Introduction

In this paper a panel data model is estimated to analyse the variables that explain the stock structure of the mining firms in Mexico, Colombia, Chile, Brazil and Peru with information from the 2004 to 2014 period, with this information the determinants that guide the indebtedness level of the firm are identified, for this analysis concepts from the capital structure corporate finance theory are used.

From actual information the interrelationship that exists between the economic factors and the financial decisions was empirically established using static and dynamic panel data models, the model is specified based on a set of selected variables that were calculated using the financial reports of the firms.

The analysis is based on the financial neoclassical economic theory as Damodaran (2001) referred; indicating that in order to study the stock structure the main focus must be set on the corporate value and the impact that contains the capital structure. In particular we focus on the Trade-Off theory and the Hierarchical Order theory.

The financing decision seeks to maximise the value of the company, which is equivalent to solving the problem of minimising the corporates capital cost, which corresponds to the weighted average of a mixture between the cost of their own funds and cost of debt used to acquire productive assets.

Literature shows that it is an issue that has been explored to find the factors that motivate different debt levels; the first researcher to address this problem was Grunfeld (1958) in his doctoral thesis. As an econometric tool he used the panel data structure to find empirical evidence, within this research his database is relevant since it has specific characteristics, which allows the problem solving.

From the economical point of view, the financing decision corresponds to the choice of the economic agents between the shareholder funds or debt subscription resources, this choice is oriented to the lower long-term cost, which creates a greater value for the company, this concept is known as the optimal capital structure. One researching aspect corresponds to identify the mechanisms that the economic agents follow in making decisions to approach an optimal capital structure based on the financial information of the company.

In a research conducted by Titman and Wessels, by analysing relevant studies, they found that there is no concluding evidence on the determinants of the capital structure within the company. A similar research from Sweden firms Gaud, Jani, Hoesli, and Bender (2003) reached the same conclusion. On the other hand, the study by Teker, Tasseven, and Tukel (2009) conducted on Turkish companies indicated clear evidence on how the companies decide on their financial structures according to a set of variables that are determined based on information from the financial statements, the overall balance and the income statement. The same conclusion was reached when Shah and Kahn (2007) conducted a study on Pakistani companies.

In developing countries the dynamics of the markets and the increased volatility presents an interesting environment to conduct further research and to go deeper on the understanding of the decisions and determinants that affect the capital structure.

In particular in Latin America there is evidence in this topic. Tenjo, López, and Zamudio (2006) analysed the relationship that existed between the financial crises Colombia experimented over the last decades and the capital structure of the firms and they found empirical support for the Hierarchical Order theory in the sense that the firms prefer their own financial resources to invest in new projects. Paredes and Flores-Ortega (2012) explore the financial behaviour of mining companies in Mexico and their empirical results are also consistent with the argument that firms prefer to be financed with their own resources. Milena, Salinas, Ochoa, and Molina (2012) presents a review of empirical studies in Latin American countries that analyse the empirical verification of the hierarchical order theory. Moore et al. (2013) in a World Bank study showed how the regulation of the capital structure in concessionaires transport firms reduces the level of leverage in the companies and they use more their own resources.

In this study, the mechanisms and determinants that lead the capital structure behaviour are identified in the mining sector within five selected countries Mexico, Chile, Colombia, Peru and Brazil, because in recent years the mining activity in these countries has shown significant dynamism and the industry makes a significant contribution to the GDP of the countries. Investments in this sector are particularly intense, and hence it is relevant to identify the determinants that modify the capital structure and the rules governing its behaviour.

This research is an empirical analysis using five information variables from 14 mining companies in the countries quoted above, the methodology corresponds to a process that goes from the specific to the general in order to obtain the determinants of the indebtedness function of the companies, based on an econometric model with panel data structure that describes the behaviour of the firms between the first quarter of 2004 and the third quarter of 2014, that is 43 time observations, in total there are 602 observations in the panel. Specific details from the companies' variables were obtained from the financial statements of the Economatica database, which contains real information from the stock markets.

This investigation was inspired on a set of previous studies to choose the methodology and the relevant variables. In particular, the study from Titman and Wessels (1988), conducted an analysis of U.S. industrial companies in the 1974-1982 period, in their conclusion was established that companies with unique products are not susceptible to have debts, they also demonstrate that small size companies are in debt faster than major companies; on the other hand, companies with higher performance are less leveraged, also they find that the financial structure is not related to the structure of the assets, in their work they identify that transaction costs are crucial in the capital structure.

Franco et al. (2010) show that the capital structure in the large manufacturing companies from Uruguay is financed through 46% from own resources and 54% from debt. The results obtained indicate that the short-run debt is preferred as the long-run debt comprises only 35% in a cross section sample for 2004. They also find evidence of an important asymmetry in the possibilities to access to loans, which is biased in favour of the larger companies. In addition, they show that the log of the debt ratio variable depends on three variables, the sales to total debt ratio, the fixed assets to total assets ratio and the sales to operating costs ratio, these three variables explain 40.7% of the indebtedness variations. The study concludes that profitability has an inverse relationship with the indebtedness level.

This paper is aimed at exploring the determinants of leverage in the main mining companies in five Latin American countries and the trend that the capital structure follows over time. In addition, we seek to contrast the empirical results with relevant theories. On the basis of the results, the study assesses in which country the firms can have a better financial performance.

The paper is presented in five different sections. The first section is the introduction to the topic; the second section is devoted to review the theoretical foundations of the firm capital structure and the factors that lead them; in the third section the methodology and the procedures used in order to reach the objective are described. In section four the relevant research results and their interpretation are presented, and in the fifth section the research findings and conclusions are given.

Theoretical foundations and literature review

Modigliani and Miller's seminal research (1958, 1961, 1963) is centred in the importance of the capital structure debate, and it is shown in four propositions: The first proposition states that under certain conditions the debt-equity ratio does not affect the market value; this vision assumes that in terms of an efficient market, the value of the company does not dependent on the capital structure. The second proposition holds that the cost of capital does not depend on the leverage ratio. The third proposition shows the irrelevance of the dividend policy to determine the market value of the firm. The fourth proposition points out that the level of leverage is not relevant for the equity holders because it does not affect the value of the firm. In general this work analyses the right combination between debt and equity.

This research has been the basis for theories that explain the behaviour of the capital structure and its determinants on the firms. Two of the most influential are presented below.

Trade-Off theory

The capital structure theory presented by Bradley, Gregg, and Kim (1984) is known as the capital structure equilibrium theory or trade-off theory, which explains that the company's financing decisions are conducted to evaluate whether the tax benefit is greater than the costs incurred by the company as a result of debt. The main benefit of debt is the tax deductibility of interest, which is greater as the tax rate increases, this benefit is reflected as savings and promotes increased levels of indebtedness; on the other hand the most important costs are moneywise, operating costs and the potential cost of bankruptcy as a consequence of not paying a debt.

Miller (1988) showed how taxes can affect the debt-equity ratio. He demonstrated that under some conditions the optimal capital structure can be financed by debt due to a preferential tax treatment. The substitution of debt for equity allows the company to get surplus by reducing the firm tax payment, the surplus can be transferred to investors, and the firm value does not need to increase.

The Hierarchical Order theory

An additional point of view is from Myers and Majluf (1984) who provided a new theory where firms select capital structure not only on cost of resources, but they also take into account relevant information of the dividend policy. The hierarchical order theory states that if there are information asymmetries, then it cannot be set a fair value for the stock in the market, then the value criteria, in the choice of the capital structure, is not adequate and must be corrected, one solution corresponds to modify the capital structure in order to be financed from its own resources and better credit conditions.

In their research they showed that under conditions of undervalued share price, if the company makes a new placement to finance the effect of undervaluation produces a utility for new investors, and a loss to the original shareholders, since this is unacceptable to shareholders, the company must initially be financed with the resources issued by the profits and it will be forced to modify the reinvestment factor and dividend policy.

If the business requires more resources it must go in debt and will always search for the cheapest financing, an alternative is to issue debt and reduce placement requirements. The hierarchical order theory explains why companies, when are undervalued, require financing, the first alternative is to use their own funds and modify the rate of reinvestment; secondly the companies make low to high cost loans and, as a last resource, they place shares in the market.

Sarmiento (2005) found that the capital structure of the private sector in Colombia in 1994 mainly depended on debt and the structure has changed from the profit reinvestment. Tenjo et al. (2006) point out that as a consequence of a stock market with low level of development, the shares is one of the resources less used in the financial process, and emphasise that problems such as imperfect information and credit concentration are associated to problems related to the Hierarchical Order theory.

Research methodology and data structures

The information from each of the company's financial variables corresponds to the public data of the financial statements and the closing price information from the shares traded on the Mexican, Colombian, Peruvian, Brazilian and Chilean stock exchange.

We select these five country cases because the mining sector represents one of the main foreign exchange sources for their economies. Peru is the fourth gold producer in the world and the first silver producer, followed by Mexico and Chili, which are the sixth silver producers in the world. As for the extraction of molybdenum Chili is the third producer worldwide, Peru the fourth and Mexico the fifth. Chili is the main producer of copper in the world. Colombia is an important producer of coal and the mining sector contributes with 2.8% of its GDP. Brazil stands out in the production of iron and bauxite and the mining sector impacts on 8.5% of its GDP. The sample comprises listed firms and they are important players in the sector because of its size and its traded volume. The mining sector has been and engine of growth for the selected economies, and has also conducted substantial investments over the last few years.

The financial information was obtained from the Economática database, which is a reliable and updated source containing information on the stock exchanges where the companies, studied in this paper, operate. In order to conduct the analysis, panel data techniques were applied, the study comprises a data set of 14 different companies within the mining sector, with quarterly data corresponding to the first quarter of 2004 to the third quarter of 2014, in total there are 602 observations. The sample includes three Mexicans, two Colombians, three Chileans, three Brazilians and three Peruvians companies, and they are aimed at representing the mining sector in Latin America, the company names, their abbreviations and their corresponding countries are shown in Table 1.

To identify the leverage determinants in mining companies we followed the methodology proposed by Myers and Majluf (1984), also ideas were taken from Titman and Wessels (1988), Rajan and Zingales (1995) and Franco et al. (2010).

The variables

For the construction of the econometric model as a dependent variable was selected the level of debt (ID), this variable reflects the relationship that exists among its own resources and the funded resources used by the company to support its assets.

The independent variables that explain the debt are: capital intensity (tangibility), size, growth rate and profitability of the company.

Capital intensity is the tangible capital required for production, is a point of comparison between similar companies and represents the relationship between productive assets and total assets. Both the research of Myers and Majluf (1984) and Rajan and Zingales's (1995) state that there is a causal relationship between tangibility (TG) and leverage (LG) of firms in a positive way. Companies that have a greater amount of productive assets have a higher level of leverage.

The size of firms is assumed to be the natural logarithm of the volume of sales in each period, according to Rajan and Zingales (1995) the size of the firm is an indicator of leverage.

The company's growth refers to the increase or decrease of its income; it is an indicator that helps to know if the company has more market participation or product diversification, establishing a positive signal. Rajan and Zingales, as an approach for the level of growth opportunities to the firms, use the variable growth, developed as market-to-book. These authors suggest that one might expect a negative relationship between growth opportunities and debt levels. Myers (1977) also holds that firms with high growth opportunities tend to have low debt ratios.

Profitability is a discussion point among the Hierarchical Order theory and the Trade-off theory. On the Trade-off theory the greater the profitability of the company is, it will have more reasons to issue debt. On the other hand, the hierarchical order theory assumes that the higher the income of the companies is, they will have a lower level of debt, in an initial stage. Therefore, the trade-off theory relates profitability and leverage in a positive way, while the theory of Hierarchical Order expects otherwise. The measurement of profitability is through the relationship of net income before taxes divided by total assets.

The econometric model

Static methods

The process starts with an ordinary least squared (OLS ) regression, pooling or combining the 602 observations. The leverage function can be represented as follows:

where i stands for the i th cross-sectional unit and t for the t th time period. LG represents the level of indebtedness (leverage), TG stands for tangibility, SZ and GT are the size and growth of the firm respectively and PF is the level of profitability. The error term u it is assumed to satisfy white-noise assumptions that is, independently and identically distributed with zero mean, constant variance σ2 and serially uncorrelated, which is denoted as u ∼ I.I.D. (0, σ2). The symbols β0 to β4 are the coefficients to be estimated. The results from Eq. (1) are reported in Column 1 of Table 2.

Table 2 Results from the regressions.

Notes: The dependent variable is leverage.

* Significant at 1%.

♦ Significant at 10%. p value in parenthesis.

Source: Own computation with information from Economática (2015).

It is worth noting that the traditional OLS approach has to major drawbacks. It assumes that the intercept value of the countries is the same and it does not control for country-specific factors. In order to test whether these are implausible assumptions, two panel estimation methods, which take into account the specific nature of the countries, are performed. The first estimation is the fixed effect model (FE ), which lets the intercept vary for every firm by adding dummy variables that control firm-specific effects, the vector of group dummy variables can be represented by β 0 i. So as to explore whether the dummies belong to the model an F test is conducted. The null hypothesis is that the additional coefficients equal zero, that is β 0 i is a constant intercept β0 for all the firms (H0 : β 0 i = β0 ). In the present analysis the additional regressors are statistically different from cero and therefore they belong to the model. The results from the fixed effect regression are reported in Column 2 of Table 2.

We also conduct a FE specification in which the intercept varies for every time period by adding dummy variables that control time-specific effects, the vector of time dummy variables can be represented by β 0 t, and the null hypothesis is (H0 : β 0 t = β0 . In this case, it was found that all the additional regressors are also statistically significant and the F test rejects the null hypothesis. What it is interesting to note is that the intercept coefficients of the leverage variable decrease linearly over time, about 0.2 points per quarter, as presented in Fig. 1.

The time intercept equation of the leverage variable is:

where Period is the time variable for the 43 time observations, INTLG represents the time intercepts of the leverage variable, t is the t th time observation and u t is the error term. The R2 of Eq. (2) is 0.8082, the Dikey-Fuller test on the residuals u t, also known as the Engle-Granger cointegration test rejects the null H0 : the error term has a unit root. Thus the equation is cointegrated, which indicates that the time intercepts of the leverage variable have a long-run decreasing trend over time.

The second panel estimation is the random effect model (RE ). In this specification, differences across countries are captured through a disturbance term ω it, which follows ωit=εi+uit, where ¿ i is an unobservable term that represents the individual specific error component, and u it is the combined time series and cross-section error component. The model assumes that ¿ i is not correlated to any explanatory variable X kit in the equation. The Breusch and Pagan Lagrange Multiplier (BPLM ) test (1979) is designed to test random effects. The null hypothesis is that the individual-specific variance is zero, that is H0 : σu2=0. In the present analysis the BPLM test rejects the null hypothesis that is, there are random effects in the model.1 The results are presented in Table 2, Column 3.

The results obtained from the two previous models show that there are firm-specific effects. Now it is important to define which of the two models - FE or RE - is more convenient. In order to do so we apply the Hausman test for specification (1978). The null hypothesis is that the regressors X kit and the unobservable individual specific random error ¿ i are uncorrelated, that is H0 : Corr (Xkit,εi)=0. If the test statistic, based on an asymptotic χ2 distribution rejects the null, then the random effect estimators are biased and the fixed effect model is preferred. The p value obtained from the Hausman test tends to cero and hence, the null is rejected, which indicates that the RE estimates are inconsistent and the FE would be more appropriate. The result from the test is reported in Column 3 of Table 2.

The results from the FE model show that tangibility, size and profit of the firms are negatively related to the indebtedness level, while growth has a positive relationship with the debt. It is interesting to note that all the firm dummy variables are highly significant. In average the intercepts of the Mexican and Brazilian firms are higher than the other Latin American firms in the sample, and they tend to oscillate above 0.951 for both countries. The Colombian intercepts are the lowest; in average they are located around 0.68. In other words, the initial level of indebtedness of Colombian firms is lower than the firms from other countries in the sample.

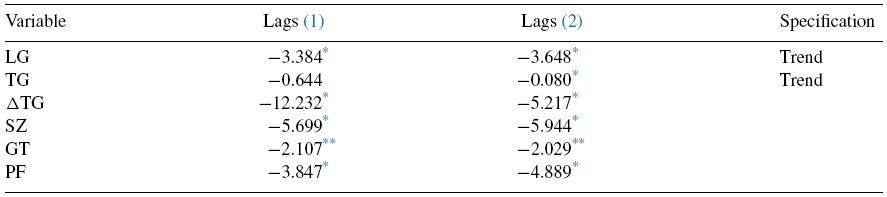

In order to explore if the variables involved in the model have a long-term relationship we apply a cointegration test to the FE specification. Initially we explore whether the dependent variable and the regressors show a unit-root process. The analysis is conducted applying the Levin-Lin-Chu unit root test (2002), with one and two lags of the dependent variable, and in the cases it is required we incorporate a trend variable on the equation. The results indicate that the leverage, size, growth and profit variables are stationary as the test rejects the null hypothesis H0 : there is unit root, in all the specifications, at conventional significance levels. The tangibility variable has to be differenced once to become stationary. The results are reported in Table 3.

Table 3 Levin–Lin–Chu unit-root test with no trend.

* Significant at 1%.

** Significant at 5%.

Source: Own computation with information from Economatica (2015).

So as to test for cointegration we apply both the Levin-Lin-Chu and the Im, Pesaran, and Shin (2003) on the residuals of the FE regression. In both cases the tests suggest that there is a long-run relationship in the equation as reject the null hypothesis of unit root on the residuals. Although tangibility does not have the same order of integration than the other variables, the linear combination of the series is I (0) and cancels out stochastic trends in them. The results are shown in Table 4.

Table 4 Cointegration test for the FE equation unit root test on the residuals.

* Significant at 1%.

Source: Own computation with information from Economatica (2015).

We also explore whether the coefficients vary across firms and for every variable. In this case interactive or differential slope dummies are constructed by multiplying each of the firm dummies by each of the explanatory variables. Table 5 presents four equations, in each one the interactive dummies are disaggregated by firm for a specific explanatory variable, and the remaining three variables are incorporated aggregating all the firms. Column 1 shows the disaggregation of the slop coefficient for the tangibility variable. We observe that the slopes of the Colombian firms are all negative and statistically significant, and two of the three Peruvian firms have negative and statistically significant slopes, all or most of the slope coefficients from the Mexican, Chilean and Brazilian firms are positive and statistically significant. Hence, we can say that the result from the Colombian and Peruvian firms is more robust and in general the level of indebtedness declines as the tangibility increases. When the slope of the size variable is disaggregated, in Column 2, it is possible to see that the results are more homogeneous because in all the firms, with the exception of Peñoles Industria in México, the coefficients are negative and statistically significant, which means that the level of indebtedness falls as the size rises. In the case of the growth variable desegregation, in Columns 3, the Colombian and Peruvian firms also present more robust results, because all of the firms and most of the firms respectively have negative and significant sign, which suggests that the firms have a reduction of debt as they increase growth; whereas the Mexican, Chilean and Brazilian firms tend to have positive sings. In Column 4 we present the slope coefficients from the profit of the mining companies and find that they are all negative and statistically significant, and hence this variable seems to have the most robust effect on the dependent variable.

Table 5 Desagregation of slope coefficients by firm and variables.

Notes: The dependent variable is leverage. Own computation with information of Economatica (2015).

* Significant at 1%.

** Significant at 5%.

♦ Significant at 10%.

p Value in parenthesis.

Dynamic methods

Before adopting the FE specification as the final estimation, it is important to keep in mind that the error term u it is assumed to satisfy white-noise assumptions and therefore, an AR(1) test should be conducted. In this respect, the modified Bhargava, Franzini, and Narendranathan (1982) Durbin-Watson test (modified DW) and Baltagi and Wu LBI (1999) test are performed. The results are reported in Column 2 of Table 1. In this case, both tests reject the null hypothesis H0 : no first order serial correlation.

To cope with the autocorrelation, we should analyse the possibility that the problem emerge owed to model misspecification, that is, because of a lagged dependent variable is not incorporated in the model. Therefore, the static specification in Equation 1 is extended and transformed into a dynamic panel data model (DPDM) by adding a lagged dependent variable as follows.

where X is the vector of the four explanatory variables introduced previously. The inclusion of a lagged dependent variable incorporates a source of persistence over time: correlation between the right hand regressor y it−1 and the error term u it. In addition, DPDMs are characterised by individual effects η i caused by heterogeneity among the individuals.2 As a result, it is necessary to apply different estimations and testing procedures for model 3.

To estimate Eq. (3), we use the GMM, for DPDMs, initially proposed by Arellano and Bond (1991) and Arellano and Bover (1995). Firstly, the estimation method eliminates country-effects η i by expressing the dynamic equation in first differences as follows:

On the basis of the following standard moment conditions:

that is, lagged levels of LG it are uncorrelated with the error term in first difference, the method uses lagged endogenous variables as instruments to control for likely endogeneity of the lagged dependent variable, reflected in the correlation between this variable and the error term in the transformed equation. The GMM estimation obtained is known as the difference estimator.

Blundell and Bond (1998) argued that the GMM estimator obtained after first differencing has been found to have large finite sample bias and poor precision. The limitations of the estimator are owed to weak instruments, since they contend that lagged levels of the series provide weak instruments for the first difference.

To improve the properties of the standard first-differenced GMM estimator, they justified the use of an extended GMM estimator, on the basis of the following moment condition:

that is, there is no correlation between lagged differences of LG it and the country-specific effects. The method therefore uses lagged differences of Y it as instruments for equations in levels, in addition to lagged levels of Y it as instruments for the equation in first differences. The extended method is known as the system GMM estimation (sys-GMM). It encompasses a regression equation in both differences and levels, each one with its specific set of instrumental variables. The sys-GMM estimation not only improves precision but also reduce finite sample bias. Results are reported in Column 4 of Table 2.

The GMM estimations, both difference and system, assume that the disturbances u it are not serially correlated. If this were the case, there should be evidence of first order serial correlation in differenced residuals u it − u it−1 and no evidence of second-order serial correlation in the differenced residuals (Doornik, Arellano, & Bond, 2002). It is an important assumption because the consistency of the GMM estimator hinges upon the fact that E[ΔuitΔuit−2]=0. Consequently, tests of autocorrelation up to order 2 in the first-differenced residuals should be available.

The tests of serial correlation in the first differenced residuals are in keeping with the maintained assumption of no serial correlation in u it. The AR(2) tests fail to reject the null hypothesis that the first-differenced residual error term is not second order serially correlated, whereas by construction, the AR(1) test rejects the null (at 1% level of significance) that the process does not exhibit first-order serial correlation. The results for the system model are reported in Columns 4 of Table 2.

So as to assess the validity of the instruments, a Sargan test of over identifying restrictions, proposed by Arellano and Bond (1991) is also performed. Under the null hypothesis that the instruments are not correlated with the error process, the Sargan Tests is asymptotically distributed as a chi-square with as many degrees of freedom as over identifying restrictions. The test is unable to reject the validity of the instruments, if the acceptance area is extended up to 95% of the distribution; the result of the test for the system specification is reported in Column 4 of Table 2.

We can observe that the lagged dependent variable enters positively and statistically significant in the GMM system equation, and the magnitude of the coefficient is high (0.781). This result indicates that debt is associated to more debt and the lagged value of indebtedness is an important determinant of present values. On the other hand, two explanatory variables, size and growth become not statistically significant. The tangibility variable becomes positive and statistically significant at the 10% level. Only the profitability coefficient keeps the same sign and the level of significance (1%) compared to the OLS, FE and RE equations.

Conclusions

The results from the fixed effect specification with disaggregated intercepts show that the leverage function has intercepts that are statistically different for every firm. In particular, the Colombian firms start from lower levels of debt than the firms from the other Latin American countries in the sample.

The fixed effect specification with constant slope coefficients indicates that capital intensity (tangibility), the logarithm of sales (size) and profitability are statistically significant and negatively related to debt, in other words, the increase in these variables is associated to a reduction of indebtedness. The growth variable is not statistically significant. This result is consistent with the first alternative of the Hierarchical Order theory, which implies that the firm must be financed with the resources generated by the profits and it will need to modify the reinvestment factor and the dividend policy. The results are in keeping with Franco et al. (2010) in the sense that debt depends on sales and tangibility and also because profitability has an inverse relationship with the indebtedness level.

When we desegregated the slope coefficient by firm and by variable we can observe that the sign and level of significance changes across the explanatory variables and the companies, but there are some robust results that can be found. The most stable effect on indebtedness across firms comes from the profit variable, as the coefficient is always negative and statistically significant at 99% level, which indicates that the profits play a consistent role to reduce debt across the 14 firms, more than the other variables, which is also empirical support for the first Hierarchical Order theory alternative, since these companies obtain resources from their own profits and not necessarily form debt. The firms with more stable coefficients across the four explanatory variables are the Colombian firms, because their coefficients are always negative and statistically significant at 99% level. In particular, the case of Colombian firms is also in keeping with the first Hierarchical Order theory alternative, since these companies do not hire more debt to finance growth or tangibility and obtain resources from their profits.

The static methods neglects the effect of lagged values of the dependent variable, when we incorporate a dynamic method in the study find that past values of the leverage variable are more important determinants of present values of leverage than the other explanatory variables. An increase of one unit of the leverage indicator in the t period increases the variable in 0.781 units in the t + 1 period. Although the relationship is positive, the effect decreases in future periods, that is, the effect of debt on itself tends to disappear over time. The coefficient of the tangibility indicator becomes positive, this outcome is consistent with Myers and Majluf (1984) and Rajan and Zingales's (1995) previous studies, but its effect is low, one unit increase in this variable raises leverage by 0.03 points. The size and growth of the firms do not affect the level of leverage. The most robust variable in the analysis is profit, as it keeps the negative sign and level of significance in the four methods presented. The results from the dynamic equation show that one unit increase of the tangibility indicator reduces leverage by 0.09 units.

From this result we might expect that the share of debt in the capital structures of the firms in the sample, decreases over time. It is corroborated when we explore the trend of the time intercepts for the leverage variable, and find that leverage tend to decrease over time.

nueva página del texto (beta)

nueva página del texto (beta)