1. INTRODUCTION

In the beginning of 2022, I had an interesting exchange of e-mails with Professor Anthony Thirlwall regarding a paper that I had published with Kalinka Martins da Silva in the Brazilian Journal Práticas de Administração Pública (Oreiro and Martins da Silva, 2021). Professor Thirlwall complains, in an e-mail sent for me at 27 of January 2022, that:

Professors Oreiro and Martins da Silva say in their recent paper on the New Developmentalism that “the balance of payments is not a restriction on long run growth because the income elasticities of exports and imports are not constant but adapt to the evolution of the productive structure of the economy” (...). I’m also reminded of Robert Solow’s 1956 model of economic growth in which investment doesn’t matter for long-run growth because the capital-output ratio adjusts passively for long run growth to revert to its “natural” rate. Early work by Atkinson, Sato and others on the time scale of economic models suggested it may take as long as fifty years for the passive adjustment to take place. No-one believes that investment is not important for growth - long- or short-run. The same with the balance of payments in an open economy. (...) How long for a developing country producing and exporting say, coffee, to turn to the production and export of, say, steel for the income elasticity of exports to rise, and the income elasticity of imports to fall, to relax a balance of payments constraint? (...).

I had answered to Professor Thirlwall and others at the same day by e-mail. In this reply I say:

Dear Professor Thirlwall,

Thanks for your comments. Regarding your question: “How long for a developing country producing and exporting say, coffee, to turn to the production and export of, say, steel for the income elasticity of exports to rise, and the income elasticity of imports to fall, to relax a balance of payments constraint?” [ I have to say that] in the case of Brazil, the time span was more or less 50 years. In 1930, when Getúlio Vargas takes power due to a Revolution, Brazil was a large coffee farm with the majority of people working in agriculture. In 1980 Brazil had the largest manufacturing sector of developing world (with 30% of working force in industry) and more than 40% of our exports are manufacturing goods (...).

If we are talking about economic development, it is not possible to consider income elasticities as a datum of nature. Because economic development is, by definition, structural change and structural change means changing the pattern of specialization in world trade.

My answer to Professor Thirlwall makes him to formulate very interesting issues regarding the capacity of structural change to ease the balance of payments constraint by means of changing the ratio of income elasticities of exports and imports. In an e-mail sent to me on 31 of January 2022 Professor Thirlwall writes:

Dear Jose,

Thanks for your e-mails, and the case studies of the time scales of structural change. I have a couple of comments and observations.

How can you be so sure that the elasticities will always change sufficiently to overcome a balance of payments constraint even in what you call “the long run”?

There cannot be a universal rule that the elasticities will change over time in the “right” direction, particularly if there is premature trade liberalisation which prevents industrialisation.

It has always worried me that the growth of exports and Gross Domestic Product (GDP) is related to the level of the exchange rate. What does the variable elasticity of demand function for exports look like?

Best regards,

Tony Thirlwall

In his reply to me, Professor Thirlwall raised the issues that are of fundamental importance for the so-called New-Developmentalism model. As it will be argued in this paper New-Developmentalism -understood as an approach to the deep determinants of economic development1 in which macroeconomic policy regime has a key role in explaining the long-term growth differentials among countries, notably middle-income countries (Oreiro and Martins da Silva, 2021)- is not incompatible with Balance of Payments Constrained Growth models (BPCG hereafter) pioneered and developed by Professor Thirlwall, but an extension and improvement of such a class of models in order to incorporate structural change2 induced by exchange rate overvaluation as the main limit of long-run growth for middle-income dual economies, thereby explaining the so-called middle-income trap (Oreiro, Martins da Silva and Dávila-Fernandez, 2020).

This article is organized as follows. The second section will present the balance of payments and capacity constraints to long-run growth. The third section will present the relation between real exchange rate, productive structure, and investment to develop a simple new-developmentalist model. Section 4 will show how this model can be used to analyse the limits for economic development in middle income countries. Section 5 presents the final remarks.

2. BALANCE OF PAYMENTS AND CAPACITY CONSTRAINT TO LONG-TERM GROWTH

Let us consider a dual economy with a modern capitalist sector and a traditional sector3, so that there is unlimited supply of labour for the modern sector (Lewis, 1954). In this case, availability of labour cannot be considered a limit to long-run growth and the growth of the modern sector will be determined by its own rate of expansion, which is induced by the increase of the level and diversity of demand for goods. Thirlwall (2013, p. 58) states there are also several mechanisms by which the growth rate of labour productivity is endogenous to demand, mainly in the manufacturing sector. Indeed, the existence of static, dynamic, and macro economies4 of scale made the growth rate of productivity to be induced by the growth rate of aggregate demand, making the so-called natural growth rate an endogenous variable (Thirlwall, 2013, p. 54).

The external constraint on long-term growth was analysed by Thirlwall (1979, 2001). The concept of balance of payments equilibrium growth rate was developed by him from the observation that Kaldorian-inspired cumulative causality growth models, in which the growth rate of exports demand is the fundamental engine of long-term economic growth, are incomplete because they do not include in their formal analytical structure a balance of payments equilibrium condition. Thus, depending on the value of the income elasticity of imports, an increase in the growth rate of output driven by a strong pace of exports expansion can generate a growing trade deficit by inducing unsustainable imports growth. Thus, the equilibrium growth rate of the balance of payments is defined as: “The growth rate that is consistent with the current account balance of payments equilibrium assuming that deficits cannot be financed forever, and external debt has to be paid” (Thirlwall, 2001, pp. 81-82).

A simple formalization of the concept of equilibrium growth rate of the balance of payments can be obtained in Atesoglu (1997) and is reproduced below.

Consider an economy described by the following system of equations:

Where Mt is the quantum imported in period t; Xt is the quantum exported in period t; Yt is the real domestic output in period t; Pm,t is the price of imported goods in period t; Px,t is the price of goods exported in period t; π is the income-elasticity of imports; ϕ is the price elasticity of imports.

Equation [1] presents the equilibrium condition of the balance of payments in the absence of external capital flows and equation [2] presents the imported quantum as a function of real output and terms of trade. It should be noted that, for simplicity, the exchange rate is assumed to be fixed and equal to one.

Substituting [2] into [1] we get the following equation:

In a balanced growth path5, the terms of trade should remain constant (Dutt, 2003, p. 318). Thus, we can assume that (log Px,t - log Pm,t) = 0 (Atesoglu, 1997, p. 331). That said, equation [3] is reduced to the following expression:

Equation [4] presents the real domestic output as a function of the quantum exported by the economy in period t; a relationship known as Harrod’s foreign trade multiplier. Differentiating equation [4] with respect to time and remembering that

Where gBPCG is the equilibrium growth rate of the balance of payments, ε is the income elastic of exports and z is the output growth rate of the rest of the world.

Equation [5] is the so-called Thirlwall’s law which tells us that the rate of growth that is compatible with the equilibrium of the balance of payments is equal to the ratio of the income elasticity of exports to the income elasticity of imports, multiplied by the output growth rate of the rest of the world.

Assuming that the external constraint is binding6, the Thirlwall’s law model offers a simple explanation for the observed divergence in the growth rates of output or per-capita income. Indeed, we know that the growth rate of output, g, can be expressed as the sum of the growth rate of per-capita income and the rate of population growth. Thus, equation [5] can be rewritten as:

Where

Based on [6] we can express the growth rate of domestic per-capita income as follows:

Assuming, for the sake of simplicity nd = nz, then it follows that the growth rate of domestic per-capita income can be expressed by:

In equation [8] if the ratio of income elasticities is less than one, then the growth rate of domestic per-capita income will be lower than the growth rate of income of the rest of the world, so that the economy will become increasingly poorer in comparison with the rest of the world, that is, there will be a growing divergence between the level of per-capita income of the domestic economy and the level of per-capita income of the rest of the world. On the other hand, if the ratio of elasticities is greater than one, then the growth rate of domestic per-capita income along the balanced growth path will be higher than the income growth rate of the rest of the world, so that the economy will converge to the per-capita income levels of the rest of the world. In short, the Thirlwall’s law model is compatible with both divergence and convergence of per-capita income between countries.

What are the factors that determine the ratio of income elasticities? An important factor in determining income elasticities is the productive structure of the country, more specifically the degree of productive specialization of the country. As a rule, a productive structure specialized in few sectors of activity and few products is compatible with a low value for the ratio between the income elasticity of exports and imports. This is because the income elasticity of imports tends to be relatively high given the need to import a wide range of products. Primary-exporting countries are typical examples of economies with a high level of productive specialization, whereas industrial and complex economies are examples of countries with diversified productive structures.

But the level of productive specialization is not the only important factor. Another equally important factor is the technological content of the exported goods, which is fundamental in determining the value of the income elasticity of exports, as it allows a greater differentiation of goods in terms of quality. Thus, countries that are near the technological frontier because they are exporters of goods with high technological intensity, should have a higher ratio between income elasticities than countries that are relatively more backward.

Thus, economies that present a diversified productive structure and export goods with high technological content exhibit a higher ratio between the income elasticities of exports and imports and, therefore, tend to exhibit a higher growth rate of per-capita income.

Equation [8] assumes that international capital mobility is equal to zero, so that countries cannot borrow to finance current account deficits. The extension of Thirlwall’s law to an economy with capital flows was made, among others, by Moreno-Brid (1998-1999). In the Moreno-Brid model, the existence of international capital flows is admitted, but the dynamics of external indebtedness must meet the condition of long-term external solvency. In particular, the model developed by this author assumes that the relationship between the current account deficit and domestic income must remain constant in the long run for the country to be solvent from the point of view of its external accounts. In this framework, assuming that the terms of trade are constant in the long run, the growth rate or real output compatible with the balance of payments equilibrium is given by the following expression:

Where θ is the ratio of the initial value of exports to the initial value of imports. Notice that θ can be expressed as the ratio of export revenues to the sum of the current account deficit (M - X) and exports. Therefore, we get:

Where xQ is the share of exports in domestic income and cc is the current account deficit as a share of GDP.

By way of example, let us consider that the income elasticity of imports, π, is equal to 1.5, that exports are 30% of domestic income, and that the growth rate of exports -equal to the product between the income elasticity of exports and the income growth rate of the rest of the world- is equal to 4% p.y. If the current account is in equilibrium (cc = 0), then the growth rate of domestic output compatible with the equilibrium of the balance of payments will be 2.67% p.y.; whereas if the current account deficit as a proportion of GDP is 2%, the equilibrium growth rate of the balance of payments will be reduced to 2.5% p.y. In other words, the current account deficit has a negligible impact on the growth rate compatible with the balance of payments balance (McCombie and Roberts, 2002, p. 95). Thus, equation [5] can be considered a good approximation of the external constraint on long-term economic growth.

Another constraint on long-term growth is given by productive capacity. Demand-led growth models, as it is the case of the SSM (Oreiro and Costa Santos, 2023), assumes that investment is an endogenous variable that adjusts to the (expected) growth of aggregate demand. For this to occur, however, it is necessary that the rate of return on capital be higher than the cost of capital. If the cost of capital is too high, then it is possible that a considerable part of the projects for the expansion of productive capacity will not be implemented due to lack of profitability. In this context, only investment projects with high profit expectations or financed at lower interest rates than those prevailing in the market will be implemented. In such circumstances, investment will be an exogenous variable; depending more on the willingness of entrepreneurs to invest (their animal spirits) than on cost-benefit calculations.

To determine the rate of output growth compatible with entrepreneurs’ investment plans, let us consider that real output is given by:

Where v is the potential output-capital ratio i.e., the maximum amount of output that can be obtained from a unit of capital; u is the level of capacity utilization and K is the stock of productive capital.

Differentiating [11] with respect to v, u and K, keeping v constant by hypothesis, we get:

Dividing both sides of [12] by Y, we get:

Assuming that the rate of depreciation of the capital stock is equal to δ, we have that the net investment is equal I = (dK - δK). Thus, we get:

Along the balanced growth path, the degree of capacity utilization is equal to the normal level of capacity utilization, that is, the level of utilization of productive capacity that is desired by firms according to their competitive strategy (Oreiro, 2004, p. 47). Thus, we can assume du = 0 in equation [14], obtaining the following expression:

Where un is the normal level of utilization of productive capacity.

Equation [15] defines the so-called warranted rate of growth, i.e., the rate of growth of output which, if obtained, will ensure that aggregate demand and productive capacity will grow at the same rate to maintain the utilization of productive capacity at its normal long-term level (Park, 2000). As we observe in equation [15], given un, v and δ the warranted rate of growth is an increasing function of net investment as a share of GDP.

3. REAL EXCHANGE RATE, PRODUCTIVE STRUCTURE, AND INVESTMENT: THE BUILDING BLOCKS OF THE NEW-DEVELOPMENTALIST MODEL

For New-Developmentalist theory the productive structure of the country, and therefore income elasticities of exports and imports, is not an immutable constant, but depend on the exchange rate; more precisely, on the relationship between the actual value of the exchange rate and the industrial equilibrium exchange rate7 (Bresser-Pereira, Oreiro and Marconi, 2015, pp. 36-38). This is defined as the level of real exchange rate for which firms operating with a state-of-the-art world technology can compete in the international and domestic market with their counterparts abroad8. When the exchange rate is appreciated with respect to the industrial equilibrium, domestic firms lose market share to foreign companies, forcing them to relocate their productive activities abroad or replace an increasing share of their production with imports, as a strategy to defend their sales and profits. In the latter case, domestic companies, formerly industrial companies, increasingly become trade representatives of foreign companies. So, real exchange rate overvaluation induces a process of premature deindustrialization and reprimarization of exports -that is, a negative structural change- which acts to reduce the income elasticity of exports and increase the income elasticity of imports9. In this context, there will be a progressive reduction in the balance of payments equilibrium growth rate to the point where it is compatible with the structure of a primary-exporting economy. If the actual value of the exchange rate is at -or slightly above- the industrial equilibrium value, there will be an increase in the manufacturing share in output10, which will result in an increase in the income elasticity of exports and a reduction in the income elasticity of imports, thus increasing the balance of payments equilibrium growth rate.

In mathematical terms, we can express this reasoning by the following differential equation:

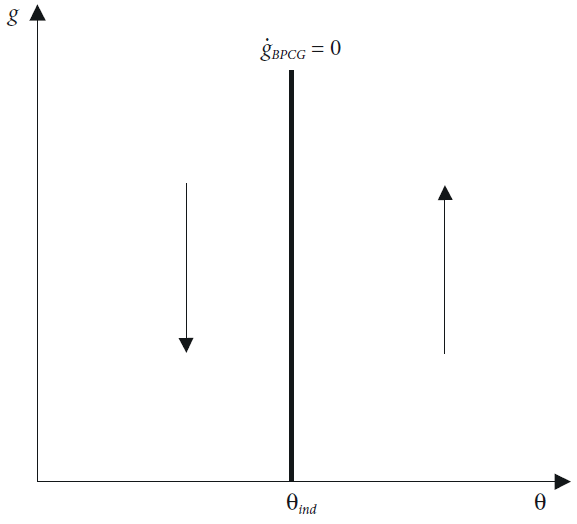

Where β is a positive constant; θ is the actual value of real exchange rate and θind is the industrial equilibrium exchange rate.

Equation [16] clearly states that income elasticities of exports and imports of the Thirlwall’s model are endogenous variables, such that the balance of payments constraint provides only a temporary constraint on long-term growth. In effect, by solving equation [5] for ε/π and replacing the resulting expression into equation [16] we get11:

In expression [17] we find that the balance of payments equilibrium growth rate will adjust over time depending on the relationship between the actual value of the exchange rate and the industrial equilibrium exchange rate. If the exchange rate is overvalued -that is, when the exchange rate is below the industrial equilibrium- the growth rate compatible with the balance of payments equilibrium will reduce over time, inducing a structural change that will deepen the external constraint over time. Similarly, if the exchange rate is undervalued -that is, if the exchange rate is above industrial equilibrium- the balance of payments equilibrium growth rate will increase over time, loosening the external constraint. From this reasoning, it follows that any rate of growth of real output is compatible with the equilibrium of the balance of payments when the exchange rate is at industrial equilibrium level (see Figure 1). Thus, in the long run, one cannot speak of an external constraint on growth if the exchange rate is at the right level, that is, at the industrial equilibrium level.

In section 2 we saw that the growth rate of output that is compatible with a normal degree capacity utilization -the warranted rate of growth- depends, among other variables, on the rate of investment. This was treated, essentially, as an exogenous variable, which depends on the animal spirit of the entrepreneurs.

In chapter 11 of the General Theory, Keynes argues that investment depends on the difference between the marginal efficiency of capital -defined as the discount rate that equalizes the expected cash flow of an investment project with the supply price of capital, i.e., the price entrepreneurs must pay to the manufacturers of capital equipment to get an additional unit of such equipment- and the rate of interest (Keynes, 1936, p. 135). The marginal efficiency of capital is therefore nothing more than the expected rate of return of investment projects, that is, the expected rate of profit by entrepreneurs.

The rate of profit can be decomposed into the share of profits in income, the degree of utilization of productive capacity and the potential output-capital ratio according to the following equation:

Where P is the aggregate profit,

Let us now consider that goods produced by domestic firms are not perfect substitutes for the goods produced by foreign firms so the law of one price does not hold. This is a very plausible assumption when one considers international trade in manufacturing. This allows domestic firms to set, within certain limits12, the price of their goods in a different level than the ones set by foreign firms. So, domestic firms are price setters that set the prices of their goods adding a mark-up over unit direct production cost, as observed in the equation [19] below:

Where p is the price of the domestic good, z is the mark-up rate or profit margin, w is the nominal wage rate, e is the nominal exchange rate13, p* is the price of the imported input measured in the currency of the country where it is produced, a0 is the unit requirement of imported inputs, and a1 is labour requirement per unit of output.

As Blecker (2002), we will suppose that the size of the mark-up rate set by domestic firms depends on the level of the real exchange rate, since domestic firms are not isolated from the pressured of international competition even in domestic markets. More specifically, the ability of domestic firms to set a price above the direct unit cost of production depends on the real exchange rate, which is defined as the ratio of the price of imported goods in domestic currency to the price of domestic goods in domestic currency. In this context, a devaluation of the real exchange rate allows domestic companies to increase the mark-up on production costs due to the reduction of the competitiveness of final goods imported from abroad.

Thus, we can express the mark-up rate as a function of the real exchange rate as follows:

Where θ = ep*/p is the level of real exchange rate.

Dividing the expression [19] by p, we get:

Where V = w/p is the real wage.

Equation [21] presents the distribution relation (DR, hereafter) of the economy, i.e., the combinations between real wage (V) and exchange rate (θ) and mark-up rate (z) for which the value added produced in the economy is entirely distributed in the form of wages and profits. Notice that, given the mark-up and the technical coefficients of production, there is an inverse relationship between the real wage and the real exchange rate, that is, a devaluation of the real exchange rate is necessarily accompanied by a reduction in the real wage. As the mark-up rate depends positively on the real exchange rate, it follows that the required reduction of the real wage will be even greater than in the case where the mark-up is fixed.

The distribution of income between wages and profits depends on the real exchange rate. As a matter of fact, the profit share in income is given by:

From the equation [22] it can be shown that a devaluation of the real exchange rate promotes an increase in the share of profits14.

So, the rate of profit depends, among other variables, on the share of profits in income, which, in turn, depends on the real exchange rate. It follows that a devaluation of the real exchange rate will, all other variables kept constant, increase the rate of profit.

Based on the previous arguments, we can express the investment rate as follows:

Where R is the rate of profit expected by entrepreneurs, r is the weighted average cost of capital (WACC)15.

Equation [23] shows that the investment rate is an increasing function of the real exchange rate, since a devaluation of the real exchange rate will produce an increase in the share of profits in income and so an increased in the rate of profit of capital, thus inducing entrepreneurs to invest more.

Substituting [23] into [15] we arrive at the following expression:

Equation [24] presents the warranted rate of growth for a developing economy, considering the effect of the real exchange rate on income distribution and the rate of profit.

As we can see from the visualization in Figure 2 below, the warranted rate of growth is an increasing function of the real exchange rate, given the output-capital ratio, the normal level of capacity utilization, depreciation rate and WACC.

Source: Author’s own elaboration.

Figure 2 Warranted rate of growth as a function of the level of real exchange rate

We are now able to present a formal new-developmentalist model of economic growth that synthesizes the state of the theoretical discussion made up to the present moment. For new-developmentalist theory, the long-term growth of developing economies depends on the export growth rate, which is equal to the output between the income elasticity of exports and the income growth rate of the rest of the world. This growth path, however, is subject to two types of restrictions.

The first is the balance of payments constraint, analysed by growth models à la Thirlwall. If we take into account the effect of the real exchange on the productive structure of the economy, we will conclude that the income elasticities of exports and imports of the Thirlwall model are endogenous, so that if the exchange rate is properly aligned, that is, at the level corresponding to industrial equilibrium, then any growth rate will be sustainable from the point of view of balance of payments equilibrium, that is, the external constraint will never be an obstacle to long-term growth.

The second constraint is given by the warranted rate of growth, derived from the Harrod growth model, which presents the growth rate of real output that is compatible with the normal level of utilization of productive capacity. Since the distribution of income and the rate of profit depend on the real exchange rate, it follows that a devaluation of the real exchange rate will stimulate entrepreneurs to invest more, making the rate of growth of productive capacity to accelerate. So, the restriction given by productive capacity can also be relaxed by appropriate variations in the real exchange rate.

The New-Developmentalist Model is therefore composed by the following system of equations:

The system formed by equations [24] and [25] has two equations and two unknowns, namely: The warranted growth rate of real output (gw) and the real exchange rate (θ). It is therefore a determined system.

The exogenous variables of the model are the industrial equilibrium exchange rate (θIND), the normal degree of capacity utilization (un, the output-capital ratio (v), the weighted average cost of capital (r) and the rate of depreciation of the capital stock (δ).

The balanced growth path of the economy under consideration is defined as the values of the growth rate of real output and the real exchange rate for which productive capacity is growing at the same rate as aggregate demand, such that the degree of utilization of productive capacity remains constant and equal to the normal level, and the productive structure of the economy is constant over time.

The determination of balanced growth can be made using Figure 3 below.

Figure 3 shows the importance of the level of the real exchange rate for long-term growth. In fact, the real exchange rate plays the role of making the growth rate of output and capacity to be compatible with the stability of the productive structure in the long run. Thus, the New-Developmentalist Model presented here places the real exchange rate at the centre of the theory of economic development.

It should be noted that at the equilibrium values of the real exchange rate (industrial equilibrium) and the growth rate of real output, the level of capacity utilization will remain constant and equal to its long-run normal value. In this way, productive capacity and aggregate demand will be growing at the same rates. Moreover, the productive structure and therefore the income elasticities of exports and imports will remain equally constant. Thus, the growth rate of real output will be equal to the ratio of the income elasticities of exports and imports multiplied by the income of the rest of the world. That is, at the equilibrium point the growth rate of exports will be equal to the growth rate of imports, so we cannot speak of balance of payments constraint to long-term growth.

So, in the balanced growth path we have:

In equation [26], we can see that the ratio between the income elasticities of exports and imports has the role of adjustment variable in the system to ensure the achievement of a balanced growth path in which productive capacity and aggregate demand are growing at the same rate and where imports grow at the same rate as exports.

Finally, we should also note that at the long-run equilibrium point of the system, the share of profits (and therefore wages) in national income is constant over time. In this way, the real wage will be growing at a rate equal to that of labour productivity

4. OBSTACLES TO ECONOMIC GROWTH: DUTCH DISEASE, CAPITAL ACCOUNT LIBERALIZATION AND PREMATURE DEINDUSTRIALISATION.

Based on the New-Developmentalist model developed in the previous section, long-term growth constraint originates neither from balance of payments constraint nor from capacity constraint; but from the tendency to overvaluation of the exchange rate that has its origin in the Dutch disease and capital account liberalization.

One of the main propositions of new developmentalism is that the existence of abundant natural resources in a country generates an unbalanced productive structure (Diamand, 1972), that is, a productive structure in which the unit cost of production of primary goods is not only lower than the international cost of production of these goods, but also lower than the unit cost of production of manufactured goods. Thus, the supply price of primary goods (that which incorporates the normal rate of profit in the domestic economy) must be lower than the supply price of manufactured goods, that is:

Where pp is the supply price of domestically produced primary goods and pm is the supply price of domestically produced manufactured products.

In economies where the productive structure is balanced, in turn, the unit costs of production of primary and manufactured goods are approximately equal, as the levels of labour productivity in both sectors of economic activity are similar. In this context, the supply price of primary goods produced in these economies is approximately equal to the supply price of manufactured goods, i.e.:

Where

Primary goods are generally homogeneous goods traded in competitive international markets in such a way that the law of one price must prevail: The price of domestically produced primary goods must be equal to the domestic currency price of primary goods produced in the rest of the world, that is:

Where E is the nominal exchange rate, i.e., the actual of the currency of economies with a balanced productive structure in terms of the currency in domestic economy. We then have the following relations:

Substituting [31] in [32] and the resulting in [30] we have:

In expression [33] we observe that, at the level of the exchange rate that equalizes the domestic and international prices of primary goods, the supply price of domestic manufactured goods will be higher than the price in national currency of manufactured goods produced in economies that have a balanced productive structure. It follows that, although primary goods are competitive in international markets, manufactured goods are not. For manufactured goods to be competitive in international markets it would be necessary for the exchange rate to be high enough (depreciated) to equalize the domestic and international prices of manufactured goods. The exchange rate for which the equalization rate occurs is the industrial equilibrium exchange rate (Ei). It is important to notice that, due to the unbalanced production structure of primary export countries, their manufacturing industries will not be competitive in international markets even if they adopt the state-of-art technology used by foreign firms that operate in the technological frontier.

The industrial equilibrium exchange rate is given by16:

It should be noted that in a freely fluctuating exchange rate regime, there is no reason to expect the exchange rate to assume the value necessary to make exports of manufactured goods competitive. The exchange rate should fluctuate around a level that equalizes the domestic and international prices of primary goods, which will be an overvalued exchange rate level from the point of view of the production and export of manufactured goods. As a result of this overvaluation, the share of manufactured goods in total exports will be gradually reduced, while domestic production of manufactured products will be replaced by imports. The Dutch disease will therefore result in a reprimarization of exports and the premature deindustrialization of the domestic economy.

Now we will analyse a middle-income dual economy that is on its balanced growth path, where a large amount of scarce natural resources (for example, oil) is suddenly discovered. In this context, Ricardian rents arising from the scarcity of natural resources allow the balance of payments to be in equilibrium with a lower (appreciated) level of the real exchange rate. In other words, there will be a detachment between the industrial equilibrium exchange rate and the current account equilibrium exchange rate17, the latter becoming more appreciated than the former, a phenomenon known as the Dutch disease18. In this setting, the real exchange rate will appreciate, giving rise to a perverse structural change in the economy. More precisely, the economy will undergo a process of premature deindustrialization and reprimarization of exports, which will induce a reduction in the ratio of income elasticity of exports and income elasticity of imports. The balance of payments constraint will then reappear in such a way that growth will be limited by the requirement of balance of payments equilibrium, as seen in the situation shown in Figure 4 below.

The exchange rate will appreciate, falling to θcc level. This appreciation of the real exchange rate will induce a reduction in private investment, due to the negative effect of a more appreciated exchange rate has on corporate profit margins and, consequently, on the long-term rate of profit. In addition, the appreciation of the real exchange rate will also induce a change in the productive structure of the economy towards goods with lower value added, acting to reduce the ratio of income elasticity of exports and income elasticity of imports. In other words, the Dutch disease will set off a gradual process of premature deindustrialization19. Due to the reduction in the pace of expansion of productive capacity and the process of premature deindustrialization, the long-run growth rate of real output will be reduced from

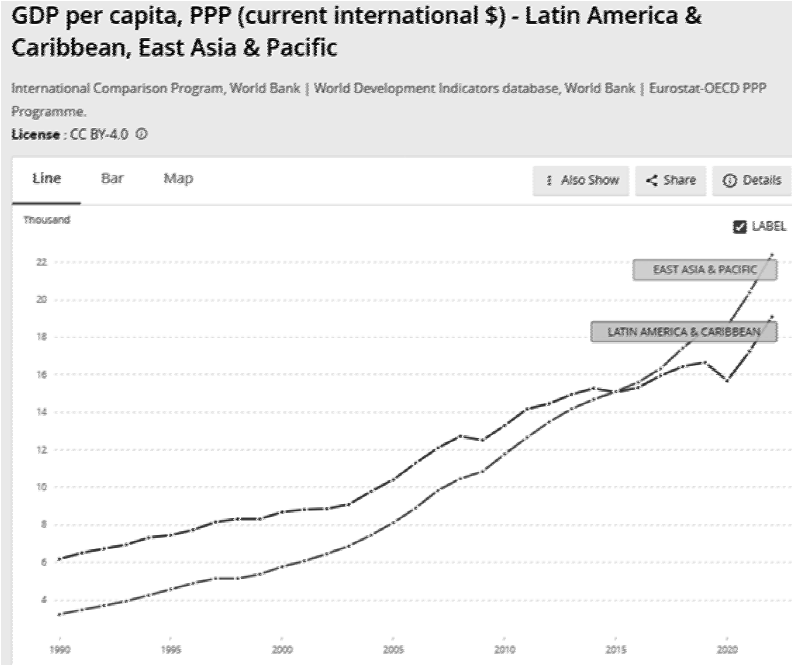

The exchange rate overvaluation could get worst if policymakers decided to open the capital account for both Foreign Direct Investment (FDI, hereafter) and Portfolio Foreign Investments (PFI, hereafter). Conventional wisdom states that foreign capital is required to finance economic development in low and middle-income countries, where domestic savings are low. As shown by Amsden (2001, p. 126), however, the share of gross investment that were financed by FDI was very low until the beginning of 1990. Latin American Economies, following the prescriptions of the so-called Washington Consensus decided to liberalize their financial systems and to open their capital accounts in the beginning of 1990’s in the hope that the attraction of foreign savings will accelerate their pace of economic growth. As we can see in Figure 5, this did not happen. From the middle of 1990’s on, East Asia economies start to grow at a higher pace than Latin American economies and overpassed them in 2015.

Source: World Bank Data Base.

Figure 5 Evolution of GDP per-capita of East Asian and Pacific Countries and Latin America and Caribbean from 1990 to 2020

The liberalization of the capital account of the balance of payments will reduce the level of the real exchange rate that is compatible with the intertemporal balance of the current account, displacing θcc to the left in figure 5. The increase in the overvaluation will depress even more the rate of profit, inducing entrepreneurs to reduce their investment spending and hence the rate of capital accumulation, mainly in the manufacturing industry. The reduction of manufacturing investment will accelerate the fall of manufacturing share in GDP thereby inducing another round of structural change that will be reflected in a further reduction of the ratio of income elasticity of exports to income elasticity of imports. As a result of this process both the balance of payments constraint and capacity constraint to growth will be tightened and so the long-run growth.

5. FINAL REMARKS

At the beginning of this article, we saw that Professor Anthony Thirlwall raised three questions regarding the long-run endogeneity of the ratio of income elasticity of exports and imports supported by New-Developmentalism. Regarding his first question, this article shows that income elasticities will not always change the balance of payments constraint, it depends if the real exchange rate is at the right level, which is the industrial equilibrium exchange rate. Regarding his second question, New developmentalism agreed that there is no universal rule that makes income elasticities to change in the right direction, they can change in the wrong direction due to real exchange rate overvaluation caused by Dutch disease and capital account liberalization. Finally, regarding the specification of income elasticity of demand, new developmentalism states that it can be a function of the manufacturing share in GDP, the dynamics of this variable depending on both price and non-price competitiveness of manufacturing industry as shown by Oreiro, Manarin and Gala (2020) for the Brazilian case.

This article shows that New-Developmentalism is not incompatible with balance of payments constrained growth models pioneered by Professor Thirlwall. On the contrary, New-Developmentalism builds up on this model to develop a more general development theory that is capable to explain premature deindustrialization and thus long-run limits to economic growth of middle-income dual economies, more precisely to explain the so-called middle-income trap.

nueva página del texto (beta)

nueva página del texto (beta)