Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Similars in

SciELO

Similars in

SciELO

Share

Investigación económica

Print version ISSN 0185-1667

Inv. Econ vol.69 n.273 Ciudad de México Jul./Sep. 2010

An alternative theory of real exchange rate determination: theory and empirical evidence for the Mexican economy, 1970–2004

Una teoría alternativa de la determinación del tipo de cambio real: teoría y evidencia empírica para la economía mexicana, 1970–2004

Francisco A. Martínez–Hernández*

Teaching Assistance, Graduate Econometrics, New School. E–mail: martf324@newschool.edu.

Received October 2009.

Accepted June 2010.

Abstract

It is well known that mainstream approaches to real exchange rate determination (e.g. those based on purchasing power parity) can fail because price adjustments between trading partners do not occur simultaneously. This paper puts forth an alternative theory with regard to the Mexico–United States (US) real exchange rate. Our approach takes a long term perspective and employs a classical political economy framework developed by Shaikh (1980, 1991, 1998, 1999b), with foundations in the works of David Ricardo and Karl Marx. Unlike mainstream theories which focus on relative consumer or producer prices, we argue that relative real unit labor costs of the Mexican and US manufacturing sectors is a good indicator of the effective real exchange rate between the two countries. The empirical methods used in this paper include unit root tests and a co–integrated vector autoregression model (VAR). This paper seeks to provide some critical insights with regard to relative prices and relative and absolute competitiveness between Mexico and the United States.

Key words: non–neoclassical theory of competition, relative real unit labor costs, effective real exchange rate, co–integrated VAR model.

JEL Classification:** F50, I 31, F41, C32

Resumen

Es bien sabido que los criterios convencionales para la determinación del tipo de cambio real (por ejemplo, aquellos basados en la paridad del poder adquisitivo) pueden fallar debido a que los ajustes de precios entre los socios comerciales no se producen simultáneamente. Este artículo propone una teoría alternativa con respecto al tipo de cambio real México–Estados Unidos. Nuestro enfoque toma una perspectiva de largo plazo y emplea un marco de economía política clásica desarrollado por Shaikh (1980, 1991, 1998, 1999b), con base en las obras de David Ricardo y Carlos Marx. A diferencia de las teorías convencionales que se centran en los precios relativos al consumidor o productor, nosotros argumentamos que la relación de costos laborales unitarios reales de los sectores manufactureros de México y Estados Unidos es un buen indicador del tipo de cambio efectivo real entre los dos países. Los métodos empíricos utilizados en el presente artículo incluyen pruebas de raíz unitaria y un modelo de vectores autorregresivos (VAR) cointegrado. Este artículo busca ofrecer algunos puntos de vista críticos con respecto a los precios relativos y la competitividad relativa y absoluta entre México y Estados Unidos.

Palabras clave: teoría no neoclásica de la competencia, costos laborales relativos unitarios reales, tipo de cambio efectivo, modelo VAR cointegrado.

Introduction

The recent history of the Mexican economy has shown that its worst economic crises have been due to balance of payments problems, which eventually lead to foreign exchange rate crises (1976–1977, 1982, 1986–1988 and, 1994–1995). Although conventional exchange rate models hold that in the long–run real exchange rates will move in such a way as to make countries equally competitive, such an argument is far from being true because in reality countries are unequally competitive. In the case of Mexico (Mex), a clear and thorough assessment of real exchange rate determination and its relationship with the balance of payment, especially with the current account, which has been negative since the late forties despite currency devaluations, is necessary.

A serious problem with conventional economic analyses is its reliance on price mechanics [Purchasing Power Parity (PPP) and related theories] and comparative advantage theory, with the aim of expecting that in the long–run exports will equal imports. In other words, conventional analyses assume that, in the long–run, trade between countries will be roughly balanced.

On the one hand, international trade theory postulates that if one abstracts from various sources of financial flows and government intervention in the foreign exchange market, exchange rates will move toward their equilibria levels when they reach their market–clearing values. That is, at an equilibrium exchange rate that reflects the relative price levels of the trading–partners domestic economies. This then leads to the central proposition of foreign trade theory, namely, that under these circumstances, nominal exchange rates move automatically to make the balance of trade equal to zero. Along this line of thought, it follows that trade deficits and surpluses are the outcome of short–run deviations of exchange rates from their equilibrium levels (Antonopoulos 1997; Ruiz–Nápoles 1996).

On the other hand, neoclassical trade theory assumes that competitiveness between countries is determined by the comparative cost principle. Thus, according to this principle, any country would always find at least one industry in which it is competitive. Hence, if the exchange rate is adequately managed to achieve and maintain such competitiveness, foreign trade will tend to be balanced (Ruiz–Nápoles 2009). In other words, this standpoint assumes that long–run real exchange rates will eventually do away with competitive differences, without requiring any change in wages and productivity.

It is, nevertheless, important to point out that despite the fact that the two foregoing principles are too often embraced by academic analyses and economic policy makers; historical data have provided ample testimony to the persistence of trade imbalances (even under managed (dirty floats), fixed and flexible exchange rate regimes, across countries and across time). Importantly, current models of the exchange rate perform quite poorly at the empirical level (Harvey 1996; Kruger 1983; Stein et al. 1995). Hence, mainstream models may be unreliable guides to economy policy. This paper aims to put forth an alternative theory of real exchange rate determination of the Mexican peso with respect to the United States dollar (us dollar). Our model is based upon a classical approach to the theory of competition developed in Shaikh (1980, 1991, 1998 and, 1999b).

According to this theory of competition, which has its origins in the works of Marx and Keynes (Milberg 1994), the international competitiveness of a country, or industry, is primarily based on its absolute advantage in terms of product technology and labor productivity. This framework argues that it is a country's competitive position, measured by the real unit labor cost of its tradable sector, which determines the center of gravity of the real exchange rate. That is, differences among the real production costs of nations determine their international terms of trade and hence their long–run real exchange rates. Our alternative approach also argues that the international money flows occasioned by balance of trade imbalances do not change price levels as the quantity theory of money claims, but rather change interest rates as Marx, Keynes and Harrod claim. This means that absolute cost advantages are not eliminated by the money flows, so they continue to rule. It also means that free trade will give rise to trade imbalances which will be automatically covered by corresponding capital flows, so that a country with a balance of trade deficit will end up as an international debtor.

Three key proposals follow from our alternative approach. First and foremost, real exchange rates can be pinned down by the vertically integrated real unit labor cost ratios of the tradable sectors of the transacting countries. Second, trade surpluses and deficits are not anomalies of a competitively functioning international world market system, nor need they be temporary. Third, devaluations will not have a lasting effect on trade balances, unless accompanied by fundamental changes in national real wages or productivity.

In order to test the main hypotheses of Shaikh's model for the Mexican economy, the second section of this paper reviews the principal models of exchange rate determination, putting special emphasis on their point of agreement (PPP). In the third section we develop the main points of the Shaikh's works and we incorporate some minor additions to his formal model of long–run real exchange rate (net capital inflows and gross domestic product). The fourth section presents the methodology used to build the relative unit labor cost time series (RULC US–Mex), as well as statistical evidence of its close relationship with the real exchange rate. The fifth section presents an econometric model of the long–run real exchange rate determination along with its misspecification tests. Final remarks are included in the sixth section.

CONVENTIONAL MODELS OF EXCHANGE RATE DETERMINATION

The aim of this section is to show that the Purchasing Power Parity (PPP) theory, which needs a stationary series in order to be a meaningful theory, is an underlying assumption of many models incorporating exchange rates. We present the main reasons of the theoretical and empirical failure of these modern models.

PPP and related theories

As is well known, PPP hypothesis has its foundation in the Law of One Price (hereafter, LOP), whose main argument claims that if one abstract from tariffs and transportation costs, unfettered trade in goods should ensure identical prices across countries. Therefore, if this law holds for every individual good, then it follows immediately that it must hold for any identical basket of goods. In other words, the LOP is not a theory of the exchange rate,1 but rather a test of market efficiency inasmuch as independently of the local conditions of production and individual producer's cost, their selling prices must be approximately equal (Antonopoulos 1997; Ruiz–Nápoles 1996).

PPP is a theory of exchange rate determination as it asserts that nominal exchange rates in general, move in the appropriate direction so as to equalize the relative price levels between two countries. Thus, although it is often not explicit which underlying mechanism would be necessary in order to create a particular common level of prices, for the adherents of the PPP hypothesis, price level movements are dominated by monetary factors in the sense that if money supply increases, then also the price level would do it in the same proportion (Dornbusch 1988; Froot and Rogoff 1994; Rogoff et al. 2001). More specifically, for the trade theory that underpins the PPP hypothesis, the mechanism through which exports match imports in the long–run is the same mechanism that guarantees that the price levels will be equalized between two countries that trade with each other. This principle is known as Hume's price–specie–flow mechanism (Antonopoulos 1997; Ruiz–Nápoles 1996; Shaikh 1980).

According to this principle, even though the trade adjustment mechanism is related to the price level of the trading countries involved, it is the amount of money in circulation which varies with the trade balance that causes the level of prices to change (Ruiz–Nápoles 2004). That is, for the mainstream trade theorists (and Ricardo's theory of trade) in a two commodities, two countries model, trade can only take place in terms of money prices. So, departing from a situation in which one country has absolute advantage in producing both commodities (due to higher productivity and better technology), it would be paid by its exports with money. Then the net inflow of money makes its price go up until one of the two absolute advantages disappears, via the quantity theory of money. Simultaneously, the net outflow of money in the less efficient country makes its prices go down until one of them is relatively lower so as to make the good attractive for importation from abroad. Here it is the money flow which does a sort of transformation of absolute into relative advantages (Shaikh 1980).2

Whether the model is the Ricardian one or that of Heckscher–Ohlin, and notwithstanding their differences regarding the source of absolute (dis)advantage, these models predict that these absolute advantages will turn into comparative ones. Therefore, both models come to the same conclusion: trade is desired by both nations because it improves their general economic welfare; money inflows and outflows, eventually change the price ratios of the two countries and in so doing they bring about balanced trade.

Along these lines and putting aside sterilization policies, the standard theory expects the long–run real exchange rate to gravitate around that level which balances trade. In this connection, the formal structure of the PPP hypothesis proposes that the nominal exchange rate between the currencies of two countries is the price ratio of the two countries:

Where, e is the nominal exchange rate, P is the price level of country A and P* of country B. This is the absolute (or strong) PPP hypothesis. The relative version of this statement, known as the relative (or weak) PPP hypothesis, states that the nominal exchange rate, instead of being equal to, has a constant proportional relationship to the price ratio of the two countries:

Where, k is a constant parameter that reflects the given obstacles to trade. Nonetheless, to the extent that there is a change in the price ratio, the nominal exchange rate will change as well. We can also write the real exchange rate as:

This last equation, implies that the real exchange rate, er, is invariant through time, since an opposite and equivalent change in the nominal exchange rate, e, always matches a change in P*/P as suggested in equations [1] and [2] (Stein et al. 1995). As a result of this monetary mechanism, the PPP hypothesis asserts that real exchange rates are expected to be stationary over the short and the long–run.

In effect, both versions of the PPP hypothesis (strong and weak) expect that in the short–run and the long–run the rate of change of the nominal exchange rate offsets the relative rate of inflation3. Hence, from this perspective, real exchange rates remain roughly unaltered through time. However, for different countries and different time spans, empirical data and econometric tests have shown that real exchange rates are simply not–stationary in either the short–run or the long–run (Antonopoulos 1997; Harvey 1996; Shaikh 1998; Stein et a. 1995).

On the one hand, PPP is not accepted in the short–run, as prices are assumed to be sticky; hence overshooting is not only possible, but predictable: the nominal and the real exchange rate depreciate when price levels rise, meaning that they fall below their equilibrium if the money supply increases (Antonopoulos 1997).4 Besides, due perhaps to the growth of capital flows via financial markets and speculation, and the volatility of the nominal exchange rate; these models have tended to accept that the PPP does not apply in the short–run. Nonetheless, adherents continue to believe that PPP applies in the long–run as a natural result of floating exchange rates (Stein et al. 1995).

On the other hand, empirical tests conducted over a 50–year span of the postwar period, also confirm that under floating exchange rates the PPP hypothesis is rejected (Froot and Rogoff 1994). This latter difficulty has forced supporters of the PPP hypothesis to argue that any convergence which might exist must be extremely slow (Rogoff et al. 2001), requiring perhaps 75 or even 100 years of data in order to become evident (Froot and Rogoff 1994).

In this regard, one must keep in mind that despite the notable differences between the classic exchange rate models5 and the later monetary models, namely asset–market approaches to the exchange rate with rational expectations and intertemporal optimization, both groups of models rely heavily on the assumption of long–run stationarity of the real exchange rate (weak version of the PPP hypothesis). Therefore, the existence of a non–stationary series of the real exchange rate invalidates all of them (Stein et al. 1995). In response to this failure, some economists have suggested that exchange rates may not be governed by fundamental forces, but by randomness (for instance, random walk) due to flexible exchange rates (see Harvey 1996).6

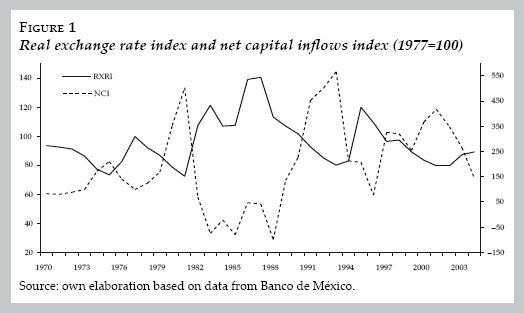

For the Mexican case, our own estimations show that the real exchange rate of the Mexican peso with respect to the US dollar,7 for annually data for the period 1970–2009, is also a non–stationary process (see table 1 and figure 1 below). Unit root tests in the level of the Mexican real exchange rate [Augmented Dickey–Fuller (ADF), Phillips–Perron (PP) and, Kwiatkowski–Phillips–Schmidt–Shin (KPSS)], by and large, do not reject the null hypothesis of the presence of a unit root. Therefore, for this period, this series follows a non–stationary process, Furthermore, real exchange rate is not only trended, but is also subject to wide fluctuations (see figure 1 below).

In short, table 1 suggests that the PPP hypothesis does not apply to the Mexican case, and moreover, also suggests that the inflation rates between Mexico and US do not follow a common path in the short and long–run. Consequently, the PPP hypothesis, which involves the use of price indexes both in its strong and weak versions, does not necessarily reflect the degree of competitiveness of the economy, since it emphasizes more the general price level.

AN ALTERNATIVE THEORY OF REAL EXCHANGE RATE DETERMINATION

The aim of this section is to develop the crucial points of Shaikh's alternative theory of real exchange rate determination (1980, 1991, 1998, and 1999b), which is based upon a non–neoclassical theory of competition and the principle of absolute advantage as the main determinant of international trade. This alternative approach arrives at quite different fundamentals of exchange rate determination than those proposed by the PPP hypothesis, as well as different conclusions for economic policy.

Theory of competition and real exchange rate

The point of departure for Shaikh's model is the classical theory of competition, which can be traced back to the writings of Smith, Ricardo, and Marx. This approach considers competition as rivalry among firms, in the classical sense where all producers try to get a share of their market by lowering costs. In addition, this concept of competition can be applied in both national and international arenas.

With regard to the domestic competition, rivalry takes primarily the form of price competition where each firm attempts to undercut competitors' prices. This rivalry is carried out, as a rule of thumb, through the introduction (at intervals) of better techniques of production with the clear objective of reducing the unit cost of production (investment).8 Shaikh assumes that any industrial economy's prices are determined by a dual, intra–industry and inter–industry, competition process.

On the one hand, competition in a generalized market economy mainly refers to competition of different capitals. Once production has taken place, producers of individual goods are disciplined by the market not to charge an arbitrary price, but rather the selling price determined by the better conditions of production. That is, the price that prevails in one particular market is not the average price of the industry but the least cost price determined by the most efficient producer in that industry. This price is called the regulating price and the producer is the regulating capital, as distinguished from the average price and the average capital (Ruiz–Nápoles 1996; Shaikh 1999b). In turn, "non–regulating capitals will be forced by competition to sell at the same price, and will therefore have a variety of profit rates determined by their own various conditions of production" (Shaikh 1999b:2).

On the other hand, competition between industries means that, to the degree that one industry is capable of realizing higher rates of return than the average prevailing rate of other industries, the more capital it will be able to attract either because other envious capitals will enter that particular market, or because the profitable enterprise will be able to expand faster by re–investing and, hence, enlarging their own capital formation. Under such circumstances, it is the free mobility of a factor(s) of production that produces the tendency for a rough equalization of profit rates between the previously unequal profit sectors (Antonopoulos 1997). Thus, the rates of profit which are equalized by capital flows are the profit rates of new investments in the regulating conditions of production (Shaikh 1999b). In other words, regulating prices of production in each industry are nothing else but the embodiments of the regulating techniques of production. As such, they incorporate the prevailing rate of profit and act as the center of gravity of selling prices. Hence, it is the best technology generally available for a new investment which forms the regulating conditions (Shaikh 1999b).

In sum, in both cases, intra–industry and inter–industry, it is the dominance of the lowest reproducible cost producers that makes absolute cost advantage the regulating principle of competition within a single nation.

With regard to international competition, Shaikh's model assumes that since production techniques used by firms within one nation differ, one would expect that techniques of production of any World Industry, where individual firms are spread out through various countries, will vary from one nation to another as well. Real wages, generally, will differ among countries as well (especially among developed and developing countries). So, the resulting lower unit cost of production, which can be measured as the total (vertically integrated) unit labor cost (ULC), allows international regulating firm(s) to either lower their own market price and thus, enlarge their market share or, perhaps, to temporarily sell at the prevailing market price and capture a higher profit per unit sold. In either case, the result is the same: the international regulating firm(s) will be in a position to make more profits relative to other international firms producing similar goods and thus faster engage in more R&D. The winners are those international firms capable of maintaining an absolute cost advantage vis–à–vis their competitor. Conversely, those firms suffering a loss of market share and shrinking profits have an absolute disadvantage (Antonopoulos 1997).

In this context, if free trade is assumed to prevail, absolute advantage is reflected in international markets by the dominance of regulating prices for each and every commodity. Therefore, tradable goods are expected to sell for approximately the same international market price, when expressed in a common currency, in every country after accounting for disparities which arise due to differences in transportation costs, indirect taxes and so on. Thus, market prices of regulating capital are expected to conform to the relative, vertically–integrated, real unit labor costs of the regulating firms (more on this below).

Based upon this theory of competition, Shaikh's model shows that the long–run real exchange rates can be pinned down by the vertically integrated real unit labor cost ratios of the tradable sectors of the transacting countries, when adjusted for differences in the price levels of a common standard wage–bundle of goods.

Formal theoretical model

Drawing on Antonopoulos (1997) and Ruiz–Nápoles (1996), we develop a model along the basic properties of Shaikh's model. Afterwards, for the Mexican long–run real exchange rate determination, we present the statistical and empirical results of such a model with a span of 35 years.

In his model, Shaikh follows the Ricardo–Marx tradition of relating prices to relative labor inputs costs (Shaikh 1980), adopting Pasinetti's model (1977). Thus, Shaikh starts from a closed economy, where relative prices of any two commodities i,j are dominated by the relative prices of the regulating capitals (P*i, P*j) which themselves are subject to their own vertically integrated unit labor costs (v*i, v *j):

In any industry, the prevailing market price of a commodity (p*) is regulated by the regulating firm's cost, which can be expressed as the vertically integrated nominal wage (w*) the regulating firm is subject to, and the vertically integrated labor requirement (λ*), dictated by the technology this regulating firm uses, in the sense of Sraffa and Pasinetti.9 If the nominal wage (w*) is divided by the consumer price index (cpi), and letting subscript r designate real instead of nominal measures, then the real wage (w*r ), is equal to w*/cpi. It follows that the real vertically integrated unit labor cost will be equal to w*r λ*, which will be referred to here as v*r .

Competition drives firms towards introducing more effective technologies. As a sector's regulating capital lowers its real relative cost, aggressive competition will drive down the sector's relative price as well. Thus, its own purchasing power, vis–à–vis the other goods, is expected to depreciate when its competitive position improves.

According to Shaikh's theory, when the ULC of one of the two goods declines, the competitive position of the country producing that good improves, and thus there is a real depreciation of its currency. We assume a two–country, two–good model. Under complete specialization, the exports of each country must be equal to the imports of the other country. In addition, specialization implies that each country contains exclusively one of the two regulating capitals, as each country is the sole producer of one of the two goods being traded. Thus, the necessity to distinguish between regulating variables, denoted by an asterisk in the previous two equations, and non–regulating variables is redundant.

The nominal exchange rate of a country eab, is defined as the number of units of currency a per one unit of currency b. Thus, a rise in the exchange rate corresponds to a depreciation of currency a, as more units are needed for one unit of the foreign currency:

Finally, given a general definition of the terms of trade of country a relative to country b as,

Combining [8] and [6], the terms of trade can be rewritten as:

At this point, Shaikh makes the simplifying assumption that both countries consume similar baskets of tradable consumption goods. Then according to the law of one price, pcTa = pcTb eab where pc is the price of consumption goods, subscript (T) stands for tradable. Expression [9] can be transformed to

From equation [6], the first two ratios on the right hand side are equivalent to the familiar vr ratio of two countries (ULC), the third ratio is the relationship of non–tradables to tradables of consumption goods in each country respectively, and the fourth ratio is equal to unity. Thus,

Here, the price ratio of non–tradable to tradable consumption goods will be represented by Z. It is interesting to note at this point that the difference between the national and international terms of trade, as expressed by the two relative price ratios in equation [5] and [11] respectively, is simply the price adjustment term Z, required due to the presence of non–tradable goods.

We are now ready to define the real exchange rate. Starting with a general definition of the real exchange rate, where pa and pb are general price indexes, such as cpi and gdp deflators.

Dividing both the numerator and denominator by pxa / pxb we get:

Substituting the inverse of [11] in the last expression of [13] we get,

The real exchange rate (rxr) is thus determined, according to Shaikh, by three main factors: real unit labor cost, terms of trade and, relative prices. In other words, the real exchange rate(s) between the currency of two countries (or the currency of one country versus a basket of currencies of several countries) is determined by the relative total real unit labor cost of the export sector adjusted for relative price differences of exports to the general price index between the two (or more) countries.

Shaikh concludes that real wages (w*r) and total requirements (λ*) are determined by the local factors within each country, and these in turn determine the terms of trade (t.o.tab). As such, the terms of trade are not free to move so as to bring about automatic balance of trade adjustment. Persistent foreign trade disequilibria will, therefore, be normal, as long as competitive differences are persistent.

In addition, Shaikh's position is that, in any case, neither flexible exchange rate nor fixed exchange rate variations will correct the structural trade imbalances induced by international competition. The generalized modernization of technology, to raise productivity and lower unit labor costs, is the only long term solution to the problem of competitive disadvantage. More precisely, a cost reduction can only be produced by the introduction of more efficient technologies, or, in the short–term, by the reduction of the real wage rate. However, it is important to notice that in this latter case, the effect of lower wages on costs is only temporary since long–term profits will eat up this wage reduction and prices will return to their previous level.

DATA CONSTRUCTION AND STATISTICAL ANALYSIS (RULC US–Mex)

This section puts forth the methodology, description, and construction of the variables needed to estimate Shaikh's alternative model of real exchange rate determination. Furthermore, we discuss why besides the relative unit labor cost ratio US–Mex as the main determinant of long–run real exchange rate, we add to our model the net capital inflows to Mexico and the Mexican real gross domestic product as temporary causes of real exchange rate deviations.

The present empirical work relies mostly on data from the manufacturing sector because there are numerous problems in the availability of data from the manufacturing export sector, especially for the Mexican economy. In other words, since not all of the required data were available in time for the period under study, the direct unit labor costs were calculated instead as a proxy of the unit labor cost in the manufacturing sector only (see below for a justification).10 Our empirical analysis just covers the period 1970–2004 since for the Mexican case, after 2004 the data for wages and employment in the manufacturing sector were calculated on a different methodology than those calculated on the period 1970–2004, that is, since 2004 the surveys conducted by Instituto Nacional de Estadística, Geografía e Informática (INEGI) took into account a greater number of economic sectors than those considered in the surveys conducted on the period 1970–2004.

Under such circumstances, in the next section, we estimate through a cointegrating VAR model, the following functional relationship for the period 1970–2004:

where,

1. The real exchange rate, rxr, is equal to the nominal exchange rate deflated by the price ratio of the foreign country (j) to the home country (i):11

2. rulcr*ij stands for a real unit labor cost ratio*, and is equal to the rulcj of the foreign country (j) divided by the rulci of the home country (i)

3. rulci,j stands for real total remuneration in manufacturing in local currency divided by productivity. That is, real unit labor cost is defined as total labor cost in manufacturing divided by productivity:

4. At the most general level, the two series that need to be developed are the real unit labor cost (RULC) of the manufacturing sector of Mexico and that of the US. Therefore, if we substitute the equation that defines the real unit labor cost ratio* (rulcr*ij) into expression [1] we get:

5. capital flow stands for real net capital inflows to Mexico and it considers deposits, loans and credits to commercial and public banks in Mexico, as well as non–banking public and private sectors; foreign investment, which includes direct and indirect investment; securities issued abroad, both public and private; controversial Deffered Investment Projects known as PIDIRIEGAS (long–term productive infrastructure projects in Petróleos Mexicanos, PEMEX);12 and the net errors and omissions in the balance of payments.

6. rgdp stands for the real gross domestic product of the Mexican economy.

Data description

The period of the present study spans from 1970–2004. All price deflators are 1970=100, and later on all series used are in index form, with 1977=100. Each money variable was measured in the corresponding local currency.13 As we mentioned above, to carry out the estimation of this alternative model, it is assumed that the manufacturing sector represents the majority of tradable goods, which is correct for all industrialized and some semi–industrialized countries. In the case of Mexico, manufacturing trade has grown in importance and it currently represents 90 percent of total exports and 87 percent of total imports (Fujii 2000; Martínez 2003; Ruiz–Nápoles 1996). In addition, the United States is Mexico's major trading partner. Exports to and imports from the US account for 75 percent of Mexico's total foreign trade.

Mexican real unit labor cost

The construction of the RULC of the Mexican manufacturing sector was carried out with the data provided by the inegi and Mexico's Central Bank (Banco de México). Gross domestic product in manufacturing was deflated by using the implicit prices of the manufacturing. Total wages and salaries were deflated by the consumer price index (1970). We also consider the total number of workers in manufacturing. Thus, real unit labor costs are wages and salaries paid in manufacturing multiplied by the number of workers in manufacturing and divided by real gross domestic product in manufacturing:

us real unit labor cost

The construction of the rULC of the United States manufacturing sector was carried out with the data provided by the Department of Commerce, Bureau of Economic Analysis (BEA). Gross domestic product in manufacturing was deflated by using the implicit prices of durable and non–durable goods indices (average). The non–durable goods index, which includes petrochemicals, gas, and petrol (motor fuel) among other derived products of oil, was included because exports of non–durable goods to Mexico have increased considerably in recent years (Martínez and Herrera 2006). Total wages and salaries were deflated by the consumer price index (1970). We also consider the total number of workers in manufacturing. Thus, for the US economy, the real unit labor cost is also real wages and salaries paid in manufacturing multiplied by the number of workers in manufacturing and divided by real gross domestic product in manufacturing:

Net capital inflows

The construction of the net capital inflows to Mexico variables was carried out with data provided by Banco de México. Once constructed, this series was deflated by the US consumer price index (base 1970=100). We considered this variable insofar as the Mexican government has since the early 1990s implemented several policies to attract foreign capital in order to stabilize the exchange rate and to finance the current account deficit (Martínez 2003). The relationship between the real exchange rate and the real net capital inflows is shown in figure 1.

In figure 1 the real exchange rate index indicates a real depreciation when its value is above 100 and a real appreciation when its value is below 100.14 There exists a negative covariation between the two variables, allowing for the possibility that net capital flows can explain to some degree the deviation of the real exchange rate of the Mexican Peso from its theoretical proposed primary determinant (center of gravity), namely real unit labor costs. Finally, as a result of this negative covariation, we would expect a negative sign between the relationship of these variables in our econometric model.

Mexican real gross domestic product

A very well–known difficulty of the Mexican economy, as well as other developing and developed economies, is the structural lack of internal and external competitiveness which is manifested in increasing external deficit during periods of steady growth. This process, known as the external constraint to growth, has taken place in the period before trade liberalization and after the signing and operation of the General Agreement on Tariffs and Trade (GATT, 1986) and North American Free Trade Agreement (NAFTA, 1994), as well as under fixed exchange rate and flexible exchange rate (López 1998; Ros and Lustig 2000; Ruiz–Nápoles 1996).

Along these lines, economic growth has two different, but equally important, effects on the real exchange rate. On the one hand, the level of income determines the level of imports. Imports, in turn, are the main determinant of foreign exchange's demand and, therefore, they have an important influence on the exchange rate. This implies a positive relation between the level of income and the real exchange rate, according to the way er is measured in equation [3]. When income rises so do imports and this puts an upward pressure on the nominal exchange rate e, which will result in an increase of er. This means a real depreciation of the currency in the short–run, unless, other factors, like a net capital inflow and/or monetary policy measure, hold the nominal exchange rate constant (Ruiz–Nápoles 1996).

On the other hand, since national income (or gross domestic product) includes exports, when the economy grows and exports rise, the expected relationship between income and real exchange rate is negative. This increase in exports implies an increase in the supply of foreign exchange that puts a downward pressure on e. In the case we are analyzing, we have included the level of real national income as a variable that has had these two important effects on the real exchange rate. But considering the various exchange rate policies followed, the dynamics of exports, and the inflow of short–run capital during the period under study, we expect the relationship to be negative.

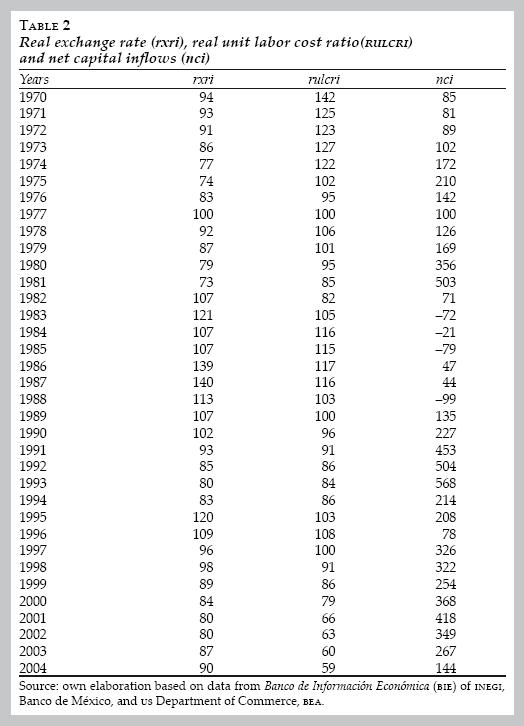

Center of gravity: real unit labor cost ratio (US–Mex)

After constructing the main structure of data of this model, we present in index form, base 1977=100, three variables that make up this alternative model of long–run real exchange rate determination, namely real exchange rate (rxr), real unit labor cost ratio (US–Mex), and real net capital inflows to Mexico (capital flow). The base year of 1977 was chosen because it was the first time in 23 years that the exchange rate was free floating, so its level was determined by market forces. Also, in that year the trade balance was balanced. These indices, (shown in table 1 and 2) reveal that for a span of 35 years (1970–2004) the real exchange rate trend is closely related to the movements of the real unit labor cost ratio (US–Mex) and the real net capital inflows to Mexico. Figure 2 supports the proposition that the trend of the real exchange rate is associated with real unit labor cost ratio (US–Mex). That is, this figure clearly shows that this real unit labor cost ratio series maintains a trend very similar to the real exchange rate series but smoother, as expected.

EMPIRICAL EVIDENCE OF ALTERNATIVE REAL EXCHANGE RATE DETERMINATION THROUGH COINTEGRATED VAR MODEL

In this section we test the hypothesis that the real exchange rate of the Mexican peso with respect to the US dollar is mainly determined by relative real unit labor costs of the US and Mexican manufacturing sectors, and the residual variation by real net capital flows to Mexico, and the Mexican real gross domestic product. Rewriting the functional relationship [22] in a form appropriate for econometric testing results in expression [23]:

where: rxrit, the index of the real exchange rate of pesos/dollar; α, a constant term; rulcrit, the index of real unit labor cost ratio (US–Mex); nciMex t, the index of real net capital inflows to Mexico; rgdpMex t, Mexican real gross domestic product.

The estimate of equation [23] is started by finding out the order of integration of each series. So, in order to find such an order, we applied unit root tests to each series because this procedure indicates the order of integration. The results of these tests are shown in table 3, which presents evidence from three unit root tests: ADF, PP and KPSS. These tests suggest that the variables rxri, rulcri, capital flow, and rgdp are nonstationary time series of order I(1). Therefore, having proved that all these series contain a unit root (nonstationary through time), it is fulfilled one of the conditions of the cointegration procedure (Charemza and Deadman 1999).

Subsequently, we calculated a VAR model for multivariate time series.

Y, A and E are matrices. Y is compound of the series rxri, rulcri, nci, and rgdp. Likewise, A is a matrix with the respective coefficients for each lag. E contains errors or innovations of each equation. Since our purpose is to try to find evidence of a cointegration relationship among the variables embedded in this model, the VAR model was estimated in levels in order to avoid loss of long–run information (Spanos 1986). Thus, the VAR model includes a dummy variable that captures the effects of the devaluation of the currency (1982:1) and includes two lags, which were based on statistical criteria (Spanos 1986). The VAR tests (autocorrelation, heteroscedasticity and normality) are shown in table 4.

The next step was to identify a cointegration relationship among the series proposed for this model. For this purpose, we used the Johansen procedure (Charemza and Deadman 1999). The result of this method is a cointegration vector (see table 5). The obtained vector expresses a long–run relationship among the real exchange rate index, real unit labor cost ratio index (US–Mex), real net capital flows index, and Mexican real gross domestic product. The signs of the coefficients correspond to those expected. It was also proven that the individual significance of these coefficients is each equal to zero. The results based on the likelihood ratio statistics (LRS) rejected the null hypothesis of a zero real unit labor cost ratio index, β1= 0. The same happened in each case, except in the Mexican real gross domestic product, β3 = 0.15

In sum, these statistical and econometric results (section 4 and 5) fully support the hypothesis raised in this paper, that real relative unit labor costs of the US and Mexican manufacturing sectors are the main determinant of the Mexican long–run real exchange rate. In addition, these results also support the hypothesis which holds that it is the dominance of the lowest reproducible cost producers that makes absolute cost advantage the regulating principle of competition within a single nation and in the international arena. Therefore, countries like Mexico, regardless of the exchange rate regime, will always have trade imbalances. This situation, as history has shown, will be permanent as long as these countries continue with structural inequalities in the real production costs of their national industries.

CONCLUSIONS

This paper has presented an alternative approach to the real exchange rate determination based upon a classical approach to the theory of competition developed in Shaikh (1980, 1991, 1998 and, 1999b). The fundamental outcome of this alternative theory is that the long–run real exchange rate can be pinned down by the vertically integrated real unit labor cost ratios of the tradable sectors of the transacting countries, when adjusted for differences in the price levels of a common standard wage–bundle of goods. This result implies chiefly two things: first, that neither the absolute nor relative versions of the PPP will generally hold; second, that devaluations will not have a lasting effect on trade balances, unless they are accompanied by fundamental changes in real production costs of nations (i.e., in national real wages and productivity).

For the Mexican economy, the empirical results show that the PPP hypothesis does not apply in its two versions (strong and weak) for a span of 35 years (1970–2004). That is, unit root tests showed that the real exchange rate of the Mexican peso with respect to the US dollar is a non–stationary series. However, it is worth noting that this result is not just typical of the Mexican economy since similar tests for other countries cast the same results. It should also be borne in mind that because the PPP hypothesis supports all the conventional exchange rate models, the empirical failure of this hypothesis also helps to explain the empirical failure of the monetary exchange rate models. The empirical results of our alternative model showed that, in contrast to PPP hypothesis, the real unit labor cost of the manufacturing sector between the US and Mexican economies is a perfect approximation to estimate the effective real exchange rate due that our econometric model (cointegrated VAR model) showed evidence that these two variables, as well as real net capital inflows to Mexico and the Mexican real gross domestic product, have held a long–run relationship for a span of 35 years.

The empirical validation of this alternative model explains why, after the multiple dramatic devaluations of the Mexican currency through time (1958, 1976, 1982, 1986–88, and 1994), this country, regardless of the exchange rate regime, has not been able to maintain an adequate level of competitiveness in order to balance its international trade. That is, this alternative theory implies that, in general, competitive position of firms in the Mexican manufacturing industry has been far away of those international (regulating) firms of the manufacturing industry. So, this structural disadvantage has allowed the latter firms to be in a position to make more profits in similar goods and thus faster engage in more R&D. Hence, in the international arena, the winners are those international firms capable of maintaining an absolute cost advantage vis–à–vis their competitor.

Finally, we have shown that as long as the Mexican economy does not improve its general technical conditions of production, this country will keep up a structural inequality in the real production costs of its national industries vis–à–vis their competitor and, as a result, a permanent trade imbalance.

REFERENCES

Antonopoulos, R., An Alternative Theory of Real Exchange Rate Determination for the Greek Economy, Unpublished PhD dissertation, New School for Social Research, New York, 1997. [ Links ]

Banco de México, Indicadores Económicos y Financieros. Available at: <www.banxico.org.mx> [ Links ].

Charemza, W. and D. Deadman, New Directions in Econometric Practice: General to Specific Modelling, Cointegration and Vector Autoregression, Second edition, United Kingdom, Edwar Elgar, 1999. [ Links ]

Dornbusch, R., Exchange Rates and Inflation, Cambridge, The MIT Press, 1988. [ Links ]

Froot, K. and K. Rogoff, Perspective on PPP and long–run real exchange rates", National Bureau of Economic Research (NBER), Working Paper no. 4952, 1994. [ Links ]

Fujii, G., "Apertura externa y empleo manufacturero en México", Momento Económico, no. 109, 2000. [ Links ]

Harvey, J., "Orthodox approach to exchange rate determination: a survey", Journal of Post–Keynesian Economics, vol. 18, no. 4., 1996. [ Links ]

Instituto Nacional de Geografía e Informática (INEGI), Banco de Información Económica (BIE). Available at: <www.inegi.org.mx> [ Links ].

Krueger, A., Exchange Rate Determination, Cambridge Surveys of Economic Literature, Cambridge, Cambridge University Press, 1983. [ Links ]

López, J., La macroeconomia de México: el pasado reciente y el futuro posible, Mexico, Miguel Ángel Porrúa/Universidad Nacional Autónoma de México (UNAM), 1998. [ Links ]

Martínez, F., Efectos de la liberalización financiera sobre el crecimiento económico de México, Unpublished Bachelor Thesis, Mexico, Facultad de Economía, UNAM, 2003. [ Links ]

Martínez, F. and S. Herrera, "Debilidades y fortalezas de la industria petrolera en México, 1985–2005", Economia Informa, no. 340, mayo–junio, 2006. [ Links ]

Milberg, W., "Is absolute advantage passe? toward a Keynesian/Marxian theory of international trade", in M. Glick (ed.), Competition, Technology and Money, Classical and Post–Keynesian Perspective, United Kingdom, Edward Elgar, 1994. [ Links ]

Pasinetti, L., "Sraffa's circular process and the concepts of vertical integration", in K. Bharadwaj and B. Schefold (eds.), Essays on Pierro Sraffa: Critical Perspectives on the Revival of Classical Theory, London, Routledge, 1992. [ Links ]

Rogoff, K.; K. Froot and M. Kim, "The law of one price over 700 years", International Monetary Fund (IMF), Working Paper no. 01/174, 2001. [ Links ]

Ros, J. and N. Lustig, "Trade and financial liberalization with volatile capital inflows: macroeconomic consequences and social impacts in Mexico during the 1990s", Center for Economic Policy Analysis (CEPA), Working Paper Series I no. 18, 2000. [ Links ]

Ruiz–Nápoles, P., Alternative Theories of Real Exchange Rate Determination, A Case Study: The Mexican Peso and the US Dollar, Unpublished PhD dissertation, New York, New School for Social Research, 1996. [ Links ]

––––––––––, "The Purchasing Power Parity Theory and Ricardo's Theory of Value", Contributions to Political economy, vol. 23, 2004, pp. 65–80. [ Links ]

––––––––––, "Vertically integrated unit labour costs by sector: Mexico and USA1970–2000", 2009. Available at: <www.networkideas.org/featart/may2009/Vertically.pdf> [ Links ].

Stein, J.L.; P.R. Allen et al. (eds.), "Fundamental Determinants of the Exchange Raates", Oxford, Clarendon Press, 1995. [ Links ]

Shaikh, A., "On the laws of international exchange", in E. Nell (ed.), Growth, Profits, and Property: Essays in the Revival of Political Economy, Cambridge, Cambridge University Press, 1980. [ Links ]

––––––––––, Competition and Exchange Rates: Theory and empirical Evidence, New York, Department of Economics, New School for Social Research, 1991. [ Links ]

––––––––––, "Explaining long term exchange rate behavior in the United States and Japan", The Jerome Levy Economics Institute, Working Paper no. 250, 1998. [ Links ]

––––––––––, "Explaining the u.s. trade deficit", Testimony before the Trade Deficit Review Commission, Washington, D.C., 1999a. [ Links ]

––––––––––, "Real exchange rates and international mobility of capital", The Jerome Levy Economics Institute, Working Paper no. 265, 1999b. [ Links ]

Spanos, A., Statistical Foundations of Econometric Modeling, Cambridge, Cambridge University Press, 1986. [ Links ]

US Department of Commerce, Bureau of Economic Analysis (BEA). Available at: <www.bea.gov> [ Links ].

* The author thanks Professor Anwar Shaikh, Mishan Hing and, two anonymous referees for their helpful comments on an early version of this paper. Any errors and omissions belong to the author.

** JEL: Journal of Economic Literature–Econlit.

1 It is worth noting that, since in itself, the LOP does not imply a long–run equilibrium real exchange rate (at which balance of trade would be equal to zero), it is possible that the LOP prevails even when there is a trade surplus or trade deficit (Antonopoulos 1997).

2 This seemed to be specifically applicable to the case of Mexico having one major trading partner, the United States (US), given the conditions of free trade and investment.

3 PPP was originally proposed in references to the general price level. In the face of empirical evidence that invalidated the initial results of this model, most empirical works shifted to indexes of prices since (Antonopoulos 1997).

4 It is worth noting also that some works have pointed out that only in hyperinflationary periods the PPP seems to apply for some economies (see Froot and Rogoff 1994; Shaikh 1998).

5 Here we refer to the elasticities approach, absorption approach and, the classical balance of payment approach.

6 As we will see briefly, the purpose of this paper is to show the opposite idea.

7 For this estimation of real exchange rate it was used the Consumer Price Index (cpi) of both countries as a price deflator (1977=100).

8 Within any one industry, be it national or international, new technologies come into being at various intervals, while prior ones decline in their competitiveness and eventually die out (are scrapped). This never–ending dynamic produces a spectrum of technologies in operation in each industry, with the capitals with the lowest reproducible costs regulating the market price (Shaikh 1999b:1).

9 For Sraffa and Passinetti, there is a unique set of rates of exchange among commodities that is determined by technology alone and that must be adopted in order to keep the system in a self–replacing state. Sraffa especially points out that these rates of exchange might indifferently be called "natural prices", or "prices of production", or "values". In a precisely parallel way, the relation in the price system does not go —as traditional marginal analysis would have it— from final consumers' preferences to 'imputed' costs. As classical analysis has always claimed, it goes from costs of production to 'natural' prices (see Pasinetti 1992).

10 It is worth noting that this sector is used for the calculation of the so called "real effective exchange rates" by most countries, members of the International Monetary Fund (FMI).

11 Pij = general price index (cpi, gdp, deflactor, among others).

12 Because of federal budgetary constraints, the Mexican Government has sought private sector participation in the building and financing of PIDIRIEGAS. The Mexican Government approves the designation of certain infrastructure projects as PIDIRIEGAS, meaning these projects are treated as off–balance sheet items for annual budgetary purposes, until delivery of the completed project to PEMEX or until payment obligations begin under the contract.

13 All data used to construct these series can be requested to the author's e–mail address.

14 It is worth nothing that in Shaikh's original exposition, he used the opposite definition of the exchange rate, that is, e = foreign currency/local currency, so that a rise is an appreciation of the exchange rate.

15 This should be seen as a result of the negligible impact of this variable on the real exchange rate.