Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Contaduría y administración

versão impressa ISSN 0186-1042

Contad. Adm vol.67 no.3 Ciudad de México Jul./Set. 2022 Epub 06-Jun-2023

https://doi.org/10.22201/fca.24488410e.2022.2938

Articles

Franchise valuation framework: a real options approach

1Universidad de Medellín, Colombia

2Corporación Universitaria Americana, Colombia

The franchise has been used as an expansion strategy, based on Know-how and the brand, which allows both the entrepreneur and the franchisor to obtain an economic benefit from said intangible assets. This work proposes a structure for the valuation of franchises using real options for three Colombian companies from different economic sectors, based on historical information from their Financial Statements, as well as market information to determine the cost of capital in order to discount cash flows. Future cash, the real option as a complement to the traditional valuation models allows, through binomial trees, to incorporate the uncertainty in the cash flows in order to estimate under simulations the royalty rate and the Initial franchise fee according to the conditions and performance of the sector.

JEL Code: D23; L14; L22; L81

Keywords: real options; franchising; Montecarlo simulation; valuation; intangible asset

La franquicia se ha empleado como una estrategia de expansión basada en el Know-how y la marca, permite tanto al empresario como al franquiciante obtener un beneficio económico a partir de estos activos intangibles. Este trabajo propone una estructura para la valoración de franquicias empleando opciones reales para tres empresas colombianas de diferentes sectores económicos, partiendo de información histórica de sus estados financieros, así como información de mercado para determinar el costo de capital con el fin de descontar los flujos de caja futuros. La opción real como complemento a los modelos de valoración tradicional permite mediante árboles binomiales incorporar la incertidumbre en los flujos de caja con el fin de estimar, bajo simulaciones, la tasa de regalía y el canon inicial de la franquicia acorde con las condiciones y el desempeño del sector.

Código JEL: D23; L14; L22; L81

Palabras clave: opciones reales; franquicia; simulación Montecarlo; valoración; activo intangible

Introduction

The world economy has undergone major changes since globalization. One such change is that markets are increasingly competitive. This explains why companies focus mainly on optimizing processes and their cost structure, assuming standardization as a competitive advantage in the search for value generation. At the same time, businesspeople must make investment decisions related to the growth and expansion of their business, while entrepreneurs seek to initiate productive activities that enable them to generate income and obtain their economic independence in complex markets.

At this point, entrepreneurs must choose whether to leverage their expansion strategy with external financing or take advantage of the competitive advantages they have developed in their company, such as know-how (knowledge of the operation of the business plus the standardization of processes) and the positioning of the brand; in other words, decide between marketing franchises or growing through their own units. This is similar to the situation faced by future entrepreneurs when the alternatives are to start with a new business model adapting its strategy to a trial-and-error system, or adopt a standardized model positioned in the market and developed over several years by the entrepreneur, paying him for using his brand and marketing his products or services.

The franchise contract materializes when a company decides to expand leveraged by its knowhow and brand, and the future entrepreneur decides to pay for them. Casson (2015) indicates that franchising is the desirable collaborative entry mode in which knowledge is a key element of the business model (Madanoglu, Alon, & Shoham, 2017).

The above decision brings certain risks, including possible negative effects on the brand and the possibility that the franchisee's expectations of recovering its investment are not met. That is why the parties need to know what would be the reasonable economic value on which to negotiate the contract and why it is necessary to identify a model for the economic valuation of the franchise contract, taking into account its particularities and its recognition as an intangible asset (Quirama & Sepúlveda, 2018).

Franchising is a business format based on a commercial agreement between two parties, in which one of the parties is the franchisor, who has the brand and specialized operating knowledge (knowhow) and who authorizes the other party (the franchisee) to use them according to certain guidelines while, as indicated by Liang et al., (2013), paying an initial economic value (initial fee) and royalties on profits.

Based on the relationship of trust between the parties, the franchisor works to obtain business experience (know-how) with the premise of excellent brand management to strengthen the brand and maximize its recognition in the market. The franchisor also assumes the reputational risk every time their prestige can be extended to others through the brand, so, in return, the franchisor expects to improve cash flows thanks to the income paid by franchisees (initial fee and royalties). The franchisor delivers, in addition, a package of services that, according to Wu (2015), may include training, specialized support in operation and administration, supply of products in certain cases, and even accounting and financial support. In this way, the franchisee benefits since they replicate an already proven business model and, at the same time, the franchisor can expand their business and take advantage of the opportunities of a new geographic market, making use of the economic benefit that their brand provides (Gillis, Combs, & Yin, 2018).

The franchisee's purpose is that commercial success can be guaranteed since they are assuming the risk of losing the investment. This risk arises due to the asymmetry of information between the parties. The franchisee finds it difficult to obtain information about the brand's quality, profitability, and viability of a possible business (Casson, 2015). Despite the above, the franchisee leverages their strategy on the franchisor's knowledge and brand, making it possible to focus on the business's productivity. This strategy is therefore based on a win-win relationship in which the franchisee quickly obtains a mature operating model that offers a well-known brand. In addition, it reduces marketing and development costs, thus mitigating operational risk (Liang et al., 2013). Meanwhile, for the franchisor, this model is a source of financing and a strategy for rapid growth (Jang & Park, 2019).

Given the above, there is the question of what valuation methods make possible a more reasonable estimation of the monetary value of franchises under conditions of uncertainty. This work aims to determine a valuation structure of the Know-how for franchising under conditions of uncertainty, taking into account the flexibility of future decisions in the development of the contract through the application of the real options methodology, which is a novel factor in the valuation. Furthermore, it applies a methodology for calculating a royalty rate, which provides differentiating aspects compared to other valuations.

In order to solve the research question, the first part presents the theoretical framework that underpins the article. Second, the proposed valuation structure is applied to three companies from different economic sectors selected for positioning their brand in the market, in addition to the availability of real financial information and the interest of entrepreneurs in recognizing the economic benefit that the franchise model could present in their organization. For the selected companies, the projection of cash flows and their present value was developed, adding the effect of possible future decisions through a real option. Third, a Monte Carlo simulation analysis was performed to take into account the uncertainty effect of the model, and the value of the initial fee and the royalty rate were determined, with selected scenarios being proposed. Finally, the work's conclusions, recommendations, and limitations are presented.

Literature review

Franchising is seen as a contractual model of vertical integration that has been configured as a tool and agreement for business organization and collaboration (Cuesta, 2004; Devia Neira, Donoso Leal, & Rojas Mosquera, 2013) and, consequently, this model is widely used by companies as a means of expanding their business, locally and in foreign countries, which is why the franchise market has experienced accelerated growth in the last decade.

The Spanish Franchise Association (2019) mentions that in Spain, the franchise market comprises 1,376 franchisors, of which 1,130 are national, and 246 are foreign. They generate 293,872 jobs. Likewise, in the United States, according to Pino Barreda (2017), the franchise format impacted US GDP by 2.33% in 2016, with a turnover amounting to USD 674 billion and the generation of 7,636,000 jobs.

In Latin America, Brazil and Mexico stand out as the countries with the largest number of registered franchises, followed by Argentina, whose market is characterized by the fact that most of its franchises are local, while Colombia ranks fourth in the Latin American franchise market (Bernal et al., 2020). The available literature on the development of franchises in Colombia is scarce, and the statistical data are deficient (Ayala de Rey & Garzón Castrillón, 2005). According to the International Trade Administration (2019), the number of franchises in Colombia has presented rapid growth in the last ten years, and an increasing number of companies have adopted franchising as a safe and less complex way to expand their businesses. According to data from the study conducted by Guevara (2019), the franchise market has had significant growth during the last thirteen years, reaching 550 franchising brands with 15,000 franchisees as of December 2018.

As evidenced above, the exponential increase in the number of franchises in the world essentially stems from the fact that the stakeholders in a franchise contract base their relationship on mutual trust with a common goal, to grow together with a balance of profit. In fact, collaborations between franchisor and franchisee can improve strengths and correct weaknesses (Simonin, as cited in Perrigot et al., 2020).

Franchising from a scarcity theory perspective

Starting from the optimization of costs associated with brand positioning and, of course, the increase in demand, the resource scarcity theory was one of the first attempts to explain the reason for the existence of franchising. Oxenfeldt and Kelly (1969) argue that companies decide to franchise to obtain resources that are scarce and, thus, achieve agile expansion in developing markets (Jang & Park, 2019). Consequently, franchising is presented as an alternative for raising capital (Park & Jang, 2018), especially for small and medium-sized enterprises that generally have difficulty accessing low-cost financing. In this way, companies can overcome capital resource constraints (Madanoglu, Castrogiovanni, & Kizildag, 2019) and expand quickly since franchising requires a lower investment than opening their own point of sale. Thus, they will reach operational and production efficiency levels, which will make it possible, for example, to have better negotiations for raw materials, optimization in advertising expenses, and better access to financing. All of the above is because, as mentioned, the company is working in an already proven activity and with a recognized brand. These factors make it possible for the company to be more competitive and improve its profit margins, not only from the royalties obtained from the franchisee but also from the expansion of demand with the increase of the scope of action of the organization.

Franchising from an agency theory perspective

Another of the theories proposed for franchises is agency, defined as a contract in which the principal agrees with another person (the agent) to perform some activity or provide some service on their behalf. According to Jensen and Meckling (1979), the above implies giving the agent a certain amount of authority to make decisions. Accordingly, a franchise can be seen as an agency contract where the franchisee takes the agent position, and the franchisor acts as the principal (Sanfelix & Puig, 2018).

Since both the franchisor and the franchisee benefit economically from the contract, both parties to the relationship are utility maximizers. Thus, Jensen and Meckling (1979) suggest that there are sufficient reasons to believe that the agent will not always act in the principal's best interest since the agent will seek their own interest. For example, the franchisee could lower the quality of the product in order to increase its profit margin, thus creating the risk of brand deterioration that would affect the franchisor and the other franchisees. However, the benefit on the profit margin would be presented in a short-term position, which leads to avoiding taking into consideration this premise for the projection of future cash flows in the valuation of the franchise, based on the premise that profitability is greater with work based on the common benefit.

Franchising from a real options perspective

Regarding the above theories, the role played by both the franchisor and the franchisee enters into the analysis and valuation exercise from the real options. By definition, a real option exists if one has the right to decide at one or more points in the future, for example, invest or not, sell or not (Brix, 2012). Real options have taken on great importance in the valuation of projects and intangible assets since markets are dynamic, in addition to the fact that projects must be flexible to future investment decisions (Quirama & Sepúlveda-Aguirre, 2020, p. 250). The real options technique facilitates decision-making on investment projects or strategies when there is flexibility (optionality) to make new decisions related to the project or strategy in the future to extend, contract, postpone, or abandon a project.

When considering the various options available to decide on the commercialization of franchises, during the process for the contracting between the parties, several aspects must be taken into account. In legal matters, and given that in Colombia the franchise is categorized as a contract of civil liability, the duration and the territory where the activity will be carried out must be agreed upon between the parties. In addition, so must the clauses that regulate the operation and the package of benefits that the franchisor delivers to the franchise. These may include, as indicated by Rodríguez Alba, Sánchez García, and Mahecha Garzón (2013), the transfer of technical know-how or assistance, making it possible for the acquirer to manufacture or commercialize a good or service―in addition to the possibility of early termination of the contract by prior notice. González and Hernández (2016) point out that breaches of contractual clauses may lead to economically risky consequences for franchisees.

In financial matters, one of the biggest drawbacks in the contracting process is setting the price of the franchise since it must include the pecuniary values resulting from the flexibility of the options and decisions of the franchiser per the clauses previously established in the franchise contract. Baldi and Trigeorgis (2009) and González, Zuluaga, and Maya (2012) indicate that this flexibility should be considered when valuing the company and the brand. A large number of publications on franchises are focused on their definition, description, and management, but there are few that attempt to quantify their value. Table 1 presents some of the most relevant contributions in the research of authors on the franchise market.

Table 11 Contributions to franchise markets

| Subtopic | Author | Contribution |

|---|---|---|

| Multi-unit franchising strategies: a real options logic | (Baldi, 2016) | The author seeks to fill the gap by proposing a theoretical framework and empirically investigating the real choices underlying multi-unit franchising strategies. |

| Franchise ownership redirection: real options perspective | (Nugroho, 2016) | The author calculates the value of the real option for the franchisor in the case that they want to convert a franchised unit into their own unit, taking into account the uncertainty of the income and royalty rate, presenting a hypothetical case and performing a simulation exercise. The author concludes that if the royalty rate is high for the franchisor, it is better not to exercise the real option and instead enjoy the benefits of the royalties. |

| The optimal decisions in franchising under profit uncertainty | (Liang et al., 2013) | This study builds a real options model to evaluate franchise contracts, which considers the guaranteed benefit the franchisor offers to franchisees in a dynamic environment. It concludes that joining a franchise enables the franchisee to quickly obtain a mature operating model that offers a recognized brand and helps reduce marketing and development costs. |

| Royalty Rate Structure in Case of Franchising | (Kotliarov, 2011) | It demonstrates that the royalty calculation model for licensing should not be applied to franchise agreements and proposes a model for royalty calculation, taking into account the technologies and support that the franchisor provides to the franchisee. |

| A model for the valuation of intangibles | (Rodríguez Bastre, 2009) | Application to franchises in the restaurant industry in Mexico. This doctoral thesis seeks to support the market value of a business under the franchise scheme, specifically a franchise that belongs to the restaurant industry in Mexico, through a regression model. |

Source: created by the authors

Franchise valuation

When a company expands its brand using franchising as a strategy, it needs to determine the items to be attributed to the franchisee, for which a brand valuation process must be carried out (Nuques & Velázquez, 2009). This is a prerequisite to begin negotiating the terms of the franchise contract. Different sources of income are presented in the development of a franchise contract. However, according to Vázquez (2004), the economic literature has focused mainly on two of these sources: the royalty rate and the initial franchise fee. Windsperger (2001) indicates that the initial fee is the remuneration for the specific knowhow transferred at the beginning of the contract and depends on the value of the brand. The calculation of this value should consider the investments related to the structuring of the network, the expenses on publicity, and the number of franchises to sell. On the other hand, royalty rates are explained by factors including inefficient risk allocation, the franchisee's and the franchisor's moral hazard, and the value of the services provided by the franchisors (Vásquez, 2004).

Franchising as an intangible

So far, it has been emphasized that the value of franchises underlies the Know-how. Therefore, an intangible asset is valued during the franchise valuation process. Vélez (2016) states that an intangible's value is subjective and adds that some authors criticize the valuation exercise because of the subjectivity and uncertainty involved. However, valuation methods provide a guideline to negotiate.

The valuation of a franchise, like that of any other intangible asset, should be done at fair value, which means that it should include market expectations and assumptions about risks inherent to the asset, and, as indicated in Flórez (2019), it is necessary to determine the specific asset that is the object of the measurement, the main (or most advantageous) market for the asset, and the ideal valuation techniques, taking into account the availability of data with which to develop variables that represent the assumptions that market participants would use when pricing the asset (Flórez, 2019).

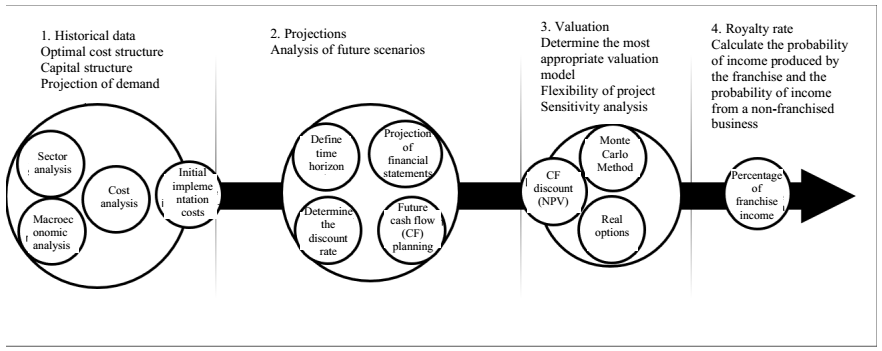

Methodology

This study was conducted with a mixed descriptive approach, composed of two stages. The first uses qualitative methods, and the second is developed through quantitative methods to validate the information obtained using hermeneutics. The case studies are taken as companies 1, La tercera Arepa de la Negra S.A.S (from now on Company A); 2, Proyección Contable (from now on Company B); and 3, Joyas Casuales (from now on Company C). The above are three small unlisted Colombian companies belonging to different economic sectors―accounting services, jewelry manufacturing and marketing, and food industry and commerce. They were selected especially for their growth in brand recognition in the market, their updated and real financial information (which is a complex aspect for the type of companies studied in this research), and, finally, the interest of the entrepreneurs in recognizing the economic benefit that the franchise could bring to their organization. All figures are given in Colombian pesos (COP). Figure 1 summarizes the macro process of the franchise valuation structure proposed in this work.

After selecting the companies, a sector analysis was carried out to identify the economic sector in which the company operates and its market behavior concerning customers, suppliers, and competitors. At the same time, an analysis of the economic aggregates that may directly or indirectly affect the organization and the future behavior of these macroeconomic variables was carried out, subsequently facilitating the projection of future cash flows for the valuation.

Once all the analyses reflected in Figure 1 in the first section (historical data) were performed, initial projections were made based on the implementation costs associated with the identified demand, the initial basis for the construction of the financial statements, future cash flows and, finally, the development of the different valuation methods starting with discounted cash flows. The above was done to present the type of distribution with a Monte Carlo model and the development of the real options method, generating the cost of royalties for each company studied as a final result.

Results and discussion

The starting point for the valuation is the review of historical data. At this point, the optimal structure of the company to be franchised and its capital structure are analyzed. Moreover, through sectorial cost and macroeconomic studies, the variables and initial costs necessary in the projection of cash flows (CF) are determined for the three companies under study over a period of five years (Table 2). The same period will be the term of the franchise contract.

Table 2 Projected cash flows

| Projected cash flows | |||||

|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Company A - 444,680,146 | 364,831,911 | 554,922,650 | 688,803,599 | 846,837,279 | 1,031,558,513 |

| Company B - 64,895,325 | - 2,279,068 | 124,436,612 | 329,369,265 | 445,860,480 | 544,201,120 |

| Company C - 87,008,784 | 10,036,994 | 22,192,725 | 57,057,839 | 145,228,883 | 367,604,216 |

Source: created by the authors

CFs were discounted to present value using the expression (1)

Where classic NPV = present value of cash flows; Uj= the estimated future cash flow; Ke = the annual rate of return expected by investors.

During the process, the NPV may give a negative result. In that case, it should be reviewed if the real option provides significant value for the future franchisor to stay in the project. If the option does not contribute significantly to the franchise's value, it will be recommended to the entrepreneur to check that the operating structure is optimal since, to value the franchise, it is assumed that the company has an adequate standardization in its processes. The Know-how represents a change in this assumption and, together with a variation in the budgeted demand, can alter the NPV results.

Calculation of 𝐾𝑒

Obtaining the approximate Ke for each project is a complicated task since there is a possibility of underestimating or overestimating the calculated cost rate. It is assumed that the risk and capital structure of the company remain constant (García & Montes, 2018) and that there is no debt because the capital structure that the future franchisee will assume is unknown. The methodology for its calculation is based on the CAPM model (Capital Asset Pricing Model).

Where RLR = risk-free rate; β = measure of the sensitivity of the stock of the company to the market; and RM= market return.

The methodology used for this work is the CAPM model adjusted to emerging countries such as Colombia, proposed by Beltrán, Ravelo, and España (2018). These authors take the United States market as a basis, given that the assumptions of the model propose an efficient market where investors seek to maximize their profit by demanding higher profitability versus higher risk assumed. Moreover, these do not influence market prices. The model has three components: (i) Klrusd risk-free rate, (ii)

US equity market risk premium PR usd, and (iii) Colombia country risk premium, given by Equation (3), where this factor is calculated with credit default swaps (CDS).

The data obtained for May 6, 2020, were:

Risk-free rate, ten-year US government bond trading rate: 0.7 % p.a.

Arithmetic PR (1928-2019) 4.93% and geometric PR (1928-2019) 4.83%

Colombia country risk premium 1.21%, and sovereign default risk factor 2.68%

Trading rate of credit default insurance on ten-year Colombian government bonds is 2.99% and US government bonds 0.31%.

Equity risk adjustment 45.35%

USD-COP exchange premium 4.10%

Historical volatility of the Colcap index 26.18%, and historical volatility of the JP Morgan EMBI Plus Colombia fixed income index 57.74%

Negotiation rate of a contract to exchange Colombian pesos at a fixed rate for dollars at a variable rate for a ten-year term (ten-year COP-Libor swap) 4.8%

Negotiation rate of a contract that allows the exchange of dollars at a fixed rate for a variable rate for a ten-year term (ten-year USD-Libor swap): 0.67 %

Table 3 presents the Ke discount rates in dollars and pesos for each company under study.

Table 3 Capital costing (Ke)

| Factor | Company A | Company B | Company C |

|---|---|---|---|

| Ke (USD) | 8.75 % | 6.16 % | 14.26 % |

| Ke (COP) | 13.20 % | 10.51 % | 18.94 % |

Source: calculations by the authors based on Damodar

The classic NPVs of the companies are presented in Table 4

Stochastic NPV and volatility calculations

Once the classic NPVs are obtained, this work proceeds to the simulation of different scenarios using the Risk Simulator software with 10,000 events and using the 12345 seed, where it is assumed that the input variables (see Table 5) have a BETA probability distribution (PERT), since there is no historical information to perform a distribution analysis of the variables. The NPV is also taken as the output forecast variable.

Table 5 Stochastic NPV values and volatility

| Stochastic NPV values and volatility | |||

|---|---|---|---|

| Input variables | Stochastic NPV | Volatility | |

| Company A | First-year sales | 1,949,351,064 | 28.65 % |

| Sales growth rate | |||

| Company B | Service price | 906,291,653 | 3.70 % |

| Demand of year 1 (percentage of maximum capacity) | |||

| Company C | Demand of year 1 | 299,044,557 | 18.32 % |

| Sales growth rate | |||

Source: created by the authors

According to Antikarov and Copeland (2001), the NPV without flexibility is the most objective approach to the market value of a project. Therefore, the simulation of the cash flows provides a reliable estimate of the volatility of the investment. Thus, the volatility of the franchise was taken as the value obtained by the Monte Carlo simulation with a confidence level of 95%. Table 5 presents the uncertainty variables taken for the Monte Carlo simulation in each company, as well as the stochastic NPV values and the volatilities obtained.

NPV calculation with flexibility

Once the stochastic NPV and an estimate of volatility are obtained, the NPV is calculated with the flexibility to include in the project the future decisions that the franchisor may make according to the clauses of the contract, thus determining the real options associated with each possible decision. For this exercise, a clause is proposed that gives the franchisor the option to convert the franchised unit into its own unit. The franchisor can exercise the option when the franchisee fails to comply with the conditions of the contract and at the expiration of the contract, which is five years. Given the characteristics of the contract clause, the franchisor's decision resembles an American sale option to abandon, in which the franchisor has the right to terminate the contract at any time.

The valuation was performed based on the binomial tree methodology, and four phases were considered. The first phase is the input parameters of each option. Underlying asset (S) = present value of the projected cash flows without initial investment for each type of franchise; K = initial franchise costs assumed by the franchisee (I); rf = risk-free rate (TES trading rate, July 20); σ= volatility obtained by Monte Carlo simulation; t = time of the franchise contract.

As the second phase, the model variable (u, d, p, q) must be calculated (Table 6), where U are the factors that increase and decrease the PV of the cash flows, respectively. They are determined by expressions (6) and (7), while the probabilities p and q are mathematical elements that allow us to discount the cash flows using the risk-free rate and were obtained by applying Equations (8) and (9).

Table 6 Parameter values for the calculation of real options for the three companies

| Real options parameters | Company A | Company B | Company C |

|---|---|---|---|

| Asset value | 2,394,031,210 | 971,186,978 | 386,053,341 |

| Implementation costs | 444,680,146 | 64,895,325 | 87,008,784 |

| Maturity (years) | 5 | ||

| Risk-free rate (percentage) | 0.053 | ||

| Volatility (percentage) | 28.7 % | 3.7 % | 18.3 % |

| Upward step value (Up) | 1.90 | 1.09 | 1.51 |

| Downward step value (Down) | 0.53 | 0.92 | 0.66 |

| Probability Neutral to risk (P) | 0.38 | 0.80 | 0.46 |

| 1-P | 0.62 | 0.20 | 0.54 |

| Terminal equation | Max, (active-salvage, 0) | ||

Source: simulation in @risk based on the author's calculations

In the third phase, the value of S is projected based on the upward u and downward d movements of the present value of the cash flows of each company.

The fourth phase corresponds to the options tree. Here the value obtained at the end of the Stree is compared with the current investment in the franchise by choosing the maximum between this value and zero according to expression (10).

Finally, it was adjusted backward from the final moment to the initial moment with probabilities p and 1 − p by finding the risk-weighted average and discounting it to the present with the risk-free rate using Equation (11) to obtain the value of the real option at time zero. Table 6 presents the parameters for the option calculations of the three companies.

Figure 2 presents the evolution of the underlying asset and the valuation of the real option for company A.

Source: calculations and creation by the authors

Figure 2 Underlying asset tree and real option valuation tree for company A

Once the valuation process was completed, the values of the real options seen in Table 7 were obtained.

Table 7 Values of the real options of the three companies

| Company A | Company B | Company C | |

|---|---|---|---|

| Actual option value | 2,057,389,735 | 904,153,807 | 306,295,278 |

Source: calculations and creation by the authors

The flexible NPV is given by Equation (12)

Royalty rate calculations and determination of the initial royalty value

Calculation of royalty rate

The next step is calculating the royalty rate for each franchise determined by Equation (13), applying the methodology proposed by Kotliarov (2011).

The values of A, B, C and D are calculated as follows:

Table 9 presents the variables taken into account to obtain the royalty rate and the royalty results for each company when there is no initial fee.

Table 9 Model for the calculation of the royal"ty rate when there is no initial fee

| Mnemonic | Model for the calculation of the royalty rate when there is no initial fee | ||||

|---|---|---|---|---|---|

| Variable | Company A | Company B | Company C | ||

| Pfr | Average income produced per franchise | 2,425,762,140 | 817,047,469 | 985,736,114 | |

| Wfr | Probability of obtaining income produced by franchise | 70 % | 70 % | 70 % | |

| Pind | Average self-employed entrepreneur income | 1,940,609,712 | 490,228,481 | 591,441,669 | |

| Wind | Probability of earning income as an independent entrepreneur | 49 % | 50 % | 49 % | |

| WsuP | Additional probability of earning income from the know -how | 21 % | 20 % | 21 % | |

| Psup | Additional income from the franchisor compared to that of an independent entrepreneur | 485,152,428 | 326,818,988 | 394,294,446 | |

| A | 0 | 0 | 0 | ||

| B | 0.302 | 0.281 | 0.302 | ||

| C | 0.200 | 0.400 | 0.400 | ||

| D | 1 | 1 | 1 | ||

| T, Royalties (without initial fee) | 16 % | 28 % | 29 % | ||

Source: created by the authors

To determine the probability, this work took into account the indications of Kotliarov (2011), who suggests that the probability of obtaining income of the independent or non-franchised entrepreneur (Wind) depends on the survival rate of the franchising companies, the economic sector, and the geographic area. In order to obtain this figure (Wind), the study took into account the data published by Espinosa, Molina, and Vera (2015), where it is indicated that in the commerce and industry sectors, 33% of the companies fail; these are the sectors to which companies A and C belong, respectively. Meanwhile, in the service sector, to which company B belongs, the failure rate is 31%. In general, in the main geographical sector of the franchises, the value of non-success is 27.10%. Concerning the probability of obtaining the income produced by the franchise (Wfr), the data published by Portafolio (2017) was taken into account, where it is indicated that 70% of franchises in Colombia survive more than five years.

The additional probability of earning income from know-how (Wsup) is calculated as the difference between Wind and Wfr.

Initial fee

As mentioned above, the determination of the initial fee (IF) value depends on the franchisor, and together with the royalty rate, it is configured as a way to recover the invested values. Therefore, several IF scenarios were taken into account to calculate the royalty rate when there is a rIF fee, based on Equation (15) proposed by Kotliarov (2011). The fee values are calculated as a percentage of the flexible NPV of each company. The simulation showed that when the ratio of initial royalty to franchise revenues is equal to the initial fee when there is no fee r, it does not make sense to calculate a new rIF, since the value of rIF = r.

Table 10 presents an initial fee simulation and royalties for the three companies. In the case of company A, for example, for an initial fee of 267,085,257, it would charge the franchisee a royalty rate of 5% of the franchise revenues. This simulation gives the franchisor alternatives to structure an attractive commercial offer. It can also be observed that as the initial fee increases, the royalty rate decreases. This is due to the fact that the sum of the values calculated by the royalty rate and the fee cannot exceed the fee without royalties (royalties = 0). On the other hand, Table 10 summarizes the NPV and the free cash flows for the three companies from the perspectives of the franchisee and the franchisor. It can be seen that the franchise of Company C is not financially viable from the franchisee's point of view since the NPV is negative.

Table 10. Negotiation scenarios

| Negotiation scenarios | ||||||

|---|---|---|---|---|---|---|

| Company A | Company B | Company C | ||||

| Percentage of the initial fee |

Initial fee value | T, Royalties | Initial fee value | T, Royalties | Initial fee value | T, Royalties |

| 0 | 0 | 16 % | 0 | 27.51 % | 0 | 28.73 % |

| 5 % | 222,571,047 | 7 % | 93,67,039 | 16.03 % | 34,617,431 | 25.22 % |

| 6.00 % | 267,085,257 | 5 % | 112,520,447 | 13.73 % | 41,540,917 | 24.52 % |

| 7.00 % | 311,599,466 | 3 % | 131,273,855 | 11.44 % | 48,464,403 | 23.82 % |

| 8.00 % | 356,113,676 | 1 % | 150,027,263 | 9.14 % | 55,387,890 | 23.12 % |

| 9.00 % | 400,627,885 | 0 % | 168,780,671 | 6.85 % | 62,311,376 | 22.41 % |

Source: created by the authors

Table 11 NPV of franchisor and franchisee for an initial fee of 5%

| Franchisor NPV | Franchisee NPV | ||||

|---|---|---|---|---|---|

| Company A | Company B | Company C | Company A | Company B | Company C |

| 579,336,534 | 348,542,981 | 364,807,166 | 945,494,293 | 318,021,050 | - 424,178,749 |

Source: created by the authors

In this case, it is evident that franchises overcome resource constraints and make company growth possible at a lower cost than would be incurred to position their own brand (Madanoglu, Castrogiovanni, & Kizildag, 2019). It also demonstrates that the valuation of franchises generally performed with traditional models is deterministic, i.e., it does not consider elements that make decisionmaking flexible in a changing environment.

It is important to highlight that, in order to determine the value of the franchise and the royalty rate proposed in this work, it is necessary to rigorously analyze the economic value of the franchise from the franchisee's perspective since the franchisee must make their own studies to make a rational decision. Moreover, they should perform the valuation in different capital structure scenarios, considering the initial investment and royalty, among other factors (Gillis, Combs, & Yin, 2018).

Franchisors can make future decisions based on the real options model to mitigate some risks. For the above, clauses are stipulated that affect the contract value. Such impacts caused by future decisions can be previously contemplated since this model incorporates volatility through simulations (Casson, 2015). This justifies the reason for the valuation using real options (Pareja & Cadavid, 2016).

Conclusions

Valuation using real options provides a type of flexibility that does not consider the traditional valuation using the net present value of the projected cash flows. However, real options present the limitation that if the asset volatility is very high, it can increase the value of the expected cash flows, overestimating the franchise's value. In other words, the results obtained conflict with what is expected. Another limitation that may affect the value of the option is how the structure and methodology for the calculation of the necessary parameters for its valuation are defined, such as the risk-free rate, the cost of the capital, time of operation, and type of option in the construction of the cash flow.

On the other hand, taking into account the variability in cash flows increases the value of the franchise fee. However, it is important to note that the value of that fee, when valuing through real options, depends to a large extent on the case study being addressed since it is generally higher than that obtained with conventional methods, which could lead to overvaluation. Considering the flexibility in cash flows reflects the value of the attributes of the company, making it possible to establish a much more reasonable negotiation figure between parties. It remains to be established how much the brand contributes.

The results obtained in the valuation of the companies studied in this work confirm that the value of the franchise through real options and discounted cash flow generates an added value by considering the risks of the sector in which each company operates, as well as the probabilities of success of its business. When determining the value of the franchise and the royalty rate using the methodology of real options, it is evident that its value depends on the sector's characteristics, and that, if the initial fee increases, the royalty rate decreases.

Finally, it is important to highlight that the valuation process using real options makes it possible to mitigate some risks and increase the value of the premium in many cases. However, the possibility of using other models for calculating volatility and other methodologies for the valuation of franchises using real options is left open for future research.

REFERENCES

Antikarov, V. and Copeland, T. (2001). Real options. Texere. [ Links ]

Asociación Española de Franquiciadores. (2019). La franquicia en España (Informe 2019). http://www.franquiciadores.com/wp-content/uploads/2016/04/Memoria-AEF-Cajamar - Disponible en: informe-La-Franquicia-en-Espana-2016.pdf y consultado: 20/01/2020. [ Links ]

Ayala de Rey, M. V. y Garzón Castrillón, A. (2005). Situación actual de la franquicia en Colombia. Revista Escuela Colombiana de Ingeniería, 15, 47-54. [ Links ]

Baldi, F. and Trigeorgis, L. (2009). A real options approach to valuing brand leveraging options: how much is Starbucks brand equity worth? Disponible en: http://hdl.handle.net/2318/1697191%0A y consultado: 05/02/2020. [ Links ]

Beltrán, A., Ravelo, P. y España, R. (2018). Rentabilidad del capital propio (Ke). Disponible en: https://investigaciones.corficolombiana.com/documents/38211/0/Rentabilidad del capital propio.pdf/517c85c6-4ba4-dbd7-8862-aa90be756d48 consultado: 05/02/2020. [ Links ]

Bernal, C. A., Amaya, N., Gaviria-Peñaranda, A. and Zwerg-Villegas, A. M. (2020). Knowledge and organizational performance in franchised restaurants in Colombia. International Journal of Emerging Markets, 16(3), 517-536. https://doi.org/10.1108/IJOEM-04-2019-0322 [ Links ]

Brix, A. (2012). Real options in franchising. real option clauses in franchising contracts. an empirical study. [Trabajo de grado de Maestría]. Facultad de Economía, Universidad de Viena. https://doi.org/10.25365/thesis.22453 [ Links ]

Casson, M. (2015). Coase and International Business: the origin and development of internalisation theory. Managerial and Decision Economics, 36(1), 55-66. https://doi.org/10.1002/mde.2706 [ Links ]

Cuesta, P. (2004). Franquicia: una fórmula comercial con éxito en pleno crecimiento. Distribución y Consumo, (noviembre-diciembre), 5-14. Disponible en: https://www.mercasa.es/media/publicaciones/99/1292347272_DYC_2004_78_5_13.pdf [ Links ]

Damodaran, A. (2020). Betas. http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/Betas.html . y consultado: 08/02/2020. [ Links ]

Devia Neira, C., Donosso Leal, D. y Rojas Mosquera, I. A. (2013). Estudio doctrinario y legislativo del contrato de franquicia. [Trabajo de grado de Derecho]. Universidad de La Sabana. Disponible en: http://hdl.handle.net/10818/5442 y consultado: 08/02/2020. [ Links ]

Espinosa, F. R., Molina, Z. A. y Vera-Colina, M. A. (2015). Fracaso empresarial de las pequeñas y medianas empresas (pymes) en Colombia. Suma de Negocios, 6(13), 29-41. https://doi.org/https://doi.org/10.1016/j.sumneg.2015.08.003 [ Links ]

Flórez, J. A. (2019). Medición del valor razonable. Disponible en: https://www.slideserve.com/gyala/conferencista-c-p-jos-asunci-n-neira-fl-rez-powerpoint-ppt-presentation y consultado: 05/02/2020. [ Links ]

García, S. y Montes, L. (2018). Modelo de valoración financiera para una pequeña y mediana empresa (pyme) en Colombia. Espacios, 39(42), 2. [ Links ]

Gillis, W. E., Combs, J. G. and Yin, X. (2018). Franchise management capabilities and franchisor performance under alternative franchise ownership strategies. Journal of Business Venturing, 35(1). https://doi.org/10.1016/j.jbusvent.2018.09.004. [ Links ]

González Londoño, Y., Zuluaga, M. and Maya, C. (2012). Real options approach to financial valuation of brands. AD-Minister, 21, 9-32. [ Links ]

González Rubiano, Y. A. y Hernández Vargas, Y. M. (2016). Contratos de franquicias en Colombia caso Kids SAS. [Trabajo de grado Contaduría Pública]. Universidad de La Salle. Disponible en: https://ciencia.lasalle.edu.co/contaduria_publica/633 y consultado: 05/02/2020. [ Links ]

Guevara, K. S. (2019). Se pueden encontrar franquicias en el mercado a partir de los 10 millones. Disponible en: https://www.larepublica.co/consumo/se-pueden-encontrar-franquicias-en-el-mercado-a-partir-de-los-10-millones-2884797 y consultado: 08/02/2020 [ Links ]

International Trade Administration. (2019). Colombia. Franchising. Disponible en: https://www.export.gov/apex/article2?id=Colombia-Franchising y consultado: 05/02/2020 [ Links ]

Jang, S. C. and Park, K. (2019). A sustainable franchisor-franchisee relationship model: Toward the franchise win-win theory. International Journal of Hospitality Management, 76(June 2018), 13-24. https://doi.org/10.1016/j.ijhm.2018.06.004 [ Links ]

Jensen, M. C. and Meckling, W. H. (1979). Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure. En C. Read (ed.), The Corporate Financiers (pp. 163-231). Springer. https://doi.org/10.1007/978-94-009-9257-3_8 [ Links ]

Kotliarov, I. (2011). A Risk-Income Method of Royalty Rate Calculation in Case of Franchising. Zbornik Radova Ekonomskog Fakulteta u Istočnom Sarajevu, 5, 67-74. https://www.ceeol.com/search/article-detail?id=90828 [ Links ]

Liang, H., Lee, K. J., Huang, J. T. and Lei, H. W. (2013). The optimal decisions in franchising under profit uncertainty. Economic Modelling, 31(1), 128-137. https://doi.org/10.1016/j.econmod.2012.11.044 [ Links ]

Madanoglu, M., Alon, I. and Shoham, A. (2017). Push and pull factors in international franchising. International Marketing Review, 34(1), 29-45. https://doi.org/10.1108/IMR-03-2015-0037 [ Links ]

Madanoglu, M., Castrogiovanni, G. J. and Kizildag, M. (2019). Franchising and firm risk among restaurants. International Journal of Hospitality Management, 83, 236-246. https://doi.org/10.1016/j.ijhm.2018.10.021 [ Links ]

Nuques Martínez, M. I. y Velázquez Velázquez, S. (2009). Valoración marcaria. Disponible en: http://www.revistajuridicaonline.com/wp-content/uploads/2009/07/6-valoracion_marcaria.pdf y consultado: 20/01/2020. [ Links ]

Nugroho, Lukito Adi. (2016). Franchise ownership redirection: real real options perspective. Financial Innovation, p. 1-11, https://doi.10.1186/s40854-016-0030-0 [ Links ]

Oxenfeldt, A. R. and Kelly, A. O. (1969). Will successful franchise systems ultimately become wholly-owned chains? Journal of Retailing, 44(4), 69-83. [ Links ]

Park, K. and Jang, S. C. (2018). Is franchising an additional financing source for franchisors? A Blinder-Oaxaca decomposition analysis. Tourism Economics, 24(5), 541-559. https://doi.org/10.1177/1354816618757561 [ Links ]

Perrigot, R., López-Fernández, B., Basset, G. and Herrbach, O. (2020). Resale pricing as part of franchisor know-how. Journal of Business and Industrial Marketing, 35(4), 685-698. https://doi.org/10.1108/JBIM-05-2018-0145 [ Links ]

Pino Barreda, R. (2017). Estudio de mercado. El mercado de las franquicias en Estados Unidos 2017. Disponible en: https://www.icex.es/icex/es/navegacion-principal/todos-nuestros-servicios/informacion-de-mercados/paises/navegacion-principal/el-mercado/estudios-informes/DOC2018776305.html?idPais=US y consultado: 20/01/2020. [ Links ]

Quirama, U. y Sepúlveda-Aguirre, J. (2018). Un acercamiento a las metodologías de valoración de activos intangibles para la búsqueda del valor razonable. Espacios, 39(41), 7. Disponible en: https://www.revistaespacios.com/a18v39n41/a18v39n41p07.pdf y consultado: 20/01/2020. [ Links ]

Quirama, U. y Sepúlveda-Aguirre, J. (2020). Activos intangibles: registro contable y financiero en el desarrollo interno de I+D+i. En V. Meriño et al. (eds.), Gestión del conocimiento. Perspectiva multidisciplinaria (vol. 18). Fondo Editorial Universitario de la Universidad Nacional Experimental Sur del Lago “Jesús María Semprúm”. Disponible en: https://www.cedinter.com/review/gestion-del-conocimiento-perspectiva-multidisciplinaria-volumen-18/ y consultado: 20/01/2020 [ Links ]

Rodríguez Alba, O. A., Sánchez García, M. y Mahecha Garzón, B. T. (2013). Contratos de franquicia. Justicia y Razón, 1, 13-48. Disponible en: http://hdl.handle.net/20.500.12010/2005 y consultado: 08/02/2020 [ Links ]

Sanfelix, G. N. and Puig, F. (2018). New challenges in franchisor-franchisee relationship. An analysis from agency theory perspective. Cuadernos de Gestión, 18(1), 85-102. https://doi.org/10.5295/cdg.150610gn [ Links ]

Vázquez, L. (2004). The Use of Up-front Fees, Royalties and Franchisor Sales to Franchisees in Business Format Franchising. En J. Windsperger et al. (eds.). Economics and Management of Franchising Networkspp (pp. 145-159). Physica-Verlag. Disponible en: https://link.springer.com/chapter/10.1007/978-3-7908-2662-3_8 y consultado: 05/02/2020 [ Links ]

Vélez Pareja, I. (2016). Métodos de valoración de intangibles. Cuadernos Latinoamericanos de Administración, 9(17), 29. https://doi.org/10.18270/cuaderlam.v9i17.1237 [ Links ]

Windsperger, J. (2001). The fee structure in franchising: A property rights view. Economics Letters, 73(2), 219-226. https://doi.org/10.1016/S0165-1765(01)00491-8 [ Links ]

Wu, C. W. (2015). Antecedents of franchise strategy and performance. Journal of Business Research, 68(7), 1581-1588. https://doi.org/10.1016/j.jbusres.2015.01.055 [ Links ]

Received: May 29, 2020; Accepted: June 10, 2022; Published: June 17, 2022

texto em

texto em