1. INTRODUCTION

Biotechnology is all technological applications that use biological systems and live organisms of their derivatives to create or modify products or processes for specific uses (United Nations, 1992). It is considered a paradigmatic technology since it represents technological and economic advantages in many sectors and industries, especially in all those productive activities based on biological processes (OECD, 1989).

Considering the nature of biotechnology and its potential, at least three kinds of capabilities are necessary for achieving productive development with an economic impact: scientific, technological, and innovative capabilities. It should also be mentioned that the experience in developing countries proves that social and institutional capabilities are also needed (Reid and Ramani, 2012).

Technological capabilities refer to how businesses develop, transfer, imitate, adapt, and assimilate technological knowledge (Westphal, Kim, and Dahlman, 1985; Kim, 1997). This requires various kinds of abilities for acquiring, using, retaining, adapting, improving, and generating new technologies (Bell and Pavitt, 1995; Lall, 1992). To build technological capabilities, some factors are specific to any given business and others depend on the context, such as incentives, institutional structure, availability of financial resources, physical investment, human capital, and technological effort.

This means that technological capabilities cannot be analyzed solely through the efforts and activities that businesses carry out but through close relationships with the context. That is the reason this research is based on the Survey on Capabilities of Innovation of Biotechnological Firms in Mexico (2018-2019) as source of information that allow for identifying the technological capabilities.

The main objective is to identify Mexican agrobiotechnology firms' type and level of technological capabilities through the proposed technological capabilities matrix.

While the subject of technological capabilities has an important tradition, especially in the case of Mexico, there are few studies with this focus like Gonsen (1998); Rodríguez, Gómez, and Ramírez (2015), and Morales and Díaz (2019). Therefore, we consider this study to be an important contribution to understanding the dynamics of the agrobiotechnology sector in Mexico regarding technological capabilities and innovation. Moreover, we hope to contribute methodologically with a matrix of technological capabilities that can be applied specifically to the agrobiotechnology sector and thus be replicated and improved on by future research.

2. TECHNOLOGICAL CAPABILITIES IN BIOTECHNOLOGY

Technological capabilities are abilities that reflect the company’s mastering of technological activities (Dutrénit, Torres, and Vera-Cruz, 2020) and are the results of investments the company makes in response to external or internal stimuli and interaction with other economic agents, both public and private, local, and foreign (Lall, 1992).

Constructing technological capabilities implies learning processes and the accumulation of knowledge. This requires capabilities of absorption (Cohen and Levinthal, 1990) of external technological knowledge as well as the adaptation and generation of new knowledge. It is especially important to mention this for companies in developing countries since through vast evidence on the subject in these countries it may be observed that learning has been a result of processes of negotiation, assimilation of technology, an adaptation of machinery, search for alternative and technological transference (Katz,1986; Dutrénit, Torres and Vera-Cruz, 2020).

The concept of technological capabilities has evolved. It has gone from being a phenomenon of static analysis to dynamic through the incorporation of the concept of “accumulation” which concentrates more on the process than on the results. Added to the natural evolution of the concept, various forms of measuring technological capabilities have been put forth. Various taxonomies have been developed (Dahlman and Westphal, 1982; Lall, 1992; Bell and Pavitt, 1995) which give an account of the processes of learning, creation, development, and accumulation of technological capabilities. Also, the particularities of businesses in developing countries have been analyzed by Katz (1986) and Dutrénit (2004). However, the taxonomy proposed by Bell and Pavitt (1995), based on Lall (1992) was a turning point for analyzing technological capabilities which have usually been mainly applied in case studies and surveys in sectors and industries and to a lesser extent nationally (Kim, 1997; Amsden and Hikino, 1994).

In synthesis, Bell and Pavitt’s (1995) taxonomy of technological capabilities considers that the seminal process is technological accumulation, which implies a learning process that allows businesses to develop technological capabilities, understood as ‘the resources needed to generate and manage technical change: Knowledge, skills, experience and institutional structures and linkages: within firms, among firms and outside firms’. This allows technical change by introducing new technology incorporated into new products, new industrial plants, and more complex research projects, besides the progressive improvements which contribute to improved production capabilities.

Pavitt’s (1984) and Bell and Pavitt’s (1995) taxonomies are meant to be applied to the manufacturing sector. Thus, it is important to point out that the firms which make up this sector, biotechnology, are science-based since it may be seen that the process of technological accumulation comes fundamentally from knowledge, skills, and techniques which emerge from academic research (Bell and Pavitt, 1995). Given the importance of sectorial differences, an adaptation of said matrix is needed to better understand the kind of activities required in biotechnology for developing technological capabilities.

In this article, we present the idea that the development of technological capabilities is a necessary factor for the creation of innovation, but not enough. Innovation is an uncertain process that does not depend solely on a business’ activities. Neither can it be considered a sequential process since it has been documented that businesses, above all those in developing countries, may have diversity in technological capabilities, or rather, having technological capabilities does not imply developing innovations (Stezano and Oliver, 2019).

There are various quantitative and qualitative studies on technological capabilities in biotechnology, for example, Huang (2011), shows how open innovation moderates the relationship between internal learning and the capability of technological innovation. In other words, when businesses participate in technological learning processes, they can internally build the capability of carrying out innovative independent activities (Figueiredo, 2003).

Due to the methodological complexity implicit in dealing with technologies like biotechnology, there is a dearth of works that analyze technological capabilities using the traditional matrix for capabilities. This is because using the matrix implies analyzing activities of investment, production, and ties at various levels, which is complicated since this is not a traditional industrial sector, for which this kind of data is available. Along these lines, the following authors have analyzed the technological capabilities of this sector separately, specifically, the capabilities of investment (Moeen, 2017; Rothaermel and Hess, 2006) and the capabilities of linkage (Xun and Xuehan, 2014; Triulzi, Pyka, and Scholz, 2014).

It is worth pointing out the following findings in the works mentioned. Rothaermel and Hess (2006) found at the individual level internal investments are reflected such as contracting employees; at the company level, investments are interpreted in R&D; and at the level of networks, these imply external investments in alliances. In other words, the investment capabilities of biotechnological companies at various levels are critical factors for innovation.

Despite efforts to study technological capabilities in biotechnology, few sectorial studies allow for analyzing developing countries’ experiences. In the case of Mexico, various studies have analyzed biotechnology and considered to some degree the technological capabilities. These tend to be clumped in case study surveys and the majority adopt the use of the concept of technological capabilities without considering the particularities of biotechnology and the differences between these and the manufacturing sectors, for which said the concept was thought up (Gonsen, 1998; Flores, 2014; Rodríguez, Gómez and Ramírez, 2015; Stezano and Oliver, 2019; Morales and Díaz, 2019).

Gonsen’s (1998) study shows that autonomous technological development was ignored in Mexican biotechnology companies, which prevented the formation of innovative capabilities, demonstrating that the use of imported technology does not in itself lead to the acquisition of advanced technological capabilities.

Stezano and Oliver (2019) found a positive relationship between the business’ capacity of absorption and the probability of innovation and a nil effect of management capabilities on innovation.

Flores (2014) finds that the few Mexican companies that try to adopt biotechnology do so within a limited institutional framework. Despite these limitations, Mexican companies have established collaboration with other biotechnological businesses, universities, and businesses in other sectors. Some have collaborated with foreign agents to acquire new knowledge and skills.

Likewise, Morales and Díaz (2019) show that businesses that produce biotechnology in Mexico find their main market niche in the development of biotechnological processes. They also find that public institutions have fundamental importance in the private production of biotechnology.

In summary, it can be observed that the various studies that analyze biotechnology companies in the country use the taxonomy of technological capabilities for manufacturing indistinctly, so there is an important gap in the analysis that may have implications for the type of results reported.

3. MATERIAL AND METHODS

Biotechnology implies a methodological challenge since it is neither an industry nor a traditional economic sector. From the perspective presented here, biotechnology is knowledge, skills, rules, and instructions, in sum, knowing that and knowhow which develops in a specific social context in answer to culturally accepted questions and problems. To analyze it as an economic phenomenon, we refer to the OECD (2009) classification1: a) startups; b) small and medium-sized firms (SMEs); c) multinational enterprises (MNEs). This classification allows for categorizing the types of businesses analyzed and differentiates them not only by size but also by their technological characteristics.

The primary source of information is the data from the Survey on Capabilities of Innovation of Biotechnological Firms in Mexico (2018-2019) and the processing is based on a qualitative focus with the proposed matrix of technological capabilities.

One of the most important elements of the present research has been the adaptation and modification of the matrix of technological capabilities, specifically for biotechnology. It is important to mention that there exist distinct technological and productive dynamics among the various kinds of biotechnology: agricultural, food, pharmaceutical, environmental, etc. This requires that the matrix we propose here be adaptable depending on the area to be analyzed. In this article and given the objective of analyzing agrobiotechnology, the matrix is based on activities of said area. However, with a few timely modifications and incorporations, the matrix may be used to identify and analyze the technological capabilities of biotechnology in general and used indistinctly in the industrial sector.

The process of adaptation and modification of the matrix was the following. Based on the theoretical approach of the second section and interviews with expert biotechnologists and entrepreneurs, specific functions which could be considered in each of the levels (basic, intermediate, and advanced) were identified depending on the degree of technical and technological complexity.

For the new matrix activities relevant to biotechnology were added and others were redefined, establishing the correspondence with various levels of accumulation. The matrix includes investment activities, creative and knowledge management activities, and collaboration, production, and marketing activities which all together require the acquisition, assimilation, and adaptation of specific knowledge for biotechnology. It is important to mention that activities of the production of capital assets were eliminated since most biotechnological businesses outsource these activities. In this matrix, the columns establish the main activities for each technological capability and the rows refer to the degree of complexity or difficulty, measured for the kind of activity from which the capability derives.

The activities which have been added to the matrix are research and development (R&D) because it is thought that R&D is the first link in the basic value chain of biotechnology and the businesses which carry out biotechnology to a great extent depend on these to achieve internal technical capabilities which may place them at the forefront of the latest technological developments, innovation and facilitate their learning capacity (Bell and Pavitt, 1995).

Concerning investment activities, in decision making and control as well as in executing projects, adding activities related to investment in R&D, pilot plants and their laboratories, intellectual property, and activities of forming and growth of human capital.

Regarding support activities proposed in the traditional matrix, these were restructured, and the activities of interaction and linkage were adapted in keeping with the opinion of linkage and transference of business personnel and personnel at research centers, so they could represent the specific dynamics of biotechnology. However, the activities of the production of capital assets were eliminated because through fieldwork it was found that biotechnological companies, while they do carry out small improvements and adaptation to machinery and equipment, mainly externalize activities related to copying and original designing of plants and machinery, inverse engineering of machinery and equipment, R&D aimed at establishing specifications and the designing of new plants.

We reiterate that the model is indicative, not necessarily revealing an idea of sequencing. It is a matrix intended to provide flexibility in such a way that it allows for both static and dynamic analysis.

Based on this, in Table 1 we propose the matrix for technological capabilities for agrobiotechnology. It must be pointed out that this study understands agrobiotechnology companies to be businesses with technological and/or scientific activity in biotechnology, dedicated to biotechnology or biotechnological innovators who provide services or produce products for the agricultural and/or food sector, and whose profile leads us to believe they generate technological capabilities. Moreover, this classification includes Mexican firms and foreign businesses with branches in Mexico, which may be startups, SMEs and MNEs (OECD, 2009).

Table 1 Matrix of technological capabilities for agrobiotechnology in Mexico

| Investment Activities | Activities of creation and knowledge management and collaboration |

Activities of production and commercialization |

||||

| Decision-making and control | Preparation and execution of projects | Research and Development | Interaction and linkage | Processes | Products and/or services | |

| Basics | Estimate of expenses (Budgets). Active monitoring and control of market studies, feasibility, selection of technology, suppliers, and personnel. Activity programming. Search for sources of financing. | Access to financing. Feasibility and market studies. Investment in infrastructure (planning, preparation, conditioning, construction, or acquisition). Permits and compliance with security and sanitary measures. Basic engineering. | Area of strategy and R&D. Technological surveillance and competitive intelligence. Technological problem statement. Design of processes for the development of research. Low complexity research. | General knowledge of clients, suppliers, competence, universities, and research centers. Search for links. Social service, daycare centers, and exchanges (university-business) Collaboration agreements with research networks. Collaboration agreements with businesses. Participation in events related to area of interest. | Forming groups to carry out trials and eliminate errors. Controlling the quality of processes. Improving layout, programming, and maintenance. Developing organizational capabilities. Improving capabilities based on operational routines. | Field trials in pilot plants and feasible prototypes. Group focus and visits to the field. Field release. Sanitary Permits. Minor adaptations to the necessities of the market and gradual improvements of the product or service. Supervision and quality control of the products and/or services. Registration of products. |

| Intermediate | Search, evaluate, and selection of technologies, standard equipment, and suppliers. Recruiting work personnel and/or hiring consulting and technical services. Negotiation with suppliers. Administration of entire project(s). | Investment in R&D. Investment and acquisition of technological change (equipment and technology) Investment in marketing. Technical training and personnel operative. Administration and follow-up of the Project. Detailed engineering. | Formal R&D department. Research of mid-level complexity. Promotion of personnel’s creativity and inventiveness. Internal licensing and/or inversive engineering. Development of the formulation and/or designs for prototypes. Laboratory-level tests. | Technology transfer. Links with customers, suppliers, universities, research centers, and businesses. Links with public institutions (chambers, secretariats, government institutions). Utilization of technological installations and packages at universities and/or firms. | Improving the process and stretching production capabilities. Introduction of organizational changes. | Various certifications. Bio-manufacturing (large-scale production of active ingredients and/or formulas). Packaging and storage. Incremental designing of new products and/or services. Release of pilot programs. Biotechnological solutions to specific problems in the field. |

| Advanced | Development of new processes and production systems | Investment in pilot plants, laboratories, and their production plants. Investment in licensing and IP permits. Activities of formation and growth of human capital. Designs and processes of related R&D. Minor adaptations to machinery and equipment. | Finished prototype Trials in pilot plants. Trials in the field. Application for registration in intellectual property (processes). Proposals for specific solutions. | Links with universities and research centers for developing technology, which can be graded, Collaboration with firms for technological developments, bio-manufacturing, and/or commercialization or distribution. Collaboration in technological developments with customers, suppliers, and partners. Acquisitions and/or mergers. | Improving the process and stretching production capabilities. Introduction of organizational changes. | Various certifications. Bio-manufacturing (large-scale production of active ingredients and/or formulas). Packaging and storage. Incremental designing of new products and/or services. Release of pilot programs. Biotechnological solutions to specific problems in the field. |

Source: Own elaboration.

According to the National Survey on Technological Research and Development (ESIDET, Encuesta Sobre Investigación y Desarrollo Tecnológico) for the period 2014-2015 approximately 283 firms using biotechnology were identified, while for 2016, 370 were reported (INEGI, 2017). With data from the Organization for Economic Cooperation and Development (OECD) in 2018, there were 154 active biotechnological firms in the country. The previous data should be taken with a grain of salt since according to OECD’s (2009) classification, cited earlier, most of the businesses registered officially in ESIDET are SMEs, and many of them are only receptor users of biotechnological techniques or products.

Given the vagueness of this data on the universe of biotechnological firms, some research has tried to more precisely identify the universe of businesses that develop biotechnology, discarding those that are sole users. For example, the case of Flores (2014), reports 58 firms. According to our research, 33 businesses developed agrobiotechnology and were active in the market, and these can be subdivided according to the OECD (2009) classification. The 33 firms were found through a process of refining the various existing directories. Telephone calls were made to determine whether the firms were developers of biotechnology. As can be observed, the number of businesses is much smaller than the data reported by ESIDET or OECD. Moreover, it must be remembered that only agrobiotechnology firms are considered, thus excluding an important number of firms in other industrial sectors.

Once the universe was identified, we proceeded to undertake the Survey of Capabilities of Innovation of Biotechnological Firms in Mexico, which is made up of five modules. Like the matrix, the survey was validated and tested by 5 experts, concerning the content of the questions as well as the extension by 3 entrepreneurs, 2 researchers, and 1 person in charge of technological management in a public research center, all belonging to the area of biotechnology. The survey was implemented beginning in October 2018 and ended in December 2019 and was carried out in person in the cases where this was possible, otherwise using telephone calls, video calls, and electronically.

The survey was analyzed using deductive reasoning and qualitatively interpreting a matrix of correspondence to assign one or more questions to each type of technological capability and from there, based on the answers the levels of each firm were identified, depending on the kind of activities they reported. This allowed for comparing the information and thus enabled identification of the kind of capability and level of the same for each firm.

4. RESULTS AND DISCUSSION

The survey shows the characteristics of 33 firms that we have catalogued as agrobiotechnology. These firms are defined as businesses related to the food industry, the beverage industry, the production of fertilizers, pesticides, and other chemicals, and basic organic chemical products.

We take the classification from the Instituto Nacional de Estadística y Geografía (INEGI). The kind of businesses surveyed through the research coincides with Trejo’s (2010) research in which he affirms that in Mexico for the agro-industrial sector associated with biotechnology, the presence of three kinds of firms is predominant. 1) businesses that develop biotechnology for the vegetal propagation of plants; 2) the development of processes and products of biological and biochemical products for the market used in agricultural production and post-harvest, and 3) drugs and vaccines for veterinary use.

It is worth mentioning that historically there has been a boom in the agro-industrial sector in Mexico, due to a series of improvements in the quality of products which is the result of large public investments combined with the specific strategies of some firms. However, it has been seen that technological development has been concentrated on areas such as fertilizers for controlling plagues weeds, fungus, etc., some kinds of genetic engineering related to crop resistance, genetic improvements that prevent the spread of diseases, plagues, and fungi and in the processes of optimization of supply chains.

It has been found that in Mexico in the sector of analysis, it is the large transnational firms that make use of biotechnological techniques and processes. This means that, despite their laboratories, they are usually installed in developed countries, while in Mexico links are created with universities or research centers for timely research. In the case of Mexican firms, few have departments for R&D although there are important ties to universities and research centers, there is also the creation of informal relationships in which consultation with experts in the field is sought. There is not much clear and opportune information on the number of collaborations and consolidations concerning firms and universities, but there are various qualitative studies that show that there are successful cases (Santana and Soria, 2023). However, these are the exception rather than the rule.

Based on the reconfiguration of the matrix of technological capabilities and the processing of the survey, the following results have been reported for the Mexican case. Using the OECD classification, we found that the firms fall into the following areas: 9% are startups, 70% are medium-sized (SMEs) and 21% are multinational enterprises (MNEs). These data differ from the composition reported by others and maybe because this research only uses information from agrobiotechnology firms. Moreover, the variation may be due to the timescale in which each of the surveys was implemented.

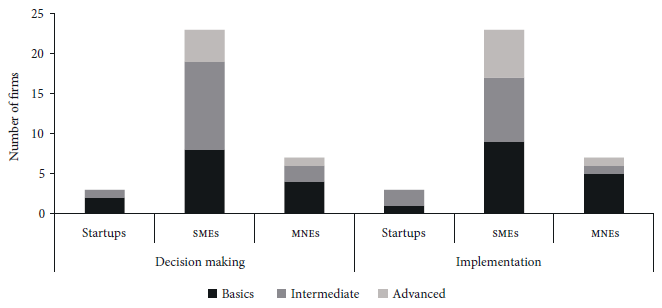

In keeping with the proposed matrix of capabilities, they are broken down for each kind of capability and each classification of firms. Referring to investment activities, are divided into two categories: Decision-making, and implementation. The former involves all those activities carried out that are related to decisions and control. In this category it may be seen that startups possess fundamentally basic capabilities, which reflect that given their maturity level, they do not yet have skills for searching, evaluating, and selecting technology, equipment, suppliers, and human resources for consulting and services. Together this shows almost zero capability for developing new production processes and systems.

In the case of SMEs, intermediate capabilities predominate, followed by basic capabilities in decision-making and control. For MNEs, they report basic capabilities, which may be due to the type of activities, processes, and products of these companies. This may reveal their lack of interest in developing new production processes and systems. This is relevant since it was identified that MNEs are the ones that have reached a higher level of capabilities in decision-making, and this is in keeping with other analysis in which it was concluded that the MNEs is the segment that has the highest levels of investment in general terms given the dynamic production they focus on. In a certain way, these are the businesses that face the most competition and therefore they become more active in the search for innovations.

These results coincide with the capabilities required for preparing and carrying out the projects or their implementation. Figure 1 shows the case of startups, no firm is classified with advanced capabilities and most have basic capabilities, followed by intermediate. In this sense, Mexican firms lack investment in infrastructure, machinery and equipment, intellectual property and process design, and the development of R&D. This data coincides with that reported by Solleiro (2000) who identified an important lack of investment capabilities in Mexican firms.

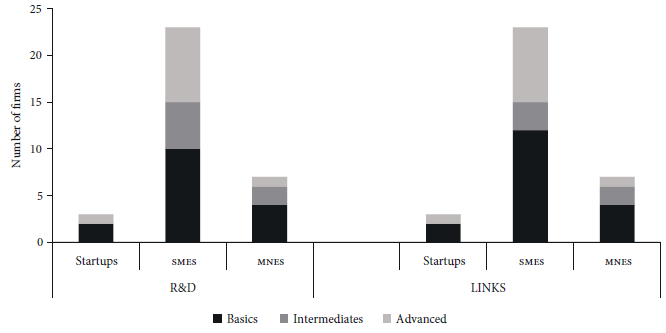

The activities of knowledge generation and management activities and collaboration are divided into R&D activities and linkage activities. It was discovered that startups have predominantly developed basic capabilities, followed by advanced ones. They have R&D strategies, carry out technological surveillance and low complexity research while SMEs have also developed mid-level and advanced levels of R&D. In this case, businesses carry out research of mid-level complexity, have a formal R&D department or plant, develop formulas, and design prototypes, carry out laboratory, field, and pilot plant level trials.

In the case of MNEs, they have developed basic and advanced capabilities in R&D. These firms have generated skills for carrying out incremental improvements in licensed developments and generating new technological developments. These in turn have been protected by patents or industrial secrets for reducing the probability of being copied. However, their main biotechnological developments have been carried out at their headquarters. In countries like Mexico, the final steps of R&D are applied to adapt the products to the conditions of the country. In this sense, they import technological capabilities.

Achieving advanced capabilities in R&D and carrying out more complex research involves businesses using their collaborative R&D strategy. This takes a long time due to the nature of these activities. The startups studied have not been in the market for very long and have developed basic and advanced capabilities of linkage. Considering the time factor, the level of linkage, and the complexity of R&D explain why these firms have not yet reached a higher level of maturity. It may be observed that SMEs present greater dynamism in the development of R&D activities. This has been a key factor for companies to generate technological knowledge and innovation of processes as well as products and thus be more competitive in the market.

Concerning linkage activities at the basic level, it may be observed that startups, SMEs, and MNEs have developed special mastery of basic capabilities given that they know their biotechnological milieu (clients, suppliers, competitors, universities, and research centers). They try to create agreements of cooperation and participation in events related to the area. We also found that SMEs and MNEs, throughout time, have managed to develop capabilities of intermediate and advanced linkages, which has allowed them to obtain different sources of technological knowledge for developing more complex activities, complementing, and strengthening various technological capabilities, and management which goes beyond scientific capabilities. They achieve important collaboration agreements for the use of installations and infrastructure, collaborative research for new technological developments, laboratory field and pilot trials, biomanufacturing, and commercialization.

For biotechnology, it is essential to generate alliances involving different types of collaborations and/or linkages. But it is worth noting that there are two major global trends. On the one hand, in developed countries, alliances are usually established between companies, since it is common for universities to create startups that are positioned by their high-quality R&D with a product of interest in the market. However, in countries such as Mexico there is little creation of startups and therefore, generally, linkage relationships are established between universities and companies (Stezano, 2012). This has diverse implications since there are well-identified problems in the linkage between universities and companies in Mexico that hinder, delay and sometimes prevent this type of linkage (Cárdenas, Cabrero and Arellano, 2014). In this sense, informal linkages are relevant for biotechnology in the country, since they allow for avoiding some of the problems associated with bureaucracy and the generation of contracts; however, they can jeopardize an efficient allocation of property rights if there is not a high level of trust among the participants.

We can observe in Figure 2 that it has been found that interaction and linkage capabilities are closely related to R&D activities, large-scale production, and commercialization. In other words, these activities are carried out together and the rate of the complexity of R&D depends on the development of the others (linkage). These results are in keeping with those obtained in Sanchez’s (2020) research. They found that the development of advanced capabilities of interaction and linkage of biotechnological firms with institutions of higher learning, research centers, and other technology businesses allow firms access to capabilities that they are lacking, broaden their horizons for future development, expand their market and make proposals for public policies in the agro-industrial and food field.

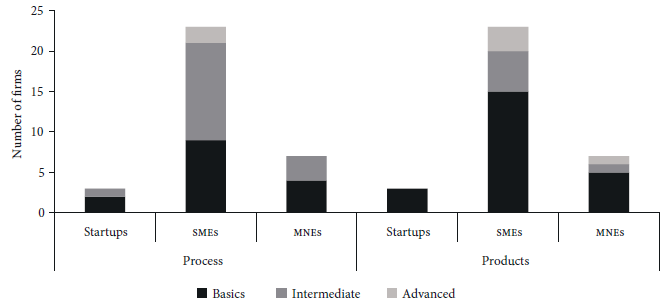

It may be observed in the matrix of capabilities that the activities of production and commercialization are divided into two: those focusing on processes and those on products and services. According to the results of our survey, we found that startups have basic capabilities, showing that while they have skills for forming groups, carrying out trials, and improving certain operative routines, they do not yet apply the processes of production nor turn them into innovations. These results are no doubt relevant considering the difference in the tendency of startups in the United States that register innovations in patents, allowing them to dynamize through knowledge markets. In the same sense, MNEs show basic capabilities while SMEs are the firms with the highest level of these kinds of capabilities, the majority having intermediate capabilities. However, in general, it stands out that Mexican firms do not achieve innovations in processes or patents for methods.

Concerning capabilities in products, it may be observed in Figure 3, that startups only report basic capabilities, which translate into carrying out field trials in pilot plants, experimental releases, management skills with regulatory authorities, and minor adaptations based on the needs of the market and quality control. However, there are no capabilities for specialized certification, incremental designs, or product innovations. Likewise, MNEs have basic capabilities that show their low level of skills for commercializing products and therefore their inability to penetrate markets. Once more, SMEs are the ones with the greatest diversification in kinds of capabilities, although the large majority have basic capabilities. Along these lines, it may be concluded that in general, for these kinds of capabilities, Mexican agrobiotechnology firms have limited production and commercialization capabilities and few perspectives for prospects of having disruptive innovations capable of modifying or creating markets.

The results we found reinforce the findings of other authors such as Stezano and Oliver (2019) on the low levels of capabilities in processes and products which force Mexican businesses to focus on niche and regional markets, besides substituting some processes and products, without this resulting in radical innovations, but rather incremental processes with little impact within the sector. While this may be a relatively adequate strategy for these businesses to maintain the market, it does not allow them to achieve greater competitiveness in global markets.

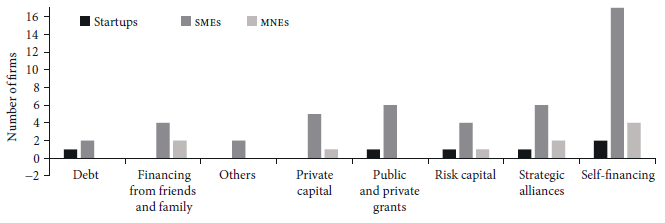

The development of biotechnology requires high levels of financial capital investment, which largely determines the development and accumulation of technological capabilities. As explained above, there are different types of biotechnology companies, but given that it is the MNEs that dominate the value chain, they impose the production and financing models that exist at the global level. In this sense, MNEs have opted for the blockbuster model, seeking to maximize shareholder value and market control (Montalban and Sakinç, 2013).

This has implications that affect the financing mechanisms of other types of companies. In the case of the agro-biotechnology companies studied, it can be observed that the newly created companies or startups depend on public and private financing. In the case of the public part, they need to submit projects to state funds or international agencies, which implies a process of competition with other companies, therefore it is not secure financing, since it depends on whether they win the support or not. On the private side, they use personal funds, their own savings, or family loans. This shows the lack of venture capital in the country for this type of company and the high risk they take by relying mostly on their own resources.

SMEs show the greatest diversification of financing sources: Self-financing, debt, venture capital, private equity, strategic alliances, and grants. As more stable companies with some sort of credit history, they report a wider range of options. They are the type of companies that show the greatest diversification of their productive activities; therefore biotech R&D activities are usually complementary to improve or develop innovative processes and/or products.

Finally, MNEs are financed by sales, venture capital, private equity, and strategic alliances. Strictly speaking, they are the companies that are least dependent on external financing, as they are able to reinvest part of their profits in R&D. However, as some studies show, they continue to seek external sources of financing because of the high technical requirements and also to diversify risk.

5. CONCLUSIONS

In this article, we have proposed a taxonomy that allows us to measure and analyze technological capabilities in biotechnology. The proposal allows for clearly establishing the specific activities corresponding to agrobiotechnology in each of its capabilities usually utilized for this kind of analysis: investment capabilities, production, and supporting activities. This adjustment has been made necessary by the difference from the traditional capability matrixes used to analyze the manufacturing sector. In biotech, we need to timely identify activities related to presenting and solving technological problems, due to the characteristics of biotechnology, its rapid technological evolution, and the demand for innovative solutions. Moreover, given the dynamics of said technology, it is also necessary to typify the levels related to the various kinds of collaboration among agents since it is a technology that requires the participation of a broad diversity of organizations, including universities and research centers.

The methodological adaptation of the matrix was the first step in this research. The second step was the application of the Survey on Capabilities of Innovation of Biotechnological Firms in Mexico (2018-2019). This was the main source of information for the results presented in this article. The survey summarizes the results of 33 firms that have been catalogued as agrobiotechnology firms in keeping with the kind of activities and the sector to which they are related.

We then analyzed the firms’ answers to the survey, thus establishing the kind of activities to which they correspond within the matrix.

The objective of this article has been to identify the level and type of technological capabilities of Mexican agrobiotechnology companies. In this sense, we observed that the results for Mexican companies do not coincide on several points with studies from other countries.

In biotech, it is usually observed that startups develop advanced levels of technological capabilities in all areas since this allows them to be valued in the market and to be acquired or merged. However, in the case of Mexican companies, basic levels predominate in the activities of investment, creation and knowledge management, collaboration, production, and commercialization.

A possible explanation and hypothesis to be tested in future research are that these companies, lacking diversified sources of financing for the initial stages, depend to a large extent on public financing to generate and accumulate technological capabilities. Therefore, the scarcity of financial resources becomes the first barrier to entry with implications for the generation of technological capabilities. In this sense, the results are the opposite of the dynamics of startups in the United States, which is indicative of the type of barriers faced by these companies.

The largest number of companies responding to the survey are small and medium-sized. Undoubtedly, it is also the segment where the greatest dynamics in the generation of technological capabilities can be observed. In the case of so-called investment capabilities, SMEs have intermediate capabilities. This reflects one of the characteristics that has been highlighted in other studies (Solleiro, 2000) since these are companies that usually carry out biotechnology activities not as their main activity, but as an auxiliary to their main line of business. In this sense, they already have infrastructure capabilities that allow them to accumulate and generate other capabilities.

In high-tech sectors such as biotechnology, technological capabilities depend, to a great extent, on financial capability. In contrast to other industrial dynamics, the size of the company may be important but is not a determinant. For example, MNEs mostly have basic and intermediate technological capabilities, but this may be due to a phenomenon observed in biotechnology whereby they tend to subcontract the R&D process or establish collaborative relationships with other companies, especially SMEs or universities.

Some nuances should be added because although the size of a company influences the type of capabilities, the largest companies do not have the highest level of capabilities. In this case, it was seen that SMEs accumulate higher capabilities in several segments. New firms were found to have problems accumulating capabilities in almost all segments.

The data presented allows us to infer that as posed at the beginning of this article, the technological capabilities are not enough to result in innovation. The results also show that Mexican biotechnological firms to a great degree depend on their relationships of collaboration with universities and research centers and public support in the form of co-financing. One of the major shortcomings is financing technological development with innovative potential, but with uncertain results since the development of biotechnological products requires large investments and may take a long time, starting with basic research and reaching industrial and commercialization escalation. Thus, the importance of promoting new sources of financing.

Given the results presented in this article, it has been proven that successful experiences can be found, but not aggregated catching-up processes. In sectorial terms, it was found that agro-biotechnological firms in Mexico show a dispersion of capabilities which while perhaps representing the potential for growth and elements of competitivity for the future, still need strong institutional support which would allow them to consolidate and strengthen the capabilities they have developed. Above all, the need for public financing and support is apparent. This could complement the weak capacity of investment of Mexican firms.

However, the question remains as to whether more funding is only required for Mexican biotechnology companies to generate and accumulate greater capabilities. Although we cannot answer this question, we can hypothesize that it is a necessary condition, but not sufficient, since this same study shows that although MNEs have more financing, this is not a determinant of their level of capabilities. This raises new questions that are worth analyzing in future research.

nova página do texto(beta)

nova página do texto(beta)