Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Contaduría y administración

versión impresa ISSN 0186-1042

Contad. Adm vol.63 no.1 Ciudad de México ene./mar. 2018

https://doi.org/10.22201/fca.24488410e.2018.871

Articles

Competition and market structure of the banking sector in Mexico

1Universidad Autónoma de Hidalgo, México

2Instituto Politécnico Nacional, México

The objective of this work is to evaluate the competition in the Mexican banking sector through two approaches: market concentration and power. Concentration indices and the Herfindahl-Hirschman index are used within the concentration measures. Two tools are used in the market power approach: the Lerner index and the H-statistic. To calculate the Lerner index, a simultaneous equations model is used, which is estimated with the generalized method of moments. On the other hand, a data panel estimated in first differences and fixed effects is used for the calculation of the H-statistic. A sample of 15 banks is used for the case of the market power approach, and of 32 banks for the concentration approach; both approaches are studied within the 2000-2012 period. It can be observed that within the concentration approach there is a decrease in the concentration indices, and therefore an increase in competition. The result obtained in the power market approach for the Lerner index and H-statistic is monopolistic competition.

Keywords: market structure; competition; concentration

JEL classification: C33; L11; L13; G21

Este artículo tiene como objetivo evaluar la competencia en el sector bancario mexicano por medio de dos enfoques: concentración y poder de mercado. Dentro de las medidas de concentración se emplean los índices de concentración y el índice Herfindahl-Hirschman. En el enfoque de poder de mercado se usan dos herramientas: el índice de Lerner y el estadístico H. Para calcular el índice de Lerner se utiliza un modelo de ecuaciones simultáneas el cual se estima con el método generalizado de momentos. Por otra parte para el cálculo del estadístico H se usa un panel de datos estimado en primeras diferencias y efectos fijos. Se emplea una muestra de 15 bancos para el caso del enfoque de poder de mercado y de 32 bancos para el enfoque de concentración; ambos enfoques se estudian dentro del período 2000-2012. Se observa que dentro del enfoque de concentración existe una disminución de los índices de concentración y por lo tanto un aumento en la competencia. El resultado alcanzado en el enfoque de poder de mercado para el índice de Lerner y el estadístico H es competencia monopolística.

Palabras claves: estructura de mercado; competencia; concentración

Clasificación JEL: C33; L11; L13; G21

Introduction

Competition in the banking sector has a long list of obvious benefits such as: greater efficiency in the production of financial services, better quality in financial products, among others. When the financial systems are more open and contested, we can generally observe a greater differentiation in the products and a decrease in the cost of intermediation, as well as more access to financial services.

However, the literature has also shown that there are adverse effects associated with the lack of banking competition. Specifically, the studies by Demirgüç-Kunt and Maksimovic (2004) and Cetorelli and Strahan (2006) have found that the lack of competition in the banking sector can result in higher prices for financial products and a reduced access to financing, particularly for smaller companies. Furthermore, Cetorelli (2003) has found that the lack of banking competition could lead to a lower revenue and growth in newer companies and also hinders the exit of older companies.

The Mexican banking sector has suffered significant changes in the last decades, among which the following stand out: the nationalization of banks in 1982, the privatization of 1991, and the financial crisis of December 1994. It is from this date that the Mexican banking system has gone through a progressive consolidation period that began with the liberalization policies. The liberalization process is present within the framework of the signing of the North American Free Trade Agreement towards the end of 1993, which allowed the entry of foreign banks to the Mexican market. This process began under a very restrictive outline that contemplated that the totality of foreign banks could only represent 8% of the market. By 1994, four international banks already operated in Mexico. However, the banking crisis of December 1994 led the system to a completely different evolving environment. The participation limits that were set in the agreement were expanded, going from 8% to 25%. The liberalization process continued to gain speed and by 1996 the participation of foreign banks had reached 52.4% of the market Turrent (2008). It was until December of 1998 1998 that foreign banks were allowed in the national market without participation restrictions. And by 2000, foreign banking started operating without any regulatory restriction. A series of mergers and acquisitions were observed as a result of these events. This new wave of mergers generated a concentrated market, in which the three biggest banks controlled around 60% of the market. One of the main benefits of this consolidation has been the contribution to the capitalization of the banking industry, as well as the improvement in the quality of the banking assets (Hernandez-Murillo, 2007). No big changes have been recorded in the 2000-2012 period concerning the level of concentration, but it is important to note that since 2006, the entry of several banks to the Mexican market, such as: Banco Base, Inter banco, Actinver, etc., has been recorded; while only one important merger has been recorded: Banorte and Ixe in 2011.

All these transformations have entailed a structural change in the conditions in which companies compete, with two opposing forces standing out: on the one hand, the promotion of free competition, propitiated by the reduction in entry barriers; on the other, the possible reduction of competition due to the increase in the concentration of baking markets as a consequence, mainly, of the merger and absorption process among entities. In this context, there is no unanimity in the existing literature regarding the global results, in other words, if the structural change of recent years has brought along an increase or decrease in competition levels, and therefore an increase or, conversely, a decrease in the social efficiency derived from the banking intermediation labor.

This investigation focuses mainly on analyzing the evolution of the level of concentration of the banking industry by using the following indices: the ratio of assets possessed by the 3 or 5 largest institutions, and the Herfindahl-Hirschman index to measure the concentration of the banking sector. On the other hand, to measure the power of the market and the accessibility of the banking system, we use the Lerner index and the H-statistic. For the case of Mexico, we expect the level of competition in the banking sector to be low in the 2000-2012 period.

It has been demonstrated that concentration is not always a reliable measure of competition, as shown in the study carried out by Cetorelli (1999). Furthermore, the relation between concentration and performance is not always positive, as suggested by Jackson (1992). Consequently, even concentrated banking sectors can be competitive if they remain contestable by promoting the entry and exit of companies.

Therefore, it is possible to measure competition without having to use explicit information regarding the structure of the market, thanks to the procurement of estimates regarding the power of the market based on the observed behavior of the banks. For example, Panzar and Rosse (1987) show that the sum of the elasticities of revenue in a company with regard to the prices of the inputs of the same, comprises what is called the H-statistic, which can be used to identify the level of competition of a market. Another alternative competition measure is the Lerner index, which measures the margin charged by the banks to their clients. This is obtained through the calculation of the differences between the price and the marginal cost, expressed as a percentage of the price. The higher values of the Lerner index imply lower levels of banking competition.

To achieve this objective, the article is divided into the following sections: theoretical framework and previous empirical literature, data, empirical application, results and conclusions.

Theoretical framework and previous empirical literature. In this section, we present the theoretical basis of the tools to be used, as well as the different studies that have been carried out on the same.

Data. In this section, we will present the basic statistics of the banking sector in Mexico.

Empirical application. This portion is focused on the explain of the methodology of the two approaches that we will use.

Results. Here, we will record the results of the investigation followed by the conclusions.

Theoretical framework and previous empirical literature

The study of banking competition is based on two approaches: the first is the "Structure-Conduct-Performance" paradigm, and the second approach is justified by two theories, which are: the new industrial organization, and the contestable market theory.

An important concept for the "Structure-Conduct-Performance" paradigm of banking competition is that banking concentration is defined as the structure of the market in which few banks have the most participation, be it in deposits, loans, or assets. Given that the "Structure-Conduct-Performance" paradigm is measured through concentration indices, it is important to know the negative effects that banking concentration entails.

The bigger the size of a bank is, the more the assets of the same will affect the assets of other banks, so there is a certain degree of interdependence; and depending on the type of barriers that exist, extraordinary earnings would be ensured. Said market structure can cause collusive behaviors among the dominant companies to the detriment of consumers as consequence of agreements (explicit or tacit) between the companies in order to fix the level of production or the price to obtain greater benefits. In this manner, it is possible that the price (the interest rate in this case) is not only the reflection of the diversification and risk decisions of the agents, but that it is also influenced by the behavior of the big banks. This approach is associated with the work done by Bain (1951), who postulates that the market structure determines the behavior and this behavior determines the result of the companies. We understand market structure as the way in which merchants interact among themselves, with consumers and with the potential entrants into the market. Furthermore, market structure affects the way goods are traded or produced. The behavior or conduct of companies comprises all those actions that they adopt to fix their price, sales, and promotion policies. Shy (1995) concludes that the result obtained is understood as the welfare of the society, and this is a result of the transactions that take place in the market. In this manner, it is confirmed that collusion is viable in concentrated markets, therefore, companies will deviate the prices in relation to those fixed in perfect competition, thus obtaining extraordinary benefits according to Tirole (1988).

A series of investigations applied to the case of banking were carried out in line with this approach; the first of them was developed by Edwards (1964), who analyzed 49 metropolitan areas of the United States between 1955 and 1957, finding a positive and significant relation between concentration and the interest rate of loans. Subsequently, there would be other works that empirically proved said hypothesis. These works have obtained results consistent with the aforementioned hypothesis, though in some cases no relation has been found between banking concentration and a measure of performance of the banks. Berger and Hannan (1989) analyze the differences in the concentration level of different banks in different metropolitan areas of the United States. This leads to the conclusion that in those sectors in which the concentration of deposits surpasses 75%, banks offer a lower rate on average within a range of 25 to 100 basis points. On the other hand, Hannan (1991) estimates that banking concentration has a positive effect on the interest rates of loans. Hannan and Berger (1991) find asymmetrical responses in the interest rates of deposits when there are changes in the Treasury rate of the United States in banking markets under the imperfect competition scheme. For their part, Neumark and Sharpe (1992) show that in concentrated banking markets the adjustment of interest rates paid to the deposits is slow when the market rate increases, whereas the adjustment is fast when there is a reduction. Andrievskaya and Semenova (2016) utilize the concentration indices to demonstrate that baking transparency can be associated with a lower market power and concentration. Their results show that a higher transparency can be associated with a lower concentration but not to a lower power in the market. When studying the impact of foreign investment on banking competition in fifty countries in Asia, the Middle East and North Africa, Lee, Hsieh and Yang (2016) employ the Herfindahl-Hirschman index as a concentration measure. The results of the study show that with a higher ratio of foreign investment, the greater the competition in the sector. In order to discuss the too big to fail hypothesis in the European banking sector, the work of Pawloska (2016) aims to find the relation between size, competition and risk-taking behavior on behalf of the banks. The investigation makes use of the concentration indices and the Herfindahl-Hirschman index, in addition to the Lerner index. The empirical results show that there is no relation between the size of banks and the stability of the sector, and no evidence is found on the existence of a relation between competition and risk taking.

Within the theory of the new industrial organization, we find the Monti - Klein model. This model was studied by Freixas and Rochet (1997) and is an adaptation of the Cournot model for the case of the banking system. The model considers several banks that face a decreasing demand of loans and an increasing demand of deposits. The earning of the banks can be seen as the sum of the intermediation margins on loans and deposits minus the administration costs. From the first order conditions, it is possible to calculate both the inverse elasticities of the demand of loans and of the offer of deposits. The equation of the Lerner index comes from the inverse elasticities mentioned by Freixas and Rochet (1997). The interpretation of the inverse elasticities is that the higher the market power in the deposits or loans of the bank, the lower the elasticity and higher the Lerner index. Thus, the intuitive result is that the intermediation margins are higher when banks have more market power. Said result also tells us that when N=1, the market scheme will be understood as a case of monopoly, and when N ∞, we are talking about perfect competition, in which the number of companies is such that the interest rate will be equivalent to the marginal cost, both in deposits and in loans. More than just the number of banks in the market, N represents the intensity of competition in the market.

One of the works based on this approach is the one by Neuberger and Zimmerman (1990) for the case of the banks in California, United States. These authors find a negative relation between the concentration indices and the interest rates that the banks fix for deposits. Corvosier and Gropp (2002) estimate a similar model for the case of European countries and find that, for the case of demand deposits and loans in more concentrated markets, banks fix non-competitive rates, though in the savings and term deposits market the hypothesis is rejected. It also indicates that the results are consistent for different econometric specifications of the variables. Other studies that analyze competition in the banking sector in several European countries are those by: Neven and Röller (1999), Bandt and Davis (2000), and Fernández de Guevara, Maudos and Pérez (2005). Neven and Röller (1999) study the case of seven European countries; the authors develop and estimate an aggregated model for the banking industry. Classifying the banks into big and small, Bandt and Davis (2000) study the effect that the adoption of a single currency has had on competition in the Banking sector of the European Union. Analyzing the tendency of market power in the main banking sectors of the European Union, Fernández de Guevara, Maudos and Pérez (2005) find that the concentration indices are not good measures.

Currently, other investigations use the Lerner index employing different approaches. The work by Huang, Chiang and Wao (2016) proposes a simultaneous stochastic frontier model based on copulas, the model is comprised by a frontier of costs and two price product frontiers. Their results suggest that banks can direct their production to the bank with the greatest potential measure of the Lerner index to obtain greater profit. Phan, Daly and Akhter (2016) study the relation between banking competition, banking concentration and the efficiency of the banking sector in six Asian countries using two types of the Lerner index. They find that banking competition has a positive effect on efficiency while competition has a negative effect. By investigating the influence of change costs in banking for the three biggest banks of the Eurozone, Egarius and Weill (2016) study if the change costs have an impact on the market power measured by the Lerner index. It is concluded that there is a positive relation between the change costs and the market power. To evaluate the effect of competition on the creation of liquidity by the banks, Horvart, Seidler and Weill (2016) conduct an estimation using a dynamic data panel with GMM on a database of banks in the Czech Republic in the 2002-2010 period. They find that a greater competition measured by the Lerner index reduces the creation of liquidity.

The theory of contestable markets was developed by Baumol (1989) and Baumol, Panzar and Willig (1983); this theory states that if there were no entry barriers in a monopolistic or oligopolistic market, then the companies within would produce and fix prices close to the ones that would be achieved in perfect competition, given that if there were great profits this would cause the entry of new companies and the profit would be reduced. Entry barriers are those legal or market aspects that limit the entry of new companies willing to compete for a portion of the market, for example, special licenses, patents, copyrights, high fixed costs, legal or illegal barriers elaborated by the same companies within the market, which do not make possible the free entry of just any company.

It is therefore said that a market is only contestable when there are low entry barriers, whereas it will be perfectly contestable if there are no entry barriers whatsoever. However, the exit cost should also be taken into consideration, thus, this theory mentions sunk costs, which are those that cannot be recovered when the company leaves the market.

All these assumptions make the existence of contestable markets questionable in reality, which does not rule out the need to empirically prove whether the market being studied is contestable or not. In any case, as stated by Weiss (1989), if the price goes up in more concentrated markets then it is concluded that the market is not contestable. Within this approach we find the H-statistic of Panzar and Rosse (1987), who elaborated perfect competition market models as well as oligopolistic and monopolistic models, from which said statistical test that allows measuring the structure of any market is derived. Said statistic is built from the sum of the elasticities of the long-term balance revenue in light of variations in the prices of the inputs. The type of competition is measured in the magnitude of the change of the balance revenues and their value before one in the price of inputs. In this manner, if the calculated statistic is lower or equal to zero, then the market is of the monopolistic type, if the value is between 0 and 1 it is of the monopolistic competition type, and when the value is equal to 1 it will be concluded that it is a perfect competition market.

Recent works such as those by Leon (2016), Apergis, Fafaliou and Polemis (2016) and that by Delis, Koka and Ongeana (2016) use the H-statistic to evaluate the competition in the banking sector. In the work by León (2016), the changes in competition in the banking industry of seven African countries are examined. The evolution of competition is analyzed using three measures: the Lerner index, the Boone index, and the Panzar-Rosse H-statistic. Their results show an escalation in the competition of these countries. When analyzing the competition of the banking sector in the European Union, Apergis, Fafaliou and Polemis (2016) provide evidence regarding the existence of monopolistic competition. To achieve these results, they utilized the Panzar and Rosse methodology in addition to a data panel using data from the banks in the European Union. To study the nexus between property and competition in the banking industry, Delis, Koka and Ongeana (2016) use a database with 131 countries and 13 years. The database includes 50000 banks, and the authors estimate three competition measures: the Lerner index, the Boone index, and the H-statistic. At a country level, the authors find that the ownership of banks by foreigners has a positive and significant impact on market power. This is mainly explained through the fact that foreign banks enter the market through acquisitions and mergers instead of creating new banks.

Empirical application

To evaluate the concentration level in the banking sector of Mexico we will use two concentration indices. The first is the ratio of assets that belong to the three biggest banks, and the second is the ratio of assets that belong to the five biggest banks; the Herfindahl-Hirschman index also will be evaluated.

Market concentration refers to the number of companies that represent the total production of a specific industry, Tirole (1988). The objective is to identify how many companies represent the majority of what is produced within a specific market, furthermore, it is sought to know whether there is space for new companies to enter and compete in that same market. One basic characteristic associated with the definition of the concentration indices is that two relevant aspects are incorporated to the structure of the industry, that is, the disparities of size and the number of companies. Market concentration is a necessary measure for investors, consumers and regulators. For the investor, the levels of competition mean a lot, given that they determine entry barriers and the price assignation mechanism of the market. In a first approach, market concentration can be simply measured by counting the number of companies in the industry. However, the inconvenience of this procedure lies on the fact that it does not take into consideration the individual strength of the companies Lijesen, Nijkamp and Rietveid (2002). Concentration indices are traditional instruments within the literature of industrial organization and are used to provide a synthetic measure of the market structure. Furthermore, they evaluate the competition level of a specific industry, Tirole (1988). There are three important measures for market concentration: the aforementioned concentration indices, the Herfindahl-Hirschman index, and the Hannah-Kay index. Since the Herfindahl-Hirschman index was adopted by the department of justice of the United States as part of its guidelines on mergers, the use of the Hannah-Kay index has become rare.

One of the first market concentration indicators that ought to be taken into consideration is the concentration index, which is defined as the sum of the market shares of the biggest companies in the market. Therefore, the concentration index is calculated in the following manner:

Where s is the market share for each bank.

If the concentration index for the five biggest banks is lower than 50%, then it is considered that the banking sector is competitive. The main problem with this indicator is the arbitrary behavior of the cut-off point. This is due to the fact that in some industries there are so many companies that the five biggest ones could not have a significant impact.

The Herfindahl-Hirschman index was independently developed by Hirschman (1945) and Herfindahl (1950) and is defined as the sum of the square of the market shares of the companies. The Herfindahl-Hirschman index takes into consideration the relative size and distribution of companies in the market; when it approaches zero, the market is characterized by a great number of companies with a similar size, when it is distant from zero then it means that the number of companies is decreasing and the disparity in size between companies increases. The greatest advantage of the Herfindahl-Hirschman index when compared to the concentration indices is the inclusion of all companies in the market analysis.

The following equation is used to calculate the Herfindahl-Hirschman index:

Where s is the participation of the assets for each bank.

On the other hand, to evaluate market power we will use two instruments: the first is the Lerner index and the second is the H-statistic.

The essence of the H-statistic, also known as the Panzar-Rosse test, is to analyze the revenue elasticity to variations in the prices of the production factors. This is achieved by estimating a reduced revenue equation. Specifically, Panzar and Rosse (1987) show that the sum of the elasticities of a company, in relation to the price of the inputs, provides an assessment of the competitive structure of a market. It is important to note that the validity of the test greatly depends on being in a long-term balance situation, where the yield rates must not be statistically correlated to the prices of the inputs.

With R as the reduced form of a revenue function that depends on the input prices (w) and on the exogenous variables (z):

Therefore, the H-statistic is defined in the following manner:

Panzar and Rosse demonstrated that when the H-statistic is negative it could be a monopoly, a collusive oligopoly or a case of a conjectural variation of oligopoly; if it is equal to one, then we are speaking of a perfect competition; and if the values are between 0 and 1 there is monopolistic competition.

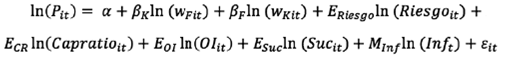

The empirical application of the H-statistic will be done in the following manner, parting from a logarithmic linear regression of the revenue function, in which the dependent variable is the ratio of financial revenue with regard to the total assets.

Where subscripts i and t refer to bank i in time t. P is the ratio of financial revenue with regard to the total assets, w is the price of the production factors, E it k are specific control variables of the banking sector, and M it L are macroeconomic variables to control macroeconomic uncertainty.

Developing the previous equation, we obtain:

Where (w K ) represents the final price of the physical and human capital, and (w F ) represents the price of the lending funds. The explicative control variables specific to the banking sector and indicators of the macroeconomic conditions capture the medium enviroment in which the banking sector operates. The explicative control variables specific to the banking sector are: (Riesgo), which is the ratio of non-performing loan portfolio with regard to the gross portfolio; (Capratio)is the ratio of capital to assets weighted by risk, this variable captures regulatory charge; (OI) is the ratio of other revenue with regard to the total asset, it captures the effect of the revenue that comes from non-financial revenue; and (Suc) is the number of branches, which captures the effect of density on the banking network in the performance of the revenue. To capture the macroeconomic conditions, we have the following variable: (Inf) is the inflation rate, which is used to control macroeconomic uncertainty. Finally, ε represents a disturbance term. To gain consistency in the results, the calculation will be carried out with a first difference estimator, thus, the resulting equation is:

From the aforementioned equation, we obtain the H-statistic in the following manner:

The above is the sum of the revenue elasticities with regard to the input price.

The most widely used model to calculate the Lerner index for market power in the specific case of the banking sector is the Monti Klein model. This model analyzes the behavior of a monopolistic bank, which faces a loan demand curve with a negative slope P(r P ) and a deposit offer with a positive slope D(r D ). The decision variables are the number of loans (P) and the number of deposits (D). These variables influence interest rates ((r P ) and (r D ), respectively) and the capital level is taken as given. Another aspect to consider in this model is that banks are price holders in the interbank market (r).

The earnings of bank π are the sum of the intermediation margins for loans and deposits minus the operational costs (C).

Taking into consideration the value of the elasticities of the demand for loans ε P and of the offer of deposits ε D , the first order conditions of the optimization problem are the following:

Equations (10) and (11) are merely the adaptation to the banking sector of the equivalences between the Lerner index and the inverse elasticity. It can be observed that with a lower elasticity there is a higher intermediation margin, and therefore the Lerner index for market power will be greater.

According to Freixas and Rochet (1997), it is possible to reinterpret the Monti Klein model as an imperfect competition model, or more specifically a Cournot model divided by an infinite number of banks (N). In this case, the Cournot balance of the banking sector is a vector (D n * P n * ) n=1…N such that (n) profits are maximized for each bank, given the volume of deposits and loans of the other banks. The model is then specified in the following manner:

Thus, there is only one balance established by each bank  .

.

We obtain the following from the conditions of the optimization problem:

Similar to the above, equations (13) and (14) represent the equivalences of the Lerner index and the inverse elasticity.

When the number of banks N is equal to 1 there is a monopoly, and when the number of banks goes to infinity there is perfect competition.

The Lerner index represents the margin of the price above the marginal costs and is an indicator of the market power level. Furthermore, it is an indicator of the "level" of the ratio in which the price exceeds the marginal costs and is calculated in the following manner:

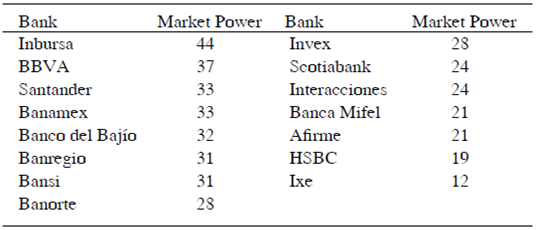

Where PTA it is the financial revenue divided by the total assets for bank i and time t, and MCTA it is the marginal cost of the total assets for bank i and time t. MCTA it is derived from the following Translog cost function:

Where at it represents the total assets for bank i and time t, and W k,it are two input prices: w k,it and wf, it which indicate the price of inputs funds and capital, respectively. These are calculated as the ratios of expenses in interests with regard to the total deposits and the second ratio is non-financial expenses with regard to the total assets. Finally, Costo is the total cost. Due to the restrictions in the availability of data on personnel expenses, we proceed as is done in Hasan and Marton (2003), and consider non-financial expenses as an approximation of labor expenses; therefore, the price of the capital must be interpreted as the price of both the physical capital and the human capital. Developing equation (16), we obtain the function of trans-logarithmic costs that will be estimated.

To gain efficiency, the costs function is estimated along with the cost participation equations of the inputs using the generalized method of moments for equation systems proposed by Arellano and Bond (1991) and Arellano and Bover (1995). Once the aforementioned has been done, the marginal cost will be calculated in the following manner.

The marginal cost for each bank (mc it ) and its corresponding production price, which is measured as the financial revenue divided by the total assets (p it ), are used to calculate the Lerner index, which varies in time and is specific to each bank.

Averaging (mc it ) and (p it ) for all banks in the industry, we find the average marginal cost (MC t ) and the market price (P t ), which is used to generate the Lerner index of the entire industry.

The Lerner index is the counterpart of the H-statistic, but it shows an evolution in time. Under perfect competition conditions, the price is equal to the marginal cost and, therefore, the Lerner index is zero. A greater difference between the marginal cost and the price suggests an increase in the monopolistic behavior when the Lerner index is close to the unit. When the Lerner index is 1 it means the full exercise of market power. Like the H-statistic, the Lerner index is limited between 0 and 1, with intermediate values which indicate monopolistic competition. However, it is not rare for the Lerner index to show negative values. According to Solis and Maudos (2008), these are periods of super competition and can occur when banks lower their price below the marginal cost.

Data

The database used for the estimation of the Lerner index is that of the historical financial indicators (adjusted series for the purpose of analysis) of the National Banking and Values Commission for the 2000-2012 period, taking a sample of the 15 banks with the more complete set of data. Moreover, for the empirical application of the H-statistic, the same database was used except for the inflation variable that comes from the INEGI. The information used to build the concentration indices and the Herfindahl-Hirschman index is the same of the previous cases, the only difference is that a sample of 32 banks is used.

Results

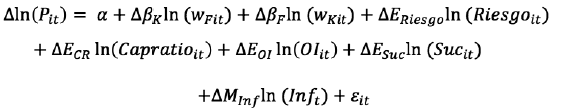

The results of the concentration indices and the Herfindahl-Hirschman index can be observed in the following figures:

Figure 1 corresponds to the concentration index of the three largest banks of the Mexican banking sector. A very small reduction, less than 10% percentage points, can be observed, indicating that for the three largest banks in Mexico there is still a high level of concentration, close to 60% of the total assets.

Figure 2 is the concentration index of the five largest banks in Mexico. When two more banks are included in the concentration index, 85% of the total assets can be reached in the year 2000. It is also observed that as time passes, the index has decreased to 73%, a descent of more than 10 points, but which remains a high level of concentration.

Figure 3 is the Herfindahl-Hirschman index, which is used by the Department of Justice of the United States, as well as by the Federal Trade Commission of the same country, to evaluate the concentration in the banking sector. If the index reaches values higher than 2500, then it means that the market is highly concentrated, and if the index varies between 2500 and 1500 then it is a moderately concentrated market; lastly, if it is below 1500 points then it is a deconcentrated market. As can be observed in Figure 3 for 2000 to 2005, the Herfindahl-Hirschman index is above 1500 points, therefore, the banking sector during these years should be considered moderately concentrated; in the following 4 years the Herfindahl-Hirschman index remained at 1500 points, and since 2009 the index has gone below the 1500 points, the banking sector in Mexico is considered deconcentrated.

The results in the approach of market power that comprise the Lerner index and the H-statistic are presented below:

The results of the Lerner index can be seen in Figure 4.

The Lerner index shows a growing behavior going from 25.45% in the year 2000 to 29.75% in 2012. However, it is worth pointing out that in 2003, the lowest value for the Lerner index was recorded at 24.44%. Whereas in 2009 it reached the highest point with 30.71%. The results shown in Figure 4 correspond to the Lerner index of the entire industry, equation (20).

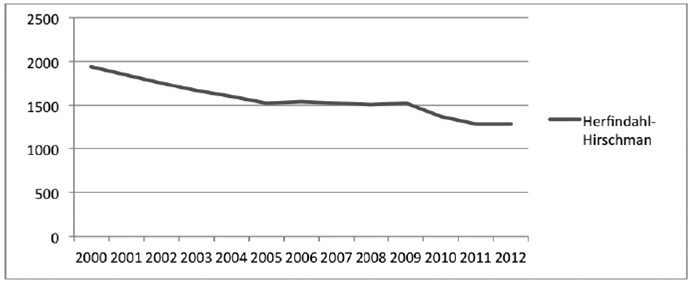

Table 2 shows the specific market power for each bank obtained from equation (19).

Source: Own elaboration.

It can be observed that Inbursa is the bank with the most market power, followed by BBVA, and Santander in third place. The case of Inbursa stands out in that in terms of size measured by the total assets it ranks sixth, however, it ranks first in market power. In the case of HSBC and Ixe, they are the banks with the lowest market power. Although in the case of Ixe, it merged with Banorte and ceased to exist.

Table 3 Results of the estimation of the Lerner index with the generalized method of moments.

Source: Own elaboration.

The results of the joint assessment of the translog cost function and of the two input participation equations are shown in Table 3. The parameters of both the input prices as well as those of the scale effect variables show the expected signs and are statistically significant at 1%. The total average of the Lerner index is .28, thus, the Mexican banking sector is characterized by a monopolistic competition as the value lies between 0 and 1. Being close to the value of zero means that it approaches to a market of perfect competition. On the other hand, the J-statistic has a value close to zero, which means that the instruments used are not correlated with the error term. Given that a very high R^2 is obtained, we proceeded to carry out the panel cointegration test proposed by Kao (1999), the results of which are shown in Table 4.

The results indicate that the null hypothesis of no-cointegration is rejected at 1% of significance, which implies that the panel is cointegrated. This gives consistency to the results obtained.

The results of the H-statistic are shown in Table 5, the Hausman test for the estimation of the data panel justifies the fixed effect model on the specification of random effects.

Table 5 Results of the H-statistic estimated with a data panel in differences and fixed effects.

Source: Own elaboration

When replacing the values obtained in the estimation in equation (8) we can obtain the H-statistic

Once it has been calculated, we have that the H-statistic is .93 and it is statistically significant at 1% as shown in Table 4. Therefore, the null hypothesis of monopoly as well as that of perfect competition are rejected. This indicates that during the study period, banks in Mexico earned their revenues under conditions of monopolistic competition. These results are consolidated by the signs and significance of the two input prices, with both being significant at 1% and positive. Moreover, the specific banking factors corroborate the above statement. The parameter estimated for the (Riesgo) variable has the expected negative sign and is statistically significant at 1%. This means that credit risk has affected the capacity of Mexican banks to offer services in the market at competitive prices. The (Capratio) variable has a positive sign and is also significant at 1%, which indicates that by maintaining high levels of capital to avoid solvency problems it is possible to maintain low costs and obtain a higher revenue. The estimated (Suc) coefficient has a negative sign and is significant at 1%, which means that the more geographically diverse a bank is, the higher the costs it has, which prevents it from obtaining higher revenues than a bank with a smaller branch network. (OI) has the expected positive sign and is significant at 1%. This shows that other revenues such as commissions have a positive effect on the revenue of the banking sector. Finally, the (inf) variable used to control macroeconomic volatility has a positive sign and was found to be statistically significant. This result seems to be counter-intuitive; however, it should be noted that during the analyzed period the average inflation was of 4%, with a standard deviation of 1%, implying less volatile results. On the other hand, even under high inflationary conditions, banks tend to create mechanisms that protect revenue from inflation by adjusting the interest rates and commissions that they charge their clients. Under these circumstances, the positive (inf) coefficient may be justified.

Conclusions

This work addressed the topic of competition in the banking sector of Mexico, using a detailed database at a company level. The generalized method of moments for equation systems developed by Arellano and Bond (1991) and Arellano and Bover (1995) was used. Two measures of the Lerner system were obtained: the Lerner index of the entire industry and the market power specific to each bank. Furthermore, we carried out the panel cointegration test proposed by Kao (1999) to review the consistency of the results. Similarly, the H-statistic was calculated through a logarithmic linear regression of the revenue function and the following variables were used: price of the loanable funds and price of the physical and human capital. Additionally, we used explicative control variables specific to the banking sector, and indicators of the macroeconomic conditions that capture the medium in which the banking sector operates. The concentration measures used are: the Herfindahl-Hirschman index, the concentration index for the 5 biggest banks and the concentration index of the three most important banks.

The results derived from the market concentration approach show that the concentration indices have decreased due to the inclusion of new agents in the market. However, these concentration indices remain at high levels given that the concentration index of the three most important banks is close to 60% in 2012, and the concentration index of the five largest banks has a value of 73% in the same year. On the other hand, the Herfindahl-Hirschman index shows a deconcentrated market as a result, given that the Mexican banking sector is below the 1500 points of the index. Thus, generally speaking, the concentration in the Mexican banking sector has decreased but remains at high levels, at least regarding concentration indices.

On the other hand, the results of the market power approach show that for the Lerner index specific to each bank, the bank with the most market power in Mexico is Inbursa, while the bank with the least power is Ixe. An average result of 28% of market power is obtained for the Lerner index of the industry. Furthermore, an increasing trend of said index can be observed, given that in the year 2000 it had 25.45% of market power, and in 2012 it records 29.75%. These results show that banks in Mexico exhibited a monopolistic competition behavior. Moreover, evidence of cointegration in the data panel was found, which makes the results consistent. These results are backed by the H-statistic, which has a value of .93, meaning that there is a monopolistic competition behavior. The results of both indices are close to perfect competition according to their corresponding measurement scales. Consequently, the banking sector in Mexico is a banking market with a high level of competition.

Concerning the competition result, we find that the result is similar to the work of Maudos and Solís (2011), who used both the Lerner index and the Rosse H-statistic. Their results indicate, on the one hand, that the Lerner index shows a decrease in competition in the deposits market, and an increase in the loan market, observing a cross-subsidies strategy. Applying a non-parametric methodology, Castellanos and Garza-García (2013) analyze the liberalization process in Mexico, which seemed to lead to the increase in the competition and efficiency level. They use the evolution of efficiency in the Mexican banking sector from 2002 up to 2012, and analyze its relation to the degree of banking competition. The main results indicate an increasing trend in efficiency in the banking sector during the study period. The work by Corbae and D’Erasmo (2015) presents the use of a conceptual framework with a simple balance to study the effects of global competition on the dynamics of the banking industry and welfare. The results indicate that there are high profits that relate to welfare, derived from allowing entry to foreign banks.

On the other hand, this investigation observes an increase in the market power of the banking industry and, therefore, a decrease in the competition of the sector, finding that the bank with the greatest market power is Inbursa. The results of the H-statistic are consistent with those of the work by Maudos and Solís (2011), as both works find evidence of monopolistic competition. It was found that in the 2000-2012 period, concentration indices showed a tendency to decrease concentration in the banking sector. Thus, it is concluded that despite the decrease of concentration indices there is an increasing trend in market power, which entails the failure of the policies created to promote competition.

The state can shape competition through its actions in its role as regulator and facilitator of a market that is rich in information and accessible to all agents. The banking sector is particularly more competitive in economies where the states design, implement, and enforce the regulatory framework that ensures more contestability in the market. Additionally, less strict entry barriers can cause a greater infiltration of foreign banks and greater competition.

Thus, the following specific measures are proposed:

Facilitate the access to the information needed by consumers. It is necessary that banks provide their clients with the information necessary to make decisions. Additionally, the language must be clear. The clients of banking services must understand the products and services that are offered to them.

Help consumers to find the best choices for them. Carry out financial education courses offered by the state. Banks should also create material to clearly explain the costs associated with the products and services offered by the banking industry.

Similarly, it is necessary to help consumers to act with regard to their decisions. Banks should offer their clients precise instructions on the process of changing banking institutions. Additionally, financial institutions should provide their clients with clear processes to cancel a service.

Well-informed and committed consumers can play a crucial role in the improvement of competition among companies in the banking sector.

Lastly, financial innovation is becoming an increasingly important factor. The entry of new companies that use new information technologies could bring along more competition to the sector, in addition to the incorporation of millions of people to the banking sector. It is therefore necessary for the state to establish a regulatory framework. Said framework should in turn implement clear guidelines that allow these new technology-based financial companies access to the payment system, and establish standards that regulate the operations of these new technology-based financial companies.

Referencias

Adams, R., Roller, L. & Sickles, R. (2002). Market power in outputs and inputs: an empirical application to banking. Discussion Series 2002-52, Board of Governors of the Federal Reserve System. https://doi.org/10.2139/ ssrn.355100 [ Links ]

Andrievskaya, I. & Semenova, M. (2016) Does banking system transparency enhance bank competition? Cross-country evidence, Journal of Financial Stability, 23: 33-50 https://doi.org/10.1016/j.jfs.2016.01.003 [ Links ]

Arellano, M. & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68(1): 29-51. https://doi.org/10.1016/0304-4076(94)01642-D [ Links ]

Arellano, M. & Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Review of Economic Studies 58 (2): 277-97. https://doi.org/10.2307/2297968 [ Links ]

Bain, J. (1951). Relation of Profit Rate to Industry Concentration: American Manufacturing 1936-1940. The Quarterly Journal of Economics 65 (3): 293-324. https://doi.org/10.2307/1882217 [ Links ]

Baumol, W. (1982). Contestable Markets: An Uprising in the Theory of Industry Structure. American Economic Review 72(1): 1-15. [ Links ]

Baumol, W., Panzar, J. & Willig, R. (1983). Contestable Markets: An Uprising in the Theory of Industry Structure: Reply. American Economic Review 73, (3): 491-96. [ Links ]

Beck, T., Demirguc-Kunt, A. & Maksimovic V. (2004). Bank Competition, Financing and Access to Credit. Journal of Money, Credit and Banking, 36(3): 627-648. [ Links ]

Berger, A. & Hannan, T. (1989). The Price-Concentration Relationship in Banking. The Review of Economics and Statistics 71(2): 291-99. https://doi:10.2307/1926975 [ Links ]

Bushman, R., Hendricks, B. & Williams, C. (2016), Bank Competition: Measurement, Decision-Making, and Risk-Taking. Journal of Accounting Research, 54: 777-826. https://doi:org/10.1111/1475-679x.12117 [ Links ]

Carbó, S., López, R. & Rodríguez, F. (2003). Medición de la competencia en los mercados bancarios regionales. Revista de Economía Aplicada 11(32): 5-33. [ Links ]

Castellanos, G. & Garza-García, G. (2013). Competition and efficiency in the Mexican banking sector. BBVA Bank, Economic Research Department (No. 1329). https://doi:org/10.1057/9781137518415_4 [ Links ]

Corbae, D. & D'Erasmo, P. (2015) Foreign Competition and Banking Industry Dynamics: An Application to Mexico. IMF Economic Review, 63(4): 830-867. https://doi:org/10.2139/ssrn.2669841 [ Links ]

Cetorelli, N. (1999). Competitive analysis in banking: Appraisal of the methodologies. Economic Perspectives 23(1): 2-15. [ Links ]

Cetorelli, N. (2003). Life-cycle dynamics in industrial sectors: The role of banking market Structure. Federal Reserve Bank of St. Louis Review 85(4): 135-147. https://doi:org/10.2139/ssrn.367201 [ Links ]

Cetorelli, N. & Strahan, P. (2006). Finance as a Barrier to Entry: Bank Competition and Industry Structure in Local U.S. Markets. Journal of Finance 61(1): 437-461. https://doi:org/10.3386/w10832 [ Links ]

Corvoisier, S. & Gropp, R. (2002). Bank concentration and retail interest rates. Journal of Banking & Finance 26(11): 2155-2189. https://doi:org/10.1016/s0378-4266(02)00204-2 [ Links ]

De Bandt, O. & Davis, P. (2000). Competition, contestability and market structure in European banking sectors on the eve of EMU. Journal of Banking & Finance 24(6): 1045-1066. https://doi:org/10.1016/s0378-4266(99)00117-x [ Links ]

Delis, M., Kokas, S & Ongena, S. (2016). Foreign ownership and market power in banking: Evidence from a world sample. Journal of Money, Credit and Banking, 48(2-3): 449-483. https://doi:org/10.2139/ssrn.2435520 [ Links ]

Edwards, F. (1964). Concentration in Banking and its Effects on Business Loans Rates. Review of Economics and Statistics 46(3): 294-300. https://doi.org/10.2307/1927390 [ Links ]

Egarius, D. & Weill, L. (2016) Switching costs and market power in the banking industry: The case of cooperative banks, Journal of International Financial Markets, Institutions and Money, 42: 155-165 https://doi.org/10.1016/j. intfin.2016.03.007 [ Links ]

Freixas, X. & Rochet, J. C. (1997). Microeconomics of Banking. 1° ed., Cambridge Massachusetts: The MIT Press [ Links ]

Guevara, J., Maudos, J. & Pérez, F. (2005). Market Power in European Banking Sectors. Journal of Financial Services Research, 27(2): 109-137. https://doi.org/10.1007/s10693-005-6665-z [ Links ]

Hannan, T. (1991). Foundations of the Structure-Conduct-Performance Paradigm in Banking. Journal of Money Credit and Banking 23(1): 68-84. [ Links ]

Hasan, I. & Marton, K. (2003). Development and efficiency of the banking sector in a transitional economy: Hungarian experience. Journal of Banking & Finance 27(12): 2249-2271. https://doi.org/10.1016/s0378-4266(02)00328-x [ Links ]

Herfindahl, O. (1950). Concentration in the Steel Industry. 2° ed., New York: Columbia University. [ Links ]

Hernández-Murillo, R. (2007). Experiments in financial liberalization: the Mexican banking sector. Federal Reserve Bank of St Louis Review 89(5): 415-432. https://doi.org/10.3886/icpsr20962 [ Links ]

Hirschman, A. (1945). National Power and the Structure of Foreign Trade. 2° ed., Berkeley, California: University of California Press. [ Links ]

Horvath, R., Seidler, J. & Weill, L. (2016) How bank competition influences liquidity creation, Economic Modelling, 52: 155-161. https://doi.org/10.1016/j.econmod.2014.11.032 [ Links ]

Huang, T., Chiang, D. & Chao, S. (2016) A new approach to jointly estimating the Lerner index and cost efficiency for multi-output banks under a stochastic meta-frontier framework, The Quarterly Review of Economics and Finance. https://doi.org/10.1016/j.qref.2016.09.004 [ Links ]

Jackson, W. (1992). The price-concentration relationship in banking: A comment. Review of Economics and Statistics 74(2): 373-376. https://doi.org/10.2307/2109676 [ Links ]

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. Journal of Econometrics 90(1): 1-44. https://doi.org/10.1016/s0304-4076(98)00023-2 [ Links ]

Lee, C., Hsieh, M. & Yang, S. (2016) The effects of foreign ownership on competition in the banking industry: The key role of financial reforms, Japan and the World Economy, 37-38: 27-46, https://doi.org/10.1016/j.japwor.2016.02.002 [ Links ]

Léon, F. (2016) Does the expansion of regional cross-border banks affect competition in Africa? Indirect evidence, Research in International Business and Finance, 37: 66-77 https://doi.org/10.1016/j.ribaf.2015.10.015 [ Links ]

Lijesen, M., Nijkamp P. & Rietveld P. (2002). Measuring competition in civil aviation. Journal of Air Transport Management 8(3): 189-197. https://doi.org/10.1016/s0969-6997(01)00048-5 [ Links ]

Maudos, J. & Solís, L. (2011) Deregulation, liberalization and consolidation of the Mexican banking system: Effects on competition. Journal of International Money and Finance 30(2): 337-353. https://doi.org/10.1016/j.jimonfin.2010.07.006 [ Links ]

Neuberger, J. & Zimmerman, G. (1990). Bank pricing of retail deposit accounts and the California rate mystery. Federal Reserve Bank of San Francisco 0(2): 3-16. [ Links ]

Neumark, D. & Sharpe, S. (1992). Market Structure and the Nature of Price Rigidity: Evidence from the Market for Consumer Deposits. The Quarterly Journal of Economics 107(2): 657-680. https://doi.org/10.2307/2118485 [ Links ]

Panzar, J. & Rosse, J. (1987). Testing for Monopoly Equilibrium. Journal of Industrial Economics 35(4): 443-456. https://doi.org/10.2307/2098582 [ Links ]

Pawlowska, M. (2016). Does the size and market structure of the banking sector have an effect on the financial stability of the European Union?. The Journal of Economic Asymmetries. https://doi.org/10.1016/j.jeca.2016.07.009 [ Links ]

Pérez, F. & Maudos J. (2001). Competencia Versus Poder De Monopolio En La Banca Española. Working Papers. Serie EC 2001-09, Instituto Valenciano de Investigaciones Económicas, S.A. (Ivie). [ Links ]

Phan, H., Daly, K. & Akhter S. (2016) Bank efficiency in emerging Asian countries, Research in International Business and Finance, 38: 517-530 https://doi.org/10.1016/j.ribaf.2016.07.012 [ Links ]

Solís, L. & Maudos, J. (2008). The social costs of bank market power: Evidence from Mexico. Journal of Comparative Economics 36(3): 467-488. https://doi.org/10.1016/j.jce.2008.04.003 [ Links ]

Shy, O. (1996). Industrial Organization: Theory and Applications. 1° ed., Cambridge Massachusetts: The MIT Press . [ Links ]

Tirole, J. (1988). The Theory of Industrial Organization. 1° ed., Cambridge Massachusetts: The MIT Press . [ Links ]

Turrent, E (2008). Historia sintética de la banca en México, Banco de México. [ Links ]

Weiss, L. (1989). Concentration and Price. 1° ed., Cambridge Massachusetts: The MIT Press . [ Links ]

Received: October 07, 2015; Accepted: December 15, 2016

texto en

texto en