Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Contaduría y administración

versión impresa ISSN 0186-1042

Contad. Adm vol.63 no.3 Ciudad de México jul./sep. 2018

https://doi.org/10.22201/fca.24488410e.2018.1260

Articles

Capital accumulation as a determinant of the rate of growth of the Thirlwall’s law***

1Benemérita Universidad Autónoma de Puebla, México.

In this paper it is developed an extension of the external constraint growth model through the inclusion of the rate of capital accumulation and of the capital productivity growth rate as determinants of the imports growth rate in a first version, and of the imports and exports growth rates in a second version. In the first version, it is argued that, apart from the exports growth rate, the rate of capital accumulation and the capital productivity growth rate determine the growth rate consistent with a dynamic equilibrium of the trade balance. The effect of the rate of capital accumulation could be positive, null or negative, depending on whether import requirements to carry it out are lower, equal or higher than the import substitution that is generated via the change in the production structure of the economies. Moreover, if capital productivity is both partly endogenous, the rate of capital accumulation could directly affect the growth rate consistent with a dynamic equilibrium of the trade balance, as well as indirectly through its further effect on the capital productivity growth rate. In the second version, it is shown that international growth rate differences rates are not only due to different specialization patterns, but also to international rate of capital accumulation differences.

Keywords: Thirlwall’s law; Capital accumulation; Capital productivity; Import substitution; Rate of growth

JEL Classification: F43; O14; O40

En el presente artículo se desarrolla una extensión del modelo de la restricción externa al crecimiento a través de la incorporación de la tasa de acumulación de capital y de la tasa de crecimiento de la productividad del capital como determinantes de la tasa de crecimiento de las importaciones en una primera versión, y de las tasas de crecimiento de las importaciones y de las exportaciones en una segunda versión. En la primera versión se argumenta que, además de la tasa de crecimiento de las exportaciones, la acumulación de capital y la tasa de crecimiento de la productividad del capital determinan la tasa de crecimiento consistente con el equilibrio dinámico de la balanza comercial. El efecto de la acumulación del capital puede ser positivo, nulo o negativo dependiendo de si los requerimientos de importación para generar la acumulación de capital son menores, iguales o mayores que la sustitución de importaciones que se genera a través de la modificación de la estructura productiva de la economía. Asimismo, si la tasa de crecimiento de la productividad del capital es en parte exógena y en parte endógena a la acumulación de capital, ésta última puede afectar a la tasa de crecimiento de largo plazo tanto de forma directa como indirecta a través de su efecto en la productividad del capital. En la segunda versión se muestra que las diferencias internacionales de las tasas de crecimiento no solo se deben a los patrones de especialización internacional, sino que también a las disparidades internacionales de las tasas de acumulación de capital.

Palabras clave: Ley de Thirlwall; Acumulación de capital; Productividad del capital; Sustitución de importaciones; Tasa de crecimiento

Clasificación JEL: F43; O14; O40

Introduction

According to the economists of the classical development economics, a fundamental problem of developing economies is the capital scarcity (see Nurkse, 1953, and Lewis, 1954, among others), and from this basic premise, they developed a set of models that could comprise one or two of the following ingredients: the existence of increasing returns to scale and an unlimited labor supply (see Ros, 2013).

On the other hand, in 1979, A. P. Thirlwall stated in his seminal article, “The Balance of Payments Constraint as an Explanation of International Growth Rate Differences”, that the dynamic equilibrium of the trade balance is the main constraint on the economic growth. According to the weak version of Thirlwall’s Law, the long-run growth rate is equal to the ratio exports growth rate to income elasticity of demand for imports; whereas according to the strong version of Thirlwall’s Law, the international growth rate differences are due to different international specialization patterns. These ideas have been the subject of multiple debates and empirical contrasts, however, to the best of our knowledge, there are no papers linking the capital scarcity to the external constraint on the economic growth.

Therefore, the objective of this paper is to incorporate the rate of capital accumulation and the capital productivity growth rate as determinants of the growth rate consistent with a dynamic equilibrium of the trade balance in an economy with an unlimited labor supply. The model presented in the following lines has two versions, the first one is differentiated from the Thirlwall’s model through the incorporation of the rate of capital accumulation, and not only of the income growth rate, as determinants of the demand for imports growth rate. The rate of capital accumulation affects in two ways to the demand for imports growth rate, one positive, which reflects the demand for imported capital goods, and one negative, which exhibits a possible import substitution process carried out by the economies when, through capital accumulation, generate the economic capacity to produce the goods and services that would otherwise have to be imported. In the second version, the rate of capital accumulation is included as a determinant of the export capacity of the economy.

This paper is divided into five sections, including this introduction. The second one presents the Thirlwall’s external constraint growth model; the third one develops an external constraint growth model, but in which the rate of capital accumulation and the capital productivity growth rate are incorporated as determinants of the growth rate consistent with a dynamic equilibrium of the trade balance, it is indicated that the former could have a positive, null or negative effect, while the second one has a full positive effect on the long-run growth rate; the fourth one incorporates the effect of the rate of capital accumulation on the export capacity of the economies and shows that the international growth rate differences are not only due to different international specialization patterns, but also to the international rates of capital accumulation differences; finally, we present our conclusions in the fifth section.

The strong and weak versions of Thirlwall’s Law

According to Thirlwall (1979), the external constraint, understood as the dynamic equilibrium of the trade balance, is the most important restriction on the economic growth, especially in the case of developing economies. From this idea, it was derived what it is now known by economists as the Thirlwall’s Law, which has two versions. According to the strong version, the international growth rate differences are due to the different international specialization patterns. On the other hand, with respect to the weak version of the Thirlwall’s Law, the long-run growth rate is equal to the ratio exports growth rate to the income elasticity of demand for imports, so that their ultimate determining factors are the foreign demand and the international specialization pattern.

The external restriction growth model developed by Thirlwall (1979) can be exposed in the following way: let us assume an open economy in which the exports growth rate (x), measured in domestic goods, is equal to:

with εx, ψ* > 0

where ε x is the real exchange rate elasticity of the demand for exports; θ is the percentage variation of the real exchange rate; ψ* is the income elasticity of demand for exports; and z is the foreign income growth rate. Similarly, the imports growth rate (m), measured in foreign goods, can be expressed as:

With ε m , ψ > 0

where ε m is the real exchange rate elasticity of the demand for imports; ψ is the income elasticity of the demand for imports; and g is the domestic income growth rate. The dynamic equilibrium of the trade balance requires that the exports and imports growth rates, both measured in terms of domestic goods, be equal:

substituting equations (1) and (2) in (3) and solving for g, we obtain the growth rate consistent with the dynamic equilibrium of the trade balance (g tb ):

As it can be seen in equation (4), θ positively affects g tb if the Marshall - Lerner condition is fulfilled, i.e., if ε x + ε m > 1. Similarly, g tb exhibits a positive relationship with z and ψ* and a negative relationship with ψ. However, Thirlwall (1979) indicates that the prices of exports and imports measured in a common currency tend to vary very little over time and that the empirical evidence shows that ε x + ε m tends to be equal to one, so that according to the Marshall - Lerner condition, θ does not affect the trade balance and, therefore, does not affect g tb .18 Furthermore, even if the above were not true and θ had a positive effect on g tb , it would be necessary to depreciate the real exchange rate every period in order to generate a permanent increase of g tb , which is not viable in the real world.

Thus, given the irrelevance of θ on the determination of g tb , Thirlwall (1979) assumes that θ is equal to zero and/or that ε x + ε m is equal to one, and then, the equation (4) is re-written as the strong version of Thirlwall’s Law:

Similarly, given that the numerator of equation (5) represents the exports growth rate of the domestic economy, we can replace ψ*z with x to get the weak version of Thirlwall’s Law19:

As it can be seen, according to equation (6), the long-run growth rate is determined by the foreign demand growth rate, reflected on x, and by the international specialization pattern, which can be identified with ψ20.

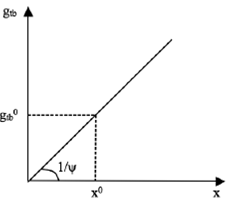

Graphically, we can illustrate the determination of the long-run growth rate through figure 1. Given the growth rate of exports (x 0 ) and ψ, there is a unique g tb 0.

Source: Own elaboration with base on Thirlwall (1979).

Figure 1 Determination of the long-run growth rate through the weak version of Thirlwall’s Law.

Therefore, on the one hand, the unique adjustment mechanism for the economy to maintain the dynamic equilibrium of the trade balance is g; on the other hand, it is clear that the growth rate of the economy depends on a variable that is beyond its control (x).

Thus, in the following section we develop a model in which the growth rate is the only adjustment mechanism to keep the dynamic equilibrium of the trade balance; additionally, g2 tb is not only a function of x, but also of the rate of capital accumulation, which is a variable that is under the “control” of the economy, and of the capital productivity growth rate, given ψ and what we call the gross capital stock elasticity of demand for imports.

Capital accumulation as a determinant factor of the growth rate consistent with the dynamic equilibrium of the trade balance

There is an aspect of Thirlwall’s Law related to the rate of capital accumulation, which has not been considered in the theoretical debates concerning the law and that, from our point of view, is a fundamental problem for the model: only in the case in which ψ = 1, the economy does not tend to become a purely export economy that does not produce anything for local consumption, or does not tend to become a closed economy, in which case, the external constraint on the economic growth does not play any sort of relevant role nor the behavior of the foreign market in general21. This can be derived through the use of equation (6), from which we obtain the long-run growth rate of the ratio exports to income:

According to equation (7), the ratio exports to income is increasing/decreasing if ψ is higher/lower than one and it is constant if ψ is equal to one. Therefore, it is important to know why the economies do not tend to produce only for the foreign market or to become a closed economy even if their ψ is higher/lower than one22.

We considered that a key factor to understand the above mentioned problem, especially in the case of developing economies, is the incorporation of the rate of capital accumulation in the model, since it is important to consider that the structure of economies is changing, not only due to the effect that a ψ different to one could have, but also due to the change in the productive structure that capital accumulation prompts, as indicated by Lewis (1954) 23.

In fact, as it is well known, Prebisch (1950), 1959 and 1962) and Thirlwall (2003) share the idea that the income elasticities of demand for imports of developing economies tend to be higher than those that correspond to developed economies and that, therefore, one way to stimulate the growth rate in developing economies is through their industrialization, which we can translate in that the growth rate can be increased through capital accumulation24. In that sense, our idea is to introduce the rate of capital accumulation in the external constraint growth model as a factor that influences m and therefore g tb . This will allow us to develop a model in which, in contrast to the weak version of the Thirlwall’s Law, g tb not only depends on x, which is not under the control of the domestic economy, but it can also depend on the rate of capital accumulation, which can be manipulated by the domestic economy25.

The rate of capital accumulation could have two effects on the demand for imports; on the one hand, there is a positive effect derived from the need to import capital goods, and on the other hand, there is a negative effect through a possible import substitution, derived from the change in the productive structure and of the generation of economic capacity that results from the capital accumulation process26.

Thus, let us consider an economy in which the real exchange rate and the export growth rate are constant (θ = 0 and x = x 0 ), additionally, m is defined as:

where I is the gross investment; K is the net capital stock; I/K is the gross capital accumulation; ce is the economic capacity growth rate; and ψ I and ψ g are the gross capital stock and the income elasticities of demand for imports, respectively. We considered that the specification of the determinant factors of m shown in equation (8), not only takes into consideration the above mentioned positive and negative effects of capital accumulation on m, but could also solve a problem indicated by Ibarra (2015) regarding the estimations of the income elasticities of demand for exports and imports through the traditional equations in which m only depends on g, and x on z:

“Let us suppose, for example, that the pace of capital accumulation is slow… The capacity to produce competitive export goods for the world market will be impaired, as will the capacity to produce domestic goods that compete with imported goods. Faced with an increase in the growth rate, exports will grow slowly… In the same way, faced with an increase in domestic demand, the production of goods that compete with imports will respond in a non-dynamic way…

What we would observe empirically would be a high world demand growth rate, with, with a low exports growth rate, as well as a high imports growth rate in relation to the domestic demand. In both cases, if we run regressions that assume that the imports and exports growth rates are explained only by the behavior of the foreign and domestic incomes, we would obtain coefficients that show a low income-elasticity of demand for exports and a high income-elasticity of demand for imports.” (Ibarra, 2015: 43 - 44, own translation).

Then, what Ibarra (2015) expresses is that the econometric estimations of the income elasticities of demand for exports and imports could be endogenous to the behavior of the domestic production and of the foreign demand. In this sense, our specification solves that problem in the following manner: let us assume a good q with an income elasticity of demand equal to ψ q , if this good q is not produced at all in the local economy, a specification such as the indicated by equation (2) should result in an unbiased estimation of ψ q , which would also be considered as the income elasticity of demand for imports of good q. Let us analyze what would happen if the economy produces the good q and also has the capacity to produce all the demand for that good, the traditional estimation would indicate that the income elasticity of demand for good q is equal to zero, thus, it would be a biased estimation. In contrast, with the specification indicated in equation (8), the import demand of good q would be equal to zero without the estimation of ψ q being necessarily equal to zero, that value could be estimated adequately by the excesses or deficiencies of the income growth rate with respect to the economic capacity growth rate. Moreover, the specification indicated in equation (8) allows to consider the requirements of the capital goods necessary to produce the good q, so that even if it were not required to import anything from it, it could be required to import the capital goods to produce it.

Furthermore, assuming capital scarcity and an unlimited labor supply, we can specify a Leontief production function:

where Y is the production level, and a and b are the average productivities of capital and labor, respectively27. Given the equation (9) and the assumption of capital scarcity, the economic capacity (CE) is determined as:

and therefore, the economic capacity growth rate is equal to:

where â is the capital productivity growth rate and δ is the rate of capital depreciation. Substituting equation (11) in equation (8), we obtain m as a function of g, I/K, â, and δ, given the parameters ψ I and ψ g :

Substituting x 0 and equation (8 or 12) in equation (3) and solving for g, we obtain the growth rate consistent with the dynamic equilibrium of a trade balance (g tbI ), not only as a function of x 0 but also as a function of I/K, â and δ, given the parameters ψ I and ψ g :

According to equation (13), the exports growth rate and the international specialization pattern are not the only determinant factors of the long-run growth rate, if ψ g is equal to ψ I , or higher/lower than ψ I , I/K has a null or positive/negative effect on g tbI . Therefore, in general, it is possible to say that if the import substitution generated by I/K is higher than the requirements of capital goods imported to generate a unit of CE, the effect of I/K on g tbI is positive.

The fact that I/K may have no effect, or even a negative effect on g tbI , should not be surprising, especially in the case of developing countries, since capital scarcity in these countries not only implies that they need to import capital goods, but also that their kind of capital accumulation process could not be the necessary to eliminate their dependence on imported manufactured goods.

Moreover, according to equation (11), â completely transfers its value to g tbI . According to Shaikh and Moudud (2004), â is partly endogenous to the rate of capital accumulation and partly exogenous, so the economies could increase g tbI through I/K, both directly and indirectly, through their effect on â.

It is important to note that, as was already mentioned, the capital accumulation processes should be directed towards the increase of a, through industrialization policies that allow countries, especially developing ones, not only to change their productive structure in any way, but also to change it towards the production of manufactured goods, since this will allow them to substitute imports and to increase their productivity.

In Figures 2a, 2b, 2c, 2d, 2e and 2f we present the possible effects, positive, null and negative of I/K and of â on g tbI .

Figure 2 Rate of capital accumulation and capital productivity growth rate as determinant factors of the growth rate consistent with a dynamic equilibrium of the trade balance.

As it can be seen in Figure 2a, if I/K has a positive effect on g tbI , and given x 0 , if there is no capital accumulation, the growth rate consistent with a dynamic equilibrium of the trade balance is equal to g tbI 0 ; however, if there is capital accumulation, the growth rate consistent with a dynamic equilibrium of the trade balance is higher than g tbI 0 (g tbI 0 ’). On the other hand, if I/K has no effect on g tbI , the graph that illustrates the determination of the long-run growth rate is the same as Figure 1 (see Figure 2b). Finally, if I/K has a negative effect on g tbI , and given x 0 and the rate of capital accumulation, the growth rate consistent with a dynamic equilibrium of the trade balance is equal to g tbI 0 , and decreases to g tbI 0 ’ if a higher rate of capital accumulation is generated (see Figure 2c).

Similarly, Figures 2d, 2e, and 2f illustrate the effect of â on g tbI , thus if a grows, given x 0 , g tbI increases from g tbI 0 to g tbI 0 ’ (see Figure 2d). If a does not vary, g tbI , given x 0 , is not modified (see Figure 2e). And lastly, if a decreases, g tbI , given x 0 , decreases from g tbI 0 to g tbI 0 ’ (see Figure 2f).

Moreover, the growth rate consistent with a dynamic equilibrium of the trade balance derived from our model makes it possible to understand why the economies do not tend to become closed economies or purely export economies, even if their income elasticities of the demand for imports are lower or higher than one. According to equation (13) the long-run growth rate of the ratio exports to income is:

As it can be seen in equation (12), independently of the value of ψ g , the ratio exports to income can be increased, constant or decreased according to the effect, not only of x 0 , but also of I/K and â on g tbI .

Now, for simplicity and for comparative purposes with respect to the weak version of the Thirlwall’s Law, it was assumed that x was given, however, if an economy accumulates capital and its economic capacity increased, it could also increase its export capacity, that is why in the next section we extend our model by introducing the effect of I/K on x. This will allow us to understand the international growth rate differences, not only as the result of different international specialization patterns, but also as a consequence of the international rates of capital accumulation differences.

Capital accumulation, external restriction and international growth rate differences

According to the strong version of Thirlwall’s Law, there are international growth rate differences because the economies exhibit different values of ψ. In fact, from equation (5) we can get that, in the long-run, the growth rate of the domestic economy as a proportion of that of the foreign economy is equal to the ratio ψ*/ψ:

Thus, if ψ* is equal to ψ or higher/lower than ψ, g 1 tb is equal to z or higher/lower than z. Therefore, according to Thirlwall (1979), the international growth rate differences are due to the different international specialization patterns of the economies, and it is clear that the international rates of capital accumulation differences do not play a relevant role in this. Now, Ros and Clavijo (2015) poses the following questions:

Why did Japan economy grow much faster than Britain’s in the first four decades of the post-war period? Why has China’s economy grown in the last thirty years between 4 and 5 times faster than Mexico’s? Are these differences in growth rates due to differences in the pattern of trade specialization and the implied differences in income elasticities of demand for exports and imports? Or do they have more to do with the fact that Japan’s investment rate was much higher than that of the Britain’s, and China’s more than twice as high as Mexico’s? (Ros and Clavijo, 2015: 81, own translation).

The model developed in the previous section can be extended to respond to the aforementioned questions30. Thus, let us assume that x not only depends on z but that it also depends on the economic capacity growth rate of the economies and, therefore, on their capital accumulation31:

where ψ xCE is the economic capacity elasticity of the demand for domestic exports and all the remaining variables and parameters are defined in the same manner as was done with equations (8) and (11), with * indicating the variables and parameters that correspond to the foreign economy. Symmetrically, m, which represents the exports growth rate of the foreign economy, not only depends on g and ce, but also on the economic capacity growth rate of the foreign economy:

substituting equations (14) and (15) in the dynamic equilibrium condition of the trade balance (equation 3) and solving for g, we obtain the growth rate consistent with a dynamic equilibrium of the trade balance that incorporates the differences in the rates of capital accumulation between the domestic and foreign economies (g 1 tbl ):

as it can be seen in equation (16), g 1 tbl depends not only on z and the international specialization patterns, but also on the domestic and foreign rates of capital accumulation. In addition, both I/K and I * /K * may have a positive, null or negative effect on g 1 tbl , which leads to diverse possibilities of reaction, both from the domestic growth rate to the domestic and foreign rates of capital accumulation, and from the foreign growth rate to the domestic and foreign rates of capital accumulation. Thus, for the domestic/foreign economy, it could be positive, irrelevant or negative that the foreign/domestic economy increases its rate of capital accumulation. Therefore, the international growth rate differences are not only explained by different international specialization patterns, but also by the international rates of capital accumulation differences.

Now, let us assume that the domestic and foreign economies have exactly the same parameters, thus the equation (16) would be re-written as follows:

therefore, the difference between the domestic and the foreign growth rates depends on the difference between I/K and I * /K * , which in turn would imply a disparity of the same sign between â and â32, given the partially endogenous characteristic of the capital productivity growth rate with respect to the rate of capital accumulation. Thus, given two economies with the same productive structures, the economy with the higher rate of capital accumulation will grow faster.

Now, it is evident that, assuming that the domestic and foreign economies have exactly the same parameters is highly unrealistic, however, this helps us to understand, in a simple way that even in an external constraint growth model, the international rates of capital accumulation differences are relevant in the explanation of the international growth rate differences.

Conclusions

In the model developed in this paper, we introduce the rate of capital accumulation and the capital productivity growth rate as determinant factors of the growth rate consistent with a dynamic equilibrium of the trade balance. In line with Thirlwall’s model, we discarded in our analysis the effect of changes of the real exchange rate, and in general that of any relevant relative price of the economy, for the determination of the long-run growth rate.

In a first version that was used to compare our results with the weak version of Thirlwall’s Law, the demand for imports growth rate does not only depend on the domestic income growth rate, but also on the rate of capital accumulation. When the economies accumulate capital, they would require to import some capital goods, which positively affects the demand for imports; on the other hand, when there is capital accumulation and generation of economic capacity, the economies could generate an import substitution process. Therefore, the net effect of capital accumulation on the demand for imports and, consequently, on the trade balance can be negative, null, or positive. Thus, it is through this line of causality that capital accumulation could relax, leave intact, or aggravate the external constraint on the economic growth.

Furthermore, given that the capital productivity growth rate is partially endogenous to the capital accumulation, the latter not only directly affects the long-run growth rate, but also indirectly through its effect on the capital productivity growth rate.

Likewise, the variations in the capital productivity are completely transferred to the long-run growth rate because they represent increments of the economic capacity that do not require imports.

Finally, the inclusion the rate of the effect of capital accumulation on the demand for imports leaves open the possibility that even if the economies have an income elasticity of demand for imports equal to one, or higher/lower than, the ratio exports to income of the economies does not tend to one or to zero in the long-run.

On the other hand, in a second version of our model, we incorporated the effect of the capital accumulation on the export capacity of the economies and we find that the international growth rate differences are not only due to different international specialization patterns, but they are also explained by the international rates of capital accumulation differences. In this sense, both the domestic growth rate and the foreign growth rate can be affected in a positive, null, or a negative way by the domestic and foreign rates of capital accumulation.

It is important to note that our model maintains the original idea presented by Thirlwall (1979), which states that the main constraints on the economic growth is the dynamic equilibrium of the trade balance. However, we considered that this constraint may be modified by the rate of capital accumulation. After all, the constraints on the demand side could appear faster than those on the supply side if there is a supply side; or in the terms that we have utilized in this paper, if there is economic capacity.

Referencias

Alonso, J. A. & Garcimartín, C. (1998). A New Approach to Balance-of-Payments Constraint: Some Empirical Evidence. Journal of Post Keynesian Economics, 21(2), 259-282. https://doi.org/10.1080/01603477.1998.11490193 [ Links ]

Aricioglu, E., Ucan, O. y Sarac, T. B. (2013). Thirlwall’s Law: The Case of Turkey, 1987-2011. International Journal of Economics and Finance, 5(9), 59-68. https://doi.org/10.5539/ijef.v5n9p59 [ Links ]

Bairam, E. y Dempster, G. J. (1991). The Harrod foreign trade multiplier and economic growth in Asian countries. Applied Economics, 23(11), 1719-1724. https://doi.org/10.1080/00036849100000066 [ Links ]

Bértola L., Higachi, H. y Porcile, G. (2002). Balance-of-Payments-Constrained Growth in Brazil: A Test of Thirlwall’s Law, 1890-1973. Journal of Post Keynesian Economics, 25(1), 123-140. [ Links ]

Clavijo, P. H. y Ros, J. (2015). La Ley de Thirlwall: una lectura crítica. Investigación Económica, LXXIV(292), 11-40. https://doi.org/10.1016/j.inveco.2015.08.001 [ Links ]

Harrod, R. F. (1939). An Essay in Dynamic Theory. The Economic Journal, 49(193), 14-33. https://doi.org/10.2307/2225181 [ Links ]

Ibarra, C. A. (2015). Comentario a ‘La Ley de Thirlwall: una lectura crítica’ de Pedro Clavijo y Jaime Ros. Investigación Económica, LXXIV(292), 41-45. https://doi.org/10.1016/j.inveco.2015.08.002 [ Links ]

Lewis, W. A. (1954). Economic Development with Unlimited Supplies of Labour. The Manchester School, 22(2), 139-191. https://doi.org/10.1111/j.1467-9957.1954.tb00021.x [ Links ]

McCombie, J. S. L. (1997). On the Empirics of Balance-of-Payments-Constrained Growth. Journal of Post Keynesian Economics, 19(3), 345-375. https://doi.org/10.1080/01603477.1997.11490116 [ Links ]

McCombie, J. S. L. (2011). Criticism and Defences of the Balance-of-Payments Constrained Growth Model: some old, some new. PSL Quarterly Review, 64(259), 353-392. [ Links ]

Moudud J. K. (2000). Harrod versus Thirlwall: A Reassessment of Export-Led-Growth. Working Paper, Jerome Levy Economics Institute, 1-20. http://www.levyinstitute.org/pubs/wp316.pdf [ Links ]

Nurkse, R. (1953). Problems of Capital Formation in Underdeveloped Countries. (2nd Ed.). Oxford: Basil Blackwell. [ Links ]

Palley, T. I. (2003). Pitfalls in the Theory of Growth: an application to the balance of payments constrained growth model. Review of Political Economy, 15(1), 75-84. https://doi.org/10.1080/09538250308441 [ Links ]

Pérez, E. (2015). Una lectura crítica de la ‘lectura crítica’ de la Ley de Thirlwall. Investigación Económica, LXXIV(292), 47-65. https://doi.org/10.1016/j.inveco.2015.08.003 [ Links ]

Perraton, J. (2003). Balance of Payments Constrained Growth and Developing Countries: An examination of Thirlwall’s Hypothesis. International Review of Applied Economics, 17(1), 1-22. https://doi.org/10.1080/713673169 [ Links ]

Prebisch, R. (1950) The Economic Development of Latin America and its Principal Problems. Nueva York: ECLAC, UN Department of Economic Affairs. [ Links ]

Prebisch, R. (1959). Commercial Policy in the Underdeveloped Countries. American Economic Review, 49(2), 251-273. [ Links ]

Prebisch, R. (1962). The Economic Development of Latin America and its Principal Problems. Economic Bulletin for Latin America, VII(1), ECLAC, Santiago, Chile. [ Links ]

Pugno, M. (1998). The Stability of Thirlwall’s Model of Economic Growth and the Balance-of-Payments Constraint. Journal of Post Keynesian Economics, 20(4), 559-581. https://doi.org/10.1080/01603477.1998.11490168 [ Links ]

Ros, J. (2013). Rethinking Economic Development, Growth, and Institutions, Oxford: Oxford University Press. [ Links ]

Ros, J. y Clavijo, P. H. (2015). Respuesta a Ibarra, Pérez y Vernengo. Investigación Económica, LXXIV(292), 81-90. https://doi.org/10.1016/j.inveco.2015.05.004 [ Links ]

Shaikh, A. M. y Moudud, J. K. (2004). Measuring Capacity Utilization in OECD Countries: A Cointegration Method. [ Links ]

Working Paper, The Levy Economics Institute, 1-19. http://www.levyinstitute.org/pubs/wp415.pdf [ Links ]

Syrquin, M. (1988). Patterns of Structural Change. H. Chenery, T. N. Srinivasan, eds. Handbook of Development Economics, Vol 1. Amsterdam: Elsevier Science Publishers: 203-273. [ Links ]

Thirlwall, A. P. (1979). The Balance of Payments Constraint as an Explanation of International Growth Rate Differences. Banca Nazionale de Lavoro, 32(128), 45-53. [ Links ]

Thirlwall, A. P. (2003). La naturaleza del crecimiento económico. (1ª Ed.). México: Fondo de Cultura Económica. [ Links ]

Thirlwall, A. P. (2011). Balance of Payments Constrained Growth Models: history and overview. PSL Quarterly Review, 64(259), 307-351. [ Links ]

Received: October 09, 2016; Accepted: May 31, 2017

texto en

texto en