JEL Classification: F41, F43

Introduction

Mainstream theory of international trade, best represented by the Heckscher-Ohlin model, rests on the Ricardian notion of comparative advantage, and the idea that productive factors are homogeneous but factor endowments differ among countries. Assuming free competition conditions, it postulates that each country would tend to specialize in the products that more intensively use its relatively abundant factor; and that by so doing, all countries would share in the gains from trade specialization (Ohlin, 1933).

In 1941, Stolper and Samuelson showed that protectionist measures in a country would negatively affect its relatively abundant factor income by hindering competition. Years later, Samuelson (1948, 1949) demonstrated that free trade among countries with different factor endowments would tend to equalize factor relative prices, as product prices converged. This process would involve income distribution effects: in each country, the owners of the relatively abundant factor would be better off after trade, as foreign demand raised their export product prices; contrariwise, the owners of the scarce factor would be worse off, as competing imports depressed the prices of the products in which they were intensively employed.

Though many assumptions of the Stolper-Samuelson model are clearly unrealistic,1 and it has been argued that factors are not always mobile across industries, but could be specific; that production might exhibit increasing rather than constant returns to scale; and technology possibly varies from country to country as factor reversals may occur; trust on the theorem’s predictions has been pervasive, and it is still considered operational. The sometimes paradoxical effects of trade liberalization on labor incomes have been explained as a result of events that are exogenous to the model, like macroeconomic disturbances, a temporary excess demand for some skills, or the particular influence of some country in a specific region, likewise the China effect in Latin America (MacAdams, 2002).

On the basis of those predictions, trade economists have avowed the benefits of free trade for developing countries (Linder, 1961; Krugman, 1980, 1992, 1995; Krugman and Lawrence, 1994; etc.). With the aim of raising wage rates and employment, and compelled by multilateral organizations, Mexico undertook far reaching trade liberalizing reforms in the 1980s, and entered the North American Free Trade Agreement (NAFTA) in 1994. The economy’s degree of openness, measured by the ratio of imports plus exports to Gross Domestic Product (GDP), rose from 17% in 1980 to 57% in 2004.

The results of trade liberalization, however, have been disappointing. GDP average growth rate during the 1990s was only 3.7% (nearly halving the 6.5% average growth rate observed from 1960-1980), and it further descended to 0.6 in 2001-2003. Income per capita growth rate, from 1990 to 2003, averaged only 1.3 per cent.

Notwithstanding the drastic increase in the share of manufactured products in total exports from 20% in 1980, to 52% in 1990 and to 85% in 2003, and the fact that the technological complexity of traded products has notably increased during the same period (Dussel, 2004), the contribution of manufacturing industry to GDP has remained stagnant around 17-18 per cent since 1980.

The sluggish growth of value added in this sector has been partly due to the rapid increase in imports, whose share in GDP rose from 9% in 1980, to 16% in 1990, and 27% in 2003;2 but it also reflects a fall in labor input per unit of output, which cannot be explained by conventional theory of international trade.

In opposition to the predictions of the Heckscher-Ohlin model, and the expected Stolper-Samuelson effects of trade liberalization in a developing economy, wherein unskilled labor is the relatively abundant factor (Krugman and Obstfeld, 1999), employment in Mexican manufacturing industry has fallen in absolute terms after the economy opened up; unskilled labor wage rates also declined, and skilled/unskilled labor wage differentials augmented.

These trends, which are also observable in other Latin American countries, have been recently coupled with a sharp decline in the terms of trade of their manufactured exports (United Nations Conference on Trade and Development, UNCTAD, 2004). The importance of this behavioral pattern for income growth and development cannot be overlooked, and it calls for an alternative theoretical model of international trade that enables policy makers in developing countries to implement efficient corrective policies.

This paper aims to make a contribution in that direction. We contend that mainstream theory of international trade, on which trade liberalizing reforms were based, is faulty because it assumes free competition in product and factor markets. More specifically, we argue that oligopolistic barriers to technology transfer, and segmented labor markets, account for the unexpected outcomes of trade liberalization in developing countries.

The paper is organized in the following way. The first section shows some effects of trade liberalization in Mexico that disprove the relevance of conventional theory of international trade in a developing economy. In the following two sections, we assemble together the contributions of various Latin American structuralists, post-Keynesian writers and segmented labor theorists, in order to work out a model of international trade applicable to late industrializing economies. In the next two sections, we test empirically the propositions of our model concerning the effects of trade liberalization on average labor income and wage differentials in Mexican manufacturing industry. In the last two sections we outline an alternative strategy for industrial development and summarize our conclusions.

International trade in theory and practice

Conventional theory of foreign trade assumes free competition in product and factor markets, and anticipates that trade will bring about:

An increase in inter-industry trade, on account of specialization gains.

A tendency towards wage rates equalization between trading countries.

Higher income growth for all participants.

In Mexico, trade openness has produced opposite results:

Intra-industry trade has increased markedly.

Real wage rates of unskilled laborers have declined.

Import propensity has risen dramatically, notwithstanding real exchange rates have oscillated widely.

Intra-industry trade with the United States, Mexico’s main trading partner, jumped from 6% in 1982, in the early phase of liberalizing reforms (Tornell, 1996), to 47% at the end of the 1990s (León y Dussel, 2001). More than 40% of intraindustry transactions are also intra-firm, and in activities characterized by high capital-labor ratios. The share of exports with high and medium technological content increased from 28% in 1985, to 64% in 2000 (Dussel, 2004).

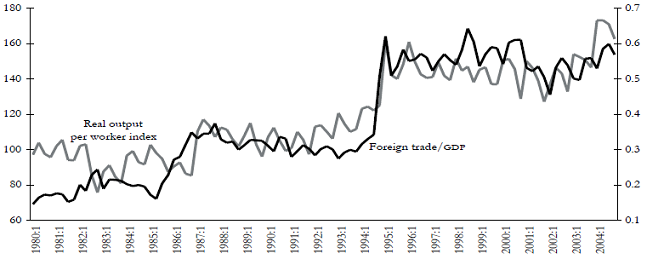

Product prices in labor intensive activities declined after trade liberalization, as a result of stronger competition from other developing countries (Hanson and Harrison, 1999); and unskilled labor wage rates in manufactures have fallen, jointly with total employment since 1982 (Graph 1).

Graph 1: Trends in output per worker, unskilled labor wage rates and employment in Mexican manufacturing industry

Reflecting the decline in blue collar workers’ incomes, the wage differentials between white and blue collar workers widened markedly after trade liberalization (Graph 2).

The relative share of skilled labor in total employment and the wage bill in Mexican manufacturing industry, increased throughout the 1990s, without significant changes in output structure (Meza, 2003). These phenomena have been explained on the grounds of a change in production techniques inherent to the globalization process.

According to Salama (1999), the new way in which production for the global market is organized does not permit developing countries to compete using labor intensive techniques, because products are standardized for the world market, and they are subject to internationally accepted norms. Under these circumstances, the number of applicable technologies is reduced.

Since developing countries participate in global production processes through subcontracting agreements with multinational enterprises, they are compelled to use labor saving techniques (Katz, 2000). The leading force of exports in income growth is thus weaken by a reversal in domestic industry integration, and a fall in overall employment (Ruiz, 2004). Stallings and Weller (2001) estimate that the employment elasticity of output in Latin American countries declined from 2.0 in the 1980s to 0.6 in the 1990s, as a result of trade liberalization and stabilization policies.

The observed trends in wage rates and employment, in open developing economies, reveal a new international division of labor, in which low value added processes are increasingly located in low-wage developing countries, while industrial countries retain the high value added activities. This international specialization arises because leading firms in international production networks use barriers to hinder technology transmission; and by controlling the more knowledge intensive processes they reap monopoly rents (Gereffi, 2001; UNCTAD, 2004).

Since multinational corporations aim to minimize unit labor costs, developing countries are competing against each other to attract foreign direct investment by offering low wages and undertaking institutional reforms to enhance labor market flexibility. In Mexico and Central America, governments granted fiscal incentives and structural facilities to develop a subcontracting industry that enabled foreign firms to compete in their own markets on the basis of lower labor costs (Katz, 2000; Dussel, 2004).

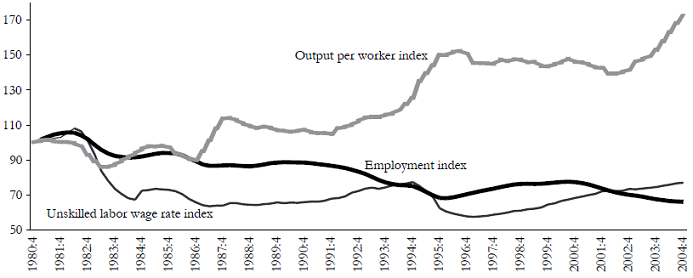

As an outcome of these policies, output per worker in Mexican manufacturing industry has increased in tandem with the rise in foreign trade (Graph 3), and unit labor costs have been falling for the last two decades. Nevertheless, this should not be considered an encouraging result. Katz (2000) demonstrates that the gains in labor productivity have been achieved mainly at the expense of employment contraction; and the empirical research carried out by López and López (2003) reveals that foreign sales have been an important cause of the simultaneous decline in real wage rates.

These evidences indicate that the theory on which Mexico and other Latin American countries based their trade liberalization strategies in the 1980s is faulty. The assumption of perfect competition does not hold in reality, and imperfect competition in technology transfer has far reaching consequences for economic development.

Structuralist theory of foreign trade and development

Economists in the Neo-classical tradition have largely neglected the effects of technical innovation on market structure, and its consequences for income distribution and growth. By contrast, non-mainstream writers have for a long time maintained that monopolistic competition is the natural state of affairs in capitalist economies, arguing that monopoly rents are the main spur for undertaking new investment projects (Sraffa, 1926; Schumpeter, 1935; Robinson, 1962; Kaldor and Mirrlees, 1962; etc.).

In the late 1940’s, Prebisch and other Latin American economists working at the United Nations Economic Commission for Latin America (CEPAL, by its initials in Spanish) focused attention on the barriers to scientific knowledge diffusion, and pointed out industrial countries received greater benefits from international trade on account of their technical superiority. Since most scientific research, the main source of technical innovations, was carried out in developed countries, these nations would tend to specialize in the production of manufactured goods. By contrast, developing countries would specialize in primary products, in which they had both absolute and comparative advantages.

The fact that demand elasticities were greater for processed goods than for primary products, and price elasticities of industrial goods were lower than price elasticities of raw materials, gave rise to unbalanced trade relationships between industrialized (center) countries and underdeveloped (periphery) countries, which could neither be accounted for by differences in the rates of domestic spending, nor be corrected by automatic movements in the real exchange rate. As the Marshall-Lerner condition was not fulfilled, developing nations would experience structural trade deficits, and a falling trend in their terms of trade; this asymmetry would persist unless backward nations implemented industrial policies aimed at changing the structure of their output and exports, increasing the share of manufactured goods, and reducing the share of primary products.

On this premise, Latin American economists elaborated a theory of inflation and a theory of development based upon center-periphery relationships. The theory of structural inflation pointed to exchange rate depreciation as the main cause of domestic inflation in technology dependent countries; and the structuralist theory of development asserted that trade account imbalances could not be eliminated solely by means of exchange rate movements. Both conclusions were clearly inconsistent with mainstream economic theory and orthodox stabilization policies.

More recently, Thirlwall (2003) has contributed to this approach, by showing that technological advantages of rich countries (and disadvantages of poor countries) have cumulative effects on their growth performance. He criticizes neo-classical writers for assuming given factor endowments and constant returns to scale in every trading country. He contends many activities exhibit increasing returns to scale; and some productive factors, mainly those derived from scientific research, are endogenously generated by demand. It follows that rich countries are able to grow faster as a result of international trade and achieve dynamic competitive advantages which augment their market power. By contrast, poor countries, who are subject to unequal trade, lag behind in technical innovations and grow much more slowly, which prevents them from developing dynamic competitive advantages.

Summing up, the main conclusion we derive from these analyses is that imperfect competition rooted in technological superiority is self-reinforcing, and brings about asymmetries in the distribution of gains from international trade. This assertion is corroborated by the fact that trade liberalization in developing countries has produced an increase in the rate of growth of imports that trebles the increase in the rate of growth of their exports (Santos-Paulino and Thirlwall, 2002). For instance, in Mexico, the income elasticity of imports, which was estimated between 0.60 and 1.80 before trade liberalization, jumped to 2.50 in 1984-1993, when most protectionist measures were eliminated (Moreno-Brid, 1999). Cardero and Galindo (2005), who have recently estimated this elasticity for period 1983-2003, report a value of 3.0, which indicates it has continued growing in the last decade. Graph 4 shows the ratio of imports to GDP has more than doubled over the last 25 years, despite a dramatic fall in employment and wage rates, a trend seemingly impervious to real exchange rate movements. A similar pattern is also observable in Brazil (Mántey, 2004).

Wage rates and factor income shares in oligopolistic global markets

Under oligopolistic competition, factor shares and real wage rates do not depend systematically on marginal productivities.

Post-Keynesian writers have traditionally assumed capital share in income is influenced by desired investment (Kaldor, 1957; Robinson, 1962; etc.). They claim market power enables oligopolistic firms to internally generate the resources required to finance new investment projects; and entrepreneurs do so by establishing unit product prices as a mark-up over unit prime costs.

Post-Keynesians presume the price leader decides the mark-up size after taking into account the costs of raising funds in financial markets, the risks of attracting new competitors to the field, and workers’ likely response to the fall in their real wages (Eichner, 1973; Wood, 1975; Arestis and Milberg, 1993; etc.).

Post-Keynesian theory of wages assumes that nominal wage bargaining is carried out in a competitive market, even though product markets are seen as oligopolistic, and real wage rates are eventually determined by entrepreneurs’ decisions on mark-up pricing. Nominal wage rates demanded by laborers are assumed to depend upon the level of unemployment, the expected rate of inflation, the real wage rate desired by workers on account of past experience, and the expected behavior of wage rates in other labor groups (Arestis and Skuse, 1991; Sawyer, 2005).

We believe the assumption of competitive labor markets in economies integrated to global oligopolistic product markets is unrealistic, particularly when capital flows across national borders are given absolute freedom, whereas labor remains a fixed productive factor.

Empirical evidence from industrialized countries as well as from developing economies indicates that real wage rates are neither systematically determined by the marginal productivity of labor or by the rate of unemployment. In developed countries, real wage rates have remained fairly stable in spite of wide fluctuations in the level of employment. Greenwald and Stiglitz (1993) explain this phenomenon as a result of oligopolistic competition in product markets and labor market segmentation.

The theory of labor market segmentation arose from different regional labor studies in the United States, which revealed that the wage rate differentials between skilled and unskilled workers were not determined by marginal productivities, as neo-classic theory of distribution postulated (Piore, 1971). It distinguished two types of labor markets. The primary market, characterized by high wages, good working conditions, employment stability and opportunities for advancement; and the secondary market, characterized by low wages, poor working conditions, employment instability and arbitrary discipline. The primary market, in itself, should also be considered a segmented market. The theory holds that oligopolistic firms protect their profits from the threat of competition in labor markets, by building up internal job structures in which skilled labor wage rates are determined by administrative procedures and institutional rules, and not by market mechanisms. Those firms use advanced technologies and adapt labor skills to innovations by means of training workers on the job. In order to minimize costly labor turnover, they pay efficiency wages at the bottom of their internal job layers; and as workers ascend in the internal hierarchy, their wage rates become administered prices set by conventional rules, and not directly dependent upon marginal productivities.

The wage patterns attached to internal job structures depend on the historical influence of technological change and labor custom, more than on external price influences.

Since external workers are not perfect substitutes for internal trained workers, skilled labor wage rates cannot be subject to arbitrage. Workers’ wages tend to increase with age, as a result of seniority privileges, fixed through bargaining and custom (Gordon, 1972; Leontaridi, 1998).

The unskilled labor market (i.e. secondary market), according to this approach, behaves differently. It is a competitive market, where wage rates depend upon demand and supply, and are not significantly affected by performance or length of time in the position. Wage rates vary according to the number of hours worked.

Dual labor market theory provides a more realistic alternative to neoclassic theory of distribution, specifically the human capital approach. It contends that education operates as a screening devise for selecting people in primary markets, but the level of education in itself is not an indicator of actual productivity, and does not guarantee employment. Furthermore, segmentationists maintain that the attitudes and social background of educated people matter more for employers, because it is through training-on-the job that leading firms adapt skills to innovations (Doeringer and Piore, 1971).

We believe the theory of segmented labor markets, jointly with the structuralist approach to foreign trade and inflation in late industrializing economies, and post-Keynesian theory of mark-up pricing under oligopoly, can provide a coherent explanation to the falling trend of real wage rates and the rise in skilled labor wage differentials observed in Mexico, as well as in other Latin American countries, in the recent past.

This theoretical framework focuses attention on the effects of technical innovations on the structure of product and factor markets, and enables us to understand the unexpected effects that conventional stabilization policies, and institutional reforms to enhance free market operation, have produced in semi-industrialized economies.

Free trade, macroeconomic stability and factor income distribution in peripheral economies

In Mexico, as in other Latin American peripheral economies, nominal exchange rate variations determine the rate of inflation, and unequal trade limits income growth. Stabilization policies, therefore, tend to peg the rate of exchange and depress domestic demand, mainly through restrictive monetary policy and fiscal austerity. That in turn leads to currency overvaluation, and negatively affects export competitiveness; bank credit astringency, on the other hand, raises financial costs, and forces firms to rely to a larger extent on internal funds.

The theories of factor income distribution under oligopoly, along the lines qualified as above, would predict that the type of orthodox stabilization strategy followed in Mexico would widen the price mark-ups and depress the real wage, thereby accentuating the labor-saving new technologies’ negative effect on labor income. It can explain the fall in the terms of trade of manufactured exports from developing economies observed in the last few years, along with the downward trend in unskilled labor wage rates and the rise of skilled-unskilled wage differentials that have been witnessed in many Latin American economies following trade liberalization.

In order to test these hypotheses, we estimate a model of average wage rates, and a model of wage differentials between skilled and unskilled workers in Mexican manufacturing industry.

Variables influencing the level of real wages

The average wage rate model assumed a positive relationship between the wage rate (W) and labor productivity (L), minimum wage legislation (Mw) and employment (E), as envisaged in efficiency wage models; and it added three types of variables to reflect the distributional conflict brought about by desired investment under oligopoly (INV), financial market conditions (LIQ), and the constraints posed by foreign competition (EXP).

We followed the Johansen methodology to explore the long run determinants of labor earnings (Charemza and Deadman, 1992). Average real earnings per worker were used for estimation, rather than the average basic wage rate, because Mexican legislation prevents downward flexibility in nominal wages, but fringe benefits are not mandatory; and actually, it has been through cuts in these items that employers have traditionally increased their share in output in the short run. We utilized output per worker as a proxy for labor productivity, and actual investment in fixed assets as a proxy for desired investment. Financial market conditions were represented by the ratio of the monetary aggregate M2 to GDP; and foreign competition by the share of merchandise exports in GDP.

The model was estimated with aggregate quarterly data from Mexican manufacturing industry, from 1980.1 to 2004.4. Our results are summarized in Table 1.

Contrary to what one would expect on the basis of conventional theory of international trade, our model indicates that the elasticity of real labor earnings to foreign demand is negative and sizable (minus 0.4). The level of employment appears to have a comparable but positive effect on labor rewards.

Our estimates coincide with those of López and López (2003), who find a significant negative relationship between the ratio of exports to total sales in all branches of industry and real wages, in their study of the effects of trade liberalization on real wages in Mexican manufacturing industry in the period 1988-1999, using panel data.

Both findings are consistent with UNCTAD’s observation that exporters in Latin America and Africa do not reduce their profit margins to improve their competitiveness in foreign trade, as it appears to be the case in developed countries where trading firms price to market, but rather depress wages (UNCTAD, 2004).

Our model also reveals a positive and significant effect of financial market conditions on real wages, an expected outcome in post-Keynesian theory of distribution under oligopoly that is not easily explicable under the perfect competition assumptions of mainstream theories of inflation and distribution.

Finally, in line with neo-classical theory of distribution, our model exhibits a unit elasticity of the average labor earnings rate with respect to output per worker (which was utilized as a proxy for labor productivity). However, it can be noted that when the basic wage rate without fringe benefits is used as the independent variable in the estimation the elasticity of labor earnings with respect to productivity falls to 0.4, and the same elasticity with respect to the variable indicating financial market conditions goes up to 0.8. With panel data, López and López’s (2003) report a positive, but insignificant, relationship between productivity and the real wage rate.

Determinants of skilled labor wage differentials

We also look at the effects of oligopolistic competition and distribution conflict on average wage differentials between skilled and unskilled workers (WD) in different branches of industry, attempting to capture the effects of technology upgrading on primary labor markets and the extent to which the distribution of productivity gains between white and blue collar workers are affected by competition from foreign producers and domestic financial market conditions.

As explanatory variables, we consider the structure of employment (SU), fixed investment decisions (INV) and liquidity in financial markets (LIQ). In order to capture the Stolper-Samuelson effects of competitive imports and exports on wage differentials, we use the ratio of imports plus exports to GDP as an indicator of the economy’s degree of openness (OPEN).

This model is estimated with yearly data from national accounts, for 38 branches of the manufacturing industry for the period 1994-2002. The methodology used is static panel cointegration. We estimate the equation by the method of generalized least squares with fixed effects (Baltagi and Kao, 2000), and utilize the Engle-Granger method to test for cointegration. Table 2 shows our results.

Table 2: Long-run determinants of skilled/unskilled workers wage differentials in Mexican manufacturing industry

Our results indicate that foreign competition has exacerbated the distributional conflict, and has had a depressive effect on skilled labor wage differentials since the mid nineties.

They also suggest that skilled labor wage rates are established as an administered mark-up over unskilled labor wage rates, in the way segmented labor market theorists argue. First, the constant term accounts for nearly 90% of the mean value of the dependent variable, and is highly significant. Second, the variable representing the structure of employment, that is the ratio of skilled to unskilled workers in each branch of activity, appears with a negative sign in the equation. This means that white collar wage rates tend to vary less than proportionately in relation to blue collar wage rates when the relative demand for skilled labor augments; hence, as skilled workers’ share in total employment increases the rise in their share in the total wage bill is less than proportional. This finding is congruent with segmentationists’ proposition that skilled labor wage differentials adjust in a way that preserves oligopolistic firms’ profitability.

Meza (2003) arrived to analogous conclusions from her research on the evolution of skilled labor demand in Mexican manufacturing industry in period 1988-1998. She found that in response to technological factors, the share of skilled workers in total employment increased in all branches of activity, but this change produced less notorious effects on the share of skilled workers in the wage bill. She discovered that white collar workers’ share in labor income has been dependent upon the ratio of the producer price index of the particular branch and the overall producer price index in manufacturing industry. This result is also consistent with the idea that in oligopolistic firms, internal job structures and skilled labor wage differentials depend upon market power.

López and López (2003) made similar deductions, as their model revealed that average wages varied widely from one branch of industry to the other, but they followed the same pattern of variations along time. The authors interpreted this result as indicative of wage bargaining being carried out at the firm or branch level, in internal labor markets.

Interestingly, the estimation of neither of our equations yields a negative effect of desired investment on labor income that is significant. In fact, the second estimation shows a positive and significant relationship between aggregate investment in manufacturing industry and skilled-unskilled wage differentials. Three possible explanations may be given for this finding. One is that technology upgrading has exerted a widespread effect on skilled labor turnover costs in the different branches of industry; a second one is that investment has strengthened the degree of monopoly, thereby increasing both profits and the skilled workers wage fund; and finally, a third explanation could be that skilled labor wage differentials increased simply because labor saving technical progress depressed unskilled labor wage rates. Graph 2 lends some support for the last interpretation.

On these grounds, we conjecture that restrictive monetary policies, and the labor saving bias of the new technologies that are required when producing for the global market, account for the real wage flexibility observed in Mexico’s as well as in other developing countries’ labor markets, after the implementation of trade liberalizing reforms.

The fall in wage rates at the same time that output per worker increases cannot be explained by neo-classic theories of international trade and income distribution. Instead, they arguably arise from the direct and circular relationship between scientific research, technical progress and market power, and their implications for trade specialization, product pricing, and factor income distribution.

The early approaches of Latin American structuralists to the problems of unequal trade and technical dependence did not contest the assumption of freely competitive markets; they focused attention on the characteristics of primary products demand, and neglected the distribution conflicts derived from oligopolistic competition rooted on technical superiority. Therefore, they assumed that as manufactures increased their share in output and exports, the secular downward trend in the terms of trade of peripheral countries would disappear.

By contrast, the empirical research reviewed above indicates that the phenomenon of unequal trade, in Mexico as in other Latin American economies, originates from oligopolistic barriers to the transmission of scientific knowledge. The body of this work implies that the sharp fall experienced in the terms of trade of these countries’ manufactured exports since 1996, along with the decline in their real wage rates, growing unemployment, and the shrinking shares of labor income, are directly linked to their technical dependence on the central countries.

An alternative policy strategy for economic development

In the present stage of global capitalism, it is unthinkable, to rely on protectionist measures to foster technical innovation and industrialization. But it is also unlikely that a stagnant economy can induce the accumulation of capital that is required to upgrade industrial techniques.

It is doubtful that developing countries can rely on relative price adjustments to achieve internal and external balance as they simultaneously face the problems of unequal trade and structural inflation, where exchange rate depreciation tends to spur inflation without any significant impact on imports.

In a liberalizing developing economy, the central bank is often forced to constrain income growth to a level that is compatible with export earnings plus foreign capital inflow by means of restrictive monetary policies. The costs of such macroeconomic stability are then currency overvaluation, unemployment, falling wages and growing income inequality. This is what Ocampo and Taylor (1998) sarcastically name the ‘tropical’ version of open economy macroeconomics, that many Latin American governments follow because in their economies the exchange rate pass-through inflation is too large, and the Marshall-Lerner condition does not hold.

Furthermore, this type of stabilization policies preclude any long term solutions to the problems of unequal trade and structural inflation which can only be tackled through capital accumulation that is dependent on effective demand (Thirlwall, 2003; Ocampo and Taylor, 1998).

In these countries, central banks must solve two intricate problems: first is how to channel financial resources from the banking system to investment outlays, without impairing the trade balance; and secondly, what to do in order to stabilize the real exchange rate without accelerating domestic inflation.

South East Asian monetary authorities discovered a solution to both questions, by means of an active policy of selective credit allocation, in which commercial banks were given incentives to lend to strategic and priority sectors by means of rediscount facilities at the central bank; and unlimited amounts of long term credit in the national currency, at moderate and stable cost, were offered to firms that were committed to pursuing the goals and targets established in the industrial policy strategy. Since export industry was a key sector in their development policy, credit expansion eventually produced trade balance surpluses.

Cheap credit facilities were an important determinant of export firms’ profitability, and they were conditional on price competitiveness. By means of this device, currency devaluations ceased to be passed through domestic inflation, and exchange rates could even be moderately undervalued, to promote exports. Thus, this credit policy also prevented an inflationary solution to the distributive conflict.

Conclusions

Trade liberalizing reforms implemented in Mexico and other Latin American economies have produced unexpected negative results. Contrary to what one would have expected on the basis of mainstream theory of international trade, free trade has led to falling relative prices of labor intensive activities and real wages, rising unemployment as demand for skilled labor rose in relative terms, and a decreasing output growth rate.

We have argued that the theoretical framework on which trade liberalizing reforms were based is faulty, because it neglects the circular causation of scientific research, technical innovations, and market power, as well as its implications for trade specialization, factor income distribution and growth asymmetries between developed and semi-industrialized economies.

The disappointing results of trade liberalization in Mexico and other Latin American countries and the fall in the terms of trade of their manufactured exports in the last decade can be better explained, we argue, by a theoretical model of factor income distribution in a semi-industrialized economy that explicitly assumes imperfect competition in product markets, oligopoly barriers to technology transfer, and segmented labor markets.

Unequal trade and structural inflation, the main obstacles to growth in Latin America, are rooted in the oligopolistic nature of technology diffusion. The stabilization policies that rely on credit restriction to balance the current account, and currency overvaluation to control domestic inflation discourage productive investment, and thereby exacerbate technical dependence, widening the income gap between developed and developing countries.

We tested the relevance of our theoretical framework by estimating two econometric specifications, respectively, for labor average real earnings and skilled/unskilled wage differentials in the Mexican manufacturing industry. The estimations support our hypotheses, and suggest that exporting firms depress wages to improve their competitive position in foreign markets and that credit astringency has a negative effect on the share of labor in income.

We conclude that stabilization policies that depress effective demand and discourage productive investment are counterproductive in dealing with unequal trade and structural inflation, which are the main obstacles to growth, and a more equitable income distribution in Latin American countries. An alternative development strategy, that mobilizes domestic financial resources for investment in export activities with high value added and other priority sectors in accordance with a sensible industrial policy, would be as effective in Latin American countries as it was for various South East Asian economies in the past.

nueva página del texto (beta)

nueva página del texto (beta)