Serviços Personalizados

Journal

Artigo

Indicadores

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Contaduría y administración

versão impressa ISSN 0186-1042

Contad. Adm no.223 Ciudad de México Set./Dez. 2007

Artículos de investigación

Value Relevance of the Ohlson model with Mexican data

Rocío Durán Vázquez* Arturo Lorenzo Valdés** Humberto Valencia Herrera***

* Profesora de tiempo completo del Departamento de Contabilidad y Finanzas, División de Negocios, Instituto Tecnológico y de Estudios Superiores de Monterrey, Campus Ciudad de México. Correo electrónico: rocio.duran@itesm.mx

** Profesor de tiempo completo del Departamento de Contabilidad y Finanzas, División de Negocios, Instituto Tecnológico y de Estudios Superiores de Monterrey, Campus Ciudad de México. Correo electrónico: arvales@itesm.mx

*** Profesor de tiempo completo del Departamento de Contabilidad y Finanzas, División de Negocios, Instituto Tecnológico y de Estudios Superiores de Monterrey, Campus Ciudad de México. Correo electrónico: humberto.valencia@itesm.mx

Fecha de recepción: 29/05/2006

Fecha de aceptación: 11/05/2007

Abstract

In this study, the value relevance of Mexican accounting variables is tested under econometric terms. The aim of the study is to provide evidence of the ability of Mexican accounting numbers to summarize the information underlying stock prices. The accounting variables used are from companies listed in the Mexican stock market from 1991 to 2003. The value relevance was operationalized using the Ohlson model criteria (1995) from the market–based accounting research field. The methodology employed is that described by Collins, Maydew, and Weiss (1997). The econometric results show that, under Panel Data Analysis, book value and earnings are value relevant in Mexican stock market companies, and only the book value is value relevant under Ordinary Least Squared Regression Analysis. In addition to the Ohlson model results, an alternative model is presented as a better proxy of the value relevance of the characteristics of Mexican information. The operative cash flow variable per share was identified as the third variable to be considered, and together with book value and earnings, constitutes the alternative model. The proposed alternative model was tested under the full–sample and Intangible versus Tangible economical classification. In these tests, the alternative model provides extra information and better statistics than the original Ohlson model.

Keywords: Ohlson Model, Value relevance, Panel Data, Empirical financial accounting.

JEL classification: M41, C33

Resumen

En este trabajo se evalúa el valor de relevancia econométrico de las variables contables mexicanas. El propósito del estudio es probar el poder explicativo de las variables contables en el precio de mercado de las acciones de las empresas que cotizan en la Bolsa Mexicana de Valores, de 1991 a 2003. El valor de relevancia se analiza utilizando el modelo de Ohlson (1995) de la línea de investigación contable basada en el comportamiento del mercado. La metodología seguida es conforme a lo descrito en Collins, May dew, and Weiss (1997). Los resultados econométricos, utilizando el Análisis de Datos de Panel, proveen evidencia de que el Capital Contable y las Utilidades son relevantes para las empresas mexicanas públicas y únicamente el Capital Contable es relevante utilizando el Análisis de Regresión de Mínimos Cuadrados Ordinarios. Además de los resultados obtenidos con el modelo de Ohlson, se presenta evidencia de un modelo alternativo que brinda mayor poder explicativo. Este modelo alternativo agrega como tercera variable el Flujo Operativo por acción y se probó tanto para la muestra general como para la clasificación de empresas de índole Tangible o Intangible (de acuerdo con su actividad económica), obteniéndose mejores estadísticos que el modelo de Ohlson original.

Palabras Clave: Modelo de Ohlson, valor de relevancia, poder explicativo, análisis de datos de panel, contabilidad financiera empírica.

JEL clasificación: M41, C33

1. Introduction

1.1 Value Relevance Motivation

In order to understand the functioning of capital markets, it is important to recognize that financial statements provide the most widely available data on public corporations' economic activities. Investors and other stockholders rely on these statements to assess the plans and performance of firms and corporate managers. But how can we measure the impact of these financial statements on stock market prices? In accounting research, value relevance criteria are used for this purpose.

Value relevance criteria are referred to the ability of accounting numbers (independent variables) to explain the differences in stock prices in capital markets (dependent variable) under valuation purposes. This ability can be measured with the explanatory power of the independent variables coefficient significance and the Adjusted R2 number of significance of the whole model used. In this study, the value relevance is tested under econometrical criteria of significance for Regressions and Panel Data Analysis.

1.2 Ohlson model's use justification

The main utility reason of accounting systems is to provide investors with relevant information that may be useful for efficient resource allocation decision–making. Following this purpose, different valuation models have been used in the accounting literature in order to contrast the value relevance of each.

The first capital markets models used in empirical research have placed a major emphasis on market efficiency. This informational perspective brought little attention to fundamental analysis of determinants of the companies' value. The usefulness of accounting numbers for firm valuation focus was emphasized in the works of Ou and Penman (1989), and Ohlson (1989, 1995).

This study follows the valuation perspective in an attempt to explain the intrinsic value of the firm and assess to what extent accounting information may be useful to identify mispriced stocks. Book values and earnings have been suggested as the two fundamental accounting variables when trying to explain stock prices (Ohlson, 1995).

Collins, Maydew and Weiss (1997) provided evidence by using the Ohlson model that the joint explanatory power of earnings and book values has not decreased in the last forty years in the United States market. They found that the value relevance of accounting numbers has increased slightly during the last four decades. However, Brown, Lo and Lys (1998) interpret this result as a consequence of an upward bias in the R2 metric generally used in accounting research as a measure of value relevance.

The Ohlson model (1995) made a hit in the market–based accounting research, because the financial information was considered as a value component. This model underlies the traditional belief that the company value is compounded of two main parts: the net value of the investment made in it (Book value) and the present value of the period benefits (Earnings) that together bring the "clean surplus" concept of the Shareholders' Equity value. In specific, Ohlson (1995) motivates the adoption of the historical price model in value relevance studies, which expresses value as a function of earnings and book values.

Book value and earnings perform a central reference role in the companies' valuation process. However, the way that both variables impact on the price behavior in the market remains as a question to answer. There are empirical results of different markets that bring some references of what to expect with the Mexican data, but in general, the knowledge about how the accounting variables interact in the value generation is still restricted. This study is oriented to the use of the Ohlson model and the practical justification of its empirical application to the Mexican data.

Since 1995, the Ohlson model has been tested extensively with United States and Foreign Developing Countries' stock market data under different methodologies of analytical or empirical points of study. Few of the studies are analytical, such as the research of Ota (2001), who worked with the autoregression assumption, or Fukui (2001), who developed new considerations that brought about a modification of residual dynamics to the Ohlson model assumptions. However, most studies are conducted under an empirical basis. In general, these studies show evidence of the value relevance of the financial statement variables of book value and earnings on stock price.

There are diverse studies that have emerged from other countries, for example: Alford, Jones, Leftwitch, and Zmijewski (1993) for European developed countries and Ali and Hwang (2000), Hwa, Qi, and Wu (2001), and Sami and Zhou (2004) for the Chinese stock market. In accounting literature, there are few applications that employ Latin American data and even fewer that use information from the Mexican stock market.

1.3 Orientation of the study

The study is motivated by the fact that the Mexican case is not well documented in previous studies in the international accounting literature. Mexico is a relevant emerging market having an active and complex financial system as well as a professional accounting community; Mexican public companies have to publish audited financial statements.

As a consequence of the above, there is a gap that provides the perfect opportunity for conducting this study, in order to attempt to provide answers to the following questions: How relevant is accounting information in the Mexican stock market? Does the information in this market increase or decrease the relevance of accounting information?1 Is the value relevance concentrated in earnings or book values? Questions like these remain essentially unanswered due to a lack of theoretical background for establishing the relevance of accounting information in emerging markets like that of Mexico. This study aims to assist this debate by providing some evidence of the value relevance of accounting information for the Mexican stock market as a proxy for an emerging market.

The importance and utility of this study is to bring the first approach of the value relevance of Mexican accounting variables tested under the Ohlson model under the valuation approach. This study brings a reference for the analysts, academics, shareholders and company owners by the use of the obtained coefficient of the Ohlson and Alternative models to estimate the behavior of the price three months after the year–end financial statements information.

1.4 Description of the Study Sections

The theoretical main framework is divided into three sections: bibliographical review; Ohlson model assumptions and applications; and characteristics of the Mexican accounting variables. The empirical study is presented in two parts: methodological issues and econometric results (related tables and details of the study's implications are provided). Conclusions and suggestions for further research appear at the end.

The econometric analysis can be divided in 3 parts. In the first part, the original Ohlson model is tested with Mexican accounting data for the period 1991–2003 using Ordinary Least Squared Regressions (OLS). This database was later tested using Panel Data Analysis. In addition to these variables, other variables were tested in the panel data as alternatives to earnings in the original Ohlson model: EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization) (Option 1), Operative Cash Flow (Option 2), Net Cash Flow (Option 3) and Dividends (Option 4).

In the second part of the study, an alternative model (created by adding a third independent variable: operative cash flow per share) is tested versus the original Ohlson model for the full database.

Finally, in the third part of the study, the alternative model was tested versus the original Ohlson model using two types of economical activities classifications of the database (Tangible and Intangible Industries).

2. Literature Review and Ohlson Model Characteristics

2.1 Accounting Research Areas

The objectives, methodology and underlying philosophies of accounting research have changed enormously over the past quarter–century. Today, the objective of accounting theory is more focused on explaining and predicting accounting practice, rather than being concerned with what accounting practices ought to be.

There are three approaches to accounting theory and research: Classical Theory, Market–Based Research, and Positive Accounting.

This study was carried out under the principles of market–based research. Two major advances in finance literature influenced this approach: efficient market hypothesis and modern portfolio theory. Market–based research in accounting formally began in the late 1960s, soon after the development of the efficient markets hypothesis and event study methodology. During the past 25 years, a large number of research studies have examined the relation between security returns and various types of accounting information.

2.2 Ohlson Model Assumptions

In accounting research, many equity valuation models have been used to examine the value relevance of accounting data. One such valuation model is the simple earnings capitalization model, where stock price is expressed as a function of earnings or the components of earnings under the assumption that earnings reflects information about expected future cash flow and the security price–earnings relation is both positive and homogeneous over the entire range of earnings realizations. There is a link between the valuation models and evaluation using other accounting information, besides earnings: the Ohlson model, which added book value as the second independent variable. Ohlson (1995) developed a formal model relating firm value to accounting variables. This study follows this model in accordance with the methodology path used by Collins, Maydew, and Weiss (1997), in order to analyze its implications with the Mexican data.

Ohlson (1995) started with a dividend–discounting model under residual income valuation assumptions. The residual income valuation expresses value as the sum of current book value and the discounted present value of expected abnormal earnings, as forecasted earnings minus a capital charge equal to the forecasted book value times the discount rate.

The original assumptions of the Ohlson model impose a time–series structure on the abnormal earnings process that affects value. The linear information dynamics in the model specifies an autoregressive, time–series decay in the current period's abnormal earnings, and models "information other than abnormal earnings" into prices (Ohlson, 1995, p.668). The economic intuition for the autoregressive process in abnormal earnings is that competition will sooner or later erode above–normal returns (i.e., positive abnormal earnings) or firms experiencing below–normal rates of returns eventually exit.

The Ohlson model is described under the following assumptions. The Present Value Relation (PVR) of the dividend discount model stipulates that the market value of a firm's equity (Pt ) equals the present value of its expected future dividends (Et [dt]) discounted at the risk–free interest rate (Rf). Applying the risk–free rate as a discount factor reflects the assumption of risk–neutral investors. Further, Rf is assumed constant, i.e., satisfying a non–stochastic, flat term structure.

The Clean Surplus Relation (CSR) ties up accounting data so all flows pass through the income statement. CSR ensures that all changes in the book value of equity (BVt) are reported as either income (accounting earnings Et ) or dividends (dt).

The third and most controversial assumption of the Ohlson model approximates the time series behavior of abnormal earnings (that is, the relation between the current and the next period's abnormal earnings) as linear and stationary, which Ohlson denominated the Linear Information Dynamics relation (LIDOM), where: Abnormal earnings are defined by the Abnormal Earnings Relation (AER) as the difference between accounting earnings (Et ) and normal earnings. Normal earnings represent a firm's normal return on the capital invested at the beginning of the period, that is, the net book value of equity multiplied by the interest rate.

Ohlson's (1995) book value–abnormal earnings model can be re–expressed as a function of current earnings and lagged book value. According to Collins, Pincus and Xie's (1999) appendix, the preliminaries of the Ohlson model are based on the Clean Surplus relation that is:

where BVt = book value of equity at time t, Et = earnings for period t, and dt = dividends in period t. The definition of abnormal earnings is:

where Rf is one plus the risk–free rate. The stochastic process assumption for abnormal earnings (where et is other non–accounting value–relevant information) is:

Ohlson's (1995) initial book value–abnormal earnings valuation model is:

where Pt is the firm's stock price at time t. Ohlson (1995, p.669) shows that with the standard assumptions underlying the dividend discount model together with equations (Eq. 1 and Eq. 2), his equation can be rewritten as:

By substituting the definition of abnormal earnings (Eta) from above into his equation (Eq. 5), Ohlson (1995, p. 670) shows that price can be expressed as a function of current period earnings, book value at time t, and other information. Ohlson notes that in this form, the valuation function shows how earnings and book values operate as the primary value indicators. That is:

P1 = α0 + α1BV + α2Eat + α3εt (6)

2.3 Model used in this study

The Ohlson model could be applied following Equation 5 or 6 showed above. Equation 5 uses future oriented information and Equation 6 uses historical information in accounting based valuation models. However, the assumptions of the Ohlson model provide little guidance on selecting an empirical proxy for expected future earnings (required in Equation 5). Tse and Yaansah (1999) examined whether and under what circumstances historical earnings and earnings forecasts offer comparable explanation of security prices, they conclude that as long as the pattern of historical earnings is consistent with the pattern of expected future earnings, historical earnings may be sufficient to explain security prices. This issue is of particular interest for this study because Mexican earnings forecasts are not available and the expected return of abnormal earnings requires the beta2 for each period of each company, and the available information in Economatica is not enough for the database. This study used Equation 6, because of the data's availability.

The equation used of the Ohlson model complies with the empirical methodology followed by Collins, Maydew and Weiss (1997) and Collins, Pincus and Xie (1999) that specify:

Pit = α0t + α1tBV + α2tEit + εit

Where:

Pit the price of a firm i share three months after fiscal year–end t,

BVit the book value per firm i share at the end of year t, and

Eit the earnings per firm i share during the year

εt other value–relevant information of firm i for year t orthogonal to earnings and book value.

All valuation models make unrealistic assumptions about the efficiency of the market or the complete panel of data. This feature is common to most theoretical models. Assuming efficient capital markets, one objective of a valuation model is to explain observed share prices. Alternatively, in an inefficient capital market, a good model of intrinsic or fundamental value should predictably generate positive or negative abnormal returns.

2.4 R2 Significance

Adjusted R2 is the explained variation in the OLS regressions and in the pool–panel data as the statistical association metrics used in this study. These metrics measure value relevance as the portion of total returns that could be earned from financial statement information and by the percentage of cross–sectional variation in price market values explained by financial statement information (the independent variables of earnings, book value and operative cash flow).

3. Methodology

3.1 Research Design and Hypotheses

The research objective is to provide evidence of the value relevance of accounting information for the Mexican stock exchange market prices, under the Ohlson model test for identifying the significance of book value and earnings in Mexican financial statements. The research design is an accounting empirical study under the market–based approach for Mexican accounting data. We tried to answer the following research questions:

• Is there value relevance of Mexican accounting variables from the Ohlson model?

• Are there other variables for Mexican accounting data that provide a better power explanation than those in the Ohlson Model? If so, what are the variables, and what is the reason for their effect?

3.2 Database Characteristics

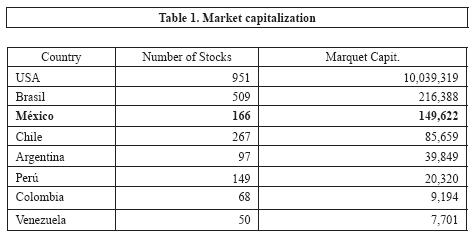

Financial accounting information and stock prices per share were taken from the 1991–2003 periods of public Mexican companies (listed on the stock market). In order to identify the size of the Mexican stock market, Table 1 shows the number of different stocks quoted for each market and the Grouped Market Capitalization in millions of US dollars, on December 31, 2003:

The stock information includes data from 206 Mexican companies. Some companies have several share series, so only one share class was selected for each company (the one with greatest volume in October 2004). In accordance with this selection method, the database was made up of 166 companies. Those companies multiplied by 13 years produce a total 2,158 year–company data; but it is incomplete, which means that it is unbalanced panel data. The reason for this unbalanced panel data is primarily due to the fact that some companies were only listed for certain years because they are new companies that either appeared or interrupted their operations during the study period. There are also companies that do not fulfill Ohlson Model characteristics, so the original database is formed by 127 companies (original database) with 704 year–company data (without outliers).3

The statistical structure of the original database (with missing values) can be filled using a variety of techniques.4 In this study, the empty spaces of the dependent variable (price per share) were filled by taking the average of one month before and one month after March 31 of each year (the closing date reference of the dependent variable). There were 368 added data. The main reasoning supporting the use of the selected technique is that the added data shows the stock price performance information around the first quarter of each year, and it is a proxy of the quote of the first quarter that the Ohlson model requires. In accordance with these criteria, the database used in this study is formed by 145 companies with 1,046 year–company data (without outliers).

For the purpose of this study, only 2 economical activities classification was used: Tangible industries and Intangible industries. The Tangible industries are identified in 3 general sectors: Trade Activities (sector 1), Manufacturing Activities (sector 2) and Primary Activities (sector 5). The Intangible industries are identified in 2 sectors: Services Activities (sector 3) and Financial Services Activities (sector 4).

3.3 Sample Definition

The financial accounting variables are at the end of each year (4th quarterly fiscal period of the balance sheet and the accumulative year results of the income statement at the end of each year). The market stock price information is from the first quarterly period after the end of each year of the accounting variables. Due to inflation in Mexico, the sample data has the same purchase power as on October 31, 2004.

3.4 Variables Definitions

The independent variables from the consolidated financial statements are as follows: "Stockholders' equity" for book value and "Net gain or loss" for earnings. Both concepts needed to be under per share calculation, so each was divided by he number of shares. These shares were adjusted by corporate actions.

The dependent variable is the price per share. For this concept, the closing entry of the market stock data was used.

In addition to the Ohlson model variables, the following were also used as independent variables:

Option 1: EBIDTA5 per share (in accordance with Economatica calculus); Option 2: OCF=Operative Cash Flow per share; Option 3: NCF=Net Cash Flow per share; Option 4: DIVIDENDS= Dividends paid per share.6

4. Results

The following four tables show the descriptive statistical data and the OLS regressions and panel data results of the full sample, testing the Ohlson model. Table 5 also shows the panel data results with 3 options instead of earnings. Later, an alternative model is tested versus the original Ohlson model.

4.1 Descriptive Data Per Share

Table 2 shows the descriptive statistics of the database. The full sample shows the high standard deviation in the dataset; which confirms the variability of a firm's size and industry classification traded on the Mexican stock market. As expected, book value and earnings are positively correlated with each other. Book value has a 0.60 index of correlation with price versus the small correlation between earnings with price. This correlation supports the intuitive idea that earnings (current results) will have less value relevance and Book value will have more. The low correlation between Book value and Earnings is an index of no collinearity problem within them.

a) The number of firm–year observations with necessary data on Economatica is 1,046 after deleting the following: the outliers were eliminated according to the Earnings/Price ratio. If the absolute value was above 1, it was identified as an extreme value.

b) Price is the price of a firm i share three months after year–end t. Earnings is the earnings per firm i share for year t. Book value is the book value per firm i share at year–end t.

c) Pearson correlations are in the bottom–left cells and Spearman correlations are in the upper–right cells. Due to the sample size, all of the above are significant at the 0.0001 level.

4.2 Econometrics Findings with OLS–Regressions

In the reference works cited,7 the Ohlson model was tested under Ordinary Least Squared (OLS) Regressions using the level or first difference. The unit root test was made and it shows that the first difference of each variable (dependent and independents) is needed instead of the level information. Accordingly, the estimation output of Table 3 shows that only book value is significant. This means that most of the relevance of accounting numbers is due to book values and emphasizes the tradeoff of earnings, explained in terms of information asymmetry and transmission. Earnings seem to have low quality and do not incorporate economic income in a meaningful way. Due to the tradeoff characteristic of Earnings, other variables were tested instead: EBITDA (Option 1), Operative Cash Flow (Option 2), Net Cash Flow (Option 3) and Dividends (Option 4).8 The results show that no one of the four options is significant and there are problems of Autocorrelation showed in the Durbin Watson parameter.9

Beside the results there are econometric limitations of the OLS Regressions, because they provide incomplete information of the characteristics of the database, which combine cross–sectional and time series data.10

a) Heteroscedasticity was controlled under the White Consistent Covariance, which was used in the Estimation Options of the OLS–Regression Estimation of Eviews.

4.3 Econometrics Findings with Panel Data

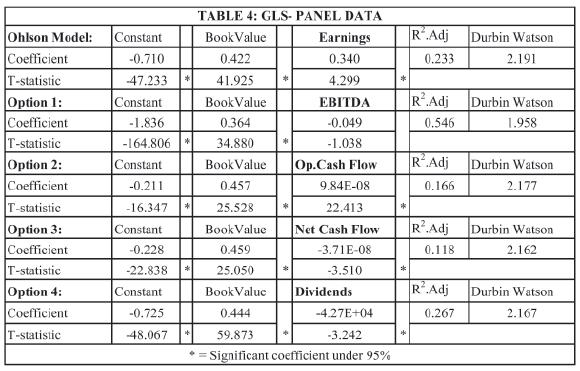

Table 4 provides the panel data results (under weighted criteria for unbalanced panel data): in order to consider the heteroscedasticity of the data, the White Consistent Covariance was used. This adjustment reduced the database to 12 annual periods of analysis with 757 company–year observations and there no autocorrelation problems.

According to Table 4, the Ohlson model tested with the Mexican accounting data shows that both of the accounting variables are significant (book value and earnings) and produce an adjusted R2 of 0.23.11 The Durbin–Watson results do not display autocorrelation problems.12 However, there are other variables that are significant: operative cash flow (Option 2), net cash flow (Option 3) and dividends (Option 4), though these options produce a smaller adjusted R2 and a little numerical coefficient for the model.

4.4 Alternative Model for Mexican Data

As observed in Table 4, the independent variables of Operative Cash Flow (Option 2), Net Cash Flow (Option 3) and dividends per share (Option 4) were significant when they were used instead of earnings in the Ohlson model under Panel data. But the Adjusted R2 parameter of Options 2, 3 and 4 are lower than the Ohlson model. This shows that the accruals are more relevant in Mexican financial statements, but, could other information be added to the Ohlson model? In order to answer this question, an alternative model was proposed.

The alternative model to the Ohlson model that this study provides was to add a third independent variable. With the operative cash flow variable, the panel data produces better econometric results, as seen in Table 5. The original Ohlson model result also appears in this table, in order to compare the higher result in the R2 statistic.13

There are reasons that support the better econometric results of the alternative model, the main one being that the accruals importance in the Mexican accounting system and the extra information under the short term cash flows provide a more complete view of the current and expected operations of the company. The Mexican result differs from the relevance that cash flow has in other countries under regression analysis.14

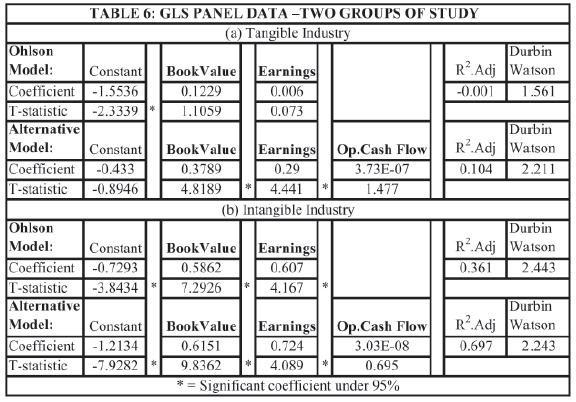

Due to the combination of behaviors inherent in the Mexican stock market, both models (the original Ohlson model and the alternative model) were tested by dividing the sample in two groups of study: (a) tangible versus (b) intangible sector activities.

The results of the two groups of study are shown in Table 6, which shows that the original Ohlson model is not relevant for the tangible Industry and displays autocorrelation problems, but is relevant for the intangible Industry. This result may be explained by the higher increase of the intangible Industry activities than the tangible Industry activities during the study period,15 and the special attention that the intangible issues received in accounting at the end of the 90's. During the study period, the intangible Industry investment was increased, and that produced a reduction in the tangible Industry. This reduction in the tangible Industry means that book value remained with the historical cost with less or without new investment, and earnings were reduced or even became negative; this is in part the reason why the accounting numbers lost significance.

On the other hand, the alternative model is significant in both industries, and thus provides a better power of explanation for the Mexican market characteristics than the original Ohlson model, though the third added variable of operative cash flow is not significant. The non–significance of the operative cash flow increases its potential for use as an instrumental variable of earnings in further research.

5. Conclusions

The first conclusion of this exploratory study is that book value and earnings have value relevance in the price of assets in the Mexican stock market.

• Both of the independent variables of the Ohlson model have statistical significance. This means that both have value relevance16 in Mexican financial statements, and the accruals (considered in earnings) provide more information than cash flow, because the use of EBITDA, Operative Cash Flow and Net Cash Flow showed no significance in the Ohlson model when applied instead of earnings.

• Another important result is that there was no value concentration of book value (as in other stock market studies17); both of the independent variables are relevant in the Mexican context.

• The second important conclusion is that the Ohlson model can be improved with other independent accounting variables.

• The results show that the Ohlson model cannot be improved by substituting earnings with the following variables: EBITDA, Operative Cash flow, Net Cash Flow and Dividends. The main reason is that earnings include the accrual importance explanation of the financial statements; the other three variables cannot provide the same power explanation of the accruals basis.

• The Ohlson model is improved by adding Operative Cash Flow per share as an independent variable. It provides a better power explanation in terms of the R2 criteria, besides the effect of including an extra variable.

• In the economical activities test of Tangible and Intangible Industries, the alternative model's variables are significant in both sectors, as opposed to the original Ohlson model's variables, which are significant only in the Intangible Industries.

This exploratory study evaluated the value relevance of accounting information in Mexico. Using a sample of all the firms traded in the Mexican stock market that fulfill the Ohlson model criteria, it was found that earnings and book value (at the end of each year) have explanatory power on the stock price a quarter later.18 These results may help us to understand the value relevance of accounting terms for entrepreneurial finance decisions of Mexican public firms.

The study also documents the benefits of accrual accounting, by showing that earnings are a better performance measure than net cash flow or operative cash flow. This is consistent with the accounting theory that states that earnings occupy a central position in financial statements (as the summary measure of a firm's performance). The main explanation is that earnings (under the inherent accrual characteristic) have a higher correlation with value than does current cash flow.

However, theoretical financial models considered that cash flows have more value in valuation models and earnings are used in specific analysis like share valuation or to measure performance in management and debt contracts. With the result of the alternative model tested in this study, we can see that both of these variables (earnings and cash flows) complemented each other in bringing a better analysis of the firms' current performance and both of them have value relevance depending on the study's characteristics in which they are used.

Additionally, we need to emphasize that this study proposes an alternative model that produces better results than the original Ohlson model. The reason for adding the operative cash flow variable to the original Ohlson model was that the added variable provided additional information that the accruals data (inherent in earnings) does not display. Both models were tested under the tangible and intangible industries classification with significant results in both sectors, unlike the original Ohlson Model. The results, contrary to what is stated in the literature, show that intangible industries accounting has more explanatory power than that of tangible industries.19 One of the reasons for this result is that intangible industries in Mexico had a higher increase in their operations in the last decade than the tangible ones, and the models are sensitive to that economical shift behavior.20

The purpose of the study was to underlie the valuation analysis of the Mexican accounting variables, but the results can be used as the first step of prediction concerns, at least it helps to identify in which companies the accounting information has an explanation power for the stock price. This means that the application of the Ohlson and Alternative models brings the orientation of the price expectations for the next year in terms of the sign of the price value annual difference forecast (whether it is going to increase or decrease). This is useful for the investors and shareholders because with this information they have one point of reference oriented to the investment decision they can make.

Another contribution of the study consists in providing evidence of the use of unbalanced fixed effect and dummies panel data analysis in the Ohlson model reference with the Mexican data.21

6. Bibliography

Alford, Jones, Leftwitch and Zmijewski (2000). The relative informativeness of Accounting Disclosures in Different countries. Journal of Accounting Research, vol. 31 (pp. 183–223). [ Links ]

Ali, A. and L. Hwang L. (2000). Country–specific factors related to financial reporting and the Value Relevance of Accounting data. Journal of Accounting Research, vol. 38 (pp. 1–21). [ Links ]

Ball, R. and P. Brown (1968). An empirical evaluation of Accounting Income numbers. Journal of Accounting Research, vol. 6(pp. 159–178). [ Links ]

Baltagi (1995). Econometric Analysis of panel data. Wiley, Chichester. [ Links ]

Barth, Beaver and Landsman (1998). Relative valuation roles of equity book value and net income as a function of financial health. Journal of Accounting and Economics, vol. 25 (pp. 1–34). [ Links ]

Broedel, A. (2002). The Value Relevance of Brazilian Accounting Numbers: an empirical Investigation. In Social Science Research Net–Abstract Database at www.ssrn.com Working Paper [ Links ]

Brown, Lo and Lys (1999). Use of R2 in accounting research: measuring changes in value relevance over the last four decades. Journal of Accounting and Economics, vol. 28 (pp. 83–115). [ Links ]

Collins, Maydew and Weiss (1997). Changes in the value–relevance of earnings and book values over the past forty years. Journal of Accounting and Economics, vol. 24 (pp.39–67). [ Links ]

Collins, Pincus and Xie (1999). Equity Valuation and Negative Earnings: The role of Book value of Equity. The Accounting Review, vol. 74, núm. 1 (pp. 29–61). [ Links ]

Dechow, P. (1994). Accounting earnings and cash flows as measures of firm performance: The role of accounting accruals. Journal of Accounting and Economics, vol. 18 (pp. 3–42). [ Links ]

Fukui, Y. (2001). A Data Admissible Ohlson Model. In Social Science Research Net–Abstract Database at www.ssrn.com [ Links ]

Lo, K. and T. Lys (2001). The Ohlson model: contribution to Valuation Theory, limitations and empirical applications. Working paper. [ Links ]

Ohlson, J. A. (1995). Earnings, book values and dividends in security valuation. Contemporary Accounting Research, vol. 11 (pp. 661–687). [ Links ]

Ota, K. (2001). The Value–Relevance of Book Value, Current Earnings, and Management Forecasts of Earnings. Working Paper. [ Links ]

Ou and Penman (1989). Financial Statement analysis and the prediction of stock returns". Journal of Accounting and Economics, vol. 11 (pp. 295–329). [ Links ]

Palepu, Healy and Bernard (2000). Business Analysis & Valuation: Using Financial Statements (2nded.). Southwestern Thompson Ed. [ Links ]

Popova K. (2003). Applying the Ohlson and Feltham–Ohlson Models for Equity Valuation: Some Accounting Considerations. International School of Social Sciences, Yokohama National University. Working Paper. [ Links ]

Sami and Zhou (2004). A comparison of value relevance of accounting information in different segments of the Chinese stock market. The International Journal of Accounting, núm. 39 (pp.403–427). [ Links ]

Wooldridge, J. (2001). Econometric analysis of across section and panel data. Massachusetts Institute of Technology Press. [ Links ]

1 By testing Book Value and Earnings as independent variables in the Ohlson Model.

2 According with the Capital Assets Price Model.

3 The outliers were eliminated according to the Earnings/Price ratio. If the absolute value was above 1, it was identified as an extreme value.

4 Censored and Truncated techniques could be used, but according to the information available in the database, neither of these techniques applied. An improvement would be to use a Censored scenario by adding non–financial information as an instrumental variable.

5 EBITDA= Earnings Before Interest, Taxes, Depreciation and Amortization.

6 Dividends were used because there are references that use them instead of earnings.

7 Collins, Maydew, & Weiss (1997) and Collins, Pincus, & Xie (1998).

8 Ech of these was under per share basis.

9 The limitations to OLS is that it is less able to estimate the econometric behavior than a panel data technique model for a panel data characteristics that combine cross–section and time–series data.

10 For example, there are autocorrelation problems, as we can see in the Durbin Watson result for these four OLS regressions.

11 According to the STATA–Manual, R2 between is directly relevant for the goodness to fit measure for Panel Data (p. 196).

12 By using the first difference of each variable in the tested models.

13 The fixed effects studies were not applied in the comparison of models, because the R2 is not a point of reference.

14 See Dechow (1994), where the Operative and Net Cash flows are not as relevant as Earnings.

15 According with the quarterly PIB information of 1998 to 2003, the tangible industries increased 24% and intangible industries increased 38%.

16 Value relevance criteria are referred to the ability of accounting numbers (independent variables) to explain the stock prices in capital markets (dependent variable). The model was tested using the first difference of each variable.

17 See Dechow (1994) for the United States stock market, and Broedel (2002) for the Brazilian stock market.

18 Using the first difference of each variable.

19 See Collins, Maydew, and Weiss (1997) and Broedel (2001).

20 The accounting impact of these behaviors is analyzed in the conclusions section.

21 There are few studies that apply the Panel data analysis with the Olhson model.