Jel Classification: E52, E58, E61, F15.

INTRODUCTION

Since the European Monetary Union (EMU) was implemented, its members benefited from higher price stability and output growth, exchange rate volatility removal, lower interest rates and reduced country risk. Nevertheless, joining EMU also entails some costs. By entering the EMU, member states automatically surrendered their monetary policy instruments to the European Central Bank (ECB) and were automatically constrained by the fiscal rules imposed by the Stability and Growth Pact (SGP).1

The recent financial crisis has shown that even a monetary union, the hardest form of pegged exchange rate regimes, might be ineffective to isolate an economy in the presence of large economic shocks. This is especially the case when, as in the EMU, countries possess different macroeconomic fundamentals and experience diverse economic developments. In this environment, fiscal policy is insufficient to respond to asymmetric shocks, since fiscal imbalances compromise the ability of policymakers to deal with macroeconomic instability and could even feedback into the financial system.

Indeed, according to Moro (2014), although the recent financial crisis in the Euro area is often described as a sovereign debt crisis, in reality it is a sequence of interactions between sovereign problems and financial system problems. He suggests that, as public finances deteriorate, sovereign risk increases and ends up weakening banks' balance sheets. Also Tagkalakis (2013) points out how unsound fiscal policies, by impacting negatively on market confidence, could represent a risk to economic and financial stability. Hence, financial instability can have significant implications on public finances either directly or through its effects on economic activity. Clearly, there is an important interlink age between fiscal policy and financial markets.

In a monetary union where monetary policy is carried out by a single central bank but fiscal policy is the choice of individual members, fiscal instruments like government expenditure and the budget deficit can be chosen in a way that provides imminent welfare gains for one member at the expense of the others. Therefore, the presence of externalities and free-riding incentives might yield inefficient outcomes in the absence of fiscal policy coordination (Ferré, 2008). The existence of this sort of spillovers justifies the case for further policy coordination not just of the monetary authorities but also of the fiscal authorities.

Two strands of literature have addressed the impact of fiscal and monetary policy coordination on the stabilization policies of a monetary union. The first assumes identical economic structures in modeling macroeconomic policymaking and the second, implicitly or explicitly, uses asymmetric structure features. In the first strand of literature, Evers (2015) has recently employed a dynamic stochastic general equilibrium model with two regions to quantitatively assess two different designs of fiscal federalism in a monetary union: fiscal equalization with nominal tax revenue sharing and a common central fiscal authority. Using a fully decentralized regional fiscal authority as a benchmark, he observes that while a central fiscal authority stabilizes regional consumption and increases interregional consumption risk sharing, fiscal equalization somewhat destabilizes regional consumption and income, while lowering the scope of interregional risk sharing.

Meanwhile, Ferré (2008) uses a simple one-period, two-goods and two-country model to define a game in which the fiscal authorities choose whether to coordinate under a broad or a narrow agenda. Narrow coordination is limited to monitoring national economic policies of the union members and challenging practices that could harm price stability, but leaves freedom to choose policy objectives and instruments. In contrast, broad fiscal coordination implies agreement on common policy objectives. He shows that, even though a broad type of coordination is preferred, there will be incentives for fiscal authorities to deviate.2

Literature using implicit or explicit asymmetric structures is less abundant. Levine and Pearlman (2001) analyze the conduct of fiscal and monetary policy in a multi-country setup where all the economies have identical economic structures. A group of "ins" forms a monetary union and a group of "outs" retain monetary sovereignty. Consistent with Martin (1995), they find that, there are significant incentives for countries to decide individually not to join EMU and free-ride from the benefits that staying out of the monetary union provides. In their analysis, asymmetric features implicitly arise when fiscal authorities pertaining to a monetary union form coalitions to cooperate on stabilization. They find that, joining can be convenient only if the "ins" conduct their own fiscal policy in a coordinated fashion; when this happens a large monetary union becomes feasible. Engwerda, Aarle, and Plasmans (2002) introduce asymmetric features in a more explicit form. They employ a two-country dynamic model with asymmetries in the authorities' preferences, some of the model structural parameters and on the bargaining power of the policymakers in collective decisions. They find that cooperation is often efficient for fiscal players but results in considerable losses for the central monetary authority. In the absence of asymmetries, fiscal players' cooperation leads in most of their simulations to a Pareto improvement for them but not for the central monetary authority.3

In this paper we explore the benefits of monetary and fiscal policy coordination from the perspective of a small economy employing a two-country model of policy coordination. We think that the difference between the sizes of the EMU members is an important aspect that may have profound effects on the stabilization of these economies. Hence, this paper focuses on the presence of size asymmetries and the role of fiscal policy in macroeconomic stabilization to shed some light on two particular questions. First, we ask if participating in a monetary union is desirable for small open economies. The second question is whether fiscal coordination is beneficial or counterproductive for those small open economies that surrender their monetary policy to a central authority.

We find that, leaving fiscal policy considerations aside, it is straightforward to conclude that participation in a monetary union is counterproductive for a small economy. The key point to this result is that a small open economy is better off "free riding", and using its own monetary policy to counteract the inflationary pressures produced by supply shocks. Following this result, we expand the analysis to consider the interactions between fiscal and monetary authorities on macroeconomic stabilization. We then observe that, once representative fiscal policymakers have been incorporated into the model, taking part in the monetary union becomes desirable from a social welfare perspective. The reason for this is that, by taking part in stabilization, fiscal authorities concerned about employment respond to shocks by reducing taxes and spending, thus offsetting inflationary pressures and ameliorating unemployment. In addition, under a monetary union regime, the absence of exchange rate volatility and the reduction in taxation are both factors that contribute to decreasing the losses that society experiences in the face of the shock. Finally, the evaluation of three alternative forms of monetary and fiscal policy coordination shows that the pure coordination of fiscal authorities (playing Nash against the central monetary authority) results in a counterproductive strategy for both economies. On harmonizing the interaction between fiscal and monetary authorities, a monetary leadership strategy results in a deterioration of the position of the small economy's fiscal authority position but a fiscal leadership strategy leads to a Pareto improvement from the perspective of both economic authorities and the societies they represent. Hence, a fiscal leadership strategy is not only the most efficient coordination solution, but also the most feasible one.

The rest of this paper is organized as follows. Section 2 presents the two-country model employed in this chapter, the reduced forms of the model, and an analysis of the inflation employment trade-offs faced by monetary and fiscal authorities under the two main regimes considered. The assessment of inflation employment trade-offs explains the intuition behind the free-riding opportunities enjoyed by the authorities of small economies when they operate under non-cooperative regimes. Section 3 assesses the viability of forming a monetary union in the absence of fiscal policy consideration. Section 4 introduces fiscal authorities that maximize society's welfare and reconsiders the feasibility of forming a monetary union between a small and a large economy. Once the convenience of participating in a monetary union has been reassessed in the presence of non-cooperative fiscal stances, this section also examines the viability of engaging both economies in fiscal coordination by evaluating three different fiscal cooperation schemes: the simple coordination of fiscal policymakers playing Nash against the monetary authority, and monetary and fiscal leadership. Finally, Section 5 summarizes the main conclusion and implications of this paper.

THE MODEL

The basic model we employ is based on Canzoneri and Henderson's (1991) two-country model. Asymmetric features are adopted from Ghironi and Giavazzi (1998) and Eichengreen and Ghironi (2002) who have used this model to analyze the optimal size of a currency union and the case for transatlantic policy coordination between the United States (U.S.) and Europe. In order to introduce fiscal policy considerations into the analysis, we follow Jensen (1991), Pizzati (2000), and Eichengreen and Ghironi (2002).

General framework

In the model, all variables are expressed in logarithms except for the interest rate. Each economy specializes in the production of one particular good. Aggregate supplies in both economies are increasing functions of the employment rate (nj ) and decreasing functions of a productivity disturbance x :

where 0 < α< 1 and j = h,f . The superscript h denotes the variables of a small home economy, an f those of a large foreign economy (e.g. an already formed monetary union). For simplicity and tractability, we assume that the elasticity of output with respect to employment, α, is the same for both economies. Total labor demand in each economy is determined by profit maximizing firms for which labor demand is complete when the marginal labor productivity is equal to the real wage:

where τ j , w j , and p j are, respectively, the rate of taxation of revenues, the nominal wage rate and the price of the good produce by economy j . Consumer Price Indices (CPIs) are weighted averages of the prices of domestic and foreign goods. Residents in the home economy spend a fraction (1−β) of their income on domestic goods and a fraction β on goods produced in the foreign economy. On the other hand, consumers in the foreign economy spend a fraction β of their income on their own goods and a fraction (1−β) on goods produced in the home economy. The CPIs are then described by:

where q h and q f denote the CPIs of the home and the foreign economies, and e and z = e + p f - p h are, respectively, the nominal and real exchange rates. In [3], β is an indicator of the relative size of the two economies and of their integration toward each other. Notice that when β = 1/2 the two economies are identical. As β rises the size of the home economy shrinks, while that of the foreign economy increases. In the extreme case in which β = 1, the home economy is so small that it is not able to affect the foreign economy's CPI at all. Demand is positively influenced by the output of both economies according to the proportion of income they allocate to domestic and foreign-produced goods. The marginal propensity to spend ¿ is the same for both goods and in both economies. Demand is also favorably affected by the two governments' spending on domestic and foreign goods. Residents in the two economies reduce expenditure by the same amount (0 < υ < 1) after an increase in the real interest rate r j . The market equilibrium conditions for the two economies are given by:

where δ measures the sensitivity of the demand to the real exchange rate (z ) and ¿ is the marginal propensity to consume.

Clearly, a depreciation of the real exchange rate shifts demand away from the foreign toward the home economy. Notice that when, for instance, β= 1 the real exchange rate does not affect the foreign economy at all. A priori, the ex-ante real interest rate in each economy is defined as the nominal interest rate minus the expected rate of change in its consumer prices index:

where i j is the nominal interest rate in economy j . Each economy issues bonds denominated in the domestic currency, which investors regard as perfect substitutes. They hold positive amounts of both kinds of bonds when expected interest rates measured in a common currency are equal to:

Money demand in both economies is described by:

where λ > 0 and m j represent the nominal money supply in economy j . By substituting [1] and [2] into [7] we obtain the semi-reduced form for employment as:

Employment rises with increases in money supply and decreases with higher wage rates and taxes. In [8], the nominal interest rate has a positive effect on employment. At the end of period t− 1, trade unions set the nominal wage rate prevailing in period t . Their purpose is to minimize the expected deviations of employment from its full employment target (here normalized to zero). Thus, they minimize the following loss function:

Substituting [8] into [9] and minimizing with respect to n j , we obtain the nominal wage rates set by the trade unions as:

Trade unions set nominal wages according to the expected stances of monetary and fiscal policymakers in period t and the effect of those stances on the domestic interest rate. In order to focus our attention on the role of strategic interactions between the two economies and on the importance of size asymmetries for the choice of the most appropriate exchange rate regime, we neglect the time inconsistency problems that might arise between the trade unions and the monetary and fiscal authorities in each economy.4 Since shocks are random and non-observable by unions at period t− 1, in the absence of time inconsistency problems expected money supplies and taxes are equal to zero. Hence, the rational decision for trade unions is to set wages equal to zero, w j = 0.5

Finally, with no time inconsistency problems, the government budget constraint abstracts from seigniorage as a possible source of revenue. Fiscal authorities face a budget constraint given by:

Since our framework is static, we assume that the fiscal authorities cannot issue debt either and consequently are subject to a balanced budget constraint.6

Policymakers' preferences

The money supply is the only instrument that monetary authorities possess. They chose their instrument, mj , to minimize the quadratic loss functions described by:

The monetary authorities' losses increase with deviations of employment from zero and positive changes in their CPIs. The parameter σ reflects the weight that policymakers attach to employment and inflation deviations from their targets of zero. In the event that the home and foreign economies decide to constitute a monetary union, a single central authority minimizes the weighted sum of both economies' losses, as given by:

For simplicity's sake, we assume that the weight of each economy in the central authority's decisions is proportional to its size in the monetary union.7

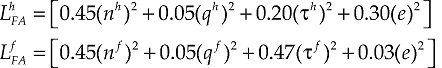

Fiscal authorities' only policy instrument is the rate of taxation of revenues; hence, government spending is obtained residually. In addition to unemployment and inflation, fiscal authorities dislike the volatility of taxation and exchange rates. Fiscal authorities care about exchange rate volatility because of its effect on society's welfare in terms of uncertainty and transaction costs and they dislike the volatility of taxation due to the distortions it imposes on society. Thus, each fiscal authority chooses its instrument, τ j , to minimize:

where χj is the cost that exchange rate volatility imposes on society's welfare in economy j , σ2,j , j represents the relative dislike of the fiscal authorities for the volatility of taxation and the nominal exchange rate, and σ3 measures their relative dislike for employment and inflation. An important point to notice in equation [14] is the j subscript in σ2,j. This suggests that, according to their relative size and integration with one another, the two economies' dislike for the volatility of taxation and the exchange rate may differ. As β→1, the home economy becomes not only smaller but also increasingly integrated into the foreign economy; hence, the weight that the home fiscal authority attaches to the exchange rate volatility also increases. Notice that the greater the aversion of the small economy for exchange rate volatility, the more its activism in fiscal policymaking grows (i.e. it reduces its dislike for the volatility of taxation). In the event that the two economies form a single currency union, the nominal exchange rate volatility is no longer a concern for their residents (i.e. (2,j = 0). In that scenario, the loss function observed by the two fiscal authorities is identical and defined as:

where σ3 measures the relative aversion of the fiscal authorities for employment and inflation relative to taxation volatility.

For simplicity and tractability we consider the fiscal authority to be benevolent and able to internalize the preferences of the society. Following this assumption, to compare the societies' welfare gains or losses across regimes we only need to contrast the fiscal authorities' losses.

Reduced forms

In this section, we express the employment and inflation endogenous variables of the model in terms of exogenous, predetermined or control variables for the non-cooperative and monetary union regimes.

Non-cooperative (flexible exchange rates) regime

In the absence of cooperation, each economy possesses its own currency and conducts its macroeconomic policy independently. Fiscal and monetary policymakers in both economies choose their instruments by playing Nash against each other.

Since the algebra to solve the reduced forms for employment and inflation under flexible exchange rates is cumbersome, we present the derivations of those expressions in Appendix A1. In compact notation and leaving the size parameters [β and (1-β)] clearly expressed, those reduced forms are summarized as:

where the capital Greek letters A , E , Λ, Φ, Σ and H are a group of positive nonstructural parameters of the model defined in Table 1. In addition to shocks, employment and inflation in both economies are affected by intra-economy policy spillovers. For both economies, regardless of their size, an increase in their own money supply raises domestic inflation and employment, while an expansion of their neighbor's money supply decreases domestic inflation and raises employment. An increase in domestic taxation raises inflation in both economies, causes domestic job losses and increases employment abroad. Meanwhile, the supply shock triggers unemployment and raises inflation in both economies.

Table 1 Non-structural parameters.

Observing the effect of size asymmetries on these reduced forms, notice that when β= 1 the monetary and fiscal authorities in the trivially small home economy are incapable of affecting the large foreign economy's employment and inflation through changes in their monetary or fiscal stances. Meanwhile, when both economies are size symmetric (i.e. β = 1/2), they both affect each other equally.

Monetary union

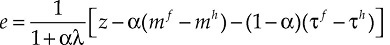

We consider now the case in which the home and foreign economies decide to constitute a monetary union. In this scenario, the nominal exchange rate disappears and the real exchange rate is simply determined by relative prices (i.e. e = 0 and z = p f - p h ). Monetary policy is controlled by a single central bank that issues a single currency; hence, changes in the money supply are identical in both economies. Taking this into consideration, the reduced forms for employment and inflation when the two economies take part in a monetary union are simply given by8:

where m u is the money supply in the union and N and Q are positive nonstructural parameters defined in Table 1. Notice how under this regime the two economies are equally affected by the central authority's monetary policy. An increase in the taxation of revenues by either of the two governments raises inflation in both economies, generates domestic job losses and increases employment abroad. Meanwhile, the supply shock reduces employment and increases inflation in the same direction and proportion as under flexible regimes.

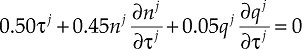

Inflation-employment trade-offs

Eichengreen and Ghironi (2002) show that under non-cooperative regimes, size asymmetries give rise to different inflation-employment trade-offs for policymakers.9 In general, they show that authorities in relatively smaller economies face more favorable employment-inflation trade-offs than those confronted by relatively larger economies. For instance, for the reduced forms presented in [16] and [17], the trade-off faced by the central bank in the home economy is steeper as its size gets smaller (i.e. ∂q h /∂n h > ∂q f /∂n f for β> 1/2; see Appendix B1 for proof).

The advantage of having a steeper inflation-employment trade-off for the small economy is illustrated graphically in Figure 1. As can be observed, a larger positive trade-off allows the central bank in the small home economy to exchange a large (given) inflation reduction for a smaller employment loss. Hence, if -as we assume later- central banks care more about inflation than about employment (i.e. σ1 < 1), a steeper trade-off is also more advantageous for the small home economy.

A similar situation arises in the case of fiscal authorities. For the reduced forms presented in [16] and [17], the trade-off faced by the government in the home economy is flatter as its size gets smaller (i.e. -(∂q h /∂n h ) < ∂q f /∂n f for β > 1/2; see Appendix B2 for proof). As shown in Figure 2, the small economy's fiscal authority is capable of exchanging a higher (given) employment gain for a small price stability loss. Considering that fiscal authorities are more concerned about employment than about inflation, a negative flatter inflation-employment tradeoff allows the government of the home economy to hold a more favorable position regardless of the exchange rate regime considered.

Nevertheless, cooperation between the two economies' monetary and fiscal authorities eliminates the advantage of possessing a more favorable trade-off. Employing the reduced forms for the monetary union regime presented in [18] and [19], it is straightforward to show that once the home economy takes part in the monetary union, the inflation-employment trade-off faced by the central monetary authority is one and the same for both economies. Irrespective of the size of the countries involved, the centralization of monetary policy decisions provides the same inflation-employment trade-off for both economies. The elimination of their more favorable inflation-employment trade-off will have an influence over the ability of the home policymakers to react to shocks. In what follows, we first observe how relinquishing monetary policy independence-with and without fiscal policy considerations- affects the macroeconomic stability of a small economy. Then, we examine how alternative fiscal cooperation schemes can help to ameliorate the stabilization costs endured by the small economy that decides to take part in a monetary union.

ASSESSING A MONETARY UNION REGIME WITHOUT FISCAL POLICY CONSIDERATIONS

The purpose of this section is twofold. The first is to draw attention to the relevance of size asymmetries for macroeconomic policymaking. The second is to set a point of reference to analyze the role of fiscal policy in macroeconomic stabilization that we carry out in the next section. The starting point in this analysis is a situation where both economies have their own currency and policymaking is only delegated to central banks whose main objective is to achieve price stability. This forms the benchmark with which we assess the decision of taking part in a monetary union. As in early studies exploring this issue (see for instance Martin, 1995; Lane, 1996 and 2000; Rantala, 2001), in this section fiscal authorities are excluded from the analysis. In order to do so, we simply eliminate the taxation of revenues and the effect of government spending from the equations in the general framework of the model (i.e. equations [2], [4] and [11]). The resulting reduced forms under both regimes are identical to those in [16] to [19], setting τj for j = h ,f equal to zero.

To illustrate the importance of size asymmetries on stabilization policies, we observe the policymaking process under two different states of the world. In the first, we examine the constitution of a monetary union between two economies of equal size. In the second, we consider the case of a small economy forming a monetary union with a considerably larger economy or region (e.g. an already formed monetary union).

Employing the reduced forms in [16] to [19] and the central banks preferences in [12] and [13], we solve the policy game under the two regimes considered by assigning numerical values to the structural parameters of the model and computing the resulting equilibrium. The parameter values employed to solve the model are given by α = 0.34, δ = 0.7, λ = 0.34, υ = 0.4, ε = 0.65, and σ1 = 0.2. These structural parameters are not assigned arbitrarily, but are justified based on empirical evidence or are set to reflect the expected environment faced by policymakers. A value of α = 0.34 implies that from the original Cobb-Douglas production function where capital is constant and normalized to unity, labor requires two-thirds of the total inputs.10 A choice of δ = 0.7 intends to reflect a high sensitivity of trade to variations in the real exchange rate.11 λ = 0.34 is the mean value of the elasticity of the money demand with respect to the interest rate found by Knell and Stix (2003) in a survey of 500 individual money demand estimations. The values of ε = 0.65 is about the average of the marginal propensity to consume found by Osada (1999) for a group of 12 industrial and developing economies. The parameter υ = 0.4 is the same as the one employed by Ghironi and Giavazzi (1998) and Eichengreen and Ghironi (2002) in a numerical estimation of a similar model.12 Finally, assuming that σ1 = 0.2 realistically implies that the central banks care more about inflation than about employment.

For the two alternative states of the world, we consider the values of β = 0.5 and β = 0.9. The first parameter value refers to the scenario in which the two economies are size symmetric, while the second corresponds to a state of the world in which the home economy is only one-tenth of the size of the large foreign economy.

Flexible exchange rate regime . In the absence of fiscal policy considerations, the central banks are the sole authorities responsible for dealing with stabilization in the event that disturbances affect their economies. Under flexible exchange rates, individual central banks respond by contracting their money supplies to fight the inflationary pressure caused by the supply shock; a strategy that produces a negative externality on their neighbor via the real exchange rate. For instance, a decrease in the money supply of the home economy will appreciate the exchange rate and then increase inflation in the foreign economy. Under the flexible exchange rate regime, both central bankers play Nash against each other and minimize their loss function in [12], taking the money supply of their neighbor as given.

The solution to the minimization problem of both central bankers yields the following First Order Conditions (FOC):

Solving the resulting two equations for m h and m f simultaneously, we obtain the equilibrium money supplies for both economies. Substituting those equilibrium money supplies in the employment and inflation reduced forms presented in [16] and [17], and then the resulting expressions in the loss functions of the monetary authorities, we obtain the flexible exchange rate equilibrium outcomes presented in Table 2 for both states of the world (β = 0.5 and β = 0.9).

Table 2 Welfare evaluations without fiscal authorities.

|

A. Symmetric size economies (β = 0.5) |

| Flexible exchange rates |

Monetary union |

| Econ |

N |

q |

m |

∂q j/∂n j

|

L CB |

n |

q |

m |

∂q j/∂n j

|

L CB |

| f |

-1.685 |

0.043 |

-2.170 |

0.790 |

0.375 |

-1.077 |

0.634 |

-1.371 |

0.340 |

0.317 |

| h |

-1.685 |

0.043 |

-2.170 |

0.790 |

0.375 |

-1.077 |

0.634 |

-1.371 |

0.340 |

0.317 |

|

Asymmetric size economies (β = 0.9) |

| Flexible exchange rates |

Monetary union |

| Econ |

N |

q |

m |

∂q j/∂n j

|

L CB |

n |

q |

m |

∂qj /∂n j

|

L CB |

| f |

1.268 |

0.594 |

-1.618 |

0.427 |

0.337 |

-1.077 |

0.634 |

-1.371 |

0.340 |

0.317 |

| h |

-1.528 |

0.260 |

1.992 |

1.180 |

0.267 |

-1.077 |

0.634 |

-1.371 |

0.340 |

0.317 |

Monetary union regime . By adopting a common currency, the members of a monetary union loose control over their own money supply. When a symmetric supply shock affects them, a central monetary authority that minimizes the weighted average of the two economies' losses contracts the world money supply to restore price stability in the union.

Considering that m j = m u for j = h,f , we obtain the equilibrium money supply set by the central monetary authority by minimizing the loss function defined in [13]. The central monetary authority minimization problem results in the following FOC:

Solving this equation for m u , plugging the resulting equilibria in [18] and [19], and subsequently the expressions obtained on the loss functions of the individual monetary authorities, we arrive at the monetary union regime equilibrium outcomes shown in Table 2.

We first contrast the equilibrium outcomes for the two regimes in the state of the world in which a currency union is formed between two economies of equal size (i.e. β = 0.5). As can be observed in Table 2 Panel A, when the two economies are size symmetric the inflation-employment trade-offs (i.e. ∂q j /∂n j ) they faced in each regime are identical. Under this state of the world, gains from participating in a monetary union for both economies stem from ameliorating the externalities that each economy exerts on its neighbor through the real exchange rate. After adopting a common currency, the central monetary authority contracts the world money supply less aggressively than individual policymakers. By reducing the employment losses of the two economies without increasing inflation substantially, adopting a common currency ultimately allows a better position for both economies in terms of the losses they endure.

The implications of the analysis change when we compare a state of the world in which a monetary union is constituted between economies that differ in size (i.e. β = 0.9). As we observed earlier, under a non-cooperative regime the asymmetries in the size of the economies give rise to dissimilar inflation-employment trade-offs which are more favorable for a relatively smaller economy.

As shown in Table 2 panel B, while both economies continue attaining the same trade-off by participating in a monetary union, the small economy's faces a (steeper) more advantageous trade-off than the large economy policymaker when it operates under a flexible regime. Due to its steeper trade-off, the small home economy's policymaker is capable of responding more effectively to the supply shock. As a result, the home money supply is contracted more aggressively, thus shifting the inflation burden arising from the shock to the foreign economy and reducing domestic inflation more effectively.

Assessing the decision faced by the policymaker in the small economy about taking part in a monetary union, we observe that by abandoning the flexible regime the economy experiences considerably higher losses. Clearly, the small home economy would be better off "free riding" from its size -by using its own monetary policy- to counteract the inflationary pressure produced by the supply shock.13

Reassessing participation in a monetary union

From now on, we concentrate on the asymmetric state of the world (i.e. the case when β = 0.9). The timing of events is similar to that described earlier in the absence of fiscal policy considerations. At period t −1, trade unions form expectations and set wages accordingly. Thereafter, at period t, the shock x is realized and observed by monetary and fiscal authorities in both economies. Following this, under the flexible exchange rate regime the four authorities chose their instruments simultaneously taking the actions of the other policymakers as given. The exchange rate is then endogenously determined according to the responses of the four policymakers to the shock. The nominal exchange rate reduced form is shown in Appendix A1 to be:

where φ and ρ are defined in Table 1. Given the forms of the respective preferences of monetary and fiscal authorities described in [12] and [14], monetary authorities reduce their money supplies to ameliorate the inflation pressure provoked by the shock and fiscal authorities decrease taxation to counteract the reduction in employment. As a result, the actions of monetary and fiscal authorities have opposite effects over the nominal exchange rate. For instance, when -in response to a supply shock- the home monetary authority reduces its money supply (by more than the foreign central bank thanks to its steeper trade-off), this appreciates the nominal exchange rate. Meanwhile, the reduction in taxation by the home fiscal authority (above the foreign fiscal authority) reduces the extent of the appreciation and brings the nominal exchange rate back towards its original level.

In the presence of fiscal policy considerations, monetary authorities continue to minimize the loss function described by equation [12]. Meanwhile, fiscal authorities minimize the deviations of employment, inflation, taxes and the nominal exchange rate from zero, as shown in equation [14]. The preferences of the fiscal authorities, under flexible exchange rates feature the values of σ21 = 0.06, σ22 = 0.6, and σ3 = 0.9. Numerically, these values provide the following loss functions:

Following Eichengreen and Ghoroni (2002), the above parameters are calibrated with roughly a five-fold higher weight on employment than on inflation and a higher concern for fiscal policy volatility than for price stability. However, in contrast to Eichengreen and Ghironi (2002), we weight nominal exchange rate volatility in the fiscal authority (and the societies) preferences. We place an unequal and asymmetric weight on fiscal policy (taxes) and nominal exchange rate volatility for both economies. Given its higher openness towards the foreign economy and its relative smaller size, the home economy is ten times more sensitive to exchange rate volatility than the foreign economy. As shown later, these parameters are consistent with the policymakers expected trade-offs.

In order to make the fiscal authorities' preferences consistent with the size of the two economies and their integration towards each other, we assume that the small economy cares ten times more about the volatility of the exchange rate than the large economy. Its higher dislike for variations of the exchange rate increases the activism of the government in managing fiscal policy (i.e. reduces the home fiscal authority's dislike for taxation volatility). Finally, both policymakers care more about employment than about inflation.

Under the monetary union regime, the adoption of a common currency eliminates the exchange rate volatility concern from the fiscal authorities' loss functions. As a result, the preferences of the fiscal authorities are described by [15]. Numerically, the loss functions minimized by the two fiscal authorities are in this case identical and given by:

In the absence of exchange rate volatility, the activism of two authorities is reduced and they continue to care more about employment than about inflation. Meanwhile, the central monetary authority minimizes the weighted sum of both central banks' losses as described in equation [13].

Using the structural parameter values defined above (α = 0.34, δ = 0.7, λ =0.34, υ = 0.4 and ε = 0.65), the reduced forms under flexible exchange rates (in [16] and [17]) and the monetary union regime (in [18] and [19]) are numerically presented in Table 3. As expected, foreign instruments have considerably higher impact on home employment and inflation than home instruments on foreign variables. Only when a monetary union is constituted, the impact of the union's money supply is the same in both economies' employment and inflation.

Table 3 Numerical reduced forms.

| A. Flexible regime

|

| nh = 0.703m h + 0.59m f - 0.877τh + 0.503τf - 0.033x

|

| nf = 0.756m f + 0.006m h - 0.429τf + 0.056τh - 0.033x

|

| qh = 0.829m h - 0.570m f + 0.501τh + 0.372τf + 0.989x

|

| qf = 0.323m f - 0.063m h + 0.831τf + 0.041τh + 0.989x

|

| B. Monetary union

|

| nh = 0.762m u- - 0.870τh + 0.496τf - 0.033x

|

| nf = 0.762m u + 0.428τf + 0.055τh - 0.033x

|

| qh = 0.259m u - 0.479τh + 0.393τf + 0.989x

|

| qf = 0.259mu - 0.830τf + 0.044τh + 0.989x

|

Flexible exchange rate regime . Employing the loss functions in [23], under the flexible ex-change rates the fiscal authorities' minimization problem yields the following two FOCs:

Meanwhile, central banks continue to face the FOCs defined in [20]. Plugging the numerical reduced forms in Table 3 on the FOCs in [20] and [26], and solving simultaneously for m j and τ j , we obtain the equilibrium outcomes presented in Table 4 panel A.

Table 4 Welfare evaluations with fiscal authorities.

| A. Flexible exchange rates |

Trade-offs |

Losses |

| Econ |

n |

q |

m |

τ |

L CB |

CB |

FA |

L CB |

L FA |

| f |

-1.685 |

0.043 |

-2.170 |

0.790 |

0.375 |

0.427 |

-1.937 |

0.128 |

0.335 |

| h |

-1.685 |

0.043 |

-2.170 |

0.790 |

0.375 |

1.180 |

-0.571 |

0.025 |

0.331 |

| B. Monetary union without fiscal coordination |

Trade-offs |

Losses |

| Econ |

n |

q |

m |

τ |

L CB |

CB |

FA |

L CB |

L FA |

| f |

1.268 |

0.594 |

-1.618 |

0.427 |

0.337 |

0.340 |

-1.935 |

0.126 |

0.150 |

| h |

-1.528 |

0.260 |

1.992 |

1.180 |

0.267 |

0.340 |

-0.551 |

0.082 |

0.135 |

Contrasting the equilibrium outcomes for the flexible exchange rate regimes in Tables 1 (panel B) and 4 (panel A), the first thing to notice is how both central bankers operating under flexible exchange rate regimes are better off once fiscal authorities exert their own effort towards stabilization.

Following the inflation and unemployment tolls yielded by the shock, the actions of the fiscal policymakers produce a positive externality on the central bankers. This happens because the contraction of taxes -and hence government spending- by the fiscal authorities reduces inflation. Nonetheless, this positive externality does not extend to the actions of the central bankers.

Following the supply shock, the tightening of the central banks' money supplies reduces the level of employment in conjunction with the shock. Hence, the stabilization efforts of the central bankers produce a negative externality on the fiscal authorities that care more about employment than about inflation.

Comparing the equilibrium outcomes for the two economies under flexible exchange rates in Table 4, we observe how the flatter inflation employment trade-off faced by the small economy's fiscal authority allows it to (contract taxes more aggressively and) experience lower unemployment. Similarly, as a result of its steeper trade-off, the central banker in the small economy (contracts its money supply by more than its counterpart and) experiences less inflation.14 The combination of lower inflation and unemployment results in considerably lower losses for the small economy's central banker. On the other hand, despite its more favorable trade-off, the activism required to reduce unemployment (i.e. a larger contraction of τh ) and its higher concern for the volatility of the exchange rate lead the fiscal authority in the small economy to endure similar losses to those of its counterpart in the large economy.

Monetary union regime . Under this arrangement, the fiscal authorities' minimization problem yields the following two FOCs:

Meanwhile, using [13] the central monetary authority FOC is given by:

Solving the FOCs in [27] and [28] simultaneously for m u and τ j , we obtain the equilibrium outcomes presented in Table 4 panel B.

Looking at the desirability of taking part in the monetary union, we observe that giving up monetary policy implies the small economy abandoning its ability to exploit the exchange rate to react to the shock (i.e. giving up its more favorable trade-off). As a result, the small economy experiences more inflation than under the flexible regime. In terms of employment, the fiscal authority retains its flatter trade-off and endures fewer job losses than its counterpart after the formation of the monetary union. However, the lower contraction of the central authority's money supply and the higher concern of the fiscal authorities for the taxation of revenues (i.e. its lower activism in fiscal policy once the exchange rate volatility is eliminated) produce a less aggressive reaction from the small economy's fiscal authority. As a result, both unemployment and inflation are larger for the small economy under the monetary union than under the flexible regime. This results in considerably larger losses from the monetary authority's perspective.

Nevertheless, participating in the monetary union allows the small economy's fiscal authority to reduce the social welfare losses arising after the shock. There are two explanations for this result. The first is that under the monetary union regime the exchange rate volatility disappears and that eliminates the level of losses suffered by its society in terms of transaction costs and uncertainty. The second has to do with the reduction in the volatility of taxation. Although the small economy experiences higher inflation and unemployment by participating in the monetary union than operating under a flexible regime, the less aggressive response of the central monetary authority and the absence of exchange rate volatility concerns challenge a lower restraining of taxes by the fiscal authority. This reduces the welfare losses associated with a fall in taxation of revenues and government spending.

Despite the lower social welfare losses arising under the monetary union regime, inflation and employment are larger than under the non-cooperative regime. In episodes of prolonged instability, this of course would be a cause for concern for monetary and fiscal authorities. Particular discomfort may arise in the foreign large economy, as it endures more inflation and unemployment than the small economy. In what follows, we explore whether fiscal coordination can help to ameliorate the inflation and unemployment experienced by the members of the monetary union.

Fiscal coordination

The treaty establishing the European Union provides some room for fiscal coordination by suggesting that "Member states shall regard their economic policy as a matter of common concern and shall coordinate them within the (European) Council".15 Nevertheless, up until now, coordination in the EU has not involved explicit cooperation schemes between fiscal authorities at the Economic and Financial Affairs Council (ECOFIN) level or a full formal agreement between the ECB and the ECOFIN Council.

Although coordination among authorities thus far has been rather limited to the commitment towards the rules imposed by the SGP and the mutual attendance of ECB and ECOFIN representatives at each other's Council meetings, the interaction of monetary and fiscal policy remains an increasingly crucial issue for the EU, especially as the monetary union is continuously preparing to embrace additional members. Indeed, bringing together the presence of a supranational monetary authority and coordinated fiscal agents is an interesting research topic that is relevant for the future design of Europe's fiscal and monetary institutions.

In this section we explore a simple cooperation scheme in which fiscal authorities in both economies are coordinated by a central fiscal authority but no involvement of the monetary authority exists (i.e. fiscal authorities cooperate against the central monetary authority). In other words, monetary and fiscal central authorities play Nash against each other. While the monetary authority chooses the money supply of the union, the fiscal authority sets the rate for the taxation of revenues. Under fiscal cooperation, the central authority that coordinates fiscal policymaking in the monetary union minimizes the weighted sum of the two fiscal authorities' loss functions:

with respect to the fiscal authority instruments τf and τh . The corresponding FOCs of this minimization problem are:

Substituting the numerical reduced forms for the monetary union regime presented in Table 3 and solving the system of three equations involving [28] and [30], the resulting equilibrium outcomes for the regime are presented in Table 5 panel

Table 5 Welfare evaluations for alternative forms of coordination.

|

A. Monetary union with fiscal coordination |

Losses |

| Econ |

n |

q |

m |

τ |

e |

L CB |

L FA |

| f |

-0.714 |

0.420 |

-1.059 |

-0.338 |

- |

0.140 |

0.157 |

| h |

-0.714 |

0.420 |

-1.059 |

-0.338 |

- |

0.140 |

0.157 |

|

B. Monetary union Stackelberg leader |

Losses |

| Econ |

n |

q |

m |

τ |

e |

L CB |

L FA |

| f |

-0.928 |

0.275 |

-1.377 |

-0.410 |

- |

0.124 |

0.254 |

| h |

-0.928 |

0.275 |

-1.377 |

-0.410 |

- |

0.124 |

0.254 |

|

C. Fiscal authority Stackelberg leader |

Losses |

| Econ |

n |

q |

m |

τ |

e |

L CB |

L FA |

| f |

-0.463 |

0.272 |

-0.845 |

-0.570 |

- |

0.059 |

0.128 |

| h |

-0.463 |

0.272 |

-0.845 |

-0.570 |

- |

0.059 |

0.128 |

Assuming that the central fiscal authority harmonizes the taxation of revenues in the two economies (i.e. that τ= τη= τϕ) and that it minimizes the weighted sum of the two fiscal authorities loss function (as shown in [29]), we obtain exactly the same outcomes for both economies in Table 5.16

As in the case of monetary unification (without fiscal cooperation), coordination of fiscal policies leads to a less aggressive response of the central fiscal authority to the shock. This happens because centralization of fiscal stances allows the fiscal authorities to internalize (and eliminate) the negative external effects that a larger contraction of taxes by both economies has on each other's employment. However, this less significant contraction by the fiscal authority translates into a smaller positive externality on price stability. Consequently, the central monetary authority responds more aggressively to the shock than in the absence of fiscal coordination.

For the two economies involved in the regime, the more aggressive reaction of the central monetary authority to the shock and the weaker response of the central fiscal authority lead to higher inflation and unemployment than in the absence of fiscal coordination. As a result, despite the lower activism of fiscal policy (i.e. the lower contraction of taxes than under no coordination), both economies experience higher losses from a monetary or fiscal perspective.

Hence, centralization of fiscal policies results in a counterproductive strategy for the members of the monetary union.

In order to control for the more aggressive reaction of the central monetary authority and the weaker response of the central fiscal authority, coordination can be extended to harmonize the stabilization efforts of both policymakers. In what follows, we examine coordination schemes comprising the fiscal and the monetary central authorities committed to following each other's stabilization efforts.

Monetary and fiscal policy coordination

Since fiscal policy centralization against the monetary authority results in a counterproductive strategy for the members of a monetary union, in this section we explore forms of international coordination that involve synchronizing the stabilization effort of both fiscal and monetary central authorities. We present the solution for two alternative arrangements. In the first, the central monetary authority acts as a Stackelberg leader, while in the second the fiscal authority acts as such. Under both arrangements, the authority that acts as leader minimizes its own losses, taking into account the reaction of the other player.17

Monetary leadership . First, we consider the case where, following the supply shock, the central monetary authority chooses the money supply for the union, taking into account the response of the central fiscal authority to its actions. In this case, the monetary authority's problem is to:

Employing the reduced forms in Table 3, the resulting equilibrium for the monetary leadership regime is presented in Table 5 panel B.

The more significant the monetary authority's reaction to the disturbance, the more aggressively the fiscal authority responds after the shock. This is because a greater contraction of the money supply triggers more unemployment which the fiscal authority tries to ameliorate by cutting taxes. This, of course, creates a larger positive externality for the central monetary authority.

Hence, the latter takes advantage of its leadership to contract its money supply more aggressively than in previous regimes. As a result, it is capable of achieving lower inflation and losses than under no cooperation with the central fiscal authority. Nonetheless, due to the more aggressive reaction by both authorities, unemployment and taxation volatility increase considerably; as a result, social welfare losses significantly exceed those under the previous regimes (i.e. monetary union without fiscal cooperation or pure coordination of fiscal authorities playing Nash against the central bank). In the end, cooperation under monetary leadership is counterproductive for the fiscal authorities and the societies they represent.

Fiscal leadership . When the fiscal authority acts as the leader and the monetary authority as the follower, the optimization problem of the former is defined as follows:

The equilibrium outcomes for this arrangement when employing the numerical reduced forms presented in Table 3 are shown in Table 5 panel C.

Comparing the outcomes in Table 5 panels B and C with those in panel A, it is apparent that whoever has the first mover advantage determines the equilibrium ranking of inflation, employment and welfare for the two authorities. In the event that the fiscal authority acts as Stackelberg leader, it also uses its first mover advantage to reduce unemployment more actively than in the absence of coordination. It realizes that -despite its aversion for the volatility of taxation- a more contractionary fiscal policy conveys a positive externality over the monetary authority which responds by tightening its money supply less aggressively after the shock. Hence, by challenging a lower money supply contraction from the central monetary authority, the fiscal authority also achieves considerably lower employment losses. The combination of lower inflation and unemployment with a moderate cutback in taxes leads to a reduction in the losses experienced by monetary and fiscal authorities. As a result, the fiscal leadership strategy brings a Pareto gain from the perspective of all the policymakers involved and the societies they represent.

Ranking the social welfare losses experienced by both economies over all the arrangements examined, it is clear that the fiscal leadership strategy makes engaging in monetary and fiscal coordination attractive for the residents of both economies and their authorities. Fiscal leadership is preferred by policymakers to a monetary union where fiscal authorities play Nash against the central monetary authority and to a monetary leadership regime. Moreover, the fiscal leadership regime is superior to a fully non-cooperative equilibrium in which both countries have their own currency and possess their own fiscal policy.

In terms of feasibility, whether a fiscal leadership regime can be a realistic option for EMU would depend on the commitment of fiscal and monetary authorities to achieving effective coordination. Lambertini and Rovelli (2004) suggest that looking at the fiscal authority as the leader is naturally embedded in the institutional policymaking process. This happens because in practice fiscal policy is set prior to monetary policy and revised much less frequently. Typically, fiscal policy is defined on an annual basis, whereas monetary policy is constantly monitored and may change several times over the course of a year. These circumstances point towards the fiscal authority as the natural first mover (i.e. the Stackelberg leader), a situation that in our model is indeed desirable for the policymakers and the residents of both economies.

CONCLUSION

The aim of this paper has been to assess the desirability of taking part in a monetary union from the perspective of a small open economy. The paper addresses two important questions. The first is whether participation in a monetary union is desirable for a small open economy. We find that, leaving fiscal policy considerations aside, it is straightforward to conclude that participation in a monetary union is counterproductive for a small economy. The key point to this result is that a small open economy is better off "free riding", and using its own monetary policy to counteract the inflationary pressures produced by supply shocks.

Following this result, we expand the analysis to consider the interactions between fiscal and monetary authorities on macroeconomic stabilization. We find that, once representative fiscal policymakers are incorporated into the model, taking part in the monetary union becomes desirable from a social welfare perspective. The reason for this is that, by taking part in stabilization, fiscal authorities concerned about employment respond to the shock by reducing taxes and spending, thus offsetting inflationary pressures and ameliorating unemployment. In addition, under a monetary union regime, the absence of exchange rate volatility and the reduction in taxation are both factors that contribute to decreasing the losses that society experiences in the face of the shock.

The second question this paper explores is whether monetary and fiscal coordination can help to improve the macroeconomic stability of the members of a monetary union. Evaluating three alternative forms of cooperation, shows that the pure coordination of fiscal authorities (playing Nash against the central monetary authority) results in a counterproductive strategy for both economies. On harmonizing the interaction between fiscal and monetary authorities, we find that while a monetary leadership strategy results in a deterioration of the position of the small economy's fiscal authority's position, a fiscal leadership strategy leads to a Pareto improvement from the perspective of both economic authorities and the societies they represent. With respect to the latter finding, we concur with other papers in the literature in suggesting that, given the timing required to implement and change monetary and fiscal policies, a fiscal leadership strategy is not only the most efficient coordination solution, but also the most feasible one.

Clearly, our model leaves aside many issues that are potentially relevant for small open economies facing the decision of participating in a monetary union. First, although we try to set asymmetric structures, our model assumes, for instance, that labor productivity in the two economies is the same. Integration could potentially create this effect but in the short term this may not be the case. Second, we assume a balanced budget constraint for the two economies. Indeed the SGP aims at "balanced budget or in surplus in the medium term" but this hardly means that debt should be excluded from the analysis in the short term.18 At least in the short run, debt sustainability deserves more attention. Finally, this paper does not address the mechanism through which the coordination schemes examined here could be implemented. Clearly, the commitment of fiscal and monetary policymakers is necessary in order to achieve effective cooperative solutions like the ones we have proposed. However, the necessary agreements and mechanisms to achieve coordination are beyond the scope of this paper.

References

Andrés et al., 2004 Andrés, J., Doménech, R., and Fatás, A., 2004. The stabilizing role of government size [CEPR Discussion Paper no. 4384]. Centre for Economic Policy Research (CEPR), London. Available at: < http://www.cepr.org/active/publications/discussion_papers/dp.php?dpno=4384>.

[ Links ]

Artis y Buti, 2001 M. Artis, M. Buti. Setting medium term fiscal targets in EMU. The Stability and Growth Pact: The Architecture of Fiscal Policy in EMU. Chippenham, Wiltshire: Palgrave Macmillan Ltd; 2001.

[ Links ]

Beetsma et al., 2001 R. Beetsma, X. Debrun, F. Klaassen. Is fiscal policy coordination in EMU desirable. Swedish Economic Policy Review. 2001; 8(1):57-98

[ Links ]

Cabral, 2010 R. Cabral. Why dollarization didn’t succeed: Comparing credibility and the impact of real shocks on small open economies. The North American Journal of Economics and Finance. 2010; 21(3):297p

[ Links ]

Canzoneri y Henderson, 1991 M.B. Canzoneri, D. Henderson. Monetary policy in interdependent economies: A game-theoretic approach.. Cambridge, MA: MIT Press; 1991.

[ Links ]

Cooley and Prescott, 1995 T.F. Cooley, E.C. Prescott. Economic growth and business cycles. Frontiers of Business Cycle Research. Princeton. NJ: Princeton University Press; 1995.

[ Links ]

Cooper and Kempf, 2004 R. Cooper, H. Kempf. Overturning Mundell: Fiscal policy in a monetary union. Review of Economic Studies. 2004; 71(2):371-397

[ Links ]

Dixit and Lambertini, 2001 A. Dixit, L. Lambertini. Monetary-fiscal policy interactions and commitment versus discretion in a monetary union. European Economic Review. 2001; 45(4-6):987-997

[ Links ]

Dixit and Lambertini, 2003a A. Dixit, L. Lambertini. Symbiosis of monetary and fiscal policies in a monetary union. Journal of International Economics. 2003; 60(2):977-987

[ Links ]

Eichengreen and Ghironi, 2002 B. Eichengreen, F. Ghironi. Transatlantic trade-offs in the age of balanced budgets and European Monetary Union. Open Economies Review. 2002; 13(4):381-411

[ Links ]

Engwerda et al., 2002 J.C. Engwerda, B. van Aarle, J. Plasmans. Monetary and fiscal policy interaction in the EMU: A dynamic game approach. Annals of Operational Research. 2002; 109(1-4):229-264

[ Links ]

European Council, 1997. Treaty of Amsterdam. [online] Available at: < http://europa.eu.int/eur-lex/lex/en/treaties/index.htm >.

[ Links ]

European Council, 2003 European Council. Recommendation, under Article 10.6 of the Statute of the European System of Central Banks and of the European Central Bank. Official Journal of the European Union, 2003; C/29-6

[ Links ]

Evers, 2015 M.P. Evers. Fiscal federalism and monetary unions: A quantitative assessment. Journal of International Economics. (forthcoming) 2015;

[ Links ]

Fatás et al., 2003 A. Fatás, J. von Hagen, A. Hughes Hallet, R.R. Strauch, A. Sibert. Stability and Growth in Europe: Towards a Better Pact [Monitoring European integration 13]. London: CEPR; 2003.

[ Links ]

Ferré, 2008 M. Ferré. Fiscal policy coordination in the EMU. Journal of Policy Modeling. 2008; 30(2):221-235

[ Links ]

Giavazzi and Giovannini, 1998 F. Giavazzi, A. Giovannini. Monetary policy interactions under managed ex-change rates. Economica. 1998; 56(222):199-213

[ Links ]

Ghironi and Giavazzi, 1998 F. Ghironi, F. Giavazzi. Currency areas, international monetary regimes, and the employment-inflation trade-off. Journal of International Economics. 1998; 45(2):259-296

[ Links ]

Jensen, 1991 Jensen, H., 1991. Tax distortion, unemployment and international policy cooperation. [online] Available at: < http://www.econ.ku.dk/personal/Henrikj/pdf/taxweb.pdf >.

[ Links ]

Kiley, 2004 M.T. Kiley. Is moderate-to-high inflation inherently unstable?. [Finance and Economics Discussion Series no. 2004-43]. Board of Governors of the Federal Reserve System, United States of America. 2004;

[ Links ]

Knell and Stix, 2003 M. Knell, H. Stix. How robust are money demand estimations? A metaanalytic approach [Working Paper no. 81]. Vienna, Austria: Oesterreichische Nationalbank; 2003.

[ Links ]

Lambertini and Rovelli, 2004 L. Lambertini, R. Rovelli. Monetary and fiscal policy coordination and macroeconomic stability: A theoretical analysis [Working Paper no. 464].. Bologna, Italy: Department of Economic Science, Università di Bologna; 2004.

[ Links ]

Lane, 1996 P.R. Lane. Stabilization policy in a currency union. Economic Letters. 1996; 53(1):53-60

[ Links ]

Lane, 2000 P.R. Lane. Asymmetric shocks and monetary policy in a currency union. Scandinavian Journal of Economics. 2000; 102(4):585-604

[ Links ]

Levine and Pearlman, 2001 P. Levine, J. Pearlman. Monetary union: The ins and outs of strategic delegation. The Manchester School. 2001; 69(3):285-309

[ Links ]

Martin, 1995 P. Martin. Free riding, convergence and two speed monetary unification in Europe. European Economic Review. 1995; 39(7):1345-1364

[ Links ]

Moro, 2014 B. Moro. Lessons from the European economic and financial great crisis: A survey. European Journal of Political Economy. 2014; 34:S9p

[ Links ]

Osada, 1999 H. Osada. Intra-regional multiplier effects through trade linkages in the APEC Area. [APEC Discussion Paper Series no. 27]. Singapore: Asia-Pacific Economic Cooperation (APEC); 1999.

[ Links ]

Pizzati, 2000 L. Pizzati. Monetary policy coordination and the level of national debt. Empirica. 2000; 27(4):389-409

[ Links ]

Rantala, 2001 A. Rantala. Does monetary union reduce employment?. [Discussion Papers no. 7/2001].. Helsinki, Finland: Bank of Finland; 2001.

[ Links ]

Tagkalakis, 2013 A. Tagkalakis. The effects of financial crisis on fiscal positions. European Journal of Political Economy. 2013; 29:197-213

[ Links ]

von Hagen, 2004 von Hagen, J., 2004. Fiscal sustainability in EMU: From the Stability and Growth Pact to a Sustainability Council for EMU [CESifo Working Paper]. CESifo Group Munich, Munich, Germany. Available at: < http://www.cesifo-group.de/por-tal/page?_pageid=36,103017&_dad=portal&_schema=PORTALem_link=del04-porogramme.htm >.

[ Links ]

A. DERIVATION OF THE REDUCED FORMS OF THE MODEL

A1. Flexible exchange rates

We start by obtaining the reduced forms for the flexible regime. Utilizing [8] and assuming wj = 0, the semi-reduced form for employment becomes simply:

To obtain the home price semi-reduced form, we solve [2] for pj to arrive t :

Substituting the employment semi-reduced form into [A.2] we obtain that:

The derivation of the real exchange rate reduced form requires several steps. Using equation [6] and assuming no speculative bubbles, we define the nominal exchange rates as:

Solving z for e and substituting [A.3] into the resulting expression, the nominal exchange rate semi-reduced form is simply:

Now, subtracting home supply and demand in [1] and [4] from those same expressions for the foreign economy, we obtain that:

Substituting the employment semi-reduced form in [A.1] into [A.6] and plugging equation [A.5] into [A.7], equalizing the two expressions and solving for z , the resulting real exchange rate reduced form is simply:

where

Γ=1-α1+αλδ+1-αλ

To obtain the nominal exchange rate reduced form, simply substitute [A.8] into [A.5] to obtain:

where

ϕ=1-α+αδ1+αλδ+1-α)λ

and ρ = (1 − δ )Γ .

Now, we need to obtain the interest rate reduced forms. Using [5] and assuming no speculative bubbles, it follows that:

Since real exchange movements cancel each other around the world and shocks are symmetric, it can be shown that qw = pw and xw = x . Using [A.3] rw can be expressed as:

World demand is given by the weighted sum of the demands in the two economies. Using [4], the world demand is equal to:

Solving for r w we obtain that the world real interest rate is simply:

On the other hand, using [1] and [8], the world supply can be written as:

Substituting the above expression on [A.13], it follows that:

Equalizing [A.11] and [A.15] and solving for i w , we obtain:

where

ξ=α+1-ε1-αν,ω=1υ+1-ε1-αυ-1-α,ζ=1-1-ευ,θ=1+αλ+1-ε1-αλυ

. To obtain the interest rate reduced forms we combine [A.9] and [A.16] to obtain:

where Δ = φ − ξ/ θ and π = ω/ θ − ρ.

Finally, we employ the domestic prices [A.3], interest rates [A.18] and real exchange rate in [A.8] to obtain the employment and inflation reduced forms under a flexible regime presented in [16] and [17].

A2. Monetary union regime

Following the adoption of a common currency, money supply in the union is controlled by the central monetary authority. Since there are only two countries, the central monetary authority has full command over the world money supply (i.e. m u= m w ). The nominal exchange rate disappears once the two economies employ a single currency; hence the real exchange rate becomes simple z = p f− p h .

Plugging the equations for the price semi-reduced form defined in [A.2] on z , considering that m u= m j and solving for I f− I h , we obtain:

Equalizing [A.7] and [A.6], substituting [A.19] and solving for z we obtain the real exchange rate reduced form:

where

ι=1-α1-α+αδ

. Substituting [A.20] into [A.19] we obtain that:

where

κ=1-α1-δ1-α+αδλ

. Combining equations [A.21] and [A.16], the interest rate reduced forms are given by:

Finally, we employ the domestic prices [A.3], interest rates [A.22] and real exchange rate in [A.20] to obtain the employment and inflation reduced forms under the monetary union presented in [18] and [19].

B. TRADE-OFF PROOFS

B1. Proof that a smaller economy's monetary authority faces a steeper trade-off

The trade-offs for both economies' monetary authorities are given by:

The statement that a small economy faces a steeper trade-off implies that:

Cross multiplying both sides we obtain that this requires:

Providing that the capital Greek letters are positive, this inequality holds if β > (1−β). That is, whenever the home economy is relatively smaller than the foreign economy. Intuitively, the smaller home economy consumes a larger proportion of its goods from the foreign one. Therefore, a contraction of its money supply, which appreciates the exchange rate produces a larger reduction of its CPI.

B2. Proof that a smaller economy's fiscal authority faces a flatter trade-off

The trade-offs for both economies' monetary authorities are given by:

The statement that a small home economy faces a steeper trade-off implies that:

Simplifying this expression shows that the domestic economy has a flatter tradeoff when β > (1−β). A similar proof can be derived by employing the reduced forms for the monetary union regime.

1. Were you in favour of Greece joining the euro?

No, I was not, and in fact, I addressed a conference on this issue in Athens in 2001 shortly before Greece joined the eurozone arguing against this policy. The reason I gave was that Greece's structural and institutional conditions at the time were simply not robust enough to allow Greece to cope with the constraints of a uniform exchange rate and monetary policy. This position was also that of the leading authorities behind the euro project up to about early 2001. Before the Asian currency crisis of the summer of 1997, it was expected that 5-7 EU countries would join the euro, in other words, only those that met all the stringent pre-entry fiscal criteria (debt and deficit to GDP ratios) and monetary criteria (inflation rate and interest rate). After that crisis, the entry conditions were loosened to the point where 14 of the then 15 EU member countries were invited to join the euro, Greece alone being the exception because its record on all of the pre-entry criteria was so abysmal. The European authorities argued that Greece should first introduce radical structural and institutional reforms before joining the euro, while the Greek authorities put the contrary view that the economic and financial stability conferred on Greece by virtue of euro entry would provide just the kind of macroeconomic framework necessary to achieve the required structural and institutional changes. The Greek view somehow prevailed and Greece was allowed to join the euro in January 2002. Needless to say, rather than pursuing any serious radical economic programme behind the currency stability shelter provided by euro membership, the Greek political, business and banking elites simply took advantage of that stability to promote their own vested interests.

2. What were the consequences for the Greek economy arising out of euro membership?

The key benefit to Greece from joining the eurozone was an end to the currency depreciation-domestic inflation spiral that had plagued the Greek economy in the previous decades. Thus between 1978 and 2001, the Greek drachma's rate against the European Currency Unit (ECU) fell from about 48 to 340, with the result that the domestic inflation rate was on average about 25% higher than the EU average over this same period. Following entry into the euro, Greece's domestic inflation rate fell to about 1.5% above the eurozone average, a result less of above average domestic wages (these in fact lagged behind the eurozone average) than of below average productivity levels. However, the main downside of membership of a single strong currency was that this gave impetus to the de-industrialisation of the Greek economy -as many Greek manufacturing businesses relocated to the Balkans where labour costs were even lower than in Greece- and to its further transformation into a pure 'service' economy, with the two principal keystones in this regard being shipping and tourism.

3. What were the reasons behind Greece's economic crisis?

Before answering this question, let me first look at how all the countries in the eurozone periphery suffered in the crisis. Before the creation of the euro, government, financial and corporate bonds issued in the smaller member states of the EU typically carried higher than average yields because currency risk in addition to credit risk was factored into the prices of these bonds. With the establishment of the euro, the yields on the bonds of the peripheral member countries converged towards those on German bonds -Germany being by far the strongest eurozone economy- because of the elimination of currency risk. What of course then happened is that the private commercial banks in countries such as Ireland, Portugal and Spain, seeing the massive profit opportunities offered by the low interest rates in the wholesale euro money markets, borrowed massively in these short term markets in order to lend long term loans (mortgage loans in particular, but also other credit loans) at higher interest rates in their domestic economies. When the subprime crisis which broke out in the summer of 2007 undermined confidence in the world's leading money markets causing short term interest rates to raise sharply, many European commercial banks (all of the large ones in the case of the Republic of Ireland) went bankrupt. The case of Greece was somewhat different in that many large Greek commercial banks were exposed less to the domestic housing sector than to the Greek government that had taken advantage of the low interest rates on eurozone government bonds to massively expand its borrowing level. It is beyond doubt that German and other foreign banks were complicit in driving up Greece's public debt as they were only too happy to buy Greek governments bonds which, despite euro membership, still generated a yield premium over German and other core eurozone government bonds. This said, the fact remains that both the Pasok and New Democracy governments -unwilling or unable to collect taxes on the scale required to meet the increasing demands on the public finances- simply took the easy way out by issuing increasing amounts of government bonds. When the crisis broke out, and the yield premiums on peripheral eurozone country bonds soared, it was Greece that suffered the worst because of the sheer scale of outstanding public debt.

4. What are the alternatives for the post-crisis Greek economy?

When Syriza won the election in January 2015, it had campaigned on the basis of two promises: to end the harsh austerity measures imposed by Greece's creditors as the precondition for its bail-out and to keep Greece in the eurozone. Despite every effort to keep both promises, it ultimately failed (largely because of the strength of Germany's opposition to any softening of the bail-out terms) and was thus faced with a stark choice: either to accept the foreign creditor's terms and remain in the euro or reject the terms, default on the external debt and thus face the likelihood of euro exit. The Left Platform of Syriza -a far left group that has since split off and formed the Popular Unity party- insisted that Grexit was the better of the two alternatives because the repudiation of the debt would give Greece elbow room to grow while a return to the drachma would boost Greece's international trade competitiveness to the point required to actually generate economic growth. All this sounds fine in theory, but the grim reality is very different. I have already mentioned the fact that prior to euro entry, Greece was locked in a vicious currency depreciation-internal inflation spiral. Close inspection of the current state of the Greek economy-heavily import dependent in virtually every major industrial and technologically advanced area- indicate that any return to the drachma would herald a return to that depreciation-inflation spiral with catastrophic consequences for large sections of the Greek population, notably the poor, the old and the sick. This is why Syriza under Tsipras' leadership, while continuing to argue the case for debt relief and/or debt restructuring, have in the meantime opted to keep Greece in the eurozone. I, for one, certainly agree with this position.

5. Why does Germany want Greece out of the euro?

To answer this question it is necessary to rephrase it correctly. First, Germany as a whole does not want Greece to leave the euro. Chancellor Merkel has made clear, as have many other German and leaders that Greece must stay in the euro. This is not so much for altruistic reasons as because of a fear that Grexit would trigger an unravelling of the euro project which, after all, is only a decade and a half old. Second, the position of Wolfgang Schauble, the German finance minister, is not that Greece should leave the euro but that it should agree to all the bailout terms and, if it does not, only then should it consider leaving the euro. These two positions may look the same but they are not. The crux of the matter is that while all the leading eurozone governments want to keep the eurozone together, they differ over the form that the eurozone should take. Thus while the French and Italian governments want a more flexible eurozone where the weaker member economies could be supported by the stronger member economies either through fiscal transfers or through the issuance of euro government bonds or through a combination of both policies, the German government by contrast wants a more disciplined eurozone where every member country is expected to solve its own economic and financial problems without too much outside help. Shauble's position on Grexit is entirely consistent with his determination that the eurozone continues to fit in with his neo-liberal vision.

6. What alternatives are open to small economies such as Greece, Portugal and Ireland to restore economic growth?