Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Contaduría y administración

versión impresa ISSN 0186-1042

Contad. Adm vol.64 no.3 Ciudad de México jul./sep. 2019 Epub 21-Ago-2020

https://doi.org/10.22201/fca.24488410e.2019.2340

Uncertainty of the international oil price and stock returns in Mexico through an SVAR-MGARCH

1Universidad Nacional Autónoma de México, México

2Universidad Autónoma Metropolitana, México

In this work, the impact of oil price uncertainty on Mexican stock market returns is examined. The uncertainty of the international oil price is approximated through the conditional standard deviation of the error forecast one step ahead of the variation in the oil price. To this end, a SVAR-MGARCH-in-mean model was estimated with monthly data of the international oil price returns and the Mexican Stock Exchange price and quotation index, both in real terms from January 1975 to September 2018, with the main advantage being that it allows the simultaneous estimation of both the mean and the uncertainty. The results reveal that the uncertainty of the international oil price does not have an immediate impact on stock market returns. However, the results show the presence of short-term asymmetric effects in the face of negative and positive shocks in the international oil price.

JEL Codes: C32; G10; G15; Q43

Keywords: Oil Prices; Stock Returns; Volatility; GARCH Models; Energy; Emerging Markets

En este trabajo examinamos el impacto de la incertidumbre del precio del petróleo en los rendimientos del mercado accionario de México. La incertidumbre del precio internacional del petróleo es aproximada mediante la desviación estándar condicional del pronóstico de error de un paso adelante de la variación en el precio del petróleo. Con tal fin estimamos un SVAR-MGARCH en media con datos mensuales de los rendimientos del precio internacional del petróleo y del índice de precios y cotizaciones de la Bolsa Mexicana de Valores, ambos en términos reales de enero de 1975 a septiembre de 2018, cuya principal ventaja es que permite la estimación simultánea tanto de la media como de la incertidumbre. Los resul-tados revelan que la incertidumbre del precio internacional del petróleo no tiene un impacto inmediato en los rendimientos del mercado accionario. No obstante, los resultados muestran la presencia de efectos asimétricos de corto plazo ante choques negativos y positivos del precio internacional del petróleo.

Códigos JEL: C32; G10; G15; Q43

Palabras clave: Precios del Petróleo; Rendimientos Accionarios; Volatilidad; Modelos GARCH; Energía; Mercados Emergentes

Introduction

Recently, world energy prices have shown instability (Aye, 2015). In fact, there have been periods of great volatility in international oil prices even though their average level has remained constant (Baskaya et al., 2013).Volatility is an inherent characteristic of oil prices in general, due to its vast use as input in the production process, and as a consumer good (Swanepoel, 2006). Similarly, it is recognized that oil price volatility can have a major influence on global economy. This characteristic has raised concerns among economic policymakers, international institutions, politicians, and investors, with regard to the possibility of a detrimental impact on macroeconomics (Aye, 2015). Consequently, researchers have become more interested in the understanding of the nature of the link between oil price volatility and macroeconomic performance.

Several studies have focused on the impact of oil price uncertainty on certain real macroeconomic variables, such as consumption, investment, and growth. Along with this interest in studying the impact of oil price volatility and uncertainty on economic activity, the recent global financial crisis has also drawn attention to the stock market. In this context, understanding how oil prices impact stocks has become relevant and critical for different funds, such as hedge funds, commodity indices, and other financial institutions (Maghyereh and Awartani, 2016).

Theoretically, the prices of the assets are determined by the discounted cash flows (Fisher, 1930; Williams, 1938). In this manner, the factors that come into play in the expected cash flows have a significant impact on stock prices (Bass, 2017). In general terms, any increase in the price of oil would result in an increase in costs, limiting the earnings and, to a greater degree, it would cause a decrease in the stockholder value. Therefore, any increase in the price of oil would entail a decrease in stock prices (Filis et al., 2011).

According to Bjornland (2009) and Jiménez-Rodríguez and Sánchez (2005), in an oil-exporting country, an increase in the price of oil has a positive impact, as it increases the income of that country. If aggregate income increases, spending and investment increase, which in turn raises productivity and decreases unemployment. In this scenario the stock market tends to respond positively.

In an oil importing country, an increase in the price of oil can have adverse effects (LeBlanc and Chinn, 2004; Hooker, 2002) as oil is one of the main production factors used by companies and households. This leads to an increase in costs (Filis et al., 2011; Arouri and Nguyen, 2010; Backus and Crucini, 2000; Kim and Loungani, 1992). This increase in prices is transferred to companies and households, which can lead to inflationary pressures and a fall in the demand of families with an elastic demand function (Bernanke, 2006; Hamilton, 1988). Reduced demand and rising inflation expectations lead to declining output and employment (Lardic and Mignon, 2006; Brown and Yücel, 2002; Davis and Haltiwanger, 2001). This ultimately deteriorates the macroeconomic environment and leads to a negative stock market reaction (Sadorsky, 1999; Jones and Kaul, 1996). Filis et al. (2011) point out that shocks to oil prices can influence the stock market through uncertainty, which in turn affects the stock market according to their origin, either on the supply or demand side. If the oil price shock comes from the demand side, then the reaction of the stock market can be positive, conversely, if it comes from the supply side, the impact can be negative (Bass, 2017).

Ross (1989) suggests that volatility in price change can be a good approximation of the information flow rate in financial markets. In consequence, oil price volatility shocks can have an impact on real stock returns.

Another interesting aspect that has caught the attention of researchers is the fact that the impact of oil price is asymmetric, that is, the impact of an increase in the price of oil is not the same as that of a reduction in price (Aye, 2015). Sadorsdy (1999) provides two possible explanations regarding the asymmetric effects of international oil price shocks in economic activity. The first suggests that what is important is the magnitude of the changes in the relative prices. The second has to do with the irreversibility of the investment under uncertainty and emphasizes that there is an option value associated with the wait-to-invest.

Nevertheless, despite this growing interest, research on this topic has mostly been carried out for developed countries. Studies on developing countries are limited and the majority focuses on the stock markets of oil-importing countries, while only a few have been done for oil exporting countries (Awartani and Maghyereh, 2013; Basher et al., 2012; Chen, 2010; Elder and Serletis, 2010; Maghyereh and Al-Kandari, 2007; Maghyereh and Awartani, 2016; Jones and Kaul, 1996; Maghyereh, 2004; Kilian and Park, 2009; Masih et al., 2011; Sadorsky, 1999; Wei, 2003).

In this work, the aim is to determine whether the uncertainty associated with the international price of oil affects the Mexican stock market. To this end, a modified general bivariate model that incorporates a GARCH term into one of the equations of the mean is used, thus avoiding the regressor problem generated by Pagan (1984), which relates to the estimation of the variance function parameters separately from the conditional mean parameters by estimating all parameters simultaneously through the maximum likelihood method with complete information, as proposed by Elder (1995; 2004) and Elder and Serletis (2010).

Review of the Empirical Studies

This section presents a summary of the main studies that have addressed the relationship between oil price uncertainty and stock market prices, or its returns, from oil importing and exporting counties.

A brief review of the literature that has addressed this relationship is presented in Table 1.

Table 1 Summary of the relevant empirical studies

| Author (year) | Variables | Methodology | Results |

| Hannoudeh and Li (2005) | 3-month oil Price futures NYMEX, MSCI, US Amex Oil Index, US NYSE Transportation Index, Mexico CPI, Oslo Stock Exchange Index | VECM, APT | The increase of oil prices is detrimental to global capital marjets, and it has a positive impacto n oil related stocks. |

| Agren (2006) | Stock markets in Japan, Norway, Sweden, the United Kingdom, and the United States | Asymmetric BEKK model | Evidence of spillover effects of international oil Price volatility to stock markets except Sweden; Spillover effects of voatility are small in magnitude but statistically significant. |

| Sadorsky (2006) | Oil Price risk and 21 emmering stock market returns | International Multifuncional Model | Evidence found that oil Price risk has a positive impact on stock returns in emering markets |

| Malik and Ewing (2009) | Oil Price and three U.S. sectoral stock returns (technology, health, and consumer services). | Bivariate GARCH models | Evidence of negative and significant relationship between sector index returns and oil Price volatility. |

| Arouri et al. (2011) | Transmission of volatility between oil and stock markets in Europe and the United States at sector level. | Generalized VAGARCH model | Generalized direct propagation of volatility between sectoral and oil stock returns. Cross-effects of oil volatility on European stock markets, while in the United States there are spillovers volatility in both directions. |

| Lee and Chiou (2011) | Relationship between WTI oil Price and S&P500 | Univariateregrime switching GARCH model. | In the face of significant fluctuations in the Price of oil, unexpected changes in the Price of oil lead to negative impacts on the returns of the S&P500, the result is not maintained in a regime of minor fluctuations in the Price of oil. |

| Choi and Hammoudeh (2010) | Brent and WTI Oil Prices, Commodity Prices, and S&P500 Index. | Symmetric GARCH-DCC model | Show evidence of increasing correlations between Brent oil, WTI oil, copper, gold, and silver prices, butc correlations decrease with the S&P500 index. |

| Filis et al. (2011) | Stock market prices and oil prices for oil-importing countries (United States, Germany, and the Netherlands) and oil-exporting countries (Canada, Mexico, and Brazil) | Variant correlations in time | Evidence that the variable correlation in time does not differ for the oil importing and oil exporting economies, the correlation increases positively (negatively) in response to important shocks in the Price or oil on the agrregate demand side (precautionary demand) as a result of the fluctuations of the world economic cycle. The results of the outdated correlation show that oil prices have a negative effect on all stock markets. |

| Masih et al. (2011) | South Korea | VEC model | Negative impacto of oil Price volatility on real stock returns |

| Jouini (2013) | World oil Price and sector returns in Saudi Arabia | VAR-GARCH model | Evidence of transmission of volatility between oil prices and sector returns. |

| Chang et al. (2009) | WTI oil futures returns and stock returns of 10 global oil companies. | Multivariate GARCH models | There is no evidence of volatility spills |

| Arouri et al (2012) | European oil markets and stockholders | VAR-GARCH model | They find significant effects of volatility spillovers between the Price of oil and sectorial stockholder returns. |

| Jiranyakul (2014) | Oil Price uncertainty and Thai stock returns. | Bivariate GARCH model, Granger causality test in pairs. | Evidence that movements in the real Price of oil do not adversely affect real stock market performance, but stock Price volatility does affect real stock performance. They find evidence of positive one-way volatility transmission from oil to the stock market. |

| Olson et al. (2014) | Energy and stock markets of the Goldman Sachs Energy Index and the S&P500 | Multivariate Bekk model | The results show that low S&P500 returns cause substantial increases in energy index volatility; however, they find a weak response from S&P500 volatility to energy Price shocks. |

| Basher and Sadorsky (2006) | Oil Price in a set of 21 emerging stock market returns. | Clustered regression analysis. | There is a satistically significant strong impact. |

| Gupta and Modise (2013) | South African oil prices and stock market returns | Structural VAR | Foir oil-importing countries, stock returns increase as a result of an increase in oil prices only when the world economy is growing. In case of speculative demand and oil supplt shocks, stock returns decrease. |

| Wang et al. (2013) | World oil production, real global economic activity, WTI crude oil Price and stock índices from the United States, Japan, Germany, France, United Kingdom, Italy, China, Korea, India, Saudi Arabia, Kuwait, Mexico, Norway, Russia, Venezuela, and Canada. | Structural VAR | None of the stock markets under study responds to oil Price shocks. Stock markets in oil-exporting countries respond positively to positive aggregate demand shocks. Results are inconclusive for precautionary demand shocks, for most capital markets the effects are insignificant. |

| Maghyereh and Awartani (2016) | Weekly closing prices of the stock markets of ten countries included in the simple and, as proxy for the Price of oil, the spot Price of Brent crude oil. | SVAR-MGARCH-in-mean. | Oil Price uncertainty is important in determining actual stock returns. There is a significant negative relationship between oil Price uncertainty and actual stock return in all countries in the simple. The incidence of oil Price risk is strongest in those economies that rely heavily on oil revenues to grow. |

| Bass (2017) | International oil Price and stock market returns of Russia | SVAR-MGARCH-in-mean. | Uncertainty in oil prices has a positive and statistically significant impacto n stock returns. It also finds evidence of asymmetrical effects on stock returns in the face of negative and positive oil Price shocks. |

| Kocaarslan et al. (2017). | Daily closing prices of the Morgan Stanley International Capital Indices, specifically of BRICs and the United States as well as different short-term volatility índices of the S&P500 Index, of Exchange rate of the dólar against the euro, of oil, and of gold | VAR-A-DCC-EGARCH (1,1) and VAR-DCC-EGARCH (1,1) models | The impact of volatility expectations on US stock, gold and oil markets are asymmetric and dependo n the level of correlations. Additionally, the interdependence between markets is driven by risk perceptions in both financial and non-financial markets. |

| Mensi et al. (2017) | Daily closing spot prices of the WTI and the índices of four developed capital markets (S&P 500, STOXX 600, DJPS and tsx). | Variational mode decomposition (VMD) and symmetric and asymmetric copulation functions that vary in time. | They show the existence of a queuing dependence between oil returns and all stock markets. Similarly, the reveal the existence of an average dependence between markets considered for short-term horizons- They also find dependence on long-term queues between the oil and stock markets, with the exception of the S&P500 index. Addiotionally, ther find strong evidence of ups and downs in asymmetric risk and viceversa in different time horizons. |

| Li and Wei (2018). | The daily spot Price of Brent crude, expressed in yuan, and the Shanghai Stock Exchange (SSEC) stock index. | Copula method base don variational decomposition mode. | The recent financial crisis increases the dependence between the international oil market and the Chinese stock market, long-term dependence increases more significantly tan short-term dependence. The VaR of the Chinese stock market increases sharply around the financial crisis, but it is reduced compared to the pre-crisis risk. Oil Price risk spillvers to the Chonese stock market display strong asymmetric characteristics. |

| Shazad et al. (2018) | WTI daily spot prices and stock índices from five markets (World Islamic Market Index, Islamic Index for the US, the UK, and Japan, and Islamic Financial Sector Index). | Text of extreme dependence through the copula method. | Evidence of lower tail dependence that varies over time between the Islamic and oil stock markets. |

Source: Updated base don Table 1 by Bass (2017)

Given the results presented in Table 1, the following can be highlighted: i) research on the subject has focused on developed countries, hence the relevance and importance of researching emerging economies; ii) existing studies are mainly devoted to the analysis of the relationship between oil prices and the market value of stocks, studies on the impact of oil price uncertainty on stock markets are scarce; iii) evidence from previous studies is mixed (Bass, 2017), in this manner, some researchers have come to the conclusion of an existing relationship between the uncertainty of oil prices and stock market returns, while others have concluded the absence of said relationship; iv) most of the studies symmetrically analyze the reaction of the stock market to the positive and negative shocks of uncertainty in the oil prices.

Methodology of Econometrics

In order to determine whether oil price uncertainty affects stock market activity in Mexico, the model used was that developed by Elder (2004), utilized in Elder and Serletis (2010), which is a bivariate model for stock market returns (at market prices) and oil price fluctuations. The model consists of a structural VAR modified to take into account the parametric conditional heteroscedasticity of a bivariate GARCH-in-mean. The dynamics of the structural system can be summarized by a linear function of the sample variables and the terms related to the conditional variance, which can be represented as follows:

Ay=K+

Conditonal variance Ht is modeled as a bivariate GARCH, which is a general version of the representation of Engle and Kroner (1995):

Where

Where diag is the operator that extracts the diagonal from a square matrix. The second and third terms in equation (3) represent the terms ARCH and GARCH. By imposing an additional restriction, that the conditional variance of yi,t depends solely on its own past errors and conditional variances, the parameter matrices Fj and Gi are also diagonals. The function of variance is estimated with J = I = 1, which is a specification for a VAR-GARCH (1,1) -in-mean model.

The bivariate VAR-GARCH-in-mean modelis represented by equations (1) and (3), which are estimated using the maximum likelihood method with complete information to avoid the problem of the generated regressor related to the estimation of the variance function parameters separately from the conditional mean parameters (Pagan, 1984; Bass, 2017). The estimation procedure consists of maximizing the likelihood logarithm with respect to the structural parameters A, K, Г1,Г,,Гn, Ω, F and G, where:

According to Elder and Serletis (2010), pre-sample values of the conditional variance matrix H0 are determined according to their unconditional hope and are conditional on the values of the sample. Additionally, the following restrictions are imposed to ensure that H1 is defined as positive and that has stationary covariance: i) that Cv is positive; ii) that F contains non-negative elements; and iii) that the eigenvalues of (F + G) have a module less than one (Aye, 2015; Bass, 2017). If standard regularity conditions are met, the maximum likelihood method with complete information provides asymptotically normal and efficient estimates.

By imposing the usual identification conditions on autoregressive vectors, it is possible to estimate the B free parameters subject to the rank condition. Following Aye (2015) and Bass (2017), in order to comply with this condition, the following restriction was imposed: the returns of the Mexican stock market respond to the shocks of real international oil prices, but not vice versa.

Similarly, it is possible to test asymmetric effects of real international oil price shocks on stock market returns in real terms. To this end, the impulse-response functions are used. The impulse-response functions of VAR-GARCH-in-mean are estimated according to the proposal by Elder (2003), and the confidence intervals are determined according to the Monte Carlo method (Hamilton, 1994). Responses to simulated shocks are derived through the maximum likelihood method of the model. From the parameter values randomly extracted from the sample distribution of the maximum likelihood estimators, confidence intervals are generated from the simulation of 1000 impulse-response functions.

Data

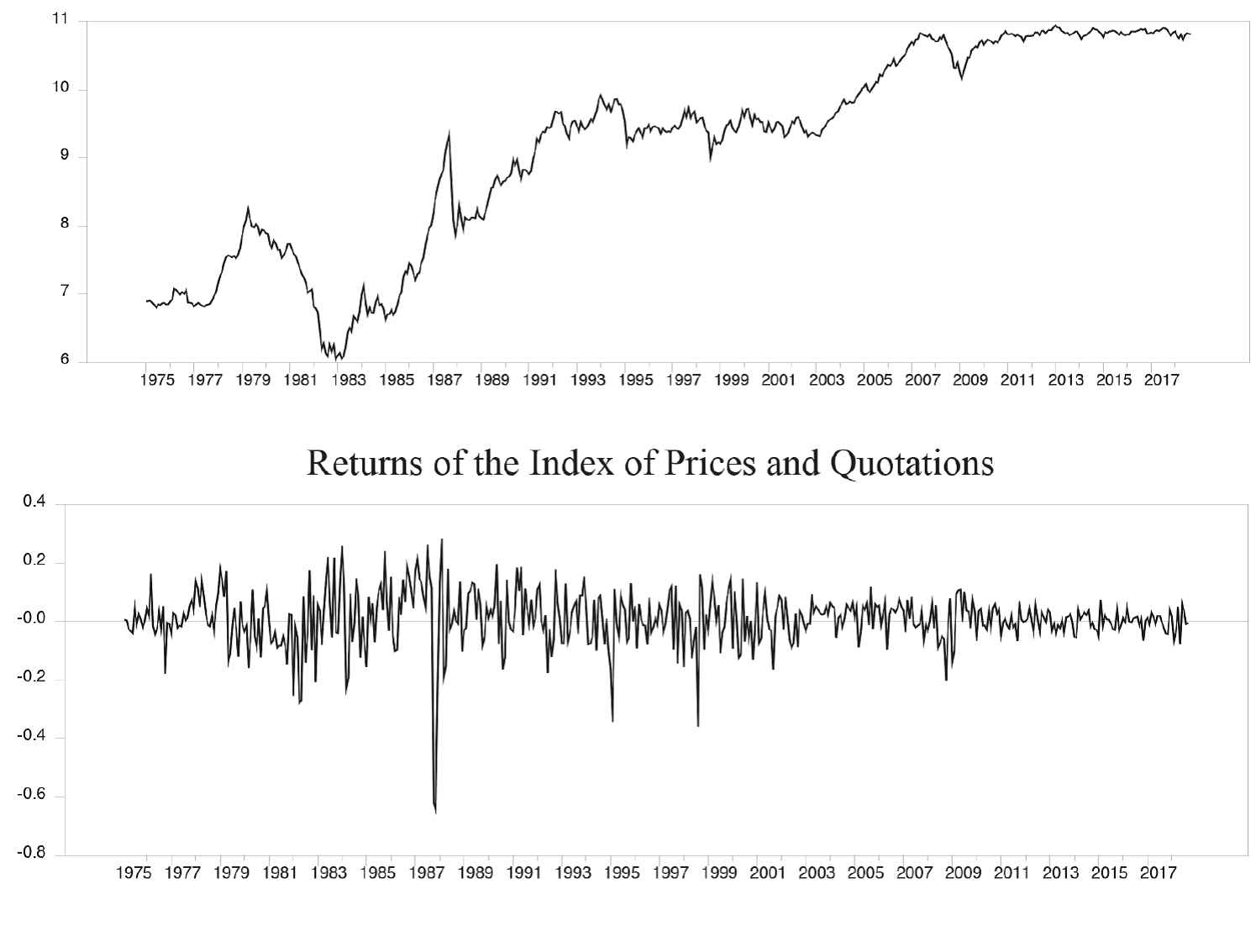

International oil price returns were calculated from the West Texas Intermediate (WTI) price, which was obtained from two sources: from January 1975 to December 1985 it was taken from Balcilar, Gupta, and Miller (2015), while from January 1986 to September 2018 the series comes from the U.S. Energy Information Administration (EIA)1. To express it in real terms, it is deflated with the U.S. consumer price index. Meanwhile, stock market returns were obtained from the Index of Prices and Quotations (IPC for its acronym in Spanish) expressed in local currency and in real terms from the Mexican Stock Exchange (BMV for its acronym in Spanish), this last series was extracted from Economatica. In this manner, there are a total of 525 observations of the two series. Both series of returns were obtained from their first logarithmic differences.The choice is made to use local currency returns to isolate the effect of the exchange rate; Bass (2017) carries out a similar procedure for the case of Russia. Conversely, Aye (2015) converts the international price of dollars to the South African rand in order to not ignore the effect of the exchange rate. However, Aye (2015) stresses that his conclusions remain, regardless of whether the oil price is expressed in dollars or in the local currency of South Africa.

Figure 1 shows the evolution of the real price of oil and its returns in the analysis period. Figure 2 presents the evolution of the Index of Prices and Quotations in local currency and its returns.

Empirical Results

Table 2 shows the results of the Lagrange multiplier unit root tests with two changes in (mean) level.

Table 2. Endogenous two-break Lagrange multiplier unit root test

|

Logarithmic difference

of international oil price in real terms. Model A: k = 0, TB1=1985:12, TB2 =2008:11, N = 519. Critical value at 5%: -3.842 (T=100) | ||||

| Parameter | μ0 | d 1 | d 2 | ᴓ |

| Estimate t statistic |

-0.0134 -4.0287 |

-0.1486 -2.0152 |

-0.2724 -3.6494 |

-0.7178 -16.9791 |

|

Logarithmic difference

of the Index of Prices and Quotations in real

terms. Model A: k = 0, TB1=1975:7, TB2 =2018:9, N = 519. Critical value at 5%: -3.842 (T=100) | ||||

| Parameter | μ0 | d 1 | d 2 | ᴓ |

| Estimate t statistic |

-0.0134 -4.0287 |

-0.1486 -2.0152 |

-0.2724 -3.6494 |

-0.7178 -16.9791 |

Nule Hypothesis:

Alternative hypothesis:

where Djt = 1 for t ≥ TBj + 1,j = 1,2 and 0 otherwise; Bjt =1 for t ≥ TBj + 1,j = 1,2 and 0 otherwise; TBj indicates the break date

As can be seen in Table 2, the results of the two-break unit root tests in the mean reveal that both series are stationary. Bearing in mind that both series are stationary, the SVAR-MGARCH-in-mean model is estimated on average with the returns of both oil prices in real terms and those of the Index of Prices and Quotations, also in real terms, by including 1 lag according to what is suggested by the Akaike and Schwarz criteria. The results of the specification test are presented in Table 3.

Table 3 Model Specification Tests 1984:2 - 2017:4

| VAR model and sample | VAR | VAR with MGARCH-M |

| Real oil price and stock market returns | 7423.46 | 7188.48 |

The Schwarz criterion values reported in Table 3 indicate that the VAR, with both real oil price and stock market returns with GARCH-in-mean effects, better captures the characteristics of the data as compared to the homoscedastic VAR.

Table 4 reports the estimated coefficients of the conditional variance equations for each of the variables incorporated in the model. The values of the estimated parameters clearly show that the coefficients of the terms ARCH and GARCH are statistically significant for both variables. These results provide additional support to the validity of the SVAR-MGARCH-in-mean model.

Table 4 Estimated Variance Function Coefficients of the VAR MGARCH-M

| Equation of the returns | Conditional variance | Constant |

|

|

| Of oil | H1,1(t) | 32.02** (12.14) | 0.456** (5.49) | 0.00 - |

| Of the stock market | H2,2(t) | 0.473** (2.25) | 0.150** (8.54) | 0.859** (55.23) |

Note: The numbers in parentheses are the t-statistics associated with each estimated

parameter.

** Indicates significance at a level of 5%.

* Indicates significance at a level of 10%.

The effect of the international oil price uncertainty on the Mexican stock market returns is presented in Table 5. This table shows the punctual estimate of the parameter of interest and its corresponding asymptotic statistic in parentheses. As can be seen, this coefficient was negative but is not significant. From this, it can be concluded that for the Mexican stock market there is no evidence that the uncertainty of the real international oil price negatively impacts real stock returns. This result is in contrast to what most studies have found for other markets.

Table 5. Estimated Oil Volatility Coefficients

| Economic activityindicator | Oil Volatility Coefficient |

| IPC | -0.028 (-0.29) |

Note: The numbers in parentheses are the absolute values of the asymptotic statistics.

** Indicates significance at a level of 5%.

* Indicates significance at a level of 10%.

The impact of oil price uncertainty on the dynamic response of stock returns is assessed through impulse-response functions, which are simulated from model parameter estimates obtained by the maximum likelihood method. In order to compare impulses with those of a homoscedastic VAR, the magnitude of impulse responses used to simulate impulse-response functions is based on an oil price shock that is equal to the unconditional standard deviation of the change in oil price. To examine whether responses to positive and negative shocks are symmetric or asymmetric, the response of stock returns to both types of oil price shocks is simulated. The impulse-response functions (solid lines) and the error bands to a standard deviation (dotted lines) are presented in Figure 3. The impulse response indicate that a positive oil price shock tends to immediately and significantly reduce stock returns of the market in Mexico.

On the other hand, the dynamic response of stockholder returns to a negative oil price shock tends to increase the profitability of the stock market immediately within a month, after this time the effect tends to dissipate. In this way it is observed that the returns of the stock market show asymmetric effects before positive and negative shocks of the international oil price.

Finally, the responses of stock returns are compared to positive and negative oil price shocks with and without the mean term shown in Figure 4, where confidence bands are suppressed for clarity. In Figure 4, the solid lines represent the response of stock returns to an oil price shock in the model that incorporates oil price uncertainty into the stock return equation, while the dotted lines represent the response of stock returns after an oil price shock excluding oil price uncertainty from the stock return equation. The graph shows that the pattern associated with the multivariate VAR-GARCH-in-mean is very similar to that of the homoscedastic VAR. This suggests that the multivariate VAR-GARCH-in-mean is an appropriate model specification to capture the influence of oil price uncertainty on stock returns.

Conclusions

In this work the effect of international oil price uncertainty on the stock market returns in Mexico is researched through a SVAR-MGARCH-in-mean model with monthly data in the period from January 1975 to September 2018.

The uncertainty of the oil price was estimated as the conditional standard deviation of the forecast error one step ahead of the change in the oil price. Based on the informative criterion by Schwarz, the results show that the VAR with GARCH-in-mean effects better represents the data compared to the conventional homoscedastic VAR. Similarly, no evidence was found to support the hypothesis that the uncertainty of the international oil price has an immediate negative impact on stock returns in Mexico. However, the analysis of the asymmetric effects through the impulse-response functions shows that, before a positive shock of the international oil price, the stock returns tend to decrease abruptly and later tend to reverse this effect and dissipate in a relatively short period of time. On the other hand, the dynamic response of stock returns to a negative oil price shock is that they tend to increase up to about one month after the shock, and after this period, this impact is reversed to be diluted after three months.

This implies that the response of stock returns to the positive and negative shocks of equal magnitude of the price of oil is asymmetrical. The evidence also shows that the pattern of impulse-response functions of VARs with and without in-mean effects is very similar, which allows concluding that the VAR model with GARCH-in-mean effects is an appropriate specification to capture the influence of oil price uncertainty on stock returns.

It is important to emphasize that the result of non-significance of the parameter that captures the impact of the uncertainty associated with the international price of oil in the equation of mean stock returns in Mexico is not consistent with most of the results of empirical studies carried out with this same methodology for other countries. Nevertheless, the results of the asymmetric impacts on the dynamics of returns show behavior patterns similar to those found by the same studies.

The results obtained from this study have potentially important policy implications for investors, market participants, and policymakers. For example, investors and market participants should be aware of the links between international oil price uncertainty and stock returns when using oil to cover and diversify their portfolios, particularly in economies where oil is important for economic growth.

In general terms, policies that reduce the volatility of the international oil price will benefit the stock market in Mexico by reducing import bills and expanding exports through the exchange rate channel, which is why the desirability of keeping the oil price stable may not be exaggerated.

One of the main economic policy recommendations derived from this study is that government authorities can assist in the design and implementation of hedging instruments and strategies that contribute to mitigate the risk for investors in the stock market in Mexico, derived from the uncertainty associated with the international oil price. Nevertheless, it would be interesting to determine if the uncertainty of the international oil price affects the level of stocks in the capital market. In fact, in the works that address this topic, it is highlighted that the uncertainty of the oil price has a greater incidence in the stock markets of the oil exporting countries than in the oil importing countries (Maghyereh and Awartani, 2016). This implies that investing in oil-importing countries may be a better option than investing in oil-exporting countries in terms of portfolio diversification, mainly in periods of greater volatility and uncertainty in the international price of oil.

Several issues remain to be explored, for example the impact of international oil price shocks with more frequent data, whether fortnightly, weekly, or daily, since, according to Arouri et al. (2012), data with monthly frequency may be inadequate to capture volatility transmission mechanisms due to time aggregation and compensation effects

REFERENCES

Agren, M. (2006). Does Oil Price Uncertainty Transmit to Stock Markets? Working Paper, No. 2006, 23, Department of Economics, Uppsala University. Available from: http://www.econstor.eu/bitstream/10419/82778/1/wp2006-023.pdf. [ Links ]

Arouri, M.E.H. y Nguyen, D.K. (2010). Oil prices, stock markets and portfolio investment: Evidence from sector analysis in Europe over the last decade. Energy Policy, 38, 4528-4539. https://doi.org/10.1016/j.enpol.2010.04.007 [ Links ]

Arouri, M.E.H., Jouini, J., Ngugen, D.K. (2011). Volatility spillovers between oil prices and stock sector returns: Im-plications for portfolio management. Journal of International Money and Finance, 30(7), 1387-1405.https://doi.org/10.1016/j.jimonfin.2011.07.008 [ Links ]

Arouri, M.E.H., Jouini, J., Ngugen, D.K. (2012). On the impacts of oil price fluctuations on European equity mar-kets: Volatility spillover and hedging effectiveness. Energy Economics, 34, 611-617. https://doi.org/10.1016/j. eneco.2011.08.009 [ Links ]

Aye, G. (2015). Does oil price uncertainty matter for stock returns in South Africa?. Investment Management and Financial Innovations, 12(1):179-188. [ Links ]

Awartani, B. y Maghyereh, A. (2013). Dynamic spillovers between oil and stock markets in the Gulf Cooperation Council Countries. Energy Economics , Vol. 36 No. 2, pp. 28-42. https://doi.org/10.1016/j.eneco.2012.11.024 [ Links ]

Balcilar, M., Gupta, R. and Miller, S.M. (2015). Regime switching model of US crude oil and stock market prices: 1859 to 2013. Energy Economics , doi: 10.1016/j.eneco.2015.01.026 [ Links ]

Basher, S.A., Sadorsky, P. (2006). Oil price risk and emerging stock markets. Global Finance Journal, 17, 224-251. https://doi.org/10.1016/j.gfj.2006.04.001 [ Links ]

Basher, S.A., Haug, A.A. y Sadorsky, P. (2012). Oil prices, exchange rates and emerging stock markets. Energy Economics , Vol. 34 No. 1, pp. 227-240. https://doi.org/10.1016/j.eneco.2011.10.005 [ Links ]

Baskaya, Y.S., Hülagü, T. and Küçük, H. (2013). Oil price uncertainty in a small open economy, Central Bank of the Republic of Turkey 2013, Working paper No: 13/09. [ Links ]

Bass, A. (2017). Does oil prices uncertainty affect stock returns in Russia: A bivariate GARCH-in-mean approach. International Journal of Energy Economics and Policy, 7(4), 224-230. [ Links ]

Backus, K.D. and Crucini, M.J. (2000). Oil prices and the terms of trade. Journal of International Economics, 50, pp. 185-213. https://doi.org/10.1016/S0022-1996(98)00064-6 [ Links ]

Bjornland, C.H. (2009). Oil price shocks and stock market booms in an oil exporting country. Scottish Journal of Political Economy, 2 (5), pp. 232-254. https://doi.org/10.1111/j.1467-9485.2009.00482.x [ Links ]

Brown, P.A.S. y Yücel, M.K. (2002). Energy prices and aggregate economic activity: An interpretative survey. The Quarterly Review of Economics and Finance, 42, 193-208. https://doi.org/10.1016/S1062-9769(02)00138-2 [ Links ]

Chang, C.L., McAleer, M. y Tansuchat, R. (2009). Volatility Spillovers between Crude Oil Futures Returns and Oil Company Stock Returns. Working Paper CARF-F-157, University of Tokyo. [ Links ]

Chen, S.S. (2010). Do higher oil prices push the stock market into bear territory?. Energy Economics , Vol. 32 No. 2, pp. 490-495. https://doi.org/10.1016/j.eneco.2009.08.018 [ Links ]

Choi, K., Hammoudeh, S. (2010). Volatility behavior of oil, industrial commodity and stock markets in a regime-switch-ing environment. Energy Policy , 38, 4388-4399. https://doi.org/10.1016/j.enpol.2010.03.067 [ Links ]

Davis, J.S. y Haltiwanger, J. (2001). Sectoral job creation and destruction responses to oil price changes. Journal of Monetary Economics, 48, 465-512. https://doi.org/10.1016/S0304-3932(01)00086-1 [ Links ]

Elder, J. (2003). An impulse response function for a vector auto regression with multivariate GARCH-in-mean. Economic Letters, 79, 21-26. https://doi.org/10.1016/S0165-1765(02)00283-5 [ Links ]

_____, (2004). Another perspective on the effects of inflation uncertainty. Journal of Money, Credit and Banking, 36(5), 911-28. [ Links ]

Elder J, Serletis A. (2009). Oil price uncertainty in Canada. Energy Economics , 31(6), 852-856. https://doi. org/10.1016/j.eneco.2009.05.014 [ Links ]

_____, (2010). Oil price uncertainty. Journal of Money, Credit and Bank. 42(6), 1137-1159. https://doi. org/10.1111/j.1538-4616.2010.00323.x [ Links ]

_____, (2011). Volatility in oil prices and manufacturing activity: an investigation of real options. Macroeconomic Dynamics, 15(Supplement 3), 379-395. https://doi.org/10.1017/S1365100511000630 [ Links ]

Filis, G., Degiannakis, S., y Floros, C. (2011). Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. International Review of Financial Analysis, 20, 152-164. https://doi. org/10.1016/j.irfa.2011.02.014 [ Links ]

Fisher, I. (1930). The Theory of Interest. New York: Macmillan. [ Links ]

Gupta, R. y Modise, M.P. (2013). Does the source of oil price shocks matter for South African stock returns? A struc-tural VAR approach. Energy Economics , 40(1), 825-831. https://doi.org/10.1016/j.eneco.2013.10.005 [ Links ]

Hamilton, D.J. (1988). A neoclassical model of unemployment and the business cycle. Journal of Political Economy, 96, 593-617. [ Links ]

Hamilton, J.D. (1994). Time Series Analysis. Princeton, NJ: Princeton University Press. [ Links ]

Hammoudeh, S. and H. Li (2005). Oil sensitivity and systematic risk in oil-sensitive stock indices. Journal of Economics and Business 57(1): 1-21. https://doi.org/10.1016/j.jeconbus.2004.08.002. [ Links ]

Hooker, A.M. (2002). Are oil shocks inflationary? Asymmetric and nonlinear specifications versus changes in regime. Journal of Money, Credit and Banking , 34 (2), pp. 540-561. [ Links ]

Jimenez-Rodriguez, R., Sanchez, M. (2005). Oil price shocks and real GDP growth: Empirical evidence for some OECD countries. Applied Economics, 37(2), 201-228. https://doi.org/10.1080/0003684042000281561 [ Links ]

Jiranyakul, K. (2014). Does Oil Price Uncertainty Transmit to the Thai Stock Market? MPRA Paper No. 56527. Available from: http://www.mpra.ub.uni-muenchen.de/56527. http://dx.doi.org/10.2139/ssrn.2450974 [ Links ]

Jones, C.M. y Kaul, G. (1996). Oil and the stock markets. The Journal of Finance. Vol. 51 No. 2, pp. 463-491. https:// doi.org/10.1111/j.1540-6261.1996.tb02691.x [ Links ]

Jouini, J. (2013). Return and volatility interaction between oil prices and stock markets in Saudi Arabia. Journal of Policy Modeling, 35 (6), pp. 1124-1144. [ Links ]

Kim, I.M. and Loungani, P. (1992). The role of energy in real business cycle models. Journal of Monetary Economics , 29, pp. 173-189. https://doi.org/10.1016/0304-3932(92)90011-P [ Links ]

Kocaarslan, B., Sari, R., Gormus, A., & Soytas, U. (2017). Dynamic correlations between BRIC and US stock markets: The asymmetric impact of volatility expectations in oil, gold and financial markets. Journal of Commodity Markets, 7, 41-56. https://doi.org/10.1016/j.jcomm.2017.08.001 [ Links ]

Kilian, L. y Park, C. (2009). The Impact of Oil Price Shocks on the U.S. Stock Market. International Economic Review, 50(4), 1267-1278. https://doi.org/10.1111/j.1468-2354.2009.00568.x [ Links ]

Lardic, S. y Mignon, V. (2006). Oil prices and economic activity: An asymmetric cointegration approach. Energy Economics , 34, 3910-3915. https://doi.org/10.1016/j.eneco.2006.10.010 [ Links ]

LeBlanc, M. and Chinn, D.M. (2004). Do high oil prices presage inflation? The evidence from G5 countries. Business Economics, 34, pp. 38-48. http://dx.doi.org/10.2139/ssrn.509262 [ Links ]

Lee, Y. H. y Chiou, J. S. (2011). Oil sensitivity and its asymmetric impact on the stock market. Energy, 36, 168-174. https://doi.org/10.1016/j.energy.2010.10.057 [ Links ]

Li, X., y Wei, Y. (2018). The dependence and risk spillover between crude oil market and China stock market: New evidence from a variational mode decomposition-based copula method. Energy Economics , 74, 565-581. https:// doi.org/10.1016/j.eneco.2018.07.011 [ Links ]

Lin, B., Wesseh, P.K.Jr., Appiah, M.O. (2014). Oil price fluctuation, volatility spillover and the Ghanaian equity mar-ket: Implication for portfolio management and hedging effectiveness. Energy Economics , 42, 172-182. https://doi. org/10.1016/j.eneco.2013.12.017 [ Links ]

Maghyereh, A. (2004). Oil Price Shocks and Emerging Stock Markets: A Generalized VAR Approach. International Journal of Applied Econometrics and Quantitative Studies, 1, issue 2, p. 27-40. https://doi. org/10.1057/9780230599338_5 [ Links ]

Maghyereh, A. y Al-Kandari, A. (2007). Oil prices and stock markets in GCC countries: new evidence from nonlinear cointegration analysis. Managerial Finance, Vol. 33 No. 7, pp. 449-460. https://doi.org/10.1108/03074350710753735 [ Links ]

Maghyereh, A. y Awartani, B. (2016). Oil price uncertainty and equity returns: evidence from oil importing and ex-porting countries in the MENA region. Journal of Financial Economic Policy. Vol. 8 No. 1, pp. 64-79. https://doi. org/10.1108/JFEP-06-2015-0035 [ Links ]

Malik, F. y Ewing, B. (2009). Volatility transmission between oil prices and equity sector returns. International Review of Financial Analysis , 18(3), 95-100. 10.1016/j.irfa.2009.03.003 [ Links ]

Masih, R., Peters, S., de Mello, L. (2011). Oil price volatility and stock price fluctuations in an emerging market: Evi-dence from South Korea. Energy Economics , 33(5), 975-986. https://doi.org/10.1016/j.eneco.2011.03.015 [ Links ]

Mensi, W., Hammoudeh, S., Shahzad, S.J.H., Shahbaz, M. (2017). Modeling systemic risk and dependence structure between oil and stock markets using a variational mode decomposition-based copula method. Journal of Banking and Finance, 75, 258-279. https://doi.org/10.1016/j.jbankfin.2016.11.017 [ Links ]

Olson, E., Vivian, A.J. y Wohar, M.E. (2014). The relationship between energy and equity markets: Evidence from vol-atility impulse response functions. Energy Economics , 43, 297-305. https://doi.org/10.1016/j.eneco.2014.01.009 [ Links ]

Pagan, A. (1984). Econometric issues in the analysis of regressions with generated regressors. International Economic Review , 25, pp. 221-247. [ Links ]

Ross, S. (1989). Information and volatility: the no-arbitrage Martingale approach to timing and resolution irrelevancy. Journal of Finance, 44, pp. 1-17. https://doi.org/10.1111/j.1540-6261.1989.tb02401.x [ Links ]

Sadorsky, P. (1999). Oil price shocks and stock market activity. Energy Economics , 21, 449-469. https://doi.org/10.1016/S0140-9883(99)00020-1 [ Links ]

Shahzad, S.J.H., Mensi, W., Hammoudeh, S., Rehman, M.U., AI-Yahyaee, K.H. (2018). Extreme dependence and risk spillovers between oil and Islamic stock markets. Emerging Markets Review, 34, 42-63. https://doi.org/10.1016/j. ememar.2017.10.003 [ Links ]

Swanepoel, J.A. (2006). The impact of external shocks on South African inflation at different price stages. Journal for Studies in Economics and Econometrics, 30(1), pp. 1-22. [ Links ]

Wang, Y., C. Wu, and L. Yang (2013). Oil price shocks and stock market activities: Evidence from oil-importing and oil-exporting countries. Journal of Comparative Economics 41(4): 1220-1239. https://doi.org/10.1016/j. jce.2012.12.004. [ Links ]

Wei, C. (2003). Energy, the stock market, and the putty-clay investment model. American Economic Review, Vol. 93 No. 1, pp. 311-323. 10.1257/000282803321455313 [ Links ]

Williams, B.J. (1938). The theory of investment value. Cambridge: Harvard University Press. [ Links ]

Received: December 05, 2018; Accepted: March 26, 2019; Published: 2019

texto en

texto en