 | 1.0 | 0.8 | 0.2 | -2.1 |

| Base metals | 0.6 | -2.5 | -0.2 | 5.8 | 2.6 | -1.8 | 3.9 | 4.6 | 0.6 | -1.4 |

| Metal products | 1.3 | -1.0 | 0.5 | 5.6 | 1.0 | -0.2 | 2.9 | 4.9 | 0.6 | 1.0 |

| Machinery and equipment | 1.8 | -1.2 | 0.2 | 6.2 | 1.9 | -0.9 | 6.4 | 11.1 | 1.4 | -0.1 |

| Computing and communication | 2.4 | 0.1 | -1.9 | 1.1 | 3.9 | 1.7 | 20.2 | 19.3 | 4.2 | 0.4 |

| Electrical equipment | 1.7 | -1.0 | -0.4 | 3.4 | 2.1 | 0.1 | 7.4 | 6.9 | 1.7 | 0.4 |

| Transport equipment | 4.8 | -0.2 | 1.0 | 4.0 | 13.6 | -2.3 | 27.5 | 12.5 | 4.1 | -0.6 |

| Other manufacturing | 1.4 | -1.3 | 0.6 | 2.3 | 1.3 | 0.2 | 3.4 | 2.9 | 0.4 | 1.5 |

| Services Sector | ||||||||||

| Transportation | 1.9 | -1.4 | 0.6 | 2.5 | 4.1 | -0.8 | 0.4 | 0.6 | 1.4 | 1.3 |

| Mass media | 7.4 | 2.9 | 6.5 | 2.0 | 4.3 | -5.5 | 0.2 | 0.1 | 0.4 | 1.3 |

| Financial Services | 7.5 | 0.0 | 4.2 | 9.9 | 14.6 | -3.5 | 0.8 | 1.5 | 2.9 | -0.4 |

| Real estate activities | 3.0 | -0.9 | -0.6 | 0.6 | 2.9 | -0.4 | 0.0 | 0.1 | 3.2 | -0.4 |

| Professional Services | 2.5 | -4.5 | 0.4 | 3.1 | 1.2 | -1.4 | 0.1 | 0.8 | 2.0 | 1.7 |

1/ Average annual growth rate; 2/ percentage share in the total

VA: value added; TFP: total factor productivity; PL: labor productivity; FBK: gross capital formation; FDI: foreign direct investment (includes data from 1999 to 2020); CLU: unit labor cost; X: exports; M: imports; PO: personnel employed; RM: average remuneration.

Source: created by the authors with data from INEGI and the Ministry of Economy

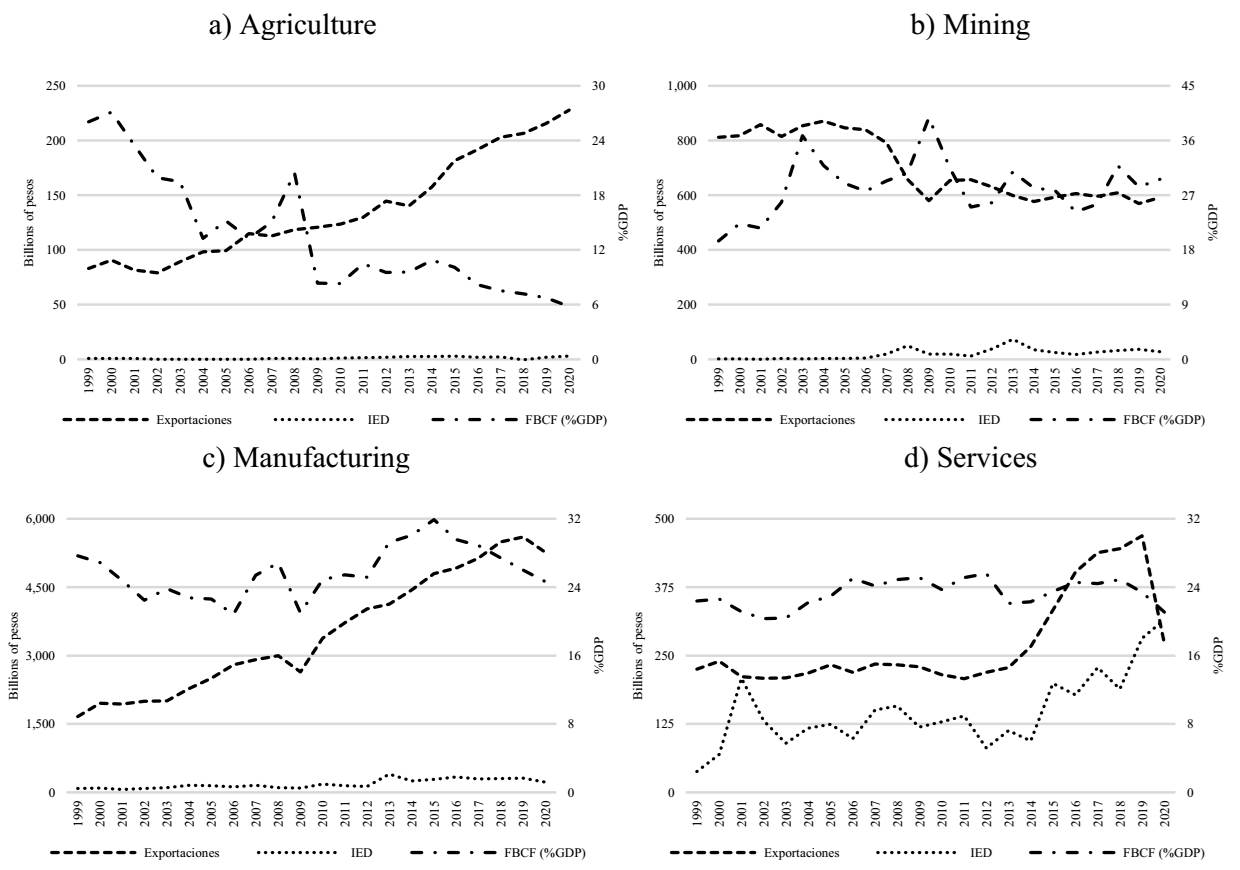

Economic liberalization has generated a significant increase in exports and FDI inflows (particularly in the services sector). However, the effect of economic liberalization on gross fixed capital formation (GFCF) and productive drag/dispersion capacity has been less significant. Over the last three decades, GFCF in Mexico has contracted by about 2 percentage points of GDP (gross fixed investment was 21.1% in 2019). An analogous pattern is observed at the level of economic sectors: in manufacturing, GFCF has not increased steadily, but rather it remained quasi-stagnant on average between 1999 and 2008, and between 2009 and 2015, it grew at a more or less accelerated pace, but since then it has plummeted and currently remains at a level below 1999, which has decreased installed capacity (see Figure 1).

Source: created by the authors with data from INEGI and the Economy Secretariat

Figure 1 Mexico: Fixed capital formation, trade flow, and FDI

Trade liberalization makes it possible for the Mexican economy to reconvert its export structure; manufacturing has been the main winner of trade liberalization; dynamic industries (transportation, electrical, computing, and chemical equipment and machinery) and mining-extractive activities comprise the backbone of export production, that is, 74.0% of total exports. However, the open economy model (OEM) also configured an import-export mechanism that has generated a significant dependence on foreign value added in export manufacturing (see Table 1 and Figure 1).

These vicissitudes constitute a relevant explanation for the bias in favor of static gains against the dynamic gains of international trade, the structural stagnation of productivity, the predominance of price competitiveness, and wage deflation instead of competitiveness through product differentiation. Against this trend, some subsectors, such as information technologies and financial services, exhibit a significant efficiency expansion consistent with their share in gross capital formation and FDI inflows.

As mentioned above, one axis of the OEM strategy was establishing the manufacturing sector as an engine of economic growth; in this sense, strengthening production chains is a fundamental condition. From this perspective, the challenges of economic liberalization consisted of achieving greater exposure to global competition and increasing the presence of transnational companies to strengthen the production linkages of the industrial network and promote the formation of clusters due to greater specialization and increased productivity. However, the results have been less than expected.

These calculations present evidence of marginal changes in the dispersion and absorptive capacity of the national productive sector, which is associated with economic openness, particularly in the economic subsectors with high trade intensity and greater FDI inflows. Low forward linkage power and a gradual loss of backward composition persist across the board in these subsectors. An exception is the automobile subsector, which during this new phase of development exhibits a strengthening of the degree of interdependence with the rest of the manufacturing sector.

In the case of traditional sectors, they continue to stagnate or regress structurally toward thresholds of low economic interdependence. As far as tertiary activities are concerned, the estimates of this study present specific gains in productive integration, particularly in the mass media information and financial services subsectors (see Table 3).

Table 3 Sectoral production linkage capacity

| Economic Activity | EHA 1995 | EHD 1995 | Sector Type | EHA 2006 | EHD 2006 | Sector Type | EHA 2018 | EHD 2018 | Sector Type |

|---|---|---|---|---|---|---|---|---|---|

| Primary, extractive, and energy activities | |||||||||

| Agriculture | 1.409 | 3.220 | Key | 1.245 | 2.030 | Key | 1.444 | 2.148 | Key |

| Mining | 1.338 | 5.845 | Key | 2.363 | 6.575 | Key | 1.514 | 3.042 | Key |

| Manufacturing activities | |||||||||

| Food | 8.485 | 2.872 | Key | 6.458 | 2.472 | Key | 6.570 | 2.833 | Key |

| Textile | 2.192 | 1.351 | Key | 1.315 | 0.549 | IMP | 0.797 | 0.382 | IND |

| Wood and paper | 0.654 | 0.635 | IND | 0.450 | 0.358 | IND | 0.443 | 0.349 | IND |

| Oil | 1.237 | 0.698 | IMP | 1.759 | 1.088 | Key | 1.274 | 0.735 | IMP |

| Chemistry | 2.932 | 1.684 | Key | 2.545 | 1.600 | Key | 1.795 | 0.857 | IMP |

| Plastic | 0.680 | 0.404 | 0.541 | 0.272 | IND | 0.609 | 0.295 | IND | |

| Non-metallic products | 0.703 | 0.499 | IND | 0.580 | 0.338 | IND | 0.311 | 0.282 | IND |

| Base metals | 0.445 | 1.600 | Base | 0.722 | 1.570 | IMP | 1.089 | 0.894 | IMP |

| Metal products | 0.899 | 0.382 | IND | 0.767 | 0.363 | IND | 0.743 | 0.369 | IND |

| Computing and electronics | 3.921 | 1.896 | Key | 4.341 | 1.372 | Key | 3.238 | 0.850 | IMP |

| Electrical equipment | 1.454 | 0.353 | IMP | 1.373 | 0.347 | IMP | 1.145 | 0.296 | IMP |

| Machinery and equipment | 1.099 | 0.378 | IMP | 0.907 | 0.319 | IND | 1.049 | 0.384 | IMP |

| Transport equipment | 5.473 | 1.056 | Key | 5.128 | 1.169 | Key | 8.166 | 2.096 | Key |

| Other manufacturing | 1.271 | 0.527 | IMP | 0.936 | 0.379 | IND | 0.876 | 0.321 | IND |

| Tertiary activities | |||||||||

| Transportation | 3.717 | 3.471 | Key | 3.988 | 3.883 | Key | 3.932 | 4.214 | Key |

| Information in mass media | 1.285 | 0.883 | IMP | 1.612 | 1.241 | Key | 1.033 | 0.910 | IMP |

| Financial Services | 2.029 | 2.530 | Key | 1.951 | 2.183 | Key | 2.337 | 3.122 | Key |

| Real estate activities | 5.445 | 14.392 | Key | 4.510 | 11.397 | Key | 3.463 | 8.845 | Key |

| Professional Services | 0.275 | 1.587 | Base | 0.361 | 3.099 | Base | 0.256 | 2.271 | IND |

EHA: Backward linkages; EHD: Forward linkages. The indicators were developed based on the Laumas algorithm.

Source: created by the authors with data from OECD Database Structural Analysis

The profound heterogeneity of the productive apparatus dominated by the persistent contraction of productivity, the slow expansion of capital investment, and price-competitiveness as the basis for trade specialization are some of the main factors that have conditioned the capacity of the industrial network to absorb the dynamic effects associated with economic liberalization, particularly the impact on the formation of internal value chains.

Methodological aspects

This study specifies the following model with panel data to understand the impact of FDI on capital formation and production linkage capacity:

Where τit constitutes the explanatory variable of each specification (capital stock and production linkage) and Hit is a vector of kx1 explanatory variables (labor and total factor productivity; exports, unit labor cost, value-added, or physical capital stock). The vectors αit and εit represent nparameter intercept vectors and random disturbances, respectively, and by definition εit is composed of a group-specific component (vi) and a purely random one (uit). The subscripts i and t indicate the crosssectional unit (industry aggregation) and time, respectively.

It is important to note that in the literature (Baltagi, 2015; Beck, 2001), panel-type specifications are interpreted through their error components (one-way or two-way), which are broken down as:

In this equation vi captures the unobservable heterogeneity that varies only among the study units, δt changes only over time, and uit is the purely random error term. By empirically assuming that δt = 0, then Equation (5) is limited to the following formulations: i) pooled data, ii) fixed effects, and iii) random effects.

In a fixed effects specification, the slope coefficients are constant, and the independent term varies between cross-sectional units but not over time. That is, the unobservable heterogeneity is incorporated into the model constant, obtaining the following formulation:

Where τit constitutes the reaction variable of each specification (labor demand, capital stock, and production linkage) and Hit represents a vector of kx1 explanatory variables of industry i in period t. In this formulation, the error term is constituted by the specific individual effect for each cross-sectional unit (vi) and the purely random error term (uit).

As for the random effects model, the coefficients of the slopes are constant, and the unobserved heterogeneity is a random variable, that is:

In this specification vit represents a random variable, and uit the error component, which is identically and independently distributed with zero mean and constant variance.

This study uses the Hausman contrast, autocorrelation tests, heteroscedasticity, and contemporaneous correlation to determine the estimates' econometric robustness and establish the best panel specification. By the above, if the parameters by Ordinary Least Squares (OLS) are not efficient and consistent, Equation (5) is estimated using the Panel Corrected Standard Error (PCSE) method.

From this analysis, it is expected that variations in FDI and exports generate a positive and statistically significant impact on the capital stock and linkage indices. This supports the conjecture that the process of economic openness is a sustained source of dynamic productivity gains and, therefore, a promoter of economic growth, as supported by the new theories of international trade and endogenous growth. Similarly, it is assumed that the increase in industrial efficiency is directly related to the dispersion and dragging capacity of the production network. This condition supports the idea of the role of the formation of technological capabilities in the internalization of the spillover effects associated with the greater presence of transnational companies and exposure to global competition.

Analysis and interpretation of results

The data comprise annual series from 1990 to 2019 for 21 sectoral aggregates, for Mexico, concerning compensation of employees, consumer prices, value-added, employed personnel, hours worked, foreign direct investment, exports, gross capital formation, and total factor productivity. The information was taken from the National Institute of Statistics and Geography (INEGI) statistical repositories and the OECD.

First, it was necessary to perform the best panel specification using the Hausman test; second, to evaluate whether the estimated parameters are consistent and efficient using the Wald, Pesaran, and Wooldridge statistics. The resulting regressions exhibited problems of heteroscedasticity and contemporaneous or serial correlation; finally, derived from the above, the study applied the Panel Corrected Standard Error method to ensure orthogonal estimators (see Annex A).

In the estimates, the study finds a positive impact of economic openness through investment and exports on capital formation, which is consistent with the fundamentals of endogenous growth theory; however, the size of this effect is small (see Table 4). One possible explanation for this result is the nature of FDI inflows oriented to the consolidation of export platforms and the acquisition of pre-existing assets, which reduces the appearance of dynamic gains linked to the greater presence of transnational companies; and, second, although specialization has produced an increase in exports in international markets, the export growth model has configured an import-export mechanism that ultimately constitutes a pattern of outward industrialization. This has led to industrial production being based in the intermediate stages of global value chains, which limits the capacity for dispersion and dragging of the production network.

Table 4 Production linkages, capital formation, and FDI

| Variable | Model 1 K |

Model 2 k |

Model 3 k |

Model 4 eha |

Model 5 eha |

Model 6 eha |

Model 7 ehd |

Model 8 Ehd |

Model 9 ehd |

|---|---|---|---|---|---|---|---|---|---|

| Constant | 3.9035 [0.000]* | 7.4175 [0.000]* | 3.6966 [0.000]* | -5.8851 [0.000]* | -2.2934 [0.043]* | -4.5097 [0.000]* | -1.9102 [0.179] | 3.2407 [0.004]* | 1.3197 [0.321] |

| FDI | 0.0146 [0.000]* | -0.0112 [0.162] | 0.0106 [0.000]* | 0.2150 [0.000]* | 0.2398 [0.000]* | 0.1855 [0.000]* | 0.0355 [0.426] | 0.0461 [0.308] | 0.0190 [0.664] |

| X | 0.0091 [0.000]* | 0.0066 [0.344] | 0.0087 [0.000]* | 0.0403 [0.001]* | 0.0081 [0.648] | 0.0348 [0.005]* | -0.0448 [0.049]* | -0.0526 [0.022]* | -0.0269 [0.131] |

| K | -0.1426 | -0.1426 | -0.1426 | 0.3657 [0.000]* | -0.1426 | 0.3658 [0.000]* | 0.3459 [0.000]* | -0.1426 | 0.3023 [0.000]* |

| Pl | -0.1137 [0.000]* | -0.1426 | -0.1426 | 0.1856 [0.057]** | -0.1426 | -0.1426 | 0.4092 [0.008]* | -0.1426 | -0.1426 |

| Ptf | -0.1426 | -1.1447 [0.000]* | -0.1426 | -0.1426 | 0.3922 [0.001]* | -0.1426 | -0.1426 | 0.2193 [0.057]** | -0.1426 |

| Clu | -0.1426 | -0.1426 | 0.0248 [0.000]* | -0.1426 | -0.1426 | 0.0542 [0.430] | -0.1426 | -0.1426 | -0.1426 [0.038]* |

| Va | 0.2373 [0.000]* | 0.5378 [0.000]* | 0.1499 [0.000]* | -0.1426 | -0.1426 | -0.1426 | -0.1426 | -0.1426 | -0.1426 |

Estimates are based on the Panel Corrected Standard Error (PCSE) and Generalized Least Squares (GLS) method for panel. The sample includes data from 21 industrial aggregations (subsectors) from 1999-2018. Variables are expressed in a natural logarithm. Backward linkage index (eha); forward linkage index (ehd); foreign direct investment (FDI); export flow (x); net capital stock (k); labor productivity (pl); total factor productivity (ptf); unit labor cost (clu); value added (va). P-value in brackets, significance at *5%, **10%.

Source: created by the authors with data from INEGI and OECD

Regarding the implications of economic liberalization on the formation and consolidation of local production chains, the estimates suggest a mixed impact. On the one hand, the results indicate that FDI seems to stimulate the capacity for sectoral dispersion, which implies a greater presence of transnational companies that have made it possible for the Mexican economy to project the sectoral interdependence (multiplier effect) associated with the increase in net final demand. On the other hand, this effect on the backward linkage index seems insufficient to ensure an effective deepening of the composition of the production network and, consequently, the sustained expansion of value added. This can be explained by the degree of concentration of investment flows in a small group of subsectors that, due to their production characteristics and input requirements (technological differentiation/sophistication), are incompatible with the profile of traditional industries. Moreover, the study finds no evidence of a statistically significant relationship between FDI and the forward linkage index in its regressions. One explanation is the high content of foreign value added in export production, which is associated with the assembly/maquila model and the fundamentals of industrial competitiveness.

Contrary to the expected sign, the regressions suggest a negative relationship between productivity/competitiveness variations and capital stock. One explanation for this lies in the comovement between low rates of capital formation and the systematic contraction of productivity. Also, in the characteristics of the competitiveness of the productive national system, i.e., the persistent regression of efficiency gains has led to a significant slowdown in capital investment and, therefore, in output growth.

Along the same line of reasoning, the estimates suggest that the rapid export expansion linked to the operation of the OEM has induced mixed effects on productive dispersion and absorptive capacity (see Table 4). While the growth of export sectors boosts backward linkage dynamics, the results of this study also suggest a negative impact on the forward linkage index.

According to economic theory, productivity and fixed capital investment positively affect backward and forward linkage indices. This illustrates the importance of developing local technological capabilities (absorption, innovation, and infrastructure) as a mechanism to synchronize inter-sectoral relations and guarantee efficient insertion in international markets. However, the results of the empirical analysis are inconsistent with the precepts and forecasts of economic liberalization policy.

The export growth model has generated some positive effects, among which this study highlights the expansion of non-manufacturing exports and the increase in FDI inflows. However, the impact of this dynamic on the deepening of installed capacity and production linkages is not significant. Given the above, it is necessary to implement an industrial strategy aimed at consolidating the participation of the export sector in world markets in a way that is compatible with the promotion of domestic value added in domestic global value chains.

In the medium and long term, it is advisable to implement policies that strengthen inter-sectoral linkages and encourage the expansion of productivity and non-price competitiveness (technological innovation). The aim should be to effectively use the dynamic advantages associated with economic liberalization to boost installed capacity and the output growth rate. One condition of this strategy is to consider the kinetic symbiosis between the public and private sectors in developing technological capabilities that reformulate the financing and nature of research and development (R&D) activities and strengthen supply chains between traditional and dynamic sectors.

Conclusions

This study analyzed the impact of economic liberalization on the structural conditions of Mexico's productive network, with special emphasis on the effect of FDI inflows and exports on capital formation and the capacity for multisectoral drag/dispersion. To this end, it discusses the dynamic relationship between international trade and economic growth and analyzes the dynamic effects of FDI.

The analysis of backward and forward linkages indicates that the so-called dynamic subsectors have a low capacity for intersectoral linkages. These subsectors' productivity and competitiveness bias has prevented them from accelerating economic growth and has induced outward industrialization by configuring export platforms.

The econometric estimates of this study reveal a marginal effect of FDI and exports on capital formation and a mixed impact on production linkage capacity. It cannot be unequivocally established that trade openness and financial liberalization have strengthened inter-sectoral interdependence, given that the results, while confirming a boost in the backward linkage index, in terms of dispersion, do not make it possible to establish a statistically significant relationship. Likewise, it finds evidence confirming the strategic role of productivity and competitiveness in forming sectoral linkages.

Some factors that could explain the limited impact of the strengthening of international trade and the greater flow of foreign capital, and the bias in the pattern of economic specialization, lie in the nature of the corporate strategy of TNCs and the capacity for local technological disincorporation, linked to the local development of technological and social capabilities (Fagerberg & Srholec, 2008). These conditions have led to the consolidation of the production network in the lower-intermediate stages of the value chains (assembly/maquila) and, consequently, the high participation of foreign value added in the export sectors' production, thus creating a pattern of outward industrialization.

Therefore, it is essential to design a structural transformation policy aimed at reducing these sectoral productivity biases and projecting production capacity (eliminating supply restrictions) toward technological innovation and the creation of economies of scale. This would increase the share of the national value added in exports, global value chains, and inter-sectoral linkages. This process requires, among other aspects, the reconversion of private and public sources of financing for R&D activities, the strengthening of technological cooperation between universities and companies to promote applied and experimental research, a labor policy oriented toward a more equitable income distribution (wageproductivity link), stimulating strategic agreements between transnational and national companies aimed at strengthening the accumulation of factors generating externalities and key clusters, creating a selective framework of stimuli and tax subsidies for R&D, and increasing credit for financing domestic business innovation projects. These topics represent possible future lines of research.

nueva página del texto (beta)

nueva página del texto (beta)