Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Investigación económica

versión impresa ISSN 0185-1667

Inv. Econ vol.71 no.280 Ciudad de México abr./jun. 2012

What is the Relationship Between the Rates of Interest and Profit? An Empirical Note for the U.S. Economy, 1869-2009

¿Cuál es la relación entre las tasas de interés y ganancia? Una nota empírica para la economía de los Estados Unidos, 1869-2009

Alejandro Valle Baeza* e Ivan Mendieta Muñoz**

* Professor and researcher of the Division of Postgraduate Studies, Faculty of Economics, UNAM. Correo electrónico: <valle@servidor.unam.mx>

** Postgraduate student at the School of Economics, University of Kent. Correo electrónico: <ivan45_650_2@hotmail.com>.

Received May 2011

Accepted January 2012

Abstract

The current paper aims to contribute to the study of the relation between the interest rate and the rate of profit by presenting an empirical analysis of the United States economy during the period of 1869-2009. The main findings rendered are: 1) the general rate of profit has set an upper limit for the real short-term and long-term interest rates; 2) the real long-term interest rate has undergone similar changes to those of the general rate of profit, whereas the real short-term interest rate has experienced movements opposite to the latter; and 3) evidence supports heterodox theories which stress that monetary policy affects the distribution of income through the modification of the rate of profit.

Keywords: rate of interest, rate of profit, United States economy.

JEL Classification:* B50, E43, E58 ................................................................................... 163

Resumen

El presente artículo intenta contribuir al estudio de la relación entre las tasas de interés y de ganancia ofreciendo un estudio empírico de la economía de los Estados Unidos durante el periodo 1869-2009. Los principales resultados encontrados son: 1) la tasa general de ganancia ha fijado un límite superior a las tasas de interés reales de corto y largo plazo; 2) la tasa de interés real de largo plazo ha experimentado movimientos similares a los de la tasa general de ganancia, mientras que la tasa de interés real de corto plazo ha experimentado movimientos opuestos respecto a esta última; y 3) la evidencia empírica apoya a las teorías heterodoxas que enfatizan que la política monetaria afecta la distribución del ingreso a través de la modificación de la tasa de ganancia.

Palabras clave: tasa de interés, tasa de ganancia, economía de los Estados Unidos.

"The highest is to understand that all fact is really theory. The blue

of the sky reveals to us the basic law of color. Search nothing

beyond the phenomena, they themselves are the theory."

Johan Wolfgang von Goethe, Theory of Colours

INTRODUCTION

As Panico (1987a) states, the analysis of the relationship between the rates of interest and profit involves the important issue of how to integrate the theory of money and that of value and distribution. Accordingly, the study of the relationship between both variables is essential for the understanding of the development of capitalist economies since they are prominent variables in the process of capitalist accumulation, the analysis of technical change, the periodization of capitalism, the study of economic crisis and the income distribution.

Despite its well-known importance and the relatively abundant theoretical literature, there have been few empirical studies specifically dealing with the relationship between the rates of interest and profit. The current paper aims at contributing to the study of the relationship between the rates of interest and profit by offering an empirical analysis of the United States (U.S.) economy during the period 1869-2009, which has rendered the following findings: 1) the general rate of profit has fixed an upper limit to the real short-term and long-term Federal Funds interest rates; 2) the real long-term Federal Funds interest rate has undergone movements similar to those of the general rate of profit, whereas the short-run Federal Funds interest has experienced opposite movements regarding the latter; and 3) there is evidence supporting heterodox theories emphasizing that monetary policy affects the distribution of income through the modification of the rate of profit, which entails that monetary factors can be directly allowed in the determination of the rate of profit.

In this sense, we believe that the results found here stress the relevance of the study of the relationship between these variables and can be seen as a plea to undertake future theoretical and empirical research aimed at providing more accurate results, particularly regarding the existing relationship between both variables and the controversy over the interest rate-profit rate link (Dickens, 1999 [2001]).

The rest of the paper is organized as follows. Section II briefly discusses the basic theoretical arguments related to the study of the analysis of the relationship between the rates of interest and profit, section III presents some stylized facts and the formal empirical tests for the U.S. economy during the period 1869-2009, and finally section IV synthesizes the main conclusions and offers some relevant issues addressed for future research.

SOME VERY BRIEF NOTES ON THE RELATIONSHIP BETWEEN THE RATES OF INTEREST AND PROFIT

Since there has been an extensive debate surrounding the theoretical issue (Dobb, 1973; Panico, 1980; 1985; 1987a; 1987b; 1988a; 1988b; 2001; 2008; Fine, 1985-1986; Lianos, 1987; Pivetti, 1988; 1991; Dickens, 1999 [2001]; Itoh and Lapavitsas, 1999; Evans, 2004; Hein; 2004; Valle Baeza and Mendieta Muñoz, 2010), the purpose of this section is merely to offer an outline stressing the most important fundamentals.

As Dickens (1999) points out, within mainstream neoclassical theory profits result from the use of capital in the production process, in much the same way that crops result from the employment of land. In this world, all distributive variables are determined endogenously and simultaneously, together with equilibrium prices and quantities (Panico, 1988a). When the classical approach was abandoned because of the emergence of neoclassical theory by the end of 19th century, it was argued that the rate of interest was determined by the same real factors that set the rate of profit on real capital employed in production, that is, productivity and thrift (Panico, 2008). In the subsequent equilibrium analyses both rates were considered equal (or at least conceptually equal) and the existing differences (when they were admitted) were explained with respect to the different risk levels taken by the decisions to invest (Panico, 1980). As a consequence, the analysis of the determinants and the study of the relation between the rates of interest and profit were progressively forgotten (Panico, 1980).1 Since mainstream neoclassical economics considers that monetary variables represent the market manifestation of real variables, the dominant view in economic literature has been that whilst monetary factors determine the everyday fluctuations of interest rate, its average value over long periods depends upon the rate of profits to be made from the employment of capital in production (Panico, 1988a). In this sense, the causal links between the rates of interest and profit are presumed to proceed from the latter to the former and, hence, monetary factors do not directly influence the determination of the rate of profit (Panico, 1988a). Consequently, in these theories in which money is neutral, the rates of profit and interest tend to move together2 and, owing to the operation of competitive market forces, variations of the rate of interest independent of those of the rate of profit can only be temporary (Panico, 1988a).

However, in the analysis of the capitalist economies it is essential to understand that both at the theoretical and at the empirical level the rate of profit and the rate of interest are two different variables of an economic system (Valle Baeza and Mendieta Muñoz, 2010), as it was made clear by Marx (2001 [1894]), Keynes (2003 [1936]), von Hayek (1939), and Sraffa (1960).3 At the theoretical level it is necessary to distinguish between the different notions of interest and profits. Regarding the rate of interest, it is necessary to make a distinction amongst the "money" or "market" interest rate and the "average" or "natural" or "real" interest rate (Panico, 1980; 1987a; 1988a). Panico (1980; 1985; 1987a; 1988a) has pointed out that movements in the "average" or "natural" or "real" interest rate are related to those of the rate of profit through the operation of competitive market forces. In turn, the daily variations of the "money" or "market" interest rate are not systematically related to those of the rate of profit (Panico, 1980; 1987a; 1988a). Thus, the "average" or "natural" or "real" interest rate might be interpreted as the rate of interest that prevails over a complete business cycle (Evans, 2004), or the long-run tendency of the "money" or "market" interest rate (Panico, 1980; 1988a; Evans, 2004; Valle Baeza and Mendieta Muñoz, 2010). Regarding the rate of profit, it is necessary to mention the distinction between the "realized" or "actual" rate of profit and the "normal" rate of profit (see Lavoie, 2003). Whereas the classical economists, Marx (2001 [1894]) and Sraffa (1960) used the concept of "normal" rate of profit calculated at the normal or planned rates of capacity utilization, Kaleckians, Post-Keynesians and modern Marxists tend to use the "realized" or "actual" rate of profit which is affected by fluctuations in the actual degree of capacity utilization (Lavoie, 2003). Consequently, at the theoretical level, the analysis of the relationship between the rates of interest and profit has considered mainly the following questions (Panico, 1987a: 1) which functional relations describe the operation of the competitive market forces linking the "average" or "natural" or "real" interest rate and the "normal" rate of profit?; 2) which are the factors affecting the two rates?; and 3) which of the two is independently determined?

Most heterodox theories of income distribution follow the SraffaPanico-Pivetti suggestion (Sraffa; 1960; Panico, 1980; 1988a; Pivetti, 1991) that argues for a monetary determination of the rate of profit in which the causality between the rates of interest and profit posited by mainstream economic theory is inverted. Thereby, Sraffa (1960), Panico (1980; 1988a) and Pivetti (1991) argue that the rate of interest is strictly a monetary phenomena, a prime determinant of the distribution between profits and wages in the long-run and that the rates of interest generate a positive impact on the rate of profit. Along with the Sraffian tradition, the endogenous money branch of the Post-Keynesian and Kaleckian approaches think that there should exist a positive relation between the short-term rate of interest set by the central bank and the long-term rate of interest charged by banks on prime clients since the latter should be composed of the long-term rate on riskless public bonds plus some spread for corporate risk. Hence, in general it is thought that the long-term rate on public debt bonds reflects mostly the actual and the expected short-term rates of interest set by the central bank over the longer period of those public debt bonds.

Taking as case study the U.S. economy from 1869 to 2009, the following section will seek to present some evidence that might help cast light on the relation between the rates of interest and profit.

Empirical evidence: the case of the U.S. economy

With respect to the rate of profit, it is necessary to say that profitability must be approached from different viewpoints, depending on the specific problem considered (Duménil and Lévy, 1993a). Consequently, "there is no true definition of the profit rate independently of the topic under consideration" (Duménil and Lévy, 2002a: 420). A rate of profit is a ratio of a measure of profit to a measure of capital, that is, profit/capital. Profit is a flow which can be expressed as the difference of two other flows (for example, output minus costs); in turn, capital is a stock (a sum of money which has been invested in a given line) (Duménil and Lévy, 1993a).4

Beginning with the works by Gillman (1957) and Mage (1963), considerable research has been devoted to the historical movement of the general rate of profit in the U.S., both theoretically and empirically. It is beyond the immediate scope of this paper to address the incidents and particulars surrounding the extraordinary bulk of works regarding the measurement of rates of profit or the subsequent bequest of prolific debates they have given birth to.5 However, it is likely that the estimations found in Shaikh (1987; 1989; 1990; 1992; 1999; 2011), Moseley (1988; 1991; 1997; 2004), and Duménil and Lévy (1993a; 1993b; 1993c; 1994; 2002a; 2002b; 2004; 2007) are the ones grounded on stronger theoretical roots.6 Following these three authors, the general rate of profit of the U.S. economy seems to have followed similar trends in their works, the existing differences are found in the level of the series. An easy procedure to illustrate the latter can be shown by comparing the estimations of the general rate of profit for the U.S. economy by Duménil and Lévy (1994)7 with the one presented in Shaikh (2011):8

To our knowledge, Duménil and Lévy (1993a; 1993b; 1993c; 1994; 2002a; 2002b; 2004; 2007) have presented the most extensive estimates of the general rate of profit for the U.S. economy (1869-2009), which might be helpful to get a more complete outlook of the historical patterns. Therefore, the U.S. economy general rate of profit used in this study will be the one presented by Duménil and Lévy (1993a; 1993b; 1993c; 1994; 2002a; 2002b; 2004; 2007).

In the same way that there is no true definition of the rate of profit independently of the topic under consideration (Duménil and Lévy, 2002a), there is also no true definition of the rate of interest. A particular short-term interest rate and a particular long-term interest rate were selected amongst the great bulk of possible interest rates in order to carry out the exercise: whereas the Federal Funds effective rate (that is, the overnight rate or one-day rate) was selected as the short-term interest rate, the Aaa corporate bond rate was used as the long-term interest rate. Both interest rates were selected mainly because they are the longest and easiest series that have been found thanks to the praiseworthy work of Officer (2010)9 and might be useful to provide a broad approximation to all other existing rates of interest. Furthermore, as a first approximation, the current paper assumes that the Federal Funds rate can be set exogenously by the Federal Reserve.10

Graph 2 presents the relation between the general rate of profit (hereafter p), the nominal Federal Funds effective rate and the nominal Aaa corporate bond rate for the U.S. economy during the period 1869-2009:

Nonetheless, an important issue has to be stressed at this point. As Shaikh (2011) claims, if in the quantification of a rate of profit a current-dollar profit flow is used as numerator and a current-cost capital stock is used as denominator, then both numerator and denominator reflect the same set of prices, which is the essence of a real measure. As a consequence, p is a real variable and a relevant and coherent comparison has to be developed between p and the real rates of interest (Duménil and Foley, 2008). Graph 3 presents the relation of p and both short-term and long-term real interest rates11 for the U.S. economy:

Graph 3 presents some interesting facts. In the first place, it seems that, for the whole period of analysis, in the United States p has fixed the upper limit to both the real short-term interest rate (hereafter Rst) and the long-term (hereafter Rlt) interest rate. Rst has only exceeded p in the years of 1921, 1931, 1932 and 1933; in turn, Rlt has exceeded p only in the years 1917, 1918 and 1920. This result seems to buttress the argument developed by Marx (2001 [1894]), who explained that the category of interest is linked to the division of profit between financial capitalists (which earn the rate of interest) and productive capitalists (which earn the rate of profit of enterprise) (Evans, 2004). Therefore, according to Marx (2001 [1894]), the general rate of profit is normally higher than the rate of interest, and usually sets the upper limit for the latter (though in certain phases of the capitalist business cycle this might not hold) (Itoh and Lapavitsas, 1999).12 This empirical result seems to be robust since the estimate of the rate of profit presented by Duménil and Lévy (1994) is the highest estimate compared to the ones presented by Shaikh (2011) and Moseley (1991).

In second place, it seems that Rlt has moved in parallel with p, whereas the movements of the Rst has been opposite to that of p. For the whole period of study, there is a positive correlation of around 0.14 between p and Rlt, and a negative correlation of around 0.13 between p and Rst, as it is shown in Table 1:

Moreover, the movements of Rlt, Rst and p can be seen more clearly if, using the Hodrick-Prescott filter (Hodrick and Prescott, 1997), we extract the trend of the series presented in Graph 3:

To our knowledge, the only studies that have presented a comparison between the rates of interest and the profit rate for the U.S. economy are the ones by Duménil and Lévy (2001; 2004; 2007), and Shaikh (2011).13 Shaikh's concerns (Shaikh, 2011) are somewhat different since he is interested in determining the rate of profit of enterprise (which is the relevant variable in the analysis of capitalist accumulation) and not in establishing any comparison between the general rate of profit and the rates of interest, as a consequence, he subtracts the 3-month T-bill nominal interest rate of his own calculation from the general rate of profit in order to determine the rate of profit of enterprise. In turn, the analyses of the rate of profit of non-financial corporations in the United States (Duménil and Lévy, 2001; 2004; 2007) show that from 1960 to 2005 the rate of profit and the real rates of interest (short-term and long-term) tended to undergo similar movements, demonstrating that the rise in the rate of profit of the non-financial sector in the U.S. since the early 1980s has been mainly due to the rise in net real interest payments.14 However, the studies by Duménil and Lévy (2001; 2004; 2007) do not make clear neither which short-term and long-term interest rates have been used nor which price deflator was used in order to estimate the inflation rate.

The inverse relation between the Rst and p is a puzzling result since it is difficult to interpret theoretically. However, since the p used in the current study can be considered to be a "realized" or "actual" rate of profit, this inverse relation may be occurring through the negative impact of increases in real short-term interest rates on consumption and/or residential investment that reduce aggregate demand, output, actual capacity utilization and hence the "realized" or "actual" rate of profit. This is an important issue since the theoretical relationship between short-term rates of interest and the "normal" rate of profit should be always positive as the rate of interest should put a floor to the minimum "normal" rate of profit on capital.

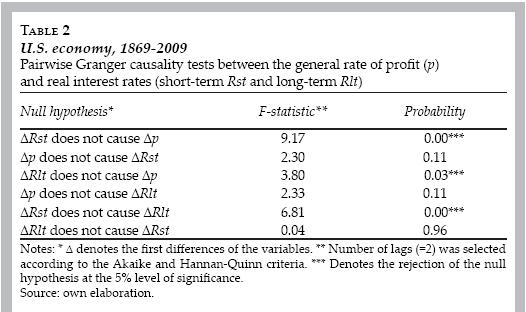

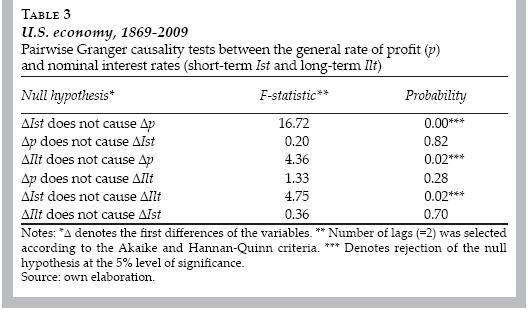

Finally, in trying to complete a more comprehensive study, pairwise Granger causality tests between the real and nominal rates of interest and the general rate of profit were carried out. Table 2 and Table 3 respectively show the results for the Granger causality tests between variations in the general rate of profit (∆p) and variations in the real interest rates (∆Rst and ∆Rlt), and variations in the general rate of profit (∆p) and in the nominal interest rates (∆Ist and ∆Ilt):

From Table 2 it can be seen that variations in real short-term and long-term interest rates precede variations in the general rate of profit. Therefore, it seems to be a unidirectional relationship that runs from real short-term and long-term interest rates to the general rate of profit at the 5% level of significance. Furthermore, it also seems that variations in real short-term interest rate precede variations in real long-term interest rate. In turn, Table 3 presents evidence that variations in short-term nominal and long-term nominal interest rates also precede variations in the general rate of profit and that also variations in the short-term nominal interest rate precede variations in the long-term nominal interest rate. Again, these relationships seem to be unidirectional.

FINAL REMARKS AND FUTURE RESEARCH

The main findings of this study may be summarized as follows:

1) In the analysis between the rates of interest and the profit rate, it is necessary to emphasize that the rate of profit and the rate of interest represent two different variables in an economic system. If in the calculation of a rate of profit a current-dollar profit flow is used as numerator and a current-cost capital stock is used as denominator, then both (numerator and denominator) reflect the same set of prices, which is the essence of a real measure (Shaikh, 2011). As a consequence, the rate of profit that has been estimated is a real variable. Therefore, in the empirical analysis of the relationship between both variables, the relevant comparison has to be developed between a rate of profit and a real rate of interest.

2) In the U.S. economy, during the period of study (1869-2009), there seems to be evidence that the general rate of profit has fixed the upper limit to the real short-term interest rate (real Federal Funds effective rate) and to the real long-term interest rate (real Aaa corporate bond rate). Whereas the real long-term interest rate has exceeded the general rate of profit only in the years 1917, 1918 and 1920, the real short-term interest rate has exceeded it only in 1921 and in the period 19311933. Furthermore, it seems that the real long-term interest rate has undergone movements similar to those of the general rate of profit, that is to say, both variables have moved in parallel; in turn, the real short-term interest rate has experienced movements opposite to those of the general rate of profit, that is, both variables have moved in opposite directions. It is important to emphasize that the inverse relationship between the real short-term rate of interest and the general rate of profits is rather unusual since it also seems to imply an inverse relationship between the real short-term rate of interest and the real long-term rate of interest, which is something especially difficult to interpret theoretically.

3) Granger causality tests for the whole period of study present evidence that variations in both real and nominal interest rates (short-term and long-term) have preceded variations in the general rate of profit. Thus, it seems that in the U.S. real and nominal rates of interest have played a more important role in establishing the general rate of profit than the one usually attributed to them. In that respect, the current study presents evidence supporting the heterodox views that emphasize that monetary policy affects the distribution of income through the modification of the rate of profit (i.e. a theory of distribution where monetary factors can be directly allowed in the determination of the rate of profit), which entails that monetary factors can be directly allowed in the determination of the latter (Dobb, 1973; Panico, 1980; 1985; 1987a; 1987b; 1988a; Pivetti, 1988; Duménil and Foley, 2008).15 In this sense, in the analysis of the relationship of the rates of interest and the profit rate (and therefore for the study of income distribution), the U.S. economy provides evidence that it is possible to consider the rate of interest as the independent variable, with the general rate of profit being affected by its movements. However, most heterodox theories of income distribution follow the Sraffa-Panico-Pivetti (Sraffa, 1960; Panico, 1980; 1988a; Pivetti, 1991) suggestion that deems a positive effect of short-term rates of interest on long-term rates of interest and on the general rate of profit, which, strictly speaking, contradicts the empirical evidence found in the current work.

As the current paper has tried to put forward, the empirical study between the rates of interest and the profit rate is a difficult issue given the vast bulk of rates of interest and profit rates that can be found. Consequently, the conclusions here presented need to be taken with the proper reservations. Furthermore, there are several issues that remain to be dealt with in future research. In the first place, perhaps a more detailed analysis emphasizing the periodization of the U.S. economy (that is, taking into account business cycle and economic crisis more emphatically) is needed. In second place, the study of the relation between the rates of interest and the profit rate has become more complex since the instability of deregulated financial markets (which leads market participants to make wide swings in their risk assessment over time) has made long-term market interest rates largely endogenous (Pollin, 2008; 2009).16

With no doubt, further empirical and theoretical work is needed in the analysis between the rates of interest and the rate of profit. However, we are hopeful that future research in this vein will be useful in the study of the economic cycles and the theories of value and distribution.

REFERENCES

Basu, D. and Manolakos, P., 2010. Is there a tendency for the rate of profit to fall? Econometric evidence for the U.S. economy, 1948-2007. Economics Department Working Paper Series no. 2010-04. Amherst: University of Massachusetts. [ Links ]

Dickens, E., 1999 [2001]. Interest rate-profit rate link. In: O'Hara, P. ed. Encyclopedia of Political Economy, 1, London: Routledge, pp. 547-49. [ Links ]

Dobb, M., 1973. Theories of Value and Distribution since Adam Smith, Cambridge: Cambridge University Press. [ Links ]

Duménil, G. and Lévy, D., 1993a. The economics of the Profit Rate: Competition, Crises, and Historical Tendencies in Historical Capitalism. Aldershot: Edward Elgar. [ Links ]

Duménil, G. and Lévy, D., 1993b. The rise of the profit rate during World War II. Review of Economics and Statistics, 75(2), pp. 315-19. [ Links ]

Duménil, G. and Lévy, D., 1993c. Why does profitability matter? Profitability and stability in the U.S. Economy since the 1950s. Review of Radical Political Economics, 25(1), pp. 27-61. [ Links ]

Duménil, G. and D. Lévy, 1994. The U.S. economy since the Civil War: sources and construction of the series. EconomiX, Paris: PSE. Available at: <http://www.jourdan.ens.fr/levy/dle1994e.pdf> [ Links ].

Duménil, G. and Lévy, D., 2001. Costs and benefits of neoliberalism. A class analysis. Review of International Political Economy, 8(4), pp. 578-607. [ Links ]

Duménil, G. and Lévy, D., 2002a. The field of capital mobility and the gravitation of profit rates (USA 1948-2000). Review of Radical Political Economics, 34(4), pp. 417-36. [ Links ]

Duménil, G. and Lévy, D., 2002b. The profit rate: where and how much did it fall? Did it recover? (USA 1948-2000).Review of Radical Political Economics, 34(4), pp. 437-61. [ Links ]

Duménil, G. and Lévy, D., 2004. The real and financial components of profitability (United States, 1952-2000). Review of Radical Political Economics, 36(1), pp. 82-110. [ Links ]

Duménil, G. and Lévy, D., 2007. Crisis y salida de la crisis. Orden y desorden neoliberales. México: Fondo de Cultura Económica (FCE). [ Links ]

Duménil, G. and Foley, D., 2008. Marx's analysis of capitalist production. In: Durlauf, S. and Blume, L. eds. The New Palgrave Dictionary of Economics. London: Palgrave Macmillan. Available at: <http://www.jourdan.ens.fr/levy/dfo2008a.htm> [ Links ].

Epstein, G. and Power, D., 2003. Rentier incomes and financial crises: an empirical examination of trends and cycles in some OECD countries. Political Economy Research Institute (PERI), Working Paper no. 57. Amherst: University of Massachusetts. [ Links ]

Epstein, G. and Jayadev, A., 2005. The rise of rentier incomes in OECD countries: financialization, central bank policy and labor solidarity. In: Epstein, G. ed. Financialization and the World Economy, Cheltenham: Edward Elgar, pp. 46-74. [ Links ]

Evans, T., 2004. Marxian and post-keynesian theories of finance and the business cycle. Capital & Class, 83, pp. 47-100. [ Links ]

Fine, B., 195-1986. Banking capital and the theory of interest. Science and Society, 49(4), pp. 387-413. [ Links ]

Gigliani, G., 2007. Tasa de ganancia y macroeconomía. Paper for I Jornadas de Economía Política, 6-7 de diciembre. Buenos Aires: Argentina, [ Links ]

Gillman, J., 1957. The Falling Rate of Profit. London: Dennis Dobson. [ Links ]

Gram, H., 1985. Duality and positive profits. Contributions to Political Economy, 4(1), pp. 61-77. [ Links ]

Hayek, F. von, 1939."Profits, Interest and Investment" and Other Essays on the Theory of Industrial Fluctuations. New York: Augustus M. Kelley. [ Links ]

Hein, E., 2004. Money, credit and the interest rate in Marx's economics. On the similarities of Marx's monetary analysis to Post-Keynesian economics. International Papers in Political Economy, 11(2), pp. 1-43. [ Links ]

Hein, E., 2009. (Post-)Keynesian perspective on 'financialisation'. IMK Studies Working Paper no. 1/2009. Düsseldorf: IMK. [ Links ]

Hodrick, R. and Prescott, E., 1997. Postwar U.S. business cycles: an empirical investigation. Journal of Money, Credit and Banking, 29(1), pp. 1-16 [ Links ]

Itoh, M. and Lapavitsas, C., 1999. Political Economy of Money and Finance. New York: St. Martin's Press. [ Links ]

Keen, S. and Standish, R., 2006. Profit maximization, industry structure, and competition: a critique of neoclassical theory. Physica A, 370(1), pp. 81-5. [ Links ]

Keynes, J., 2003 [1936]. Teoría General de la ocupación, el interés y el dinero, México: FCE. [ Links ]

Lavoie, M., 2003. Kaleckian effective demand and Sraffian normal prices: towards a reconciliation. Review of Political Economy, 15(1), pp. 53-74. [ Links ]

Lee, F. and Keen, S., 2004. The incoherent emperor: a heterodox critique of neoclassical microeconomic theory. Review of Social Economy, 62(2), pp. 169-99. [ Links ]

Lianos, T., 1987. Marx on the rate of interest. Review of Radical Political Economics, 19(3), pp. 34-55. [ Links ]

Mage, S., 1963. The law of the falling tendency of the rate of profit. Ph.D. Dissertation Columbia University. [ Links ]

Marx, K., 2001 [1894]. El Capital, vol. 3. México: FCE. [ Links ]

Minsky, H., 1957. Central Banking and money market changes. The Quarterly Journal of Economics, 71(2), pp. 171-87. [ Links ]

Moseley, F., 1988. The rate of surplus value, the organic composition of capital and the general rate of profit in the U.S. economy, 1947-67: a critique and update of Wolff 's estimates. The American Economic Review, 78(1), pp. 298-303. [ Links ]

Moseley, F., 1991. The falling rate of profit in the postwar United States economy. New York: St. Martin's Press. [ Links ]

Moseley, F., 1997. The rate of profit and the future of capitalism. Review of Radical Political Economics, 29(4), pp. 23-41. [ Links ]

Moseley, F., 2004. Marxian crisis theory and the postwar U.S. economy. Paper for Seminar of Development Strategy of Traditional Market, Gyeongsang. [ Links ]

Naples, M. and Aslanbeigui, N., 1996. What does determine the profit rate? The neoclassical theories presented in introductory textbooks. Cambridge Journal of Economics, 20(1), pp. 53-71. [ Links ]

Officer, L., 2010. What was the interest rate then? Measuring Worth [on line]. Available at: <http://www.measuringworth.com/interestrates> [ Links ].

Panico, C., 1980. Marx's analysis of the relationship between the rate of interest and the rate of profits. Cambridge Journal of Economics, 4(4), pp. 363-78. [ Links ]

Panico, C., 1985. Market forces and the relation between the rates of interest and profits. Contributions to Political Economy, 4(1), pp. 37-60. [ Links ]

Panico, C., 1987a. Interest and profit. In: Eatwell, J., Milgate, M. and Newman, P., eds. The New Palgrave: A Dictionary of Economics, vol. 2. London: Palgrave-Macmillan, pp. 877-79. [ Links ]

Panico, C., 1987b. The evolution of Keynes's thought on the rate of interest. Contributions to Political Economy, 6(1), pp. 53-71. [ Links ]

Panico, C., 1988a. Interest and profit in the theories of value and distribution. London: Macmillan Press. [ Links ]

Panico, C., 1988b. Marx on the banking sector and in the interest rate: Some notes for a discussion. Science and Society, 52(3), pp. 310-25. [ Links ]

Panico, C., 2001. Monetary analysis in Sraffa's writings. In: Cozzi, T. and Marchionatti, R. eds. Piero Sraffa's Political Economy: A Centenary Estimate. London: Routledge, pp. 285-310. [ Links ]

Panico, C., 2008. Keynes on the control of the money supply and the interest rate. In: Forstater, M. and Wray, R. eds. Keynes and Macroeconomics after 70 Years. Critical Assessments of the 'General Theory'. Bodmin: Edward Elgar, pp. 157-75. [ Links ]

Panico, C., Pinto A. and Puchet, M., 2011. Income distribution and the size of the financial sector: a Sraffian analysis [mimeo]. Italy: Università di Napoli Federico II. [ Links ]

Pivetti, M., 1988. On the monetary explanation of distribution: a Rejoinder to Nell and Wray. Political Economy: Studies in the Surplus Approach, 4(2), pp. 275-83. [ Links ]

Pivetti, M., 1991. An Essay on Money and Distribution. London: Macmillan. [ Links ]

Pollin, R., 2008. Considerations on interest rate exogeneity. PERI Working Paper no. 177. Amherst: University of Massachusetts. [ Links ]

Pollin, R., 2009. Interest rate exogeneity: theory, evidence and policy issues for the U.S. economy. Ekonomiaz, 72, pp. 244-68. [ Links ]

Power, D., Epstein, G. and Abrena, M., 2003. Trends in the renter incomes share in OECD countries, 1960-2000. PERI Working Paper no. 58a. Amherst: University of Massachusetts-Amherst, 2003. [ Links ]

Salvadori, N. and Steedman, I., 1985. Cost functions and produced means of production: duality and capital theory. Contributions to Political Economy, 4(1), pp. 79-90. [ Links ]

Shaikh, A., 1987. The falling rate of profit and the economic crisis in the U.S. In: Cherry, T. ed. The Imperiled Economy: Macroeconomics from a Left Perspective, Book 1. New York: U (URPE), pp. 115-126. [ Links ]

Shaikh, A., 1989. The Current Economic Crisis: Causes and Implications, Detroit: Against the current pamphlet. [ Links ]

Shaikh, A., 1990. Valor, Acumulación y Crisis. Bogotá: Tercer mundo. [ Links ]

Shaikh, A., 1992. The falling rate of profit as the cause of long waves: theory and empirical evidence. In: Kleinknecht, A., Mandel, E. and IWallerstein, I. eds. New findings in long wave research. London: Macmillan Press, pp. 174-202. [ Links ]

Shaikh, A., 1999. Explaining the global economic crisis: a critique to Brenner. Historical Materialism, 5(1), pp. 103-44. [ Links ]

Shaikh, A., 2011. The first great depression of the 21st century. Socialist Register, 47, pp. 44-63. [ Links ]

Sraffa, P., 1960. Production of Commodities by Means of Commodities. Cambridge: Cambridge University Press. [ Links ]

Valle Baeza, A. and Mendieta Muñoz, I. 2010. Apuntes sobre la teoría marxista de la tasa de interés. Problemas del Desarrollo, 41(162), pp. 161-73. [ Links ]

* JEL: Journal of Economic Literature-Econlit.

We are grateful to Carlo Panico (Department of Economics, University of Naples Federico II), Hans-Martin Krolzig (School of Economics, University of Kent), Rob Jump (School of Economics, University of Kent) and to the anonymous referees of Investigación Económica for valuable comments and suggestions. Needless to say, any remaining errors must be imputed exclusively to the authors.

1 It is also important to emphasize that the concept of rate of profit has practically faded within modern orthodox macroeconomics (Gigliani, 2007). This omission is an outstanding hassle since, as Gigliani (2007) points out, orthodox microeconomic theory argues for the existence of rational enterprises with a core rationale, namely, maximize profits. Therefore, what constitutes a concern at the micro level dissipates at the macro level without any satisfactory explanation. This might be due to the fact that research has documented the serious flaws stemming from the concept of the rate of profit used by mainstream economists (see Salvadori and Steedman, 1985; Gram, 1985; Naples and Aslanbeigui, 1996; Lee and Keen, 2004; Keen and Standish, 2006).

2 The zero profit condition or lack of economic profit that is well-known in many variants of neoclassical theories of competitive price entails the same condition.

3 Although it is a very important and interesting point to describe each of the views of these authors, it is impossible to deal with this issue in the current paper. However, see Dobb (1973), Panico (1980; 1985; 1987a; 1987b; 1988a; 1988b; 2001; 2008), Fine (1985-1986), Lianos (1987), Pivetti (1991), Itoh and Lapavitsas (1999), Evans (2004), Hein (2004), and Valle Baeza and Mendieta Muñoz (2010) for some works on the thought of these authors.

4 A rate of profit must be differentiated from the share of profit (which can be obtained by dividing profit by total income and therefore is a ratio between two flows and reflects a straightforward measure of distribution) or from the profit margin (a ratio of profit to costs). A very recent work by Panico, Pinto and Puchet (2011) has addressed the links between the expansion of the financial system (financialization) and income distribution, arguing that the expansion of the financial sector can affect the level of production and generate changes in the income shares of workers and capitalists, even if the wage rate and the profit rate remain constant. Thus, the work of Panico, Pinto and Puchet (2011) represents an important advance in the explanation of why the rate of profit and the share of profit can undergo different movements, as it can be seen in different economies in recent years.

5 For a relatively complete source regarding the measurement of the rate of profit and the debate on the downward tendency of the rate of profit see Basu and Manolakos (2010).

6 The reader interested in a more synthesized bibliography can find the gist of each estimation in Shaikh (2011), Moseley (1991) and Duménil and Lévy (1993a).

7 An extended Duménil and Lévy data set is available at: <http://www.jourdan.ens.fr/levy/uslt4x.txt>. Duménil and Lévy (1994) use the net rate of profit, defined as the ratio of the net domestic product minus the wage bill and the net stock of fixed capital. For the explanation of the construction of the series since 1869 see Duménil and Lévy (1993a).

8 Shaikh (2011) estimates the U.S. general rate of profit using the National Income and Product Accounts (NIPA). Thus, the rate of profit is defined as the sum of nonfinancial corporate profits found in Table 1.14 (line 27), and nonfinancial corporate net monetary interest paid found in Table 7.11 (line 11 minus line 17) divided by the fixed assets found in Table 6.1 (line 4).

9 Since the U.S. Federal Reserve system was established in 1913, Officer (2010) refers to the New-England municipal bonds rate for the period 1869-1898 and to the corporate bonds rate since 1899.

10 However, as Pollin (2008; 2009) points out, the Federal Reserve operates with a reaction function that reflects the activities of the market. Moreover, as the ongoing economic crisis has demonstrated, the Federal Reserve is required to serve as a lender-of-last-resort, and this responsibility limits its ability to set the interest rates because, in such situations, the role of the Federal Reserve is to shovel low-interest short-term credit to a distressed market (Minsky, 1957). In this sense, "[t]he latitude of the Fed to set the Federal Funds rate is thereby constrained by the regularity and extent of market distress" (Pollin, 2009: 248).

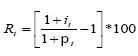

11 In order to calculate the real interest rates we proceeded as follows:  In this equation Rt depicts the short-term or long-term real interest rate (depending on each case), it denotes the nominal short or long-term interest rate, and πt is the actual inflation rate measured by the GDP deflactor. Whereas the GDP deflactor series was extracted again from the Augmented Duménil and Lévy data set (available at: <http://www.jourdan.ens.fr/levy/uslt4x.txt>), the nominal short-term interest rate (Federal Funds effective rate) was extracted from Officer (2010) for the period 1869-1954 and from the Federal Reserve electronic database for the period 1955-2009, and the nominal long-term interest rate (Aaa corporate bond rate) was extracted from Officer (2010) for the period 1869-1975 and from the Federal Reserve electronic database from 1976 to 2009.

In this equation Rt depicts the short-term or long-term real interest rate (depending on each case), it denotes the nominal short or long-term interest rate, and πt is the actual inflation rate measured by the GDP deflactor. Whereas the GDP deflactor series was extracted again from the Augmented Duménil and Lévy data set (available at: <http://www.jourdan.ens.fr/levy/uslt4x.txt>), the nominal short-term interest rate (Federal Funds effective rate) was extracted from Officer (2010) for the period 1869-1954 and from the Federal Reserve electronic database for the period 1955-2009, and the nominal long-term interest rate (Aaa corporate bond rate) was extracted from Officer (2010) for the period 1869-1975 and from the Federal Reserve electronic database from 1976 to 2009.

12 For a more detailed work on Marx's ideas regarding the average and market rates of interest and the relationship between the general rate of profit and the rate of profit of enterprise see Valle Baeza and Mendieta Muñoz (2010).

13 Epstein and Power (2003), Power, Epstein and Abrena (2003), and Epstein and Jayadev (2005) present evidence regarding the movements of the non-financial income share and the short-term real interest rate, the first two for 29 OECD countries and the latter for 15 OECD countries (the nominal short-term interest rate was extracted from the OECD Main Economic Indicators, and the real interest was obtained by subtracting the inflation rate from the nominal interest rate). The evidence shows that the share of profit and the real interest rate have tended to undergo similar movements.

14 Therefore, as Hein (2009) mentions, rising interest payments have had to be paid for by decreasing the labour income share and thus the rentier class has been the one mainly benefiting from redistribution at the expense of labour.

15 Whether the real wage rate is determined as a residuum or not will be left for future research.

16 Pollin (2008; 2009) presents evidence on the U.S. economy regarding the movement of five nominal market rates relative to the Federal Funds rate: two short-term rates (the 6-Month Treasury bill rate, and the bank prime rate) and three long-term rates (the 10-year Treasury Bond rate, the 30-year mortgage rate, and the Baa corporate bond rate). It is difficult to sustain the argument that the Federal Reserve can exogenously determine long-term market interest rates. In this sense, long-term market interest rates can be said to be largely endogenous; as for the period 2001.03-2008.02 there is no statistically significant Granger causation running from the Federal Funds rate to the long-term market interest rates.