JEL Classification: F16.

Clasificación JEL: F16.

Introduction

In light of the turmoil caused by Spain’s unemployment since the current global crisis began in 2008, diverse economic policy options are vying for contention. One common current of thought in European countries insists, following the German example, on encouraging greater foreign sales as a way to compensate lower domestic demand1. This lower demand arises both as an immediate effect of the implicit crisis of confidence (reflected by a drop in private consumption and investment), and because of economic austerity policies, most of which are being implemented (through cutbacks in public consumption and investment).

As Fujii and Cervantes (2013) have shown, there is nothing new in attempts to explain economic growth through exportled growth models. In this paper, we explore the relationship between export and growth variables and reference the fact that competition in export markets stimulates greater efficiency in the output structure (Bhagwati and Srinivasan, 1979; Feder, 1983; Kohli and Singh, 1989; Krueger, 1980). Furthermore, exports favor specialization, allowing benefits to accrue from economies of scale (Helpman and Krugman, 1989); export-driven firms also tend to be more technologically advanced and their technical progress spreads throughout the entire economy (Grossman and Helpman, 1993). Further, by bringing hard currency into an economy, exports help to overcome the possible external constraint on growth (Thirlwall, 2011).

Still, the chances that exports will be the main driving force behind economic growth, as seen in some Asian countries or, closer to home, in Germany, bear close relation to the net spillover effects that exports might have on the entire domestic economy (Irawan and Welfens, 2014). This will depend on how Spain’s exports function within global production chains (Fuentes, Mainar and Cardenete, 2015). It is of little use to export goods described mostly as having “middle to high technology” (in reference to the technological factor intensity incorporated in the final good), if Spain’s contribution to the global production chains emphasizes, for example, producing components with higher labor intensity, and if exporting depends on importing inputs to produce a large proportion of export-bound goods. In addition, hypothetically, the export-growth rate, and, mainly, exports’ sectorial structure and the spillover effect of imports required by output (with their corresponding sectorial structure) condition the “exportled growth” model (Sinn, 2006).

Given this context, we should consider the export sector’s potential demand for labor in order to gage if it is indeed possible to counter high unemployment in a country like Spain by expanding exports. If possibilities exist in this regard, then the following logical question is how to expand Spain’s exports, which require ongoing improvements in the competitiveness of domestic output2. By extension, a greater volume of exports will bring not only greater sales abroad but also displacement of goods imported to the domestic market (Bayerl, Fritz and Hierländer, 2008). This paper endeavors to analyze the potential job-creation capacity of Spanish exports in the short term, by means of a detailed study of information provided by Input-Output Tables (IOT) and an inverse-matrix methodology. This will also entail analyzing the structure and the sectorial characteristics of Spanish exports, as well as macro and microeconomic (industrial) policies that directly affect this function. We will return to this latter aspect in our closing comments.

Objectives

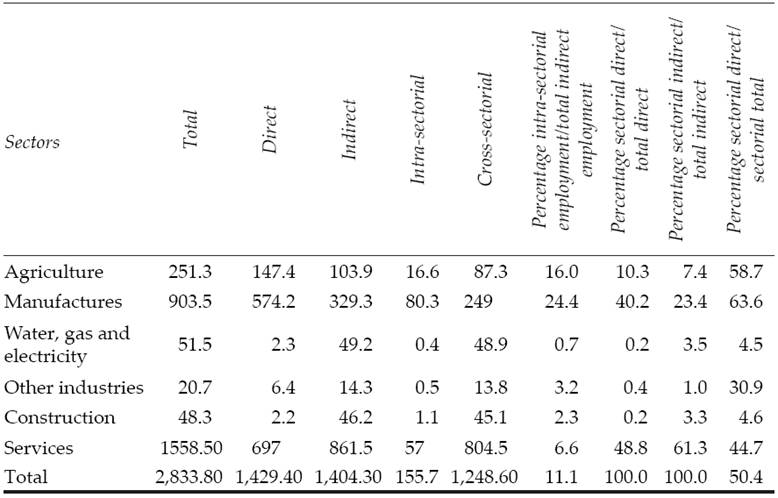

The objectives of this paper involve estimating employment created by exports of the Spanish economy and their sectorial distribution, in order to reach conclusions regarding future job creation in Spain. We are interested in direct, induced, or indirect job creation because of inputs demanded by exports (Miller and Blair, 2009). In this latter case, we also consider the difference between employment induced within the export sector itself (intra-industrial effect), and within all remaining economic sectors (inter-industrial effect). This distribution affects the job-creation capacity within the domestic market. In addition, we consider both the spillover effects of imports generated by exports, which here we deem to have substitution effects on domestic employment that should be considered when evaluating their net employment effect (Sousa et al., 2012).

The subject is particularly relevant since results from this analysis can inform conclusions regarding how Spanish exports function in sectorial production chains. It is of interest to know what spillover effects Spain’s exports have on the domestic economy and, by extension, on job creation and on the balance of payments. There are quite a few economies that, being strong exporters, have few multiplier effects domestically (López, 1999), and show ongoing balance of payments instability, owing to the significant spillover effect of imports inherent in a specific type of export specialization (Cervantes and Fujii, 2012; Fujii, Cervantes and Fabián, 2014).

Economic context and economic policy

We will briefly review the current situation of Spain’s economy, especially its external sector, recently implemented economic policies, and the export strategy defined therein.

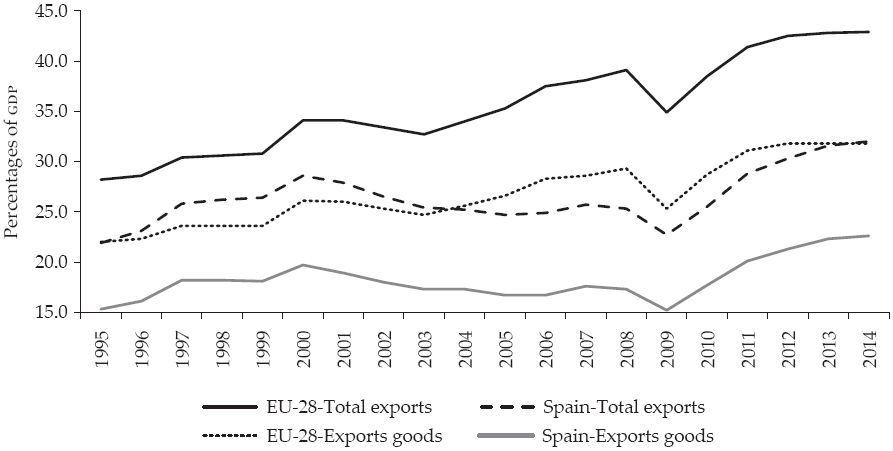

During the first decade of the 21st century and until the onset of the financial crisis, the export sector was characterized by a growing deficit see Figure 1), which revealed some important limitations therein3. We begin by noting that exports are highly concentrated in a few large companies (Durán, 2014). This fact would seem to limit the role of this economic sector in becoming the driving force of recovery, given that Spain has many very small firms.4 Thus, Durán (2014, pp. 191-192) notes, “the number of small-scale exporting firms is high, and these firms made few efforts [to modernize their technology]”. This situation leads to low productivity growth (Nuñez, 2004). Some analysts call it the “Spanish paradox”: Ongoing improvement of productivity is due to large, more export-oriented companies5 (Crespo, Pérez-Quirós and Segura-Cayuela, 2011). Cardoso, Correa-López and Domenech (2012) explain this paradox as “a modest market share loss since the launch of the euro alongside a real exchange rate appreciation” And they continue, “The non-price determinants of competitiveness are more important than export prices in explaining the change of world export shares. Notably, Spanish firms’ strategic decision-making has helped shape Spain’s internationalization and may, ultimately, be the crucial factor that explains the paradox”. Durán and Úbeda (2013) reach similar conclusions about the strategy of larger Spanish (multinational) companies.

Source: Own calculations based on Eurostat data, available at: <http://ec.europa.eu/eurostat/data/database>.

Figure 1: Exports rate (exports/Gross Domestic Product) for Spain and European Union (total exports and goods exports)

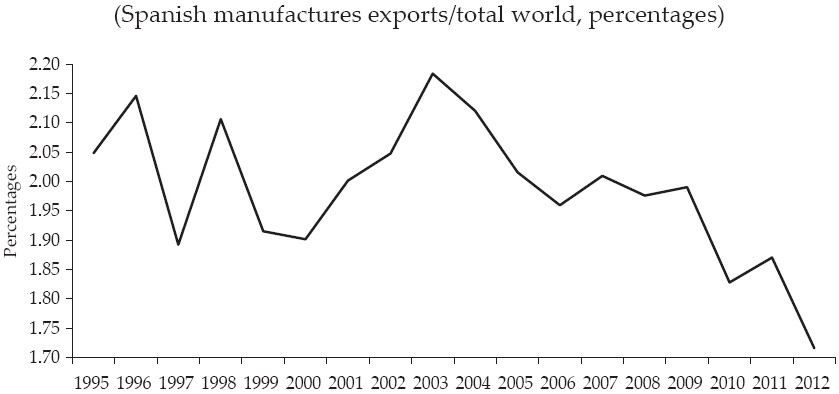

In other words, large Spanish firms are determinants of productivity improvement (López-García, Puente and Gómez, 2007) and in fact seem to be more productive than large European firms (Antrás, 2011). Further, smaller Spanish companies are less productive than European ones, and, obviously, the latter are less productive than large European companies (Mora Sanguinetti and Fuentes, 2012), reinforcing the idea that Spain’s export sector continues to be weak. For these authors, this reasoning would explain why Spain’s exports have had more relative success (compared to all other European Union countries) in containing the loss of their export share in world markets (see Figure 2), since the launch of the euro.

Source: Own calculations based on International Monetary Fund (IMF) data, World Economic Outlook, available at: <http://data.imf.org>.

Figure 2: World share of Spanish manufactures

Later recovery, beginning in 2010, has been more a result of an ongoing drop in Gross Domestic Product (GDP) than of a significant recovery of exports. It turns out that the performance of a group of large exporting companies that dominate most export sales is the reason behind the rise in recent years of the export coefficient. In fact, the competitive advantage gains that occurred from the drop in real wage costs (from 2012 on) do not seem to have translated into a significant rise in exports, but rather in greater net returns for exporting companies6.

Although we can see in Figure 1 that, since the current crisis began in 2007, there has been significant growth in Spain’s export coefficient (percentage exports/GDP), it varies little from the phenomenon observed in the rest of our European Union partners in terms of total exports and manufactures. Therefore, Spain has gained very little market share in the European Union.

Spain’s exports have fallen continuously since the beginning of this century, from a ratio of Spain’s exports to total world exports of 2.2% in 2003, to 1.7% in 2012 (Figure 2). This confirms that on a global scale, Spain’s economic competitiveness continues a decline that began several years ago.

Spain experienced a relative upswing of exports during the recession that seems to have encouraged authorities to search for a way out of the crisis through exports (Hanley and Monreal, 2012). As we shall see from the analysis below, this line of reasoning seems shortsighted, insofar as Spain’s sizable unemployment problem is concerned.

It would seem that a strategy of internal (wage) deflation drives economic policy7, which is implicit in many of the structural reforms8 and austerity policies implemented. Apparently, these policies seek to improve Spanish firms’ competitive position in European markets through prices (by decreasing absolute wage costs). The mainstream economic viewpoint that has guided economic policy in recent years would approve of these measures, given that they seem to coincide with the implementation of a type of export-led growth model.

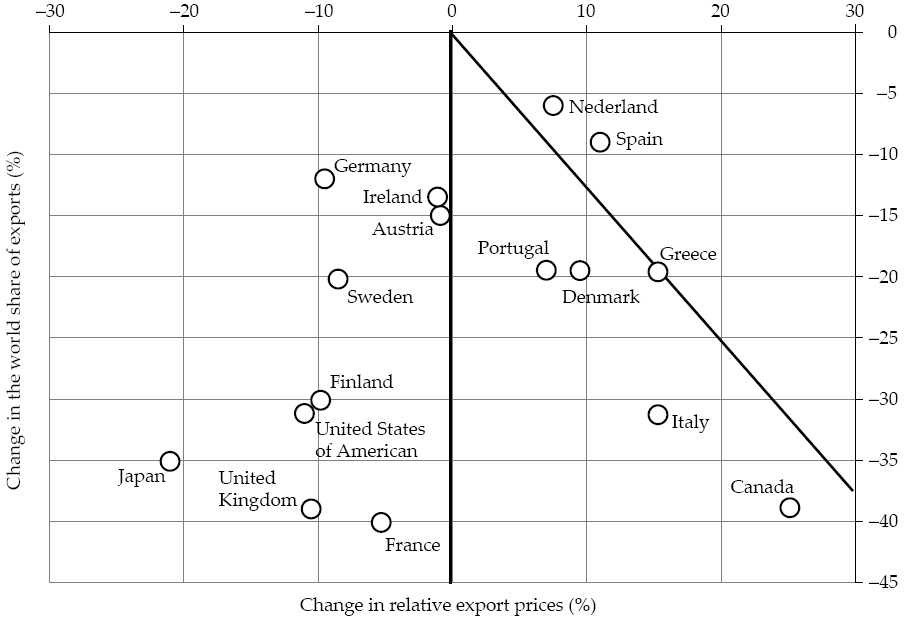

And yet, the empirical literature points to a different conclusion, i.e., the relative improvement of Spanish competitiveness during the recession (from 2010) has not been due to the improvement in terms of relative prices of exports, but to the other variables to which we have alluded in previous paragraphs. These variables are linked to the characteristics of the process of internationalization of big companies and firms’ strategic decision-making over the last two decades (Cardoso, Correa-López and Domenench, 2012), in line with the “Kaldor paradox” (Maroto Sánchez and Rubalcaba Bermejo, 2006).

Source: Cardoso, Correa-López and Domenench (2012).

Figure 3: Change in the world share of exports and in relative exports prices for goods and services, 1999-2011

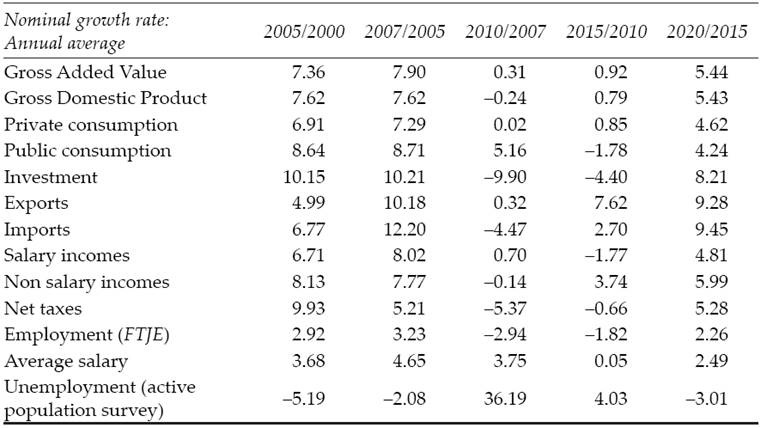

The estimations undertaken herein (the basis for the constructed and forecast IOT for the Spanish economy from 2000 to 2020) are described in the following section. The macroeconomic scenarios in which these estimations are made foresee lower nominal wages in 2010-2015, and a moderate growth thereof in the following five-year period, but lower than GDP growth.

Research methodology

Preparing the input-output tables

Here we develop models that incorporate a supply and demand perspective and are proliferating as powerful instruments to increase understanding of economic reality. They also allow for an integrated analysis known as the Keynes-Leontief model, based on their main authors (Klein, 1952; Leontief, 1946 and 1977).

This analytic tool is clearly informed by the development of a model that determines the performance of the different demand components, which generally become the inputs that make up the sectorial structure, i.e., from supply components, through an input-output methodology (hereinafter IOM).

Given its wide acceptance, it seems unnecessary to comment on the versatility and suitability that this methodology lends to an analysis of any economy’s sectorial performance. Yet, its usefulness as an instrument for simulating future scenarios undoubtedly expands its possibilities in the area of economic analysis, and is therefore well suited for interpreting the complexity of economic relationships.

The analysis undertaken is based on a scenario regarding Spain’s possible economic growth until 2020, given the integration of demand estimations generated by a causal econometric model, whose forecasts are perfectly consistent with a set of dynamic input-output tables, estimated for 2000-2020. The last governmental IOT for Spain’s economy was for 2008 (Pulido and Pérez, 2006; Pérez, 2005).

To define the macro scenario of Spain’s economy until 2020, we have used the predictions from the Wharton-Universidad Autónoma de Madrid (UAM) model made in 2014 and thus include the official estimates of the Spanish economy until 2014 and predictions from 2015 to 2020.

This model was developed by the Lawrence R. Klein Institute for Investigation of the Autonomous University of Madrid, Spain’s representative entity in Project Link (sponsored by United Nations), to which the authors of this paper are affiliated. Project Link brings together more than 80 teams throughout the world that continuously carry out analyses and predictions regarding the entire world economy through integrated econometric models.

The Wharton-UAM model is defined as a causal macroeconomic model, based on more than 600 equations that characterize the behavior of Spain’s economy on a quarterly and annual basis. It is designed with a Keynesian approach and in its construction includes world economic growth predictions, differentiated by economic areas and countries, as well as the foreseeable evolution of exchange rates, interest rates, and international prices, especially those related to raw materials.

In terms of predictions during the period considered, we believe that the Spanish economy has rebounded from the nadir of the recession. The need to reconsider the economy’s main disequilibria led authorities to apply restrictive economic policies and fundamental labor-related reforms in keeping with European Union recommendations. These measures have brought economic and social transformations in Spain and it is forecast that by 2020 the Spanish economy will show positive growth.

Global estimates of the different demand components and labor market variables, obtained by the Wharton-UAM model, are included in a supply model built following the classic Leontief model, although modified by technical distribution and employment coefficients included in its formulation.

This process gives us the growth of the foreseen sectorial gross value added for Spain’s economy and the estimation of a set of dynamic input-output tables that cover 2009-2020, from which the analysis is based regarding the foreseeable impact of the foreign market on the growth of employment in Spain, the main objective of this study.

This estimation is part of an IOT updating exercise, known as RAS method, undertaken by Professor Stone (1961, 1980; Stone and Brown, 1962), who views the modification of the technical relationships of output in accordance with both the dynamics of added values, either observed or quantified, and final demand, i.e., assuming that the substitution and manufacturing effects are combined9.

The model thus defined allow us to establish inter-sectorial connections with a focus on supply, but also to apply the model of employment that is implicit in more traditional approaches to input-output modeling (Pulido and Fontela, 1999).

Nonetheless, given that our main interest is identifying what spill-over effect is exerted by foreign trade in terms of job creation, while pondering the implications of current economic policy on the Spanish job market, the classic formulation of the iom has been subjected to an additional econometric analysis, which will allow us to identify at least three differential effects:

How much output growth would result from an expansion of external demand?

The effect that the observed change might exert on the structural composition of the Spanish economy (domestic demand versus foreign demand), with regard to the foreseeable evolution of the job market.

Total or partial compensatory employment gains, depending on each sector’s factor endowment, created by exportled economic growth, taking into account the rise in imports needed to respond to said growth.

Thus, a series of IOTs have been prepared that describe and anticipate the demand for employment generated by the external demand of the Spanish economy in 50 branches of production. The applied methodology lends consistency to these results with a macroeconomic scenario, which incorporates forecasts for both Spain’s economy and the world economy, as recently estimated by several international institutions and organizations (imf, United Nations, European Commission, etc.)

Methodology for estimating employment content

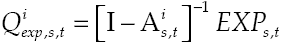

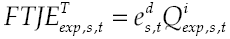

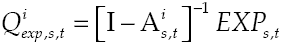

In this study, we shall focus exclusively on export sales. In other words, accounting for the direct employment coefficients, hereinafter e d , and assuming that job creation for every million euros of output is independent of its geographic destination, we obtain:

where FTJE

s,t

: Full-time jobs equivalent;

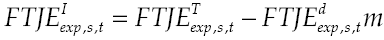

These equations make it possible to transform output growth to employment growth due to exports, in accordance with the following equations:

Further, by matrix diagonalization

However, according to our approach, these results for employment do not take into account that the increase in output derived from exports generates, in turn, an increase in imports and, thus, a loss of domestic employment10.

Therefore, the employment transferred overseas should be deducted due to the increase in imports. To this end, we have estimated the outsourced product, that is, the value of the imports generated by both total activity and that associated with exports, and these have been translated into terms of employment, according to the following equations:

where

Thus, we obtain an approximation of the foreseeable effects on employment attributed to the degree of economic openness, which also takes into account output specialization. Furthermore, the sectorial breakdown allows us to characterize the more internationalized sectors by differentiating their labor endowment (labor intensity), and their demand of imported products to generate their output with the resulting loss of effectiveness, in terms of employment.

Exports and job creation in Spain

Job creation through exports. Characteristics and tendencies

Employment contained in exports or the labor used to produce these exports is attributable to various output functions. Firms that produce goods and services for export directly demand labor to do so. In addition, they purchase supplies from other companies or use those that they themselves make, which, in turn, require labor for their output or, alternatively, they must import those goods and services, as supplies, in order to keep up with exports. This latter aspect would mean a hypothetical deduction (as if they had been made domestically), of domestic job creation. Thus, net employment created by exports accounts for direct, induced, or indirect employment created by means of the inputs consumed, and for employment “lost” due to imports. The following Figure 4, synthesizes the analytical framework of exports’ effects on the domestic market, from which the corresponding impacts are deducted in terms of creating a demand for labor, i.e., job creation.

Source: Prepared by the authors based on Fujii and Cervantes (2013, p. 145).

Figure 4: Exports effects on internal demand

For the purposes of this analysis, we consider that the relative impact of exports on the general volume of employment depends on:

In the case of direct employment and indirect intra-industry employment generated by exports, the volume of employment depends on the ratio of employment generated by exports to total (or sectoral) employment. Thus, the lower this ratio, the lower the job creation capacity (in relative terms) due to the increase in export activity. The higher the proportion (exports become increasingly labor intensive), the greater the overall effect on job creation (equations [5], [6], and [7]).

Inter-industry employment generated by exports will depend on the volume of exports as well as the employment demands generated in the economy as a whole through the cross-sectoral relationships that arise from supplier-supplier relationships (equations [8], [9], and [10]).

In the case of increased imports due to the production of goods and services for export, the volume of employment depends on the ratio between the employment rate of exports and the coefficient of employment of imports on the coefficient of the total national or sectorial product. So the net employment balance generated by exports, minus the “loss” due to imports, will increase as the previous ratio increases (exports become increasingly labor intensive) (equations [13], [17], and [18]).

In essence, the result in terms of job creation due to exports will be related to exports’ sectorial structure, as established by labor performance in output with respect to the output for domestic consumption (output realized and output hypothetically displaced due to imports). The above, in the final analysis, will also have to do with relative wage levels of jobs created by exports and that of jobs created by output for domestic consumption.

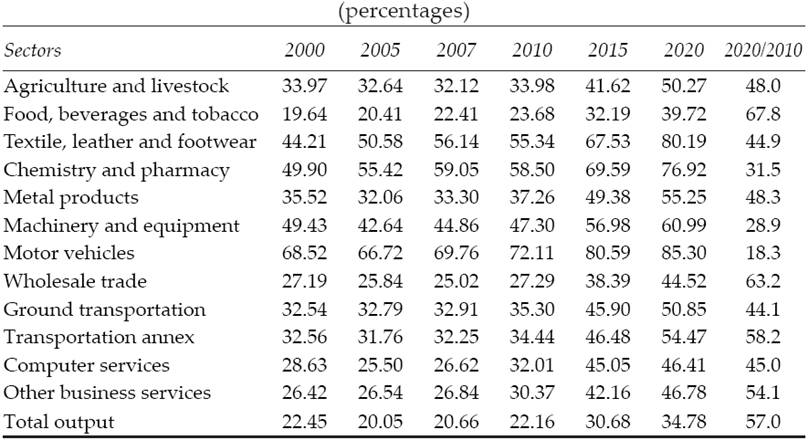

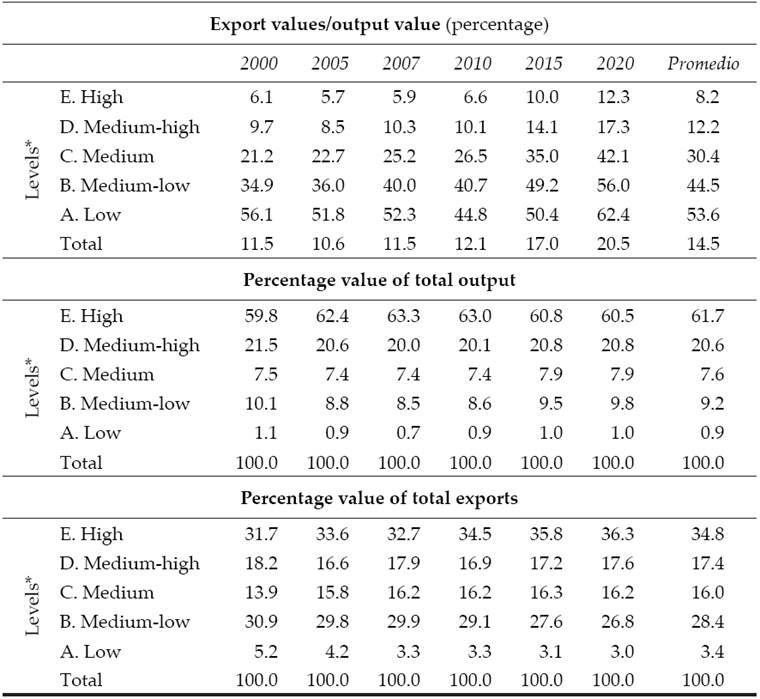

The volume of Spanish exports has grown steadily since the mid-2000s, following a relative decline reflecting the country’s lack of economic competitiveness during the period of economic expansion that lasted until 2007. If the forecasts in the macroeconomic scenario are correct, Spanish exports will continue to grow over the next few years (see Table 3 in the Appendix), thus, under the conditions set out above, export growth will mean an increase in the relationship between job creation linked to exports and employment.

Now, as we can see in Table 3 (Appendix), over the next decade the exports that will experience the greatest growth will be mainly services. Thus, manufacturing sectors (except processed foods) will lose relative importance. In summary, the more labor-intensive sectors will experience greater growth if the Spanish economy behaves according to macroeconomic expectations, as reflected in Table 2 (Appendix). The same table also shows a process of wage deflation in 10 years, becoming more moderate in the last five years. It would seem then that the external sector responds to the stimuli derived from lower wage costs, reinforcing and even intensifying the pattern of export performance that has characterized the Spanish economy in the past. We will return to this topic below.

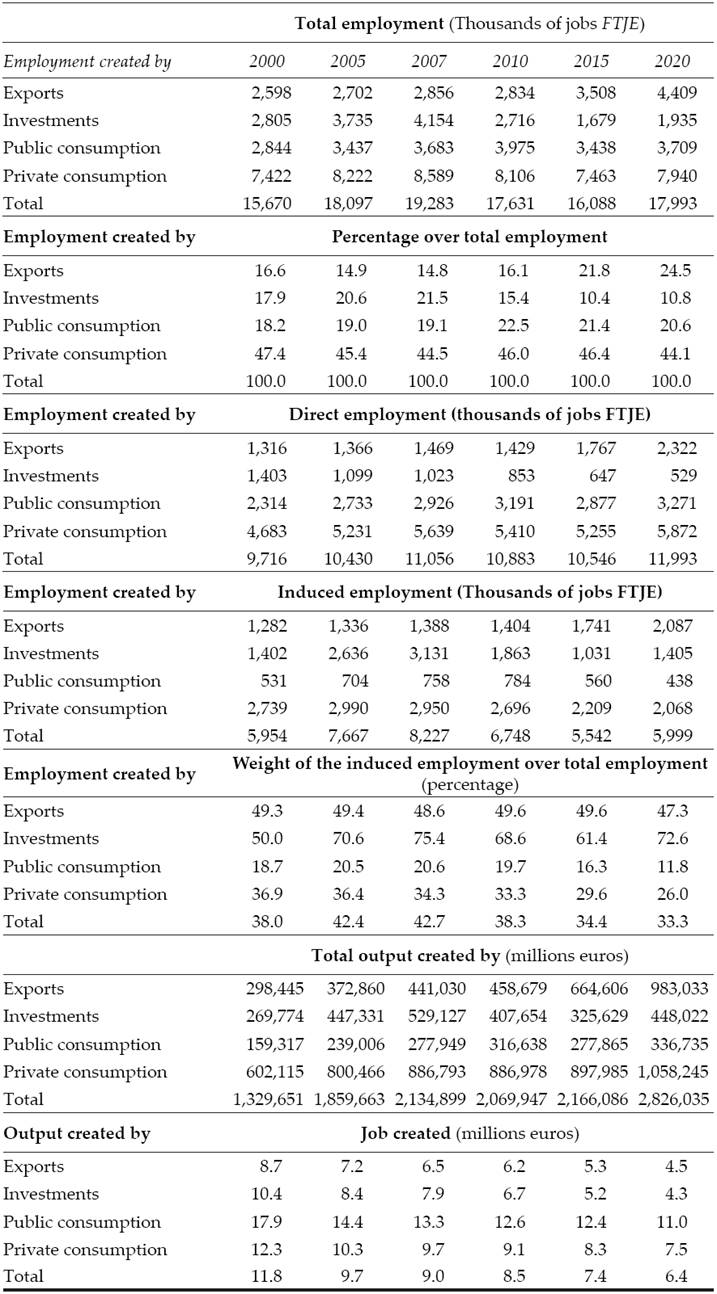

During 2010, Spanish firms’ exports created 16% of all employment (in full-time job equivalents, FTJE). Because of the relative loss of weight of exports in total output during the first decade of the 21st century, this proportion decreases and reaches 2010 levels equivalent to those found at the beginning of the century. With regard to the decline, we can estimate an upward trend in the overall volume of exports, which could reach close to 35% of total output for 2020. Regarding the impact on employment, it is worth noting that the increase in the relative importance of export sectors is more intense in services than in manufacturing (again, except food processing), or in agriculture; in other words, export activity seems to be increasingly concentrated in the most labor-intense sectors in their respective output processes11.

In fact, it is the low or medium-low labor-intensive sectors that represent just over 70% of the value of exports, generating a similar volume of employment in 2010. In the following decade, these sectors will increase their exports only slightly, indicating that a strategy of wage deflation will not change their overall presence in the Spanish economy and, therefore, will not significantly benefit the low to medium-low labor sectors. This means that in the future, the production model that has been in force for decades, with its low level of competitiveness, will continue to maintain the current pattern of exports of labor-intensive goods.

The job creation capacity of exports per million euros of production is lower than the average found in the entire productive structure. For example, in 2010 for every million euros of export production, 3.1 jobs were created, while for all domestic production the figure was 8.5, indicating that export- linked production is less labor-intensive. Although the relationship between the above figures remained relatively stable during the first ten years of this century, it is expected to increase, given that forecasts point to a significant increase in the next decade of exports of services, with respect to total exports.

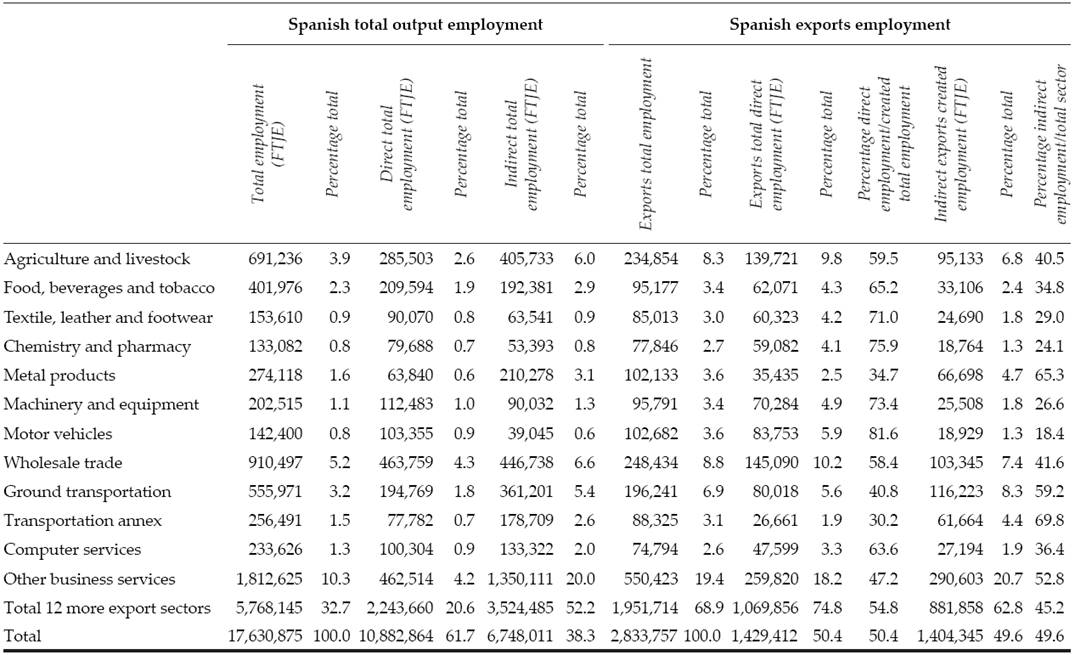

In addition, the greatest capacity for job creation is concentrated in public expenditure, given that, in 2010, 12.6 jobs were created for every million euros. This function shows a relative tendency to decrease with time.

Twelve sectors (out of a total of 50, see Table 4, Appendix), with more than 2% of total jobs created through exports, account for more than two-thirds of the jobs created in 2010, showing a tendency to increase since 2000. The designated sectors account for almost one-third of the total output of goods and services and somewhat more than this proportion of jobs created than the entire domestic output structure (indicating a slightly higher labor intensity than that of the total economy), and represent more than 50% of the total value of Spain’s exports.

Worth noting is the relative increase in job creation by the services sectors that are the most export oriented, and which since the start of the century have maintained an upward trend in job creation due to exports. Interestingly, the relative weight of employment linked to the export of business services continues to grow and is expected to continue growing in the coming decade. Given the relative increase of services in exports, we see a relative increase in the capacity of job creation in the economy as a whole.

Direct and induced (indirect) export-led job creation

The analysis undertaken indicates the way in which (direct and indirect) employment needed to produce exports is distributed among the various output sectors. This is, therefore, an important component of all labor demanded by Spain’s output structure. Awareness of this distribution lends insight regarding the export sector’s contribution to a country’s economic development (Fujii, Cervantes and Fabián, 2014).

The exporting companies/sectors concentrate half of the jobs created directly by Spanish exports; output from sectors that supply the former generates the remaining employment (see Table 4, Appendix). However, sectorial differences exist that are worth mentioning. Three sectors (transport, ground transportation, and metal products) stand out because they generate more jobs through exports. These exports have a high percentage of indirect employment or employment induced thorough the rest of the Spanish output structure.

Further, direct or induced employment attributable to exports is concentrated in a limited number of sectors. Just ten sectors, each absorbing a minimum of 3% of total employment, account for around 70% of the overall figure, both in the past and current decades. On balance, no significant changes over time have occurred, besides the relative rise in job creation due to the services sectors.

Nonetheless, when accounting for the net effect of linking exports to domestic output, we must also consider the spillover effect of exports. Considering the spillover effects of imports necessary to produce in the domestic market, we find that around a million and a half jobs have been lost, which gives a comparative idea of exports’ net capacity for job creation.

Imports linked to production of exports could have created an equivalent of around 50% of total (direct and indirect) employment derived from exports. We can consider it as “employment loss” from the domestic labor market generation process. Accounting for the “substitution effect”, (Cervantes and Fujii, 2012), the net result of job creation by Spanish exports comes out to be less than half of what the data show to be the direct and indirect labor needed to produce those exports.

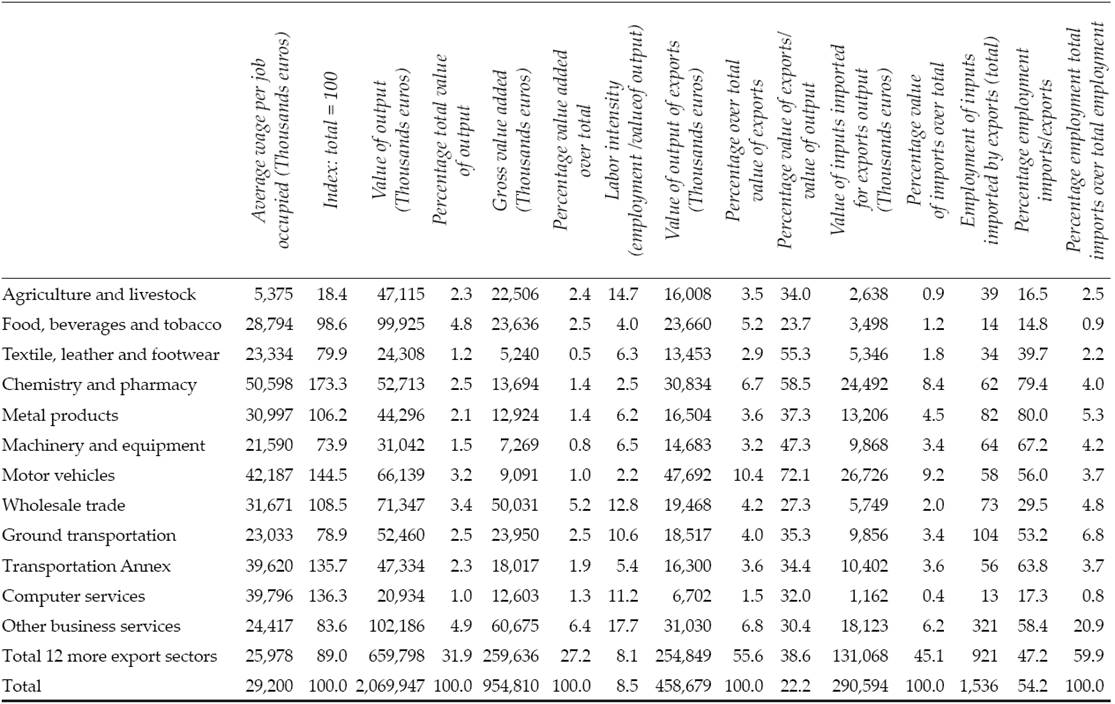

Yet, in this regard, the sectorial differences are more pronounced. Thus, sectors such as metal products, textiles, leather and shoes, machinery and electronic equipment, and transport-related activities import products that could have employed a quantity of labor above 60% (in FTJE) of the jobs created, respectively, by their exports. These sectors are located in the low to medium-low labor-intensity strata. This fact is indicative of a deep insertion in international industrial chains, but with little repercussion in domestic output. Therefore, in designing export-oriented strategies to encourage job creation, export sectors should have inter-sectoral relationships within the internal market. This is an important objective that becomes very relevant in the orientation of industrial policies.

The combination of low indirect job creation and employment relatively displaced by imports points to the sectors most deeply integrated in international production chains, but weakly linked to the domestic market. This cross-reference shows sectors with such traits, such as chemicals and pharmaceuticals, machinery and electronic equipment, and motor vehicles, with low or very low labor intensity, but with a high led-export behavior. Further integration of these industrial chains into the domestic market would means more jobs from Spain’s exports.

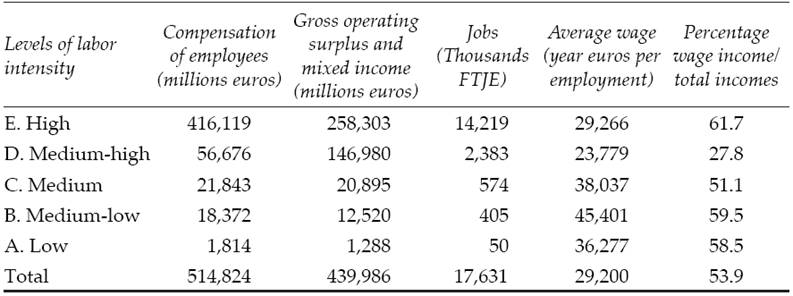

It is thus worthwhile to confirm the performance of Spain’s export sector according to the labor intensity of various output sectors. To this end, we prepared a simple typology of five sectorial strata (defined for 2010), according to the number of jobs created for every million euros of output. Total Spanish output shows a clear preponderance of output with medium or low-medium labor intensity. In addition, these low labor-intensive sectors show a clear export orientation. Their export ratio (value of exports/value of output) is quite above average in all years reviewed. In 2010, our year of reference, the export/output values ratio is above 40% for more labor-intensive sectors (A and B in Table 9 Appendix) versus 12% on average; these sectors produce more than a third of total exports and almost 10% of total output. Moreover, in the coming years we can expect a slight increase in the relative importance of low labor-intensive sectors in exports. This is due to increasing weight of services, which are becoming relatively important both in the overall output of Spain’s economy and in its exports.

According to some analysts and policy-makers, this high specialization in exports of low-labor intensive output could justify a strategic decision to deflate wages as a way of increasing the competitive advantage of labor-intensive sectors. The crux of the matter is that, once again, this seems to be consolidating a model that, in terms of its exports, does not seem to have been very successful in the past, rather just the opposite.

Furthermore, an analysis of the IOM-Spain leads us to conclude that a combination of high export propensity and low labor intensity is linked, from a sectorial perspective, to relatively high wages (see Tables 11 and 12, Appendix). This can be observed in sectors such as chemicals and pharmaceuticals, motor vehicles (automobiles), and activities related to transport, with wage levels (FTJE wages by job) that are on average 25% to 55% higher than the national average. Looking to the future and to a program of sustained growth led by an export growth strategy, this finding would seem to underscore the inadequacy of a strategy that encourages export competitiveness based exclusively or preeminently on ongoing wage deflation.

Another very important outcome of our analysis is related to global production chains of, and their impact on, exportled employment creation. Medium-low (B) and low (A) sectors concentrate 8.5% of total employment created by exports but, at the same time, both accumulate 15% of total employment “lost” by necessary imports to produce their exports. Between these two groups of sectors, they themselves generate with their exports 1% of the net jobs created by total exports (minus total necessary imports) of the country (in 2010). That means that the sectors with the greatest export intensive level are strongly linked to global production chains of a transnational nature (in most cases, foreign enterprises) in which national exports are incorporated and so their import intensity is also very high.

Conclusions

The performance of the Spanish export sector has historically been very weak and relatively anti-cyclical. During the current recession, and in light of the contraction of domestic demand, the number of exporting companies has increased and so too the volume of sales abroad and their respective weight in GDP. Yet, exports continue to be mostly dominated by large companies (Durán, 2014; Myro, 2012), that are more productive and most of which have foreign investment.

An analysis of the Spanish business structure shows a great predominance of small firms that have relatively little weight in global export sales and show great volatility in the face of economic fluctuations.

Conclusions from our analysis of the IOM-Spain prepared for 2000-2010 and projected until 2020 are relevant for understanding the performance of the Spanish export sector and current tendencies therein. We can conclude that the export model forecast for the future does not seem to change substantially the patterns found currently, which point to a strengthening of services in overall export sales and a slight increase in labor intensity (job-creation capacity) of these activities.

Sectors that create greater value added per job are within manufacturing, but these will lose relative weight over time; these are also the sectors that are more export oriented and have wage levels above the national average. Concurrently, exports in these sectors show little inter-sectorial integration, with substantial spillover effects from imports needed to produce exports. All this points to a limited effect on net job creation in the greater Spanish labor market.

Other conclusions are useful for designing macro and micro economic policies: Current policies that, apparently, are strengthening a strategy of wage deflation, would tend to consolidate an output and export model that is largely inefficient to strengthen the sector, favoring activities with high labor intensity, low levels of labor qualification, and relatively low wages. These factors are at the heart of the enormous volatility of the output structure and its exports, and, by extension, the volatility of job creation.

Furthermore, from the above we can also conclude that to improve the domestic spillover of Spain’s exports, policymakers would do well to develop a farreaching industrial policy that is oriented to creating domestic productive chains linked to the output of exportable goods and services, a step that would widen the indirect inter-sectorial effect.

nueva página del texto (beta)

nueva página del texto (beta)