“Two souls abide, alas, within my breast, and

each one seeks for riddance from the other.”

Goethe ([1808] 2014).

“Fallacies do not cease to be fallacies

because they become fashions.”

Chesterton ([1935-1936] 2012).

Introduction

Price stability, that much-coveted policy objective eagerly pursued by many an inflation-targeting central bank (CB), occasionally chased after even with ludicrous doses of bigotry, is nowadays thought out as the upshot of a monetary policy framework where an explicit or an implicit inflation target ―specific or within a narrow range― is the monetary authority’s paramount concern, and the nominal interest rate its policy operating target. Most importantly ―at least for the present study―, the central bank’s nominal interest rate is also taken to be the anchor securing both price stability and a supply equilibrium level of output which corresponds to a zero output gap and to a non-accelerating inflation rate of unemployment.

Over the last decades, several prominent central banks (CBs), including the U.S. Federal Reserve, the European Central Bank, the Bank of England, and the Bank of Japan, among many others, have abandoned the explicit handling of the money supply to impinge on inflation (see, for instance, Bernanke et al., 1999; Arestis, Baddeley, and McCombie, 2005); now they rather focus on controlling the interest rate to influence the price level (Woodford, 2003). As Romer (2000, p. 149) puts it: “(…) one important change is that most central banks, including the U.S. Federal Reserve, now pay little attention to monetary aggregates in conducting policy”.

This new consensus in monetary theory and policy rules puts forth models of inflation and stabilization built on such theoretical foundations as: Knut Wicksell’s hypothesis ([1898] 1965) of the natural rate of interest ―governed by the marginal productivity of capital― which equates savings and investment bringing them into full employment equilibrium; Milton Friedman’s (1977) concept of a unique natural unemployment rate (taken to be the only sustainable rate of unemployment consistent with steady inflation); and the so-called New-Neoclassical Synthesis or New-Keynesian proposition that the interest rate is the unique anchor for an optimal rate of inflation (Woodford, 2003).

Certainly, most modern models of inflation targeting set the central bank’s interest rate as the monetary policy instrument (cf.Taylor, 1993; Bernanke and Mishkin, 1997; Bernanke et al., 1999; Woodford, 2003). Yet, whether in practice such interest rate also works as the actual anchor for stable inflation is an open question. Svensson (1998) and Ball (1999), for instance, have emphasised the significant role of the exchange rate as being part and parcel of a monetary conditions index for striking the inflation target. Some heterodox commentators, in turn, have broadmindedly defied the conventional belief on empirical grounds as well, arguing that the exchange rate happens to be the real anchor of the inflation rate ―either through sheer currency appreciations (cf.Galindo and Ros, 2008; Bresser-Pereira, 2010) or by way of foreign exchange sterilised interventions (cf.Hüfner, 2004; Mántey, 2009)―. The heterodox case for the inflation stabilising role of the exchange rate is, in a way, tantamount to endorsing Calvo’s and Reinhart’s (2002) “fear of floating” argument.

The aim of the present paper is to show that modern monetary policy models of inflation targeting, in actual fact, rely on income distribution in order to achieve price stability. Specifically, we argue that, in countries that have adopted inflation targeting monetary policy rules, price inflation has been anchored neither by the nominal interest rate nor by the exchange rate, but by the wage rate. Moreover, the monetary policy interest rate is just the central bank’s most preferred instrument and the exchange rate an intermediate target, if anything. This is the main contribution of the present study. Yet, such role of income distribution variables is far from obvious. The artfulness and complexity of the newly enthroned model’s monetary transmission mechanism tends to obliterate the function played by wages and unit labour costs in the overall central bank´s price stability strategy. These very subtleties, in contrast, favour the mirage of interest rates and/or exchange rates, allegedly, as inflation anchors. Empirical evidence supporting our hypothesis is herein reported.

The outline of the paper is as follows. We start with a brief survey of the relevant literature assessing the role of both the interest rate and the exchange rate in the inflation targeting monetary policy framework; the gist of the importance of income distribution and wages for price stability is succinctly discussed. Having established our main tenet, a few stylised facts about inflation and economic growth follow. We then turn to test our hypothesis empirically; this part contains the econometric analysis and, for obvious reasons, it represents the main component of the document. The final part of the paper sums up and concludes.

A brief survey of the literature

Price-level targeting, nominal-Gross Domestic Product (GDP) targeting, money-supply targeting or any other level-based approach have been casted-off from the standard toolkit of many CBs that adopted the monetary policy framework identified as inflation-rate targeting (henceforth IT). According to Bernanke et al. (1999, p. 8), the IT policy is “neither an ironclad rule nor a form of unbridled discretion”, but a monetary policy framework1 best understood as constrained discretion “characterized by” an explicit (low and stable) inflation-rate objective. Price stability is said to be a sine qua non condition for market-driven optimal output growth. Since monetary policy operates in an environment of endogenous money supply, it is the determinant of inflation in this policy framework; in the conduct of monetary policy the CB uses one short-term instrument, its nominal interest rate, to achieve one target, the inflation-rate representing price stability (cf.Bernanke and Mishkin, 1997; Walsh, 1998; 2002)2.

The IT framework belongs to the class of models known qua interest-rate rules as central banking in practice focuses on interest-rate targeting to meet the chosen inflation objective. The rationale behind why CBs are keen on interest-rate targeting is twofold: first, if the economy´s LM curve is less stable than the IS curve, such policy framework will be more efficient at stabilising economic activity than, say, Friedman’s rule focused on monetary-targeting (Poole, 1970); second, in present-day monetary and financial markets the supply of money and credit is endogenous and most open market operations are “essentially defensive”3, hence interest-rate targeting is more effective than other competing monetary policy approaches (see Moore, 1988; Lavoie, 2014).

The historical provenance of interest-rate rules actually dates back to Knut Wicksell’s ([1898] 1965, pp. 62, 70; [1906] 1978) “thorough analysis” of a “purely imaginary case”, namely an “organised credit economy” (i.e. a system with developed credit markets) where all transactions are “effected by means of the Giro system and bookkeeping transfers” (italics in the original). In his pioneering oeuvre, Wicksell swam against the tide of the dominant quantity theory of money (QTM) of his time and set the rate of interest as the true regulator of commodity prices, thus bridging the hiatus between price theory and monetary theory that plagued the classical QTM (see also Myrdal, [1931] 1962; Lindhal, [1939] 1970). Wicksell ([1898] 1968, pp. 98, 100) considered that the QTM was no longer suitable for dealing with “the organic development of a regular movement of prices” in the realm of a modern economy characterised by “a fully developed credit system”. In this case, the fluctuation of the general level of money prices hinges upon the relationship between the loans or money rate of interest (r m ) and the natural rate of interest on capital4 (r n ), which is the centre of gravity of Wicksell’s monetary macroeconomics. r n is determined by the marginal productivity of capital, by the supply of land and labour and by the amount of both fixed and liquid capital (op. cit., p. 106). Deviations of r m from r n will trigger movements in commodity prices and the equilibrium of the economic system will sooner or later be disturbed; in periods when r m < r n inflation will ensue, and deflation will follow when r m > r n . In equilibrium, r m = r n , a neutral rate of interest on loans will be observed which is consistent with price stability. Wicksell’s norm can be represented mathematically as follows:

Where α measures the sensitivity of price inflation vis-à-vis the interest rate gap. Wicksell took cognisance of the fact that “an exact coincidence of the two rates of interest” was far-fetched because r n “is not fixed”, it “fluctuates constantly” along with its various determinants (ibid.). Hence, according to Knut Wicksell’s norm, a market clearing equilibrium situation might call for a fairly awkward condition, a negative natural rate of interest (r n < 0), a scenario that Böhm-Bawerk ([1889] 1891) had entertained momentarily. In this respect, we should like to note in passing, the Wicksellian monetary theory sheds light on some current debates on secular stagnation and the role of monetary policy in the aftermath of the global financial crisis (see Boianovsky, 2004; Summers, 2014).

Since the Wicksellian tradition has of late been resurrected by so-called Neo-Wicksellian monetary theory, and ever since a great many of the new vintages of monetary economists are being schooled to believe in such reinterpretation of the Swedish economist’s noteworthy contribution, it appears fair to warn present-day readers’ and draw their attention to Wicksell’s continuous critical revision of his own tenets after he had put them forward in 1898. Particularly, he was cognizant of the seemingly insurmountable problems plaguing his own theory of the natural rate of interest. In this regard, he wrote in the preface to the first Swedish edition of his Lectures on Political Economy, II: On Money and Credit ([1906] 1978): “Beside the somewhat too vague and abstract concept natural rate of interest I have defined the more concrete concept normal rate of interest, i.e. the rate at which the demand for new capital is exactly covered by simultaneous savings.” While the Wicksellian theory can be useful for the static analysis of price determination, it appears less so for the dynamic analysis of inflation. As Ohlin (1965, p. xix) contends, while Wicksell grew older intellectually he “came more and more to doubt the solidity of (…) the cornerstone of his monetary theory: ―the idea that if the money rate coincided with a normal rate of interest, which brought about equality between savings and investment, the commodity price level would remain constant”5.

Interest-rate rules have become fashionable with the development of a new consensus around the it approach to conduct monetary policy in a global economy of pure fiat money. The most popular monetary policy rule is the Taylor rule where the central bank is taken to react to both inflation gaps and output gaps through suitable nominal interest rate adjustments aimed at stabilising price inflation and real economic activity. According to Taylor (1993; 1994), the central bank’s reaction function takes the form:

Where i

t

and

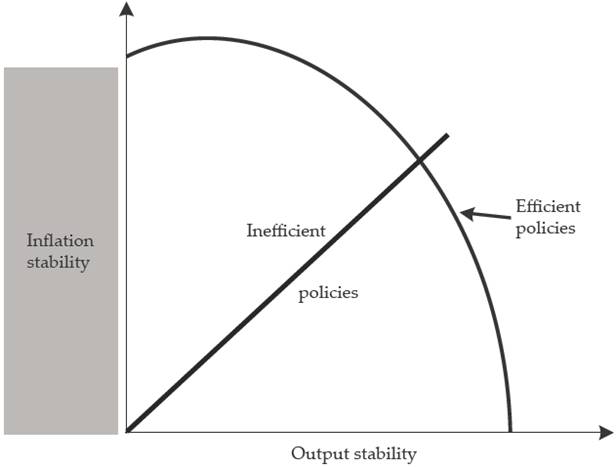

Taylor (1994) introduced a new (variability) trade-off between inflation and output in lieu of the previous trade-off predicated by the Phillips Curve. The latter, he claims, is not adequate for the evaluation of monetary policy rules as it is focused on the levels of inflation and unemployment; Taylor’s trade-off focuses on the magnitude of the fluctuations in both inflation and real GDP, their deviations with respect to desired targets. The core assumption of his analysis is that inflation is a demand-driven phenomenon. Figure 1 illustrates Taylor’s rule: the production possibilities frontier represents efficient policies, wherein less inflation (output) stability involves the opportunity cost of more output (inflation) stability. Since the economy is subject to exogenous demand and supply shocks that cause both inflation and GDP to fluctuate throughout the business cycle, the duty of the monetary authority is to cushion and keep such shocks effects to a minimum, alternatively choosing between more (less) real GDP stability and less (more) inflation stability. Hence the new variability policy trade-off the central bank is faced with (Taylor, 1999b, pp. 37-44, passim).

Figure 1 The new policy trade-off between inflation stability and output stability (adapted from Taylor, 1994)

Many authors have estimated interest-rate rules6, and found that, due to their asymmetric preferences for price stability, several CBs tend to respond more heavily to inflation gaps than to output gaps, thereby give inflation risks a heavier weight in their reaction functions (see Bunzel and Enders, 2010 and Cukierman and Muscatelli, 2008). Other economists include expectations in forward-looking policy rules. For example, Vickers (1998) argues that the Bank of England should employ its policy instrument within the framework of an inflation-forecast targeting rule; Clarida, Galí, and Gertler (2000) followed a similar method and conclude that the Fed has not reacted to actual inflation, but to inflation forecasts since 1979. Woodford himself prefers a neo-Wicksellian rule in a cashless economy than Friedman’s rule, even assuming an econometrically stable money-demand function for the monetary base (ibid., p. 54).

Officially, a freely floating exchange rate regime is part and parcel of the optimal monetary policy of it central banks. This implies that the exchange rate plays no role whatever in the strategy devised to meet the inflation target. Yet, many commentators rebut such assumption arguing that exchange rates and import prices influence inflation, pass-through effects of exchange rate fluctuations and commodity price oscillations alter domestic inflation. At least in developing economies IT central banks must consider these and other supply-side shocks that, at any rate, reduce the effectiveness of the transmission mechanism of monetary policy. Hence it central banks in these countries have incentives to turn to the exchange rate channel and adopt it as a second policy tool (allegedly faster than the nominal interest rate) with the aim of hitting the target (see Svensson 1999; Hüfner, 2004; Edwards, 2006; Mántey, 2009; Benlialper and Cömert, 2016; Benlialper, Cömert, and Öcal, 2017). But the exchange rate not only does play a role; the it central banks in developing countries deliberately follow an asymmetric exchange rate policy, enduring exchange rate appreciation and preventing major depreciation pressures (Ho and McCauley, 2003; Roger and Stone, 2005; Galindo and Ros, 2008). Benlialper, Cömert, and Öcal (2017) estimate a nonlinear monetary policy reaction function for a group of developing countries, their chief findings being that IT central banks in such countries behave asymmetrically with regards exchange rate fluctuations, loosening monetary policy in face of appreciations and tightening it in face of depreciations. Furthermore, this asymmetric policy stance is an idiosyncratic feature of IT developing countries.

On net, this vast literature furnishes amazing analyses of the intricacies of the it monetary policy framework in a wide range of aspects, from the nominal interest rate to the exchange rate. Nonetheless, the role of the wage rate and the unit labour costs in the new monetary policy consensus appear to remain in oblivion. The wage rate is the price of labour-power; in this regard, wages are linked “with other prices and economic quantities” (Dobb, [1928] 1959, p. 88). Actually, most prices of industrial goods are shaped on a mark-up over unit labour costs, regardless of the dominant market structure in the economy. As Lavoie (2014, p. 542) argues, “the money wage is the exogenous factor explaining the price level that orthodox authors have sought.” Since money wages are exogenously determined in the short-term (real wages are endogenous), the rate of inflation tinker with the extent to which money wage increases exceed the increment in average labour productivity7. In his magnum opus, Keynes ([1936] 1964, p. 309) put forth a distributional conflict theory of inflation while emphasising the relevance of unit labour costs: “the long run stability or instability of prices will depend on the strength of the upward trend of the wage-unit (or, more precisely, of the unit cost) compared with the rate of increase in the efficiency of the productive system”.

Does the foregoing analysis mean that wage inflation is necessarily the main cause of price inflation? Moreover, inflation moves pro-cyclically along with output growth and higher rates of employment. Keynes ([1936] 1964, pp. 301-303) distinguishes between ‘positions of semi-inflation’ ―when increasing levels of effective demand lead to discontinuous changes in wages “not fully in proportion to the rise in the price of wage-goods”― and ‘positions of absolute inflation’ or “true inflation” ―when effective demand expands “in circumstances of full employment”, in which case no further expansion in output will be forthcoming and the effect of the increasing demand will be reflected fully in higher unit costs―. Only in this latter case can it be said that wage inflation is the main cause of price inflation. However, this is a far-fetched scenario.

Some stylised facts

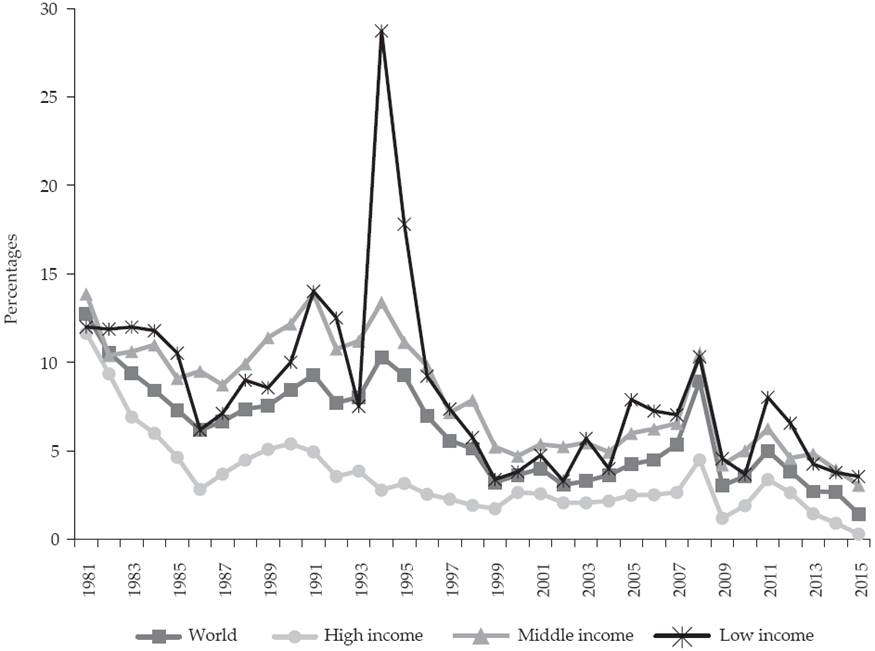

A low and stable inflation has been predicated as the panacea for optimal economic growth worldwide. Annual rates of inflation in high-income countries have been on a downward trend since the mid-eighties and in the rest of the world at least since the mid-nineties ―with a couple of short-lived pauses at the beginning of the 1990s and the mid-2000s―. Remarkably, the annual rate of inflation of all high, middle and low income groups of countries has been lower than 5% since 2013 (see Graph 1).

Source: Authors’ elaboration using data from the World Development Indicators of the World Bank.

Graph 1 Annual rate of inflation of the world and groups of countries by income levels (%)

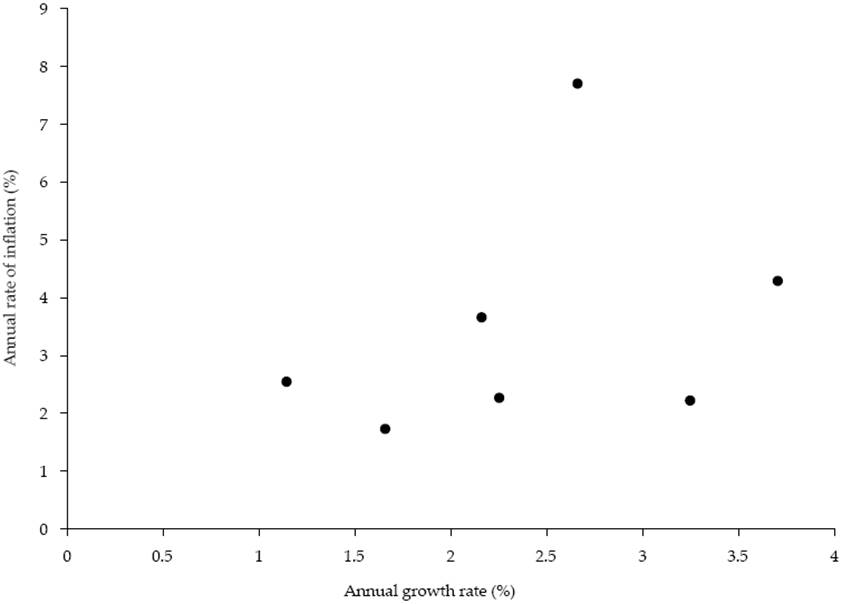

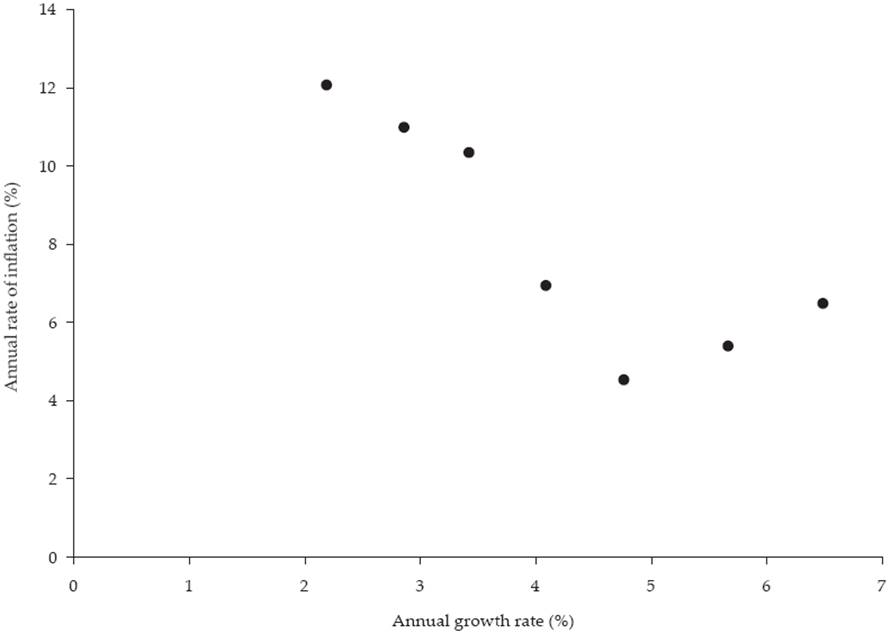

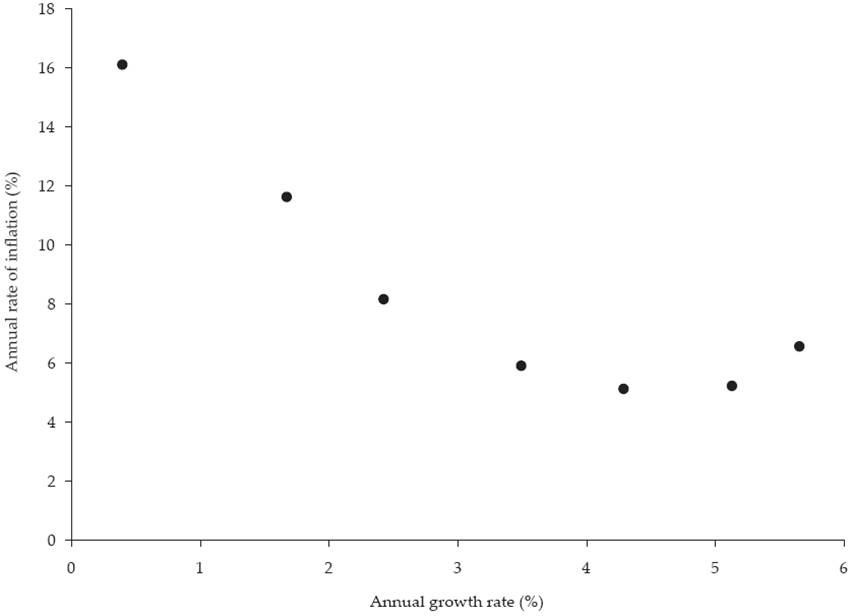

It is also worth mentioning that the relationship between economic growth rates and inflation rates for the various countries diverge, signalling different opportunity costs and sacrifice ratios in terms of forgone output growth associated with the disinflation process. It appears that the magnitude of the opportunity cost varies in accordance with the relationship between output growth and inflation of each country. For example, whilst in the case of the high income level group of countries such relationship looks positive, for those countries in the middle and low income groups it looks like an U-shape (see Graphs 2, 3 and 4). So, high growth rates of output can occur along with high inflation rates in all three groups of countries, but in the cases of middle and low income countries it is also possible to observe low growth rates hand in hand with high inflation rates, a situation that induces contractionary policies in depressive regimes.

Source: Authors’ elaboration using data from the World Development Indicators of the World Bank.

Graph 2 Annual growth rates and annual inflation rates of high income countries (five-year average), 1981-2015

Source: Authors’ elaboration using data from the World Development Indicators of the World Bank.

Graph 3 Annual growth rates and annual inflation rates of middle income countries (five-year average), 1981-2015

Source: Authors’ elaboration using data from the World Development Indicators of the World Bank.

Graph 4 Annual growth rates and annual inflation rates of low income countries (five-year average), 1981-2015

Clearly, high-income countries, middle-income and low-income economies do not exhibit the same pattern of correlations between inflation and economic growth. This stylised fact should suffice to understand that one-size does not fit all in terms of targeting price stability.

Econometric analysis

The following countries are considered in our empirical analysis: Australia, Canada, Mexico, New Zealand, Norway, Poland and the United Kingdom. We look at these countries both individually and jointly within a non-balanced panel. Moreover, we ponder the United States as a benchmark for two reasons: First, we expect that the nominal exchange rate of the dollar will affect domestic inflation differently in comparison with the effect of nominal exchange rate in other countries included in our sample. Second, although the United States explicitly adopted the it regime only in 2012, the Fed has been implementing it implicitly since the late 1970s, starting with Volcker’s administration (see Goodfriend, 2005)8. The time series used in the estimations are the consumer price index (CPI), the nominal exchange rate (e), the unit labour costs index (ULC), the labour compensation per hour worked index (w), the gdp per hour worked index at constant prices (lp), the employee compensation as a percentage of the value added (w Y ), the nominal lending interest rate (i), the inflation rate target (π0), GDP (Y) and potential GDP (Y 0). All series, with the exception of the last one, were gotten from the database Economic Indicators of the Organisation for Economic Cooperation and Development (OECD), and when possible they were extended with the help of data from the Federal Reserve Bank of St. Louis. Lastly, Y 0 was generated from the Y series through the Hodrick-Prescott filter.

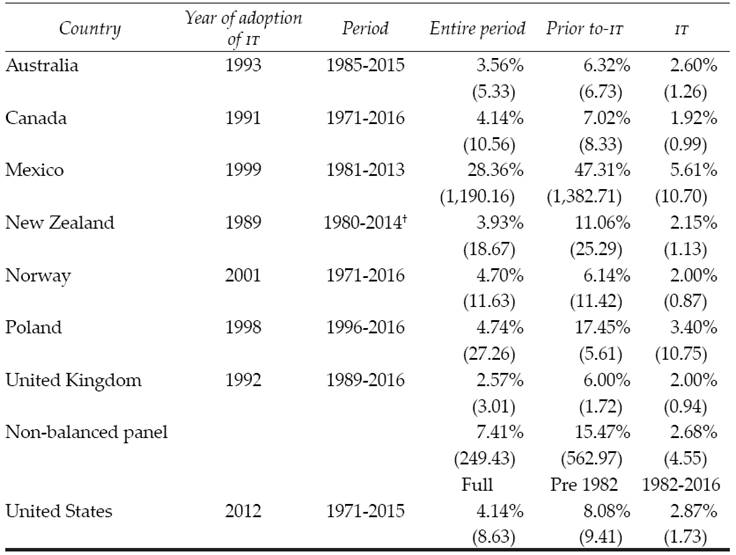

Table 1 shows the average and the variance of the annual rate of inflation of the countries under consideration for the whole period and the sub-periods prior to IT and during it. The adoption of the IT regime brought about a reduction in the average annual rate of inflation and, with the exception of Poland, a decrease in the variance of the annual rate of inflation9. Obviously, the same is true of the panel sample of countries. Moreover, in the United Sates both the average and the variance of the annual rate of inflation declined since 1982.

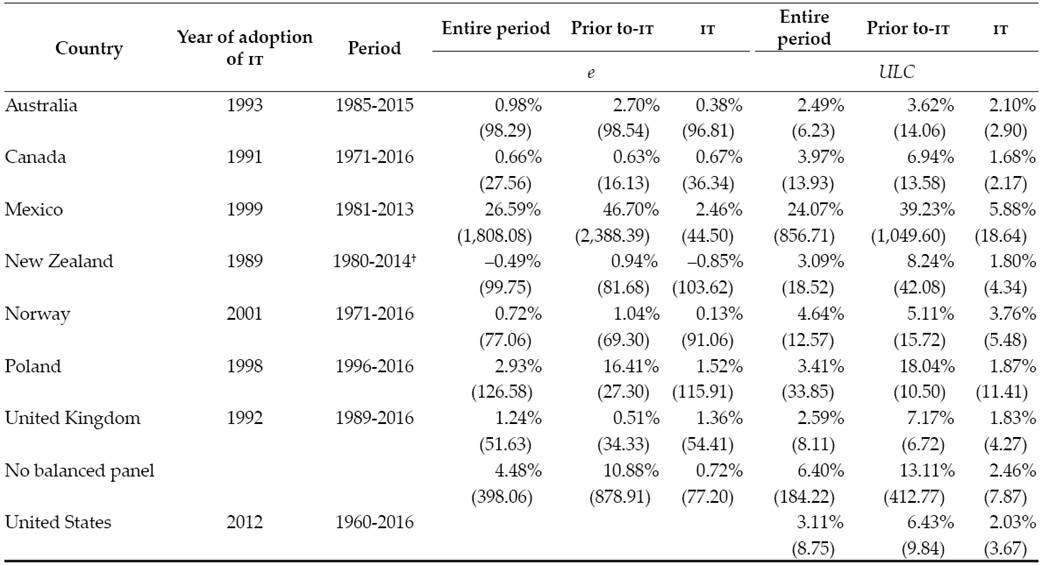

The disinflation process experienced by it countries involved a nominal exchange rate appreciation. However, the growth differential of lp and w, i.e., the growth rate of ULC also played a fundamental role in the disinflation process, a fact supporting our hypothesis. Let a mark-up equation for the determination of prices be written:

Where P is the unit price, τ is the mark-up percentage over the unit total cost, UMC is the unit imported input-costs, which is affected by e. Equation [3] provides a benchmark for assessing the growth rates of e and ULC as determinants of the rate of inflation.

Table 2 presents the average and the variance of the annual growth rates of e and ULC for the entire period and the sub-periods prior to it and during it. As can be shown, the annual growth rate of e decreased during the sub-period it with respect to the sub-period prior-it in five out of the seven countries of our sample; in Canada e changed very little, the United Kingdom’s e increased and for the whole panel e decreased. On the other hand, the variance of the annual growth rate of e for the panel shrank during the sub-period it with respect to the prior-it one, despite the variance of five out of seven countries exhibited an increase. Mexico and Poland experienced a decline in their variance of the annual growth rate of e10.

Table 1 Average and variance (in parentheses) of the annual rate of inflation11

† Excludes the interval 1982-1986 due to lack of data.

Source: Authors’ elaboration using data from the OECD and from the Federal Reserve Bank of St. Louis

Table 2 Average and variance (in parentheses) of the annual growth rates of e and ULC

† Excludes the interval 1982-1986 due to lack of data.

Source: Authors’ elaboration using data from OECD and from the Federal Reserve Bank of St. Louis

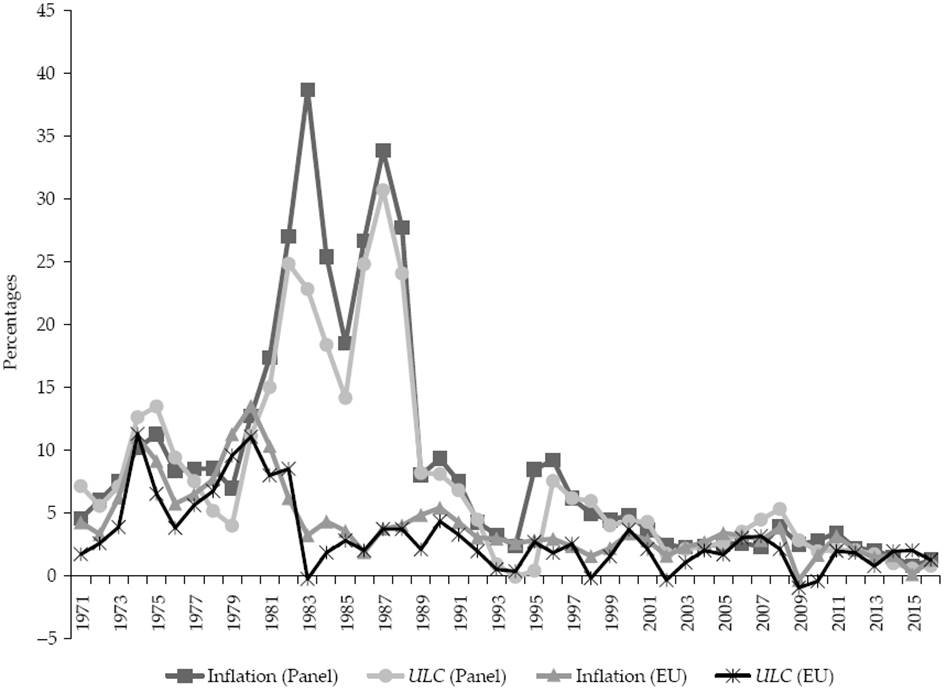

Interestingly, in all countries in the sample, including the United States, and the panel as a whole, both the average and the variance of the annual growth rate of ULC decreased, signalling the higher importance of ULC ―vis-à-vis e― as a determinant of the rate of inflation. Likewise, this is also indicative of the higher relevance of controlling the growth rate of ULC for reining in the rate of inflation. Graph 5 displays the above finding visually.

Source: Authors’ elaboration using data from OECD and from the Federal Reserve Bank of St. Louis.

Graph 5 Annual rate of inflation and annual growth rate of unit labour costs (%), 1971-2016

In order to substantiate the above tenet more rigorously, the following long-run equation is estimated for each of the countries in our sample and for the panel as a whole12:

Where ln is the natural logarithm operator; β i are the parameters to be estimated, u is an error term (this term’s one-period lag is used as the long-run deviation of the CPI with respect to its long-run equilibrium value), the subscript t stands for time.

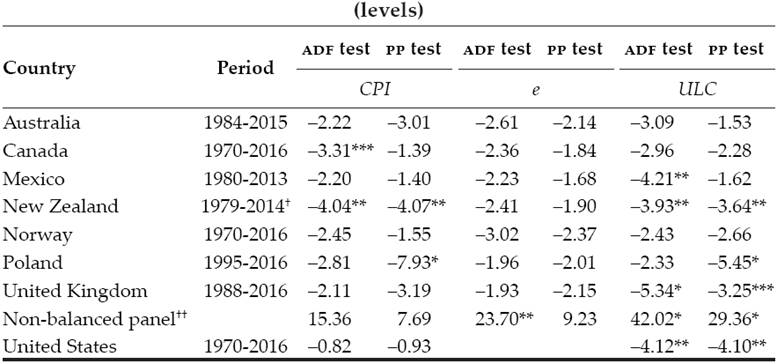

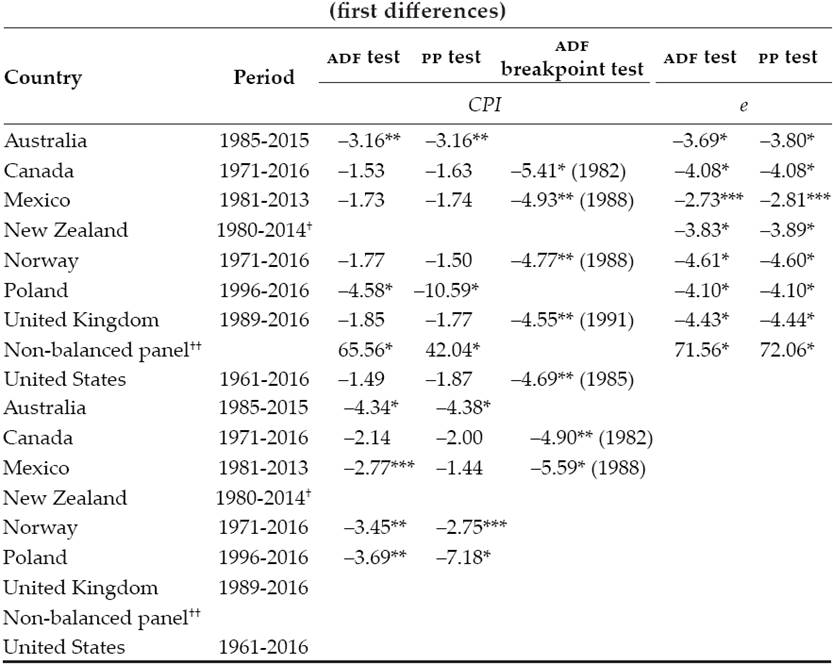

Before estimating equation [4], we present the unit-root tests corresponding to each of the time-series used for each country and for the whole panel (see Tables 3a and 3b). As can be shown, with the exception of New Zealand’s CPI and New Zealand’s ULC, the United Kingdom’s ULC, the United States’s ULC and the panel’s ULC, which are stationary, the rest of the time series are integrated of order one. We estimate the long-run equation [4] for the CPI using the bound test approach cointegration methodology (BTA) for each country and for the panel; the Generalized Method of Moments (GMM) was also used for the whole panel. We report the simple average of the estimated parameters for each country and, with the aim of confirming robustness of our estimations, compared them with those obtained through the panel methodologies (see Tables 4 and 5)13.

Table 3a Unit root tests for CPI, e and ULC

* Denotes statistically significant at the 1% level.

** Denotes statistically significant at the 5% level.

*** Denotes statistically significant at the 10% level.

† Excludes 1982 through 1985 due to lack of data.

†† We report the Fisher X2 test.

Note: All the series are expressed in natural logarithms. All tests include intercept and trend. The number of lags were determined on the basis of the Schwarz information criterion and the Newey-West statistical criterion, respectively.

Source: Authors’ elaboration using data from OECD and from the Federal Reserve Bank of St. Louis.

Table 3b Unit root tests for CPI, e and ULC

* Denotes statistically significant at the 1% level. ** Denotes statistically significant at the 5% level. *** Denotes statistically significant at the 10% level.

† Excludes 1982 through 1986 due to lack of data. †† We report the Fisher X2 test.

Note: All the series are expressed in natural logarithms. All tests include only intercept. In the ADF breakpoint tests the existence of an innovative shock was assumed, except in the case of the CPI of the United Kingdom. In this latter case we assumed the existence of an additive shock. Values in parentheses denote the years in which the break was experimented. The number of lags used were determined on the basis of the Schwarz information criterion and the Newey-West statistical criterion, respectively.

Source: Authors’ elaboration using data from OECD and from the Federal Reserve Bank of St. Louis.

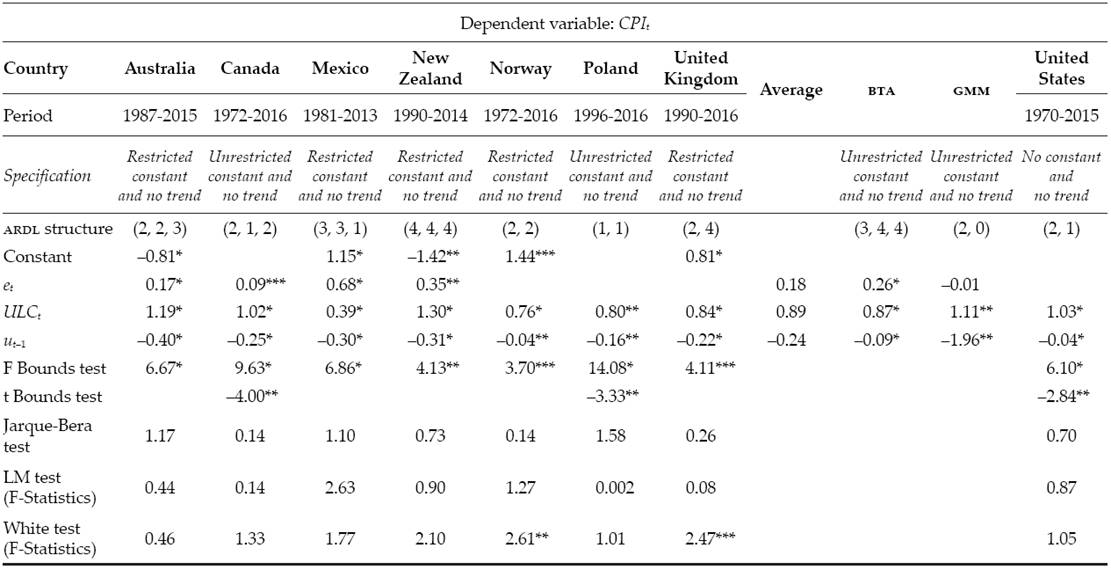

Table 4 Estimation of the long-run elasticities of the CPI with respect to e and ULC for the entire period

* Denotes statistically significant at the 1% level. ** Denotes statistically significant at the 5% level. *** Denotes statistically significant at the 10% level.

Note: All the series are expressed in natural logarithms. The ARDL structure was determined on the basis of the Schwarz information criterion. White heteroscedasticity tests were conducted using cross terms in the cases of Canada, Norway, Poland and the United States. Standard errors and covariance matrices are adjusted for heteroscedasticity in the appropriate cases. Lags of the dependent variable and the independent variables were used as instruments in the estimation for the GMM methodology; the error terms do not exhibit autocorrelation neither of first nor of second order. The rest of the relevant statistics for each of the estimations were omitted for the sake of brevity. However, they are available from the authors upon request.

Source: Authors’ elaboration using data from OECD and from the Federal Reserve Bank of St. Louis.

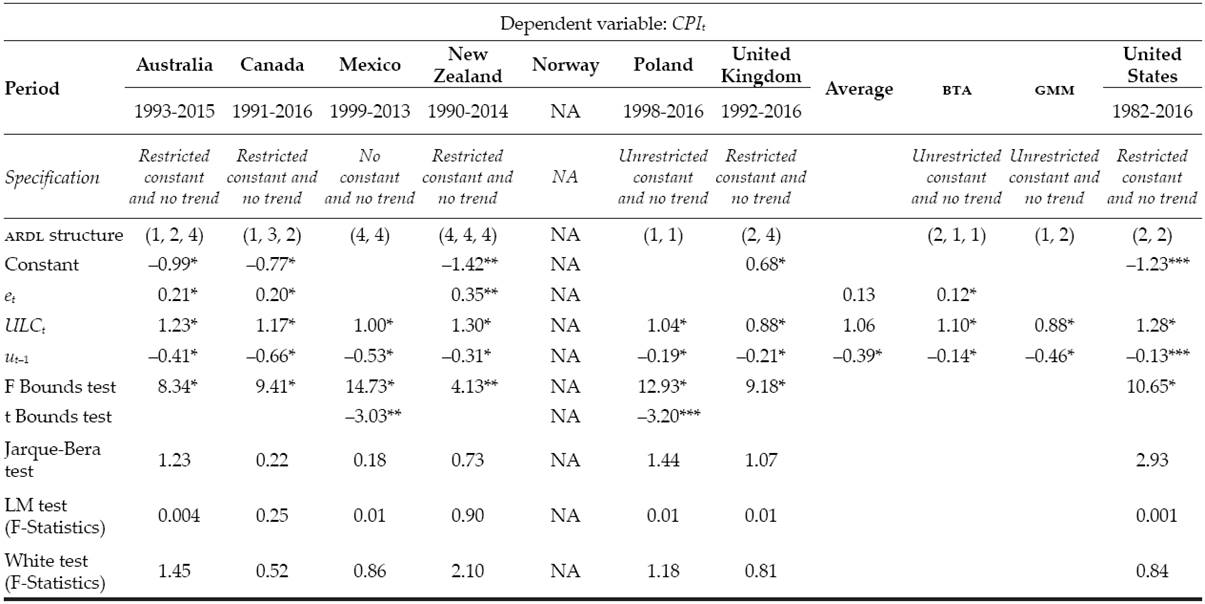

Table 5 Estimation of the long-run elasticities of the CPI with respect to e and ULC for the IT sub-period

* Denotes statistically significant at the 1% level. ** Denotes statistically significant at the 5% level. *** Denotes statistically significant at the 10% level.

Note: All the series are expressed in natural logarithms. The ARDL structure was determined on the basis of the Schwarz information criterion. White heteroscedasticity tests were made using cross terms for the cases of Poland and the United States. Lags of the dependent variable and the independent variables were used as instruments in the estimation of the GMM; the error terms do not exhibit autocorrelation neither of first nor second order. The rest of the relevant statistics for each of the estimations were omitted for the sake of brevity. Yet, they are available from the authors upon request.

Source: Authors’ elaboration using data from OECD and from the Federal Reserve Bank of St. Louis.

Our estimations for the whole period reveal a number of characteristics (see Table 4): First, the ULC is relevant in the determination of the CPI for all the countries considered, including the United States. In contrast, in three such countries (Norway, Poland and the United Kingdom), e does not exhibit a long-run relationship with the CPI. Only in Mexico the elasticity of the CPI with respect to e is higher than with respect to ULC. Moreover, the simple average of the estimated elasticity for each individual country is not very different from the estimated parameters for the panel based on the bta cointegration methodology; the simple average of the estimated elasticity of the CPI with respect to e for each country is equal to 0.18, whilst the BTA cointegration estimated parameter is equal to 0.26. On the other hand, the simple average of the estimated elasticity of the CPI with respect to the ULC for each country is almost the same as the one estimated for the panel using the BTA cointegration methodology (0.89 versus 0.87). Likewise, although the estimated elasticities for the panel based on the GMM methodology are very different from the simple average of the estimated elasticities of the CPI with respect to e and the ULC for each country, the estimated parameters support our hypothesis about the higher importance of the ULC vis-à-vis e in the determination of the CPI. In fact, under the GMM the estimated elasticity of the CPI with respect to e is not statistically significant. Lastly, the elasticity of the CPI with respect to the ULC for the United States is equal to 1.03, that is, a value within the range of the estimations for the panel. Second, the error correction term is statistically significant for each country, yet its simple average is very different from both the one estimated by the BTA cointegration methodology and the average estimated by the GMM. Given these results, it can be argued that in the long-run the CPI follows the behaviour specified in equation [4], with or without the effect of e. What is more, the adjustment of the CPI to its long-run equation is verified for the United States as well.

As for the estimations for the it period, the following characteristics were found (see Table 5): First, because of data constraints, it was not possible to get a robust estimation for Norway; the estimation for New Zealand was the same as the one reported for the entire period. Second, the ULC is statistically relevant in the determination of the CPI for all the countries for which we were able to run estimations. In contrast, e was not statistically relevant in the determination of the CPI of Mexico, Poland and the United Kingdom. In countries where e is statistically significant, the estimated elasticity of the CPI with respect to e is lower than that with respect to the ULC. For the it period, even though we included the seven countries in the panel, the simple average of the estimated elasticities of the CPI with respect to e and with respect to the ULC are almost the same as those estimated for the panel using the BTA cointegration methodology (0.13 versus 0.12 for the estimated elasticity of the CPI with respect to e, and 1.06 versus 1.10 for the estimated elasticity of the CPI with respect to the ULC).

The simple average of the estimated elasticities and those estimated with the BTA cointegration methodology are very different from the estimated elasticities obtained with the GMM. We found again that the results support our hypothesis regarding the higher importance of the ULC vis-à-vis e in the determination of the CPI. Third, the simple average of the error correct term for each country is similar to the one estimated with the GMM for the panel, while that estimated with the BTA cointegration methodology is very different. In sum, from these three cases we gather that the behaviour of the CPI follows the long-run specification given by equation [4], with or without the effect of e. The same is true of the United States.

Given our estimations, the elasticity of the CPI with respect to the ULC ranges between 0.87 and 1.11 for the entire period and between 0.88 and 1.10 for the it sub-period. These calculations not only support our hypothesis regarding the ULC as the main determinant of the CPI; they also show that if the ULC increases, firms tend to transfer all or almost all of the increment onto consumers’ shoulders.

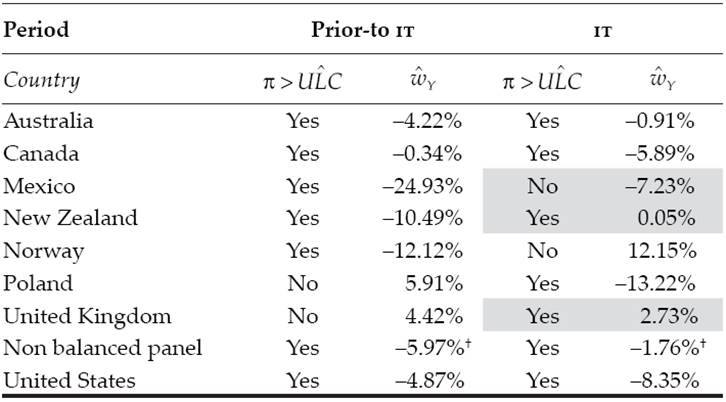

The behaviour of firms affects the functional distribution of income, defined as w Y , w times the number of workers divided by the total value of produced output, expressed as the CPI times Y. So, using equation [3], w Y can be expressed as:

Where θ is the proportion of the ULC with respect to the total unit costs. Therefore, the growth rate of w Y is equal to:

Where all variables are expressed in growth rates. Now, reconsidering our econometric results where the main determinant of the CPI is the ULC, we can re-write equation [6] as:

Where π is the inflation rate. According to equation [6]), w

Y

will increase or decrease if the growth rate of the ULC is higher or lower than the rate of inflation. Table 6 presents the value of

Table 6 Percentage variation of employees’ compensation as a percentage of gross value added

† Denotes the average value of the annual average of each country.

Source: Authors’ elaboration using data from OECD and the Federal Reserve Bank of St. Louis.

As shown in Table 6, when

Now, the adoption of the it strategy implies the acceptance of a monetary policy rule for controlling π (the Taylor rule); this rule relates the real interest rate (i - π) with the inflation gap (π - π0) and the output gap (Y - Y 0) positively. Bearing in mind our hypothesis and our empirical evidence, the instrument of the monetary policy rule must be related with the components of the ULC, of which the natural candidate is w. In consequence, we estimate the traditional Taylor rule (equation [7]), as well as our implicit monetary policy rule derived from both our hypothesis and the empirical analysis (equation [6]):

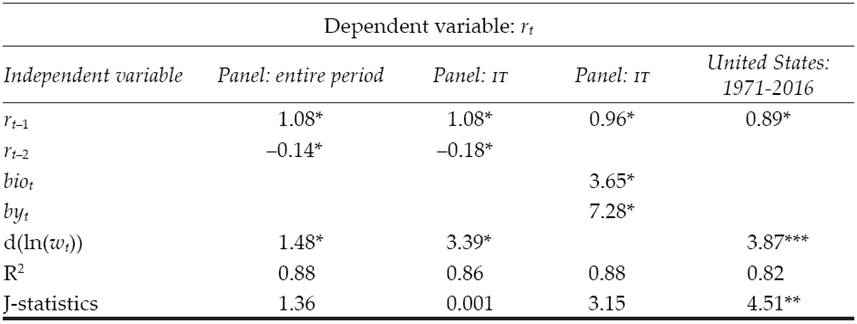

Where d(·) expresses the first difference. According to equation [7], the Central Bank increases (reduces) i and, therefore, the real interest rate when π is higher (lower) than π0 and/or when Y is higher (lower) than Y 0, and/or when e depreciates (appreciates). On the other hand, according to equation [8], w is the benchmark used to adjust i. Table 7 presents the results of our estimations for the panel corresponding to the entire period and the sub-periods, and for the United States for the entire period. We used the GMM in all cases.

Table 7 Estimation of the alternative Taylor rules

* Denotes statistically significant at the 1%.

** Denotes statistically significant at the 5%.

*** Denotes statistically significant at the 10%.

Note: Lags of the dependent variable and the independent variables were used as Instruments. The nominal exchange rate was not significant in the estimation of the traditional Taylor rule.

Source: Authors’ elaboration using data from OECD and from the Federal Reserve Bank of St. Louis.

Given the results presented in Table 7, it can be said that: First, e was not relevant in the estimation of the traditional Taylor rule. Second, the panel estimation of the traditional Taylor rule exhibits the expected values of the parameters. Third, the panel estimation of the alternative monetary rule exhibits the expected values of the parameters, both for the entire period and for the IT sub-period. Fourth, although it is true that both estimations, the traditional Taylor rule and our alternative monetary policy rule, exhibit the expected values of the parameters, the J-statistics, the Sargan-Hansen test about the over-identifying restrictions of the model, is higher for the case of the traditional Taylor rule than for our alternative monetary policy rule, signalling the latter is a better option. Fifth, if we compare the estimation for the IT sub-period with that of the entire period, the elasticity of the real interest rate with respect to w is two times as big in the first case in comparison with the second one, which is indicative of the use of w as the reference variable for changes in the monetary policy instrument, i, especially during the it sub-period. Sixth, the estimation of our alternative monetary policy rule also exhibits the expected values of the parameters for the case of the United States. However, it is not possible to reject the fact that the model is over-identified at the 1% level.

The following reasoning ensues from our empirical results: in order to stabilise π, the ULC must be controlled through reining in w. Firms try to get a higher proportion of total production increasing the mark-up, thus reducing w Y , which in turn implies a reduction of aggregate demand. Such contraction in aggregate demand diminishes inflationary demand pressures14. Finally, it appears that central banks’ reaction functions do not link real interest rates with inflation and output gaps, but rather with percentage changes in w. This finding strengthens the idea that the inflation targeting monetary policy framework, at the end of the day, represents a price stability strategy that redistributes income against wages. Hence inflation targeting requires wage-deflation to meet the target.

Summary and conclusion

Interest-rate rules have become fashionable over the last three decades in advanced and developing economies alike. A new consensus on how to conduct monetary policy has emerged as an increasing number of central banks has adopted inflation-targeting monetary policy frameworks to tackle price instability in a world economy essentially characterized by pure fiat money. The most popular version of such consensus is the well-known Taylor rule where the central bank responds to both inflation gaps and output gaps adjusting the nominal interest rate with the aim of hitting a low inflation target and achieving long-run price stability. The implication is that in IT countries the nominal interest rate operates as the anchor of inflation. However, to quote Chesterton (1935-1936: 4/19/30), “fallacies do not cease to be fallacies because they become fashions.”

As discussed above, such new conventional wisdom has not gone unchallenged. Many economists from different theoretical persuasions have shown, on empirical grounds, that the majority of inflation-targeting central banks (if not all of them) often resort to an asymmetric exchange rate policy (chiefly through currency appreciations and sterilised interventions in the foreign exchange markets) aimed at fulfilling their inflation goal. This means that the worldwide price stability observed throughout the so-called Great Moderation period (1982-2007) should be attributed not mainly to the interest rate, but to a large extent to exchange rate appreciations deliberately exacted by the very IT central banks, particularly in developing countries. The implication of this criticism is that the exchange rate, rather than the interest rate, is the anchor of inflation in IT countries.

Now, if price stability depends on appreciating the exchange rate, then the model as a whole involves a contradictio in adjecto. For in an export-led growth cum inflation targeting macroeconomic model the exchange rate must not be appreciated if tradeable goods are to remain competitive and balance of payments equilibrium is to be preserved. Yet, if the exchange rate does not appreciate in order to spur exports, the inflation target will be missed. The position resembles a Faustian dilemma: As it were, two souls abide within the breast of the it model, and each one seeks for riddance from the other (Goethe, [1808] 2014).

In the present paper we argued that the veritable anchor of inflation is the wage rate, rather than the nominal interest rate or the exchange rate. Our econometric results, based on empirical evidence from a set of IT countries, show that CBs have come close to long-run price stability through reining in both the wage rate and unit labour costs. Nonetheless, wage deflation ultimately leads to contractions in aggregate demand, polarization in income distribution and economic stagnation.

nova página do texto(beta)

nova página do texto(beta)