Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Contaduría y administración

Print version ISSN 0186-1042

Contad. Adm vol.65 n.1 Ciudad de México Jan./Mar. 2020 Epub Apr 24, 2020

https://doi.org/10.22201/fca.24488410e.2018.1779

Articles

Going concern opinion prediction for football clubs: Evidence from the spanish league

1Universidad de Málaga, España

The accounting principle of going concern has been the focus of attention of financial research in recent decades, and has led to the development of models of prediction of audit opinions qualified by going concern that help to assess the continuity of business. These models have focused exclusively on industrial and financial companies. However, a specific model that reflects the special characteristics of the football industry has not been created. Since recently the governing bodies of the football industry have increased the financial control of the clubs, as in the case of UEFA with the approval of the Financial Fair Play Regulation and demand a pronouncement on going concern in the annual accounts of clubs, it seems necessary to have a model adapted to the characteristics of this industry. The present work provides an exclusive model of prediction of audit opinions qualified by going concern in the football industry with a precision that exceeds 95%. It also offers a vision of the challenges facing the football industry in financial matters, helping the different interest groups to evaluate the expectations of continuity of the clubs.

Keywords: Financial fair play; Going concern; Football industry; Audit

JEL codes: C53; C63; M42; L83

El principio contable de gestión continuada (going concern) ha sido foco de atención de la investigación financiera en las últimas décadas, y ha dado lugar al desarrollo de modelos de predicción de opiniones de auditoría calificadas por going concern que ayudan a evaluar la continuidad de las empresas. Dichos modelos se han centrado exclusivamente en empresas industriales y financieras. Sin embargo, no se ha creado un modelo específico que recoja las especiales características de la industria del fútbol. Dado que recientemente los órganos de gobierno de la industria del fútbol han aumentado el control financiero de los clubes, como es el caso de la UEFA con la aprobación del Reglamento de Fair Play Financiero, y exigen un pronunciamiento sobre going concern en las cuentas anuales de los clubes, parece necesario disponer de un modelo adaptado a las características propias de esta industria. El presente trabajo proporciona un modelo exclusivo de predicción de opiniones de auditoría calificadas por going concern en la industria del fútbol con una precisión que supera el 95%. También ofrece una visión de los desafíos a los que se enfrenta la industria del fútbol en materia financiera, ayudando a los distintos grupos de interés a evaluar las expectativas de continuidad de los clubes.

Palabras clave: Fair play financiero; Going concern; Industria del fútbol; Auditoría

Código JEL: C53; C63; M42; L83

Introduction

The accounting principle of going concern is one of the most important to consider in the preparation of corporate financial statements, as much of the financial information is based on the assumption that the company will maintain its regular development in the future. Current international accounting standards require the auditor to assess the ability of a company to continue. These assessments are useful for forecasting and providing possible explanations for bankruptcy. Therefore, the prediction of audit opinions rated by going concern has been the focus of accounting and financial research in recent years (Goo, Chi, and Shen, 2016; Martens, Bruynseels, Baesens, Willekens, and Vanthienen, 2008; Yeh, Chi, and Lin, 2014). Existing research has developed predictive models for different industries. For example, Kuruppu, Laswad, and Oyelere (2012) for industrial companies; Myers, Schmidt, and Wilkins (2014) for the financial industry; and Chen, Chi, and Wang (2015) for the biotechnology industry. However, no specific model has been created to reflect the special characteristics of the football industry. Having a model adapted to the characteristics of football clubs would help the different interest groups to evaluate the expectations of continuity of the clubs, and in particular the auditors, who, for example, and at European level, must comply with the requirements of the new legal framework of Fair Play Financial (FFP) on the issuance of a going concern opinion of football clubs (UEFA, 2015). This paper attempts to fill this gap in the research by developing a specific model for predicting going concern rated audit opinions for football clubs. This work can therefore be seen as a first attempt to formulate global hypotheses on the continuity of clubs in the international arena and subsequently confirm the predictive power of the model developed for clubs in a particular region or country.

In 1999, the Union of European Football Associations (UEFA) decided to initiate a system of club licensing for the participation of clubs in European competitions (UEFA, 2008). According to the UEFA, the initial purpose was to explore the possibility of creating a salary cap, but it was soon decided that this could not be done without first creating a legal framework. The rules of the licensing system are established by the UEFA, and the licensing is supervised by the different national federations with the aim of bringing the members of these federations closer to their clubs. Initially, the licensing system laid down rules relating to sports development, infrastructure, personnel and administration, and legal and financial issues. The financial requirements focused on the provision of audited financial statements and on the fact that clubs should not have debts with other clubs or players. These requirements were applied from the 2004/05 season onwards and were extended in the 2008/09 season to include late payments to the tax authorities and the booking of budget forecasts. This whole process culminated in 2009 with the introduction of the FFP. One of the main indicators set out in the FFP regulation is the opinion of the auditor regarding the continuity of the activity of the club. The going concern indicator requires that the report of the auditor, concerning the annual financial statements presented in accordance with articles 47 and 48 (relating to the annual accounts), must express or qualify an opinion with respect to going concern. In the event of receiving a going concern opinion under article 52 (future financial information), the licensee must prepare and submit interim financial information to demonstrate to the supervisor its ability to continue until the end of the license season. The going concern opinion therefore becomes an essential part of a football club, enabling it to participate in both European and national competitions (UEFA, 2015, Article 45.2, item “e”).

This study aims to shed some light on the research of going concern opinion prediction in the football industry. To this end, it develops a new model that is exclusive to the industry. In the construction of this new model, financial and non-financial information for the 2005-2016 period has been used for a sample of 40 Spanish professional football clubs, which has provided a total of 140 observations/year, half of them going concern clubs and the other half without this rating. Different methodologies (logistic regression, multiple multi-discriminant analysis, artificial neural networks, and decision trees) have been applied to the data in this sample and have been successfully used in the previous literature on prediction of going concern (Inoue and Kilian, 2005; Martens et al., 2008; Yeh et al., 2014). The results obtained have made it possible to know the factors that are the best predictors of continuity in the football industry, with accuracy rates higher than 90%. These results are important for the various stakeholders in the industry, such as auditors, investors, club managers, and governing bodies, whom it would help to improve the financial control of clubs.

The rest of the study is organized as follows: Section 2 presents a review of the literature on going concern audit opinion prediction. Section 3 provides a summary of the scope and objectives of the FFP regulation. Section 4 presents the methods used. Section 5 details the data and variables used in the research; and section 6 analyses the results obtained. Finally, the conclusions of the study and their implications are presented.

Previous Literature

The International Standards on Auditing (ISAs), in accordance with the precepts proposed by the International Auditing and Assurance Standards Board (IAASB) (issued by the International Federation of Accountants), include IAS 570 on the responsibility of the author for the audit of financial statements relating to going concern. This standard proposes that audit opinions should assess whether the going concern assumption is appropriate for the preparation of financial statements. In addition, these opinions should identify any uncertainty that may cause doubts about the continuity of the business.

The importance of assessing business continuity has been a concern not only for legislators but also for academic research. Subsequent to the initial work by McKee (1976), studies have been published that addressed international legislative harmonization (Cordos and Fülöp, 2015; Kusar, Taffler, and Tan, 2017; Martin, 2000); the importance of the quality of audit opinions (Mo, Rui, and Wu, 2015; Myers et al., 2014); the effects of a going concern audit opinion (Citron, Taffler, and Jinn-Yang; 2008; Gallizo and Saladrigues, 2016; Khan, Lobo, and Nwaeze, 2017; O’Reilly, 2010); the influence of the symmetry and efficiency of the information available to the auditor (Ittonen, Tronnes, and Wong, 2017; Gerakos, Hahn, Kovrijnykh, and Zhou, 2016); and the development of various models for predicting audit opinions rated by going concern (Bellovary, Giacomino, and Akers, 2007; Goo et al., 2016; Koh and Low, 2004).

Initially, the models developed to predict audit opinions rated by going concern achieved accuracy slightly above 80% through the use of multiple and discriminant analysis (McKee, 1976; Mutchler, 1985). Subsequently, Probit analysis (Dopuch, Holthausen, and Leftwich, 1987; Koh and Brown, 1991) and logistic regression (Cornier, Magnan, and Morard, 1995; Gaeremynck and Willekens, 2003; Menon and Schwartz, 1987; Mutchler, Hopwood, and McKeown, 1997) were used to improve the results of the initial models. In addition to the statistical techniques mentioned above, other studies were carried out in which artificial neural network computational techniques were applied (Anandarajan and Anandarajan, 1999; Klersey and Dugan, 1995; Koh and Tan, 1999; Lenard, Alam, and Madey, 1995). Koh and Low (2004) compared the usefulness of artificial neural networks, decision trees, and logistic regression to predict the state of business continuity. Their classification results indicate the potential of data mining techniques in a context of going concern opinion prediction. Martens et al. (2008) used ant colony type optimization and data mining (AntMiner +), and other techniques such as support vector machines and decision trees. Yeh et al. (2014) successfully applied the so-called rough sets. Goo et al. (2016) used the operator with the Least Absolute Shrinkage and Selection Operator (LASSO) to select variables, and subsequently applied data mining techniques to establish predictive models with multilayer perceptron (MLP), classification and regression tree (CART), and support vector machines (SVM). The LASSO-SVM combination achieved the best result from the different combinations, achieving an accuracy of 89.79%. Recently, Sánchez-Medina, Blázquez-Santana, and Alonso (2017) used logistic regression and artificial intelligence techniques such as Boosting and Bagging, achieving an accuracy slightly above 80%.

On the basis of the previous literature focused on the prediction of audit opinion rated by going concern, it is possible to deduce that certain variables have turned out to be the best predictors. On the one hand, financial variables that are related to liquidity, indebtedness, profitability, and activity (Hung and Shih, 2009; Martens et al., 2008; Yeh et al., 2014). On the other hand, non-financial variables, such as the effect of corporate governance (Beasley, 1996; Hung and Shih, 2009; Wang and Deng, 2006), intellectual capital (Yeh et al., 2014), company size (Anandarajan and Anandarajan, 1999), type of auditor (Ireland, 2003; Martens et al., 2008; Yeh et al., 2014), and variables specific to the activity of the sampled companies (Anandarajan and Anandarajan, 1999; Ciechan-Kujawa, 2017; Hung and Shin, 2009).

Scope and objectives of Financial Fair Play

The FFP regulations apply to clubs participating in competitions organized by the UEFA. These regulations govern the rights, duties, and responsibilities of all parties involved in the club licensing system and define, in particular, the minimum requirements to be met by a UEFA member federation in order to act as a licensor of its clubs, as well as the minimum procedures to be followed by the licensor with reference to minimum sporting, infrastructure, administrative, legal, and financial criteria.

The FFP regulations also regulate the rights, duties, and responsibilities of all parties involved in the supervision process of the UEFA; this is done in order to achieve financial fair play objectives. In addition, it determines the role and tasks of the Club Financial Control Body of the UEFA, the minimum procedures to be followed by licensors in their assessment of club supervision requirements, the responsibilities of licensees during competitions, and the monitoring requirements to be met by licenses.

One of the objectives stated in the FFP regulations refers to achieving financial “fair play” in UEFA club competitions. This is aimed at improving the economic and financial capacity of clubs, increasing their transparency and credibility, giving the necessary importance to the protection of creditors and ensuring that clubs settle their obligations to players, tax authorities, and other clubs on time. It is therefore a matter of introducing more discipline and rationality into the finances of football clubs, encouraging them to operate on the basis of their own revenues, abandoning other sources of financing incompatible with European regulations (Soto-Pineda, 2017).

Methodology

As stated above, in order to resolve the research question, different methods in the construction of the going concern audit opinion prediction model of the football industry were used. The use of different methods aims to achieve a robust model, which is contrasted not only through a classification technique, but by applying all those that have shown success in previous literature. Specifically, logistic regression, multiple discriminant analysis, artificial neural networks, and decision trees have been used. A synthesis of the methodological aspects of each of these classification techniques appears below.

Logistical Regression

The logistic regression model (Logit) is a non-linear classification model, although it contains a linear combination of parameters and observations of explanatory variables (Hair et al., 1999). The logistic function is delimited between 0 and 1, thus providing the probability that an element is in one of the two established groups. Parting from a dichotomous event, the Logit model predicts the probability that the event will or will not occur. If the probability estimate is greater than 0.5, then the prediction is that it does belong to that group, otherwise it would assume that it belongs to the other group considered. To estimate the model, it is necessary to start from the quotient between the probability that an event occurs and the probability that it does not occur. The probability that an event occurs will be determined by expression (1).

where β0 is the constant term of the model, and β1,…,βk are the coefficients of the variables.

Multiple discriminant analysis

Multiple discriminant analysis (MDA) is a statistical technique that allows both the analysis of whether there are differences between the groups with respect to the variables considered, and the sense in which these differences occur. It also allows the elaboration of a systematic classification model of unknown individuals in any of the groups analyzed (Fisher, 1936). It involves identifying the linear combination of two or more independent variables that best discriminate between the groups defined a priori. The weighting of each variable will be carried out in such a way that it maximizes the variance between-groups as opposed to the variance within-groups. The equation of the discriminant function will be determined by expression (2).

where Zjk is the discriminant score Z for the discriminant function j for object k; a is the constant; W i represents the discriminant weighting for the independent variable i; and X ik is the independent variable i for object k.

The procedure used to estimate the different weights (W i ) is that of Ordinary Least Squares, with the objective of estimating the values of the parameters that allow making more accurate predictions, thus minimizing the error term. Hair et al. (1999) establish that MDA is the appropriate statistical technique to contrast the hypothesis that the means of the groups of a set of independent variables, for two or more groups, are equal. To do this, MDA multiplies each independent variable by its corresponding weighting and adds these products together. The result is a single composite discriminant Z score for each individual in the analysis. By averaging the discriminant scores for all individuals within a particular group, the group mean is obtained. This group mean is known as centroid. When the analysis encompasses two groups, there are two centroids; with three groups, there are three centroids, and so on. The centroids indicate the most common situation of any individual in a given group, and a comparison of the centroids of the groups shows the sections in which the groups are found along the dimension being contrasted.

Multilayer perceptron

The Multilayer Perceptron (MLP) is a forward-feeding, supervised artificial neural network model that consists of a layer of input units (sensors), another output layer, and a number of intermediate layers, called hidden layers as long as they have no connections to the outside. Each input sensor is connected to the units of the second layer, these in turn to those of the third layer, and so on (Figure 1). The objective of the network is to establish a correspondence between a set of input data and a set of desired outputs.

Nuñez de Castro and Von Zuben (2001) confirmed that learning in MLP was a special case of functional approach, where there is no assumption about the model underlying the analyzed data. This process involves finding a function that correctly represents the learning patterns, as well as carrying out a generalization process that allows for efficient treatment of individuals not analyzed during such learning (Flórez and Fernández, 2008). In order to do so, W weights are adjusted from the information coming from the sample set, considering that both the architecture and the network connections are known. The objective is to obtain those weights that minimize the learning error. Given a set of pairs of learning patterns {(x1, y1), (x2, y2)… (xp, yp)} and an error function ε (W, X, Y), the training process involves the search for the set of weights that minimizes the learning error E(W) (Shang and Benjamin, 1996), as is expressed in (3).

Most analytical models used to minimize the error function employ methods that require the evaluation of the local gradient of the E(W) function; but techniques based on second order derivatives may also be considered (Flórez and Fernández, 2008). Furthermore, and in order for the MLP to be able to report on the importance of each variable in the results of the model built, it is possible to perform a sensitivity analysis (Yang, Shen, Ong, and Xiao-Ping Li, 2008). This analysis consists of taking 100% of the data and dividing them into groups, each group of data is then processed in the network built as many times as there are model variables. Each time, the value of one of the variables is modified by giving it a zero value. The answers of the network are evaluated in relation to the objective values or already known values of classification through the expression (4).

where Φxij (0) is the value of the network output when the variable Xij has a value of zero; Φxij is the classification value already known; Xi is the variable with an importance to be established; and Sxi is the sensitivity value of the variable.

Decision Trees

A Decision Tree (DT) is a graphical and analytical way to carry out the classification of data through different possible paths (Kingsford and Salzberg, 2008). Each of the tree nodes represents the different attributes of the data, the tree branches represent the possible paths to follow to predict the class of a new example, and the terminal nodes or leaves establish the class to which the test example belongs if followed by the branch in question. The DT description language corresponds to the formulas in the DNF (Disjunctive Normal Form). Thus, and in the case of having 3 attributes (A, B, and C), each of them with two values, xi and ¬xi, where i = 1, 2, 3; 2n, combinations can be built in CNF (Conjunctive Normal Form). Each of the combinations in CNF describes a part of the tree, so there would be disjunctives for the tree of the form expressed in (5).

These difficulties are descriptors of the built tree, so 22n possible descriptions could be formed in DNF. Since the order of DT is very large, it is not possible to explore all the descriptors to see which is the most suitable, therefore, heuristic search techniques are used to find an easy and quick way to do it. Most DT construction algorithms are based on the Hill Climbing strategy. This is a technique used in Artificial Intelligence to find the maxima or minima of a function through a local search. It is an algorithm that starts with an empty tree, then it is segmented into sets of examples, choosing in each case the attribute that best discriminates between classes, until the tree is completed. A heuristic function is used in order to know which attribute is the best; this choice is irrevocable, as such it must be ensured that it is the closest to the optimal one.

Data and Variables

This research uses a sample of 40 Spanish professional football clubs that have participated in the Spanish First and Second Divisions during the 2005-2016 period, and that have fulfilled the characteristic of providing full and public information on their annual accounts (Table 1). The financial information of the clubs in the sample has been obtained from the Iberian Balance Sheet Analysis System (SABI for its acronym in Spanish) database of Bureau Van Dijk, which provides economic and financial data on more than one million Spanish companies. For its part, the information on the variables specific to the football industry has been extracted from the Transfermarkt web portal.

Table 1 Football clubs in the sample

| Albacete Balompié, S.A.D. | Rayo Vallecano de Madrid, S.A.D. |

| Athletic Club | Real Betis Balompié, S.A.D. |

| Club Atlético de Madrid, S.A.D. | Real Club Celta de Vigo, S.A.D. |

| Club Atlético Osasuna | Real Club Deportivo de La Coruña, S.A.D. |

| Club Deportivo Tenerife, S.A.D. | Real Club Deportivo Mallorca, S.A.D. |

| Cádiz Club de Fútbol, S.A.D. | Real Club Deportivo Recreativo de Huelva, S.A.D. |

| Club Deportivo Leganés, S.A.D. | Reial Club Deportiu Espanyol de Barcelona, S.A.D. |

| Club Deportivo Mirandés, S.A.D. | Real Madrid Club de Fútbol |

| Club Deportivo Numancia de Soria, S.A.D. | Real Murcia Club de Fútbol, S.A.D. |

| Club Unión Deportiva Las Palmas, S.A.D. | Real Racing Club de Santander, S.A.D. |

| Córdoba Club de Fútbol, S.A.D. | Real Sociedad de Fútbol, S.A.D. |

| Deportivo Alavés, S.A.D. | Real Sporting de Gijón, S.A.D. |

| Elche Club de Fútbol, S.A.D. | Real Valladolid Club de Fútbol, S.A.D. |

| Fútbol Club Barcelona | Real Zaragoza, S.A.D. |

| Getafe Club de Fútbol, S.A.D. | Sevilla Fútbol Club, S.A.D. |

| Club Gimnástic de Tarragona, S.A.D. | Sociedad Deportiva Éibar, S.A.D. |

| Girona Fútbol Club, S.A.D. | Sociedad Deportiva Huesca, S.A.D. |

| Granada Club de Fútbol, S.A.D. | Unión Deportiva Almería, S.A.D. |

| Levante Unión Deportiva, S.A.D. | Valencia Club de Fútbol, S.A.D. |

| Málaga Club de Fútbol, S.A.D. | Villarreal Club de Fútbol, S.A.D. |

S.A.D. Sociedad Anónima Deportiva - Public limited sports company

Source: own elaboration.

In the sample selection a balance has been sought between clubs that have a going concern audit opinion and those that do not have such an audit opinion in their annual accounts. This matching has been made considering the year and size (according to total assets) and the economic activity code 9312 in NACE Rev.2 (Martens et al., 2008). The selected sample provided 70 observations/year for clubs that received a going concern opinion, and also 70 observations/year from clubs that did not receive going concern opinions. Additionally, 80% of the total sample has been reserved for the training phase of the model, and 20% for the testing of the model.

The dependent variable in this research is a dichotomous variable (GCO) that takes the value of 1 if the auditor issued a going concern opinion and of 0 otherwise. On December 21, 2010, the Instituto de Contabilidad y Auditoría de Cuentas de España published a resolution that modified the previous Standard on Auditing. Since then, the opinions given have had a new structure and content in terms of rating by going concern. Prior to 2010 they were treated as uncertainty, suggesting a qualified opinion if it was of a significant nature. The auditor, when faced with this situation, was faced with the preparation of a qualified report, or even, considering the importance of the qualification or its accumulation with other qualifications, denying their opinion on the basis of technical reasons. As of 2010, these uncertainties about the continuity of the business of the company are not included in the audit opinion as a qualification, but as a warning, and therefore, without effect on the audit opinion. In order to achieve homogeneity in the treatment of information, each audit report of the clubs in the sample has been thoroughly analyzed.

For their part, the independent variables have been selected from the previous literature on going concern prediction (Koh and Low, 2004). In addition, other variables specific to the football industry were selected (Barajas and Rodríguez, 2010, 2014). Table 2 shows the definition of the variables used. In total, it is a set of 18 variables including 8 financial ratios, 8 non-financial indicators, and 2 control variables. Particularly, liquidity variables are included since they were considered determinants in the decision to qualify the audit opinions with going concern (Anandarajan and Anandarajan, 1999; Yeh et al., 2014; Martens, 2008; Hung and Shih, 2009; Goo et al., 2016). Profitability variables are also included (Anandarajan and Anandarajan, 1999; Hung and Shih, 2009; Martens et al., 2008), as well as debt variables ((Anandarajan and Anandarajan, 1999; Hung and Shih, 2009; Martens et al., 2008). To complete the selection of independent variables, variables on corporate governance-considered in the previous literature as a risk factor for financial reporting (Beasley, 1996; Hung and Shih, 2009; Wang and Deng, 2006)-and variables that refer to intellectual capital-as it is accepted that they play an important role in ensuring greater economic benefit (Yeh et al., 2014)-, have been included. Other variables related to the characteristics of football clubs are also included, such as the size of the market in which the club operates, salary expenditure, and points accumulated in the competitions in which it participates (Barajas and Rodríguez, 2010; 2014). Finally, the size of the club has been used as a control variable, as it has been demonstrated that the size of companies is significantly associated with going concern ratings (Anandarajan and Anandarajan, 1999; Ireland, 2003). Also, the type of auditor, as large auditors tend to publish more conservative reports (Ireland, 2003; Martens et al., 2008; Yeh et al., 2014).

Table 2 Independent variables

| Category | Variable | Definition |

| LIQUIDITY | CRR LQR WCR |

Cycling Assets/Current Liabilities Treasury + Equivalents/Total Assets Operating Capital/Total Assets |

| PROFITABILITY | ATR ROA RTR |

Sales/Total Assets Earnings before Interest and Taxes/Total Assets Retained Earnings/Total Assets |

| INDEBTEDNESS | DCR LVR |

Total Cash Flow/Debt Total Debt/Total Assets |

| CORPORATE GOVERNMENT |

NMB | Number of Board Members |

| INTELLECTUAL CAPITAL |

IC1 IC2 IC3 |

Sales/Personnel Earnings before Interest and Taxes/ Personnel Research and Development Expenses/ Total Assets |

| FOOTBALL CLUB CHARACTERISTICS |

PER MSP WGB ACP |

Club Sport Performance (Szymanski Ranking1) Market Size (Province Population) Salary Expense2 Accumulated Points |

| CONTROL VARIABLES |

SIZ AUD |

Logarithm Total Assets 1 if the Auditor is Big 4, and 0 otherwise |

1 Szymanski Ranking = -ln (p/43-p). The “p” term represents the final position each club reached at the end of the season.

2 The Salary Expense variable is measured by the salary expenses of the players of a given club divided by the League total.

Source: own elaboration.

Results

For the analysis of the results obtained in this work, a descriptive study of the variables used is presented first. Subsequently, the development of the prediction model applying the proposed methods is shown.

Descriptive Analysis

The main descriptive statistics of the variables that comprise the sample appear in Table 3. Football clubs with a going concern opinion (GCO = 1), when compared to those without (GCO = 0), are characterized by a higher average liquidity value (LQR), a higher ratio of sales to total assets (ATR), and a higher level of indebtedness (LVR). On the other hand, all other variables have lower average values. In addition, there is also a moderate dispersion in the distribution of the variables analyzed, which can be extended to the entire sample. Table 4 shows the correlation between the variables. According to the results obtained, it can be deduced that the independent variables present a high correlation with respect to the dependent variable (GCO), with some exceptions. This allows inferring that, in principle, the set of variables selected may be appropriate for the development of the desired model.

Table 3 Descriptive Statistics

| CRR | LQR | WCR | ATR | ROA | RTR | DCR | LVR | NMB | IC1 | IC2 | IC3 | PER | MSP | WGB | ACP | SIZ | ||

| GCO=1 | Mean | 1.051 | 0.407 | -0.273 | 1.278 | -0.084 | -0.628 | 0.032 | 1.305 | 3.513 | 78.692 | -0.405 | 0.018 | 1.160 | 133878.571 | 14.125 | 52.278 | 10.032 |

| Median | 0.641 | 0.239 | -0.015 | 0.581 | -0.073 | -0.204 | -0.012 | 0.827 | 3.000 | 74.811 | -2.163 | 0.027 | 1.054 | 95750.000 | 10.411 | 50.000 | 9.928 | |

| Standar Desviation | 1.682 | 0.210 | 0.720 | 1.154 | 0.105 | 0.783 | 0.253 | 1.251 | 2.632 | 43.606 | 9.785 | 0.011 | 0.398 | 13576.223 | 9.851 | 14.712 | 1.302 | |

| N | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | |

| GCO=0 | Mean | 1.911 | 0.289 | 0.086 | 0.061 | 0.061 | 0.218 | 0.183 | 0.503 | 4.314 | 259.543 | 32.920 | 0.021 | 2.215 | 3622306.714 | 21.221 | 65.140 | 10.048 |

| Median | 1.065 | 0.177 | 0.020 | 0.057 | 0.057 | 0.266 | 0.119 | 0.389 | 3.010 | 81.384 | 7.767 | 0.032 | 2.100 | 405750.000 | 18.533 | 62.502 | 10.173 | |

| Standar Desviation | 2.809 | 0.188 | 0.104 | 0.082 | 0.082 | 0.503 | 0.204 | 0.342 | 4.753 | 121.096 | 11.123 | 0.029 | 0.979 | 25372.967 | 13.419 | 19.911 | 1.845 | |

| N | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | |

| t-test | 2.540 | -4.002 | 4.129 | 3.996 | 3.996 | 4.708 | 2.481 | -4.399 | 1.378 | 1.302 | 1,639 | -0.284 | 2.324 | 1.762 | 1.487 | 2.029 | 1.894 | |

| Valor p | 0.008 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.022 | 0.000 | 0.129 | 0.143 | 0.076 | 0.735 | 0.024 | 0.017 | 0.085 | 0.072 | 0.118 | |

Definition of the variables: CRR is the Cash Reserve/Current Liabilities ratio; LQR is the Treasury + Equivalents/Total Assets ratio; WCR is the Working Capital/Total Assets ratio; ATR is the Sales/Total Assets ratio; ROA is the Return on Assets and Tax/Total Assets ratio; RTR is the Retained Earnings/Total Assets ratio; DCR is the Cash Flow/Debt Coverage Ratio; LVR is the Total Debt/Loan to Value Ratio; NMB is the number of members on the board of directors; IC1 is the Sales/Personnel ratio; IC2 is the Earnings Before Interest and Tax/Personnel ratio; IC3 is the ratio of total R&D expenses/assets; PER is the Sports Performance ratio of the club; MSP is the market size of the club; WGB is the wage bill of the players; ACP are the accumulated points; SIZ is the natural logarithm of total football assets.

Source: own elaboration.

Table 4 Correlation Matrix

| CRR | LQR | WCR | ATR | ROA | RTR | DCR | LVR | NMB | IC1 | IC2 | IC3 | PER | MSP | WGB | ACP | SIZ | AUD | GCO | |

| CRR | 1 | 0.254** | 0.305** | -0.090 | 0.112 | 0.117 | 0.192** | -0.134** | 0.028 | -0.039 | -0.005 | -0.060 | -0.050 | -0.028 | -0.043 | 0.102 | 0.135 | 0.097 | -0.163** |

| LQR | 1 | -0.137* | 0.560** | -0.257** | -0.347** | -0.093 | 0.366** | 0.013 | -0.071 | -0.050 | 0.151* | 0.192* | 0.167* | 0.148* | -0.357* | -0.227* | 0.371** | 0.235** | |

| WCR | 1 | -0.339** | 0.695** | 0.792** | 0.168** | -0.873** | 0.040 | -0.001 | 0.122 | 0.022 | 0.072 | -0.187** | -0.131* | 0.245** | 0.227** | -0.063 | -0.240** | ||

| ATR | 1 | -0.271** | -0.280** | -0.093 | 0.293** | -0.019 | -0.026 | -0.069 | 0.229** | 0.239** | 0.214** | 0.087 | -0.527** | -0.461** | 0.171** | 0.254** | |||

| ROA | 1 | 0.644** | 0.221** | -0.694** | 0.024 | 0.025 | 0.226** | 0.070 | 0.051 | -0.158* | -0.124 | 0.191** | 0.191** | -0.187** | -0.263** | ||||

| RTR | 1 | 0.174** | -0.923** | 0.037 | 0.028 | 0.114 | 0.063 | 0.073 | -0.156* | 0.056 | 0.348** | 0.348** | -0.290** | -0.291** | |||||

| DCR | 1 | -0.163** | -0.034 | 0.007 | 0.079 | 0.013 | 0.027 | -0.171* | 0.008 | 0.089 | 0.089 | -0.031 | 0.141* | ||||||

| LVR | 1 | -0.048 | -0.015 | -0.093 | -0.024 | -0.022 | 0.159* | 0.028 | -0.264** | -0.284** | 0.211** | -0.257** | |||||||

| NMB | 1 | -0.009 | 0.095 | 0.090 | 0.089 | 0.238** | 0.177** | 0.219** | 0.251** | 0.229** | -0.090 | ||||||||

| IC1 | 1 | 0.581** | -0.013 | -0.024 | 0.035 | 0.021 | 0.026 | 0.026 | -0.089 | -0.090 | |||||||||

| IC2 | 1 | 0.008 | 0.074 | -0.001 | 0.034 | -0.111 | 0.134* | -0.055 | -0.108 | ||||||||||

| IC3 | 1 | 0.062 | 0.062 | -0.032 | -0.158** | 0.035 | 0. 1 64 | 0 . 0 1 5 | |||||||||||

| IPER | 1 | 0.054 | 0.207* | 0.210 | 0.070 | -0.076 | 0.234** | ||||||||||||

| MSP | 1 | 0.048 | 0.254 | 0.033 | 0.149* | 0.085 | |||||||||||||

| WGB | 1 | 0.145 | 0.081 | 0.153* | -0.138* | ||||||||||||||

| ACP | 1 | 0.074 | -0.021 | -0.167** | |||||||||||||||

| SIZ | 1 | -0.047 | 0.272** | ||||||||||||||||

| AUD | 1 | 0.202** | |||||||||||||||||

| GCO | 1 |

Definition of variables: CRR is the Cash Reserve/Current Liabilities ratio; LQR is the Treasury + Equivalents/Total Assets ratio; WCR is the Working Capital/Total Assets ratio; ATR is the Sales/Total Assets ratio; ROA is the Return on Assets and Tax/Total Assets ratio; RTR is the Retained Earnings/Total Assets ratio; DCR is the Cash Flow/Debt Coverage Ratio; LVR is the Total Debt/Loan to Value Ratio; NMB is the number of members on the board of directors; IC1 is the Sales/Personnel ratio; IC2 is the Earnings Before Interest and Tax/Personnel ratio; IC3 is the ratio of total R & D expenses/ assets; PER is the Sports Performance ratio of the club; MSP is the market size of the club; WGB is the wage bill of the players; ACP are the accumulated points; SIZ is the natural logarithm of total football assets: AUD is a dichotomous variable equal to 1 if the auditor belongs to BIG 4, and 0 otherwise; GCO is a dichotomous variable equal to 1 for the going concern opinion and 0 otherwise.

* Significant at 5% level; ** Significant at 1% level.

Source own elaboration.

Classification Results

Table 5 presents the classification results obtained with the different methods proposed. It is observed that the explanatory variables that have been significant coincide in the selection made by the majority of methods. Also, the highest degrees of precision are obtained with MLP and DT (around 90%), while with Logit and MDA the precision is lower (around 80%). These results are consistent with the conclusions of Jones, Johnstone, and Wilson (2017), who in their study on a comparative analysis between classification methods applied to the prediction of financial difficulties conclude that computational methods are more precise, although statistical techniques still offer reliable results.

Table 5 Classification results

| Classification (%) | RMSE | |||||

| Method | Training | Testing | Training | Testing | COR curve | Significant Variables |

| Logit | 83.36 | 86.24 | 1.28 | 1.35 | 0.90 | MSP, PER, CRR, ROA |

| MDA | 93.75 | 82.86 | 1.69 | 1.81 | 0.86 | MSP, PER, AUD, CRR, WCR, RTR, ROA, SIZ |

| MLP | 80.68 | 95.35 | 0.97 | 0.92 | 0.95 | MSP, PER, DCR, RTR, ROA, IC3 |

| DT | 88.89 | 89.64 | 1.41 | 1.28 | 0.88 | MSP, WGB, AUD, ATR |

RSME: Root-Mean-Squared Error. Source: own elaboration.

Figure 2 shows the classification results of each method in the computational algorithm used. This algorithm starts with the set of selected independent variables and performs 100 iterations; taking at random, for each iteration, 80% of the data for training and 20% for testing. Once the 100 iterations have been carried out, the definitive classification percentages are obtained using the mean of the successes on the test data set.

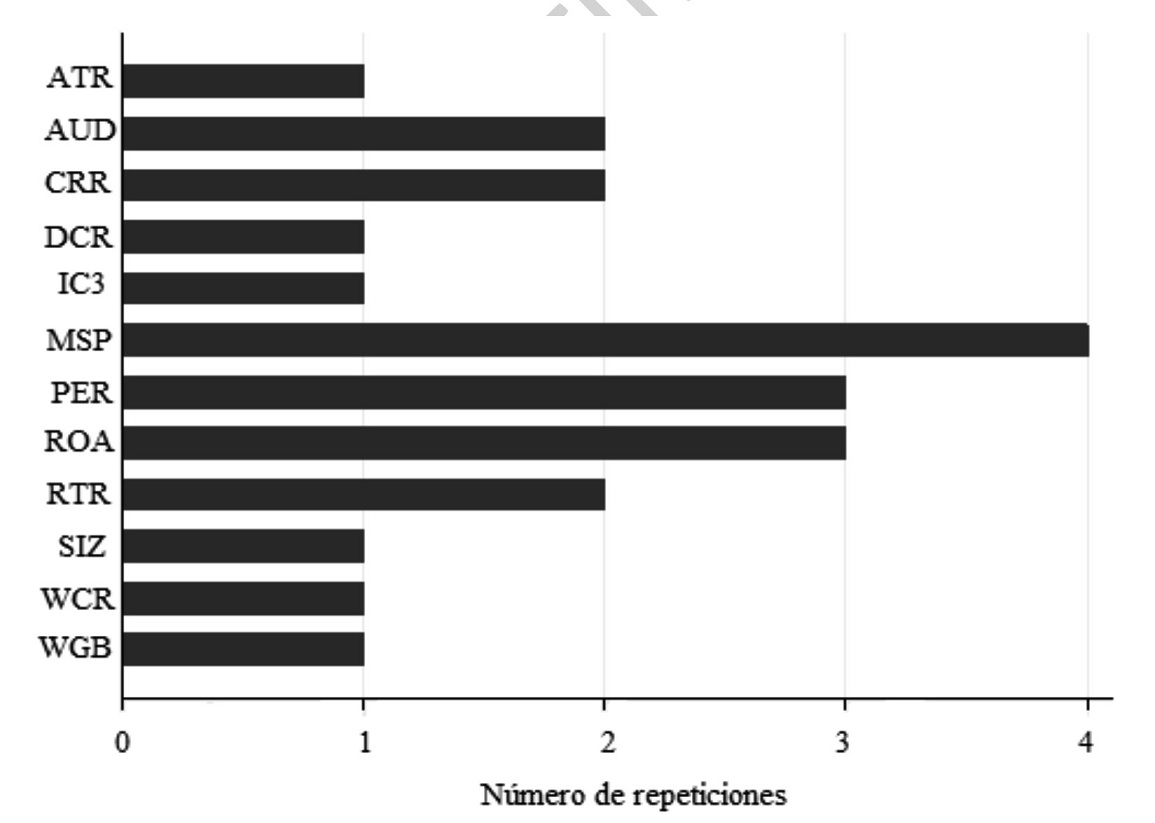

As indicated above, the results obtained show a set of significant variables that are repeated in almost all methodologies used (Figure 3). One of these variables is the size of the provincial market where the club is located (MSP), which has been significant in all four methods. The larger size of the market is related to a higher level of sales and attendance to the stadium, and is closely linked to the economic profitability of the club (Barajas and Rodríguez, 2010; Scelles, Szymansk, and Dermit-Richard, 2016). For its part, the sports performance (PER) variable has been a recurrent ratio in three methods, reflecting the importance of the evolution of the sports scores of the club, closely related to a greater ability to generate income from sporting successes from the managing bodies of competitions, and income from other concepts such as television rights (Barajas and Rodriguez, 2010; Buraimo, Paraimo, and Campos, 2010). Finally, the return on assets (ROA) variable has also been significant in three of the four methods used. ROA is a variable of great importance for business financial viability, as contrasted in numerous previous studies on insolvency prediction (e.g. Atiya, 2001; Callejón, Casado, Fernández, and Peláez, 2013; Hu and Tseng, 2005; Lin and Piesse, 2004). Therefore, clubs that show a small market size (MSP), a low sports performance ratio (PER), and a low return on assets (ROA) are more likely to receive a going concern opinion.

These results for the football industry are different from those obtained for other sectors such as industry or finance. First, due to the variables of the football industry that have been significant in the model developed and that, logically, do not appear in the previous works on other sectors. Such is the case of the sport performance ratio and the size of the market. Second, only one variable has proved to be common with general models, this being return on assets (ROA). This profitability variable is practically significant in all previous models (Anandarajan and Anandarajan, 1999; Hung and Shih, 2009; Yeh et al., 2014). Third, it has also been observed that certain variables that have been significant in previous generic works are not significant for the football industry. For example, indebtedness, corporate governance, auditor type, and intellectual capital, which have been prominent predictors of going concern for the manufacturing, commercial, and service sectors (Abbott, 2000; Anandarajan and Anandarajan, 1999; Beasley, 1996; Martens et al., 2008; Wang and Deng, 2006; Yeh et al., 2014). Therefore, the significant variables in the going concern prediction model for the football industry form a unique and distinct set from that which has been appropriate for other sectors.

Finally, the results obtained in this study also demonstrate that MLP has been the method with the highest level of precision, significantly improving the results obtained in the previous literature on going concern opinion prediction in other industries (Belovary, Giacomino, and Akers, 2007; Sánchez-Medina et al., 2017; Yeh et al., 2014).

Conclusions

The principle of going concern is one of the most important in the preparation of financial statements. Due to this, it has been the focus of financial research for decades, which has developed models to assess the continuity of industrial and financial companies. However, no model has been developed exclusively for the football industry. The activity of football clubs is unique in many ways and, therefore, it seems important that auditors, as well as other stakeholders such as investors and managers, have specially designed tools for the management of these. In order to fill this gap in the literature, this study attempts to shed light on going concern prediction by developing an exclusive model for the football industry. This new model can constitute an empirical control instrument on the indicator referred to in the regulation of the FFP, and it can also improve the recommendations to clubs that present audit reports with going concern.

The model developed in this work has shown that profitability, sport performance, and the size market of the club are the best predictors of the continuity of football clubs. Moreover, with MLP methodology, it is possible to obtain high rates of accuracy in the prediction of audit opinions qualified by going concern (above 95%).

The importance of the football industry in countries such as Spain, where the industry represents a relevant pillar in the social-economic dynamism, suggests a greater involvement of research tasks. Addressing this gap from a scientific point of view, trying to improve the body of evidence that allows better prediction and analysis of clubs, leads to a milestone in research from which future lines of research can derive. Thus, it would be interesting to contrast the results of the present work against models developed with samples of clubs belonging to other regions of the world, for example, the South American Football Confederation (CONMEBOL for its acronym in Spanish) and the Confederation of North, Central America, and the Caribbean Football (CONCACAF), which would allow to know the moderating effect of other cultural and legislative environments on the viability of clubs. It would also be interesting to test the predictive capacity of this model to predict the audit opinion on going concern in other sports industries, since it considers performance characteristics of the football industry and these could be extrapolated to clubs of different disciplines.

REFERENCES

Abbott, L.J., (2000). The effects of audit committee activity and independence on corporate fraud. Managerial Finance, 26, 55-67. https://doi.org/10.1108/03074350010766990 [ Links ]

Anandarajan, M., y Anandarajan, A., (1999). A comparison of machine learning techniques with a qualitative response model for auditors’ going concern reporting. Expert Systems with Applications, 16 (4), 385-392. https:// doi.org/10.1016/s0957-4174(99)00014-7 [ Links ]

Atiya, A., (2001). Bankruptcy prediction for credit risk using neural network: a survey and new results. IEEE Transactions on neural networks, 12 (4), 929-935. https://doi.org/10.1109/72.935101 [ Links ]

Barajas, Á., y Rodríguez, P., (2010). Spanish football clubs’ finances: Crisis and player salaries. International Journal of Sport Finance, 5, 52-66. https://doi.org/10.1057/9781137467959.0008 [ Links ]

Barajas, Á. , y Rodríguez, P. , (2014). Spanish football in need of financial therapy: Cut expenses and inject capital. International Journal of Sport Finance , 9, 73-90. https://doi.org/10.2139/ssrn.2392533 [ Links ]

Beasley, M.S., (1996). An empirical analysis of the relation between the board of director composition and financial statement fraud. The Accounting Review, 71 (4), 443-465. https://doi.org/10.2469/dig.v27.n2.79 [ Links ]

Bellovary, J.L., Giacomino D.E., y Akers, M.D., (2007). A review of going concern prediction studies: 1976 to present. Journal of Business and Economic Research, 5, 9-28. https://doi.org/10.19030/jber.v5i5.2541 [ Links ]

Buraimo, B., Paramio, J.L., y Campos, C., (2010). The impact of televised football on stadium attendances in English and Spanish league football. Soccer & Society, 11 (4), 461-474. https://doi.org/10.1080/14660971003780388 [ Links ]

Callejón, A.M., Casado, A.M., Fernández, M.A., y Peláez, J.I., (2013). A System of Insolvency Prediction for industrial companies using a financial alternative model with neural networks. International Journal of Computational Intelligence Systems, 6 (1), 29-37. https://doi.org/10.1080/18756891.2013.754167 [ Links ]

Chen, K.C.W., y Church, B.K., (1992). Default on debt obligations and the issuance of going-concern opinions. Auditing: A Journal of Practice and Theory, 11 (2), 30-50. [ Links ]

Ciechan-Kujawa, M., (2017). The business audit as an alternative to discriminant analysis in assessing risks of going concern. Financial Environment and Business Development, 113-126. Proceedings of the 16th Eurasia Business and Economics Society Conference. https://doi.org/10.1007/978-3-319-39919-5_10 [ Links ]

Citron, D., Taffler, R., y Jinn-Yang, U., (2008). Delays in reporting price-sensitive information: the case of going concern. Journal of Accounting and Public Policy, 27, 19-37. DOI: https://doi.org/10.1016/j.jaccpubpol.2007.11.003 [ Links ]

Cordos, G.S., y Fülöp, M.T., (2015). Understanding audit reporting changes: introduction of Key Audit Matters. Accounting and Management Information Systems, 14 (1), 128-152. https://doi.org/10.2139/ssrn.3069755 [ Links ]

Cornier, D., Magnan, M., y Morard, B., (1995). The auditor’s consideration of the going concern assumption: A diagnostic model. Journal of Accounting, Auditing & Finance, 10(2), 201-222. https://doi. org/10.1177/0148558x9501000201 [ Links ]

Dopuch, N., Holthausen, R., y Leftwich, R., (1987). Predicting audit qualifications with financial and market variables. The Accounting Review , 63 (3), 431-453. https://doi.org/10.2139/ssrn.1672826 [ Links ]

Fisher, R.A., (1936). The use of multiple measurements in taxonomic problems. Annals of Human Genetics, 7 (2), 179-188. https://doi.org/10.1111/j.1469-1809.1936.tb02137.x [ Links ]

Gaeremynck, A., y Willekens, M., (2003). The endogenous relationship between audit-report type and business termination: Evidence on private firms in a non-litigious environment. Accounting and Business Research, 33 (1), 65-79. https://doi.org/10.1080/00014788.2003.9729632 [ Links ]

Gallizo, J.R., y Saladrigues, R., (2016). An analysis of determinants of going concern audit opinion: Evidence from Spain stock exchange. Intangible Capital, 12 (1), 1-16. https://doi.org/10.3926/ic.683 [ Links ]

Gerakos, J., Hahn, P.R., Kovrijnykh, A., y Zhou, F., (2016). Prediction versus inducement and the informational efficiency of going concern opinions. Chicago Booth Research Paper No. 16-01. https://doi.org/10.2139/ ssrn.2727771 [ Links ]

Goo, Y.J.J., Chi, D.J., y Shen, Z.D., (2016). Improving the prediction of going concern of Taiwanese listed companies using a hybrid of LASSO with data mining techniques. SpringerPlus, 5, 539. https://doi.org/10.1186/ s40064-016-2186-5 [ Links ]

Hair, J.F., Anderson R.E., Tatham, R.L. y W.C. Black, W.C., (1999). Análisis multivariante, 5ª edición. Editorial Prentice Hall. Madrid. [ Links ]

Hu, Y., y Tseng, F., (2005). Applying backpropagation neuronal networks to bankruptcy prediction. International Journal of Electronic Business Management, 3 (2), 97-103. https://doi.org/10.4018/9781591401766.ch008 [ Links ]

Hung, Y.C., y Shih, Y.N., (2009). A prediction model of going-concern from the viewpoint of sustainable development. The 1st International Conference on Information Science and Engineering. https://doi.org/10.1109/ icise.2009.138 [ Links ]

Inoue A., y Kilian, L., (2005). How useful is bagging in forecasting economic time series? A case study of U.S. CPI Inflation, NCSU and University of Michigan. [ Links ]

Ireland, J.C., (2003). An empirical investigation of determinants of audit reports in the UK. Journal of Business Finance and Accounting, 30 (7-8), 975-1015. https://doi.org/10.1111/1468-5957.05417 [ Links ]

Ittonen, K., Tronnes, P.C., y Wong, L., (2017). Substantial doubt and the entropy of auditors’ going concern modifications. Journal of Contemporary Accounting & Economics, 13 (2), 134-147. https://doi.org/10.1016/j.jcae.2017.05.005 [ Links ]

Khan, S. A., Lobo, G., Nwaeze, E. T., (2017). Public re-release of going-concern opinions and market reaction. Accounting and Business Research , 47 (3), 237-267. https://doi.org/10.1080/00014788.2016.1255586 [ Links ]

Kingsford, C., y Salzberg, S. L., (2008). What are the decision trees? Nature Biotechnology, 26, 1011-1013. [ Links ]

Klersey, G. y Dugan, M., (1995). Substantial doubt: Using artificial neural networks to evaluate going concern. Article in Advances in Accounting Information Systems, Volume 3, S. Sutton (ed.). Greenwich, CT: JAI Press, Inc., 137-159. https://doi.org/10.1016/j.jcae.2017.05.005 [ Links ]

Koh, H. y Brown, R., (1991). Probit prediction of going and non-going concerns. Managerial Auditing Journal, 6(3), 18-23. https://doi.org/10.1108/02686909110004914 [ Links ]

Koh, H.C., y Low, C.K., (2004). Going concern prediction using data mining techniques. Managerial Auditing Journal , 19 (3), 462-476. https://doi.org/10.1186/s40064-016-2186-5 [ Links ]

Koh, H. y Tan, S., (1999). A neural network approach to the prediction of going concern status. Accounting and Business Research , 29 (3), 211-216. https://doi.org/10.1080/00014788.1999.9729581 [ Links ]

Kusar, A., Taffler, R.J., y Tan, C.E.L., (2017). Legal regimes and investor response to the auditor’s going-concern opinion. Journal of Accounting, Auditing & Finance , 32 (1), 40-72. https://doi.org/10.1177/0148558x15602390 [ Links ]

Lenard, M., Alam, P., y Madey, G., (1995). The application of neural networks and a qualitative response model to the auditor’s going concern uncertainty decision. Decision Sciences, 26 (2), 209-227. https://doi. org/10.1111/j.1540-5915.1995.tb01426.x [ Links ]

Lin, L., y Piesse, J., (2004). Identification of corporate distress in UK industrials: A conditional probability analysis approach. Applied Financial Economics, 14, 73-82. https://doi.org/10.1080/0960310042000176344 [ Links ]

Martens, D., Bruynseels, L., Baesens, B., Willekens, M. , y Vanthienen, J., (2008). Predicting going concern opinion with data mining. Decision Support Systems, 45, 765-777. https://doi.org/10.1016/j.dss.2008.01.003 [ Links ]

Martin, R.D., (2000). Going-concern uncertainty disclosures and conditions: A comparison of French, German, and U.S. practices. Journal of International Accounting, Auditing & Taxation, 9 (2), 137-158. https://doi. org/10.1016/s1061-9518(00)00029-x [ Links ]

McKee, T., (1976). Discriminant prediction of going concern status: A model for auditors. Selected Papers of the AAA Annual Meeting. [ Links ]

Menon, K., y Schwartz, K.B., (1987). An empirical investigation of audit qualification decisions in the presence of going concern uncertainties. Contemporary Accounting Research, 3 (2), 302-315. https://doi. org/10.1111/j.1911-3846.1987.tb00640.x [ Links ]

Mo, P. L. L., Rui, O. M., y Wu, X., (2015). Auditors’ going concern reportingin the pre- and post-bankruptcy law eras: Chinese affiliates of Big 4 versus local auditor. The International Journal of Accounting, 50, 1-30. https:// doi.org/10.1016/j.intacc.2014.12.005 [ Links ]

Mutchler, J., (1985). A multivariate analysis of the auditor’s going-concern opinion decision. Journal of Accounting Research, 23 (2), 668-682. https://doi.org/10.2307/2490832 [ Links ]

Mutcher, J., Hopwood, W., y McKeown, J.M., (1997). The influence of contrary information and mitigating factors on audit opinion decisions on bankrupt companies. Journal of Accounting Research , 35 (2), 295-310. https:// doi.org/10.2307/2491367 [ Links ]

Myers, L. A., Schmidt, J., y Wilkins, M., (2014). An investigation of recent changes in going concern reporting decisions among Big N and non-Big N auditors. Review of Quantitative Finance and Accounting, 43, 155-172. https://doi.org/10.1007/s11156-013-0368-6 [ Links ]

Nuñez de Castro, L., y von Zuben, F.J., (1998). Optimised training techniques for feedforward neural networks. Technical Report DCA RT 03/98. Department of Computer Engineering and Industrial Automation. FEE/UNICAMP, Brasil. [ Links ]

O’Reilly, D.M., (2009). Do investors perceive the going-concern opinion as useful for pricing stocks? Managerial Auditing Journal , 25 (1), 4-16. https://doi.org/10.1108/02686901011007270 [ Links ]

Sánchez-Medina, A.J., Blázquez-Santana, F., y Alonso, J.B., (2017). Do auditors reflect the true image of the company contrary to the clients’ interests? An artificial intelligence approach. Journal of Business Ethics, 141 (1), 1-17. https://doi.org/10.1007/s10551-017-3496-4 [ Links ]

Scelles, N., Szymanski, S., y Dermit-Richard, N., (2016). Insolvency in French soccer: The case of payment failure. Journal of Sports Economics, 19 (5), 603-624. https://doi.org/10.1177/1527002516674510 [ Links ]

Soto-Pineda, J.A., (2017). El control de ayudas públicas en la Unión Europea sobre los clubes del fútbol español. Revista de Derecho, 48, 54-130. https://doi.org/10.14482/dere.48.10142 [ Links ]

Sun, J., y Li, H., (2009). Financial distress prediction based on serial combination of multiple classifiers. Expert Systems with Applications , 36, 8659-8666. https://doi.org/10.1016/j.eswa.2008.10.002 Union of European Football Associations (UEFA), (2008). Club Licensing: Here to Stay. [ Links ]

Union of European Football Associations (UEFA), (2015). UEFA Club Licensing and Financial Fair Play Regulations, Edition 2015. [ Links ]

Wang, Z.J., y Deng, X.L., (2006). Corporate governance and financial distress. The Chinese Economy, 39 (5), 5-27. https://doi.org/10.4337/9781843769835.00011 [ Links ]

Yang, J.B., Shen, K.Q., Ong, C.J., y Xiao-Ping Li, X.P., (2008). Feature selection via sensitivity analysis of MLP probabilistic outputs. IEEE International Conference on Systems, Man and Cybernetics. https://doi. org/10.1109/icsmc.2008.4811372 [ Links ]

Yeh, C.C., Chi, D.J. , y Lin, Y.R., (2014). Going-concern prediction using hybrid random forests and rough set approach. Information Sciences, 254, 98-110. https://doi.org/10.1016/j.ins.2013.07.011 [ Links ]

Annex

Table A1 Abbreviations

| Abbreviation | Meaning |

| ACP | Accumulated Points |

| AntMiner + | Ant colony optimization |

| ATR | Sales/Total Assets |

| AUD | 1 if the Auditor is Big 4, and 0 otherwise |

| CART | Classification and regression tree |

| CONCACAF | Conjunctive Normal Form |

| CONMEBOL | Confederation of North, Central America, and Caribbean Football |

| COR | South American Football Confederation |

| CRR | Cash Reserve Ration |

| DCR | Debt Coverage Ratio |

| DT | Disjunctive Normal Form |

| FFP | Decision Trees |

| FNC | Financial Fair Play |

| FND | Dichotomous dependent variable |

| GCO | Hill Climbing |

| Hill Climbing | International Auditing and Assurance Standards Board |

| IAASB | Sales/Personnel |

| IC1 | Earnings Before Interest and Taxes/Personnel |

| IC2 | Research and Development Expenses/Total Assets |

| IC3 | International Standards on Auditing |

| LASSO | Least Absolute Shrinkage and Selection Operator |

| Logit | Logistic Regression |

| LQR | Treasury + Equivalents/Total Assets |

| LVR | Loan To Value Ratio |

| MDA | Multiple Discriminant Analysis |

| MLP | Multilayer Perceptron |

| MSP | Market Size (Province Population) |

| NACE Rev.2 | Statistical classification of economic activities in the European Community |

| NIA | Number of Board Members |

| NMB | Sport Performance of the club (Szymanski Ranking) |

| PER | Return on Assets |

| ROA | Receiver Operating Characteristics |

| RSME | Root-Mean-Squared Error |

| RTR | Retained Earnings/Total Assets |

| S.A.D. | Sports Public Limited Company |

| SABI | Iberian Balance Sheet Analysis System |

| SIZ | Total Assets Logarithm |

| SVM | Support Vector Machines |

| UEFA | Union of European Football Associations |

| WCR | Working Capital Ratio |

| WGB | Wage Bill |

Received: November 15, 2017; Accepted: August 13, 2018; Published: October 21, 2019

text in

text in