1. INTRODUCTION: NEW DEVELOPMENTALISM IN PERSPECTIVE

Over the last several years, in a series of papers, Bresser-Pereira (2016, 2018, 2020a) has advanced the construct of New Developmentalism (ND). Though developed in the context of Brazil’s debate about economic development, ND claims to offer a new development formula for middle-income economies with a large globally competitive commodity producing sector (Bresser-Pereira, 2020a).

ND has caught the imagination of many Brazilian Keynesian economists. It has also provoked a critical response from other Brazilian economists operating in the classical developmentalism tradition (see Medeiros, 2020) who argue ND oversimplifies the development problematic. In particular, from the classical perspective associated with Celso Furtado and Raúl Prebisch, ND under-states both the need for transformation (sociological and economic) and the problems posed by the center-periphery structure of the global economy. Those twin challenges necessitate a critical major role for the state that includes and goes beyond industrial policy.

A second concern with ND is that it is relatively unbacked by formal economic analysis. Consequently, its economic logic is opaque, and its claims are untested. That makes intellectual exchange difficult because ND’s arguments are unclear and can be refashioned in response to its critics, making it is as if the target is constantly shifting.

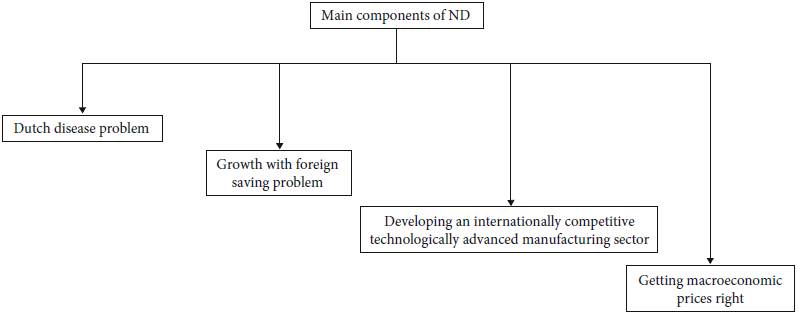

This paper examines the economics of ND. It begins by formally analyzing the main propositions, the goal being to shed light on them and test their internal economic logic. As shown in Figure 1, the paper identifies four main components: The problematic of Dutch disease, the problematic of growth with foreign saving, the claim that development requires a modern technologically advanced industrial sector, and the need to get macroeconomic prices right.

Thereafter, the paper examines four lines of critique of ND: The internal economic logic critique, the Classical Developmentalism (CD) critique, the Keynesian and Neo-Kaleckian critique, and the “fighting the last war” critique. The conclusion is ND is a Third Way styled analysis that blends CD heterodoxy (left) and Neoliberalism (right), with the Neoliberal element being most prominent in its views about fiscal policy and the role of the state in the process of industrial development. From a Classical Development perspective, the problematic of development cannot be solved as easily as suggested by ND.

2. THE PROBLEM OF DUTCH DISEASE

The starting point of the analysis is Dutch disease, which ND identifies as the fundamental problem afflicting Brazil. Dutch disease refers to the problem caused by discovery of natural resources which generate both large capital inflows to develop them and large trade surpluses, thereby appreciating the exchange rate and making the industrial sector internationally uncompetitive. It is named after the experience of The Netherlands in the 1960s following the discovery of large off-shore natural gas deposits1. The problem of Dutch disease can be analyzed in terms of a two sector economy consisting of a primary goods sector that produces commodities and an industrial goods sector. The primary goods sector is assumed to have globally low costs of production and to be hyper-competitive in the global economy.

The Dutch disease problematic is illustrated in Figure 2. It shows the primary sector trade balance (PB), the industrial sector trade balance (IB), and the overall trade balance (TB) as a function of the nominal exchange rate (e). The nominal exchange rate is defined as units of foreign currency per unit of domestic currency, so that an increase in e corresponds to an exchange rate appreciation2. All prices are assumed constant.

The IB line is the thinnest and the TB line is the thickest. The overall trade balance is defined as:

The TB is therefore a linear combination of the PB and IB functions. In all cases, the trade balances are drawn as a negative function of the exchange rate so that an appreciation worsens each trade balance3. e1 corresponds to the exchange rate that yields balanced trade in primary goods (PB = 0). e 2 corresponds to the exchange rate that yields balanced trade in industrial goods (IB = 0), and e 3 corresponds to the exchange rate that yields overall balanced trade (TB = 0).

Now, for simplicity, assume the actual exchange rate is determined by market forces so as to deliver overall trade balance (TB = 0). In that case, the actual exchange rate is e 34. The Dutch disease problem is that the industrial sector is not internationally competitive at that rate (IB < 0). The underlying cause is that the primary sector is hyper-competitive (PB > 0). That causes the trade balance to be positive (i.e. surplus) at lower exchange rates, thereby driving exchange rate appreciation.

That fundamental structural problem is further exacerbated by the global economic cycle. Thus in global booms, global demand for commodities increases, which drives up the price of commodities. That increases the primary sector’s trade surplus. In terms of Figure 2, it shifts the PB function right, which in turn shifts the TB function right and appreciates the exchange rate. That appreciation worsens the competitive position of the industrial goods sector and worsens the industrial goods trade deficit.

ND’s proposed solution is an export tax on the primary sector, which it claims will reduce both the primary sector balance and the overall trade balance. That solution is illustrated in Figure 3. The claim is the export tax makes the primary sector less competitive. If calibrated correctly, it shifts both the PB and TB functions down (PB’, TB’) such that the actual exchange rate settles at e 2. That makes the industrial sector more competitive, enabling it to thrive in the global economy. To deal with the supplementary problem of the global business cycle, the tax needs to be pro-cyclically indexed to export conditions. One possibility is indexing the tax rate to the real price of commodities.

3. THE PROBLEM OF GROWTH WITH FOREIGN SAVING

The second core element of ND is the problem of growth with foreign saving, which is related to the problem of Dutch disease. The current account (CA) deficit constitutes foreign saving. Reliance on CA deficits along the growth trajectory is termed growth with foreign saving, with imports providing needed resources. The worse the problem of Dutch disease, the worse the problem of growth with foreign saving.

The significance of CA deficits is they add to foreign debt. That imposes a debt service burden and can also lead to financial crisis. Such crises cause a sudden stop to growth which can endure for years. That pattern aggravates the development problem posed by Dutch disease. Now, the development of the industrial sector is undercut by Dutch disease induced structural over-valuation of the exchange rate, and it is also undercut by boom-bust exchange rate cycles and enduring slumps resulting from the damage done by financial crisis.

The problem of growth with foreign saving can be illustrated with a simple two period model describing the country’s net present value budget constraint. That constraint requires a country to pay back its foreign borrowings from period 1 (used to finance the CA deficit in period 1) at the end of period 2. The constraint is given by:

D t = exogenous Dutch disease factor, r = country borrowing interest rate. An appreciation of the exchange rate worsens the CA balance. A worsening of Dutch disease (increase in D) improves the current account by increasing the primary sector trade surplus. The budget constraint requires that a country earn a CA surplus in period 2 sufficient to repay the borrowing incurred in period 1 plus interest.

Equation [2] can be solved to yield the needed second period “solvency” exchange rate which is given by:

The solvency exchange rate ensures that a country can pay back its foreign debts, including interest due.

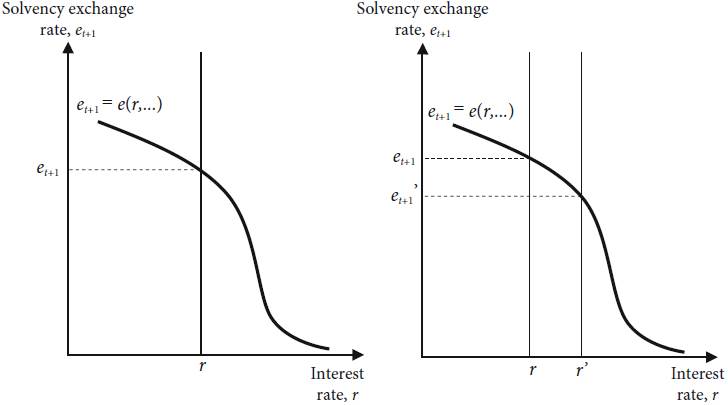

The model is illustrated in Figure 4. The left hand panel shows the core model. The vertical line is the exogenously given borrowing rate determined by global financial market conditions. The negatively sloped line determines the solvency exchange rate as a function of the global interest rate. A higher interest rate requires a large CA surplus in period 2, which necessitates a lower exchange rate. The solvency exchange rate function is drawn as non-linear reflecting the possibility that trade elasticities may be non-linear5. The intersection of the two lines determines the second period exchange rate needed to ensure the necessary CA surplus to pay back period 1 foreign borrowing plus interest.

The center-left panel shows the case where there is an increase in the interest rate (r’ > r). That increases the debt burden, requiring a depreciation of the solvency exchange rate to enable the country to earn a larger CA surplus to meet its increased financial obligations. The center-right panel also shows the effect of an increase in the interest rate (r’ > r) but, owing to the shape of the solvency exchange rate function, there is a large depreciation in the exchange rate. Such an outcome might be associated with an exchange rate crisis, but that needs to be embedded and explored in a complete model to fully capture the logic. The important point is it illustrates an outcome that commonly afflicts emerging market (EM) economies, whereby financial tightening in the global center (i.e. the US) increases the interest rate, thereby causing financial crisis in the periphery.

The far right panel shows the case where there is a reduction in the extent of Dutch disease in the second period (D t+1 > D t+1 ’). That can be identified with either a collapse in global commodity prices owing to the end of the boom or with natural resource supply exhaustion. In either case, the second period CA deteriorates, requiring depreciation of the exchange rate to generate a CA surplus sufficient to meet its existing obligations.

The above thought experiments raise the issue of stability. The analysis in Figure 4 assumes adjustment in response to an exogenous disturbance is stable in that exchange rate devaluation enables a country to earn its way out of financial difficulty. The presence of foreign currency denominated debt can undo that since devaluation will increase the burden of foreign currency debt and associated debt service payments (Krugman, 1999; Céspedes, Chang, and Velasco, 2004; Kohler, 2017). That unstable possibility adds another concern to the growth with foreign saving strategy.

In sum, the simple model highlights the dangers of the growth with foreign saving strategy. Countries are rendered financially vulnerable to external financial developments and may confront financially induced instability. The industrial goods sector is already pressured by the problem of Dutch disease. The growth with foreign saving strategy adds another threat in the form of financial crises that can generate extended stagnation.

4. ND’S GROWTH MODEL

The third major component of ND is its theory of development and growth. According to Bresser-Pereira (2016, p. 341): “Economic development is a process of capital accumulation with the incorporation of technical progress (…). It involves industrialization or, more precisely, increasing productive sophistication combined with the transference of labor from low to high income per capita industries.”

For ND, the modern industrial sector is the economic engine of growth and development. It is also key to escaping the problem of growth with foreign saving as it voids the need to import sophisticated capital goods as they can be produced domestically. The challenge is to develop a technologically advanced industrial sector that competes effectively with firms in mature economies, uses state of the art technology, and generates its own technological innovations.

Doing so requires encouraging the industrial sector and appropriately protecting it from the competition of mature rival firms in industrialized countries. That makes the exchange rate critical as an over-valued exchange rate undermines the ability to compete: “When the exchange rate is over-valued in the long term, the business enterprises that use the state-of-the art technology are disconnected from effective demand, as the average expected rate of profit falls and possibly turns negative, which leads them to reduce or stop investment” (Bresser-Pereira, 2016, p. 342).

That importance of the exchange rate connects ND’s development model with Dutch disease. The latter is disastrous for development because it spurs exchange rate over-valuation, thereby undermining growth of the technologically advanced industrial sector.

Similarly, growth with foreign saving is bad for the industrial sector because it promotes boom-bust cycles that generate pro-cyclical financial inflows which appreciate the exchange rate, compounding the industrial sectors problems. Growth with foreign saving also leads to foreign indebtedness, which creates financial fragility as countries become vulnerable to shortfalls of foreign currency earnings that render them unable to service their foreign debt.

Lastly, though not expressly stated, ND’s concern about growth with foreign saving tacitly connects it with the extensive theoretical literature on export led growth and the extensive empirical literature on the growth benefits of an under-valued real exchange rate (see Rapetti, 2020, for a survey of that literature)6. Export-led growth avoids the pitfall of growth with foreign saving, while an undervalued exchange rate facilitates development of the modern industrial sector.

5. GETTING MACROECONOMIC PRICES RIGHT

The fourth component of ND is the challenge of getting macroeconomic prices right: “New Developmentalism works with five macroeconomic prices: The profit rate, the exchange rate, the interest rate, the wage rate, and the inflation rate, and understands that they must be kept right” (Bresser-Pereira, 2016, p. 341).

Right macroeconomic prices are supposed to ensure a macroeconomic context that ensconces and facilitates ND’s other policies, thereby promoting stable growth.

The recommendation of right macroeconomic prices is entirely understandable. However, ND’s macroeconomic prescription boils down to a macroeconomic bromide as it lacks substance regarding the definition of what constitutes “right”. Whereas ND has a theory of and policy target for the exchange rate, it has no theory of inflation and nor does it propose an inflation target (i.e. right inflation price). Similarly, it has no policy prescription for interest rates in the form of an interest rate rule or interest rate target. Nor is there any discussion of the policy instrument assignment problem (i.e. what target should the interest rate be assigned to). Lastly, it has neither a theory of income distribution nor a theory of growth identifying the impacts of income distribution on growth. Consequently, it has no construct of what constitutes an optimal distribution (i.e. the right profit rate price and the right wage rate price) yet, despite that, ND still advocates profit-led growth. Those observations anticipate the next section of the paper.

6. CRITIQUES OF NEW DEVELOPMENTALISM

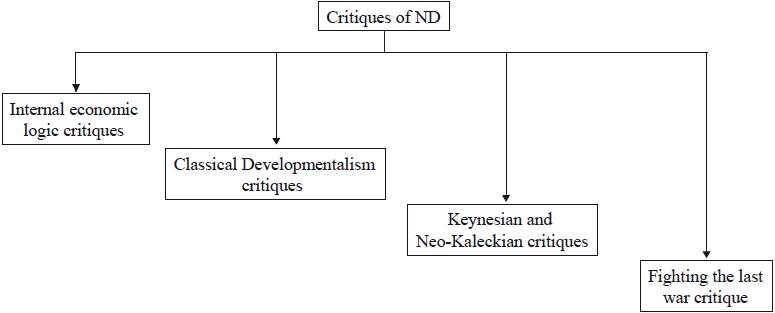

The previous sections have laid out the core elements of ND that underlie its claim to be a new development paradigm. This section critically examines ND. Figure 5 identifies four different strains of critique: Internal economic logic critiques, classical developmentalism (CD) critiques, Keynesian and neo-Kaleckian critiques, and fighting the last war critique.

6.A. Internal economic logic critiques

The first set of critiques concern ND’s own internal economic logic.

6.A.1. Does the ND story make empirical sense?

Dutch disease induced exchange rate over-valuation is central to ND, with Brazil’s recent economic history being invoked to support it. That begs the question how empirically significant has Dutch disease been for Brazil over the past fifty years (and how important it is in other middle-income countries for which ND is supposed to be relevant)?

In the post-war era through to 1980, if there was a Brazilian Dutch disease problem, policy tacitly partially addressed it via import substitution policies. Thereafter, the decade of the 1980s was one of a relatively weak currency owing to the combination of Latin America’s debt crisis and the Reagan administration’s “strong dollar” policy. The 1990s were a period of strong currency in Brazil, but that was also a period when the exchange rate was used as a nominal price anchor (as recommended by mainstream economists and the International Monetary Fund, IMF) so that Dutch disease cannot be blamed. It can be argued that the period 2001-2008 corresponded to a period of Dutch disease with the global commodity boom driving up Brazil’s exchange rate, but the Lula government also pursued financially conservative tight monetary policy that raised interest rates and appreciated the exchange rate. Consequently, the cause of Brazil’s strong currency is unclear. Lastly, since approximately 2009 Brazil has had a relatively weak currency (measured in purchasing power parity terms), low inflation, and slowly declining interest rates, yet it still has not prospered.

That historical record questions the claim that Dutch disease is the principal obstacle to Brazil’s development, which knocks out a main pillar of ND. Additionally, the failure to prosper since 2009 despite low interest rates, low inflation, an undervalued exchange rate, and sound fiscal conditions raises questions about whether getting macroeconomic prices right as defined by ND is sufficient for development. That observation links to both the Classical Developmentalism critique and the Keynesian and Neo-Kaleckian critique which are discussed below.

6.A.2. Exchange rates and the effectiveness of export taxes

A second internal critique concerns the logic of export taxes. A central component of ND is the notion of two exchange rates: The industrial equilibrium exchange rate and the current (account) equilibrium exchange rate, with the latter exerting “a direct but non-linear” influence on actual exchange rate (Bresser-Pereira, 2016, p. 343). The ND argument is that Dutch disease contributes to driving the actual exchange rate above the industrial equilibrium exchange rate via its influence on the current account, thereby adversely impacting the modern industrial sector.

As described earlier in section 2, ND proposes a tax on commodity exports which it claims will reduce the primary goods trade surplus, worsen the current account, and depreciate the actual exchange rate to the benefit of the industrial sector. That logic is questionable. The export tax is claimed to be a tax on rents earned by the hyper-competitive primary goods sector: “The commodity producers will pay nothing in net terms, but they will lose the country rents, which will be captured by the state” (Bresser-Pereira, 2018, p. 11).

As such, being a tax on rents implies the tax redistributes rents from the primary sector to the state. Export volumes are unaffected, and so is the trade balance. Consequently, the tax will have little or no impact on the exchange rate, and its impact purely concerns distribution.

6.A.3. Putting the pieces together

If ND’s claim about the significance of Dutch disease is wrong and its commodity export tax does not depreciate the exchange rate, its policy framework reduces to one of relying on an undervalued real exchange rate (RER) for growth. There is much empirical evidence that strategy has worked (see the literature survey in Rapetti, 2020), and an undervalued RER is quickly becoming the latest conventional wisdom for development. However, the implication is that there is little in ND to distinguish it from that new conventional wisdom. Additionally, as argued later, there are solid grounds for believing the strategy may not work in future.

An export revenue tax can affect output, but the impact will depend critically on the shape of industry’s marginal cost function. Output will only contract if producers are just competitive at the margin. However, that is not the scenario envisaged by ND which represents the primary sector as being globally hyper-competitive. In that scenario, supply is pre-determined by past fixed investments and marginal cost is essentially zero. Consequently, output will be essentially unchanged and, given an exogenously determined world commodity price, commodity export earnings will also be essentially unchanged7.

To the extent that a commodity export tax generates output effects, these are likely to be more long run in nature. Thus, firms may reduce future investments expanding commodity production. However, were that to happen, it would not be a benefit. The economy would suffer reduced investment spending, and it would also lose foreign exchange earning capacity.

In sum, ND’s commodity export tax is unlikely to depreciate the exchange rate by worsening the current account because of primary exporters’ hyper-competitive position. In that context commodity export taxes become more of a policy tool for income redistribution rather than exchange rate management. That misunderstanding undercuts ND’s internal logic8.

6.B. Classical Developmentalism critiques

A second line of critique comes from Classical Developmentalism (CD), a critique which has been comprehensively detailed by Medeiros (2020)9.

6.B.1. Failure to adequately recognize the development challenge

The over-arching CD critique is that ND fails to adequately recognize the scale of the development challenge. In particular, it fails to recognize the profound social, political, and economic transformation that development requires. It also fails to adequately recognize the fundamental obstacle to development posed by the center -periphery structure of the global economy. Those failures mean it is prone to represent the development problem as one of market failure, to neglect the need for industrial policy and societal change policies, and to identify the solution as one of getting macroeconomic prices (exchange rate, profit rate, interest rate, inflation rate, and wage rate) right.

Bresser-Pereira (2020b) denies the validity of Medeiros’ (2020) critique and claims ND fully recognizes the development problematic as identified by CD. However, to this author, there do seem to exist very substantial differences. Those differences become especially apparent when considering the role of the state (see below section 6.B.3.). They are also evidenced in Bresser-Pereira’s (2016, pp. 341-348) canonical statement of ND, which sequentially lists: Getting macroeconomic prices right, growth is driven by investment and investment is driven by profitability, the determinants of the exchange rate, the problem of Dutch disease, the problem of cyclical over-valuation of the exchange rate, the problem of balance of payments crises, the need for responsible counter-cyclical monetary and fiscal policy, rejection of wage-led growth, support for export-led growth, using minimum wage policy to address inequality, and the need for a business-bureaucrat- worker political coalition to counter the rentier-financier-foreign interest coalition. Industrial policy gets a single bullet point and is described as a strategic addition to right macroeconomic prices (Bresser-Pereira, 2016, p. 348).

None of the above is intended to take sides in the ND versus CD debate. Instead, it is intended to show that there is substance to Medeiros’ (2020) critique that ND is different from CD. The difference is less due to what ND adds, and more due to what ND omits.

6.B.2. Analytical relationship to Neoliberalism

The most important difference between ND and CD concerns the role of the state, and that difference links back to their respective views about Neoliberalism. Neoliberalism is a pro-market political and economic philosophy that is hegemonic in contemporary political economy. It holds that free markets are an essential ingredient for political freedom, and they are also the best way to deliver economic prosperity (Palley, 2013, pp. 1-2).

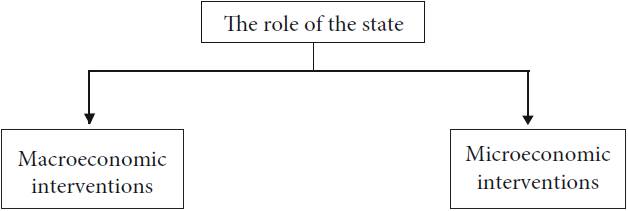

A helpful way of teasing out differences between ND and CD is to distinguish between macroeconomics and microeconomics. Figure 6 decomposes the role of the state into macroeconomic interventions and microeconomic interventions. Neoliberalism inclines against both macroeconomic and microeconomic interventions by the state, especially the latter. Broadly speaking, ND is comfortable with state sponsored macroeconomic interventions but much less comfortable with microeconomic interventions. Contrastingly, CD is comfortable with both types of intervention.

CD categorically rejects the Neoliberal perspective on both macroeconomics and microeconomic interventions. ND’s relation to Neoliberalism is more complex, reflecting the fact that it is a product of the Neoliberal era (1980-today). Metaphorically speaking, ND’s macroeconomics is tinged by Neoliberalism, whereas its microeconomics is colored by Neoliberalism.

With regard to macroeconomics, ND’s Neoliberal tinge is evident in its use of the language of “macroeconomic prices”, plus its a-theoretical affinity with profit-led growth and fiscal austerity (see below sections 6.C.1. and 6.C.2.). The former reflects the triumph of Neoliberal macroeconomics which emphasizes price signals over quantity signals. However, Neoliberals have a well thought out schema, whereas ND’s approach to macroeconomic prices is rhetorical (as discussed above in section 5)10.

That said, whereas ND may have overly embraced Neoliberal macroeconomics, CD can be faulted for failing to adequately update. That failure reflects a combination of factors. One justified concern is apprehension that the language of macroeconomic prices risks swamping understanding of the deeper problems of structure and structural change which are the core of CD’s approach to development. A second unjustifiable factor is that Structuralist and Post Keynesian macroeconomists were reflexively resistant to the new language and idea of macroeconomic prices because that language was principally developed by the Chicago School of economics, which was so critical of Structuralist Keynesian macroeconomics. That resistance was particularly clear in the 1990s regarding inflation targeting and unwillingness to analyze policy effectiveness in terms of policy rules. However, the macroeconomic prices approach can be incorporated into Structuralist and Post Keynesian economics (Palley, 2007).

With regard to microeconomics, ND’s Neoliberal coloring is stronger and its distinctions with CD are sharper. CD rejects Neoliberal microeconomic theory and policy prescriptions. ND claims to do the same, but the rejection of policy prescriptions is more lip-service than fact. ND’s view of the microeconomic role of the state is very much consistent with Neoliberal economics which emphasizes “market failure”, the greatest market failure being lack of competition. Thus Bresser-Pereira writes:

Turning to the microeconomics of new developmentalism, it starts from the assumption that the market is an excellent institution for the coordination of economic systems, provided there is competition. Thus, the role of the market and the role of the state in economic coordination depend on the level of actual competition (…) new developmentalism leaves the competitive sector to be market coordinated, and understands that the non-competitive sector, which eventually includes the big banks that are too big to fail, requires planning and day-to-day regulation (Bresser-Pereira, 2016, pp. 334-335).

6.B.3. The role of the state in industrial development

The microeconomic policy differences between CD and ND become especially evident regarding the role of the state in the process of capital accumulation and industrialization. For ND, the task of capital accumulation is best left in the hands of private sector businesses. The state’s role is to get macroeconomic prices right, where those prices are defined to include the profit rate and the interest rate. The rate of accumulation then depends on the difference between the expected profit rate and the interest rate (Bresser-Pereira, 2016, pp. 341-342). That is a substantially Neoliberal view of the accumulation process, and it contrasts with the CD view in which the state occupies a far more activist position.

That difference is illustrated by consideration of the post-World War II era when there were large state-owned “nationalized” industries which were viewed as critical engines of development. The Neoliberal era has eradicated the view of the state as an important engine of industrial development. Around the world, nationalized industries have been substantially transferred to private ownership through “privatization”. Industrial policy, whereby the state seeks to promote the development of particular sectors, has been tarred as a failure on grounds that the state cannot pick winners.

CD rejects that Neoliberal perspective, whereas ND substantially embraces it even though it gives lip-service to industrial policy11. Moreover, ND’s lightness on the state’s role in industrial development is despite the renaissance in thinking about the innovative role of the state, exemplified in Mazzucato’s (2013) celebrated book The Entrepreneurial State: Debunking Public vs. Private Sector Myths.

The neglect of the role of the state is also evident in ND’s neglect of the infrastructure question. Thus, infrastructure is unmentioned in Bresser-Pereira’s (2016) twenty-two page canonical statement article. That omission may be just a mistaken oversight, but it is intellectually consistent with both ND’s skepticism toward state investment activism and ND’s inclination against budget deficits (see more below in section 6.C.1.). The budget deficit fear is particularly inappropriate with regard to infrastructure. That is because infrastructure investment constitutes public capital accumulation which, as with private capital accumulation, may necessitate deficit finance. In private corporations that takes the form of equity issuance or borrowing. In the public sector it takes the form of budget deficits, which may be money- or bond-financed.

ND’s neglect of infrastructure does double damage to the economy. First, it undercuts the supply-side by lowering private productivity and raising private costs. That harms the development of the modern industrial sector and makes it internationally less competitive -which is the principal problem according to ND12. Second, it undercuts the demand side according to Keynesian macroeconomic logic (again, see more below in section 6.C.1.).

Another significant difference between CD and ND concerns the role of tariffs and import substitution, which CD historically emphasized (see Medeiros, 2016, p. 151, Table 1, column 4). Contrastingly, ND favors export-led development (about which more below in section 6.C.1.) and emphasizes commodity export taxes that are supposed to depreciate the exchange rate. To ND, tariff-based import substitution is a flawed way of addressing the problem of Dutch disease: “Although many countries have neutralized the Dutch disease with import tariffs, they are not the best way to neutralize the disease because they do that in relation to the domestic market” (Bresser-Pereira, 2018, p. 1).

That misrepresents CD’s stance on tariffs and import substitution, which are not for addressing Dutch disease. Rather, they are a means of simultaneously promoting both domestic market development and addressing the problem of growth with foreign saving.

Several things follow from that. First, ND’s concern with the problem of growth with foreign saving is not novel. In fact, it has been a central problematic of development since the inception of development economics by Prebisch (1949) and his fellow Latin American structuralist economists.

Second, CD’s focus on tariffs reflects a fundamentally different perspective on the development problematic, whereby developing the domestic market is the central challenge. For CD, the main contribution of exports is foreign exchange earnings that relax the foreign exchange constraint rather than the demand constraint (Kaldor, 1966, 1978; Medeiros, 2016). That contrasts with ND which emphasizes export-led growth as a primary source of demand, for which the exchange rate is key: “The exchange rate acts as a switch that grants or withholds access to existing demand, be it international or domestic” (Bresser-Pereira, 2016, p. 2).

That difference explains CD’s prioritization of tariffs and import-substitution. Too often, export-focused growth can lead to “shallow” development, as epitomized by the export-processing zone (EPZ) phenomenon.

Third, ND also overlooks the adverse aspects of an undervalued RER and ignores the specific benefits of tariffs. As regards benefits of tariffs, they can be targeted to critical specific industries, whereas an undervalued RER cannot. As regards adverse impacts of an undervalued RER, it imposes costly terms of trade effects. That is particularly so regarding imported sophisticated capital goods which are necessary for development of modern industry and must be imported.

Additionally, though less of a problem now, an undervalued RER increases the cost of imported oil which was a big problem in the 1970s when the real cost of oil was higher. However, that oil burden has now been replaced by the burden of foreign debt. In that regard, there is a large literature dating from the 1998 East Asian financial crisis which shows how exchange rate devaluations can trigger serious adverse economic impacts operating through country balance sheets (Krugman, 1999; Céspedes, Chang, and Velasco, 2004; Kohler, 2017). Given the enormously indebted status of many EM economies after forty years of Neoliberal policy, that indebted status has major implications which should not be ignored in the design of a development strategy, yet that is what ND does.

Fourth, and lastly, ND’s opposition to tariffs fits with its tacit opposition to government activism, as reflected in its stances on industrial policy and fiscal policy. ND’s antipathy to government activism tends to be framed in terms of government’s proclivity to economic “populism” (Bresser-Pereira, 2016, p. 339). The populism charge is a cousin of the Neoliberal charge of rent-seeking (Krueger, 1974), which in ND’s language could be labelled “tariff populism”13.

6.C. Keynesian and Neo-Kaleckian critiques

The third line of critique in Figure 4 is labelled Keynesian and Neo-Kaleckian critiques.

6.C.1. Keynesian critique: Export-led growth and fiscal austerity

The Keynesian critique concerns ND’s stance toward export led growth and budget deficits. As regards export-led growth, there are two distinct critiques regarding “beggar-thy-neighbor” concerns and balance of payments (bop) constraints.

To start with, ND is unambiguously pro export-led growth: “New Developmentalism favors an export-led growth strategy after the once-and-for-all depreciation required to move the value of the national currency from the current to the industrial equilibrium (…)” (Bresser-Pereira, 2016, p. 347).

At the industrial equilibrium rate (e 2 in Figure 1) the country will run an export surplus, which implies pursuit of export-led growth with a surplus. Since one country’s exports constitute another’s imports, that structure of growth raises the specter of “beggar-thy-neighbor” dynamics identified by Robinson (1947 [1937]) which can create a global deflationary dynamic. In a world of robust aggregate demand growth (1980-2000), the pursuit of export-led growth by a few countries was relatively unproblematic, at least at the macro level. In a world of deflationary aggregate demand shortage (2010-today), such a strategy is unlikely to work when pursued by many and also stands to amplify the deflationary forces unleashed by Neoliberal globalization.

The other Keynesian export critique rests on Thirlwall’s law (Thirlwall, 1979, 2019) which imposes a balance of payments constraint on a country’s steady state growth rate equal to the rate of growth of exports. The two export critiques are connected. If ND’s export-led strategy were pursued on a global scale, its beggar-thy-neighbor character could worsen the bop constraint on growth.

As regards budget deficits, the Keynesian critique is ND leans toward fiscal austerity. Though formally favoring counter-cyclical fiscal policy, that policy recommendation is hedged in ways that incline ND to fiscal austerity. Support for counter-cyclical policy is expressed as follows: “Fiscal deficits are recommended only when there is a clear insufficiency of demand making the expenditures counter-cyclical” (Bresser-Pereira, 2016, p. 345).

However, that endorsement of counter-cyclical policy is seriously hedged. First, the budget baseline is a primary surplus “which should be about 2.5 percent of GDP” (Bresser-Pereira, 2016, p. 340). Not only does that baseline impart an austerity bias, the bias is also amplified since interest payments on government debt disproportionately go to upper-income households which have a higher marginal propensity to save.

Second, there is a tacit disinclination to use counter-cyclical fiscal policy, reflected in the language of qualified endorsement of such counter-cyclical policy. That disinclination is driven by the charge of “fiscal populism” (Bresser-Pereira, 2016, p. 345), whereby proponents of larger deficits are accused of having “such a loose concept of insufficiency of demand that every economic condition fits in it and wrongly legitimizes expansionary policy” (Bresser-Pereira, 2016, p. 339).

That thinking leads Bresser-Pereira (2016, p. 340) to castigate the Dilma administration for loose fiscal policy in 2013 and 2014 when Brazil was still beset by stagnation triggered by the 2008 global financial crisis which caused the deepest recession and ended the commodity boom. Yet, far from being wrong, history is supportive of the Dilma administration’s budget deficits. Indeed, Keynesian critics (see for instance Serrano and Summa, 2015) argue the deficits were too small and outlays were also too focused on items with low aggregate demand impact.

ND’s antipathy to fiscal policy has its roots in ND’s Neoliberal proclivities. First, like Neoliberalism, there is an antipathy to the state which is reflected in disinclination to industrial policy and state sponsored industrial capital accumulation, omission of concern with infrastructure, antipathy to tariff policy, and charges of “economic populism”. Second, there is an echo of Neoliberal macroeconomics in ND’s view that the macroeconomic difficulties of progressive Latin American governments are due to unsound fiscal populism (Bresser-Pereira, 2016, p. 339), rather than their fiscal policy problems being due to Latin America’s structural challenges.

6.C.2. Neo-Kaleckian critique: Wage-led growth

The Neo-Kaleckian critique concerns ND’s antipathy to wage-led growth: “New Developmentalism rejects a wage-led strategy” (Bresser-Pereira, 2016, p. 347).

That antipathy is rooted in two elements of ND. The first is its support for export-led growth, which in turn justifies wage suppression to promote international competitiveness. The second is its view of investment and capital accumulation, which emphasizes the role of the profit rate but gives no place to more equal income distribution as a driver of capacity expansion.

From a Neo-Kaleckian standpoint, the neglect of wages and income distribution is misplaced and will lower growth if the economy is wage-led. Moreover, ND’s endorsement of export-led growth would worsen the problem by allowing the forces of globalization to add to wage suppression.

A major difficulty in discussing ND’s position on growth and distribution is that it is contradicted. On one hand, ND explicitly states growth is profit-led. On the other hand, it advocates an export tax in the commodity sector which is a form of redistribution away from profit to society. It also advocates a higher minimum wage in the economy at large as a way of addressing income distribution concerns (Bresser-Pereira, 2016, p. 348). Together, in a country like Brazil, those policies would be tantamount to wage-led growth policy. That points to ND’s confusion on the issue, which is related to the earlier observation regarding ND’s failure to analytically model the economy and make clear the basis of its recommendations.

Nor is ND’s profit-led rhetoric supported empirically. Empirical estimates suggest that Brazil’s demand regime is wage-led (Tomio, 2020). That conclusion also holds for most studies of industrialized economies, except for the US which some studies have reported to be profit-led14.

One possible way out of these contradictions is for ND to reject the Neo-Kaleckian growth model, with its construct of wage-led versus profit-led growth. Thus, Oreiro, da Silva, and Dávila Fernández (2020) adopt a super-multiplier perspective in which growth is determined by the rate of autonomous demand growth. However, that does not escape the inconsistencies of ND’s policy positions. First, income distribution is irrelevant for long run growth in the super-multiplier framework as it does not affect the growth of autonomous demand. That speaks for a more egalitarian distribution (i.e. higher wage share) for social welfare reasons, yet ND endorses profit-led growth. Second, growth of government spending is an important determinant of growth in the super-multiplier model (Freitas and Christianes, 2020) yet ND inclines toward fiscal austerity.

6.D. Fighting the last war critique

The fourth and final line of critique in Figure 4 is termed “Fighting the last war.” The argument is that ND’s approach to development fights the last war. What worked over the past forty years is unlikely to work in the future.

Over the last century industrialization has been the critical engine of development, and over the past forty years export-led growth has been successful in jump-starting that engine. However, the global economy may have entered the era of the twilight of industrialization as engine of development and the end of export-led growth. Of course, there is no knowing what is to come. The best that can be done is evidence-based inference, which is consistent with the historical-deductive method emphasized by ND “which generalizes from the observation of empirical regularities, not from axioms on rational behavior” (Bresser-Pereira, 2016, p. 341).

6.D.1. The end of export-led growth

During the Neoliberal era, successful developing countries (exemplified by the East and Southeast Asia region) adopted outward oriented export-led strategies supported by industrial policy. ND proposes taking the export-led aspect of that approach and adjusting it to address the problem of Dutch disease.

Even assuming ND’s diagnosis of Dutch disease and its remedy of commodity export taxes are correct (which was questioned earlier in section 6.A.), it is possible that the end of export-led growth has arrived (Palley, 2012). The argument is China’s entry into the global economy has undone the export-led growth strategy. That strategy had early starters move up the ladder of industrialization, opening a rung at the bottom for newcomers. China’s immense population effectively puts an end to that strategy by crowding-out the possibility for other large economies to repeat the experience. Though a few well-placed small countries may gain a niche at the bottom, most will not be able to do so. Moreover, as China moves up the ladder, its immense size means it will occupy many rungs (from bottom through middle to top), thereby crowding out space for middle-income countries seeking an export-led strategy at a slightly higher level of product sophistication.

Lastly, after forty years of the Neoliberal experiment, the global economy is burdened by debt and short of demand. That macroeconomic condition also works against an outward focused export-led development strategy.

6.D.2. Twilight of industrialization

The second emergent development is the twilight of industrialization. Historically, industrialization has been associated with higher per capita GDP, and the development of a modern industrial sector is ND’s holy grail. However, more recently, there is little evidence that growth is faster in countries with larger industrial sectors, measured as a share of GDP. Moreover, for at least the last three decades, the trend in industrialized countries has been de-industrialization, measured as a share of employment (Rowthorn and Ramaswamy, 1997)15. Those empirical facts cast doubt on ND’s framing of the development solution in terms of industrialization.

The acceleration of technological progress in manufacturing, through application of intelligent robots (artificial intelligence combined with automation), implies manufacturing is unlikely to generate the proportionate quantity of well-paid jobs it historically did. Instead, the growing sectors look to be healthcare, elderly care, the creative economy (entertainment), media and information services, tourism and travel, and computing and information technology. The latter will also be especially important for intelligently automated manufacturing. In such a world, the role of the state will be critical for ensuring investment in human capital and widespread access to opportunity. Furthermore, the destructive challenge posed by climate change will also likely require state activism, in the form of infrastructure investment and regulation, to reduce climate consumption and mitigate climate damage.

Those activities (i.e. investments in human capital, healthcare infrastructure, general infrastructure, and climate damage mitigation) will require hugely enlarged government budgets. They speak to CD’s conception of government and development as transformation, rather than ND’s conception.

7. CONCLUSION: A THIRD WAY ANALYSIS

This paper has critically assessed the economics of ND. It began by identifying and formalizing the principal components of ND which are identified as neutralizing Dutch disease, ending growth with foreign saving, development driven by a technologically advanced and internationally competitive manufacturing private sector, and getting macroeconomic prices right. It then examined four strands of critique consisting of internal economic logic critiques, CD critiques, Keynesian and Neo-Kaleckian critiques, and the fighting the last war critique. The analysis shows those critiques are substantive.

ND claims to be a new paradigm in development economics, especially suited for “the understanding of middle-income countries” (Bresser-Pereira, 2016, p. 333 and 2020). In this author’s view, it is better understood as a Third Way analysis that rhetorically blends heterodoxy and Neoliberalism. The Neoliberalism is evident in ND’s inclination for export-led growth, antipathy to tariff-led import-substitution, inclination for fiscal austerity, apprehensions about government economic activism, antipathy to wage-led growth, and preference for private sector-led industrialization rather than state-led industrialization. The heterodox is evident in its endorsement of Keynesian macroeconomics and recognition of need for government intervention in the development process. That said, deeper excavation of ND reveals a significant walking back of support for government intervention.

As for analytical novelty, ND’s principal contribution is the claim that Dutch disease is a major impediment to development, accompanied by a proposal to tax commodity exports as a way of remedying the Dutch disease problem. If that claim does not hold up, ND reduces to a strain of export-led growth based on an undervalued RER.

nueva página del texto (beta)

nueva página del texto (beta)