1. Introduction: the great stagnation and the emergence of NIRP

In the wake of the 2009 Great Recession and ensuing Great Stagnation, many central banks embraced the idea of setting negative interest rates by charging commercial banks for reserves placed on deposit with the central bank. The list of central banks that adopted this policy includes the Bank of Japan, the European Central Bank, the Swiss National Bank, the Swedish Riksbank, and the Danish Central Bank.

The embrace of negative interest rate policy (NIRP) has been supported by most mainstream macroeconomists and NIRP has now become part of consensus mainstream macroeconomic policy. In a December 2015 interview, former Federal Reserve Chairman Ben Bernanke said the Federal Reserve was likely to add negative interest rates as a policy tool. In March 2016 Bernanke followed that up with an extended Brookings Institution blog on the tools central banks have to fight slow growth, beginning with negative interest rates. In February 2016 testimony before the US House of Representatives, Federal Reserve Chairwoman Janet Yellen stated negatives were still on the policy table. And in April 2016 the International Monetary Fund (IMF) jumped on to the negative interest rate bandwagon when Managing Director Lagarde declared they are a net positive to the global economy, a position that was strongly echoed by IMF financial counsellor Jose Vinals in a briefing at the IMF 2016 spring meetings and in an IMF blog posting (Vinals, Gray, and Eckhold, 2016).

This paper explores the new NIRP consensus and argues it is profoundly wrong. The new consensus embodies both flawed theory and flawed policy. At the theoretical level, it mistakenly believes in the classical natural rate of interest (NRI) doctrine, which claims there exists a real interest rate that delivers full employment. That theoretical belief has been supplemented by zero lower bound (ZLB) economics (Eggertsson and Krugman, 2012), which adds the twist that the NRI may be negative and out of reach of market forces. That justifies the recommendation that central banks set negative rates via NIRP.

At the policy level, the new consensus embodies two failures. First, negative interest rates may be counter-productive regarding their impact on aggregate demand (AD). Second, NIRP continues and actively encourages the debt-led asset price inflation model of economic growth that has caused so much trouble. Not only will NIRP not solve the problems posed by stagnation, it risks aggravating them.

2. The “modern” theory behind NIRP: the NRI and the ZLB

NIRP represents both a continuation and extension of the theoretical thinking that has shaped macroeconomic policy over the past thirty-five years. The continuation reflects the focus on interest rates as the critical tool for stabilizing the economy and ensuring full employment. The extension reflects the embrace of negative interest rates; which policy must deliver in times of low inflation with demand shortage because the market cannot do so owing to the zero lower bound (ZLB) to nominal interest rates.

On the surface, NIRP appears revolutionary. However, its analytical justification rests on pre-Keynesian macroeconomic thinking that regained ascendancy in the 1970s2. That thinking was celebrated in the notion of the “Great Moderation” (1980-2007) which prevailed prior to the financial crisis of 2008. The claim was macroeconomic performance, as measured by inflation and the frequency and depth of recessions, greatly improved after 1980 owing to improvements in the conduct of monetary policy.

a) Stage 1: Revival of the NIRP

According to Great Moderation believers, the improvement rested on policy developments informed by improved theory. First, at the theoretical level, there was a restoration of pre-Keynesian classical macroeconomic ideas which described the economy as stable and self-adjusting relatively quickly back to full employment in response to economic disturbances. According to classical macroeconomics, the real interest rate is the critical macroeconomic price that clears the loanable funds market, ensuring full employment saving equals full employment investment. Second, at the policy level there was a shift to low inflation targeting conducted via independent central banks using clear credible interest rate rules. Policy identified an inflation target, and then set a nominal interest rate consistent with the inflation target and the full employment loanable funds real interest rate (i.e. the NRI).

Anytime the economy got into trouble, monetary policy engineered a lower nominal interest rate, which lowered the real interest rate given an unchanged inflation target. That stimulated investment and lowered saving. Moreover, to the extent that lower interest rates increased asset prices, that was also beneficial since higher asset prices encourage consumption which lowers saving, and they also encourage investment.

This policy response was adopted in the recessions of 1991-1992 and 2001-2002. It also constituted the immediate response to the financial crisis of 2007-2008, the belief and hope being that lower rates would quickly reflate asset prices and stimulate demand.

b) Stage 2: The ZLB

NIRP began to enter the picture when the policy interest rate was pushed to zero -hitting the so-called ZLB. Initially, hitting the ZLB prompted central banks to engage in quantitative easing (QE), which involves purchasing longer-dated bonds3. When that failed to adequately stimulate the economy, NIRP became the next policy of choice based on simple extrapolative logic: If lower interest rates stimulate AD, then lowering rates into negative territory should do the same.

The justification for NIRP has been significantly assisted by the claim that the ZLB explains the stagnation that set in after the Great Recession of 2007-2009 (Eggertsson and Krugman, 2012). The ZLB hypothesis of stagnation was originated by Krugman (1998) to explain Japan’s stagnation after the collapse of its asset price bubble in 1991. Now, the story has been modified in an attempt to explain stagnation in the United States.

The story is that after the financial crisis, US households decided to repair their balance sheets by deleveraging and paying down debt. That caused an increase in the full employment supply of saving (loanable funds), necessitating a fall in the real interest rate to equilibrate the loanable funds market. However, that was blocked off by the ZLB. The resulting excess supply in the loanable funds market then compelled a contraction of employment and output, to balance the goods market.

The ZLB theory of stagnation is illustrated in Figure 1 4. The left-hand panel shows loanable funds market in which saving and investment are equilibrated via adjustment of the interest rate. The economy is initially at full employment equilibrium with an interest rate of r 0, which constitutes the “natural rate of interest” (NRI) as determined by initial economic conditions5. Given an exogenous inflation rate (π), the nominal interest rate is i 0 = r 0 + π.

The ZLB explanation of the stagnation holds that the equilibrium was disturbed by a deleveraging shock that increased saving and shifted the saving function (i.e. the supply of loanable funds) to the right, as shown in the left-hand panel of Figure 1. Maintaining balance between full employment saving and full employment investment required a negative real interest rate of r 1, but that was blocked of by the ZLB.

The middle panel shows the goods market in which aggregate demand (AD 0) initially equals full employment aggregate supply (y*) at the real interest rate of r 0. The deleveraging shock increases saving and shifts the AD function down (AD 1), requiring a negative real NRI of r 1 to clear the goods market. That is blocked off by the ZLB, leaving the economy with demand shortage and excess supply6. The excess supply of saving and output in turn trigger a contraction of output, which is illustrated in the middle panel by a shift along the new AD schedule. Output and income contract until the level of output is equal to the level of AD, given the new real interest rate (r 2 = -π).

The right hand panel shows the parallel adjustment process in loanable funds market adjustment. The fall in output from y* to y 2 reduces income, causing the saving function to shift left (S 2) and saving to fall. It also causes the investment function to shift left (I 2) and investment to fall. The contraction of output continues until saving and investment are brought back into balance at the real interest rate of r 2.

c) Assessing the ZLB story

There are several features to note about the ZLB story. First, the ZLB is the cause of unemployment and stagnation as it prevents the nominal interest rate from falling, thereby blocking the real interest rate from falling to the NRI.

Second, the underlying economic belief is that a lower real interest rate can always solve the problem of aggregate demand shortage. It is assumed to do so by increasing investment demand and reducing saving.

Third, the core economic theory behind the ZLB story derives from pre-Keynesian classical macroeconomics. At the center of classical macroeconomics is the loanable funds theory of interest rates, according to which saving and investment are coordinated via adjustment of the real interest rate, thereby delivering full employment. The real interest rate (i.e. the loanable funds rate) is the critical mechanism, and it adjusts to ensure full employment saving equals full employment investment demand -or equivalently, that aggregate demand equals full employment aggregate supply. In New Keynesian models, this classical interest rate adjustment mechanism is managed by the central bank via its nominal interest policy. The central bank sets the nominal interest rate aiming to target an inflation rate consistent with its belief regarding the NRI required for clearing the loanable funds market7.

Fourth, though the core theory derives from classical macroeconomics, the economy can appear Keynesian because output adjusts when the real interest rate cannot. In normal times, the real interest rate adjusts to balance full employment saving and full employment investment to ensure AD equals full employment aggregate supply (AS). However, when the real interest rate cannot adjust (as at the ZLB), output does the adjusting to align as with AD. That gives the economy its Keynesian look.

Fifth, there are two policy solutions to the problem as diagnosed by ZLB economics. Solution number one is for the monetary authority to drive up inflation expectations. Since the real interest rate is equal to the nominal interest rate (which is stuck at zero) minus expected inflation, a higher expected inflation rate lowers the real interest rate. However, that is easier said than done as inflation expectations appear to be determined by expectations of real economic conditions rather than pronouncements by the monetary authority.

Solution number two is for the monetary authority to set a negative nominal interest rate. In principle, it can do this directly by setting its own lending rate below zero, or alternatively it can adopt non-standard tools such as charging commercial banks for their deposits with the central bank. Either way, according to the reasoning embodied in ZLB economics that should solve the problem of demand shortage.

3. New Keynesians have forgotten Keynes’ message that interest rates may not solve demand shortage

The ZLB hypothesis has now become received wisdom regarding stagnation, and it has significantly informed policy discussion over negative interest rates. ZLB economics is a mix of classical and Neo-Keynesian (sometimes called bastard Keynesian) economics. The classical dimension concerns its thinking about interest rates and their role in the economy. The Neo-Keynesian dimension is the belief that a rigidity (i.e. the ZLB) prevents market economies from automatically self-adjusting to full employment. Both aspects of ZLB economics are wrong.

Keynes’ (1936)General Theory fundamentally challenged classical macroeconomics and its theory of interest rates. The challenge was directed at both the theory of interest rate determination and the theory of interest rate effectiveness.

First, Keynes challenged the classical claim that interest rates are determined by the supply (saving) and demand (investment) for loanable funds, thereby equilibrating goods market AD and as. According to Keynesian economics, the loanable funds market is a fiction that does not exist, so interest rates cannot be determined in this way. Instead, Keynes proposed that interest rates were determined according to his liquidity preference theory. Asset prices and interest rates adjust to ensure asset demands (including the demand for money) equal asset supplies.

Second, Keynes argued that AD and as are primarily equalized via output adjustment, rather than interest rate adjustment. That is Keynes famous theory of demand-determined output. If AD exceeds AS, output expands until AD and as are equal: If AD is less than as, output contracts until AS and AD are equal. According to Keynesian economics, it is the level output (i.e. income) that adjusts to equilibrate the goods market, not the interest rate. Of course, interest rates may be affected as output adjusts owing to the impact of changing income on portfolio demands for financial assets, but that interest rate impact is a secondary induced income effect. The Keynesian construction of the economy is therefore completely different from the classical construction.

Third, for Keynesians, it is possible that saving and investment may not respond to lower interest rates as assumed by classical macroeconomics and modern-day ZLB economics. In effect, the Keynesian concern is with “interest rate sensitivity of AD”, which is fundamentally different from the ZLB concern with “nominal interest rate rigidity”. Most importantly, the Keynesian “sensitivity” argument potentially demolishes the classical NRI doctrine since there may not exist an interest rate that can deliver full employment.

4. Interest rate ineffectiveness: the NRI, the ZLB and NIRP reconsidered

The issue of interest rate ineffectiveness is critical to assessing the ZLB explanation of stagnation and the debate over NIRP. Figure 2 depicts the competing theoretical positions regarding interest rate ineffectiveness. The debate is divided between arguments that identify nominal interest rate rigidity as the problem versus arguments that identify the interest rate insensitivity of AD as the problem.

The Neo-Keynesians made arguments on both sides of the debate but, as argued below, their arguments regarding the interest rate insensitivity were not adequate. With regard to nominal interest rate rigidity, the Neo-Keynesians emphasized the liquidity trap (Keynes, 1936, p. 207), captured by the notion of a horizontal LM schedule in Hicks’ (1937) IS-LM exposition of The General Theory. In the liquidity trap, the interest rate has fallen to a level such that it can fall no further because “everyone prefers cash to holding a debt which yields so low a rate of interest” (Keynes, 1936, p. 207). However, Keynes’ dismissed the liquidity trap as an esoteric irrelevancy. Instead, he argued for the potential importance of interest rate floors owing to costs of financial intermediation and default risk which require lenders to charge a rate “over and above the pure rate of interest” (Keynes, 1936, p. 208).

ZLB economics is also a nominal interest rate rigidity argument, and it blends with the arguments of both Keynes and the Neo-Keynesians. First, rather than identifying intermediation costs as the source of the interest rate floor, ZLB economics attributes the floor to the pure rate of interest and the existence of money which pays zero interest.

Second, ZLB economics misleadingly calls this floor a liquidity trap (Palley, 2000). Doing so gives ZLB economics a rhetorical edge that helps it masquerade as being Keynesian in spirit. However, the ZLB is not the same as the liquidity trap. In the liquidity trap expansionary open market operations cannot affect asset prices and interest rates, making QE is ineffective. However, QE has been shown to have effects at the ZLB on asset prices, proving the ZLB is not synonymous with the liquidity trap.

Third, ZLB economics connects with Neo-Keynesian economics by asserting the macroeconomic problem is a “rigidity” that blocks lower nominal interest rates. Thus, the ZLB serves as a new nominal rigidity for explaining unemployment, supplementing existing Neo-Keynesian explanations built on price and nominal wage rigidity.

The right-hand side of Figure 2 shows interest insensitivity of AD as the other side of the debate. If AD is interest insensitive, lowering the nominal interest rate has no impact on employment and output, rendering the issue of nominal interest rate rigidity irrelevant for explaining unemployment. Furthermore, there may be no interest rate capable of delivering full employment (i.e. no NRI).

Neo-Keynesians captured this possibility via a vertical IS schedule, which was justified by the claim of zero interest elasticity of investment demand. They argued full employment could be blocked off because either the LM was horizontal due to the liquidity trap, or because the IS was vertical due to the interest insensitivity of investment demand. The Neo-Keynesians therefore invoked both interest rate rigidity and interest rate ineffectiveness. However, and important and faulty feature of their thinking was to separate investment demand (interest rate insensitivity of the vertical IS) and money demand (interest rate rigidity of the horizontal LM). In contrast, as argued next, Keynes (1936) had a unified theory in which investment demand and money demand interacted and were two sides of a common argument. That unified argument can be labelled the “investment saturation hypothesis”.

5. A new interpretation of Keynes’ thinking about interest rate ineffectiveness

Neo-Keynesians argued lower interest rates would not solve the AD shortage problem if investment was interest insensitive. However, the microeconomics of that argument were never properly worked out. Instead, the issue was finessed by claims that investment demand was exclusively dependent on entrepreneurs’ animal spirits and the level of output (or capacity utilization), and animal spirits are unresponsive to interest rates.

An unfortunate implication of the Neo-Keynesian framing of the investment shortage problem was it squeezed money out of the picture, making it look as if the investment function was the source of the problem and money had nothing to do with it8. That Neo-Keynesian characterization of the investment function failed to capture Keynes’ (1936) rich approach to capital accumulation which saw investment (i.e. real capital accumulation) as competing for a place in wealth portfolios, with marginal allocations depending on marginal returns.

Keynes’ view of accumulation is developed in Chapter 17 (1936, pp. 225-229) and it puts non-reproduced assets (NRAs), which include money, at the center of capital accumulation decision. NRAs consist of money, real estate, precious metals and precious minerals, works of art, patents and copyrights, rent streams generated by firms with market power. New capital (i.e. investment) must compete with NRAs for a place in portfolios. That competition links investment demand, money demand, and demand for NRAs.

The possibility that investment could be displaced by NRAs with higher returns was identified by Keynes (1936, pp. 225-236) in a cryptic section on commodity rates of interest in Chapter 17 of The General Theory:

Our conclusion can be stated in the most general form (taking the propensity to consume as given) as follows. No further increase in the rate of investment is possible when the greatest among the own-rates of own-interest of all available assets is equal to the greatest amongst the marginal efficiencies of all assets, measured in terms of the asset whose own-rate of own-interest is greatest.

In a position of full employment this condition is necessarily satisfied. But it may be satisfied before full employment is reached, if there exists some asset, having zero (or relatively small) elasticities of production and substitution, whose rate of interest declines more slowly as output increases, than the marginal efficiencies of capital-assets measured in terms of it (Keynes, 1936, p. 236).

One reason why Keynes’ portfolio analysis of investment may have gotten over-looked by post-war Keynesians is that it was developed rather obscurely in Chapter 17. A second reason is Keynes’ use of the term “entrepreneur”, which conflates the firm and the individual agent. Instead, it is best to talk about the firm as the locus of investment activity. Firms can be considered as real sector multi-input multi-output financial intermediaries. They take finance from different sources and use that finance to hold different types of assets that produce different returns, and this multi-input multi-output choice has analogies with portfolio decision making.

When framed in this way, it explains why negative nominal interest rates may not alleviate the problem of aggregate demand shortage. The reason is once the marginal efficiency of investment (MEI) hits zero, firms will prefer to use additional finance to acquire NRAs whose marginal return is still positive. Consequently, the ZLB floor is not the problem. Instead the problem is the existence of NRAs, including money.

Money is a distinct type of NRA. The existence of money explains the existence of the ZLB, but the deeper problem for investment is the existence of NRAs with higher returns than investment. Consequently, even if the central bank were to make the nominal cost of finance negative (i.e. there were no ZLB), firms will still refuse to invest more and prefer to acquire NRAs assets instead.

Furthermore, if the return on money is negative, firms will shift toward holding other NRAs. Thus, even Gessel’s suggestion of taxing money via a negative interest rate on money does not solve the problem9.

The argument can be illustrated with the following simple partial equilibrium model of investment and asset allocation10. On the asset side, firms have an initial capital stock (K 0) which they can increase via new investment (I), and they can also hold money (M) and NRAs (G). Each asset has its own pattern of diminishing marginal returns. The marginal return to investment eventually becomes negative owing to the diminishing marginal efficiency of investment11. The marginal return to non-produced stores of value is diminishing but always strictly positive. Money has a diminishing positive own return (i.e. liquidity services) plus interest. The interest rate on money is the central banks money market rate minus a fixed intermediation cost (a fixed charge per dollar deposited). If the interest rate on money is negative, the marginal total return on money can turn negative. On the liabilities side, firms are financed by a mix of equity (E) and loans (L) and there is a positively sloped supply of each type of finance. The loan rate is a mark-up over the money market interest rate plus a default premium that increases with lending owing to declining credit worthiness of marginal borrowers.

Rates of return and costs of finance are given by:

where r I = rate of return on investment (marginal efficiency of investment); R(K 0) = marginal product of the existing capital stock (K 0); κ(I) = marginal adjustment costs of adding new capital via investment; δ = depreciation rate, π = inflation; r M = total return on money; i M = deposit interest rate; φ(M) = marginal own return on money from its liquidity services; r G = total return on non-produced assets; ψ(G) = rate of return on non-produced assets; r E = nominal rate of interest on equity finance; ξ(E) = real cost of equity finance; i L = wholesale cost of finance (i.e. money market interest rate); ρ = commercial banks’ loan mark-up per dollar of loans; λ(L) = default rate per dollar of loans; i F = central bank policy interest rate; k = reserve requirements per dollar of deposits, and c = commercial banks’ administrative cost per dollar of deposits. Figure 3 shows the pattern of rates of return on different assets and the supply function for different types of finance12.

In equilibrium, firms equalize the marginal costs of sources of funds with marginal benefits from application of funds so that rates of return and cost are equalized. This implies the condition r I = r M = r G = r E = r L . The solution is illustrated in Figure 4. The total demand for assets is obtained by summing the different asset demands. All variables are in real terms, deflated by the general price level. The total supply of finance is obtained by horizontally summing the different sources of supply13. The intersection of demand and supply determines the equilibrium return on assets and cost of finance. The mix of asset holdings and sources of finance is then determined by the individual demand and supply functions at the equilibrium rate of return.

Figure 4 Equilibrium financing, investment and asset holdings of firms in normal times (i F > 0); r I = r M = r G = r E = r L

Monetary policy works by lowering the money market risk free interest rate. That shifts down the loan supply function and also lowers the return on money holdings (via a lower deposit rate). Total supply and demand shift down by an equal amount, which leaves the total size of the firms’ balance sheet unchanged. However, there is a change in the composition of the firm’s balance sheet. First, firms switch from equity finance to loan finance because loan finance is cheaper. A lower policy interest rate induces firms to return equity to shareholders and adopt a more risky balance sheet financing structure. Second, firms reduce money holdings and increase investment (capital accumulation) and holdings of NRAs.

Now, suppose the monetary authority sets a negative interest rate by targeting a negative money market rate. The loan supply shifts down and its initial portion becomes negative. Money demand also shifts down and its end portion becomes negative. With regard to financing of firms, if the money market interest rate is sufficiently negative so that the loan rate is sufficiently low, firms may switch completely to loan finance. They do this via debt-financed share buybacks and special dividends that return all equity to shareholders.

With regard to asset holdings, even though the deposit interest rate is negative, firms still hold some money because the “own liquidity return” on money is positive and increases as the firm´s money holdings fall. Once the MEI falls to zero, no firm will invest more because they can do better acquiring NRAs. Given the marginal return to NRAs is always greater than or equal to zero, there comes a point when all extra loan finance from negative loan rates will be directed to increasing holdings of NRAs rather than investment.

In sum, the ZLB is not the problem. The problem is the existence of NRAs such as money, real estate, precious metals, commodities, assets like patents and copyrights, rents streams derived from monopoly power, and assets like technical knowhow and organizational capital embodied in existing firms. Negative interest rates will contribute to bidding up the price of those assets but will not increase investment.

6. Other structural factors limiting investment

The above analysis is in the spirit of Keynes’ General Theory. It shows why negative interest rates will not increase investment. Instead, firms will increase leverage, buy-back equity, and bid up the price of non-produced assets via take-overs.

Additionally, there are other structural factors that limit investment spending. First, production function theory is critical. In neoclassical theory additional capital can always be put to use because of perfectly smooth substitutability between capital and labor, which means it is impossible to have excess capital. However, if production is characterized by Leontieff conditions or capital is putty-clay in nature, it is possible to have excess capital in times of demand shortage, which will further constrain the sensitivity of investment to negative interest rates.

Second, capital is long-lived and lumpy. In a multi-period model, the willingness to use low interest rate loans to finance investment today depends on expectations of future interest rates. Even if today’s loan rates are negative, firms may be unwilling to borrow to finance relatively low yielding investment today if they think those investment projects will be saddled with future high loan interest costs.

Third, in neoclassical capital theory the MEI schedule is determined by technological conditions. Keynes had in mind a different construct in which the MEI depended on the state of animal spirits and perceptions of the fundamentally uncertain future. In this case the MEI may shift toward the origin in bad times, making it even more difficult to increase investment.

7. Can negative interest rates reduce saving?

The other side of the Keynesian AD shortage problem is saving. That raises the question if negative interest rates cannot increase investment, can they increase AD by reducing saving? Here too, the answer is probably not.

First, in pure consumption theory a lower real interest rate gives rise to both positive inter-temporal substitution and negative income effects. Consequently, the theoretical effect of lower real interest rates on consumption is ambiguous. The conflict between substitution and income effects is easily understood. Negative interest rates provide an incentive to save less and consume now. Balanced against that, negative interest rates lower future income and total lifetime income, which gives an incentive to increase saving to compensate for that loss. For instance, consider the case of a household which lives for two periods, has a zero discount rate, income of y in period 1 and zero income in period 2. The real interest rate is r. The optimal consumption plan has equal consumption per period so that C 1 = C 2 = y[1 + r]/[2 + r] and period 1 saving is S 1 = y/[2 + r]. A lower interest rate lowers period 1 consumption (dC 1/dr > 0) and increases period 1 saving (dS 1/dr > 0).

Second, a negative nominal interest rate on money holdings (i.e. deposits) can be thought of as a form of tax on deposits. That lowers real wealth and will generate a negative “Pigou effect” on consumption spending and AD. Balanced against this, there will be a positive wealth effect on AD owing to the portfolio shift away from money to NRAs that increases the price of those assets.

Theoretically, the net impact of negative nominal interest rates on saving and AD is therefore ambiguous. Negative interest rates could reduce saving, but they could also increase saving. The saving function could be a positive function of interest rates (S r > 0), but it could also be a negative function of interest rates (S r < 0).

8. Non-existence of the NRI: the implications of interest rate ineffectiveness

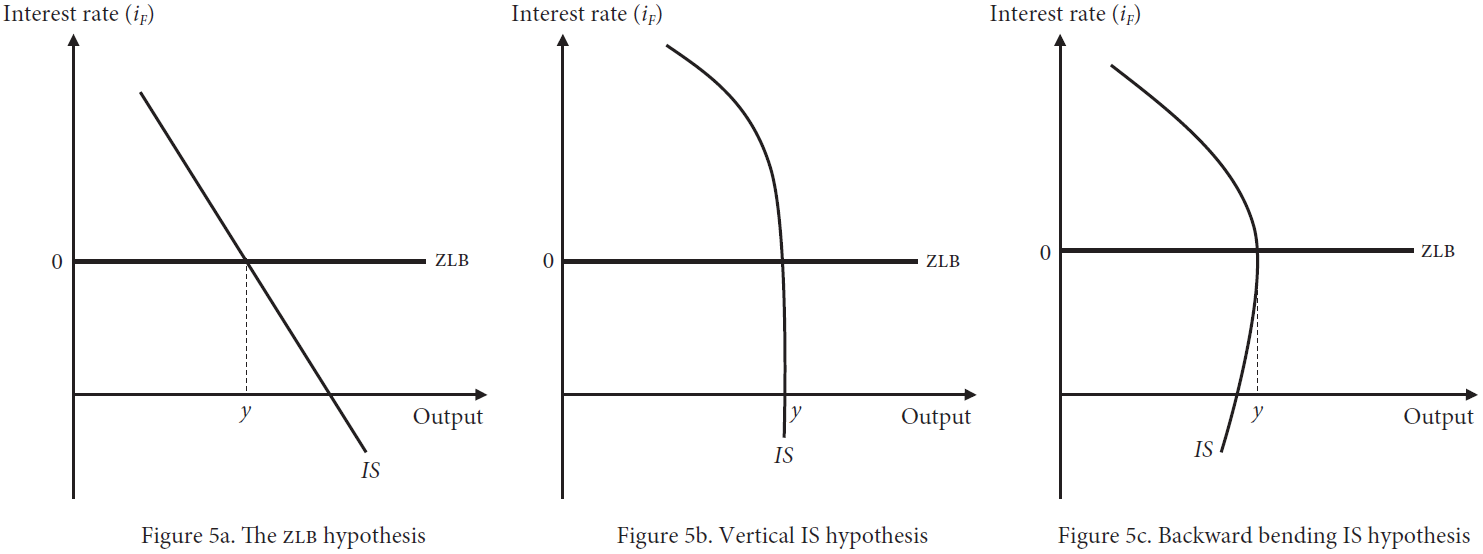

The above theoretical excavation of investment and saving has profound implications that can be readily understood via a Keynesian investment-saving (IS) model of the goods market. Figure 5 provides a graphical representation of the ZLB and investment saturation hypotheses14. Figure 5a shows a standard IS schedule which is confronted by a ZLB interest rate floor. If monetary policy could lower the interest rate below zero, AD and output would increase. The economy would slide down the IS via a combination of increased investment and reduced saving.

Figure 5b shows the case where the IS schedule becomes vertical as the nominal interest rate approaches zero and then turns negative. In that case both investment and saving become unresponsive to further reductions in the nominal interest rate. There are two important implications. First, the impact of monetary policy, conducted via lower interest rates, will steadily diminish and eventually become zero. Second, there may be no interest rate that can ensure sufficient AD to deliver full employment. In technical terms, there is no “natural” rate of interest that equilibrates full employment AD and AS.

Lastly, Figure 5c shows the case where the IS schedule is backward bending and becomes positively sloped once the nominal interest rate drops below zero. In this case, the response of saving to the interest rate becomes negative (i.e. Sr < 0), making the situation even more problematic. Now, in the region where the IS schedule is positively sloped, lowering interest rates below zero actually worsens the shortage of demand and lowers output and employment. Consequently, pursuit of NIRP will be counter-productive and will lower employment and output.

Figure 5 makes clear the analytical difference between ZLB economics and the investment saturation hypothesis. ZLB economics focuses on interest rate rigidities. The investment saturation hypothesis rests on a pathological IS schedule rooted in the behavior of investment and saving. The two arguments are easy to conflate as money plays a role in both. ZLB economics argues money is the cause of the ZLB. The investment saturation hypothesis emphasizes the role of NRAs, one of which is money, that make investment insensitive to negative interest rates.

9. Negative financial sector effects of NIRP15

The above analysis shows how the ZLB may not be the cause of Keynesian unemployment and how NIRP may have negative AD effects. Worse yet, NIRP may have additional adverse financial sector effects that include credit disruption in the banking sector, promotion of generalized financial instability, and promotion of macroeconomic policy whiplash effects16.

a) Disruption of bank credit

Negative interest rates can disrupt the provision of bank credit and also raise the cost of credit. Bank interest rates are determined as follows

where i L = inter-bank loan rate; i F = central bank’s money market target interest rate; r L = bank loan rate; ρ = loan mark-up; λ(L) = administration and default costs per dollar lent; i M = deposit interest rate; k = bank reserves held per dollar of deposits, and c = administration cost per dollar.

Banks are mark-up pricers. Equation [1] has the wholesale cost of finance for banks equal to the central bank’s money market target interest rate. Equation [2] sets the loan rate as a mark-up over the wholesale cost of bank finance. The mark-up includes a profit margin plus all loan administration and default costs. Equation [3] sets the deposit rate. Deposits are perfect substitutes with wholesale finance, so banks pay an interest rate on deposits that is adjusted for the costs of reserve holdings and deposit administration. If k = c = 0, the deposit rate is the same as the money market rate.

At this stage, it is necessary to discuss how negative rates are implemented. Option 1 is the central bank lowers its lending rate to commercial banks below zero. Option 2 is the central bank charges commercial banks with interest on their deposits of liquid reserves with the central bank. In practice, central banks have favored option 2 over option 1.

Option 1. If the central bank charges a negative lending rate, this implies i L = i F < 0. The deposit rate is strictly negative, and the loan rate can be negative if the central bank sets its lending rate sufficiently negative. As argued earlier, wealth holders will have an incentive to reduce money holdings and shift into other assets. Lower rates of return may then increase or decrease saving. As regards firms, they will not increase investment if the marginal efficiency of investment is negative. Instead, they will use credit to pay back equity (i.e. stock buybacks) and acquire non-produced assets (i.e. take-overs).

An important point about a negative central bank loan rate is that it is an implicit fiscal transfer, conducted via the central bank. Effectively, the central bank is subsidizing borrowing. Since existing borrowers will look to refinance existing loans, the central bank will likely end up refinancing much of the debt stock. Those who can borrow will also do so to buy non-produced assets that still have positive expected return, so debt would increase sharply and so would prices of non-produced assets. Viewed in this light, a negative central bank loan rate is a form of helicopter money that drops money on the debtor segment of the economy. Via the intermediation activities of banks, it also impacts rates of return on assets. The fact that it is an implicit fiscal transfer, combined with the incentive it gives to increase the debt stock, may explain why central banks have shied away from setting a negative target interest rate.

Option 2. Involves the central bank charging commercial banks interest on reserves. This is a subtly different way of lowering interest rates. It works asymetrically by lowering the deposit rate but leaving the wholesale finance rate unchanged at i L = i F . The new deposit rate is given by:

where p = the interest penalty on deposits with the central bank. Since commercial banks deposit k of each dollar of customer deposits, the interest penalty that is passed on to depositors is kp. Charging a penalty on reserves imposes a cost on banks, and that cost is passed along to depositors.

On the positive side, a lower deposit rate induces a portfolio shift into other financial assets. That drives up asset prices and generates a wealth effect that stimulates consumption. On the negative side, lower rates on deposits are akin to a tax on that lowers interest income, which may decrease consumption spending and increase saving.

In addition to these simple effects, there are also more complex possible effects. Suppose depositors are valued by individual banks because they are a cheap and stable source of bank finance and deposits are acquired by building customer relationships. In that case, banks may refrain from passing on the cost to depositors for fear of losing depositors to other banks that are competing for depositors. In that event, the central bank’s deposit charge will be shifted.

One possibility is that banks bear the cost, which will lower bank profits. That could cause banks to engage in credit rationing or withdraw from providing credit to particular markets and customers which are more risky and only marginally profitable. That would adversely impact AD.

A second possibility is that banks would pass the cost on to borrowers via higher loan rates. In that case, the central banks attempt to generate negative interest rates to stimulate the economy would backfire in the form of higher loan rates that discourage borrowing and reduce AD. Asset prices could also fall if higher loan rates cause deleveraging of debt financed asset purchases. This would be good for reducing debt, but would be bad for AD and economic activity which is the motivation behind NIRP.

b) Financial fragility and instability

A second financial problem from negative interest rates concerns financial fragility and financial instability, and there are many dimensions to this issue. In general, many of these concerns can also apply to lower interest rates, but they are amplified in an environment of negative interest rates.

With regard to the specifics of financial fragility and instability, the earlier analysis of investment showed that NIRP will promote risky balance sheet re-engineering by firms. Availability of negative interest rate credit will not induce additional investment. Instead, firms will use that credit to repurchase equity (i.e. shift toward debt financing) and to purchase non-produced assets (i.e. engage in speculative merger and acquisition activity). These are exactly the features we have seen, and the result is to leverage up corporate balance sheets. That leveraging of balance sheets creates financial fragility as increased debt makes firms vulnerable to future unexpected adverse developments. It also poses a threat to future economic activity by limiting firms’ capacity to undertake future investments.

A second problem is that negative interest rates encourage asset price bubbles and fragile balance sheets. With regard to firms, there is an incentive to engage in credit-financed mergers and acquisitions. With regard to households, there is an incentive to reduce portfolio holdings of money and bonds, and to increase holdings of risky assets and alternative stores of value in a chase a chase for yield and capital gains.

c) Financial disintermediation and disruption

Another set of problems concerns financial disintermediation and disruption. Negative interest rates induce economic agents to reduce money holdings and look for other stores of value and media of exchange. As regards stores of value, this may show in the form of precious metals inflation, commodity price inflation and land inflation as agents look for other ways to hold wealth. As regards media of exchange, it may show in increased use of cash and credit cards, the introduction of new monies such as bit-coin, and devotion of more resources to minimize money holdings subject to holding charges.

These developments constitute a form of inefficiency that reduces potential economic output. Money reduces transactions costs. Imposing a penalty on money raises transaction costs, which can both discourage productive transactions and reduce the gain from those transactions that are undertaken. This constitutes an adverse “supply-side” effect of negative interest rates. Furthermore, particularly as regards use of cash, there may be adverse fiscal implications in the form of tax evasion and increased size of the underground economy.

Additionally, ultra-low and negative interest rates can cause financial disruption by jeopardizing the business models related to insurance and retirement income provision, which are large and important financial sub-sectors. Insurance companies rely on premium and interest income to meet claims, while pension funds rely on investment income to meet future pension payments. Both insurance companies and pension funds are threatened by ultra-low and negative interest rates which lower their income. In response, insurance companies may raise premiums, which is the equivalent of a small tax that lowers aggregate demand. Both insurance companies and pension funds will also likely shift the composition of their portfolios toward risky assets, in a search for yield. That shift will add to asset price bubble pressures, and it also makes their balance sheets more fragile and vulnerable in the event of future asset price reversals. This vulnerability has no immediate impact today, but it is a channel for future economic disruption. That illustrates how use of monetary policy today can impose significant costs tomorrow.

d) Whiplash effects of NIRP

The potential future costs of financial fragility and asset price bubbles raise the prospect of policy whiplash effects. The core problem is the contradiction between current and future policy actions.

The economy currently suffers from shortage of AD owing to systemic failings related to income inequality and trade deficit leakages (Palley, 2009, 2012). That demand shortage was papered over by a thirty-year credit bubble plus successive asset price bubbles, which eventually burst with the financial crisis of 2008. Now, central banks are seeking to revive AD via negative interest rates that will reflate the credit and asset price bubbles.

That process creates a contradiction. If the policy is successful, it will necessitate raising interest rates in future. That risks triggering another financial crisis as the new bubbles burst and the effects of accumulated financial fragility magnify the ensuing fallout. When asset prices are inflated, subsequent very small upward moves in the interest rate can produce large capital losses. In effect, policy measures to revive the economy now via NIRP can generate even greater imbalances that produce whiplash effects later.

This whiplash process has been building for thirty years. Disinflation allowed successive lowering of interest rates from the double digit levels of 1980, thereby producing successively larger boom -bust cycles. That process appeared to be ended by the financial crisis of 2008 which pushed the economy to the ZLB. However, central banks have sought to circumvent the ZLB circuit-breaker via NIRP. If NIRP is pursued for an extended period of time, without remedying the deep causes of AD shortage, the prospect is a future more intractable economic crisis.

Each fresh crisis is harder to escape because the economy enters it with greater debt burdens and more fragile balance sheets. The history of successive crises may also induce a form of financial post-traumatic stress syndrome whereby businesses and households are psychologically scarred and fearful. That generates risk aversion which lowers investment and increases saving, thereby aggravating the systemic shortage of AD.

e) Competitive devaluation and NIRP

In addition to these adverse domestic economic effects, NIRP also has adverse international economic effects. Those adverse effects concern the process of competitive devaluation, which Brazil’s former finance minister Guido Mantega, referred to as “currency wars” in 2010.

The problem of competitive devaluation was identified in the Great Depression of the 1930s and it produces “beggar-thy-neighbor” international economic relations. In an economic environment of demand shortage, countries have an incentive to depreciate their currencies. That makes their exports cheaper and imports more expensive, which together increases demand for domestically produced goods and services. The trouble is the demand comes at the expense of demand for other countries’ products: Hence, the beggar-thy-neighbor label.

Table 1 Competitive devaluation as a negative sum game between countries (payoff to A, payoff to B)

| Country A | |||

|---|---|---|---|

| Devalue | Do not devalue | ||

| Country B | Devalue | (-5, -5) | (-10, 10) |

| Do not davalue | (10, -10) | (0,0) | |

This problem was pervasive in the 1930s and has re-emerged with NIRP, which generates competitive devaluation on steroids. That is because negative interest rates give private investors an incentive to exit a country’s money and exchange it for another’s to earn higher rates elsewhere. Moreover, increased financial capital mobility and capital account openness have strengthened that incentive. This is exemplified by Japan, where negative interest rates have sparked a carry-trade that involves borrowing yen and then converting into dollars to buy higher yielding dollar denominated securities.

Competitive devaluation does not just shift demand between countries, it may also reduce total global demand. That makes it a negative sum game with a prisoner’s dilemma structure. The reason competitive devaluation lowers global demand (i.e. is negative sum) is it creates financial uncertainty, which undermines firms’ incentives to invest. Firms will refrain from making costly investments if they think exchange rate movements may undermine the competitiveness and profitability of those investments.

NIRP encourages competitive devaluation dynamics by encouraging carry-trade currency speculation and international chase for yield by investors. Additionally, globalization has increased policymakers’ incentive to engage in strategic competitive devaluation. That is because globalization has encouraged an offshore manufacturing model in which corporations from developed countries either build export production platforms in developing countries or outsource manufacturing to those countries. Developing countries then sell that production in developed country markets. This has encouraged the phenomenon of export-led growth whereby developing economies grow by exports rather than by developing their own domestic markets.

Exchange rates are key to the export-led model, which intensifies the tendency toward competitive devaluation dynamics. The reason is the export-led growth model promotes intense competition between developing countries both for export markets and for new foreign investment. That intensifies the incentive for developing countries to engage in competitive devaluation, and NIRP worsens that proclivity.

10. Political economy and future stagnation dangers of NIRP

A final set of problems with NIRP concern its political economy impacts. Like QE, NIRP aims to increase the price of financial assets -particularly risky assets like equities which become more attractive as interest rates fall. Since such risky assets are predominantly held by wealthier households, that further increases the relative wealth of those households at a time of heightened income and wealth inequality.

That may have significant adverse impacts on politics and policy. First, given the powerful role of money in politics, increasing the wealth of the wealthy enables them to further influence politics. Second, to the extent that the wealthy are satisfied with the impacts of NIRP, that diminishes the pressure for additional policies to strengthen the economy. As documented by political scientists Gilens and Page (2014), the affluent significantly get the policies they want. NIRP therefore does double damage: It has a plutocratic bias and it also removes the pressure for other more substantial policies.

NIRP also has profound effects on the outlook for retirement and retirement income. Lower interest rates reduce the capacity to save for retirement, and negative interest rates have an even worse effect. Ordinary households are more risk averse because of their lower wealth and inability to bear losses. Thus, asset price gains induced by policies like QE and NIRP are likely to bypass those households because they cannot afford to take the risk of holding risky asset classes and suffering potential future losses.

Historically, bank certificates of deposit (CDs) and bonds have provided returns with appropriate risk for such households, but NIRP takes both off the table. cd yields can go negative, while bonds become vulnerable to large price losses in the event that future interest rates are higher. In a NIRP fed environment of asset price bubbles, ordinary risk averse households are stuck between the devil and the deep blue sea -the devil of negative interest rates and the deep blue sea of potentially disastrous capital losses from a burst asset price bubble. Moreover, this is particularly painful at a time when defined benefit pensions have been significantly eliminated and the risk of retirement income provision has been shifted on to individual households. This microeconomic impact is over-looked by monetary policy which tends to focus exclusively on macroeconomic concerns, and it explains why NIRP has contributed to fostering bitter political feelings that foster toxic political outcomes.

Younger workers are also vulnerable to NIRP induced asset market distortions. Those who acquire equities for their retirement portfolios risk large future losses if interest rates revert to normal levels, which is the express goal of NIRP. Historically, retirement income has been facilitated by an equity premium. NIRP risks transforming that into an equity penalty.

The problem is even worse with house prices, which are particularly prone to NIRP induced bubbles. House purchases are largely financed with mortgages, and lower interest rates therefore drive up prices by lowering mortgage payments and increasing cash-flow affordability. However, there are massive downsides stemming from mortgage debt. The interest payment on a $200,000 home at 6% is the same as the payment on a $400,000 home at 3%. Yet, purchasers are saddled with a larger mortgage that they must pay back in the future, and they also lose financial flexibility and are rendered more financially vulnerable.

As regards flexibility, if house prices subsequently fall back because interest rates mean revert (i.e. revert to normal), then borrowers will find themselves underwater. That may prevent them from selling and moving to take up better economic opportunities. As regards vulnerability, if the household suffers an economic shock (e.g. a job loss), it may be unable to pay its mortgage and risks default and the lasting losses that go with that.

The benefits of NIRP induced stock price and house price inflation go to existing owners. Normal future capital gains are brought forward and transferred to current owners, while buyers are subjected to significant financial risk. Viewed in that light, asset price inflation is a form of inter-generational transfer that ladens the future with burdens and risks, and the transfer of future capital gains removes an important source of future economic stimulus.

Putting the pieces together, using NIRP to fight stagnation today is likely to be ineffective and possibly counter-productive for reasons discussed earlier. At the same time, NIRP may shift stagnation into the future via asset transactions that burden the future, and that process can generate future disappointments and resentments that produce ugly politics.

11. Conclusion: the misguided new consensus of ZLB economics and NIRP

The mainstream economics profession has now settled on the ZLB as the theoretical explanation for the stagnation that followed the Great Recession of 2008-2009. On the back of that new theoretical consensus, NIRP has quickly become a consensus policy within the economics establishment.

This paper has argued that this new policy consensus is dangerously wrong, resting on flawed theory and flawed policy assessment. Regarding theory, NIRP draws on fallacious pre-Keynesian classical economic logic that asserts real interest rate adjustment can ensure full employment. Regarding policy assessment, NIRP turns a blind eye to the possibility that negative interest rates may reduce AD, cause financial fragility, create a macroeconomics of whiplash owing to contradictions between policy today and tomorrow, promote currency wars that undermine the international economy, and foster a political economy that spawn’s toxic politics. Worst of all, NIRP maintains and encourages the flawed model of growth, based on debt and asset price inflation, which has already done such harm.

nueva página del texto (beta)

nueva página del texto (beta)