1. Introduction

Since the 1990s, despite the many institutional reforms that were introduced, the Brazilian economy has slowed down considerably, both in relation to its own historical trend and in comparison with other developing economies. Considering only the period following the adoption of the current institutional-monetary framework, the inflation targeting regime (ITR), between 1999 and 2015, the average growth rate was 2.7% per year, a performance much lower than the world and developing countries average growth rates that were, respectively, 3.8% and 5.7%)1 per year.

Not only have growth rates been low and unstable, but several domestic macroeconomic indicators have also deteriorated and/or entered a worrisome trajectory since then. It should also be highlighted that: 1) The behaviour of investment declined substantially in this period, maintaining low levels of 17.2% of Gross Domestic Product (GDP) on average; 2) the share of industry in GDP fell to levels similar to those prevailing in the 1950s (11.0% in 2014)2, and 3) the export basket tended toward “reprimarization” in a context of modest increases in productivity and the decreasing quality of international insertion.

Although the causes of this performance are varied and complex, the monetary institutions certainly played a central role in its explanation. This is because, after the adoption of the ITR in 1999, increasing the basic interest rate of the economy, that is, the Special System for Settlement and Custody (Selic), became the main tool for fighting inflation. This brought the following adverse effects on the economy: 1) Discouraged private investment and economic growth; 2) attracted speculative capital and aPPreciated the exchange rate, which affected, negatively, the current account balance, and 3) increased spending on the public debt service, both directly, via the debt share indexed to the Selic rate, and indirectly, via rising risk premium, which increased the stock of public debt.

In view of the above, the central purpose of this article is to present and analyse the theoretical arguments and the empirical results of the ITR in Brazil. We will highlight the ineffectiveness of this institutional framework, not only to keep inflation rate below its target but also to promote GDP growth. In addition to that, we will discuss how the Brazilian economy, since the introduction of the ITR, was found under a regime that has proven inadequate for the Brazilian reality, both theoretically and empirically.

In theoretical terms, the ITR -based on the orthodoxy of the New Consensus Macroeconomics (NCM) -has been unable to explain and keep inflation under control in emerging countries, because inflation rates in these countries are only partially explained by the conditions of demand, as assumed by the ITR3. In empirical terms, the ITR has contributed to low GDP performance, and fiscal and external deficits, among others4.

To achieve the objective, besides this introduction, the article is divided into four sections. Section 2 presents the main foundations of the ITR and discusses the implementation of this regime in Brazil. Section 3 analyses the performance of the Brazilian economy under the ITR, highlighting the behaviour of the main macroeconomic indicators in the period 1999-2015. Section 4, the empirical part, tests the hypothesis that monetary institutions have played a central role to the poor economic growth performance and contributed to increase the fiscal and external imbalances of the Brazilian economy since 1999. Section 5 presents the concluding remarks.

2. Brazil’ s central ITR model and experience

The monetary institutions in Brazil and their recent evolution form are an interesting case of the relationship between institutions and economic performance. Or better still, they form a case of how the existence of institutions is creating obstacles in the process of domestic economic growth. This is because the institutions’ change over time failed to provide an adequate framework of incentives to influence key aspects, such as private investment, or, from a Keynesian perspective, to awaken the animal spirits of entrepreneurs, not to mention the failure to generate innovations, and organize and manage the work process and the macroeconomic policies.

As is commonly known, monetary stability has long been a major concern in the Brazilian economy, which over the last decades has promoted a series of institutional changes with the objective of reducing and keeping inflation under control. To this end, after the high and chronic inflation period, caused by the external debt crisis and the economic stagnation of the 1980s, the economy entered a new standard of development and international insertion in the 1990s based on the principles established by the Washington Consensus -trade and financial liberalization, deregulation, privatization of state-owned enterprises, and fiscal discipline, among other measures- all of which have decisively influenced the performance of the economy since then.

Within the scope of institutions for monetary stability, as part of the introduced changes, the Real Plan was adopted in 1994, which had the exchange rate and the interest rate as its main instruments of stabilization: The exchange rate was managed as an anchor for inflation stabilization5, while the basic interest rate was designed to attract large net capital inflows. Moreover, it is important to note here that trade and financial liberalization were a crucial part of this stabilization strategy.

The high interest rate differential, in addition to contributing to financing the balance of payments, prevented further pressure on domestic demand, actions that ultimately kept inflation under control (Bacha, 1995). It is worth noting that the strategy led to a very low average growth rate of 1.6% per year in that decade6. Because of this, throughout the 1990s it received the moniker “second lost decade”, in reference to the 1980s which was the first turbulent period.

Then in 1999, a major institutional change took place: The ITR was adopted and the Brazilian Central Bank (BCB) decided to change the exchange rate regime from a managed to a floating system. Despite the change in the monetary regime, the rationale for conducting monetary policy did not, in essence, change. Monetary policy remains highly restrictive and the exchange rate continues to be one of the main transmission mechanisms of monetary policy.

Regarding the Brazilian experience, the monetary authorities have adopted the NCM model since 1999, characterized by the ITR, a target for primary fiscal budget as share of GDP and floating exchange rate regime. Focusing our attention on monetary policy, the BCB has religiously followed the theoretical framework that underpins the ITR strategy. According to Arestis, Ferrari-Filho and Paula (2011), the main theoretical features of the BCB macroeconomic model, closely based on the NCM model, can be summarized as follows:

1. Price stability is the monetary policy’s long-term primary objective. In addition, the price stability goal may be accompanied by output stabilization so long as price stability is not violated.

2. ITR is a monetary policy framework whereby public announcement of official inflation targets is required. In this approach, “expected inflation” and the transparency of inflation forecasts are important element of the policy.

3. Monetary policy is the main instrument of macroeconomic policy, and it should not be operated by politicians, but by experts: “Independent” central banks.

4. Fiscal policy is no longer viewed as a powerful macroeconomic instrument for stabilizing the economy. Hence, the economic authorities should adopt a fiscal target in terms of primary budget surplus.

5. The level of economic activity fluctuates around a supply-side equilibrium. This means that the level of effective demand does not play an independent role in the long-run level of economic activity.

6. Finally, considering that Brazil is an open economy and has a long history of external imbalances and crises, exchange rate is of crucial importance because it transmits certain external effects to the inflation rate, among others. It is given that, in the BCB macroeconomic model, the ITR may lead to a more stable currency since it signals a clear commitment to price stability in a floating exchange rate system.

The Brazilian ITR has been modelled similarly to the British ITR model. The Brazilian National Monetary Council (Conselho Monetário Nacional, CMN), which has three members, the Minister of Finance, the Minister of Planning, and the President of the BCB, sets the inflation targets. In June of each year, the CMN establishes the inflation targets and their corresponding intervals of tolerance for the next two years.Besides the inflation target, CMN is also responsible for the aPProval of the main norms regarding monetary and exchange rate policies, as well as the regulation of the financial system.

The interest rate target is set by the Monetary Policy Committee (COPOM) based on the Selic, an interest rate for overnight interbank loans, collateralized by public debt bonds. The interest rate target is fixed for the period between the COPOM regular meetings.

The President of the BCB, though, has the power to change the Selic interest rate target anytime between regular COPOM meetings (every 45 days). This is made possible by the way the COPOM decides policy rates. It can introduce a monetary policy bias at its regular meetings, whereas the bias refers to easing or tightening of monetary policy between meetings. Immediately after the COPOM meetings, the BCB publishes an Inflation Report, which provides specific information on economic conditions, as well as the COPOM’s inflation forecasts upon which changes in the Selic interest rate are deteRMIned. The objective of this report is to inform the public and the financial market about the goals, design, and implementation of monetary policy.

Another feature of the ITR in Brazil is that the price index considered by the BCB when setting the inflation target is the Broad Consumer Price Index (IPCA)7. Since 2005, the desired target has been 4.5% per year, with lower and uPPer limits of 2.5% and 6.5% per year, which must be achieved within the calendar year. Moreover, the Selic interest rate, managed by the monetary authorities, is also the rate which pays a significant portion of the public debt bonds, so that these markets are linked.

After the adoption of the ITR, however, inflation remained at relatively high levels compared to the world economy average, which was 4.1%. Table 1, below, shows that, over this period, the upper limits of tolerance were missed for the years 2001, 2002, 2003 and 2015 by a substantial margin, especially in 2002 and 2015, while in 2004 the inflation target was only met after it was raised by mid-2003. However, the inflation rates were above the point targets in nine years (1999, 2004-2005, 2008, and 2010-2015).

Table 1 IPCA, Selic and growth rates (%), 1999-2015

| Year | Point targets | Tolerance intervals | Effective headline inflation rates (IPCA) | Annual interest rate (Selic)1 | Annual real interest rate2 | Annual growth rate |

|---|---|---|---|---|---|---|

| 1999 | 8 | 6 to 10 | 8.94 | 19.0 | 9.2 | 0.3 |

| 2000 | 6 | 4 to 8 | 5.97 | 15.75 | 9.2 | 4.3 |

| 2001 | 4 | 2 to 6 | 7.67 | 19.0 | 8.5 | 1.3 |

| 2002 | 3.5 | 1.5 to 6.5 | 12.53 | 25.0 | 11.1 | 3.1 |

| 2003 | 4 | 1.5 to 6.5 | 9.3 | 16.5 | 6.6 | 1.3 |

| 20043 | 5.5 | 3.5 to 8 | 7.6 | 17.75 | 9.4 | 5.7 |

| 2005 | 4.5 | 2.5 to 7.5 | 5.69 | 18.0 | 11.6 | 3.1 |

| 2006 | 4.5 | 2.5 to 7.5 | 3.14 | 13.25 | 9.8 | 4.0 |

| 2007 | 4.5 | 2.5 to 6.5 | 4.46 | 11.25 | 6.5 | 6.0 |

| 2008 | 4.5 | 2.5 to 6.5 | 5.9 | 13.75 | 7.4 | 5.0 |

| 2009 | 4.5 | 2.5 to 6.5 | 4.31 | 8.75 | 4.3 | -0.2 |

| 2010 | 4.5 | 2.5 to 6.5 | 5.91 | 10.75 | 4.6 | 7.6 |

| 2011 | 4.5 | 2.5 to 6.5 | 6.5 | 11.0 | 4.2 | 3.9 |

| 2012 | 4.5 | 2.5 to 6.5 | 5.84 | 7.25 | 1.3 | 1.8 |

| 2013 | 4.5 | 2.5 to 6.5 | 5.91 | 10.0 | 3.9 | 2.7 |

| 2014 | 4.5 | 2.5 to 6.5 | 6.41 | 11.75 | 5.0 | 0.1 |

| 2015 | 4.5 | 2.5 to 6.5 | 10.67 | 14.25 | 3.2 | -3.8 |

Notes: 1/ End of period. 2/ Annual interest rate (Selic)/IPCA. 3/ The original inflation target for 2004 was 3.75% (with a tolerance interval of 2.5%). Subsequently, the BCB changed the inflation target to 5.5% and kept the ± 2.5% of tolerance interval.

Source: Author’s elaboration based on BCB (2016a).

Despite the modest results in terms of the effective inflation, monetary policy has been characteristically tight, placing Brazil in the ranking of countries with the highest interest rates in the world and causing serious constraint on economic growth, through the price of credit (loan rates) and entrepreneurs’ poor expectations.

In this sense, in the period 1999-2015, GDP has followed a stop-and-go pattern and its average growth rate hovered around 2.7% per year, significantly below the average growth rate of other emerging countries that have adopted an ITR (Arestis, Ferrari-Filho and Paula, 2011; Ferrari Filho and Schifino, 2010). However, by analysing the relationship between the interest rate and inflation, we can realize that this relationship is, at most, weak.

In addition to the depressive effects on economic activity, the ITR has led to several serious imbalances, in both the internal sphere and the external sector, as we will discuss in the following section.

3. Internal and external imbalances resulting from the Brazilian ITR

Starting with the internal imbalances, to understand why they stem from the implementation of the ITR, it is important to know that a peculiarity of the Brazilian macroeconomic policy is the link between the money market and public debt through the provision, by the National Treasury, of several public debt bonds (pre-fixed), paid both by the Selic interest rate and by certain price indexes. These bonds, it is worth noting, make up, at present, a significant portion of the domestic public debt in Brazil8.

Therefore, every time the Selic rate rises to curb inflation, there is a contagious effect on the public debt. This effect not only increases spending on interest payments, but also has implications on its growth, since a significant portion of the federal security debt is tied to the basic interest rate. As a result, since the debt stock has reached sufficiently high levels, further increases in interest are required as a risk premium, increasing the fiscal fragility of the Brazilian economy even more.

Some indicators of fiscal policy for the period 1999-2015 are presented in Table 2, which shows the primary result (total revenue minus total expenditure), the nominal result (the total government deficit, including interest and the monetary adjustment of the public debt), and the net debt of the public sector as a percentage of GDP.

Table 2 Indicators of public debt in Brazil, 1999-2015

| Year | Primary result | Nominal result | Net public debt |

|---|---|---|---|

| 1990 | 3.19 | -5.78 | 35.10 |

| 2000 | 3.46 | -3.61 | 36.50 |

| 2001 | 3.64 | -3.57 | 42.40 |

| 2002 | 3.22 | -4.58 | 44.70 |

| 2003 | 3.39 | -5.42 | 43.30 |

| 2004 | 3.50 | -3.61 | 42.63 |

| 2005 | 3.90 | -3.10 | 43.13 |

| 2006 | 3.29 | -3.78 | 46.30 |

| 2007 | 3.36 | -2.84 | 50.15 |

| 2008 | 3.63 | -2.08 | 49.76 |

| 2009 | 1.89 | -3.19 | 48.95 |

| 2010 | 2.20 | -2.82 | 48.06 |

| 2011 | 3.08 | -2.24 | 47.16 |

| 2012 | 2.52 | -2.40 | 46.18 |

| 2013 | 1.76 | -2.70 | 44.55 |

| 2014 | 0.94 | -3.82 | 44.67 |

| 2015 | -0.79 | -8.23 | 50.60 |

Source: Author’s elaboration based on BCB (2016a).

As can be seen in Table 2, during specific years, there is a close relationship between the public debt and Selic, growing in times when the interest rates remained at high levels, and vice versa. The first column of this Table shows the evolution of the primary result of the public sector. This result shows the amount of saving the government needs to have to meet the debt service and maintain its relatively stable trajectory. It is found that, in moments when interest rates are high (see Table 1), even high primary surpluses cannot stop the growth in debt.

Note also in Table 2 that, in 2015, primary surpluses were converted into deficits and the total deficit reached 8.2% of GDP, impacting the strong expansion of the stock of public debt, which reached a peak of 50.6% of GDP.

Among the main explanatory factors of this fiscal deterioration are: 1) The low growth of the Brazilian economy since 2011, which reduced revenues; 2) the strong increase in interest rates between 2012 and 2015; 3) the exchange rate depreciation, and 4) the increase in inflation. Given the pressure exerted on the public accounts, a strong fiscal adjustment began in 20159. which left the Brazilian economy in an even more dramatic situation, resulting in a drop of 3.8% in the GDP that year.

Regarding the imbalances that the ITR implies in the external sector, a key aspect to highlight is the effects of internal-external interest rate differentials on the level of the exchange rate, which maintained a steady real appreciation trajectory, notably between 2003 and 201010.

This fact contributed to keeping inflation relatively low in this phase, given the downward pressure on domestic prices. However, this process has brought negative consequences for the Brazilian economy, of which the following can be mentioned: 1) a severe deterioration of the current account balance; 2) a change in the trade balance composition, whose balance became highly dependent on primary products, and 3) a sharp drop in the relative share of the manufacturing industry in GDP.

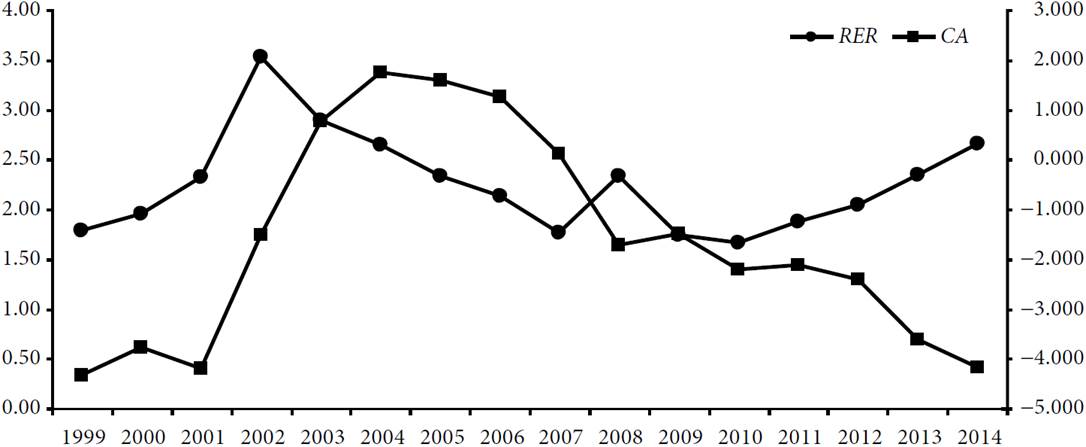

With respect to the effects on the current account balance, its evolution, in parallel with the behaviour of the real effective exchange rate, can be observed in Figure 1. It can be noted that the strong appreciation of the exchange rate was associated with a significant worsening of the current account, notably between 2003 and 2010.

Note: Current account balance on the right axis.

Source: Author’s elaboration based on BCB (2016b).

Figure 1 Current account balance (% of GDP) and real effective exchange rate, 1999-2015

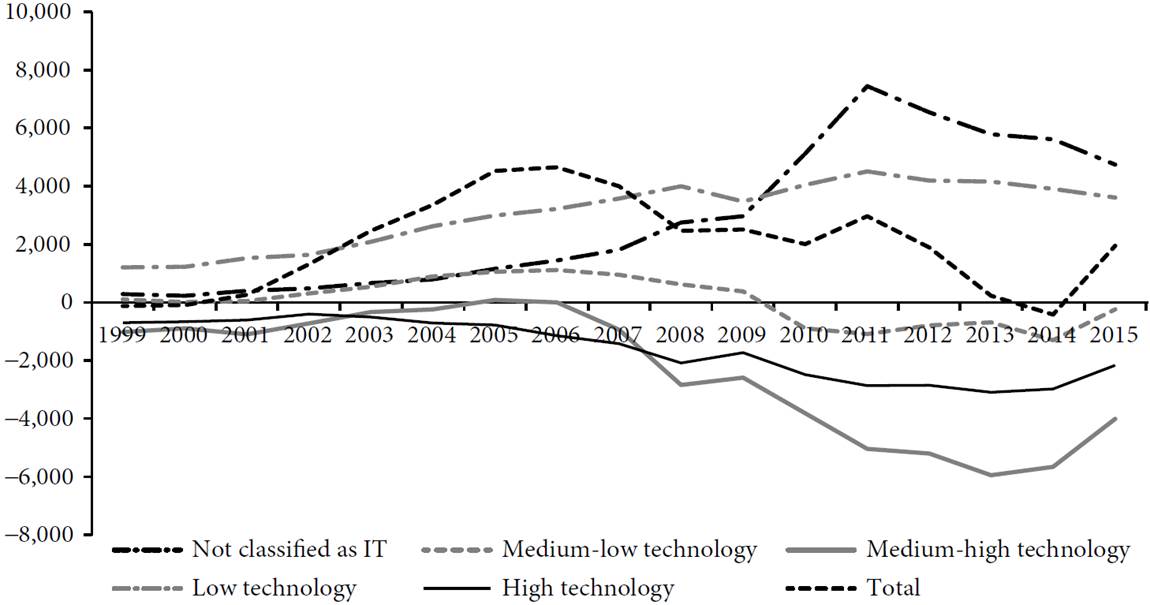

As for the composition of the trade balance, which can be considered an important indicator of the competitiveness of an economy, Brazil’s exports have concentrated in commodities and lower value-added goods (see Figure 2). As is commonly known, the dependence of the economy on the price trajectory of primary commodities and low-tech products is a problem because these are products whose prices and export volume are more sensitive to changes in the international environment. This sensitivity ends up increasing the external vulnerability of the country, especially in times when international liquidity cycles are reversed. Finally, with regard to the negative effects on the manufacturing industry, the real exchange rate appreciation that began in 1994 was associated with a structural change in the composition of national production, resulting in an extreme loss of the industry’s share in the total economy11.

Source: Author’s elaboration based on MDIC (2016).

Figure 2 Trade balance by technological intensity (millions of US dollars), 1999-2015

This significant decrease in the relative share of the industry in GDP signals the occurrence of a process of premature de-industrialization in the period after the liberalization of trade and after the Real Plan. This fact has been a major criticism of the model adopted by the Brazilian economy in the 1990s, which has the ITR as one of its central pillars12.

In the following section, an empirical analysis will be carried out to investigate the effects of the implementation of the institutional framework of monetary policy on the performance of the Brazilian economy.

4. Empirical research on the effects of monetary shocks

This section tests the hypothesis that monetary institutions played a central role in this process, especially after the adoption of the ITR in 1999. As already stated, after the adoption of the ITR, increasing the Selic rate became the main tool to fight inflation, having, however, considerable negative effects on the economy.

Hence, what we seek to investigate is how monetary shocks, represented by changes in the Selic rate, affected the Variables central to the economic performance in Brazil. Specifically, the intention is to measure the effects of a rise in the Selic rate on prices, which is the main objective of monetary policy, and its adverse effects on: 1) the GDP growth rate; 2) the real appreciation of the domestic currency, and 3) the trajectory of spending on the public debt service.

The methodology employed is Vector Autoregression (VAR)13. The variables used in the econometric analysis are as follows: Effective Selic (annualized); IPCA; y is the physical production index (quantum) of general industry (seasonally adjusted); RER is the real effective exchange rate, and Debt is the internal federal security debt as a proportion of GDP.

The Selic rate is provided by the BCB, the real effective exchange rate is obtained from Ipeadata (2016), the industrial production index, the GDP and the IPCA are calculated by IBGE (2016a), and the stock of internal federal security debt is provided by the National Treasury. The debt/GDP ratio was calculated by the authors and all the variables are used in logarithmic scale.

The period under analysis begins in January 2002 and ends in December 2015. The aim was to capture the period from the beginning of the ITR implementation, that is, June 1999. However, due to the fact that the industrial production series used started only in 2002, the period could not be altered.

In the estimated VAR model we used the difference of the logarithm of the series -a concept equivalent to the growth rate- to analyse the dynamic interactions between the Variables; the Selic is the variable representing the monetary policy, the industrial production index represents the economic activity14, RER reveals the changes in the Brazilian exchange rate against its main trading partners, and Debt is the fiscal policy variable.

The choice of the VAR model with the Variables in first difference is justified by the fact that all series used are I(1), but do not have a cointegration relationship. Tables A1 and A2 show the results of the Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) tests for the Variables in level and in first difference. They indicate that the series are not stationary in level but stationary at first difference and therefore integrated of first order, I(1).

Thus, the model uses the Cholesky identification and the structural VAR as a tool to identify the effects of monetary shocks on the model’s Variables. In the first method, the order was: y, IPCA, Selic, RER and Debt15. In the second, only the contemporary relationships of the Selic and the IPCA in public debt were maintained, given the indexing. Regarding the other possible contemporary relationships, it is believed that, with monthly data, they are quite remote.

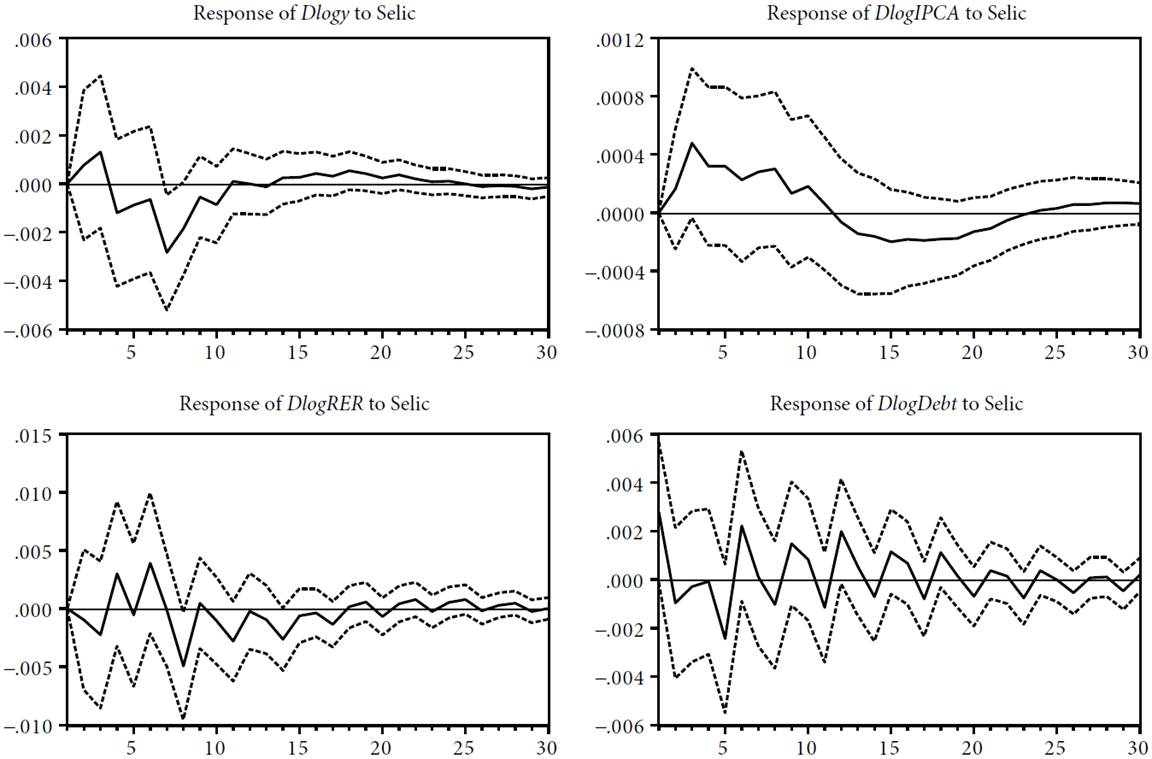

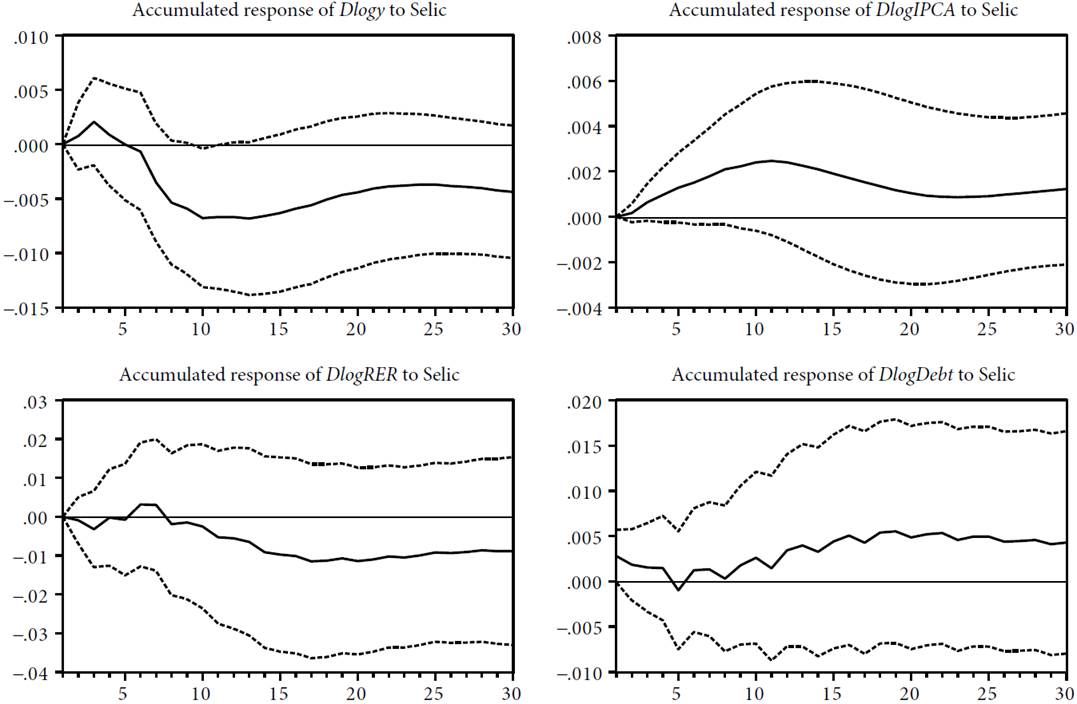

Regarding the chosen model, it can be highlighted that the results of these two methodologies pointed out that the behavioural patterns are very similar to the relationship between the Variables studied, but we have decided to present the results of the structural VAR because we consider this to be a more realistic contemporary ordering. The results of a monetary policy shock can be seen in Figure 3 and Figure 4.

Note: estimated with 3 lags.

Source: Authors’ elaboration from the research data.

Figure 3 Effects of monetary shocks. Response to structural one S.D. innovations ± 2 S.E.

Note: estimated with 3 lags.

Source: Authors’ elaboration from the research data.

Figure 4 Effects of cumulative monetary shocks. Response to structural one S.D. innovations ± 2 S.E.

As for the effects of a rise in interest rates on industrial production, used here as a proxy for GDP, there is a clearly negative effect that is felt from the third month on and is reversed only after twelve months. The explanation for this is that an increase in interest rates discourages private investments, cools the economy and implies lower rates of economic growth.

As the series are stationary, the effects of a shock in the Selic on the industrial production start to dissipate after one year (see Figure 3). But when the shocks are accumulated (see Figure 4), the sum of the effects are clearly negative, so that a positive shock in interest rates leads to lower economic performance, represented here by the fall in the growth rates of industrial production.

As to the effects of a rise of the Selic on inflation, it is known that under ITR the aim of the BCB is to keep inflation within the established target. In this sense, it adjusts the monetary policy instrument, that is, the Selic rate, so that actual inflation converges toward the long-term inflation target. As observed in Figure 4, a shock in the Selic initially leads to an increase in prices, which only fall after ten months.

Several authors that have analysed the effect of interest on prices in Brazil found the initial impact positive (Modenesi and Araújo, 2013; Luporini, 2008). Although the mainstream authors (Christiano, Eichenbaum and Evans, 1996; Sims and Zha, 1998) stress the occurrence of this unexpected effect as problems in the functional specification of the BCB’s reaction function, especially due to the omission of Variables, others (Palley, 1996; Arestis, 1992) justify this by the rise in production costs resulting from an increase in interest rates, which are quickly transmitted to the prices, thus explaining the positive effects of an increase in interest rates on prices. However, after the first months, the increase in interest rates contributes to the reduction in inflation, as assumed by the ITR.

Concerning the effects of a Selic rate rise on the exchange rate, in an environment where financial openness implied liberalization of the capital account and left the country subject to fluctuations in capital flows, the rise in interest rates promotes a capital inflow and contributes to the real appreciation of the exchange rate, making Brazilian products more expensive than external ones.

Figure 3 shows an initially negative response in the exchange rate when faced with an increase in the Selic rate, followed by cyclical movements in the exchange rate. The cumulative effect of a shock in the Selic on the exchange rate is negative, as shown in Figure 4. Thus, increases in the Selic contribute to the real appreciation of the exchange rate, a fact which have important effects on the long-term growth, especially in emerging and developing economies, as many authors have pointed out16.

Finally, in relation to the effects of a monetary shock on public debt, the monetary authority affects fiscal policy because the increase in the Selic rate increases the payment of debt interest, implying the need to increase the primary surplus to keep the debt/GDP ratio. On the other hand, a rise in the Selic rate may imply a reverse wealth effect. This is because, as a significant part of public debt bonds are indexed to Selic, a rise in interest rates increases the financial wealth of the agents holding these bonds, which may end up stimulating the consumption of this group17.

Figures 3 and 4 show the negative effects on the economy of a rise in interest rates on the debt ratio securities/GDP: Given an increase in the Selic rate, the public debt rises (see Figure 4), despite the cyclical results arising from a non-cumulative shock in the Selic rate (see Figure 3).

These results provide important insights for the analysis of the effects of monetary shocks in Brazil. For this reason, it is possible to highlight two central points: One concerns the functional problem of the transmission mechanisms of monetary policy and the other concerns the causes of inflation in Brazil, which jointly contribute to a reduced effectiveness of monetary policy.

Considering the first point, that is, the existence of failures in the functioning of the monetary policy transmission mechanisms, several authors (Modenesi and Araújo, 2013; Carvalho, 2005; Souza Sobrinho, 2003; Carneiro, Salles and Wu, 2006) have pointed out that the existence of problems in these mechanisms implies the need for higher interest rates to contain rising prices.

The first problem, as already stated, is the significant share of public debt bonds indexed to the Selic rate in the federal security debt. Contrary to what advocates of the transmission mechanism of monetary policy argue -according to which the increase in interest rates reduces the market price of securities and makes the holders of such assets poorer-, the public debt bonds indexed to the Selic, the so-called Financial Treasury Bills (LFTs), are characterized by the ineffectiveness of such mechanisms. This is because the increase in the Selic rate raises the income of LFT holders, which eliminates the negative impact of the interest rate on the price of securities and the wealth of its holders18.

Another problem that leads to the poor functioning of the transmission mechanisms of monetary policy arises from the structure and functioning of the Brazilian banking system. This is due to the obstruction of the interest rate channel and the credit channel. Carvalho (2005), for example, stresses that the absence of longer segments of financing in the Brazilian credit market, whose main focus is on short-term credit, implies that the stimuli generated by monetary policy are not transmitted to these segments, such as investment financing. Souza Sobrinho (2003) and Carneiro, Salles and Wu (2006) reject the effectiveness of the credit chanel transmission mechanism on empirical grounds, due to reduced depth of the Brazilian financial system and the high share of directed credit in the total credit granted.

Another aspect that limits the functioning of the transmission mechanisms of monetary policy is the existence of regulated prices (for instance, telecommunication and eletric energy services). Sicsú and Oliveira (2003), for example, suggest that regulated prices are rather insensitive to the conditions of supply and demand because they are established by contract or government agency and do not react to the monetary policy. Since approximately 28.0% of the IPCA consists of regulated prices, monetary policy needs to be even more contractionary in orden to meet the inflation target, considering that this portion of prices does not respond to changes in interest rates.

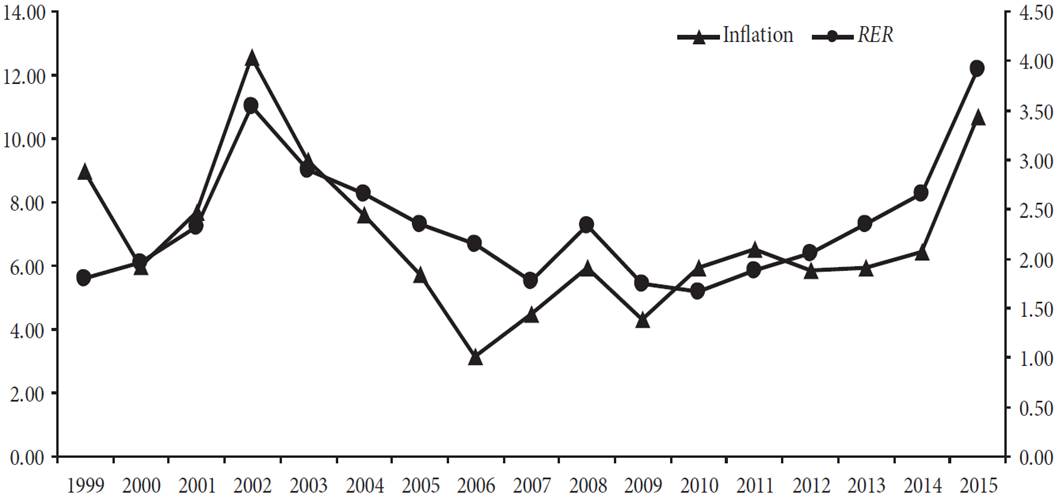

Finally, it is worth highlighting the importance of the real exchange rate to affect the price levels. Several authors, including Belaisch (2003), Minella et al. (2003) and Carneiro, Salles and Wu (2006), have, in fact, presented estimates of the exchange rate pass-through coefficient for the Brazilian economy. An increase or decrease in interest rates results in Variations in the entry and exit of foreign capital, causing a real exchange rate depreciation when the inflow of capital is reduced and a real appreciation when the inflow of capital is higher. This, in turn, significantly impacts inflation (see Figure 5).

Note: Exchange rate is on the right axis.

Source: Author’s elaboration based on BCB (2016a).

Figure 5 Relationship between exchange rate and inflation, 1999-2015

In addition to the direct effects of exchange rate variation on the price of tradable goods, there is also the indirect effect on the domestic prices, that being in the form of a variation in the cost of imported raw materials and inputs and the substitution effect of domestic products for similar imports, or vice-versa.

From these direct and indirect ways, the final result of a Variation in the exchange rate is expressed in the rate of inflation. In Brazil, between 2004 and 2008, for example, there was a tendency toward exchange rate appreciation due to the increase in large net short-term capital inflows and improvement in the terms of trade, as empirically shown by Nassif, Feijó and Araújo (2017). Although contributing to price control by means of an increase in competition with domestic products given the cheap imports, this appreciation proved harmful to some sectors of the economy as it increased external vulnerability, discouraged exports and generated deficits in the trade balance and the current account balances. The result was an increase in the fragility of the economy which left the country susceptible to exchange rate crises.

From 2008 on, although reversing in some moments, the exchange rate followed a trajectory of depreciation, accompanied by a rise in the inflation rate. Figure 5 illustrates the relationship between the exchange rate and the inflation rate in Brazil. The evidence shows that an appreciation in the exchange rate contributes to a reduction in inflation, whereas an exchange rate depreciation has been accompanied by rises in the rate of inflation. This indicates that the exchange rate has been a central mechanism in the transmission of monetary policy in Brazil.

The conclusion regarding the transmission of monetary policy in Brazil is, therefore, that changes in monetary policy are not fully transmitted because of problems in the transmission mechanisms of asset prices, interest rates and credit. This ends up making the monetary policy effects highly dependent on the exchange rate level.

Regarding the relevant causes of domestic inflation under the ITR, the basic assumption is that inflation is essentially a monetary phenomenon. This considers only demand inflation, which should be combated by raising interest rates, the main instrument of monetary policy. In this light, the strictly non-monetary causes of inflation, such as changing expectations, an inertia phenomenon and a shock in costs, are neglected. This clearly seems to be the case of the Brazilian economy.

An alternative analysis of the causes of inflation, however, can be found in Lavoie (1992), Davidson (1994) and Sicsú (2003). They offer a more comprehensive explanation of the causes of rising prices, such as the decision-making process of the leading price setters, the market structure, interest rate, exchange rate, and wages. In these cases, the inflationary process usually originates in the supply side, regardless of the conditions of demand and the level of employment.

Although the contractionary monetary policy, via increases in interest rates, may be effective in reducing inflation that originates from supply shocks, it ends up attacking the effects of inflation and not its causes. To attack its causes would require the adoption of active economic policies, such as, tax policy, directed monetary policy and exchange rate policy, among others.

A suitable procedure, according to this alternative approach to the causes of inflation, would be to identify what the real cause of inflation is in each moment and to act with anti-inflationary measures commensurate with their different causes. This is because the use of contractionary monetary policy to contain an inflationary process originating in the supply side does not contribute to eliminating the cause of the problem. By reducing the inflationary phenomenon to purely demand inflation, the ITR may, therefore, compromise economic performance, generating an excessive rise in interest rates, which greatly affects output and employment.

In this regard, Modenesi and Araújo (2013) show that the sensitivity of inflation to interest rates is low19. Through the estimation of a VAR model, they conclude that an increase in the Selic rate has a reduced deflationary impact. Thus, the BCB would need to keep it at levels excessively high to have inflation targets minimally met. The effect of a Selic rise on the level of activity is clearly negative: The economy slows down. It is here that the authors identify a problem in the transmission mechanism: An increase in interest rates contracts aggregate demand; however, the economic slowdown is not fully transmitted to the prices. That is, the cooling of inflation is disproportionately less than the fall in economic activity.

In line with this analysis, the conclusion that can be drawn on the effects of monetary shocks in Brazil is that the problems related to the transmission of monetary policy, as well as the inflation diagnosis that is restricted to demand shocks, lead to a loss in the effectiveness of this policy under the ITR.

5. Concluding remarks

This article analysed the relationship between monetary institutions and macroeconomic performance in Brazil, under the hypothesis that monetary policy has been ineffective with respect to controlling inflation, and at the same time has generated high costs for the Brazilian economy.

With respect to the performance of the Brazilian economy since the adoption of the ITR, we can conclude that: 1) inflation still remains at relatively high levels compared to international levels; 2) interest rates have registered extremely high levels, and 3) economic growth has been low and unstable, while the real exchange rate has followed a tendency toward appreciation. In addition, the economy presented a tendency to expand internal and external imbalances, represented respectively by the deterioration of both public accounts and balance of payments accounts.

One explanation for these results is that the monetary institutions have been less effective in achieving inflationary stability and, above all, economic growth. The fundamental question discussed was that the ineffectiveness of price stability in Brazil has two main causes, namely, the existence of failures in the transmission mechanisms of monetary policy, and the diagnosis of inflation not always being correct, given that the ITR assumes that it is always a phenomenon of excess demand and that the interest rate must rise against these shocks so that inflation converges to the set target.

On the first point, the analysis pointed out that the changes in the Brazilian monetary policy are not fully transmitted to output and prices because there are problems in their transmission mechanisms relative to asset prices, interest rates and credit. This implies that, for the policy to take effect, the interest rate levels need to be higher and the exchange rate level, which is the main transmission channel of monetary policy in the country, has to be at lower (appreciated) levels.

With respect to inflation being normally misdiagnosed, it is possible to cite several other determinants of inflation. These are the decision-making process of the leading price setters, market structure, a certain rigidity of prices, interest rates, exchange rates and wages. In these cases, although the contractionary monetary policy, via increases in interest rates, may be effective in reducing inflation that originates from supply shocks, it ends up attacking the effects of inflation and not its causes.

In view of the foregoing, the main observation that can be made is that, since the Brazilian monetary institutions have harmed macroeconomic performance, and at the same time been ineffective in controlling inflation, a redesign of these institutions is essential for the resumption of economic growth.

Among the redesign suggestions for the monetary institutions, which in our view could help improve the results of effective inflation and economic performance, is the adoption of a more flexible version of the ITR, in which the objective of price stability is accompanied by a commitment to maintain the stability of output. This is indeed the case in some countries that have adopted this type of regime, for example, Australia and Canada.

Other flexible versions of the ITR could be the adoption of a broader period of convergence for the set inflation targets, for example, to eighteen and twenty-four months, and the use of a core inflation measure that captures the tendency of prices and disregards disturbances resulting from temporary shocks captured through the use of the indexation process. All these changes, without harming stability, could be more appropriate for a developing economy like Brazil.

In addition to economic growth, some authors, like Yellen (2014), suggest that monetary policy can have exchange rate stability as one of its goals. The empirical evidence presented in this research showed that exchange rate had a tendency to appreciate and, despite its benefits for controlling prices, the exchange rate appreciation implied deficits in the current account balance of payments and contributed to the strong tendency to “reprimarization” of the export basket and the premature de-industrialization that is taking place in the Brazilian economy. In this sense, the adoption of measures that allow the management of the exchange rate and that lead this variable to more appropriate levels of economic growth would be essential and would encompass the reduction of the interest rate, the purchase of international reserves and the adoption of measures of capital controls.

One last suggestion would be to work on the problems that involve failures in the transmission mechanisms of monetary policy in Brazil, highlighting here the question of price indexation. As mentioned earlier, the indexation is still an important component of Brazilian prices, either because a large part of the administered prices is corrected according to an indexation rule, or because a significant portion of the public debt bonds are indexed to the interest rate which is the instrument of monetary policy.

In light of this, it is important that some measures are taken to reverse the inflationary inertia. Such measures can include changes in the composition of the public debt, prioritizing fixed-income securities to the detriment of indexed, and having the Brazilian government endeavour to adopt measures involving de-indexation of public taxes and regulated prices of the economy.

nueva página del texto (beta)

nueva página del texto (beta)