Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Investigación económica

versión impresa ISSN 0185-1667

Inv. Econ vol.68 spe Ciudad de México ene. 2009

Can balance–of–payments constrained economies pursue inflation targeting? A look at the case of Chile

¿Pueden las economías con restricción de balanza de pagos perseguir metas de inflación? Un examen del caso Chileno

Esteban Pérez Caldentey*

* The author is Economic Affairs Officer at Economic Commission for Latin America and the Caribbean (ECLAC), Santiago, Chile. E–mail: <esteban.perez@eclac.org>.

Abstract

The current international financial system is anchored on the United States dollar. Countries that do not issue the reserve currency must be able to acquire, and indeed accumulate, the currency they cannot issue to carry real and financial transactions. As a result, their external performance shapes and constrains to a significant extent their capacity to pursue domestic policies including fiscal and monetary policies. In this sense countries are said to be 'balance–of–payments' constrained. This paper examines, for the case of Chile, the limitations imposed by external conditions to the undertaking of a monetary policy strategy, inflation targeting, which focuses explicitly on a domestic objective, namely a low and stable rate of inflation. Chile adopted an inflation targeting strategy in 1991. Since, the adoption of the inflation targeting strategy followed two clear and distinct phases. The first one lasted from 1991 to 1999 and can be termed an Eclectic Inflation Targeting Regime (EIT). From 1999 to the present Chile switched to a Full Fledged Inflation Targeting Regime (FFIT). The analysis of both phases shows that pursuing inflation targeting under balance–of–payments constrained conditions ultimately leads to a conflict of interest between internal and external objectives, and that the conflict tends to be solved in favor of the latter.

Key words: inflation targeting, balance–of–payments constrained economies, inflation, Chile, Latin America, Central Bank, monetary policy.

Clasificación JEL: ** E, E5, O, O11

Resumen

El sistema financiero internacional está anclado al dólar estadounidense. Los países que no emiten la moneda de reserva internacional deben adquirirla y, de hecho, acumular la moneda que no pueden emitir para llevar a cabo transacciones reales y financieras. Como resultado, su desempeño externo determina en gran parte su capacidad para llevar a cabo políticas nacionales, incluyendo las políticas fiscales y monetarias. En este sentido, se entiende que estos países se enfrentan a una restricción de balanza de pagos. Este trabajo examina, para el caso chileno, las limitaciones impuestas por las condiciones externas a la persecución de una estrategia de política monetaria: la de metas de inflación, cuyo objetivo es la consecución de una tasa de inflación baja y estable. El Banco Central de Chile adoptó una estrategia de metas de inflación a partir de 1991. Esta estrategia se caracteriza por seguir dos fases distintas. La primera se puede denominar un enfoque de metas de inflación ecléctico y duró hasta 1999. A partir de esa fecha el Banco Central de Chile adoptó una estrategia de metas de inflación integral. El análisis de ambas fases muestra que la persecución de metas de inflación en un contexto de restricción de balanza de pagos imperante genera en última instancia un conflicto de interés entre objetivos internos y externos, y que el conflicto se resuelve a favor del objetivo externo.

Palabras clave: régimen de metas de inflación, economías con restricción de balanza de pagos, inflación, Chile, América Latina, Banco Central, política monetaria.

INTRODUCTION

The economic performance of small economies is determined to a greater extent by the existing financial architecture. The current financial system is anchored on the United States dollar and countries that do not issue the reserve currency, especially small open economies, must be able to acquire, and indeed accumulate, the currency they cannot issue to pay for their imports and to carry other type of real and financial transactions.

As a result, countries' domestic policies, and in particular those of small open economies are to a greater extent shaped and constrained by their external conditions and performance. In this sense they are said to be balance–of–payments constrained. More specifically "countries are said to be balance–of–payments constrained when their (current and expected) performance in overseas markets, and the response of the world financial markets to this (current and expected) performance, shapes and constrains their domestic policy space, including that of fiscal and monetary policy."1

This paper examines the limitations imposed by external conditions to the undertaking of a monetary policy strategy, inflation targeting, which focuses explicitly on a domestic objective, namely a low and stable rate of inflation for the case of Chile.2 Chile became in 1991 the second country in the world, after New Zealand (1989) and the first developing country to adopt inflation targeting. Moreover according to the standard literature on the subject, Chile is one of the most re–known small open economy inflation targeting successes.3 The study and analysis of this case can thus provide a source case for the upper boundary on the space for monetary policy under balance–of–payments constrained conditions. The paper specifically argues that pursuing inflation targeting under balance–of–payments constrained conditions ultimately leads to a conflict of interest and goals between internal and external stability, and that the conflict tends to be solved in favor of external stability.

Following this introduction the paper is structured in five sections. The first section delineates, albeit briefly the main elements of inflation targeting. In particular, following the literature on the subject, it describes inflation targeting as a monetary policy strategy characterized by the public announcement of numerical targets for inflation. Essential elements for a successful inflation targeting strategy include the commitment to maintain a unique nominal anchor (the inflation rate) and one instrument which is in general the policy interest rate of the Central Bank; the effective communication of the monetary authorities (or Central Bank) of their objectives, policies and underlying reasons for their decisions; and improved accountability.4 This section follows faithfully the logic of the inflation targeting approach as an optimal policy rule extending it to the case of an open economy. It shows that a low and stable inflation is always its 'hierarchical mandate' and that as long as the exchange rate and the rate of inflation move in the same direction (say as a result of an external shock) the interest rate policy feedback rule is a stabilizing force at the domestic and external levels.

Sections two to five, focus on inflation targeting in Chile. Chile has not evidenced a unique, unified inflation targeting strategy. Rather the country adopted two distinct inflation targeting phases which are dealt with in each of the said sections of this paper respectively.

During the first phase (1991–1999), the monetary authority maintained in fact two nominal anchors, the rate of inflation and an exchange rate band, and partly as a consequence communication and accountability proved to be weak. The maintenance of two anchors proved to be incompatible and eventually external sector considerations took precedence over the domestic inflation target. The experiment ended with an undershooting of inflation relative to its target, the first recession in the 1990's decade and greater output and inflation volatility despite the remarkable reduction in the rate of inflation from 27% in 1990 to 3% in 1999.

The second phase began in 1999 with the decision to float the exchange rate, improve communication and accountability and thus adopt a 'full fledged inflation targeting regime' (FFIT). A relevant aspect of this second phase is that in spite of the adherence to a free float, the Central Bank intervened on three occasions (2001, 2002–2003, 2008) in the foreign exchange market, and in two of these (2001 and 2008) intervened in the spot market.

The first two interventions were justified on the basis of the positive effects of nominal exchange rate depreciation on prices and its destabilizing effect on the financial sector. In the last intervention, a third motive was added, namely international reserve accumulation for 'precautionary motives.' The final intervention, justified on a precautionary reserve accumulation basis not contemplated in the inflation targeting literature, occurred in a context of increased inflation and an appreciating trend in the exchange rate. The effects of the consequent increase in the rate of interest to reduce inflation clashed with those derived from 'precautionary international reserve accumulation.' The former appreciated the exchange rate and the latter had the opposite effect. The end result was a reversal in the appreciation of the exchange rate and the largest overshooting of the actual rate of inflation (8%) relative to its target (3% with ±1% tolerance band).

The final reflections are found in the fifth section. The section reinforces the need to devise policies and policy instruments that is a policy space, that in the absence of a change in the international monetary and financial order, can adapt and work under balance–of–payments constrained conditions.

INFLATION TARGETING FRAMEWORK: A BRIEF SKETCH

Inflation targeting is traditionally defined as a monetary policy strategy framework consisting in the public announcement of numerical targets for the inflation rate, acknowledging that price stability is the fundamental goal of monetary policy and a firm commitment to transparency and accountability.5 Within the context of this definition, numerical targets can refer to a point inflation rate, a range or a point with a tolerance range. The inflation rate can refer to the consumer price index (CPI) as is the standard case for most developing economies or to the core CPI.6 Transparency means that the monetary authorities must communicate their targets, forecasts of inflation, decisions on monetary policy and the motivation for their decisions. Finally, accountability here means that the monetary authorities are responsible for attaining the announced objectives and subject to "public scrutiny for changes in their policy or deviations from their targets."7

The above definition typifies the components of a FFIT. The literature notwithstanding recognizes that some countries are also characterized by other types of inflation targeting regimes including, 'inflation targeting lite' (ITL) and the 'eclectic inflation targeting' (EIT).8 Inflation targeting lite refers to countries that announce publicly numerical targets for inflation but are not capable of sticking to price stability as the fundamental goal of monetary policy. For its part, eclectic inflation targeting refers to those countries that do not fully adhere to the entire set of inflation targeting principles. EIT countries can pursue other goals besides price stability.9

In practice, especially in the case of developing countries, the dividing line between a FFIT and EIT regime is not easily drawn and many countries can be said to practice some type of EIT regime. That is very few countries practice a FFIT regime. The mainstream literature while not willing to use the EIT classification recognizes nonetheless that most countries practice 'flexible inflation targeting' as opposed to 'strict inflation targeting'.10

Flexible inflation targeting implies that the monetary authorities or the Central Bank do not have only a monetary objective (stabilizing inflation) but also has a real objective (stabilizing real output). As put by Svensson (2007:1): "In practice inflation targeting is never 'strict' inflation targeting but always 'flexible' inflation targeting, in the sense that all inflation–targeting central banks [...] not only aim at stabilizing inflation around the inflation target but also put some weight on stabilizing the real economy [...]. Implicitly or explicitly stabilizing a measure of resource utilization such as the output gap between actual output and 'potential output'." The literature also refers to 'flexible' inflation targeting as pursuing stability of interest rates or of the variation of the exchange rate in an open economy.11

The adoption of flexible inflation targeting entails pursuing a 'gradualist' approach to the achievement of monetary policy objectives. Flexible inflation targeting and hence a gradualist approach to monetary policy is conceptually justified mainly on the grounds of uncertainty regarding: (i) the workings and current state of the economy; (ii) the transmission mechanisms and policy parameters; and (iii) the nature of external shocks as well. A gradualist policy can also contribute to buffer the effects on real variables caused by external shocks.

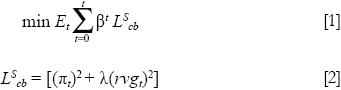

These ideas can be formally stated in the case of an open economy through a traditional monetary authority or Central Bank loss function. The loss function states that a central banks solves a "standard optimal control problem, choosing the path of the price level that minimizes a quadratic loss function subject to the constraints imposed by the linear structure of the economy" (Cecchetti and Kim 2005:176) or the linear dynamics or laws of motion of the economy. 12 That is the Central Bank minimizes:

s.t. the dynamics or laws of motion of the economy, where:

Et: the mathematical expectation at time t.

β: time discount factor.

LScb: loss function

π: inflation gap.

rvg: real variable gap. It refers for example to the difference between actual and target real output or between the actual real exchange rate and the target exchange rate.

λ: degree of preference for inflation stability relative to real variable stability.

According to this approach in each time period, the Central Bank chooses an instrument to minimize the loss function subject to a model or equation capturing the linear structure of the economy, its dynamics, or its laws of motion. In other words the monetary policy rule is derived from "the nature of the loss function jointly with the constraint (i.e., the model or equation capturing the linear structure of the economy, the dynamics, or laws of motion) under which it is optimized." (Arestis and Sawyer 2008).13

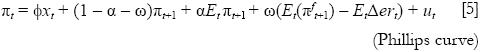

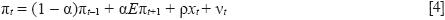

The typical approach to flexible inflation targeting is to assume that 1 > λ > 0 and that the structure of the economy is subject to market imperfections (i.e., rigidities) so that a Phillips curve and an aggregate demand curve can capture the linear structure of the economy.14 The specification for an open economy of the Phillips and the aggregate demand curve here adopted follows that of the new Keynesians as both depend on future values of inflation and output gap.15 That is,

Where:

πf: external inflation rate.

er: nominal exchange rate.

rer: real exchange rate.

xt: output gap.

Δ: discrete change between t and t–1.

Φ, α, ω, ψ, γ, κ, δ, > 0

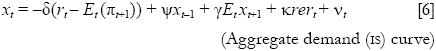

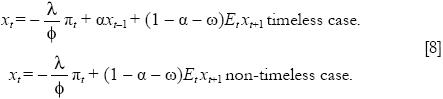

A useful practical approach to the minimization problem is to minimize the loss function (i.e., equation [2]), subject to the constraint imposed by the Phillips curve (equation [5]), obtain the optimality condition for the output gap (xt) and replace it in the aggregate demand curve (equation [6]) to obtain the policy instrument (rate of interest) compatible with that condition.16 Using this approach the first order conditions derived from the application of the Lagrange method are as follows:

Where:

μt: Lagrangian multipliers corresponding to the Phillips curve constraint.

The substitution and combination of first order conditions yield the optimality condition for the timeless and non–timeless cases.17 That is,

According to equations [8] the output and inflation gap have an inverse relationship. This indicates that the monetary authorities follow a 'lean against the wind' monetary policy. They contract (expand) aggregate demand if inflation is above (below) target. The extent to which authorities are willing to contract demand in this situation is weighted by the ratio of the weight attached to output stability (λ) relative to the gains in the reduction of inflation per unit of output loss (Φ).

The solution to the optimization problem makes the clear case that low and stable inflation should not be pursued at any cost. However, the logic of the exercise and its conceptual foundations clearly reveal that even the concern of 'flexible inflation targeting' for real variables refers exclusively to their variability (stability) since monetary policy can not affect the level of real variables. In this sense, inflation targeting whether strict or flexible maintains the dichotomy between real and monetary variables. In the absence of 'market imperfections' real variables are determined in the short and long run by the 'real forces', that is by endowments, technology and preferences. In the presence of 'market imperfections', monetary policy can affect real variables but only in the short run. Thus monetary policy, whether embedded in a strict or flexible targeting inflation framework should look mainly after the control of inflation as its primary and hierarchical goal and mandate.18

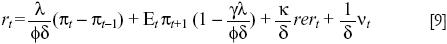

Finally, the substitution of the desired value of the output gap (xt) in the aggregate demand curve (IS) provides the 'optimal feedback policy' for the interest rate. That is,

The interest rate is positively associated with the acceleration in the rate of inflation in period t (πt — πt–1), which is equivalent to an inflation rate rising above its target, to the expected rate of inflation in period t+1 and to the exchange rate (rer). The real exchange rate is positively related to the interest rate, indicating that the authorities increase (decrease) the interest rate when the exchange rate depreciates (appreciates).19

The specification of equation [9] is thus consistent with equations [8] in terms of a 'lean against the wind' policy. Also, equation [9] shows that the 'lean against the wind policy' is a stabilizing force not only in terms of inflation (domestic) but also in terms of the exchange rate (external sector), when both variables move in the same direction (i.e., when increases (decreases) in the rate of inflation are accompanied by a real exchange rate depreciation (appreciation)).20

The formalization of the inflation targeting framework allows the derivation of important considerations regarding the role of the external sector and the exchange rate in an inflation targeting framework. The exchange rate does not enter as an argument into the Central Bank's loss function. Thus the level or value of the exchange rate should not be, in principle, a main concern for monetary policy.

However, and second, the framework recognizes that the exchange rate has effects on the main variables guiding monetary policy (i.e., the targets), namely the output and inflation gaps. Indeed, changes in the (real) exchange rate reflecting variations in the ratio of tradables to non–tradables, and hence in competitiveness, produce changes in the demand for imports and exports and affect the output gap (equation [6]). In a similar manner changes in the (nominal) exchange rate translate into changes in actual inflation and affect the inflation gap (equation [5]).

Thus according to this framework changes in the exchange rate can require monetary policy interventions in so far as these translate into variations in the inflation and/or output gaps. An increase in the nominal exchange rate (nominal depreciation) will result in a higher inflation gap (through the price of intermediate or final goods). A higher inflation gap (i.e., a greater rate of inflation relative to target) will induce a monetary policy intervention in the form of a contraction in aggregate demand.

In a similar vein, a rise in the real exchange rate (a depreciation of the real exchange rate) will induce a greater output gap (a larger positive deviation of output from its target) (equation [6]), and thus through (equation [5]) a higher current inflation rate and hence a greater inflation gap. The narrowing of the gap will require, again, a contraction in aggregate demand. This is in line with the specification of equation [9].

If the depreciation of the real exchange rate is accompanied by higher inflation, the monetary authorities will react by increasing the rate of interest with the explicit objective to lower the rate of inflation (this follows from the specification of the loss function). However, in so doing, the monetary authorities will also rein in exchange rate depreciation. Again, as mentioned earlier the framework postulates no conflict between domestic and external sector objectives.

INFLATION TARGETING IN CHILE

Chile adopted an inflation targeting monetary policy strategy in January 1991 with a publicly announced yearly inflation target range comprised between 15 and 20 per cent.21 The adoption of inflation targeting followed the granting of autonomy to the Central Bank. In this sense this monetary policy strategy is interpreted in part as a means to fulfill its mandate of preserving the value and the stability of the currency and the adequate workings of the internal and external payment systems.22

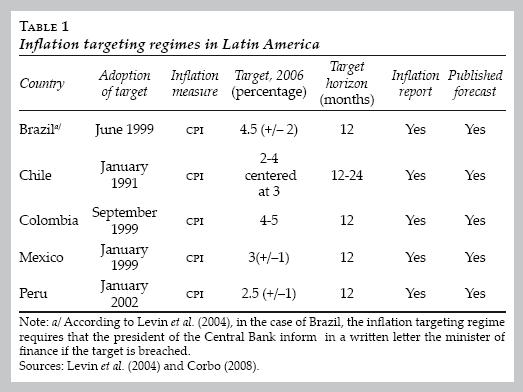

The adoption of the inflation targeting strategy follows two clear and distinct phases. The first one lasted from 1991 to 1999 and can be termed an Eclectic Inflation Targeting Regime according to the definition given above. However, there are serious grounds to question whether in fact it was an inflation targeting regime at all. From 1999 to the present the Chilean monetary policy authorities switched according to their own words to a Full Fledged Inflation Targeting Regime very much in line with other Latin American inflation targeters (see table 1).

THE FIRST INFLATION TARGETING PHASE (1991–1999)

As in any inflation targeting regime the first phase was characterized in the first instance by the announcement of numerical inflation targets. These took the form of gradual annual inflation target ranges from 1991 to 1996 and point targets thereafter.

However, as pointed by Mishkin and Savastano (2000:42) and Mishkin (2004:16), the inflation objectives were interpreted as official inflation projections and only became hard targets three years after the announcement of the first yearly inflation target range in 1991. Following the first public announcement in 1991 of a target inflation range comprised between 15 and 20 per cent, the Central Bank reduced its target range gradually at an average of 1.5% annually.

During this phase, the Central Bank did not pursue only an inflation target as is the standard practice of inflation targeting regimes. Rather it pursued at the same time an inflation target and an exchange rate band target. This meant in fact the Central Bank had two nominal anchors, a price and an exchange rate anchors.

Inflation targeting regimes should adhere to a single nominal anchor. However, in practice there are a few countries, mostly comprised by emerging market small open economies and countries in transition that officially pursue inflation targeting and at the same time maintain two nominal anchors.

It must not be forgotten, that while the exchange rate band was viewed as a nominal anchor, there were important implications derived from the balance–of–payments constrained nature of the Chilean economy that justified targeting the exchange rate bands. These included the promotion of exports and growth and most important to maintain a bounded current account deficit (De Gregorio and Tokman 2004).

This can be justified by the fact that in small open economies, the exchange rate plays a key nominal and real role, and that the monetary authority or Central Bank cannot be oblivious to its fluctuations.23 Nonetheless, maintaining two nominal anchors (that is three targets in the loss function: output, inflation and exchange rate gaps) can pose significant inconsistencies within an inflation targeting regime. This point is amply recognized in the inflation targeting literature. For one thing, the exchange rate can, under certain conditions, say in the case of external shocks, take precedence over the inflation target. Also, seeking to stabilize the exchange rate or giving priority to the external sector over domestic conditions can lead to a pro–cyclical policy amplifying real and nominal fluctuations.24

Such situations are likely to be encountered by balance–of–payments constrained economies whose overall performance is strongly tied to that of the external sector. An illustrative example is provided by the Chilean Central Bank's reaction to the 1998–1999 Asian–cum–Russian crisis episodes.

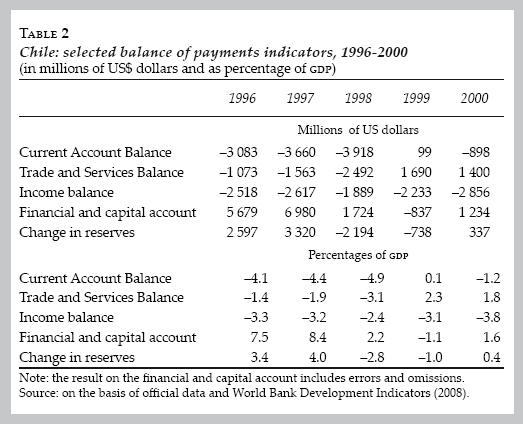

In 1998, Chile experienced at the same time a terms–of–trade shock and capital outflows. These were reflected in a widening of the current account deficit from 4 to 5 per cent of Gross Domestic Product (GDP) for 1997 and 1998 and a reduction in the surplus in the financial account from 8 to 2 per cent of GDP respectively. The end result for 2008 was a deficit in the balance–of–payments global result that had to be covered by giving up reserves. The change in international reserves which was positive in 1997 representing 4% of GDP turned negative in 1998 reaching (3% of GDP) (see table 2 below).

To avoid further deterioration in the reserve position of the country, which would in fact have undermined the very credibility that the Central Bank was groping to achieve, it decided to implement the traditional Latin American policy prescription consisting in contracting absorption and thus aggregate demand. That is, it implemented a pro–cyclical monetary policy.

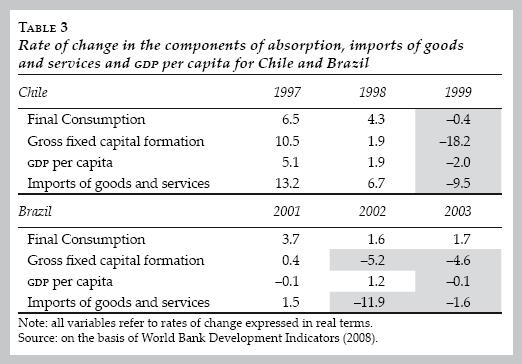

Between January and October 1998, the Central Bank raised its policy interest rate from 6.9 to 12.9 per cent. The consequent contraction of absorption was felt rapidly and reflected mostly that of domestic investment (—18% in real terms in 1999). For its part, consumption declined in real terms by less than 1% in 1999. The contraction in absorption led in turn to a decline in the rate of growth of GDP of 1% in 1999. The decline in absorption and income fed into the reduction in imports (—9% in real terms for 1999 for goods and services). This policy strategy managed to eventually reduce the balance of payments imbalance. Between 1998 and 2000 the balance of payments result measured by the change in reserves turned from a negative to a positive outcome (—2.8 and 0.4 per cent of GDP respectively).

The literature analyzing this episode considers the pro–cyclical nature of the measure to confront this external shock a 'policy mistake.' Referring to this episode Mishkin (2004:25) states: "In hindsight these decisions were a mistake: the inflation target was undershot and the economy entered a recession for the first time in the 1990's. With the outcome, the Central Bank came under strong criticism for the first time since it had adopted its inflation targeting regime in 1991, weakening support for the independence of the Central Bank and its inflation targeting regime."

Yet, as also recognized by Mishkin (Ibid.), the fact is that indeed "Chile's Central Bank did have to worry about a loss of credibility from exchange rate depreciation" and 'that the ability of the Central Bank to pursue countercyclical monetary policy in the face of a capital shock (or sudden capital stop) is limited." The fact of the matter is that, as the record shows in the case of Latin America, governments and central banks have a pro–cyclical reaction function when the balance–of–payments restriction bites and the adoption of inflation targeting has not in any way changed this policy stance.

Other Latin American inflation targeters such as Brazil have also contracted absorption in the face of an external shock even following the adoption of an inflation targeting regime. Brazil adopted inflation targeting in 1999. Two years later the country confronted the first shock under that monetary regime. This shock refers to the Argentine abandonment of its currency board and consequent devaluation which had significant repercussions for some of the countries in the Latin American region. As seen in table 3 below, Brazil reacted by contracting aggregate demand mainly in the form of a decline in investment (—5.2 and –4.6 per cent in 2002 and 2003). Imports of goods and services also contracted (—11.9 and —1.6 per cent in 2002 and 2003).

In this sense, the 1998 Chilean episode is not an exception and the 'pro–cyclical' nature of the Chilean measure of 1998 is not a mistake. It rather emanates as a natural response to external shocks of economies that are balance–of–payments constrained and the adoption of inflation targeting (in whatever nature or form) or non–inflation targeting does not change the balance of payments constrained nature of Latin American economies.

The importance of the external sector and the way in which it can enter into conflict with inflation targeting practices during this first phase is furthermore highlighted by the fact that during this time the authorities implemented several discretionary and ad hoc modifications to the exchange rate regime in an effort to control exchange rate fluctuations. These weakened some of the very same elements that form part of the core of an inflation targeting framework, namely transparency and communication.

During this first targeting inflation phase, the country adopted initially (1991–1992) a crawling peg in relation to the dollar accompanied by daily devaluations according to the internal–external inflation differential. Thereafter, the exchange rate regime switched to a target zone around a basket peg. The central parity was tied to a basket of currencies including the United States dollar, the Deutsche Mark and the Japanese Yen (see table 4).

During the period 1992–1999, there were several and frequent modifications to the central parity, to the currency basket weights and to the bands. In fact, overall from 1992 until 1999, there were ten different changes to the parameters of the exchange rate target zone regime (see table 3 above).

The main difficulty with the exchange rate regime and the different changes was the fact that it was very hard on the basis of the information provided for market participants to know or understand the type of exchange rate regime that prevailed at the time. Frankel et al. (2000) introduce the concept of verifiability, that is, "the ability of market participants to infer statistically from observed data that the exchange rate regime announced by the authorities is in fact in operation. Verifiability is an instance of transparency, a means to credibility."25

The empirical evidence presented by Frankel et al. (2000) is straightforward: "in the case of Chile, when the band was relatively narrow and the peg involved only the dollar, verification is relatively easy to achieve. But from 1992 to 1999, when the band became wider and the peg involved additional currencies, our simple statistical procedures fail to achieve verification." In other words, there is no empirical basis for market participants to verify that the exchange rate regime announced was indeed being followed.

Weak transparency, the existence of two nominal anchors and the primacy given to external considerations over the concerns for domestic inflation attest that a coherent inflation targeting strategy was not being pursued. Rather, the analysis of the first inflation targeting phase attests to the fact that countries, even when committed verbally to inflation targeting principles, give priority to the external sector, when the external constraint bites. In this particularly case, the frequent changes to the exchange rate system and the Central Bank's reaction to the 1998 shock, indicate the extent to which the authorities of a country are willing to forego some of the basic monetary principles to which they adhere in order to safeguard the external position of the country.

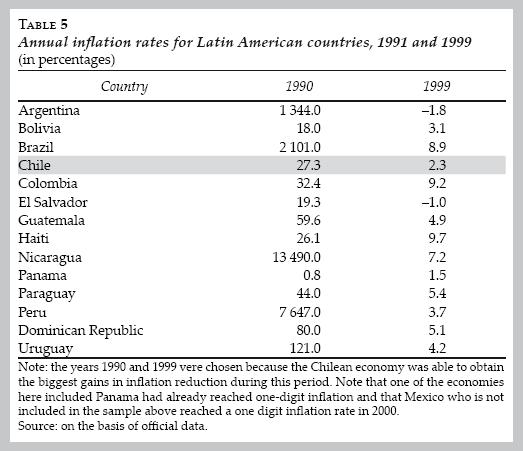

The absence of a coherent inflation targeting strategy is reflected to some extent in its macroeconomic results. Overall looking at the period 19901999, there can be no doubt that the rate of inflation declined significantly. In 1990 the year prior to the adoption of the inflation strategy, the rate of inflation was at double digits reaching 27% annually. By 1994, the rate of inflation was in single digits (8.5%) and decreased further to reach 4.5% in 1998.

While this reduction of the rate of inflation was significant there is no consensus in the literature that this 'great inflation moderation,' was produced by the adoption of inflation targeting. Indeed, the reduction of inflation took place, for the most part, in a favorable international and domestic context.

At the international level, the prices of energy and raw materials which comprise an important part of imported prices decreased significantly following the Gulf War episode at the beginning of the 1990s. The Chilean Central Bank's external inflation index shows a declining trend during the first inflation targeting phase and negative values during the latter part of the 1990s (see figure 1).26

On the domestic front, positive productivity shocks, high growth and wage reduction are the main candidates that explain the reduction in the rate of inflation. The 'favorable conditions' argument is heightened by the fact that other eleven Latin American economies (more than half of the total) managed to reduce their inflation rates from two to one digit in the 1990s (see table 5 below).

A summary of the state of research explaining the causes of the big 'inflation moderation' in Chile in the 1990s is provided by Valdés (2007). As he puts it (Ibid. :7): "There is no consensus for the remarkable outcome of inflation reduction. Some authors (e.g., De Gregorio 2003; García 2003) identify the positive productivity shocks faced by the economy in the 1990s as the key driving force of the inflation dynamics. In their view, unit labor costs decreased despite indexation and declining inflation, thanks to the unexpectedly high growth performance. Others (Corbo 1998; Morandé 2002) identify the existence of the inflation target as a key coordinating device for expectations."

The moderation in the rate of inflation was not accompanied by a significant reduction of nominal volatility. In fact, inflation volatility proxied by the rolling coefficient of variation with a 24 month window equaled on average 0.19 for the immediate period that preceded the adoption of inflation targeting regime and 0.15 for the first inflation targeting phase27 (see figure 2).28

Finally, available data for real GDP volatility, proxied by the coefficient of variation for quarterly real GDP shows that the volatility level in the period of the first inflation targeting phase 1991–1999 was not smaller than that of the available data points preceding it. In fact, the volatility in the last year of the first inflation targeting phase was greater than that recorded since 1988 (see figure 3).

THE SECOND INFLATION TARGETING PHASE 1999–2008: ITS MAIN FEATURES

In 1999, Chile announced the adoption of a full fledged inflation targeting strategy (FFIT). One of the main elements included the announcement of a multiyear target for inflation consisting of an annual point target of 3.5% for 2000 that was replaced by an indefinite target range of 2–4 per cent with a 3% centre–value objective and a 12–24 month policy horizon.

The new strategy also comprised the adoption of a free floating exchange rate regime. Nevertheless, the monetary authorities reserved to intervene in special circumstances informing the public about these decisions.29 The decision to switch from a target zone exchange rate regime to a free float is explained in detail by De Gregorio and Tokman (2004):

Since September 1999, the Central Bank has allowed the free adjustment of the dollar to the free market forces. The decision to adopt a free float was made after less than a decade with an implicit inflation target and the recognition that the control of inflation would not be achieved with two nominal anchors: the exchange rate band and the rate of inflation. The coexistence of both lessened the credibility of the inflation targeting regime and, at the same time, reduced its efficiency.

Later in 2007, the Central Bank announced its explicit objective of ensuring that the rate of inflation neared the 3% boundary most of the time with a ±1% tolerance range and a two year policy horizon. With this reform the Central Bank explicitly adopted a unique value nominal anchor (3%) for the economy. It nonetheless acknowledged the possibility of transitory deviations from 3% anchor and beyond the ±1% tolerance range due to transitory shocks.30

Finally, the Central Bank also took measures to improve its transparency. This involved mainly the publication of a series of external publications indicating their assessment of inflation, their intentions and the underlying basis for their decisions. More precisely these efforts materialized in: "the publication of a regular inflation report, a calendar for monetary policy meetings, and the minutes of policy meetings (published within a 3–month delay). The report includes growth and inflation forecasts for the future policy horizon, making policy decisions consistent with these forecasts."31

One of the most intriguing, interesting and perhaps controversial aspects of this inflation targeting phase are the foreign exchange market interventions and the policy of reserve accumulation by the Central Bank. It is an intriguing aspect firstly because of the explicit commitment of the authorities to a full fledged inflation targeting regime which presupposes the adoption of a free float. Also, as postulated by the logic of the inflation targeting framework (equation [9]), the policy reaction to an increase (decrease) in inflation stabilizes at the same time the exchange rate. Finally, there is no rationale within the inflation targeting framework that calls for precautionary, reserve–accumulation, policy on the part of the monetary authorities.32 Moreover, in the particular case of Chile, the establishment of the Economic Stabilization Fund should have allowed the Central Bank to focus solely on its inflation target objective.

THE FOREIGN EXCHANGE MARKET INTERVENTIONS IN THE SECOND INFLATION TARGETING PHASE

As stated above the Central Bank reserved the right and authority to intervene in 'exceptional circumstances' in the foreign exchange market. Nonetheless, these are hard to define, to identify and to rationalize, even more so for the case of reserve accumulation indicating that the monetary authority has in reality 'fear of floating' and that, in fact, the external position of the country is a concern that can take precedence over that of attaining the inflation rate target.

During the second inflation targeting phase time the Central Bank intervened on three occasions in the exchange rate market. The first time occurred in the second half of 2001, when the Central Bank opted for fifteen pre–announced exchange rate interventions. According to the Central Bank, the Chilean Peso was subject to significant devaluation pressures due mainly to the Argentinean debt default and to the decline in the terms of trade as a consequence of the drop in the price of copper.33 Between December 2000 and the first half of August 2001, the price of copper fell from US$ 80 cents per pound to US$ 60 cents per pound. For its part the nominal exchange rate depreciated by 20 per cent.

As a result the Central Bank decided to intervene standing ready to use 2 billion of its international reserves (roughly 13% of its total stock of international reserves at the time) in the spot market in a four month period to prop up the international value of the peso. It also announced that it would issue 2 billion in US$ dollar denominated instruments. The motivation for the intervention was put in the following way: "the substantial weakening of the peso in this period produced concern in the financial markets. The rapidity and succession of events deteriorated the external conditions, exacerbated the depreciation and volatility of the peso, in spite of the fortitude of the Chilean economy and the coherence of its macroeconomic policies. This phenomenon motivated the Central Bank council to adopt measures to provide greater stability to the countries' financial markets."34

In a second occasion in 2002, the Central Bank announced again its determination to intervene to stabilize the external value of the domestic currency. This time the reason for the announced intervention was grounded in the possibility of contagion caused by the increase in the country risk ratings of Brazil. As put by De Gregorio and Tokman (2004:43): "The rate of exchange peso/dollar depreciated 7% in one month showing an acceleration without a deterioration of its fundamentals, except for the situation of Brazil. Thus it seemed that the depreciation responded more to contagion than to fundamental variables." The Central Bank limited its interventions to issuing denominated dollar debt for US$ 1.5 billion between the months of November 2002 and February 2003. That is, there were not foreign exchange market spot interventions.

According to De Gregorio and Tokman (2004) foreign exchange interventions are in general justified on two grounds. On the one hand, exchange rate depreciation can result in higher rates of inflation and thus endanger the compliance with the target rate of inflation. On the other hand, exchange rate volatility can lead to substantial difficulties in the financial sector when dollarization of liabilities is high or prevalent, under conditions of financial fragility or when currency mismatches between assets and liabilities predominate. It is worthy to note, that within the logic of inflation targeting, foreign exchange interventions are justified under exchange rate depreciation. However, foreign exchange interventions due to exchange rate volatility are not.

Notwithstanding, both concerns, the pass through from exchange rate depreciation to inflation and financial sector difficulties formed the basis for the interventions of the Central Bank in 2001 and 2002–2003. According to these authors Central Bank interventions were not concerned with the level of the exchange rate.

In the particular case of Chile, it is estimated that for the most part the pass through from exchange rate depreciation to inflation is rather limited even for a permanent shock.35 Also, the country does not share the elements that make the financial sector highly vulnerable to the negative effects of exchange rate depreciation. Moreover, it is difficult to understand the reason why the Central Bank interventions accentuated the volatility of the exchange rate as in the first intervention and were not undertaken at a time when the exchange rate was more volatile, as in the first months of 2004 (see figure 4). Finally it should also be noted, as pointed by Caputo et al. (2007), that prior to the 2002 intervention (data on expectations are not available for 2001) market expectations reflected the strong belief that the exchange rate would appreciate in the near future thus questioning the need for an intervention or the announcement of an intervention.

Finally, the Central Bank intervened in a third occasion in 2008. In this case, Central Bank interventions were aimed at increasing the stock of international reserves of the monetary authority. This policy was undertaken to safeguard the stability of the Chilean economy from an adverse shock as a result of the United States financial crisis.36 The monetary authorities reiterated the fact that the foreign exchange interventions are undertaken in exceptional circumstances, are not meant to achieve any level or band for the exchange rate and are consistent with the inflation targeting framework.37

The policy of international reserve accumulation was implemented after a five–year period characterized by very favorable external circumstances. From 2003 until 2008, the terms–of–trade improved significantly rising more than 100%. Similarly the purchasing power of exports increased by 160% the same period. The improvement in the terms–of–trade allowed the external sector to post surpluses throughout this period and greatly facilitated the achievement of positive results in the fiscal accounts (see table 1A in the annex).38

In the fourth quarter of 2007, the rate of inflation began to increase above the 3% (+1%) target reaching 7% annually by the end of 2007. The inflationary pressures emanated mainly from the cost side and more precisely derived from rises in food and energy prices (see also figure 1). At roughly the same time the nominal exchange rate began to appreciate (8% for 2007). Higher prices and nominal exchange rate appreciation fed into greater real exchange appreciation.

The Central Bank responded by tightening its monetary policy stance. Its main key rate which had remained at 5% in the first half of 2007, increased to 6.25% by January 2008. Note that this is a case where the inflation rate and the exchange rate move in opposite directions (see the discussion on equation [9] above) and thus increases in interest rates does not act simultaneously as a domestic and external stabilizing force and there is in fact a conflict between internal and external stability.

During the first half of 2008, the inflation rate did not subside remaining around 7% and the exchange continued to appreciate. On the one hand the Central Bank maintained its main interest rate policy tool at the current level. On the other hand, it engaged in spot exchange rate interventions (i.e., international reserve accumulation) which increased the demand for dollars and began by May to reverse the appreciation of the peso.

In the second half of 2008, the inflation rate took a renewed impetus increasing above 8% at an annual rate in the last quarter.39 The Central Bank further tightened its policy stance during this period increasing its key rate from 6.25 to 8.25 per cent by the end of 2008. At the same time it continued to engage in spot foreign exchange operations.

The end result was that monetary policy overshot its inflation target. Indeed, notwithstanding, the acknowledged lags in monetary policy, and the stated monetary policy horizon (see table 1) the rate of inflation did not subside and attained 8% by the end of 2008, representing the most significant deviation from its inflation rate target. Curiously enough the simple correlation coefficient between the monetary policy rate and the rate of inflation is positive and statistically significant equaling 0.86 (see figure 6).40

The increases in interest rates while aimed at reducing the rate of inflation had an appreciating effect on the exchange rate. The spot interventions had exactly the opposite effect. Too an aggressive contractionary monetary policy would have neutralized the effect of the spot interventions. Trying to control the appreciation of the exchange rate and reducing the rate of inflation at the same time were contradictory.

LESSONS FROM THE CHILEAN APPROACH TO INFLATION TARGETING

As in the case of other Latin American countries until the 1990s Chile was an inflation prone country and inflation was viewed as one of the most dangerous threats to economic, social and even political stability. In 1990, the Central Bank of Chile became independent and in 1991 adopted an inflation targeting framework lasting to the present day.

The analysis presented in the paper shows that the adoption of inflation targeting in Chile followed two distinct phases. The first phase lasted from 1991 to 1999. It combined the announcement of numerical targets for inflation with the belief of using two nominal anchors to 'anchor' inflationary expectations, the exchange rate and the rate of inflation. (Figure 5)

The adoption of the exchange rate as a target responded to nominal considerations (the pass through from exchange rates to prices) as well as to balance of payments objectives. During this phase, the frequent changes to the exchange rate regime and the clear precedence of external conditions over domestic ones weakened and undermined the possibilities for effective communication, transparency and accountability which are so essential to an inflation targeting regime. And while the rate of inflation was successfully brought down from double to single digits, as in the case of most Latin American countries during the 1990s, the first phase inflation targeting experiment ended with an undershooting of the rate of inflation, similar inflation volatility and with higher real output volatility. Moreover, there is no consensus on the extent to which the inflation targeting regime was responsible for the significant reduction of inflation.

The difficulties encountered by targeting at the same time the rate of inflation and the exchange rate, led to the adoption of a full fledged inflation targeting strategy. The full fledged inflation targeting strategy meant the explicit recognition that the inflation rate and thus domestic conditions would constitute the main concern of monetary policy. The exchange rate was left to be determined by market forces. As in other cases, the full fledged inflation targeting regime was implemented after inflation had been substantially reduced nearing a desirable 3% annually, so that the main goal of the monetary authorities was to maintain it at that level.41

During this second inflation targeting phase, as in the first phase, Chile was confronted with exogenous shocks. As a result, the Central Bank decided to intervene in the foreign exchange market mainly in 2001 and 2008. The latter intervention is of particular interest because it was justified in terms of a precautionary reserve accumulation policy to confront potential adverse scenarios due to the United States financial crisis. The end result of the combination of policies applied in 2008 was an overshooting of the inflation rate.

When the monetary authorities 'cut to the quick,' as in the first inflation targeting phase, the external sector seems to have taken priority and indeed hierarchical importance over domestic inflation rate considerations. In the first inflation targeting phase the inflation target was undershot and in the second it was overshot, but the reason for both was very similar, namely external sector concerns.

The Chilean inflation targeting experience shows fundamental and, perhaps, forgotten lessons about small open economies. The performance of small open economies, as well as their development pattern, has been and is shaped to great extent by the vicissitudes of the external sector, and any policy experiment, whether monetary or fiscal, that does not take into account this fact, ultimately ends up bringing it to the forefront of any economic analysis or discussion. The main policy research agenda that follows from an analysis of the inflation targeting experience is how to delineate the domestic policy space that countries require to develop when they are balance–of–payments constrained.

REFERENCES

Alvarez, R.; P. Jaramillo and J. Selaive, "Exchange rate pass–through into import prices: the Case of Chile", Banco Central de Chile Working Papers no. 465, 2008. [ Links ]

Angeriz, A. and P. Arestis, "Assessing the performance of 'inflation targeting lite' countries", World Economy, vol. 30, no. 11, 2007, pp. 1621–1645. [ Links ]

Arestis, P. and M. Sawyer, "A critical reconsideration of the foundations of monetary policy in the new consensus macroeconomics framework", Cambridge Journal of Economics, vol. 32, no. 5, 2008, pp. 761–779. [ Links ]

Bernanke, B.S.; Th. Laubach; F.S. Mishkin and A.S. Posen, Inflation Targeting. Lessons from the International Experience, Princeton, Princeton University Press, 1999. [ Links ]

Betancourt, C.; J. De Gregorio and J.P. Medina, "The great moderation and the monetary transmission mechanism in Chile", Banco Central de Chile Working Papers no. 393, 2006 [ Links ]

Blanchard, O. and S. Fisher, Lectures on Macroeconomics, Cambridge, Massachusetts Institute of Technology (MIT) Press, 1990. [ Links ]

Blinder, A.; M. Ehrman; M. Fratzscher; J. De Haan and D–J. Jansen, "Central Bank communication and monetary policy: a survey of theory and evidence, Journal of Economic Literature, vol. XLVI, no. 4, 2008, pp. 900–945. [ Links ]

Caputo, R.; M. Nuñez and R. Valdés, "Análisis del tipo de cambio en la práctica", Banco Central de Chile Working Papers no.434, 2007. [ Links ]

Cecchetti, S.G. and J. Kim, "Inflation targeting, price path targeting, and output variability, in B.S. Bernanke and M. Woodford (eds.), The Inflation Targeting Debate, National Bureau of Economic Research (NBER), Chicago, University of Chicago Press, 2005, pp. 173–195. [ Links ]

Central Bank of Chile, Economic Data, 2009. Available at: <www.bcentral.cl> [ Links ].

––––––––––, Monetary Policy Report, Santiago, Central Bank of Chile, 2003. [ Links ]

––––––––––, Monetary Policy Report, Santiago, Central Bank of Chile, April 2008. [ Links ]

Chang, R., "Inflation targeting, reserves accumulations, and exchange rate management in Latin America", Borradores de Economía, no. 487, Colombia, Banco Central de la República, 2008. [ Links ]

Clarida, R.; J. Galí and M. Gertler, "The science of monetary policy: a new Keynesian perspective", Journal of Economic Literature, vol. XXXVII, 1999, pp. 1661–1707. [ Links ]

Corbo, V, "Reaching one–digit inflation: the Chilean experience", Journal of Applied Economics, vol. 1(1), 1998, pp. 153–164. [ Links ]

Corbo, V, "The Chilean inflation targeting experience", presentation prepared for the Anniversary of the Czech National Central Bank, Prague, Czech Republic, 2008. [ Links ]

De Gregorio, J., "Productivity growth and disinflation in Chile", Central Bank of Chile Working Paper no. 246, 2003. [ Links ]

De Gregorio, J. and A. Tokman, "Overcoming fear of floating: exchange rate policies in Chile", Banco Central de Chile Working Papers no. 304, 2004. [ Links ]

Fontaine, J.A., "Banco Central Autónomo: en pos de la estabilidad", in F. Larraín B. and R. Vergara M. (eds.), La transformación económica de Chile, Santiago de Chile, Centro de Estudios Públicos, 2000, pp. 393–428. [ Links ]

Frankel, J.; E. Fajnzylber; S. Schmukler and L. Servén, "Verifying exchange rate regimes", mimeo, 2000. [ Links ]

García, P., "Achieving and maintaining monetary credibility in Chile", Paris, Organization for Economic Cooperation and Development (OECD), Mimeographed, 2003. [ Links ]

García, C. and J. Restrepo, 'Trice inflation and exchange rate passthrough in Chile", Banco Central de Chile Working Paper no. 128, 2002. [ Links ]

Godley W and F. Cripps, Macroeconomics, New York, Oxford University Press, 1983. [ Links ]

Greenspan, A., 'Statement before the Subcommittee on Domestic Monetary Policy', Committee on Banking, Finance and Urban Affairs, US House of Representatives, Washington, DC, 28 July, 1988. [ Links ]

Jonas, J. and F.S. Mishkin, "Inflation targeting in transition economies: experience and prospects", in B.S. Bernanke and M. Woodford (eds.), "The inflation targeting debate", NBER, Chicago, University of Chicago Press, 2005, pp. 353–413. [ Links ]

Kuttner, K., "A snapshot of inflation targeting in its adolescence", mimeo, 2007. [ Links ]

Larraín, F. and F. Parro, "Chile menos volátil", El Trimestre Económico, Vol LXXV(3), no. 299, 2008, pp. 563–596. [ Links ]

Leitemo, K., "Inflation–targeting rules: history–dependent or forward looking?", Economic Letters no. 100, 2008, pp. 267–270. [ Links ]

Levin, A.T.; F.M. Natalucci and J.M. Pigger, "The macroeconomic effects of inflation targeting", Federal Reserve Bank of St. Louis Review, vol. 86, no. 4, 2004, pp. 51–80. [ Links ]

McCombie, J.S. and A.P. Thirlwall, "Growth in an international context. A Post Keynesian view", in J. Deprez and J.T. Harvey (eds.), Foundations of International Economics. Post Keynesian Perspectives, New York, Routledge, 1999. [ Links ]

Mishkin, F.S., "Can inflation targeting work in emerging market countries?", NBER, Working Paper no. 10646, 2004. [ Links ]

Mishkin, F.S. and M. Savastano, "Monetary policy strategies for Latin America", NBER Working Paper no. 7617, 2000. [ Links ]

Mishkin, F.S. and K. Schmidt–Hebbel, "A decade of inflation targeting in the world: what do we know and what do we need to know?", in N. Loayza and R. Soto (eds.), Inflation Targeting: Design, Performance, Challenges, Santiago de Chile, Banco Central de Chile, 2002. [ Links ]

Morandé, F., "A decade of inflation targeting in Chile: developments, lessons and challenges", in N. Loayza and R. Soto (eds.), Inflation Targeting:Design, Performance, Challenges, Santiago de Chile, Banco Central de Chile, 2002, pp. 583–626. [ Links ]

Morandé F. y M. Tapia, "Exchange rate policy in Chile: from the band to floating and beyond", Banco Central de Chile Working Papers no. 152, 2002. [ Links ]

Pérez Caldentey, E. and M. Vernengo, "Back to the future. Latin America's growth pattern", Ideas Working Paper no. 7, 2008. [ Links ]

Schmidt–Hebbel, K. and M. Tapia, "Inflation targeting in Chile", North American Journal of Economics and Finance, no. 13, 2002, pp. 125–146. [ Links ]

Svensson, L., "Inflation targeting", mimeo for L. Blum and S. Durlauf (eds.), The New Palgrave Dictionary of Economics, 2nd edition, Bedford, Palgrave Macmillan, 2007. [ Links ]

––––––––––, "'Commentary', in 'Inflation targeting: prospects and problems'", Federal Reserve Bank of St. Louis Review, vol. 86, no. 4, 2004, pp. 161–164. [ Links ]

––––––––––, "Inflation targeting in an open economy: strict or flexible inflation targeting", mimeo, 1997. [ Links ]

Valdés, R., "Inflation targeting in Chile: experience and selected issues", Banco Central de Chile, Economic Policy Papers no. 22, 2007. [ Links ]

World Bank, World Bank Development Indicators, 2008–2009. [ Links ]

The opinions here expressed are the authors' own and may not coincide with those of the institutions with which he is affiliated. Ramon Pineda provided useful suggestions to improve an earlier version of this paper.

** JEL: Journal of Economic Literature–Econlit.

1 The definition here provided is based essentially on that given by McCombie and Thirlwall (1999:49). According to both authors "countries are balance–of–payments constrained when their performance in overseas markets, and the response of the world financial markets to this performance, constrains the rate of growth of the economy to a rate which is below that which internal conditions would warrant."

2 For the limits imposed by external sector conditions on the fiscal policy space see Godley and Cripps (1983). As put by both (Ibid.:283): "In the long run fiscal policy can only be used to sustain growth of real income and output in an open economy provided that foreign trade performance so permits. This is the most important practical conclusion of our book." Keynes' idea of a Currency Union can also be viewed as an international arrangement that allows countries to pursue full employment policies in the absence of external constraints.

3 The success of inflation targeting in Chile is not only voiced in the published research work of the central bank itself which is an internal reference to the inflation targeting regime but also by external references. See for example Valdés (2007), Betancourt et al. (2006) and Schmidt–Hebbel and Tapia (2002) for central bank references. See, Mishkin and Savastano (2000) and Mishkin (2004) for external references.

4 Other essential elements of an inflation targeting strategy, comprises the absence of fiscal dominance over monetary policy.

5 Bernanke et al. (1999:4) define inflation targeting as a: "framework for monetary policy characterized by the public announcement of official quantitative targets (or target ranges) for the inflation rate over one or more time horizons, and by the explicit acknowledgement that low, stable inflation is monetary policy's primary goal." According to Mishkin (2004) inflation targeting comprises five distinct but interrelated aspects: "(i) the public announcement of medium–term numerical targets for inflation; (ii) an institutional commitment to price stability as the primary goal of monetary policy; (iii) an information inclusive strategy in which many variables, and not just monetary aggregates or the exchange rate, are used for deciding the setting of policy instruments; iv) increased transparency of the monetary policy strategy through communication with the public and the markets about the plans, objectives, and decisions of the monetary policy authorities, and v) increased accountability of the central bank for attaining its inflation objectives." Svensson (2007) provides a similar definition.

6 Note that price stability is not an easy concept to define. It is defined generally in terms of the demand for money, i.e., a situation where agents do not change their demand for money in response to price changes. Angeriz and Arestis (2007) quote Greenspan (1988) on price stability: "a situation in which households and businesses in making their savings and investment decisions can safely ignore the possibility of sustained generalized price increases or price decreases." Clarida et al. (1999:1669) refer to price stability as the inflation rate at which inflation is no longer a public concern. According to these authors, an inflation rate between one and three percent meets this definition and perhaps the reason that explains the 3% mean inflation target in the case of Chile.

7 Svensson (2007:2–3) states: "In several countries inflation–targeting central banks are subject to more explicit accountability. In New Zealand, the Governor of the Reserve Bank of New Zealand is subject to a Policy Target Agreement, an explicit agreement between the Governor and the government on the Governor's Responsibilities. In the United Kingdom (UK), the Chancellor of the Exchequer's remit to the Bank of England instructs the Bank to write a public letter explaining any deviation from the target larger than one percentage point and what actions the Bank is taking in response to the deviation. In several countries, central–bank officials are subject to public hearings [...]. And in several countries monetary policy is [...] subject to extensive reviews by independent experts."

8 See Angeriz and Arestis (2007 and their contribution to the present issue of Investigación Económica).

9 The definitions for ITL and EIT regimes are provided by Angeriz and Arestis (2007). It seems from their definitions that a key difference between both is their credibility. ITL have low credibility and are unable to "maintain inflation as their foremost policy objective." EIT countries have a high degree of credibility and are thus able to pursue other goals such as output stability besides that of price stability. In this paper EIT is used in a more general context to mean simply a strategy that adopts other targets besides prices stability

10 See Svensson (1997 and 2007); Schmidt–Hebbel and Tapia (2002).

11 See Svensson (1997) and Jonas and Mishkin (2005).

12 According to the reasoning here followed inflation targeting is viewed as an optimal targeting rule derived from an explicit objective function. However, this is not the only way to view inflation targeting. An alternative includes inflation targeting as an ad hoc instrument rule with a fixed inflation target or as a means to characterize the way central banks implement monetary policy in practice. See Kuttner (2007); Arestis and Sawyer (2008).

13 The approach here adopted to inflation targeting, which is not the only valid one, is that of an optimal rule under central bank commitment. See Kuttner (2007) for a taxonomy of inflation policy rules. There are obvious conceptual difficulties with the assumptions that inflation and output deviations are quadratic in nature. See Blanchard and Fisher (1990) and Arestis and Sawyer (2008).

14 As put by Svensson (2004:161) the adjective flexible in 'flexible inflation targeting' has to do with the value of λ.

15 A typical formulation of the Neo–classical Phillips curve can be specified as:

where:

xt: output gap at time t.

πt: inflation gap at time t.

Eπt: expected inflation gap at time t.

vt: error term (i.i.d) with variance σ2v.

The new Keynesian Phillips curve can be specified as:

See Cecchetti and Kim (2005:177–179) for a formulation of the Neo–classical Phillips curve and Clarida et al. (1999) for an inflation targeting framework within a new Keynesian tradition.

16 See Clarida et al. (1999).

17 See Leitemo (2008).

18 As put by Svensson (2004:161–162): "[...] there is a target for long run mean inflation [...]. This target is subject to choice by the central bank [...]. But the target for output is not subject to choice. It is a 'fact'. It is given by the economy, by its potential output. Since potential output is an unobserved variable, it requires estimation, but it is certainly not subject to choice [...]. Since there is a meaningful choice of the target for long–run inflation but not of the target for long–run output or the output gap, and therefore an asymmetry between the two targets, we can [...] talk about a hierarchical mandate for long–run inflation."

19 In Arestis and Sawyer (2008) the exchange rate does not appear in their interest rate policy equation. However, as it is shown here, the logic of the optimization problem leads to the inclusion of the exchange rate as an argument in equation [9].

20 Due to factors unrelated to interest rate movements, say an external shock.

21 The first target range was announced in September 1990. Since inflation targets are announced in the first fifteen days of September for the following year. The charter of the central bank requires that it presents its prospects of the economy to the congress in the month of September including inflation, growth and balance of payments prospects.

22 See Fontaine (2000). The decision to adopt an inflation targeting strategy is viewed in part as accidental. As stated by Schmidt–Hebbel and Tapia (2002:129): "This initial target can be interpreted as a hard policy or as a simple inflation forecast intended to fulfill the Central bank's new mandate to publish a report on the economic perspectives for the following year." It is also viewed as arising out of necessity. As put by Morandé (2002:587): "The necessity for an inflation–targeting regime arose as a result of the important increase in inflationary pressures caused by the expansionary policies in 1988–89 and the oil price shock stemming from the 1990 Gulf War." Also inflation targeting provided a way to reduce the importance of widespread indexation mechanisms making stabilization less costly (Ibid:588)

23 While there is ground to state that having two anchors can not be termed Inflation Targeting, in practice a few countries have at least announced inflation targets at the same time that they maintained two nominal anchors. Chile is not in this sense a unique case. Among the developed countries these include, Australia, Israel and Spain. See Bernanke et al. (1999:203–251).

24 Some of these issues are clearly stated in Mishkin and Schmidt–Hebbel (2002:192–193): "The fact that exchange rate fluctuations are a major concern in so many countries raises the danger that monetary policy may put too much focus on limiting exchange rate movements, even under an inflation targeting regime. The first problem with a focus on limiting exchange rate movements is that it can transform the exchange rate into a nominal anchor that takes precedence over the inflation target [...]. The second problem [...] is that the impact of changes in exchange rates on inflation and output can die substantially depending on the nature of the shock that causes the exchange rate movement [...]. Targeting the exchange rate is thus likely to worsen the performance of monetary policy. This does not imply, however, that central banks should pay no attention to the exchange rate. The exchange rate serves as an important transmission mechanism for monetary policy, and its level can have important effects on inflation and aggregate demand, depending on the nature of the shocks."

25 Frankel et al. (2000:34).

26 The external rate of inflation is computed on the basis of the 'relevant external price index' published by the Central Bank of Chile.

27 These results are in line with those presented by Larraín and Parro (2008).

28 The literature on inflation targeting in Chile states that inflation targeting resulted in low and stable inflation. The stability (volatility) of inflation is measured by the standard deviation of the rate of inflation. Indeed, using the same data as that for the coefficient of variation, if the standard deviation is used as the proxy for inflation volatility, then volatility declined significantly (from roughly 4.7% to less than 1% between 1989 and 1999). However, when there are changes in measures of central tendency (i.e. the mean or average) such as during the time period under scrutiny, the correct measure to compare two different periods with different means is the coefficient of variation, that is the deviation of the time series in question (the inflation rate) with respect to its mean or average.

29 See, for example, Banco de Chile, Monetary Policy Report (2003) and De Gregorio and Tokman (2004). See also, Corbo (2008).

30 See footnote 6 above on the justification for a 3% target inflation rate.

31 Schmidt–Hebbel and Tapia (2002:131).

32 This point is made by Chang (2008:48). Chang (2008) also analyzes the caveats to reserve accumulation under an inflation targeting regime. As he states, (pp. 48–49): "First, there is nothing in the theory that says that hard currency 'war chests' should be built by the central bank, as opposed to a distinct government agency similar, say, to the US Treasury's Exchange Stabilization Fund. And there may be good reasons to keep the war chests separate from the central bank. One could argue, for example, that the current arrangements, by confounding policies to achieve the inflation targets with attempts at accumulating reserves, undermine the stated objectives of transparency and accountability that an inflation targeting regime should aim at. Second, the accumulation of foreign exchange reserves is costly, and perhaps insufficiently so. International reserve assets pay little or no interest, so holding them implies an opportunity cost approximately equal to the interest foregone by not holding interest bearing assets or by financing reserves with public debt. If purchasing foreign exchange is possible because of the issuance of public debt, the cost of the 'turbulence vaccine' is higher future fiscal expenditures, to finance the interest on the debt. More generally, one could ask why it is necessary to hold international reserves to match short term debt, as opposed to using reserves to prepay the debt."

33 As put by the Central bank's Monetary Policy Report (September 2001:32): "According to the central scenario for this report, the significant depreciation of the peso in the first half of August corresponded to a transitory phenomenon resulting from the greater uncertainty surrounding the moment and the way in which the Argentine crisis would be resolved and the fall witnessed by the price of copper in international markets."

34 Central bank interventions reached less than half (US$ 803 billion) of the announced amount.

35 According to De Gregorio and Tokman (2004) the coefficient has also declined over time. According to both the implicit exchange pass through coefficient of the Structural Projections Model of the Central Bank of Chiles is equal to 21 and 25 per cent for the first and second years when the system is subject to a 1% permanent exchange rate depreciation shock. Findings along similar lines are provided by García and Restrepo (2002), Morandé and Tapia (2002). For a recent contrary view see Alvarez, Jaramillo and Selaive (2008).

36 The statement justifying the policy of international reserve accumulation is stated in the following terms: "The uncertainty that surrounds the implications of the financial crisis in the United States about the development of the world economy has given a relevant probability to risk scenarios whose consequences on the national economy can be very negative. To this end and taking into account the risks posed to the financial stability of the Chilean economy the concretion of a more extreme scenario [...] it decided [...] to intervene in the foreign exchange market announcing a program international reserve accumulation." See Monetary Policy Report, April 2008, Central Bank of Chile.

37 Ibid.

38 See Pérez Caldentey and Vernengo (2008).

39 The monthly annualized core inflation rate reached 6.5% by December 2007 and 9% by December 2008.

40 The acceleration in the rate of inflation subsided when external inflation began to decline (see figure 1).

41 As shown in some empirical studies, countries adopt inflation targeting regimes after inflation begins a downward trend and Chile with the adoption of a full fledged inflation targeting regime in 1999 is not an exception. See, Blinder et al. (2008).