Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Contaduría y administración

versión impresa ISSN 0186-1042

Contad. Adm no.234 Ciudad de México may./ago. 2011

Artículos de investigación

Challenges and perspectives in using PIMS methodology to explain the success of the marketing strategy in businesses

Retos y perspectivas de la metodología PIMS para explicar el éxito de la estrategia de marketing en los negocios

Rubén–Martín Mosqueda Almanza* y Cynthia Montaudon Tomas**

* Tecnológico de Monterrey Campus Irapuato, ruben.mosqueda@itesm.mx

** Tecnológico de Monterrey Campus Irapuato, cynthia.montaudon@itesm.mx

Fecha de recepción: 26.05.2010

Fecha de aceptación: 12.10.2010

Abstract

It is assumed that an appropnate strategy will positively impact on profits and it will con tribute to the growth of the company 's market share. Recent findings suggest that only the adaptation of the strategic plan elements can bring the company's performance to an optimum standard. The Profit Impact of Market Strategy (PIMS) is an archetype model to achieve that; but, fundamental problems remain that limit the model. This paper shows the evolution of the PIMS methodology that allows to reveal its challenges and its possible development. The adequate definition of the strategy, redesign of the PIMS questionnaire, problems of multicollinearity and the market share effect would be the most relevant problems. The results show the need to accurately define the strategy adopted by the company and the redesign of the PIMS survey when applied to incomplete markets. This way, the findings suggest PIMS econometric studies have to emphasize the Relative Quality Proceeds variable in order to solve the thorny issue of market share effect on ROI.

Keywords: PIMS, Marketing Strategy, ROI, Market Share Effect, Corporate Strategy.

Resumen

Se asume que una estrategia adecuada impactará positivamente sobre las ganancias de las empresas y las llevará a expandirse. Recientes descubrimientos sugieren que sólo con la revisión y adecuación de los elementos más relevantes del plan estratégico es posible llevar los resultados económicos de la empresa a un punto óptimo. El impacto de la estrategia de mercado en las ganancias (PIMS, en inglés) constituye un modelo arquetipo para lograrlo, sin embargo, subsisten problemas fundamentales en el modelo que lo limitan. Así, en el presente trabajo se hace un estudio exploratorio de la evolución de la metodología PIMS que permite develar los retos y el posible rumbo del tema. La definición de la estrategia, el diseño de la encuesta tipo PIMS, los problemas de multicolinealidad y el efecto de la cuota de mercado se plantean como los más relevantes. Los resultados muestran la necesidad de definir con precisión la estrategia asumida por la empresa, el rediseño de la encuesta PIMS cuando se aplique a mercados incompletos y, finalmente, se advierte un avance en el estudio econométrico de PIMS poniendo énfasis en la variable calidad relativa del producto para resolver el viejo dilema del efecto de la cuota de mercado.

Palabras clave: PIMS, estrategia de marketing, retorno sobre la inversión, efecto de la cuota de mercado, estrategia corporativa.

Introduction

The Profit Impact of Market Strategy (PIMS)

PIMS is a model to measure the impact of the marketing strategy over a company's profits. The attempt to model the impact of marketing strategy on profits has been regarded as somewhat ambitious. Interest of academicians has increased in the study of PIMS from different points of view. In this particular case, focus will be set on the corporate strategy, which will permit a diligent analysis of a topic which has been considered of relevance for strategic decisión making.

Advances have been made in the definition of the strategic elements that best contribute to the financial wealth of a company, nevertheless, historical academic developments show the persistence of several problems related to methodological and structural aspects in PIMS methodology. Asymmetry in criteria has prevented per se problems to be solved, but the background and the accumulated scientific findings créate the perfect setting that allows for an adequate solution. It is around this dilemma that this paper is developed. For that we use the Resource–Position–Development Model (Day and Wensleys, 1998) as a reference in evaluating PIMS contributions and its evolution in the field of strategic planning.

In this way, the main objective of this paper is to do an exploratory–evolutional study of the literature dealing with the impact of marketing strategy on earnings (PIMS), in an attempt to unveil relevant methodological problems and important áreas of opportunity that can be observed in this sort of models. In order to do so, the work has been divided into five sections. The foliowing section introduces the theoretical context about relevant variables of the PIMS model, while the third section contains the evolutional and critic analysis about methodological omissions and the possible orientation of the PIMS Model, then, the fourth section deals with the study of Quality that conducís to profitability and growth as the possible solution ofthe main PIMS's dilemma. Finally, the last section shows the summary and implications for future research.

Theoretical framework

PIMS is a methodology which allows to measure the effect that marketing strategy makes over a company`s profits. In order to do so the methodology includes the application of surveys, the creation, management and analysis of information da–tabases created from information obtained from a group of businesses that use or apply a certain strategic plan.

PIMS was developed by Schoeffler (1960) as a project for General Electric in the North American market.1 After observing that different business units provided different levéis of profitability, the author took on the challenge of determining which factors from the marketing strategy had a higher contribution over accounting profits. Lancaster, Stevenson & Jacob (1980) acknowledge that PIMS success is in part due to the fact that it tries to provide an answer to three basic questions: a) What is the typical earning index for each kind of business? b) Based on current marketing strategies in a business, which one of them seems to be the most appropriate for the future? and c) Which marketing strategy has more probabilities of improving future profits scenarios?

By contrast to Penrose Model (Penrose, 1959), one of PIMS basic characteristics is that stakeholders are provided with a reference background which is closer to business practices because it collects strategic principies that have been practiced by those companies selected as best practices. Several studies have revealed that this is the differentiating characteristic for PIMS, that it will ensure objectivity as opposed to other strategic models (such as the SWOT analysis and Portfolio Models). Munuera (2007) suggests that PIMS expresses the dimensions of the market structure and competitive position of businesses while the other models are based only on "judgments" or recommendations based on a specific strategy. The academic community found an opportunity to detect and model strategic planning issues by using PIMS methodology. Forinstance, Will and Beasely (1982) were pioneers in recognizing the importance of PIMS, arguing that "... it is probably true that PIMS methodology has created, through its discoveries, a larger background to understand strategic planning..." (p. 435). Fromthis step, scholars began to apply a more rigorous econometric analysis to detect empirical regularities related to the strategy, convinced that the results could be helpful for businesses in their strategic steering processes (Henderson, 1976; Buzzell, Gale, Bradley & Sultán, 1975; and Rumel and Wensley, 1980).

PIMS is established as an ambitious project to entail academic and businesses practices. Nevertheless, the most significant contribution towards PIMS methodology comes from Buzzell and Gale (1987), who centered on Lancaster et al. (1980) and PCB Model, but they propose a "definitive" survey that provides for a deeper and more systematic study on the subject, and their proposal has become an arche–type for most of the studies in the same context.

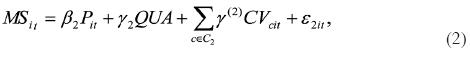

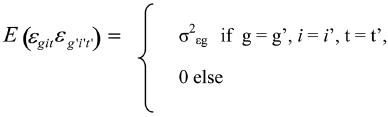

The PCB Model (Phillips, Chang & Buzzell, 1983) had a large influence over the Buzzell and Gale (1987) study because it models the structure of strategic manage–ment tasks in a more complete manner. If expressed mathematically, the funcstion will be abided by:2

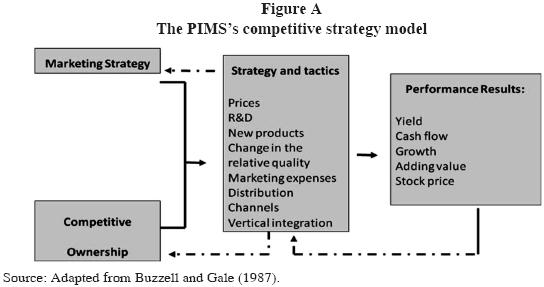

In which Cit are the costs of company i on the moment t, MSit is the market share, Pit are the relative prices of producís, ROI is the return on investment, CVc is the set of control variables for equation, QUA is the quality and εit will be the error or disturbance. So, following on Mundlak (1978) we can observe that the PCB Model assumes that conditional expectations of the random effect can be expressed linearly. In this way, two of its four dimensions (MSit and ROIit) will use the following expressions:3

Since CVc is the set of control variables for equation g, then g =1,... .4, and

Then, to control for the persistent effects that can be attributed to unobservable variables, this baseline model is gradually extended by incorporating different error components.

In summary, the most relevant conclusions of the PIMS studies constitute, at the same time, some of the most polemic aspects:

• Businesses that créate a higher added valué by employee are more profitable than those who declare opposing characteristics,

• Growth is positively related with profits and negatively with cash flow,

• There is a strong relation between market share and profitability measured by the Return on Investment Ratio (ROI), and

• Quality, measured by the consumers or by competitors, has a positive impact o ver growth and over the company's results, among others.

A brief review

Based on previous findings, four important challenges are established that surround the strategy:4 the relation between PIMS and the Corporate Strategy evolution, the analysis of PIMS questionnaire, the multicollinearity problems and the Market Share Effect. The following paragraphs are dedicated to the exploratory study of these topics.

Corporate strategy

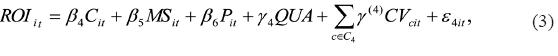

Schoeffler (1960) has established that since its origins, PIMS methodology should be centered on measuring the contribution of the marketing strategy over the company`s profits. This supposes the definition of strategy with more concrete elements. So, the first integrative effort develops with Rumelt (1974) proposal which lays the basis for the scientifical study on the impact of Corporate Strategy. This allows the emergence of two points of view: one which is centered on Corporate Strategy (Buzzell and Gale, 1987; Palich, Cardinal and Miller, 2000), and another one that emphasizes directive abilities (Goold, Campbell and Alexander, 1994).

The Buzzell and Gale (1987) study was crucial for the development of PIMS studies from the point of view of Corporate Strategy. In their work they explain that the strategy should be oriented towards the market but according to the competitive position of the business and they suggest that the way of evaluating its effectiveness is trough some profitability indicator (see figure A). Nevertheless, the selected strategy target will depend upon the directive's point of view adapted by the company, and therefore the impact over the returns can be significantly affected (Mosqueda Almanza, Pruneda Divildox and Palomares Vaughan, 2009). In fact, Markides (2001) argües that there will always be a variation in the way in which businesses consider strategy. Some will consider it as a competitive advantage, as a set of rules, as an intention or as the background to créate valué in the firm or even adapt it according to the models being used in a particular moment.

In the seventies, strategy emphasized the performance of results. In that time, PIMS was oriented towards an approach on Positional Advantages trying to typify and analyze the consequences of a strategy which is traditionally defined by models such as the Bostón Consulting Group Model or the Porter Model. Later, in the eighties, and into present days, Markides (2001) suggests that Corporate Strategy tries to satisfy indicators such as Added Valué and Balanced Scorecard, which had effects on PIMS. As a result, PIMS changed its traditional positional approach to that of Advantage resources. The current PIMS approach will measure the success of a strategy based on whether the resources generated by the company are sufficient and adequate for survival, and to adapt to settings characterized by uncertainty rather than by a search of a competitive advantage.

Differences in the definition of strategy will explain the lack of consensus that exists among different studies and theories about the conclusions obtained; therefore, it seems appropriate to question whether strategic recommendations endure or whether strategies that were successfiil in a moment in time are no longer usefiil in another time. Certain interest has been found in analyzing other áreas of the organization which are closely related with Strategic Management in an attempt to créate a more precise background, but still characterized by the Advantage Resources approach (Robinson and Parry, 2004, Buzzell, 2004).

PIMS survey

Studying the PIMS survey will result in verifying its robustness in other contexts such as incomplete markets. Only a few studies have been conducted on the subject.

This apparent lack of interest can be explained by the existence of at least three data bases with characteristics that are similar to the PIMS survey in the market: COM–PUSAT, IRS–Database and FTC–Database. Evidence suggests certain information cross–referencing that result in loss of resources.5 Nevertheless, advances on the subject require redesign and eventually adapting an elaborated survey to complete markets, because it will be difficult to be applied outside its context without the emergence of problems with information being biased (Mosqueda, 2007b).

Boyd, Farris and Hilderbrandt (2004) have noticed that perfecting the survey relates to financial ratios that would best express the business economic reality. Similar approaches can be found in Zhen and Lev (1999) and Balasubramanian and Kumar (1990) who argue that more than the marketing expenses/sales ratio, the intensity of investments over profitability is essential.

Also, Ramirez (1997) recognizes that the PIMS survey had to be corrected to make it clearer according to commercial practices in local businesses. Fariñas and Jamandreu (1994) and Fariñas (1995) go further and analyze the structure both on PIMS surveys and other business strategy surveys, and warn that the questions requiring more changes were related to market characteristics and the strategy model in use.

Recently, Mosqueda et al. (2009) have done empirical research to detect possible abnormalities in the design ofthe PIMS questionnaire. In their study they detected an Alfa Combrach of 0.638 which makes them think about perfecting the survey. In doing so, they used an archetype PIMS survey (2009).6 Eventually, they recognized that difficulties in applying the questionnaire to a collective of Mexican businesses because of the lack of information were related to questions measuring market share and producís life cycle.

Multicollinearity problems

Schoeffler et al. (1974), Rumelt (1974) and, especially, Phillips et al. (1983), represent the first solid attempts on the statistical studies of PIMS. During that stage, incorporating cross–sectional models to the tasks of analysis allowed the elimination of strong biases on the estimations.

In these findings, ROI is considered the most relevant element in measuring the effectiveness of Corporate Strategy. Criticism was immediate, and it meant an opportunity to improve methodological deficiencies.

The central premise on the múltiple regression analysis is that independent variables are independent among them, meaning that they are not related. When this premise is not complied with a multicollinearity problem arises which can be translated as a problem that creates irregular results and causes doubts about the findings (Wooldridge, 2006). Critics suggest that this problem is permanent in the PIMS Model. Ludatikin and Pitts (1983) found in an empirical test that "beyond the 66 possible relations, 38 percent ofthe relations produced in the sector groups are affectedby ahigh degree of multicollinearity" (p. 42).

Considering this problem, Buzzell and Gale (1987) constructed a correlation matrix using PIMS variables. Results suggest that there are no important correlations between any of the variables and that an existing correlation will be located near the 0.30. Schanaars (1994) warns that such result is a clear indication that there is a strong multicollinearity in and among some of the basic PIMS indicator. Tests that were later conducted revealed that the categories of "Relative perceived quality" and "Market share" were strongly correlated, and therefore both categories are not statistically independent. According to Schanaars this corresponds with practice in which it is noticed that no more than 50% of the businesses that took part in the survey show high quality levéis and a high participation in market share.

Recent studies demónstrate that multicollinearity is a problem that does not invalidate results but shifts the polemic towards methodological aspects. Wooldridge (2006) and Judge, Griffiths, Hills, Lutkepohl and Lee (1985) consider that múltiple regressions is a solid statistical technique that works well even in the presence of severe multicollinearity cases. Facing this disjunction the critics move towards the design of controlling unobserved variables.

Uniform categorization of PIMS survey as proposed in Thomas y Tymon (1982) and Rodríguez (1982). This re–categorization is useful in identifying persistent effects which are a priori attributed to unobserved variables which will confirm the effect of market share. In consequence, the PIMS Model will be gradually extended by incorporating different error components providing more robust results. Other works have developed extensions to the PCB Model focusing on the way to control (measure) the invariant effects in time (Baltagi, 2001 and Hsiao, 1986), the autoregression effects (Camerer y Fahey, 1988 and Boulding and Staelin, 1993), and a third group which try to establish the correlation of random effects with exogenous variables (Mundlak, 1978, Joreskig, 1978 and Joreskog and Sorbom, 1996). Their findings show significant improvements in its explanatory capacity.

The Market Share Effect

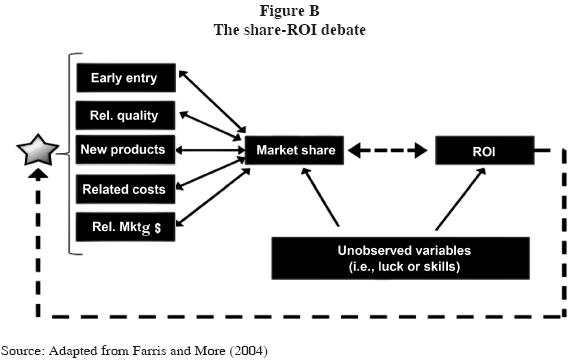

The starting hypothesis is based on Buzzell et al. (1974) which not only shows the tight relation between market share and profitability but which also makes sure that this is a consequence of the other (see Figure B).

Justification lays on the fact that a business, by having high market participation will provide higher levels of profitability with a given level of effectiveness and consequently its average costs will be low.

Buzzell et al. (1974) and Schoefler et al. (1974) empirically corroborate that hypothesis. For them, market share, intensity of investment and business characteristics are key elements in ROI Nevertheless they do not unveil neither the cause nor the effect.

In Scherer's paper (1987) the findings suggest that the effect of the market share is a "strong indicator" to explain the achieved profitability levels. Amongst the detractors of this hypothesis are Rumel and Wesley (1980) and Wesley (1982) who pay special attention to the fact that it cannot be assured into the market share has an effect (positive or negative) over profitability, because the phenomena had to be first understood. There is a need to develop a solid theoretical background to fully understand other elements that contribute to the level of profitability of a business. Several works suggest that market share is a consequence of having more effectiveness rather than its cause, which clearly implies that the market share effect over profitability is at least a false statement (Matovic, 2002; Jacobson 1988; Jacobson and Aaker 1985).

The origin of this confusión seems to come from the statement made by Demsetz (1973). Demsetz suggests that the high level of performance is a mix of luck and excellent quality management. In his empirical research he found that high executives were expecting to know the easiest way to recognize more attractive markets, develop more attractive products or to deliver marketing efforts in a more efficient way, but this invariably led them to assume that it will only lead to the increase of market share and to obtain more profits. Mosqueda's empirical work (Mosqueda, 2007a) seems to be on the way of confirming the above said; results allow differentiating factors that promote business growth from the possible existence of exceeding strategic (assets) or distinctive competences that are not fully utilized and that explain economic performance.

On the contrary, the Available Resources Theory (Barney, 1991) suggests that bu–sinesses could not have sustainable advantages unless they have unlimited resources (assets) available every time that conditions are verified in the sense that they are imperfectly imitable and imperfectly replaceable by competing businesses in a form in which they could be shaped as sources of competitive advantage.7

This dilemma produces, as a result, an intermediate theory that considers both the observable and unobservable variables (such as luck, manager's ability, and so on). Gale and Branch (1981) find that in 60% of businesses that apply PIMS, the marketing strategy does not have an impact over profitability because in general there is an inadequate management of cash flow after interests, but they argüe that these financial dimensions are strongly related to market share. These statements allow seeing, for the first time, the existence of other factors, different from market share that would explain profitability. In this way, Ailawadi, Warris and Parry (1999), Boulding and Staelin (1993) and Jacobson and Aaker (1985) found that besides the apparent existing effect between market share and ROI, profitability diluted through time by the effects of unobserved factors.

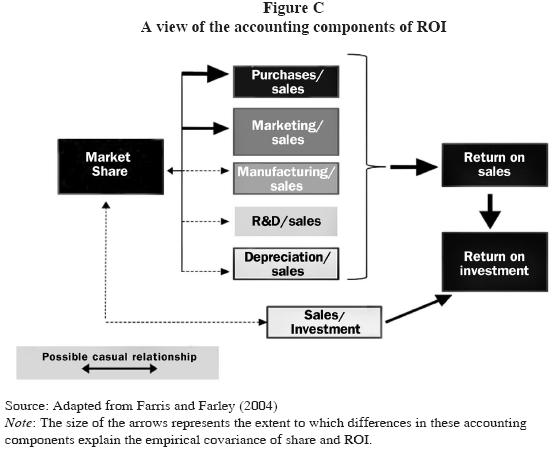

Ailawadi et al. (1999) analyze the accounting components that exist in the market share– ROI relationship and suggest patterns that could provide indirect evidence of the nature of certain variables that cannot be observed. They conclude that the reduction in buying costs is a key element not observed in the manager's abilities or luck that will relate market share to ROI, with independence of on which direction this causality will be interpreted. By using the multivariate estimation technique a high level in the market share effect can be found (0.537 with an error margin of 0.025).

The accounting components which are empirically detected by some studies that have an effect over the market share can be observed in figure C. It was precisely by disintegrating the ROI that a clearer idea about empirical causes of covariance between market share and ROUI can be found. In this figure the ratio Purchase/Sales is the most dominant dimensión followed by expenses in marketing and sales. Following on the same ideas, Christen and Gatignon (2004) introduced the development from the field of Random Effects proposed by Hausman (1978) to detect the effect of unobservable variables. The model proposed by Christen and Gatignon is named Random Effect Model (REM) and its target is to detect marginal contribu–tions of non observable elements to the market share.

To validate REM, Christen and Gatignon use PIMs information from 3,898 businesses that were grouped in 6 sectors. Then, the results were contrasted against those obtained by two other models: the simple regression model and the fix effects model. Out of the three methods used, REM was the one that reflected the major effect on market share over ROI although it did not show significant improvements in relation to the simple regression model. The cause seemed to be related to having exclusively concentrated on "tendency"; this situation generates an inefficient estimator for deviations since the adequate measure of "tendencies" should be the main objective of the test. So, this problem was solved after adopting Hausman criteria thanks to the creation of a correlation index (ρχα) between fixed components of the estimation and Market share. In effect, the new estimator considerably increased its capacity by going from a level of 0.30 to 0.57 for every sample of the market share effect.

Quality that conducts to profitability and growth

Christen and Gatignon (2004) acknowledge that even with recent findings, the persistence of proofs against the market share effect is possible because simple econometric models, in general, produce results that can be interpreted in different ways, a problem that cannot be easily solved, because when trying to use more sophisticated econometric models, valuable information is not always available. Recent works on relative product quality are centered on this indicator as a factor that will end the contraversy about the market share effect.

When businesses are able to produce products/services that are appreciated as of quality in the market, they are able to créate wealth and can expand.

The most elementary problem when dealing with quality is that of the notion or definition. Different áreas of knowledge consider quality to be a particular thing; from reduction of variation to perfection, and everything in between. Converging on quality is therefore essential. Montaudon (2009) has considered that it is possible to recognize certain elements about quality that are to be found stable over time: quality is related to an authority, a recognition system, an organization or institution; quality is a collective action in which agreement and convergence must be obtained for others to see or observe the same thing, and finally, quality becomes a notion for self improvement. Even when the authority is no longer there, it is possible to distinguish between quality and what it is not moving towards its self improvement.

Relevant studies on the subject of quality as related to market share are those of Wankhade and Dabade (2006a) & Wankhade and Dabade (2006b), which analyze quality perception and quality uncertainty due to information asymmetry. In industry, critical evaluation of major factors such as the role of divisional top managers and quality policy; the role of the quality department; training, design, supplier quality management; process management; quality data and employees relations based on Badri and Davis (1995) are also considered.

Montaudon and Mosqueda (2010) have elaborated on the creation of an índex for Product Quality that will reduce quality uncertainty and might be helpful in the promotion of an international language of product quality. The index could be used in addition to ISO 900 or industry regulations and would significantly reduce information asymmetry, therefore providing for quality.

If, and only if, everyone can observe the same thing about quality, can it be considered to provide profitability and growth? Otherwise, it becomes just a part of isolated efforts.

Summary and implications for future research

Even when Schnaars (2004) acknowledges that the consistency of PIMS findings in recent years suggests that generalizations offered by the model are lasting and not transitory, it is estimated that based on the analysis, there are serious arguments to perfect PIMS methodology.

One of the most interesting and relevant áreas for future PIMS development is related to quality. In fact, one of the most significant findings of the classical studies of Buzzel and Gale (1987) is that relative product quality is considered as adifferentiating element. Therefore, product quality should be analyzed over the profitability and market quota as proposed by Farris et.al (1992) and Hieldebrandt and Temme (2004) because of the need of evaluating the way in which the client perceives quality and its effect on business.

Conclusions based on earlier works show the need for a more precise definition of the business strategy, the redesign of the PIMS survey when it is applied to incomplete markets and, finally, advances have been found in the econometric PIMS study emphasizing the variable relative product quality to sol ve the dilemma of the market share effect.

Despite the progress shown in the PIMS model, the majority of specialists agree that the definitive breakthrough will come when the survey matches the maturity of the market studied. It must be assumed that low–quality inputs may not correctly reflect the strategy. Henderson (1976) explained that rules cannot be inexorable; Farris and Farley (2004) consider that the biggest challenge for PIMS will be the definition of the market that cannot be attached to only one dimensión, but must consider all its complexities.

References

Ailawadi, K., P. Warris and M. Parry (1999) "Market Share and ROI: Observing the Effect of unobserved variables" International Journal of Research in Marketing. 16, (1), 17–33. [ Links ]

Balasubramanian, S. and V. Kumar (1990) "Analyzing Variations in Advertising and Promotional Expenditure" Journal of Marketing 54 (April), 57–68 [ Links ]

Barney, Jay (1986) "Organization Culture: Can It Be a Source of Sustained Competitive Advantage», Academy of Management Review, 11 (3), 656–665. [ Links ]

Baltagi, B. (2001) Econometric analysis of panel data. United Kingdom: John Wiley and Sons, 2da edición. [ Links ]

Bass, F., and D. R. Wittink (1975) "Pooling Issues and Methods in Regression Analysis with Examples in Marketing Research" Journal of Marketing Research, 12 (November), 414–425. [ Links ]

Boyd, E., Paúl Farris and L. Hilderbrandt (2004) "PIMS and COMPUSTAT data: different horse for the same course" in Farris y More (eds.) The Profit Impact of Marketing Strategy Project: Retrospect and Prospect. Cambridge University Press, pp. 41–72 [ Links ]

Boulding, W. and R. Staelin (1993) "A look on the Cost Side: Market Share and the competitive Environment" Marketing Science. 12, 144–166. [ Links ]

Buzzell, R., B. Gale, T. Bradley, and Sultán, R. (1975) "Market Share–A Key to Pro–fitability" Harvard Business Review, Volume 53, January–February, 97–106. [ Links ]

Buzzell, R. D. and B.T. Gale (1987) The PIMS (Profit Impact of Market Strategy) Principies. New York: Free Press. [ Links ]

–––––––––– (2004) "The PIMS program of Strategy Research: A retrospective Appraisal" Journal of Business Research, 57, 478–483. [ Links ]

Camerer, C. and L. Fahey (1988) "The Reggresion Paradigm: A Critical Appraisal and Suggested Directions" in J. Grant (Ed.), Strategic Management Frontiers, 443–459. [ Links ]

Christen, Markus and H. Catignon (2004) "PIMS and the market share effect: biased evidence versus fuzzy evidence" in Farris y More (Eds.) The Profit Impact of Marketing Strategy Project: Retrospect and Prospect. Cambridge: Cambridge University Press, pp. 260–271. [ Links ]

Day, G. and Robin Wesley (1988) "Assessing Advantages: A Framework for Diagnosis Competitive Superiority" Journal of Marketing, 52, April, 1–20. [ Links ]

Demsetz, Harold (1973) "Industry Structure, Market Rivalry, and Public Policy" Journal ofLaw and Economics. Vol. 16, pp. 1–10. [ Links ]

Dibb S., L. Simpkin , W. M. Pride , O. C. Ferrell (2006) Marketing Concepts and Strategies, (Fifth European Edition) London: Houghton Mifflin. [ Links ]

Fariñas, J. and J. Jaumandreu (1994) "La encuesta sobre estrategias empresariales: características y usos", Economía Industrial, 299, 109–119. [ Links ]

–––––––––– (1995) "La encuesta sobre estrategias empresariales: características y usos", Documento de Trabajo Número 8 del Programa de Investigaciones Económicas, Fundación Empresa Pública, 39 páginas. [ Links ]

Farris, P., E. Parry and K. Ailawadi (1992) "Structural Analysis of Models with Composite Dependent Variables" Marketing Science, 11, 76–94. [ Links ]

–––––––––– , and J. Farley (2004) "PIMS: Visión, achievement, and scope of the data" in Farris and More (eds.) The Profit Impact of Marketing Strategy Pro–ject: Retrospect and Prospect. Cambridge: University Press, 6–27 [ Links ]

Gale, B. T. and B. Branch (1981) "Cash flow analysis: More important than ever" Harvard Business Review. 59 (4), 131–136 [ Links ]

Goold, M., A. Campbell and M. Alexander, (1994) Corporate–Level Strategy: Creating Valué in the Multibusiness Company. Chichester: Ed. John Wiley and Sons. [ Links ]

Hausman, J. (1978) "Specifications tests in econometric" Econometricam 46, pp. 1251–1271. [ Links ]

Hiedelbrant, L. and R. Buzzell (1991) "Panelanalyzen zur Kontrolle 'unbeobachtbarber in der Erfolgsfaktorenforschung" Zeitschrift für Betriebswirtschaft, 66, 1409–1426. [ Links ]

–––––––––– , and D. Temme (2004) "The Modelo PCB revisited– the Effect of unobservable variables" in Farris y More (Eds.) The Profit Impact of Marketing Strategy Project: Retrospect and Prospect. Cambridge: Cambridge University Press, 153–187. [ Links ]

Henderson, B. (1976) The Rule ofthe Three and Four. BCG: 39. Bostón: Ed. John & Wiley & Sons. [ Links ]

Hsiao, C. (1986) Analysis of Panel Data. Cambridge: Cambridge: University Press. [ Links ]

Jacobson, R. (1988) "Distinguishing Among Competitors Theories ofthe Market Share Effect" Journal of marketing. 52, pp. 68–80 [ Links ]

–––––––––– , R. and D. Aaker (1985) "Is Market Share All That It's Cracked Up to be?" Journal of marketing. 49, 11–22 [ Links ]

Joreskog, K. G. (1978) "An Econometric Model for Multivariate Panel Data" Annales de l'INSEE 30–31, pp. 355–366. [ Links ]

––––––––––, K and D. Sorbom (1996) L1SREL 8: User's reference guide. Chicago: Scientific Software. [ Links ]

Judge, G., W. Griffiths, H. Hills, H. Lutkepohl and T. Lee (1985) The Theory and Practice of Econometrics. New York: John Wiley and Sons. [ Links ]

Lancaster, L, G. Stevenson and G. Jacob (1980) "Fundamentos de la metodología PIMS" in Mosqueda Almanza, Rubén and Sanjuana Villanueva (Ed.) "Impacto de la estrategia de exportación sobre el rendimiento" Working paper 0217. Universidad de Guanajuato. Noviembre. [ Links ]

Lancaster, L., P. Massingham and R. Ashford (2002) Essentials ofMarketing. (4th ed.) New York: McGraw Hill. [ Links ]

Markides, Costas (2001) "Strategy as Balance: from either or to and" Business strategy Review. 12, 1–10. [ Links ]

Matovic, Dragan (2002) "The Competitive Market Structure ofthe U.S. Lodging Industry and its Impact on the Financial Performance of Hotel Brands" PhD Thesis. Virginia Polytechnic Institute. USA. [ Links ]

Montaudon, C. (2009) "Studying quality in the automobile industry. Three appro–aches and case studies" PhD Thesis. Great Britain: Lincoln University. Forthcomming. [ Links ]

––––––––––, and R. Mosqueda (2010) "Quality Comparing índex (QSI)". Working paper A728. Tecnológico de Monterrey. México. [ Links ]

Mosqueda Almanza, Rubén (2007a) "Efecto de la dirección de la estrategia corporativa sobre el rendimiento económico en las empresas industriales mexicanas" Memorias del Premio Nacional de Finanzas. IMEF–Deloitte & Touché. México. [ Links ]

–––––––––– (2007b) "Estrategia corporativa. Rendimiento económico" Revista Ejecutivo de Finanzas, 30, 64–65. [ Links ]

––––––––––, G. Pruneda and F. Palomares (2009) "Modelo para medir el impacto de la estrategia comercial en el rendimiento de las empresas PYMES" Memorias del Seminario Estatal de Investigación, CONCYTEG. México. [ Links ]

Mundlak Y. (1978) "On the pooling of the time series and cross section data" Econometrica 46, 69–85. [ Links ]

Munuera Alemán, José (2007) Marketing estratégico: teoría y casos. (4ta ed.) Madrid: Pirámide. [ Links ]

Palien, L., L. Cardinal and C. Miller (2000) "Curvilinearity in the Diversification–Performance Linkage: An Examination of Over Three Decades of Research", Strategic Management Journal, 21(2), pp. 155–174. [ Links ]

Penrose, E. (1959) The Theory ofthe Growth ofthe Firm. New York: Wiley. [ Links ]

Phillips, L., D. Chang and R. D. Buzzell (1983) "Product Quality, Cost Position and Business Performance: A test of some Key Hypothesis" Journal of Marketing, 47 (spring), 26–43. [ Links ]

Ramaswany, V., H. Gatingnon and D. Reibstein (2004) "Competitive Marketing behavior in Industrial Markets" Journal of Marketing. 58 (2), 45–56 [ Links ]

Ramírez, M. L. (1997) Análisis del comportamiento estratégico de las empresas españolas: Aplicación a la diversificación internacional y de producto. 1991–1995. (Tesis inédita doctoral) Universidad de Zaragoza, España. [ Links ]

Robinson, William and Mark Parry (2004) "Order of market entry: empirical re–sults from the PIMS data and future research topics" in Farris y More (eds.) The Profit Impact of Marketing Strategy Project: Retrospect and Prospect. Cambridge University Press, pp. 73–91. [ Links ]

Rodríguez, J. (2007) Marketing estratégico: Teoría y casos. Madrid: Pirámide. [ Links ]

Rumelt, R.P. (1974) Strategy. Structure and Economic Performance. Cambridge: Harvard Business School. [ Links ]

––––––––––, and Wensley (1980) "In Search ofthe Market Share Effect" University of California. Working paper MGL–61. [ Links ]

Schnaars, Steven (1994) Estrategias de marketing: Un enfoque orientado al consumidor. Madrid: Diaz de Santos. [ Links ]

Schoeffler, Sidney, R. Buzzell and D. Heany (1974) "Impact of Strategic planning on profit performance". Harvard Business Review. 52, (2), 137–145. [ Links ]

––––––––––, Sidney (1977). "Cross–Sectional Study of Strategy, Structure, and Performance: Aspects ofthe PIMS Program." In Thorelli, Hans B. (editor) Strategy + Structure = Performance. Bloomington, IN: Indiana University Press, 108–121. [ Links ]

Sherer, F. M. (1987) "The Validity of Studies with line of Business Data: Comment". American Economic Review, 77, 205–217. [ Links ]

Thomas, K. and W. G. Tymon (1982) "Necessary properties of relevant research: Lessons from recent criticisms of the organization sciences" Academy of Management Review, 45 (4), 345–352. [ Links ]

Wallace, T. (1972) "Weaker Criteria and Tests for Linear Restrictions in Regressions" Econometrica, 40, (July), 689–698. [ Links ]

Wills, L. and Beasley (1982) "The use of strategic planning techniques in the United Kingdom". Omega, 10, 433–440. [ Links ]

Wooldridge, J. (2006) Introducción a la econometría. Madrid: Thomson. [ Links ]

Zhen, D. and Baruch Lev (1999) "The valuation of acquired R&D" Working paper. New York University. [ Links ]

1 Quoted by Schoeffler (1977).

2 Even when Hildebrandt and Buzzell (1991) have presented a different econometric proposal insisting that the identified factors of the PCB model are those that determine the marketing strategy efficiency.

3 The PIMS Model is integrated by a Survey distributed in Áreas of Information of Dimensions and four econometric functions. In this way, the Survey is composed of 37 variables or questions (see Dibb, Simkin, Pride and Ferrell, 2006) which are distributed in around six Áreas of information or Dimensions: a) Return on Investment, b) Market Share, c) Marketing Budgeting, d) Market Attractiveness/ Competitiveness, e) Product Lifecycle and f) Distribution Channel.

Despite the progress to adapt and reclassify the PIMS survey to the reality of immature markets (see Rodríguez, 1982 and Mosqueda et al., 2009), there is no consensus on the variables to be included in the PIMS Survey (see Lancaster, Massingham and Ashford, 2002 or Dibb, Simkin, Pride and Ferrell, 2006). Finally, we note that the seminal model to formalize the explanatory variables of PIMS was proposed since the PCB model (Phillips et al., 1983) and was subsequently taken up by the Buzzell & Gale (1987) model. In this way the formalization of fhese variables is in equation (1). So, we base our proposals on the Buzzell & Gale model because it is one of the models which has shown more consistency fhrough time.

4 There are several challenges that PIMS model has to face, however, due to little space, this article develops the most critical problems pointed out by Schnaars (1994) and Robinson & Parry (2004). Both papers made an exhaustive study of the challenges that face the PIMS methodology. In particular, they identify those problems it revolves around: econometric specification, strategy, size of the company, methodological tools that encourage inappropriate financial Indices to measure performance, among others.

5 For further references see Ramaswany, Gatingnon and Reibstein (2004).

6 Rodríguez proposal is to divide the survey into six basic areas: market share, factors that determine ROI, marketing budget, competitive strength, product lifecycle and distribution channel.

7 This opens the possibility that strategic assets or distinctive competences could exceed in a specific moment those required for the current horizontal and vertical organization of the business. Growth will therefore be justified as to exploit boundary economies.