Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Investigación económica

versão impressa ISSN 0185-1667

Inv. Econ vol.68 no.269 Ciudad de México Jul./Set. 2009

The time–varying long–run rate of unemployment in Colombia

La tasa de desempleo de largo plazo en Colombia

Luis E. Arango and Carlos E. Posada*

Banco de la República, Colombia. <larangth@banrep.gov.co> and <cposadpo@banrep.gov.co>.

Received October 2007

Accepted March 2009.

Abstract

The long–run component of the Colombian urban unemployment rate is estimated for the last twenty years. According to the results, the main determinants of the permanent component of the unemployment rate are the real hourly wage, the non–wage labor costs and the rate of capital accumulation. Given the statistical properties of the variables, a cointegration approach was adopted.

Key words: unemployment rate, labor costs, capital accumulation, cointegration.

JEL Classificación: J32, J23, J60, E24, C32

Resumen

Se estima el componente de largo plazo de la tasa de desempleo en Colombia para los últimos veinte años. De acuerdo con los resultados, los principales determinantes del componente permanente de la tasa de desempleo son el salario real por hora, los costos laborales no salariales y la tasa de acumulación de capital. Dadas las propiedades estadísticas de las variables se adoptó un enfoque de cointegración.

Palabras clave: tasa de desempleo, costos laborales distintos del salario, acumulación de capital, cointegración.

INTRODUCTION

After the failure of the Phillips curve to explain the simultaneous occurrence of rising inflation and unemployment, the classical approach to the theory of unemployment and inflation reemerged (see Friedman 1968; Phelps 1967, 1968). Milton Friedman (1968) defined the natural rate of unemployment "[...] as the level that would be ground out by the Walrasian system of general equilibrium equations, provided there is imbedded in them the actual structural characteristics of the labor and commodity markets, including market imperfections, stochastic variability in demand and supplies, the cost of gathering information about job vacancies and labor availabilities, the cost of mobility, and so on." The main policy implication of this hypothesis is that any intervention of the government to reduce the unemployment rate below the natural rate would result in accelerating inflation or that, in other words, higher inflation cannot reduce unemployment forever, nor does lower inflation cause any permanent costs in terms of higher unemployment rate.1

The rise in unemployment in the 1970s and early 1980s, mainly in Europe, generated another view that tried to combine the involuntary unemployment hypothesis with some ideas underlying Friedman's explanation of both rising inflation and unemployment. This strand of the literature analyzes unemployment and inflation under imperfect competition. This view, known as Non–Accelerating Inflation Rate of Unemployment (NAIRU), a term introduced by Tobin (1980), brings into play Keynesian features and the existence of an equilibrium rate of unemployment.2 A result of the imperfect competition model, which considers non–competitive labor and product markets, is that the equilibrium rate of unemployment will be the rate at which inflation is constant (Carlin and Soskice 1990).

What is the relationship between the natural rate of unemployment and the NAIRU? Some different answers have been given to this question. King (1998) affirms that they are different concepts. According to him "[...] the natural rate describes a real equilibrium determined by the structural characteristics of the labor and product markets– the grinding out of Friedman's Walrasian general equilibrium system (modified, if necessary, by non–Walrasian features of labor markets such as imperfect competition, search behavior and efficiency wages). It exists independently of the inflation rate. In contrast, the latter, as well as being affected by these structural characteristics, is also affected by the gradual adjustment of the economy to past economic shocks that determine the path of inflation. Because it is defined as the unemployment rate at which there is no immediate pressure for a change in the inflation rate, it is a reduced form –not a structural– variable".

King (1998) also adds that "[...] the natural rate is likely to move only relatively slow over time in response to changes in its structural determinants. In contrast, the NAIRU will vary both with changes in the natural rate and in response to macroeconomic shocks".

In the view of Estrella and Mishkin (1998), the NAIRU might be interpreted as the unemployment rate consistent with steady inflation within the next year while the natural rate of unemployment is defined "as the level of unemployment to which the economy would converge in the absence of structural changes to the labor market". Thus, for Estrella and Mishkin (1998) and also for Walsh (1998), among others, the concepts are different. According to this view, the natural rate notion is different from the NAIRU and both can be thought of as derived from different views about the functioning of the economy.

In contrast, for others such as Ball and Mankiw (2002) there is no difference between the natural rate and NAIRU. At this extreme is also Patrick Minford who, to the question of Snowdon et al. (1994) about differences between the natural rate and NAIRU, said that "[...] they are the same concept. NAIRU comes from the adaptive–expectations Phillips curve model. [...] (Snowdon et al. 1994:234). Thus, as we can observe, the controversy about the similitude or difference of the concepts is far from solved.

The objective of this work is to give an explanation and estimate of the long–run unemployment rate in Colombia for period 1984–2004, a country whose labor market has been characterized by, among other things, a high degree of inflexibility. For example, this market accounts for the existence of a nominal minimum wage which increases annually, a legal prohibition of reducing the nominal wage assigned to a particular worker within a firm, statements of the Constitutional Court (see C–815/99 for example) about the criteria to increase of the minimum wage, the equality of the rural and urban minimum wages, etc. Given this rigidities, our work estimates the long–run unemployment rate that condenses characteristics of both the natural rate and the NAIRU.3

In Colombia there have been some studies that estimate the NAIRU.4 For example, Clavijo (1994) found a NAIRU of about 8.2% for the period 1975–1989 while Farné, Vivas and Yepes (1995), by using an expectations augmented Phillips curve, found a NAIRU of 6.1% for the period 1977:1–1994:4 and 7.2% for the period 1984:1–1994:4. Henao and Rojas (1998) obtained a NAIRU close to 10%.5 Following the approach of Staiger, Stock and Watson (1997) with a dynamic Phillips Curve for different processes to make up expectations, Julio (2001) estimated a NAIRU that varied between 7.3 and 12.4 per cent. Such approach was also applied by Núñez and Bernal (1997) who found a NAIRU between 10.4 and 11.1 per cent.

Our work is different from the previous studies in a number of aspects. First, we develop a small–scale stylized neoclassical labor market model to derive an expression for the unemployment rate and then to estimate its long–run component through a vector error correction (VEC) specification.6 Second, the study covers a more recent sample period (1984–2004), in which some of the changes related above have taken place. Finally, the study focuses on the seven main cities of Colombia instead of four such as some of the previous studies.

The behavior of the unemployment rate in Colombia gives some insights on how well the labor market works and the type of institutions that might be governing it. As we can observe in figure 1, the unemployment rate showed a diminishing trend between 1984 and mid–1994 but an increasing one between 1994 and 2000. Since then, the unemployment rate has had a decreasing trend. This behavior during the last decade is a proof that some difficulties remain in the labor market. In our view, the very prolonged period in which the unemployment rate was rising suggests that a sufficiently sound set of institutions required to support economic growth was not in place in such a labor market.

This paper evolves as follows: the next section shows the main facts over the sample period. Section three outlines a simple neoclassical–type model that provides us the framework for the discussion of the long–run component of the unemployment rate. Section four shows and comments on the results we obtain by using a standard cointegration approach. Section five draws some conclusions. The appendixes (A, B, C) show the unit root tests of the relevant variables, the stability of the system and the information of goodness of fit and the residuals.

THE OBSERVED UNEMPLOYMENT RATE AND SOME RELATED FACTS

This work refers to the unemployment rate estimated for seven cities instead of that for thirteen cities or the nationwide unemployment rate, which includes rural areas and cities of populations less than 100 000 inhabitants. The reason for this lies in the sample accessibility; the seven cities unemployment rate is available from 1984:1 up to the present, while the thirteen cities and nationwide data unemployment rates are only available from 2000 and 2001, respectively. Furthermore, the National Household Survey is the source of the basic information of the labor market for seven cities (between 1984:1 and 2000:4) while the Continuous Household Survey –a mechanism that is rather different not only in some concepts and questions but also in the frequency of data gathering– is the source of information for thirteen (including the former seven) cities and nationwide unemployment rates (since 2000:1 and 2001:1, respectively).

Given this change of methodology produced by the modification of the household surveying process (that is, the switch from the National Household Survey to the Continuous Household Survey), we use the series generated by Lasso (2002) which in essence estimates the unemployment rate by relating the figures of the Continuous Household Survey to the data of the National Household Survey and making adjustments to account for the seasonality and frequency of the surveys. Figure 1 above shows the evolution of the unemployment rate obtained by using Lasso's series from 2000:1 back to 1984:1 and the official figures produced by the official statistics agency (Departamento Administrativo Nacional de Estadística de Colombia, DANE) through the Continuous Household Survey since then up until 2004.

Figure 2 shows the behavior of unemployment rate for seven cities, thirteen cities and nationwide to provide the reader a feeling of the differences among them. Given the inclusion of rural areas, towns, and villages in the sample, the nationwide unemployment rate is lower than those corresponding to seven cities and thirteen cities.7 Among these two (seven and thirteen cities) the difference seems less important than among them and the nationwide definition.

The movement of the real wage during the sample period is noteworthy (see figure 3). Arango, Posada y Uribe (2005) documented the real wage behavior between 1984 and 2000 by decomposing it between changes in supply and demand for skilled and non–skilled labor given a skill–biased technological change. These authors show evidence of the increase in the relative wage of skilled workers during the period 1992–1998. Furthermore, they distinguished two sub–periods: 1992:3–1996:3 and 1996:4–1998:4. During the first sub–period the increase in the relative wage is explained by a limited growth of supply while a fast growth of demand. During the second sub–period the increase in the relative wage is explained by a teeming increase in the supply and a growth in the demand for skilled labor that exceeded the former.

During the nineties some important reforms dealing with social security issues were undertaken in Colombia. In first place, Law 50 of 1990 reduced severance payments for employers. A second Act, known as Law 100, took place in 1993, among many other adjustments, increased the contributions to health schemes and retirement funds for both employees and employers. In fact, Law 100 introduced deep changes in the legislation which produced an increase in the above items of about ten percentage points. Figure 4 shows the behavior of the total payroll taxes and contributions that employers have to make considering the reforms of 1990 and 1993.

Having into account these reforms along with the behavior of the real wage, our hypothesis is that the unemployment rate declined when labor became a cheap factor, but when it turned into a costly factor, the unemployment rate started to rise.8

STATISTICAL PROPERTIES AND A STYLIZED MODEL

Under conventional tests [Augmented Dickey–Fuller (ADF) and Kwiatkowski, Phillips, Schmidt and Shin (KPSS)] there is no evidence suggesting that the unemployment rate is a mean reverting process for the sample period at hand (1984:1–2004:4). This result is troublesome in the sense that conventional treatments (e.g. Henao and Rojas 1997; Ball and Mankiw 2002) cannot be directly applied in this case. Consequently, an approach to deal with non stationary variables –as we will see below– was needed.

The restriction imposed by such a statistical property of the key variable was considered to formulate the theoretical guide. Thus, the model9 to explain the facts of the previous section consists of four basic equations (variables in logs):

where ntd represents demand for labor; nts, labor supply; wte, the expected real wage;  reservation wage; θt, technological change; rt, real interest rate; ct, other labor costs different from wage (e.g. contributions to health, severance payments and pension plans, and other items showed in figure 4 above);

reservation wage; θt, technological change; rt, real interest rate; ct, other labor costs different from wage (e.g. contributions to health, severance payments and pension plans, and other items showed in figure 4 above);  , the inflation surprise;

, the inflation surprise;  , all other things that affect the supply of labor such as demographic processes, discouraged worker effect, additional worker effect, etc.; and ut, the unemployment rate. All the parameters in the model are expected to be positive except for γ which might be either positive or negative depending on the degree of gross substitutability or complementarity of capital and labor in the aggregate production function, and we have no recent priors on this property for the Colombian case. For the moment, we assume that θt, ct, and

, all other things that affect the supply of labor such as demographic processes, discouraged worker effect, additional worker effect, etc.; and ut, the unemployment rate. All the parameters in the model are expected to be positive except for γ which might be either positive or negative depending on the degree of gross substitutability or complementarity of capital and labor in the aggregate production function, and we have no recent priors on this property for the Colombian case. For the moment, we assume that θt, ct, and  behave as random walks:10

behave as random walks:10

where  , and j=θ, c, and

, and j=θ, c, and  . Accordingly, the change in unemployment rate is given by:

. Accordingly, the change in unemployment rate is given by:

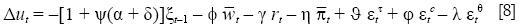

where the term  includes the long–term relationship:

includes the long–term relationship:

Equations [8] and [9] conform altogether a vector error correction representation where the term [1 + Ψ(α + δ)] represents the speed of adjustment and the parameters inside equation [9] the coefficients of the cointegrating relation after normalizing by the coefficient of ut_1 since this is the variable of interest given the objective of this article. The unemployment rate generated by this model corresponds neither to the natural rate nor to the NAIRU. Rather, it is the result of demand and supply factors, assuming that the real wage is not an endogenous variable.

For empirical purposes, for wt, as potential candidates, we used the real monthly wage, the real hourly wage, the minimum wage, the average age of the labor force, the average years of labor force education, and some interactions among these two variables; for  , besides the set used for wt, we checked the gender and the participation of young people in the labor force; for

, besides the set used for wt, we checked the gender and the participation of young people in the labor force; for  we considered female and young labor force; for θt we used the annual rate of capital growth11 by assuming that most of the technical change is embodied; for rt the alternatives that we considered were the real interest rate on loans and the fixed term deposit real interest rate. The inflationary surprise

we considered female and young labor force; for θt we used the annual rate of capital growth11 by assuming that most of the technical change is embodied; for rt the alternatives that we considered were the real interest rate on loans and the fixed term deposit real interest rate. The inflationary surprise  was computed as the difference of observed inflation without food prices and the inflation rate computed from an auto regressive integrated moving average (ARIMA) model of order four on the annual difference of inflation.12 At the end, only the real hourly wage (figure 3), the non–wage labor costs (figure 4), the capital accumulation and the inflationary surprise (figure 5) were significant for the VEC model as we show next.

was computed as the difference of observed inflation without food prices and the inflation rate computed from an auto regressive integrated moving average (ARIMA) model of order four on the annual difference of inflation.12 At the end, only the real hourly wage (figure 3), the non–wage labor costs (figure 4), the capital accumulation and the inflationary surprise (figure 5) were significant for the VEC model as we show next.

ECONOMETRIC APPROACH, RESULTS AND DISCUSSION

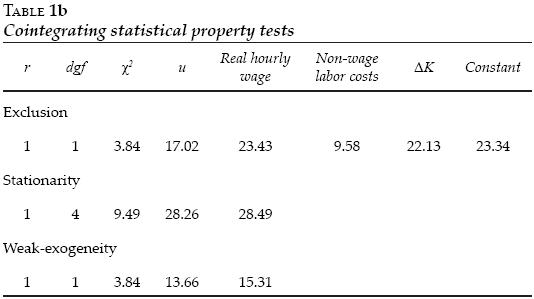

The method of Johansen (1991, 1996) provides a suitable approach for dealing with variables that are I(1). Tables 1a and 1b show the tests suggesting the existence of one cointegration vector:13 the unemployment rate happened to share a long–run pattern with the real hourly wage, the non–wage labor costs and the capital growth rate.14 Evidence of some desirable properties of the variables at hand is shown in table 1b. There we can observe that the hypothesis of exclusion of components of the cointegrating vector is rejected; the relevant variables within the system, the unemployment rate and the real hourly wage, cannot be regarded as stationary; finally, the null hypothesis that two variables appear as weak–exogenous is also rejected.15 This evidence allows us to continue with the analysis of the system.

Given these results, table 2 presents the cointegrating vector. Accordingly, the higher the real hourly wage and the non–wage labor costs, the higher the long–run unemployment rate, whereas the higher the capital accumulation, the lower the unemployment rate. These results do match with the theoretical model.16 With regard to the short run, the inflationary surprise was the only significant variable and its coefficient has the expected sign. That is, as long as the expectations are backward–formed, there will be room for inflationary surprises which will have a transitory effect on the unemployment rate (short run Phillips curve).

Figure 6 shows the long–run component of the unemployment rate for seven cities estimated by using the cointegrating relationship given by the model. The long–run component of the unemployment rate has exhibited a declining trend from 1999 up to the present. The numbers corresponding to the third quarter of 2005 are 13.4% for the observed unemployment rate and 13.9% for the long–run component.

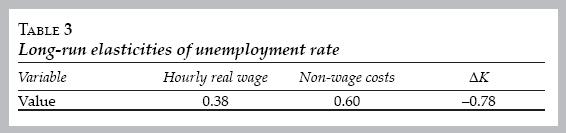

Based on the VEC model we have estimated the long–run elasticity of the unemployment rate to each variable in the cointegrating relationships. Such values are shown in table 3. The results suggest that an increase in the real hourly wage of 1% increases the unemployment rate in 0.38%; an increase of 1% in the non–wage labor costs increases the unemployment rate in 0.60%; and, finally, an increase in the rate of capital growth of 1% reduces the unemployment rate in 0.78 per cent.

What we have obtained so far corresponds to the long–run component of the unemployment rate which has been dug out from an equilibrium relationship among the unemployment rate, the real hourly wage, the non–wage labor costs and the technological change proxied by capital accumulation. However, a question about the equilibrium level of the real wage and the capital accumulation during the sample period immediately arises. Our interpretation is that, in spite of the fact that we have obtained the long–run component of unemployment rate, the level of those variables observed each time during the sample period might not correspond to the long run equilibrium levels of each.

CONCLUSIONS

In this work we estimate the long–run component of the Colombian urban unemployment rate for the last twenty years using quarterly data (1984:01–2004:04). To carry out the estimation we have constructed a stylized model to account for some particular traits of the Colombian urban labor market, which has been characterized by its lack of flexibility.

Given the statistical properties of the variables and the empirical evidence provided by some previous works on the supply of and demand for labor in Colombia, we end up with a cointegration relationship between the unemployment rate, real hourly wage, non–wage labor costs (i.e. payroll taxes and other compulsory fringe benefits) and capital accumulation rate, the latter as a proxy for technological change. In an economy where the real wage movements are somehow sluggish, the non–wage labor costs and the capital accumulation pace help to explain the long–run behavior of unemployment.17 The higher the real wage and the non–wage labor costs or the lower the capital accumulation, the higher the long–run unemployment rate.18

From these results we underline two facts. Firstly, long–run unemployment rate in Colombia is time–varying. Second, monetary policy does not have possibilities of reducing the long–run unemployment.

In the short run the unemployment rate also reacts to inflationary surprises, which is evidence in favor of a short–run Phillips curve. By contrast, some variables connected to the labor supply (proxies of the reservation wage and composition of the labor force) and labor demand (real exchange rate, terms of trade, etc.) turned out to be not significant within our model.

Nonetheless, this long–run unemployment rate we have estimated does correspond neither to the natural rate nor to the NAIRU in an exclusive fashion. Instead, it collects some characteristics of structural and reduced forms associated to them, respectively.

REFERENCES

Arango, L.E, A.M. Iregui and L.F. Melo, "Recent macroeconomic performance in Colombia: what went wrong?", Revista de Economía del Rosario, vol. 9, no. 1, 2006, pp. 1–19. [ Links ]

Arango, L.E. and C.E. Posada, "Unemployment rate and the real wage behavior: a neoclassical hint for the Colombian labor market adjustment", Applied Economics Letters, vol. 9, no. 7, 2002, pp. 425–428. [ Links ]

Arango, L.E., C.E. Posada and J.D. Uribe, "Cambios en la estructura de los salarios urbanos en Colombia (1984–2000)", Lecturas de Economía, no. 63, 2005, pp. 9–42. [ Links ]

Ball, L. and N.G. Mankiw, "The NAIRU in theory and practice", Journal of Economic Perspectives, vol. 16, no. 4, 2002, pp. 115–136. [ Links ]

Bejarano, J., "Estimación estructural y análisis de la curva de Phillips Neo–Keynesiana para Colombia", Banco de la República, Ensayos Sobre Política Económica (ESPE) no. 48, 2005, pp 64–117. [ Links ]

Cárdenas, M. and C. Gutiérrez, "Determinantes del desempleo en Colombia", Debates de Coyuntura Social no. 9, 1998. [ Links ]

Carlin, W and D. Soskice, Macroeconomics and the Wage Bargain, Oxford, Oxford University Press, 1990. [ Links ]

Clavijo, S., "Inflación o desempleo: ¿acaso hay escogencia en Colombia?", Departamento Nacional de Planeación (DNP), Archivos de Macroeconomía, no. 31, 1994. [ Links ]

Estrella, A. and F. Mishkin, "Rethinking the role of NAIRU in monetary policy: implications of model formulation and uncertainty", National Bureau of Economic Research (NBER) Working Paper no. 6518, 1998. [ Links ]

Farné, S., A. Vivas and T. Yepes, "Estimación de la tasa natural de desempleo en Colombia", Ministerio de Trabajo y Seguridad Social, Cuadernos de Empleo no. 1, 1995. [ Links ]

Friedman, M., "The Role of Monetary Policy", American Economic Review, vol. 56, no. 1, 1968, pp. 1–17. [ Links ]

Guataquí, J.C., "Estimaciones de la tasa natural de desempleo en Colombia. Una revisión", Universidad del Rosario, Borradores de Investigación no. 2, 2000. [ Links ]

Henao, M.L. and N. Rojas, "La tasa natural de desempleo en Colombia", DNP, Archivos de Economía no. 89, 1998. [ Links ]

Iregui, A.M. and J. Otero, "On the dynamics of unemployment in a developing economy: Colombia", Applied Economic Letters, vol. 10, no. 14, 2003, pp. 895–898. [ Links ]

Heijdra, B.J. and F. van der Ploeg, Foundations of Modern Macroeconomics, Oxford, Oxford University Press, 2002. [ Links ]

Johansen, S., "Estimation and hypothesis testing of cointegration vectors in Gaussian Vector Autoregressive Models", Econometrica, no. 59, 1991, pp. 1551–1580. [ Links ]

––––––––––, Likelihood–based inference in cointegrated vector autoregressive models, 2nd edition, Oxford, Oxford University Press, 1996. [ Links ]

Julio, J.M., "How uncertain are NAIRU estimates in Colombia", Banco de la República, Borradores de Economía, no. 184, 2001. [ Links ]

King, M., "At the employment policy institute's fourth annual lecture on 1 december 1998", Speech of the Deputy Governor, Bank of England, 1998. [ Links ]

Lasso, F.J., "Nueva metodología de Encuesta de Hogares: más o menos desempleados", DNP, Archivos de Economía no. 213, 2002. [ Links ]

Levin, A. and T. Yun, "Reconsidering the natural rate hypothesis in a new Keynesian framework", Journal of Monetary Economics, no. 54, 2007, pp. 1344–1365. [ Links ]

Modigliani, F. and L. Papademos, "Targets for monetary policy in the coming year", Bookings Papers on Economic Activity, no. 1, 1975, pp. 141–165. [ Links ]

Núñez, J. and R. Bernal, "El desempleo en Colombia: tasa natural, desempleo cíclico y estructural y la duración del desempleo, (1976–1998)", Ensayos sobre Política Económica, no. 32, 1997, pp. 7–74. [ Links ]

Phelps, E.S., "Phillips curves, expectations of inflation, and optimal unemployment over time", Economica, vol. 34, no. 135, 1967, pp. 254–281. [ Links ]

––––––––––, "Money–wage dynamics and labor–market equilibrium", Journal of Political Economy, July/August, Part 2, 1968, pp. 678–711. [ Links ]

Snowdon, B. and H.R. Vane, "Modern Macroeconomics, Its Origins, Developments and Current State", United Kingdom, Edward Elgar Publishing Limited, 2005. [ Links ]

Snowdon, B., H.R. Vane and P. Wynarczyk, "A Modern Guide to Macroeconomics, An Introduction to Competing Schools of Though", United Kingdom, Edward Elgar Publishing Limited, 1994. [ Links ]

Staiger, D., J.H. Stock and M.W Watson, "How precise are estimates of the natural rate of unemployment?", in CD. Romer and D.H. Romer (eds.), Reducing Inflation: Motivation and Strategy, Chicago, University of Chicago Press, 1967. [ Links ]

Tobin, J., "Stabilization policy ten years after", Brookings Papers on Economic Activity, no. 1, 1980, pp. 19–71. [ Links ]

Walsh, C, The natural rate, NAIRU, and monetary policy, Economic Research and Data, FRBSF Economic Letter 98–28 (September 18), 1998. [ Links ]

* The opinions expressed here are those of the authors and do not necessarily represent those of the Banco de la República (the Colombian Central Bank) or of its Board of Directors. The authors gratefully acknowledge the help from Juan Lora, Mario Ramos, Carlos Peña and Paola Ayala. The authors also appreciate the valuable comments and suggestions of Adolfo Cobo, Javier Gómez, Franz Hamann, José Leibovich, Juan Mauricio Ramírez, Jorge Toro, Hernando Vargas and two anonymous referees. Previous versions of this work have also benefit from comments at the Seminars of Banco de la República and Fedesarrollo. The authors thanks two anonymous reviewers for constructive comments and suggestions. Any remaining errors are solely ours.

1 The natural rate hypothesis implies a vertical long–run Phillips curve. However, Levin and Yun (2007) formulate a New Keynesian model in which, under some conditions, that might not be the case.

2 Modigliani and Papademos (1975) first defined the noninflationary rate of unemployment (NIRU) "as a rate such that, as long as unemployment is above it, inflation can be expected to decline".

3 For an up–to–date presentation see Snowdon and Vane (2005).

4 Guataquí (2000) surveys the previous works done in Colombia.

5 This work applied, among others, the approach of Layard, Nickell and Jackman (1991), a macro–model of imperfection competitiveness, where the bargaining power of workers and entrepreneurs determines the wages and prices in terms of unemployment, expected prices and other variables.

6 Cárdenas and Gutiérrez (1995) also used a cointegration approach.

7 The rural unemployment rate is lower than the urban one because, among other things, the enforcement of the minimum wage in rural areas is softer than in urban areas.

8 This hypothesis is in opposition to the Iregui and Otero's (2003) who make the point that wages above their long–run equilibrium level do increase unemployment, but wages below such level do not reduce it. This hypothesis implies that those factors that increase unemployment are not the same as those that reduce it.

9 This model builds on Arango and Posada (2002) and Arango et al. (2006). For a standard macroeconomic–labor market model see Heijdra and van der Ploeg (2002:chapter 2).

10 The assumption about the behavior of the processes is required to arrive to a VEC representation. However, it was tested on an univariate environment to undertake the estimation stage.

11 This variable has been kindly provided by Jesús Bejarano and first used in Bejarano (2005).

12 Other variables not strictly connected to the model were also considered. This is the case of real exchange rate, terms of trade, consumption taxes, the establishment of the health subsidized system and other benefits to the poor population based on the index of potential beneficiaries of social programs (SISBEN), etc.

13 The cointegration test was carried out for four lags, but the results remain for two and six lags. For eight lags the number of cointegrating vectors is two. These results are available upon request.

14 The hypothesis of exogeneity of non–wage labor costs and capital growth was not rejected by the data (see LR for binding restrictions in table 2).

15 Appendix 2 and 3 show the stability of the system and the goodness of fit of the unemployment rate and the real hourly wage.

16 The sign of the coefficient associated to capital accumulation is an empirical point.

17 This explanation corresponds to the model we use.

18 This interpretation of the results corresponds to the article´s objective which consists of estimating and explaining the long–run unemployment rate. However, it is possible to present an alternative normalization in which the other endogenous variable of system (the real hourly wage) appears explained by the unemployment rate, the non–wage labor costs and capital accumulation but in this case the result would be anomalous since an increase in the unemployment rate would cause an increase in the real wage.