Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Contaduría y administración

Print version ISSN 0186-1042

Contad. Adm n.228 Ciudad de México May./Aug. 2009

Artículos de investigación

The role of multinationals in the host country: Spillover effects from the presence of autocar makers in Mexico1

El papel de las empresas multinacionales en los países huéspedes: derramas relacionadas con la presencia de las empresas productoras de automóviles en México

Salvador Barragán1 and John Usher2

1 Academic Assistant HRM & Organizational Studies, Faculty of Management, University of Lethbridge. E–mail: salvador.barragan@uleth.c

2 Professor area chair of the Policy/Strategy, Faculty of Management, University of Lethbridge. E–mail: john.usher@uleth.ca

Fecha de recepción: 11.11.2008

Fecha de aceptación: 30.03.2009

Abstract

Multinational Companies (MNES) have a long presence in the automobile industry in Mexico, since 1925. The North America free trade agreement (NAFTA) has promoted this foreign–owned industry to develop the locally owned auto supplier industry. In this study, we focus on two analyses: in the first one, the "Double Diamond" model is used to examine the sources of competitiveness of the auto industry, the auto suppliers, and the possible spillover effects on first and second tier suppliers. In the second one, we focus on a local case by analyzing the cluster located in Puebla to see the relations between the Original Equipment Manufacturer Volkswagen (OEM VM) and its suppliers. Our findings indicate that the foreign–owned auto industry in Mexico has been successful in terms of gaining world's export market share within the period 1993–2003 and that MNES have promoted the competitiveness of some existing locally owned suppliers through collaborative agreements and joint ventures. The local case of the Puebla cluster reveals that some local, in its majority foreign–owned, auto suppliers have been certified and integrated as tier 1 suppliers of the OEM VW, but there is not enough evidence that tier 2 and 3 locally owned suppliers have been fully integrated into the supply chain.

Keywords: technology spillover, double diamond model, multinational enterprise, local content, OEM.

Resumen

Las empresas multinacionales tienen presencia en la industria automotriz en México desde 1923. El Tratado de Libre Comercio de América del Norte (TLCAN) ha buscado promover que estas empresas de capital extranjero desarrollen proveedores locales. En este estudio nos enfocamos en dos análisis: en primer lugar, el modelo de "doble diamante" se usa para examinar fuentes de competitividad de la industria automotriz, de los proveedores y de las posibles derramas hacia proveedores de primer y segundo niveles; en segundo lugar, nos centramos en un caso local examinando el cluster ubicado en Puebla para ver la relación entre la multinacional, Volkswagen, y sus proveedores. Nuestros hallazgos indican que la industria automotriz de capital extranjero ha sido exitosa en términos de exportar y ganar segmentos del mercado mundial en el periodo 1993–2003 y las multinacionales han promovido la competitividad de algunos proveedores de capital local a través de acuerdos de colaboración y joint ventures. El caso del cluster de Puebla revela que proveedores de capital extranjero, y solamente algunos proveedores de locales, han sido certificados e integrados como proveedores de primer nivel de Volkswagen, pero no hay suficiente evidencia que los proveedores de segundo y tercer niveles locales hayan sido integrados a la cadena de proveeduría.

Introduction

Multinational Companies (MNES) have a long history in the automobile industry in Mexico, the first assembly plants were established in 1925 (Micheli, 1994). Despite the fact that the Mexican manufacturing industry in general followed a protectionist model for many years, the auto industry in particular had seen a constant presence of foreign–owned firms originally oriented to the domestic market and later oriented to export markets through the implementation of some Auto Decrees, with no dramatic outcomes before NAFTA (Ochoa–Valladolid, 2005). Then, Mexico moved toward a free market model, starting with the incorporation of Mexico into the General Agreement on Tariffs and Trade (GATT) in 1986 (Secretaria de Economia, 2004) and continuing with the signature of the NAFTA agreement in 1993. One of the anticipated advantages of NAFTA was to maintain and attract MNES, especially auto car assemblers, with the expectation that such companies would use substantial amounts of "local content", (i.e. parts produced by local suppliers). This strategy was intended to develop and strengthen local–owned suppliers (i.e. Mexican investments) by establishing supply relationships with foreign–owned car assemblers. The further expectation was that this relationship would produce spillover effects such as the transfer of technology, extended collaborative agreements, and the creation of a national infrastructure to support this industry. After more than ten years with NAFTA in place, however, two questions remain largely unanswered: First, is there evidence of a general increase in the competitiveness of the auto industry? Second, to what extent can any such increase be attributed to the emergence of a national industry of auto parts suppliers? First, we use the "Double Diamond" model (Rugman and D'Cruz, 1993; Rugman and Verbeke, 1993) based on Porter's (1990) Diamond Model to analyze the sources of competitive advantage of the auto industry and the auto suppliers in general. Second, we focus on the automotive cluster located in the state of Puebla to analyze the relationship between the Original Equipment Manufacturer (OEM) Volskwagen (VW) and its suppliers, in terms of spill over effects (e.g. Blomström and Kokko, 1998; Kokko, 1994; Lall, 1978). Finally, we discuss practical implications for the industry, based on the evidence presented in this case study.

Literature review

The double diamond model of national competitiveness

Porter (1990) developed "the Diamond Model", a conceptual framework that may be used to analyze the sources of competitiveness for a given industry within a particular country. These sources are argued to arise from four national determinants of competitive advantage, government policies, and change. We use three determinants for this paper: 1) factor conditions and the infrastructure necessary to compete globally in that industry, 2) firm strategy, structure, and rivalry that increases competitive fitness within the industry, and 3) supporting and related industries that enhance the ability of the focal industry to compete locally and internationally. The model suggests that to be internationally competitive, it is necessary to have a strong national diamond or strong "home base". Some scholars have argued that many small economies that have opened to international trade do not have strong national diamonds (Rugman and D'Cruz, 1993). Instead, they have at least one weak corner of the national diamond that requires reliance on the corresponding corner of a foreign diamond. In this sense, Rugman and Verbeke's (1993) analysis contended that firms' competitiveness in small economies is influenced by the host Diamond and other nations' diamonds. This argument suggests that in some countries the diamond model of a particular industry is linked to the diamond of another country in terms of one of the determinants (Rugman and D'Cruz, 1993). The general case of Mexico is discussed by Hodgetts (1993), who suggested the importance of using a "Double Diamond" framework and made special emphasis for the implementation of the NAFTA agreement. We use the "Double Diamond framework to analyze the sources of competitiveness of the auto industry in Mexico in general, by focusing on three of the "determinants" of national competitiveness: factor conditions, firm strategy, and supporting industries. The rationale for using these three is that they provide the context for the analysis of the Mexican infrastructure that supports the auto industry as an export platform.

The role of multinational enterprises and spillover effects

We would expect that continuous levels of Foreign Direct Investment (FDI) will increase the participation of indigenous suppliers based on the literature of spill over effects (Blomström and Kokko, 1998). These spillover effects are created through the interaction between the mne and the local firms, in which the MNES transfer knowledge to the local firms (Kokko, 1994) such as the use of statistical process control, information systems, and logistical (just–in–time) supply systems, improving their quality, productivity and service levels. For these transfers to occur, it is necessary that MNES establish backward and forward relationships with suppliers (Lall, 1978). Foreign companies also create joint ventures with local firms in order to exchange benefits, such as learning (Lane, Salk, and Lyles, 2001). However, a minimum threshold of human capital understanding must already exist, called absorptive capacity, within a local firm in order for it to acquire advanced knowledge (Lall, 1996; Cohen and Levinthal, 1990). Some studies have found advantages of being part of a cluster such as technology transfer (Altenburg, 2000; Patibandla and Petersen, 2002), communication, information fl ow, pull of skilled workers, and common infrastructure (Pouder and St John, 1996; Bell, 2005). Finally, MNES provide training to their own employees who may later go on to create their own local firms (Meyer, 2004). For this paper, we are interested in the possible spill over effects from the auto industry on the related industries such as locally owned suppliers, technology transfers, and the creation of new start–ups.

Methodology

The case study method is a useful way to explore a theoretical framework when it is important to study a phenomenon in context and there are many variables to explore (Yin, 2003). The case is focused on two levels of analysis: the auto industry in general and the local cluster in Puebla were VW is located. We use the Double Diamond framework to explore three out of the four "determinants" to identify sources of competitiveness of the auto industry. The two points in time analyzed were 1993 (pre–NAFTA) and 2003 (10 years post–NAFTA). According to Porter (1990), the indicators of the international competitiveness of an industry are: 1) Sustainable increase in exports to the world, 2) Increase in world share exports, in a particular industry, 3) Foreign Direct Investment in that industry, 4) Trade balance in that industry, and 5) Proportion of exports in that industry with respect to the total exports of the country in a particular year (p.739–744). We use the COMTRA–DE data base of the United Nations, employing the Industrial Trade Classification (SITC) Revision 3. We use archival sources such as industry reports, industry magazines, industry association information, NAFTA documents, academic journals, and government studies. Finally, we interviewed 15 managers and representatives of firms within the VW cluster in Puebla, including the General Manager of the Mexican Automotive Parts Association, managers from VW Mexico, bmw Mexico, representatives of nafin Puebla, Public Relations representative of Rassini Frenos and Vitro, and other representatives of tier 1 suppliers.

The competitiveness of the automobile industry in Mexico

Antecedents and free trade

It is clear that government rules, policies, and free trade agreements have contributed in large part to the current situation in the Mexican auto industry. There have been four distinct regulatory periods for the automotive industry in Mexico that have been characterized as: vehicle imports, import substitution, development of national auto parts firms, and free trade (CECIC, 2002). In the first stage, Mexico satisfied its domestic needs through very simple vehicle assembly facilities and importing cars from the U.S., car prices were controlled by the government and the local content of the auto industry was less than 20%. Then, an import substitution model was implemented to the auto industry by government decrees in 1962, 1972, and 1977 with the intent to develop an auto parts industry (Brown, 2000) and to promote exportations of cars (Ochoa–Valladolid, 2005). At that time, FDI in a particular project was limited to 49% and the number of car assemblers and brands offered were also limited. These conditions should have allowed indigenous suppliers to grow and feed the industry. Local content was required to be 60% for cars. But by the late 70's, Mexico had a trade deficit and problems in acquiring capital goods. The cars produced in Mexico were old models with poor quality. Then, further government decrees were released in 1977 and 1987 in order to promote an export activity (Brown, 2000). At this stage the hope was to maintain the growth of local suppliers, but local content was reduced to 36% for those companies to focus on developing their export markets. Foreign ownership was allowed in auto parts firms with the purpose of increasing technology, but only if they exported. Later, Mexico incorporated first the GATT (now the WTO), and then the NAFTA agreement, with the expectation that the auto industry increase its export profile. In this period, imports of brand new cars were permitted, the market was opened to new car assemblers, and the percentages of local content were reviewed (Brown, 2000). The percentages were fixed according to different periods of time: 50% (1995–1997), 56% (1998–2000), and 62.5% (since 2001) (Bancomext, 2004). This local content had to be maintained if car assemblers wanted to be granted 0% on tariffs when exporting to the other regions of NAFTA. Despite the fact that some of the Automotive Decrees (e.g. 1972, 1977) had tried to promote an export orientation with more value–added, before NAFTA (Ochoa–Valladolid, 2005, Shaiken, 1993; Shaiken & Herzenberg, 1989), the Mexican manufacturing industry changed its export profile from a resource–based orientation concentrated on the petroleum industry (before NAFTA) to a more value–added manufacturing orientation (after NAFTA). However, the auto industry became the main manufacturing employer in Mexico providing jobs for 19.8% of the total manufacturing work force in 2004 (Industria Nacional de Autopartes (INA), 2004). By 2003, Mexico was the 8th largest producer of cars in the world (Instituto de Investigaciones Legislativas del Senado de la Republica (IILSEN), 2003), the world's tenth largest automobile exporter2 and the world's fifth largest light trucks exporter3, with a specialization in the production of small and midsize cars, light trucks, and auto parts (Vega and De la Mora, 2003, p. 176). The exports of cars (SITC 7812), auto parts (SITC 784), and light trucks (SITC 7821) were in the top 10 export industries in Mexico in 1993 rising to the top 3 by 2003. In 1993, cars, auto parts, and light trucks accounted for 13.4% of total Mexican exports, while in 2003 they represented 15 %. These three industries increased their share of total world exports from 2.3%, 2.4%, and 1.9%, respectively in 1993 to 2.7%, 3.9%, and 9.8% in 2003 (table 1).

From 1993 to 2003, cars, auto parts, and light trucks gained 0.4%, 1.5%, and 7.9% respectively in share of total world exports. Next to the petroleum industry, cars, auto parts, and light trucks were the industries with the next highest export value of the total Mexican exports, and they grew more than the petroleum industry. The exports of each of these industries grew more than the world's exports in each industry respectively. It is interesting to note that the auto parts sub–industry changed its balance of trade from positive to negative in this period, while the cars and light trucks sub–industries have increased their positive balance of trade. This means that Mexico is importing more auto parts and components than it is exporting, despite the increase of 248% in the export value of this sub–industry. This is perhaps consistent with the relocation of assembly facilities into Mexico which might previously have been located in the USA. The total FDI in the 1994 to 2004 period has been US$148,472 million, 49% of which went to manufacturing industries (INEGI, 2005a), with 9% overall going to the automobile industry (Department of Foreign Investment of the Ministry of the Economy Mexico, 2005; ECLAC, 2000). The FDI flow investment has also touched the auto parts industry, if we look at the $9.39 billion US dollars in FDI flow into the auto industry, from 1999 to 20044, 62% was directed to the auto parts industry (Department of Foreign Investment of the Ministry of the Economy Mexico, 2005).

In conclusion, Mexican performance in the three auto industry sectors outpaced world export growth placing Mexico in the top ten exporters from 1993 to 2003. According to the Secretaria de Economia (2004), only two other industries have had similar average growth over the period 1993–2003: Electric & Electronic and Textile & Apparel. The former offering more value added and technology, while the latter characterized as labour intensive and more sensitive to be shifted to China.

Sources of competitiveness

Factor conditions

Initially, the factors that made Mexico attractive to automotive MNES were cheap raw materials and labour, semi–skilled and skilled workers, less stringent environmental regulations and market access to the U.S. and Latin America (IILSEN, 2003). The majority were basic factors, with exception of the base of skilled–workers. Mexico also has a comparative advantage in the steel industry over countries such as Brazil, Taiwan, and Korea that is reflected in the price of raw materials being from 15% to 30% cheaper (Centro de Capital Intelectual y Competitividad (CECIC, 2002)). As Mexico entered into freer trade, market forces saw the preparation of an industrial infrastructure developed initially during the import substitution industrialization period (Middlebrook and Zepeda, 2003, p.20) and streamlined with the flows of FDI after NAFTA. Then, productivity in the terminal industry (car assembly) had grown 220% by 2003, if we take 1993 as a base (inegi, 2005b). Another important factor condition for a superior export platform is transportation infrastructure: highways connecting the North and South American markets and ports for the European and Asian markets. The highways in Mexico are well developed, but some of them carry the highest toll rates in the world, which represent a barrier to competitiveness. Similarly, the Mexican–US border has bottlenecks due to the corruption of customs officials, security concerns and drug traffic (Prentice and Ojaj, 2002). Ports infrastructure has become more adequate and competitive, since NAFTA allowed their privatization and FDI has helped to modernize them, but there is still a need to improve land infrastructure and transportation (Prentice and Ojaj, 2002).

Mexico has not developed advanced factors, such as research institutes that collaborate with the industry to upgrade productivity and technology. Mexico is still a technology follower in that it has not taken enough advantage of foreign technology (Valdes, 2002, p. 75). In general, the relationship between universities and industry has not been well developed. The increase in internal expenditures in research and development was from 0.22% of gdp in 1993 to 0.40 % in 2002 (Fox, 2004). This is substantially lower than other countries that invested in the auto industry in Mexico, such as the U.S. (2.67%), Canada (1.82%), Germany (2.51%), and Japan (3.06%) in 2002 (Fox, 2004). Finally, the creation of new start–ups was refrained due to the lack of capital, when the Mexican peso was devalued against the U.S. dollar. This crisis produced an inter–bank annual interest rate of 90.5%.

In conclusion, there has been an evolution of factor conditions after 10 years of NAFTA, from an emphasis on basic factors to an early stage of advanced factors. There is a strong base of engineers and technicians as well as the high levels of productivity as noted above. Through the fl ows of FDI since the inception of NAFTA, all of the manufacturing facilities of car assemblers have been modernized to transform Mexico into a successful export platform.

Firm strategy, structure, and rivalry

The automobile industry in Mexico has a long history, Micheli (1994) reports that the first assembly facility was established by Ford in 1925. By 1962, VW was following those steps after its experience of exporting cars from Germany to Mexico. After that, gm, Nissan, and Daimler–Chrysler established factories in 1963, 1966, and 1968 respectively. It is interesting to note that by 1971, just two state–owned firms have Mexican capital: vam and dina–Renault that were sold by 1993 to Renault–France (Ochoa–Valladolid, 2005, Shaiken, 1993).5 By 2003, approximately eighteen automakers distributed cars in Mexico, eight of them have manufacturing facilities in the country and the rest import cars. There are four major automotive clusters in Mexico: Northeast and West, and Center East and West. The northern clusters were located with the purpose to export to the U.S. and Canada. Around these 4 clusters of automobile plants, a collection of suppliers and related industries have been attracted that have complemented the development of the industry. Streamlining and automation have required more skilled workers. All Mexican facilities have shifted from producing largely for the local market to exporting, with attendant increases in technological sophistication (Brown, 2000). So, with the opening of free trade, the market share has had to be reassigned among many more competitors and the European and Asian cars have been stealing market share from the Big Three. By 2004, these two regions accounted for almost 50% of the market with the "Big Three" having lost 15% of overall market share since their maximum peak during 1996 and 1997 (amia, 2005).

After 10 years of NAFTA, the intense competition among the many car assemblers with manufacturing facilities in Mexico and the increase of other imported brands appears to generate intense rivalry within the industry as competitors attempt to gain or maintain a share of the local market. But it is also competition for the U.S. (and indeed, world) market(s) that pressures the car assemblers in Mexico to produce with high levels of technology in order to upgrade the productivity standards that are necessary to satisfy export markets.

Related and supporting industries: the auto suppliers

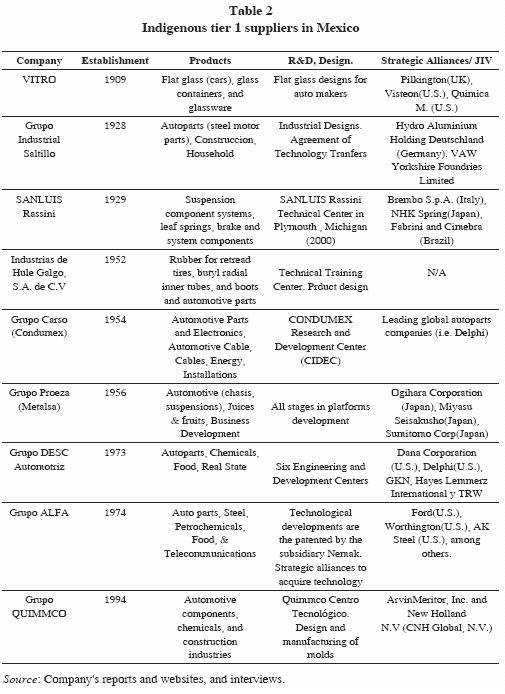

The supply chain structure in Mexico follows the same structure of the auto industry around the world. The U.S. and European automakers have attempted to copy the Japanese way of production, in which car assemblers outsource entire components to a hierarchy of suppliers (ECLAC, 2004; Gereffi , 2003, p. 212). In this integrated system, tier 1 suppliers are the direct producers of integrated systems for car assemblers and tier 2 suppliers produce components for tier 1 suppliers. At the end of the supply chain there are tier 3 firms, and in some cases tier 4 ones that supply standardized products such as part metals and connectors (ECLAC, 2004). According to Bancomext (2004), in 1994 there were 600 auto suppliers in Mexico, which by 2001, had grown to 875 registered auto parts suppliers, 60 of them tier 1 (Bancomext, 2002) (cited in ECLAC, 2004). By 2003 the number had further increased to 1350 registered auto suppliers with 281 of them being tier 1 suppliers (Bancomext, 2004). According to INA (2004), the ownership structure of the auto parts industry in Mexico comprises 70% of foreign–owned firms and 30% of indigenous firms. These foreign–owned auto suppliers have established themselves in Mexico as a direct result of local content conditions that set the rules of origin, demanding that 62.5% of engines and transmissions and 50% of other parts used in automobile manufacturing in Mexico must themselves be produced in Mexico (Chambers and Smith, 2002, p.4). The tier 1 auto parts suppliers have established their manufacturing facilities around the four automotive clusters and unfortunately for the development of indigenous firms, a 100% foreign–owned tier 1 supplier (or maquiladora) established in Mexico is considered by NAFTA as "local". Thus by doing little more than employing local labour, the auto supply chain can satisfy the rule of origin (local content). Then, tier 1 suppliers can be categorized as one of four types: A) Foreign–owned firms often supply more than one of the car assemblers. The top 10 Original Equipment Manufacturing (OEM) suppliers for North America are: Delphi, Visteon, Lear Corp., Magna International, Johnson Controls, Dana Corp., Bosch, TRW, Denso Int'l America, ThyssenKrupp, among others (U.S. Department of Commerce, 2004). All of them have a presence in Mexico. Carrillo and Lara's work (2003) found that after NAFTA, a new generation of facilities support the industry. They have not only assembly and manufacturing functions, but also specialization in design, research, and supply chain management. B) Subsidiaries are wholly owned operations of the car assemblers and generally have little margin to create designs because usually the headquarters are responsible for those activities. Some subsidiaries such as Delphi Corp. (GM) and Visteon (Ford) have evolved to become independent, although still foreign–owned, firms. C) Indigenous conglomerates constitute the smallest category of supplier (see table 2). They are diversified companies with a long tradition in Mexico. All of them, with the exception of Grupo QUIMMCO, have at least 30 years of experience. These companies have created strategic alliances or joint–ventures with foreign–owned companies, the majority of them in the auto parts industry, in order to acquire technology, know–how, expertise, or to work in collaborative projects with the automakers and auto–parts makers. These firms have high levels of technology, productivity, and quality. All of them have acquired international quality and reliability certifications such as QS–9000, ISO, VDA 6.1, among others, in order to be able to work for the automakers. All Mexican tier 1 suppliers have some level of research & development activities. D) Imported parts from foreign firms, in other countries, are the final category. These imports have a presence in the entire supply chain. As discussed above, Mexico has a negative trade balance in this sub–industry. Local auto parts firms satisfy just 23% of the local market, while the rest is covered by imports (IILSEN, 2003).

The second level, tier 2 suppliers, is based largely on indigenous conglomerates and small and medium indigenous suppliers. However, many foreign owned tier 1 firms import a substantial part of the raw materials they need, so as to maintain their own international levels of competitiveness (cecic, 2002). Some interviews from tier 1 suppliers contended that tier 2 indigenous suppliers have problems to supply them in terms of quantity and quality. The tier 3 suppliers segment is composed mainly of indigenous small and medium size suppliers of standard raw materials and imports from foreign firms located in other countries.

In conclusion, after analyzing the supply chain in the auto industry in Mexico, it seems that there is a strong structure of tier 1 suppliers of which the majority are global suppliers. There is also evidence of a few indigenous tier 1 suppliers that have a long history in Mexico, and after ten years of NAFTA, they have arranged collaborative agreements with global companies. In doing so, they have acquired high–tech capital equipment and expertise. These few diversified companies, along with other business groups, have a dominant position within "the indigenous private sector" in Mexico (Sargent & Ghaddar, 2001). The next levels of suppliers, tier 2 and tier 3, seem to be not well integrated into the supply chain and there is limited evidence of the creation of new small and medium size enterprises (SMES).

The case of VW and its suppliers in the Puebla cluster

Carrillo and Lara (2003) argue that the presence of mne auto manufacturers in Mexico has produced significant regional developments in terms of workers' learning and new start–ups, both local and foreign–owned. We focus on the Volkswagen cluster in the state of Puebla that has been established since 1962. First, some descriptive facts: this cluster agglomerates an important grouping of suppliers and related industries; however, it is itself part of one of the four larger clusters, Center East, mentioned earlier. Within the Central East area of Mexico are the states of Hidalgo, Mexico City, Morelos, Puebla, and Tlaxcala. From this total area, VW sources auto parts from nearly 300 suppliers. VW Puebla has historically had the greatest levels of local (indigenous and foreign–owned firms) purchasing. Thus, if MNES play a significant role in sustainable national competitiveness, we expected to find it here where there are more indigenous suppliers than in other clusters. We also hoped to reach some conclusions about why VW has reached this level of indigenous supply chain contribution, given the clear policy implications.

As we examined VW, in more detail, we found evidence that, by 2000, VW had benefited its 285 suppliers by acquiring 60% of its inputs from them and had helped 200 of them to get certified (iso 9000 and vda 6.1) through its Institute of Training and Development (Comunicación Corporativa VW, 2001). However, only 60 of them are located within the Puebla cluster, and 27 are located right immediately beside the VW facilities to support just–in–time delivery (Comunicación Corporativa VW, 2004). Therefore, while its use of indigenous suppliers is better than most, the fuzziness of the local vs. indigenous distinction discussed above remains evident when VW's major suppliers are examined. Although 'local', the majority of the most important tier 1 suppliers of VW in Puebla have German origin. This is not surprising, since in the 90's The German Big Three (VW, BMW, Mercedes–Benz) started a process of globalization in which it was deemed critical that tier 1 suppliers should have production factories close to the car assembler's plant (Pries, 1999). Since these suppliers, at the time, were German firms and local content rules did not recognize country of ownership, it was natural that the existing suppliers would simply locate their manufacturing facilities adjacent to the Puebla VW plant.

It is possible, however, to see the wholesale arrival of German suppliers as a necessary bridge toward a larger role for indigenous firms since local firms were not in a position at that time to take up this work. These German suppliers would need to source their own inputs from tier 2 suppliers that presumably could be indigenous firms leading to a gradual upgrading of local competencies. For example, the industrial park, Finsa, that contains the VW cluster, is composed mainly of auto part firms wherein there are two meetings a year in which every firm discusses common interest issues. In addition, the cluster promotes the development of human capital resources (Pries, 1999) which has led to an abundant source of Mexican engineers and technicians available within the cluster. According to a VW executive, the manufacturing facilities to produce the New Beetle and Bora models have high standards of productivity and technology. These models are only produced in Mexico, and, with the Jetta G5 model, are exported to foreign markets, especially to U.S. and Canada. The designs of the first two models were made in Germany, but all the manufacturing plants of the group have to compete for the exclusivity of production. The decision to produce the New Beetle only in Puebla was made based on: geographic position, the industrial park in the region, and the established global suppliers there (Tovar, 2000). VW of Mexico also has a training institute to provide several kinds of managerial, technical, and quality expertise for the organization itself and to current or potential suppliers. VW, jointly with some government programs, is helping to upgrade the knowledge and skills of 200 small and medium size indigenous companies that provide services and complementary materials. Some of these programs are: compite, crece, and nafin (Comunicación Corporativa VW, 2001). Notwithstanding, evidence reveals that only tier 1 firms work in close collaboration with VW in long term contracts, while tier 2 and 3 suppliers, of which just a few are certified in QS–9000, ISO 9000, and VDA 6.1, are not clearly incorporated into the supply chain. For VW Mexico, the work that has been done to help their 200 'local' suppliers (i.e. tier 1) to be certified in quality standards has been successful. However, the majority of them are other MNES or joint ventures with Mexican firms, not stand–alone indigenous firms. Once again, success stories do exist but they are limited. A manager from a supply company for VW mentioned two successful cases of indigenous tier 2 suppliers that had replaced imports from U.S. companies of steel and sand. Both were certified and have continued supplying the quantities specified. Overall, the presence of VW in Mexico as a mne has contributed to some extent to the region and relatively close locations with tier 1 suppliers. However, there remains little evidence that tier 2 and tier 3 suppliers have become part of the supply chain, with long terms contracts. These results are similar to other clusters in the country. For instance, the cluster around Nissan's manufacturing facilities is based on fully integrated tier 1 Japanese companies with indigenous suppliers providing only indirect materials and services such as transportation of personnel, security, and offices supplies.6 In the case of the northern clusters, there is evidence that some producers of steel mechanical pieces have evolved and now are suppliers of tier 1 firms. But, again, these are isolated cases. At this time, it is more accurate to say that the presence of VW has not fostered a massive development of indigenous suppliers.

Discussion and conclusions

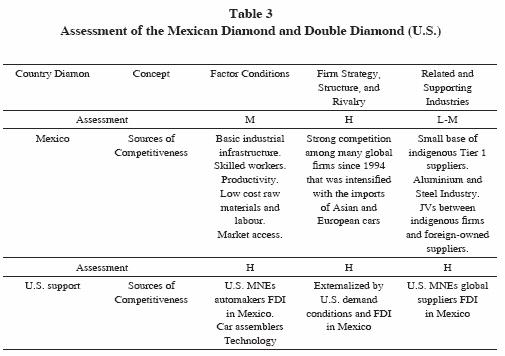

A summary table containing the assessment of each of the three determinants of the Diamond model framework that were analyzed is shown (see table 3). This table makes reference to both the Mexican diamond itself and the U.S. diamond supporting the Mexican diamond. Each of the sources of competitive advantage is rated at three possible levels: High (H), Medium (M), and Low (L) or, in some cases, at a transition stage (i.e. L–M from Low to Medium). These assessments are based on the authors' analysis of the archival data and interviews.

The Mexican diamond for the auto industry could be characterized as moderately competitive across most of the Diamond's determinants with its relative success on the global stage attributable to substantial support from the U.S. diamond. In other words, despite the fact that Mexico has won an increasing share of total world exports in small and midsize cars, light trucks, and auto parts, there is strong evidence that the exclusively domestic determinants of Mexico's national Diamond are not the main sources of its competitiveness. FDI has supported three of the "determinants" of national competitiveness: factor conditions, firm strategy, and related industries. Consequently, the U.S. automobile industry has thus taken advantage of NAFTA's regionalization impact, in which both Canada and Mexico play important roles as car producers and auto parts producers. In this respect, Rugman and Verbeke (2004) have argued that the majority of MNES follow regional strategies, rather than global strategies, citing the fact that 80.3% of the total sales of 320 firms they studied were done in the home region of their triad (NAFTA, EU, or Asia). Based on this study's findings, the presence of the mne VW has played an important role for substantial growth and development within the Puebla industrial cluster and nearby industrial locations. Mexican conglomerates have increased their expertise, technology, and export value as examples of spillover effects due to transfer of technology (Kokko, 1994). Another form of spillover effect has been the relationships between car assemblers and local–owned and foreign–owned suppliers, in which quality, just–in–time, and skill development are required as stated by Lall (1978). However, there is only limited evidence of technology transfer from MNES to indigenous small and medium size firms inside the VW cluster, the major transfer has taken place between VW and foreign–owned suppliers that are established within this region.

We conclude with this evidence that Mexico has achieved some level of competitiveness as an export platform in this industry. However, the sources of advantage can be emulated by other emergent economies (Vicencio–Miranda, 2008). For instance, China is rapidly moving from just assembling products with low labour costs to more sophisticated manufacturing, while maintaining its low costs (Álvarez–Medina & Sepúlveda–Reyes, 2006). Its ability to leverage technology transfers means that it is also producing its own Chinese car (Wu, 2006). Future research can be focused on how to develop more fully the next steps that policy makers should take to promote the development of tier 2 and 3 suppliers because it seems that after more than ten years of NAFTA, there are still only a few isolated success cases and as pointed out by Contreras (2008), the auto industry is characterized by a modular manufacture and the outsourcing of products and services, which bring interesting opportunities for local suppliers (i.e. Mexican investment). Thus, it requires a reformulation of policies under the NAFTA to replace the "local content" requirements by the increase in the number of national suppliers. Mexico deserves better.

References

Altenburg, T. (2000) "Linkages and Spillovers between Transnational Corporations and Small and Medium–Sized Enterprises in Developing Countries: Opportunities and Policies," in Proceedings of the UNCTAD X Special Round Table 'TNC–SME Linkages for Development', February, Bangkok. Geneva and New York: UNCTAD. [ Links ]

Álvarez Medina, Ma. de Lourdes and Elizabeth Sepúlveda Reyes (2006). "Reformas Económicas, Inversión Extranjera Directa y Cambios en la Estructura de la Industria Automotriz China (1980–2004)," Contaduría y Administración, 218, 88–113. [ Links ]

AMIA (2005). "Estadísticas", http://www.amia.com.mx/produc.htm. (June 20, 2005). [ Links ]

BANCOMEXT (2002). Automotive Sector Investment Opportunities in Mexico. Mexico City. [ Links ]

–––––––––– (2004). Business Opportunities, 2004: The Automotive Industry in Mexico. Invest in Mexico, Bancomext www.investinmexico.com.mx. [ Links ]

Bell, G.G. (2005). "Clusters, Networks, and Firm Innovativeness," Strategic Management Journal, 26, 287. [ Links ]

Blomström, M. and A. kokko (1998). "Multinational Corporations and Spillovers," Journal of Economic Surveys. 12: 247–277. [ Links ]

Brown, F. (2000). La industria automotriz mexicana: reestructuración reciente y perspectivas, Proyecto CEPAL/CIID CAN 97/s25, Reestructuración industrial, innovación y competitividad internacional en América Latina, Fase II, Santiago de Chile. [ Links ]

Carrillo, J. and A. Lara (2003). "Industrial Evolution of the Auto Part Sector in Mexico and Changes in the Division Labor," Eleventh gerpisa International Colloquium, June. [ Links ]

Centro de Capital Intelectual y Competitividad (CECIC) (2002). Coahuila Competitivo 2020. Coahuila: Author. [ Links ]

Chambers, E.J. and P.H Smith (2002)." NAFTA in the New Millenium: Questions and Contexts," In E.J. Chambers and P.H. Smith (Eds), NAFTA in the New Milenium (p.331–353). La Joya, CA: Center for U.S.–Mexican Studies; Edmonton: University of Alberta Press. [ Links ]

Cohen, W. M., and A. Levinthal (1990). "Absorptive Capacity: a New Perspective on Learning and Innovation," Administrative Science Quarterly, 35(1), 128. [ Links ]

Comunicación Corporativa VW (2001). "Volkswagen de México Promueve el Desarrollo de Proveedores en México," Boletín. February. [ Links ]

–––––––––– (2004). "Volkswagen, 50 años de presencia en México," Boletín. March. [ Links ]

Contreras, Óscar F. (2008). "Pequeñas Empresas Globales: un Conglomerado Autromovilístico en México," Comercio Exterior, 28(8/9), 617–629. [ Links ]

Department of foreign investment of the ministry of the economy Mexico (DFIMEM) (2005). Inversión Extranjera Directa en la Industria Automotriz. México: Author. www.economia.gob. [ Links ]

Economic Commission for Latin America and the Caribbean (ECLAC) (2000). Foreign Investment in Latin America and the Caribbean, 1999, Santiago, Chile. United Nations publication. [ Links ]

–––––––––– (2004). Foreign Investment in Latin America and the Caribbean, 2003 (LC/G.2226–P/I), Santiago, Chile, May. United Nations publication. [ Links ]

Fox, V. (2004). Cuarto Informe de Gobierno. México: Presidencia de la República. [ Links ]

Gereffi, G. (2003). "Mexico's Industrial Development: Climbing Ahead or Falling Behind in the World Economy?" In K.J. Middlebrook and E. Zepeda (Eds), Confronting Development: Assessing Mexico's Economic and Social Policy Challenges (p. 195–240). Stanford, California: Stanford University Press. [ Links ]

Hodgetts, R. M. (1993). Porter's Diamond Framework In A Mexican Context. Management International Review, 33(2), 41. [ Links ]

Industria Nacional de Autopartes (INA). (2004). The Importance of the Automotive Industry in Mexico. Congreso Internacional de la Industria Automotriz en México, 2004. [ Links ]

Instituto de Investigaciones Legislativas del Senado de la República (IILSEN) (2003). La Industria Automotriz en el Tratado de Libre Comercio de América del Norte: Implicaciones para México. Senado de la República Mexicana. [ Links ]

INEGI (2005a). Inversión Extranjera Directa por Sector Económico. Aguascalientes. Retrieved June 05, 2005 from http://dgcnesyp.inegi.gob.mx/cgi–win/bdieintsi.exe/ Consultar [ Links ]

–––––––––– (2005b). La Industria Automotriz en México, 2004. Aguascalientes. [ Links ]

Kokko, A. (1994) "Technology, Market Characteristics, and Spillovers," Journal of Development Economics, 43: 279–293. [ Links ]

–––––––––– (1996). Learning from the Asian Tigers: Studies in Technology and Industrial Policy, Macmillan: London. [ Links ]

Lall, S. (1978). "Transnationals, Domestic Enterprises and Industrial Structure in LDCs: A Survey," Oxford Economic Papers 30: 217–248. [ Links ]

Lane, P.J., J.E. Salk, and M. Lyles (2001). "Absorptive Capacity, Learning and Performance in International Joint Ventures," Strategic Management Journal 22: 1139–1161. [ Links ]

Meyer, E.K. (2004). "Perspectives on Multinational Enterprises in Emerging Economies," Journal of International Business Studies, 35, 259–276. [ Links ]

Micheli, J. (1994). Nueva Manufactura, Globalización y Producción de Automóviles en México. UNAM–FE, México, DF, 73–237. [ Links ]

Middlebrook, K.J. and E. Zepeda (2003). "On the Political Economy of Mexican Development Policy," In K.J. Middlebrook and E. Zepeda (Eds), Confronting Development: Assessing Mexico's Economic and Social Policy Challenges (p. 162–194). Stanford, California: Stanford University Press. [ Links ]

Ochoa–Valladolid (2005). "La Industria Automotriz de México: las Expectativas de Competitividad del Sector de Autopartes," México y la Cuenca del Pacífico, 8(26), 33–58. [ Links ]

Patibandla, M. and B. Petersen (2002). "Role of Transnational Corporations in the Evolution of a High–Tech Industry: the Case of India's Software Industry," World Development 30: 1561–1577. [ Links ]

Porter, M.E. (1990). The Competitive Advantage of Nations. New York: Free Press. [ Links ]

Pouder, R. and C.H. St John (1996). "Hot Spots and Blind Spots: Geographical Cluster of Firms and Innovation," Academy of Management Review, 21(4), 1192. [ Links ]

Prentice, B.E. and Ojaj, M. (2002). Transportations: Bottlenecks and Possibilities. In E.J. Chambers and P.H. Smith (Eds), NAFTA in the New Milenium (p.331–353). La Joya, CA: Center for U.S.–Mexican Studies; Edmonton: University of Alberta Press. [ Links ]

Pries, L. (1999). "The Dialectics of Automobile Assemblers and Suppliers Restructuring and Globalization of the German 'Big Three'," Actes du GERPISA No. 25, 77. [ Links ]

Rugman, A.M. and J.R. D'Cruz (1993). "The 'Double Diamond' Model of International Competitiveness: the Canadian Experience" Management International Review, 33(2), 17. [ Links ]

–––––––––– and A. Verbeke (1993). "Foreign Subsidiaries and Multinational Strategic Management: an Extension and Correction of Porter's Single Diamond Framework," Management International Review, 33(2), 71. [ Links ]

–––––––––– and A. Verbeke (2004). "A Perpective on Regional and Global Strategies of Multinational Enterprises," Journal of International Business Studies, 35, 18. [ Links ]

Sargent, J., & S. Ghaddar (2001). "International Success of Business Groups as an Indicator of National Competitiveness: The Mexican Example," Latin American Business Review, 2(3/4), 97. [ Links ]

Secretaría de Economía (2004). México: Negociaciones Comerciales Internacionales. May, Mexico: Author. [ Links ]

Shaiken, H. (1993). The Mexican Automobile Industry, Dimensions of Change. Universidad de Berkeley, mimeo. [ Links ]

–––––––––– and Herzenberg, S. (1989). Automatización y Producción Global: Producción de Motores de Automóvil en México, Estados Unidos y Canadá. Facultad de Economía, UNAM, México. [ Links ]

Tovar, E. (2000). "VW de México a Toda Marcha," Metalmecánica, March. U.S. department of commerce (2004). U.S. Automotive Parts Industry 2004 Annual Assessment. U.S.: Author. [ Links ]

Valdes, J.L. (2002). "NAFTA and Mexico: A Sectoral Analysis," In E.J. Chambers and P.H. Smith (Eds), NAFTA in the New Milenium (p.61–82). La Joya, CA: Center for U.S.–Mexican Studies; Edmonton: University of Alberta Press. [ Links ]

Vega, G. and L.M. de la mora (2003). "Mexico's Trade Policy: Financial Crisis and Economic Recovery," In K.J. Middlebrook and E. Zepeda (Eds), Confronting Development: Assessing Mexico's Economic and Social Policy Challenges (p. 162–194). Stanford, California: Stanford University Press. [ Links ]

Vicencio–Miranda, Arturo (2008). "La Industria Automotriz en México: Antecedentes, Situación Actual y Perspectivas," Contaduría y Adminstración, 221, 213–248. [ Links ]

Wu, Di. (2006). "Analyzing China's Automobile Industry Competitiveness through Porter's Diamond Model," Unpublished MSc thesis. University of Lethbridge. [ Links ]

Yin, R. K. (2003). Case Study Research: Design and Methods (3rd Ed.). U.S.: Sage Publications. [ Links ]

1 We want to thank people who facilitated the elaboration of this case study: Rubén Darío (Rassini Frenos), Antonio Tonone (Sachs), Gabriel Estrada (BMW Mexico), Fausto López, Luis M. Briones, Alejandra Noriega (Volkswagen México), Ramón Suárez (Industria Nacional de Autopartes, INA), Samuel Constantino Hernández (NAFIN Puebla) and government representatives for the VW cluster in Puebla, among others.

2 Author's calculations based on United Nations Statistics Division Data, retrieved June 15, 2005 from http://unstats.un.org/unsd/comtrade.

3 Ibidem.

4 Note that we found data from 1999 to 2004; however, the point we want to make is that a constant flow of FDI has been invested in both the auto and auto parts industry during the following ten years of the signature of NAFTA.

5 By 1983, the automakers were in hands of foreign capital only.

6 According to an interview with a government representative of the auto cluster in the State of Aguascalientes.