Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Contaduría y administración

Print version ISSN 0186-1042

Contad. Adm vol.63 n.1 Ciudad de México Jan./Mar. 2018

https://doi.org/10.22201/fca.24488410e.2018.873

Articles

Social accounting matrix and analysis of productive sectors in Mexico

Although the Social Accounting Matrix (SAM) began to be developed almost half a century ago, and many countries have developed a SAM for their own economy, a considerable delay has been observed in Mexico. While different researchers have built a SAM, oftentimes it is not possible to validate or replicate their results, as the matrix is not published. The main objective of this work is to propose a specific metho dology for the case of Mexico, and to build a SAM for the year 2003 in a transparent manner. Therefore, the proposed methodology can be discussed (improved or rectified) to apply it to the construction of broad or updated matrices for the Mexican economy, in accordance with the Mexican System of National Accounts. For its part, the SAM can be used to carry out different analyses for this period, whether structural, of Applied General Equilibrium (AGE), or others; the results of which can be replicated and thus be corroborated or rectified. Therefore, as a second objective, we used the SAM to carry out a basic characterization of the productive structure, and we calculated the General Multipliers Matrix, calculating the carry-over and dispersion indices to determine the relative importance of the sectors, and identify key and strategic sectors.

Keywords: Input - Output Table; Social Accounting Matrix; Mexico; General Multipliers; Rasmussen Indices

JEL clasification: C67; D57; D58

Aunque hace casi medio siglo que la Matriz de Contabilidad Social (MCS) comenzó a desarrollarse, y muchos países han elaborado una MCS para su economía, en México se ha observado un considerable atraso. Aunque diversos investigadores han construido su MCS, con frecuencia no es posible validarla ni replicar sus resultados, pues la matriz no se publica. El principal objetivo del presente trabajo es el de plantear una metodología específica para el caso de México, y construir de forma transparente, una MCS para el año 2003. La metodología propuesta, por tanto, puede ser discutida (mejorada o rectificada) para aplicarla a la construcción de matrices ampliadas o actualizadas de la economía mexicana, en concordancia con el Sistema de Cuentas Nacionales de México. La MCS por su parte, puede ser utilizada para llevar a cabo diversos análisis para este periodo, ya sean estructurales, de equilibrio general aplicado, u otros, cuyos resultados puedan replicarse y por tanto corroborarse o rectificarse; por ello, como segundo objetivo, utilizamos la MCS, para realizar una caracterización básica de la estructura productiva, y computamos la Matriz de Multiplicadores Generalizados, calculando los índices de arrastre y dispersión para determinar la importancia relativa de los sectores, e identificar sectores clave y estratégicos.

Palabras clave: Matriz Insumo-Producto; Matriz de Contabilidad Social; México; Multiplicadores Generalizados; Índices de Rasmussen

Clasificación JEL: C67; D57; D58

Introduction6

The structural analysis, derived for the most part from the Leontief model, has been developed throughout more than eight decades since the first works by Leontief (1936), and it is one of the methodologies used for the empirical analysis of real economies and for the design of economic policies. Virtually all the structural analysis tools-at first developed for the input-product analysis-can also be applied to the social accounting matrices.

However, despite the fact that the concept of Social Accounting Matrix (SAM) was developed and began to gain importance almost half a century ago, with at least one SAM having been developed in most countries based on the National Accounts, Mexico has had a marked backwardness due to various reasons-perhaps the main of which being that the INEGI abandoned the development of the Input - Output Table (IOT) for more than 30 years-, so that currently and in most cases each researcher in this area develops their own SAM, without the possibility of replicating the results, given that the SAM is not generally published. The main objective of this work is to build and present a SAM of the Mexican economy for the year 2003, based on the Domestic Input-Output Symmetric Table for the Total Economy, officially published by the INEGI, and using a transparent methodology, so that it can be used to carry out research with results that can be replicated and corroborated (or corrected). Furthermore, we did a basic study for the characterization of the productive sectors, and concluded with an application using the Leontief model to obtain the General Multipliers Matrix (GMM), with which we analyzed the structure of the productive sector of the country, and calculated the carry-over and dispersion indices to determine the relative importance of the productive activities in the Mexican economy.

While it is true that the OIT for 2008 is already available as well as an update for 2012,7 and therefore it is possible to update the SAM, this in no way undermines the usefulness and interest for a SAM for 2003 for various reasons.

Without being exhaustive, one of these is that the study of the evolution of variables throughout time is one of the fundamental interests of the economic analysis (this is the reason for the construction of time series), and the comparative studies of a set of data in two points of time is one of the basic approaches to the topic.

Another is that, insofar as the structural changes on the economy are not significant throughout a determined period, the conclusions could maintain their validity and, if there are indeed significant changes, their study could help understand how the different transmission mechanisms act on the economy.

In the practical field, the evaluation of the results of public policies and programs requires analyzing scenarios a posteriori (or ex post), regarding initial or reference situations, for which a SAM prior to the scenario of interest is of obvious importance.

Moreover, the fact that a set of data corresponds to a past period does not necessarily invalidate the results that could be derived from these. In other words, most (or all) of the work and the results obtained by past scientists, would lack validity.

On the other hand, the construction of this SAM is also intended to contribute elements that allow-along with the eventual contributions of other researchers interested in the topic- defining the methodology, or the most appropriate approach for the construction of Mexico’s SAM; both because the inter-temporal comparability is of central importance for the analysis of the evolution of variables, and because if each researcher builds their own database, then the results would not be comparable and thus, would be difficult to verify.

This work closely follows the methodology developed by Núñez (2014) for the construction of a macro-SAM, that is, an aggregated matrix at the macroeconomic level for the Mexican economy, and based on this macro-SAM we built the micro-SAM reported here. Furthermore, in this work we carried out a basic characterization of the productive structure, and calculated the General Multipliers Matrix, calculating the carry-over and dispersion indices to determine the relative importance of the sectors, and to identify key and strategic sectors.

We consider that the main advantage of this work is that it proposes a specific methodology for the Mexican System of National Accounts (MSNA), departing from the Input - Output Table (OIT) published by the INEGI, and data from the national accounts, to build a transparent SAM that can be replicated and corrected, or modified to carry out different researches; because as far as we know, this has not been done for Mexico, given that according to the work of Barbosa-Carrasco et al. (2009):

"Despite its importance, there is no official SAM for Mexico and each researcher builds their own: 1) A SAM, in 1975, to analyze the function of the public sector in the economy of the country (Pleskovic and Treviño, 1985); 2) a SAM, with data from 1989, to calibrate the model to evaluate the impact of Mexico trade openness (Levy and Van Wijnbergen, 1992); 3) a SAM, based on 1985, to calibrate the computable general balance models to analyze the consequences of the North American Free Trade Agreement and fiscal policies (Sobarzo, 1992 and 1994); and 4) a SAM with data from 1996 (Harris and Robinson, 2003) (McDonald and Thierfelder, 2004). Of these matrices, only those by Pleskovic and Treviño (1975), Harris and Robinson (2003), and a SAM of the GTAP with data from 1997 (Trejos et al., 2004) were published. Due to there not being a more recent SAM that is available for Mexico, this work was done with the objective of building one for 2004".

More recent works such as that by Aguayo et al. (2009) are based on updates made to considerably old matrices,8 and others such as the cited work of Barbosa-Carrazco et al. (2009) resort to econometric techniques to estimate a great quantity of unavailable data.9 The proposal followed in this work allows building a SAM based on current and complete data, therefore, it is possible to apply this methodology to the 2008 input-product matrices, and to the 2012 update published by the INEGI,10 as well as to future matrices and supplementary data of the national accounts, without having to resort to updating old data or estimating inexistent data. Both works cited in this paragraph-published in the same year (2009), regarding two matrices for the same year (2004), built with different methodologies, and thus non-comparable-also show the need for a consistent approach that avoids the duplication of efforts and, above all, the need to have a framework that allows replicating and comparing the results of different researches.

The article is organized as follows. In the first section, we considered the matrix to be used and we take the Domestic Input-Output Symmetric Table(OIT-Mx03ETD), adding the productive sectors to obtain the macro matrix from which the SAM-Mx03 will be built. In the second section, the Activities are disaggregated to carry out the basic study of the sectors and their characterization. In the third section, we select the exogenous accounts and apply the Leontief model to obtain the General Multipliers Matrix (GMM) and elaborat the Rasmussen indices. Finally, the fourth section presents some closing remarks.

Construction of the Social Accounting Matrix SAM-Mx03.

Table 1 partially compares, from the production point of view, the 4 input-product symmetric matrices published by the INEGI. The basic differences consist, on the one hand, on the disaggregation done on the imports, and on the other, the Maquila Export Industry (MEI). For this work, we have opted to use the Domestic Input-Output Symmetric Table for the Total Economy (OIT-Mx03ETD, which simply follows the OIT), given that the additional objective will be to carry out a sector analysis. The methodology used is immediately applicable to any of the other input-product matrices of Table 1 for the construction of the corresponding SAM. Throughout the article, the figures are expressed in millions of pesos for the year 2003, unlike the national accounts, where these are expressed in thousands of pesos.

Table 1 Input-Output Symmetric Tables 2003 of the INEGI. (Millions of pesos).

Source: Own elaboration based on the Mexican Input-Product Matrices for 2003 (INEGI, 2008).

Elaboration of the macro matrix.

First, we added the 20 sectors of the OIT into a single one to facilitate the elaboration of the macro matrix, since once this is squared, according to the national accounts, the subsequent disaggregation will maintain the consistency. The OIT with the aggregated productive sectors is shown in Table 2.

Table 2 OIT with the added productive sectors into a single one. (Millions of pesos).

Source: Elaborated based on the Domestic Input - Output Table of the Total Economy of Mexico for 2003 (INEGI, 2008).

Although the SAM can be seen as an extension of the OIT, conceptually, it is an accounting framework that has two fundamentally different implications: while the OIT focuses on the productive sectors, specifying all of their inputs and the destination of the production, the SAM reflects the circular flow of the economy and specifies the balance of all the accounts of the economy, focusing on the institutions of the same (namely, Households, Government, and Companies or Partnerships, thus it is denominated Social Accounting Matrix) and thus on the balance of the economy as a whole. Consequently, the SAM contains more information than the OIT due to necessity. Furthermore, according to the conventional standard format, each account has a row that specifies its incomes (resources) and a column that specifies its expenses (uses); meaning that the SAM is a squared matrix where the total per row is exactly the same as the total per column (income=expense) (Defourney and Thorbecke, 1984). Table 3 shows the information of the OIT contained in Table 2, using the previously mentioned standard SAM format.

Table 3 Data from the OIT-Mx03ETD in standard SAM format. (Millions of pesos.)

| Private consumption (Households) | Government consumption (Government) | FBCF and Change in Stocks (Investment) | Productive Sectors (Activities) | Exports (RoW) | Row Total (Resources) | |

|---|---|---|---|---|---|---|

| Private consumption (Households) | 7 168 526 | 7 168 526 | ||||

| Public consumption (Government) | 351 640 | 4 617 | 36 773 | 393 030 | ||

| FBCF and Change in Stocks (Savings) | 0 | |||||

| Productive Sectors (Activities) | 4 476 438 | 892 322 | 1 436 114 | 3 806 997 | 1 813 205 | 12 425 075 |

| Imports (RoW) | 220 430 | 1 523 | 288 896 | 1 412 780 | 102 560 | 2 026 188 |

| Column Total (Uses) | 5 048 508 | 893 844 | 1 729 627 | 12 425 075 | 1 915 766 |

Table 3 makes obvious that with the information from the OIT, only the account of the productive Activities is balanced. All the others show greater or lesser imbalances, because the OIT does not contain the necessary information that must be integrated into the SAM. For example, in the case of Households, the incomes must also include the transfers and payments of the RoW to the productive factors, and for expenses, the taxes paid by the households must also be included, mainly the ISR. In the case of the Government, there are also certain elements missing with regard to its income and others regarding public expenses, and such is the case for the other accounts. In other words, the difference between a SAM and a OIT is both conceptual and informative, and not a matter of format, thus, it is not possible to make an OIT using the SAM format.

Subsequently, we resort to the data of the Mexican System of National Accounts (MSNA) to balance the accounts of the matrix in Table 3, to obtain a squared (balanced) macro matrix, from which we can build a fully consistent micro matrix. During the process, we will introduce new accounts to build a matrix that adequately shows the data of our economy, resorting mainly to the data reported in the Goods and Services Accounts (Inegi, 2010a) and the Accounts by Institutional Sector (Inegi, 2010b). The macro matrix obtained is shown in Table 4.

Table 4 Social Accounting Macro Matrix. (Millions of pesos).

| Households | Partnerships | Government | Investment | Capital | Labor | Activities | RoW | Total | |

| Households | 3 513 249 | 113 241 | 2 239 206 | 167 223 | 6 032 919 | ||||

| Partnerships | 4 487 421 | 4 487 421 | |||||||

| Government | 578 149 | 170 107 | 4 617 | 495 025 | 1 247 897 | ||||

| Savings | 757 902 | 779 607 | 116 046 | 76 071 | 1 729 627 | ||||

| Capital | 4 487 421 | 4 487 421 | |||||||

| Labor | 2 222 853 | 16 353 | 2 239 206 | ||||||

| Activities | 4 476 438 | 892 322 | 1 436 114 | 3 806 997 | 1,813 205 | 12 425 075 | |||

| RoW | 220 430 | 24 458 | 126 289 | 288 896 | 1 412 780 | 102 560 | 2 175 412 | ||

| Total | 6 032 919 | 4 487 421 | 1 247 897 | 1 729 627 | 4 487 421 | 2 239 206 | 12 425 075 | 2,175 412 |

Source: Own elaboration with data from the Mexican System of National Accounts.

Following the order proposed in Table 3, we begin with the balance of the account for the Households. For this, it is necessary to previously introduce three more accounts: the Capital and Labor to disaggregate the Value Added, and the Partnerships to systematically make use of the data of the Accounts by Institutional Sectors (AIS).

According to Table 3 of the Goods and Services Accounts (GSA) Employee remuneration (including Social contributions) increases to 2 370 474 (as noted above, all figures are in millions of pesos for 2003), and the Gross operating surplus (GOS) increases to 4 487 421. Adding both we obtain 6 857 895, the difference of which regarding the Gross Value Added of the total economy reported by the OIT gives us 310 631, which are the Other taxes on production paid by the Activities to the Government (in addition to the net taxes on the products already mentioned). The GOS goes to the Capital account, which transfers it to the Partnerships, which shall subsequently distribute it. The Employee remuneration goes to the Labor account, minus the Social contributions that the Activities pay to the Government, given that according to the AIS the "Net social contributions" perceived by the government are of 147 621, and thus the remaining 2 222 853 must correspond to the Households.

On the other hand, according to the AIS, the Social transfers (Social benefits different to the transfers in kind) are of 117 510, from which we subtract the Other social transfers (net) 4 269, to obtain the total transfers that the government makes to the Households: 113 241. In this case, we wish to obtain only the gross income of the Households, thus we subtract the Other social transfers that the government makes.

Also, according to the AIS the Other current transfers (net) of the RoW are of 167 223, (which constitute the remittances that the Households receive), and the payment of the RoW to the labor factor is of 16 353, with which the Households incomes are completed, missing only what they receive as capital income (GOS) from the partnerships.

Before obtaining the GOS that the Households receive from the Partnerships, we can observe their additional expenses to obtain their GOS as a balance. According to the AIS the Gross savings of the Partnerships is of 779 607, of 116 046 for Government, of 757 902 for the Households and the ISFLSH, and of 76 071 for the RoW.

Finally, according to the AIS, the ISR paid by the Households is of 226 509, (in addition to the consumer tax mentioned above). The ISR paid by the Partnerships (financial and non-financial) is of 170 107.

Since we already have the total expenses of the Households, and all of the elements of their income, we can obtain the GOS they obtain as the difference given by the balance: 3 513 249, with which the Households account is balanced.

The next account is that of Partnerships, for which we have practically obtained all the elements, observing that it has a balance of 24 458 corresponding to the Property income that the Partnerships pay to the RoW, which is consistent with the AIS data. With this, the Partnerships account is now also balanced.

Here we can observe that all the other accounts are already balanced, except that of Government, showing an imbalance of 124 766, which corresponds to the payment of the Property income of the Government to the RoW. It is worth noting that this payment, plus the payment made by the Partnerships that we obtained previously, add up to 149 224, an amount equal to the (net) Property Income of the RoW, as reported by the AIS. With this, all of the accounts of the macro matrix are balanced and we can proceed to disaggregate the Activities.

Disaggregation of the Activities and basic characterization

To disaggregate the Activities, we return to the OIT to reestablish the data that we added to elaborate the macro matrix, and shall subsequently use the information of the GSA to disaggregate the remaining data.

Previously, we introduced four more accounts to separate the social taxes (ISR, Social contributions, Sale taxes, and Other taxes on the production) to adequately carry out their disaggregation by productive sector.

Once the taxes have been reorganized, we open the 20 accounts necessary to disaggregate the Activities, where we can immediately copy the data from the OIT: inter-industrial exchanges submatrix, and the columns for Private Consumption, Government Consumption, FBCF plus Change in Stocks, and Exports. This done, the assignment of all the goods and services provided by the Total supply is completely disaggregated.

We can also immediately disaggregate the data from the rows of Imports and Sales Tax, copying the data from the OIT to the SAM, thus including in the SAM all the information of the IMP that is advantageous for its construction as has been mentioned, and we proceed to using the data reported by the GSAs.

Tables 55, 58, and 59 of the GSAs contain figures, by productive sector, of the Employee remuneration, of the Other taxes on the production, and the GOS respectively. As in said tables sectors 48 and 49 are aggregated, and considering that the importance of sector 49 is relatively small to maintain the transparency of the data, we also added these two sectors to the SAM (it is always possible to disaggregate them later if the necessary information becomes available). The three listings mentioned comprise the Gross Value Added (GVA), however, unlike the IMP, the GOS reported in the GSAs includes the "Indirectly measured financial intermediation services", which are not disaggregated. Therefore, to calculate the GOS per Activity, we first added the Remunerations, the Other taxes, and the GOS of the GSAs to obtain a GVA that includes the Financial services, and subsequently subtracted the GVA from the IMP to obtain the Financial services per sector, which we in turn subtracted from the GOS of the GSAs to obtain the net GOS per Activity of the Financial services.

The Other taxes on production in Table 58 of the GSA are the net taxes (304,878), which differ from those calculated for the macro matrix (310 631); this is a relatively small (1.85%) unexplained difference, and to distribute it we assume that it is proportionally allocated between the sectors.

On the other hand, we must separate the Social contributions from the Remunerations, for which we will also assume that the payment of the Social contributions is proportional to the Remunerations paid by each sector, which is equivalent to assuming that the Social contributions paid for each Activity are similar.

Once we included the Other taxes on the production, the Remunerations, and the Social contributions by sector in the SAM, the remaining balance must then correspond to the GOS per sector, with which the SAM-Mx03ETD is left completely balanced. We present the SAM-Mx03ETD in Appendix A.

We created Table 5 to evaluate the accuracy of the abovementioned balance, regarding the GOS per sector that we obtained previously from the GSA.

Therefore, the constructed SAM shows an inconsistency in the disaggregation of the GOS regarding the figures of the IMP, however, this is a transparent error and is not quantitatively significant, given that in most cases it only increases to 3.3% for the GOS of Activity 2 (Mining), and can be immediately corrected once the necessary data are available.

Table 5 Comparison of the GOS disaggregation. (Millions of pesos).

| Activity | GOS SAM | GOS GSA | Difference | Difference % | Activity | GOS SAM | GOS GSA | Difference | Difference% |

| 1 | 209 815 | 209 549 | 266 | 0.13 | 11 | 787 251 | 786 389 | 862 | 0.11 |

| 2 | 134 895 | 139 540 | -4,645 | -3.33 | 12 | 207 590 | 207 342 | 248 | 0.12 |

| 3 | 56 135 | 56 075 | 60 | 0.11 | 13 | 5 444 | 5 513 | -68 | -1.24 |

| 4 | 280 858 | 280 531 | 327 | 0.12 | 14 | 65 871 | 65 806 | 65 | 0.10 |

| 5 | 825 868 | 824 998 | 870 | 0.11 | 15 | 87 608 | 87 515 | 93 | 0.11 |

| 6 | 812 116 | 811 283 | 832 | 0.10 | 16 | 94 318 | 94 209 | 109 | 0.12 |

| 7-8 | 356 640 | 356 191 | 449 | 0.13 | 17 | 20 673 | 20 653 | 21 | 0.10 |

| 9 | 139 864 | 139 709 | 155 | 0.11 | 18 | 144 914 | 144 750 | 164 | 0.11 |

| 10 | 119 624 | 119 551 | 72 | 0.06 | 19 | 163 187 | 136 024 | 162 | 0.12 |

| 20 | 1 749 | 1 791 | -42 | -2.37 |

Acronyms: GOS = Gross Operation Surplus. SAM = Social Accounting Matrix. GSA = Goods and Services Account.

Source: Own elaboration with data from the Mexican System of National Accounts.

Basic study and characterization of the productive sectors

Value Added and factorial participation

When the productive sectors of an economy are studied, the participation of the productive factors in obtaining the value added is one of the key points, given that from this it can be established if an Activity is relatively more or less intensive in the usage of capital or labor.

In Table 6 we calculated the sum of the payments to Capital and Labor for each Activity, what we call Value Added (VA), unlike the Gross Value Added (GVA) previously mentioned and which includes the Other taxes on production. In the last two columns of the Table we can observe the relative participations of the factors as percentages.

Table 6 Factorial participation in the Value Added. (Millions of pesos 2003).

| Gross Operation Surplus (GOS) | Remunerations (Rem) | GOS + Rem = Value Added (VA) | GOS / VA % | Rem / VA % | |

| Agriculture, livestock, forestry, fishery and hunting | 209 815 | 47 085 | 256 900 | 81.7 | 18.3 |

| Mining | 134 895 | 32 504 | 167 399 | 80.6 | 19.4 |

| Electricity, Water, Gas (end consumption ducts) | 56 135 | 33 115 | 89 251 | 62.9 | 37.1 |

| Construction | 280 858 | 179 154 | 460 012 | 61.1 | 38.9 |

| Manufacturing Industries | 825 868 | 426 962 | 1 252 830 | 65.9 | 34.1 |

| Commerce | 812 116 | 247 150 | 1 059 266 | 76.7 | 23.3 |

| Transport, Post Office and Storage | 356 640 | 162 683 | 519 323 | 68.7 | 31.3 |

| Information in mass media | 139 864 | 46 939 | 186 802 | 74.9 | 25.1 |

| Financial and Insurance Services | 119 624 | 55 758 | 175 382 | 68.2 | 31.8 |

| Real Estate and Rental Services | 787 251 | 9 007 | 796 258 | 98.9 | 1.1 |

| Professional, scientific, and technical services | 207 590 | 65 736 | 273 326 | 75.9 | 24.1 |

| Company and Corporate Management | 5 444 | 11 784 | 17 228 | 31.6 | 68.4 |

| Business support and waste management services | 65 871 | 97 099 | 162 970 | 40.4 | 59.6 |

| Educational services | 87 608 | 266 870 | 354 479 | 24.7 | 75.3 |

| Health and social assistance services | 94 318 | 119 417 | 213 735 | 44.1 | 55.9 |

| Recreation, cultural, and other services | 20 673 | 7 391 | 28 064 | 73.7 | 26.3 |

| Lodging, food and drink services | 144 914 | 54 017 | 198 932 | 72.8 | 27.2 |

| Other services except government activities | 136 187 | 66 893 | 203 080 | 67.1 | 32.9 |

| Government activities and international agencies. | 1 749 | 293 287 | 295 036 | 0.6 | 99.4 |

| Total | 4 487 421 | 2 222 853 | 6 710 274 | 66.9 | 33.1 |

Source: Own elaboration with data from the Mexican System of National Accounts.

Altogether, the remunerations to the capital increase to twice what is paid for labor. Subsequently, there are two notorious extreme cases: that of the Real Estate sector, with a rather high capital participation (98.9%), and that of the Government activities sector, with a rather low participation (0.6%). For the rest of the sectors said participation is distributed, more or less, uniformly between 81.7% (Agriculture, livestock, ...) and 24.7% (Educational services).

In absolute terms, three sectors that repay the highest payments to the capital stand out: Manufacturing, Commerce, and Real Estate Services; these three sectors pay 54.1% of the GOS. Regarding Remunerations, four sectors stand out: Manufacturing, Commerce, Educational services and Government activities, paying 55.6% of the total Remunerations of the economy. The most labor-intensive Activity, below the aforementioned extreme case, are Educational services (75.3%), followed by Corporate management (68.4%), though this is the smallest sector and only generates 0.3% of the total VA. Furthermore, it clearly is a very specific and highly specialized portion of the labor factor. The next two Activities with greater labor participation are the Business support services (59.6%) and Health services (55.9%).

The most capital-intensive Activity, below the aforementioned extreme case, is Agriculture, livestock... (81.7%), followed by Mining (80.6%), Commerce (76.7%), and Professional services (75.9%).

Manufacturing and Commerce generate the highest VA, with a combined value of 34.5% of the total. Similarly, they also jointly pay 36.5% of the GOS, and 30.3% of the remunerations of the entire economy. The third sector that generates the highest VA is Real Estate, but the possibility for job creation here tends to be null.

Inter-industrial exchanges

The participation that each industry or productive sector has in the contribution of inputs with regard to the rest of the industries for their processing and generation of goods and services, as well as the inputs it demands from the other sectors, comprise the most relevant interrelations to analyze the positioning of each sector and their importance in the network of interrelations that define the interaction of all the industries among each other for the creation of the economic wealth. Table 7 presents the inputs demanded by each sector from the others, the inputs it contributes, the absolute difference, and the difference as a percentage of the demand. In this table, the negative differences mean that the demand is lower and thus there is a net positive supply; when the difference is positive, then the sector consumes more than it contributes to the others. Given that the sum of all the distributed inputs, stemming from the internal economy, is by necessity equal to the sum of all the demands for inputs, the sum of the differences is thus equal to zero.

Table 7 Inter-industrial exchanges. (Millions of pesos 2003).

| Activity | Demanded Inputs (A) | Supplied Inputs (B) | Difference (A-B=C) | Difference % (C/A)*100 |

|---|---|---|---|---|

| Agriculture, livestock, forestry, fishery and hunting | 135 281 | 218 424 | -83 142 | -61.5 |

| Mining | 94 399 | 295 285 | -200 885 | -212.8 |

| Electricity, Water, Gas (end consumption ducts) | 121 468 | 153 274 | -31 807 | -26.2 |

| Construction | 422 822 | 81 062 | 341 760 | 80.8 |

| Manufacturing Industries | 1 703 222 | 1 152 784 | 550 438 | 32.3 |

| Commerce | 314 052 | 531 797 | -217 744 | -69.3 |

| Transport, Post Office and Storage | 238 969 | 229 649 | 9 320 | 3.9 |

| Information in mass media | 101 206 | 138 849 | -37 643 | -37.2 |

| Financial and Insurance Services | 111 565 | 171 618 | -60 053 | -53.8 |

| Real Estate and Rental Services | 76 380 | 211 016 | -134 636 | -176.3 |

| Professional, scientific, and technical services | 92 393 | 263 120 | -170 727 | -184.8 |

| Company and Corporate Management | 15 937 | 41 358 | -25 421 | -159.5 |

| Business support and waste management services | 41 560 | 196 511 | -154 951 | -372.8 |

| Educational services | 39 570 | 6 018 | 33 552 | 84.8 |

| Health and social assistance services | 59 456 | 0 | 59 456 | 100.0 |

| Recreation, cultural, and other services | 11 157 | 1 524 | 9 634 | 86.3 |

| Lodging, food and drink services | 72 334 | 35 200 | 37 134 | 51.3 |

| Other services except government activities | 54 593 | 73 750 | -19 157 | -35.1 |

| Government activities and international agencies. | 100 632 | 5 759 | 94 874 | 94.3 |

| Total | 3 806 997 | 3 806 997 | 0 |

Source: Own elaboration with data from the Mexican System of National Accounts.

Once more, in absolute terms, Manufacturing and Commerce are the sectors with greater demand and which contribute more inputs to the economy, but Manufacturing has a net demand of 32.3% (which could be interpreted as follows: for every 100 pesos of inputs it demands, it supplies 67.7 pesos to the other sectors), whereas Commerce has a net supply of 69.3%, which means that for every 100 pesos it demands, it supplies 169.3 pesos to the rest of the economy. The greatest supply rate of inputs is that of Business support and waste management services, which offer 472.8 pesos to the economy for every 100 pesos demanded, in second place we have Mining, supplying 312.8 pesos for every 100 demanded, and in third we have three service sectors: Real Estate, Professional, and Company Management, supplying 276.3, 284.8 and 259.5 pesos respectively for every 100 pesos they demand in inputs. Therefore, we can conclude that these five sectors seem to be the most necessary in the economy, in the sense that they produce the inputs most required by the other productive sectors.

On the other extreme, we have the Activities that generate the greatest relative demands. It is immediately apparent that the Health sector, according to this account, has a null contribution to the rest of the economy, and presents only the necessary demand to provide the health services it generates. This poses a problem for this type of analysis, as health is a fundamental input. However, it is not treated as a direct input and as such is unaccounted, thus remaining as a sector that only consumes and does not contribute inputs to the rest of the economy. This, however, does not mean that it is not important, on the contrary, it can indicate that it has a high multiplying effect if the expenses in said sector increase; for example, a quality improvement policy for the public health services would immediately translate into 100% increases on the input demand it requires.

In second place, we have the Government activities and international agencies sector, which offer only 5.7 pesos for every 100 it demands, though this is not a typically productive sector. Following this we have two service sectors, Education and Recreational, which supply 15.2 and 13.7 pesos, respectively, for every 100 they demand in inputs. We can say that these four sectors have a higher immediate carry-over effect and, therefore, can have greater multiplying effects.

Foreign trade

Another important indicator to evaluate the performance of the economy is given by the degree of foreign trade, that is, the measure in which goods and services are imported and exported, also known as the degree of integration with the global economy.

We begin with the imports, presenting the demand for national inputs in Table 8, followed by the demand of imports and, in the last column, the import of inputs as a ratio of the national inputs.

The first thing that calls our attention is that manufacturing, the most important sector of the economy, imports inputs for an equivalent of 61.9% of the national inputs, significantly above the other sectors, which implies a high degree of integration (or dependence) of the global economy. In the lower extreme, we have five sectors with input imports that, due to their own nature, represent less than 10% of the national inputs: Real Estate services (7.9%), Educational services (8.9%), Recreational services (8.5%), Lodging services (5.0%), and Government activities (4.3%). For the rest of the Activities, the percentage varies, more or less uniformly, between 11.7% (Financial services) and 30.2% (Other services).

Table 8 Imported inputs. (Millions of pesos 2003).

| Activity | National inputs (A) | Imported inputs (B) | Imported inputs as a percentage of the national inputs (B/A)*100 |

|---|---|---|---|

| Agriculture, livestock, forestry, fishery and hunting | 135 281 | 26 618 | 19.7 |

| Mining | 94 399 | 16 028 | 17.0 |

| Electricity, Water, Gas (end consumption ducts) | 121 468 | 22 675 | 18.7 |

| Construction | 422 822 | 68 481 | 16.2 |

| Manufacturing Industries | 1 703 222 | 1 054 394 | 61.9 |

| Commerce | 314 052 | 59 933 | 19.1 |

| Transport, Post Office and Storage | 238 969 | 53 314 | 22.3 |

| Information in mass media | 101 206 | 20 661 | 20.4 |

| Financial and Insurance Services | 111 565 | 13 035 | 11.7 |

| Real Estate and Rental Services | 76 380 | 5 999 | 7.9 |

| Professional, scientific, and technical services | 92 393 | 19 312 | 20.9 |

| Company and Corporate Management | 15 937 | 3 284 | 20.6 |

| Business support and waste management services | 41 560 | 8 978 | 21.6 |

| Educational services | 39 570 | 3 513 | 8.9 |

| Health and social assistance services | 59 456 | 11 197 | 18.8 |

| Recreation, cultural, and other services | 11 157 | 948 | 8.5 |

| Lodging, food and drink services | 72 334 | 3 597 | 5.0 |

| Other services except government activities | 54 593 | 16 503 | 30.2 |

| Government activities and international agencies. | 100 632 | 4 309 | 4.3 |

| Total | 3 806 997 | 1 412 778 |

Source: Own elaboration with data from the Mexican System of National Accounts.

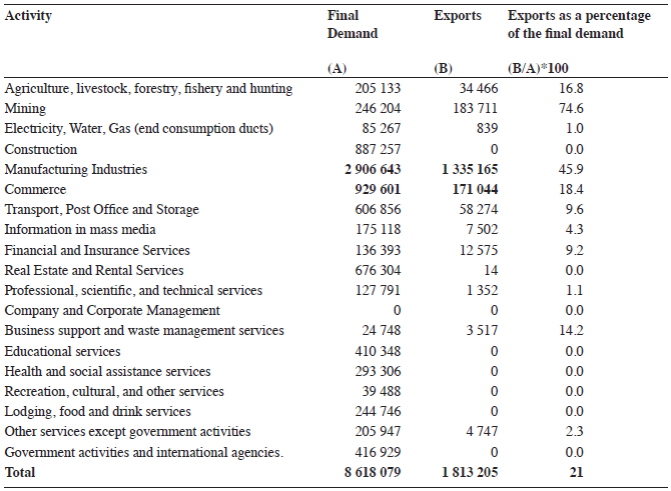

Let us now consider the exports. In Table 9, we present the total final demand per sector, the exports and, in the last column, the exports as a percentage of the total final demand. The highest percentage observed, 74.6%, corresponds to Mining, explained by the presence of Pemex with its oil exports. In second place we have Manufacturing, with exports that increase to close to half of its total net production of inputs (45.9%). In absolute terms, Manufacturing is also the most important exporting sector of the economy; the exports of the previously seen Mining sector only represent 13.8% of the exports from Manufacturing. In third place we have Commerce, which contributes 18.4% of its final consumption production. The rest of the Activities do not have significant exports.

General Multipliers Matrix (GMM)

In this section, we used the SAM-Mx03ETD to carry out an identification exercise for the accounts of our economy, based on the General Multipliers Matrix (GMM)-thus called because it generalizes Leontief multipliers to a SAM-and using the definition of Rasmussen indices.

Possibly, the most important utility -or at least the most exploited one of Leontief model- is that it allows the quantification of the interrelations between the sectors of the economy and, therefore, the identification of those that have the most intense relations with the others (key sectors). In this manner, it could be argued that such sectors, should they receive significant investments, would generate a higher growth for the economy.

Although various methods have been developed for the identification of key sectors, mainly based on their "backward" and "forward" chaining (Iráizoz, 2006), and even when Rasmussen indices have received some critiques (Sonis et al., 1995, p. 234), in this work we calculated the General Multipliers Matrix (GMM) and classified the accounts of our economy according to said indices-due to their broad use and because they comprise a first approximation to the study of the structure of a real economy.

We will not go into detail regarding the specification of the model, as it is well known and many texts discuss it in detail (in particular, Miller and Blair, 2009, Ch. 6); it suffices to specify that the general form of the model is:

Where y represents the income vector (equal to expense) of n=1, ..., N endogenous accounts; M=(I-A)-1 is the multipliers matrix (equal to Leontief inverse when the endogenous accounts are only the productive sectors); and x is an endogenous accounts vector (equal to the final demand in Leontief model).

Each M element of column j is interpreted as the impact of an exogenous unitary increase directed to account j, over the income of each endogenous institution, so that the sum comprises the total multiplying effect.

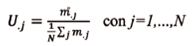

Rasmussen indices simply compare the impact of each account or sector with the average impact, both by column (carry-over) and by row (dispersion), so that when a particular impact is higher to the average there is an index greater than one. Otherwise, the carry-over or impact index per column is defined as:

Where

is the average impact of the sector or account j over the other endogenous accounts, and N is the number of endogenous accounts or sectors. Similarly, the dispersion per row of the index is defined as:

is the average impact of the sector or account j over the other endogenous accounts, and N is the number of endogenous accounts or sectors. Similarly, the dispersion per row of the index is defined as:

To carry out this exercise, we performed the follow modifications to the SAM, with the purpose of simplification. We eliminated the Societies account, making it so that the Capital account directly does the distribution of the GOS. We also eliminated Private consumption, so that the Activities directly transfer the goods and services to the Households. Finally, we considered the Rest of the World and the Government as endogenous accounts along with the tax accounts.

Appendix B presents the table with the obtained GMM, and in Table 10 we can observe the Rasmussen indices that can be interpreted as a summary of the GMM, with the identification of the 23 endogenous accounts of our economy.

According to these results, the productive factors have an above average impact, both in the carry-over and the dispersion, which is logical if we consider that all the productive sectors utilize them, and the income is generated from these. In the strategic sectors, the multiplier effect that the households have with the dispersion of their income is notable, which increases to 5.24, that is, each peso spent by the households generates a total dispersion of 5.24 pesos, an interesting result if a strengthening policy of the income of the households is considered.

Final comments

In this work, we built and presented a Social Accounting Matrix (SAM), proposing and developing a transparent methodology to make it possible to clearly track-up to the statistical sources of the national accounts-the origin of all the data contained in the SAM; therefore detecting errors, making corrections, and adapting the matrix to specific research purposes. It is worth noting that this SAM can be immediately extended to the next level of disaggregation reported by the INEGI-which comprises 79 sectors of the NAICS-to carry out more detailed analyses of the productive sectors.

Once specified, the SAM can be used to apply a broad range of multi-sectoral models to the analysis of the Mexican economy, particularly the structural analysis and Applied General Equilibrium Models, with the advantage that the results can be replicated by different researchers and, consequently, can be discussed and validated or corrected.

Additionally, we carried out an analysis of the productive sectors, followed by the calculation of a generalized multipliers matrix that provides the total effects that a boost would have on each productive sector. Finally, we identified the productive sectors based on Rasmussen carry- over and dispersion indices.

According to other similar studies (Beltrán et al. 2016 and Sobarzo 2011), the classification of the productive sectors is consistent and comprises a useful guide for the economic policy analysis. Especially, the identification of strategic sectors allows preventing bottlenecks that could hinder the growth of the economy, and that of booster sectors allows the identification of investments that could have the highest multiplier effects and thus the best return to planned investments.

REFERENCES

Aguayo, E. et al. (2009) Análisis de la generación y redistribución del ingreso en México a través de una Matriz de Contabilidad Social. Estudios Económicos , Número extraordinario. [ Links ]

Barbosa-Carrasco, I. et al. (2009) Matriz de Contabilidad Social 2004 para México. Agrociencia 43: 551-558. [ Links ]

Beltrán, L. et al. (2015) Structural analysis of the mexican economy in 2008. 23 rd International Input-Output Conference. 22-26 June 2015, Mexico, Mexico City. [ Links ]

Defourney, J. and Thorbecke, E. (1984) Structural path analysis and multiplier decomposition within a social accounting framework. The Economic Journal, 94(373). https://doi.org/10.2307/2232220 [ Links ]

INEGI (2010a) Cuentas de bienes y servicios 2003-2008. Año base 2003. Tomos I y II. Segunda versión. México. [ Links ]

INEGI (2010b) Cuentas por sectores institucionales 2003-2008. Año base 2003. Tomos I y II. Segunda versión. México. [ Links ]

INEGI (2008) Matriz de insumo producto de México 2003. Clasificación SCIAN 2002. México. [ Links ]

Iráizoz, Belén (2006) ¿Es determinante el método en la identificación de los sectores clave de una economía? Una aplicación al caso de las tablas input-output de Navarra(1). Estadística Española, 48(163). [ Links ]

Leontief, W.W. (1936) Quantitative input and output relations in the economic systems of the United States. The Review of Economic Statistics, 18(3). https://doi.org/10.2307/1927837 [ Links ]

Miller, R.E. and Blair, P.D. (2009) Input-output analysis: Foundations and extensions. Second edition. Cambridge University Press, New York, USA. [ Links ]

Núñez, G. (2014) Macro matriz de contabilidad social de México para el año 2003. Econoquantum Revista de Economía y Negocios, 11(2). https://doi.org/10.18381/eq.v11i2.2312 [ Links ]

Sobarzo, H. (2011) Modelo de insumo-producto en formato de matriz de contabilidad social. Estimación de multiplicadores e impactos para México, 2003. Economía Mexicana Nueva Época, 20(2). [ Links ]

Sonis, Michael et al. (1995) Linkages, Key Sectors, and Structural Change: Some New Perspectives. The Developing Economies, 33(3). https://doi.org/10.2139/ssrn.2420129 [ Links ]

Received: October 14, 2015; Accepted: October 14, 2016

text in

text in