Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Contaduría y administración

versão impressa ISSN 0186-1042

Contad. Adm vol.64 no.1 Ciudad de México Jan./Mar. 2019

https://doi.org/10.22201/fca.24488410e.2018.1288

Articles

Foreign direct investment, economic opening and economic growth in Latin American

1Universidad Popular Autónoma del Estado de Puebla, México.

The models of endogenous growth consider the Degree of Economic Openness (DEO) and the Foreign Direct Investment (FDI) as fundamental determinants of the economic growth. The objective of this article is to evaluate the impact of the DEO and FDI variables on the economic growth for eighteen Latin American countries during the period 1996-2014. Through the estimation of an Autoregressive Vectors model with panel data, the results show a dynamic relation among the three variables only for the total sample of countries and the high growth countries, but not for the low and median growth countries. We got short and long run opposite effects of the DEO on the economic growth, positive for the total sample of countries and negative for the high growth countries; while negative effects of the FDI on the growth so much for the total sample as for the high growth countries.

Keywords: Foreign direct investment; Degree of economic opening; Economic growth; Latin America; Autoregressive vectors

JEL codes: F21; F23; F29

Los modelos de crecimiento endógeno consideran al Grado de Apertura Económica (GAE) y a la Inversión Extranjera Directa (IED) como determinantes fundamentales del crecimiento económico. El objetivo de este artículo es evaluar el impacto de las variables GAE e IED sobre el crecimiento económico para dieciocho países de América Latina durante el período 1996-2014. A través de la estimación de un modelo de Vectores Autoregresivos con datos panel, los resultados muestran una relación dinámica entre las tres variables para la muestra total de países y para los países con nivel de crecimiento alto, pero no para los países con crecimiento bajo y medio. Obtuvimos efectos opuestos de corto y largo plazo de la apertura económica sobre el crecimiento económico, positivos para la muestra completa y negativos para los países con alto crecimiento; mientras que efectos negativos de la IED sobre el crecimiento tanto para la muestra completa como para los países con más alto crecimiento.

Palabras clave: Inversión extranjera directa; Grado de apertura económica; Crecimiento económico; Latinoamérica; Vectores auto regresivos

Códigos JEL: F21; F23; F29

Introduction

The theoretical and empirical relation between foreign direct investment (FDI) and economic openness with economic growth has been approached from different perspectives. Under the neoclassical approach and based on the Solow model (1956), it is stated that economic growth is determined by the accumulation of production factors and the increase in productivity of these through technology, that FDI and economic openness do not affect long-term economic growth because they imply markets of perfect competition, decreasing marginal productivity of physical capital and constant returns to scale, but only affect capital stock temporarily, with exogenous factors such as technology and labor being the only ways to affect long-term economic growth (Álvarez, Barraza and Legato, 2009).

For its part, the theory of endogenous growth, whose main authors are Romer (1986) and Lucas (1988), proposes an alternative analytical framework to the neoclassical model to explain sustained growth, which is apparently supported by productivity increases in some Asian regions, for which it includes new determinants of growth within the production function, such as human capital, technology and economic openness; claiming that the sustained growth of per capita income depends rather on the economic and technological conditions of the productive apparatus of the countries, made up of entrepreneurs and workers, which are endogenous elements of the production function. (Rendón Obando and Ramírez Franco, 2017).

This work aims to analyze the relationship between the variables Foreign Direct Investment, Degree of Trade Openness, and Economic Growth based on endogenous growth models, in which Foreign Direct Investment (FDI) and Trade Openness are considered fundamental determinants of growth. For this, a set of eighteen Latin American countries were taken into consideration during the period of 1996-2014, which are previously classified in tertiles according to their level of economic growth, be it high, medium or low.

The results found show a dynamic relationship only for the total sample and for countries with high growth, but not for countries with low and medium growth. Regarding the relation between Economic Openness and Growth, we observe ambiguous results given that for the entire sample we find a positive response of GDP growth to shocks coming from economic openness, in a similar way as in the studies of Balassa (1978); Sachs, J. D., et al. (1995); Levine and Renelt (1992); Irwin and Tervio (2002) and Emery (1967), although this relationship is weak. However, for countries with high economic growth, we find a negative response to the dynamics of the GDP growth in the face of economic openness shocks, results similar to those found in the studies of Rodríguez and Rodrik (1999), Rodrick (1998), Walde and Wood (20049, although our results are valid for up to 10 years.

Regarding the relation between FDI and Growth, we observe that for the entire sample, shocks from FDI have a negative and significant impact on the dynamics of GDP growth for a little over three years before dissipating, which is more clearly confirmed in the case of Latin American countries with higher economic growth. This is similar to the studies by Nunnenkamp and Spatz (2003) for the case of FDI from the United States to Latin America, Africa, and Asia regions, as well as in the studies by Luiz R. de Mello, Jr. (1994) and Auxiliadora López and Aníbal Osorto (2016) for other cases. These results differ from those found in the studies of Rendón Obando and Ramírez Franco (2017), Álvarez, Barraza and Legato (2009) and Ruxanda and Muraru (2010), who found a positive impact of FDI on growth. This could be explained by the negative effect of FDI on Domestic Investment found in this paper, meaning that there is a shift in FDI on Domestic Investment.

Another of the contributions of the work is the first-time use of a novel econometric methodology to analyze the relationships between the variables mentioned, which is the estimation of a dynamic panel using the Vector Autoregression approach with panel data. This allows the temporal and transversal dimensions of the variables to be analyzed and overcomes the limitations of the standard panel data methodology by providing information about the dynamics of each variable with impulses from the others, the persistence of each shock, and the variance of the processes. It also contributes to the literature concerning the relation between FDI and Trade Openness and economic growth by including only developing countries in the study, while most existing work mixes countries from different continents, which can help reduce the bias of including rich and poor countries.

It also contributes to the possible design of some FDI attraction policy as the dynamic panel estimate shows positive effects of economic growth towards FDI for both the entire sample of countries and for high-growth countries, meaning that a dynamic economy can attract FDI. It also suggests the design of a policy for high-growth countries that will reduce the possible displacement of domestic investment by FDI and which will instead complement both types of investment.

This work is organized as follows: after the introduction, a brief review of the literature is presented in the second section; the third section presents the econometric model and the estimation strategy; the fourth section expose the data used and shows the estimates, the analysis of the impulse-response functions, and the analysis of variance; finally, the last section presents the main findings and implications.

Review of the literature

Theory on the relation between economic growth and FDI and between economic growth and trade openness

The review of the theoretical literature indicates that the dominant theory in current studies on the relationship between FDI and Economic Growth on the one hand, and Economic Openness and Economic Growth on the other, is the endogenous growth theory. This theory supports a series of models that highlight the relevance of the first two variables in the objective of achieving stable and sustainable economic growth levels. In addition to emphasizing the importance of introducing FDI flows into the production function, the theory also argues that this has an indirect positive effect on economic growth (Romer, 1986; Lucas, 1988), while endogenous models that consider it relevant to include trade-related variables-such as the degree of openness, real exchange rate, tariffs and evolution of exports-state that more open economies achieve higher and more stable growth rates than closed economies (Balasa, 1978; Edwards, 1998). For endogenous growth models, FDI not only involves financial transactions by the direct investor to obtain a lasting stake in a host country resident company, but it is also seen as a direct gateway to technology, new production techniques, and more advanced management practices employed abroad. However, access to inventions and new designs is not the same for all countries, as some countries have the capacity to innovate and produce their own technology, while others, mainly developing countries, must benefit from the technology produced elsewhere, so that developing countries can additionally grow at higher rates than developed countries, a process known as “technological catch-up”. That said, technology diffusion can take place through different options, such as the transfer of ideas and new technologies, the import of high-tech products, the adoption of foreign technologies, and the training of human capital abroad (Elías, Fernández and Ferrari, 2006).

In the context of endogenous growth theory, FDI can positively affect the growth rate of a country in an endogenous manner if diminishing returns to production are obtained through spillover effects or externalities, thereby generating long-term economic growth. Various authors, such as Borensztein, De Gregorio and Lee (1998), agree that the influence of FDI on the growth rate of real GDP per capita is exercised, especially through the accumulation of capital and the transfer of knowledge. In addition, Romer (1993) indicates that increased FDI inflows can contribute to accelerating economic growth in developing countries through foreign exchange inflows.

The hypotheses that explain the relation between foreign trade and economic growth can be classified according to the three schools of economic thought: mercantilist, classical, and Keynesian. The advantages of trade are the basis for the analysis of the former; the neoclassical ones are recognized by the deepening and consolidation of the foundations of this theory; while Keynesians affirm that the advantages of trade occur when the comparative advantages of one country over another are added to an effective demand through population growth followed by employment growth (Rendón Obando and Ramírez Franco (2017).

The classical theory on foreign trade is based on the essay “On Foreign Trade” by (David Hume, 1752), followed by (Adam Smith, 1776, 1983), (David Ricardo, 1817), (Mill, 1848) and Malthus (1798), departing from the assumptions of both the mercantilists and David Hume and contributing with four great concepts that define international trade theory: the absolute advantage by Adam Smith1, the comparative advantage by David Ricardo2, the theory of reciprocal demand or the theory of international values by J. S. Mill3, and theory of effective demand by Malthus4.

For his part, in his work “The General Theory of Employment, Interest and Money”, Keynes assures that the classics only represent an extreme case among all the positions of equilibrium. From the discussion between the adherents to the classical theory and to the Keynesian theory, Neoclassicals emerge as derivatives of the former, whereas three major groups emerge from the latter: the Post-Keynesians, the Neo-Keynesians, and the New Keynesian Economy.

Neoclassicals evaluate the classical approaches following the value-utility theory, measuring the value of goods by their utility and not by the work they entail; to the work, the only factor included in the orthodox production function, they add the capital factor; they change constant productivity assumption of the labor factors to that of decreasing marginal productivity, keeping the quantity of one of the two factors constant and summarizing their contribution to international trade theory through the Hecksher-Ohlin-Samuelson model, also known as the H-O-S model (Rendón Obando and Ramírez Franco, 2017).

For their part, Neo-Keynesians (1950-1980), Post-Keynesians (1950-2000), and the New Keynesian Economy (NKE) (1980-2000) defined the Keynesian postulates regarding foreign trade. The Neo-Keynesians (1950-1980), also known as the Neoclassical Synthesis, integrated Keynesian ideas with neoclassical ideas in the IS-LM model (Hicks, 1937; Hansen, 1949), which combined the goods and services markets (IS curve) and the money market (LM curve) for a closed economy, which extended to the analysis of an open economy through Mundell-Fleming (1964). Post-Keynesians base their approach on the work of Kaldor (1966), which states that economic growth is determined by the growth of net exports, this translates foreign trade into an explanatory factor for economic growth.

For its part, the NKE is inserted in the theoretical model of endogenous growth and, in this sense, we can find works that relate economic growth with the technological diffusion that occurs through the international relation between economies (Rendón Obando and Ramírez Franco, 2017).

Empirical evidence of the relation between economic growth and FDI and between economic growth and economic openness

The vast majority of empirical studies on the impact of FDI (defined as an endogenous variable) on economic growth have found positive results, as is the case presented by Rendón Obando and Ramírez Franco (2017) for nine Latin American countries; Álvarez, Barraza and Legato (2009) for 14 Latin American countries; and Ruxanda and Muraru (2010) for Romania. However, many other authors subordinate the impact of FDI on economic growth to the combination of this impact with the existence of other factors. For example, Blomstorn, Lipsey and Zejan (1992) find that FDI impacts the GDP growth rate of higher income countries, but not of lower income countries; and Borensztein, De Gregorio and Lee (1998) argue that the FDI that flows from industrialized countries to developing countries contributes to economic growth in the latter, only when sufficient absorptive capacity is available in the host country through a minimum stock of human capital.

For a sample of 32 OECD and non-OECD countries, De Mello (1999) finds that FDI influences economic growth in the host country depending on the degree of complementarity and substitutability between FDI and domestic investment. Mottaleb (2007), for the case of 60 low- and middle-income countries, finds it necessary for host countries to maintain a friendly business environment, as well as abundant and modern infrastructure, to attract FDI and positively affect growth. Apergis, Lyroudi and Vamvakidis (2008) find positive influence of FDI on the growth of 27 transition economies, at least for those with high incomes that have implemented successful privatization programs. And Chaowdhury and Mavrotas (2005) find causality of GDP to FDI in the case of Chile, but bidirectional causality for Malaysia and Thailand. It is important to mention the result obtained by Nunnenkamp and Spatz (2003), who highlight the presence of the “crowding out” effect in the case of FDI from the United States to regions of Latin America, Africa and Asia, so that instead of promoting economic growth in developing countries, they stimulate the opposite.

It should be noted that the main methods of estimating these relations have been Dynamic Panel, Cross Section, Cointegration of Time Series, and Panel Data and Simultaneous Equations, among others.

Also defined as an endogenous variable on economic growth, trade openness, in most studies, also shows a positive impact on economic growth. A few examples can be found in Balassa (1978) for 11 countries that already have an industrial base; Sachs, J. D., et al. (1995) for countries in Africa, Asia and the Americas, Levine and Renelt (1992) for a sample of 119 countries worldwide, or Irwin and Tervio (2002) for 154 countries and Emery (1967). However, when controlled by other factors, the positive influence is clearer as shown by Edwards (1997) for a group of 93 countries; or Frankel and Romer (1999) for two samples-one of 150 countries and the other of 98-, who advocate for geographical characteristics; or the existence of long processes of structural change and economic development (Yaghmanian and Ghorashi, 1995); by Barro (1994) for a panel of almost 100 countries in Africa, Latin America, East Asia and Europe; Rodrick (2002), who mentions the need to maintain a government of laws, free markets, small government consumption, and high stock of human capital for such an impact to occur; or Ben David (1993), who points out the importance of the opportunity of trade reform. There are also studies such as that of Walde and Wood (2004), who consider it not very evident that tariff reductions increase economic growth, and even authors such as Rodríguez and Rodrik (1999), who find a negative impact of tariff reduction on economic growth, or Hallak and Levinsohn (2004), who question the linear econometric specifications used by other authors. It should be noted that critics of the impact of trade openness on growth are critical of new alternative theoretical models such as the neo-institutionalist and the models of the New Trade Theory (NTT), which postulate the use of additional variables-such as institutional and geographic variables-to correct problems in previous works, like the omission of variables, which could have produced biased results (Rendón Obando and Ramírez Francio, 2016).

Among the main estimation techniques used in the works that study the impact of economic openness on economic growth are: cross-section, logit model, data panel, instrumental variables, two-stage minimum squares, and simultaneous equations, among others. Within the variables that measure economic openness in these studies are exports, indices of trade openness or trade policy built for the purpose, volume of trade divided by GDP, export growth, institutional variables such as the existence of a government of laws, geographical variables, tariff reduction, and non-tariff barriers, among others.

Dynamic Panel Data: VAR model

To examine the interrelation between Foreign Direct Investment, Economic Openness and Growth of the countries in our sample we used a dynamic model for panel data. In particular, we employ the Panel Vector Autoregression approach, based on the proposal by Holtz-Eakin, et al. (1988). This econometric model allows analyzing the temporal and transversal dimension of the variables, overcoming some of the limitations of the standard panel data methodology by providing information about the response of each variable to impulses coming from the others, as well as the persistence of each shock, among other relevant characteristics on the variance of the processes.

The estimation of the panel data VAR makes it possible to measure the unobserved heterogeneity of the variables among the different countries and their joint characteristics. Equation (1) below shows the proposed VAR with panel data in our study:

Where the vector of endogenous variables zi,t-j includes four variables: the annual growth of GDP, foreign direct investment, domestic investment as a proportion of the GDP, and exports, according to the analysis of the above section. Each variable records the information of each country i and the impact of the lags t-j with j= [0, ..., k] on the contemporary value of each variable in zi,t. The marginal impacts γij are comprised in Гj for each lag j>=1. We recognize that the temporal and transverse dynamics of each country are different and have a specific origin, which is why the heterogeneity of each country is modeled including fiy, and dt is included to capture temporal heterogeneity.

It is evident that the proposed VAR specification reveals a correlation between the fixed effects and the explanatory variables, in particular with the lags of each variable contained in zi,t-j. This violation of the independence assumption is usually corrected by differentiation. However, in the case of panel data VAR, such differentiation would induce bias in the estimated parameters. To avoid this problem and ensure the orthogonality between the fixed effects and the lags of the variables in our econometric exercise, we used the advanced differentiation with respect to the mean, known as the Helmert, Arellano and Bover procedure (1995) 5.

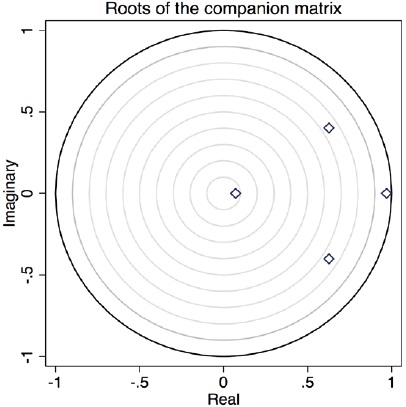

We verify that the panel data VAR model complies with the assumptions: E (ei,t )=0 and E(ei,e’i,t)=Wi. The panel data VAR is estimated using the Generalized Method of Moments (GMM) and employs the routine developed by Inessa Love6,7 The number of lags in the panel data VAR is decided based on the determination coefficient, Hansen J statistic and the Bayes and Akaike selection criteria developed by Andrews and Lu (2001), namely MBIC, MAIC and MQIC, respectively (Table A.1 in the annex shows these criteria). It is verified whether the eigenvalues are within the unitary circle so that we can rely on the stability of the estimates (see also Graph A.1 in the Annex).

The use of this method lies-among other instruments-on the possibility of examining the Impulse Response Function (IRF) and the variance analysis, which does not allow standardizing the methodology of the panel data. The identification of the model uses Cholesky decomposition.

Exploratory analysis of the data and results

The data used in this study come from the World Bank and the International Monetary Fund (IMF) for the period of 1996-2015, mainly based on the availability of information, corresponding to the 18 selected Latin American nations: Brazil, Mexico, Chile, Colombia, Argentina, Peru, Panama, Venezuela, Costa Rica, Dominican Republic, Uruguay, Honduras, Guatemala, Ecuador, Salvador, Bolivia, Paraguay and Nicaragua. A strongly balanced panel was formed with these data, comprised of 342 observations for the following variables: Annual Economic Growth of the countries; Foreign Direct Investment (FDI), measured as a percentage of Gross Domestic Product (GDP); Domestic Investment (DI), measured as a percentage of GDP; and Trade Openness, measured by the logarithm of the sum of the exports and imports of the countries, expressed in millions of dollars. Previously, Latin American countries were classified according to their level of annual economic growth in tertiles, in nations with low, medium, and high levels of growth.

Descriptive Statistic

Table 1 shows the descriptive statistics of the variables Degree of Economic Openness (DEO), Foreign Direct Investment (FDI) and Economic Growth, to which Domestic Investment was added, which is also an endogenous growth variable.

Table 1 Descriptive statistic of the variables.

| Municipalities | μa | Xb | σc | Min.d | Máx.e | Sf | Kg | Nh | ρi |

|---|---|---|---|---|---|---|---|---|---|

| The entire sample (n=342) | |||||||||

| Annual GDP growth | 0.005 | 0.02 | 0.147 | -0.77 | 0.48 | -1.27 | 8.5 | 324 | 1.00 |

| Foreign Direct Investment (GDP %) | 7.68 | 7.45 | 1.63 | 2.32 | 11.46 | 0.13 | 2.67 | 333 | 0.12 |

| Domestic Investment (GDP %) | 2.99 | 2.99 | 0.213 | 2.45 | 3.76 | 0.23 | 3.54 | 303 | 0.17 |

| Log. (Exports plus Imports) (millones de dólares) | 10.49 | 10.19 | 1.21 | 8.28 | 13.58 | 0.55 | 2.70 | 342 | -0.08 |

| Grupo A: países con nivel bajo de crecimiento económico | |||||||||

| Annual GDP growth | -0.134 | -0.08 | 0.144 | -0.77 | -0.03 | -2.24 | 8.24 | 0.9 | 1.00 |

| Foreign Direct Investment (GDF %) | 7.81 | 7.44 | 1.638 | 3.93 | 11.25 | 0.307 | 2.41 | 0.5 | 0.10 |

| Domestic Investment (GDP %) | 2.95 | 2.96 | 0.199 | 2.48 | 3.39 | -0.201 | 2.72 | 91 | 0.36 |

| Log. (Exports plus Imports) (millones de dólares) | 10.47 | 10.17 | 1.28 | 8.28 | 13.54 | 0.349 | 2.37 | 109 | 0.03 |

| Grupo B: Países con nivel medio de crecimiento económico. | |||||||||

| Annual GDP growth | 0.017* | 0.02 | 0.209 | -0.02 | 0.05 | -0.04 | 1.92 | 113 | 1.00 |

| Foreign Direct Investment (GDF %) | 7.17* | 6.93 | 1.616 | 2.32 | 11.04 | 0.32 | 3.47 | 109 | -0.01 |

| Domestic Investment (GDP %) | 2.97 | 3.00 | 0.217 | 2.45 | 3.51 | -0.03 | 2.40 | 101 | -0.11 |

| Log. (Exports plus Imports) (millones de dólares) | 10.12* | 9.81 | 1.185 | 8.31 | 13.58 | 1.24 | 4.26 | 113 | 0.03 |

| Grupo C: Países con nivel alto de crecimiento económico. | |||||||||

| Annual GDP growth | 0.14* | 0.11 | 0.083 | 0.06 | 0.48 | 1.77 | 6.46 | 102 | 1.00 |

| Foreign Direct Investment (GDF %) | 8.07 | 8.07 | 1.53 | 4.16 | 11.46 | -0.16 | 2.61 | 102 | 0.07 |

| Domestic Investment (GDP %) | 3.05* | 3.03 | 0.206 | 2.64 | 3.76 | 0.98 | 4.86 | 95 | -0.23 |

| Log. (Exports plus Imports) (millones de dólares) | 10.94* | 10.86 | 1.05 | 9.18 | 13.58 | 0.47 | 2.45 | 102 | 0.16 |

a μ=arithmetic mean; b X=median; c σ=standard deviation; d Min=minimum; e Max=Maximum; f S=bias; g K=Kurtosis; h N=number of observations, comprised by n countries and T time, i =correlation coefficient between the economic growth rate and each of the remaining variables, all significant values at 95%; *Hypothesis test on the difference of means between the values of the countries with a low economic growth against those countries with medium economic growth and the countries with high economic growth. Significant difference at 99%.

Source: Own elaboration with data from the World Bank (2016) and the International Monetary Fund (2016).

It is also observed that, as a result of a test of differences between means, the countries with the highest growth are not the ones that receive the most FDI and have the highest DEO, but rather the countries with the average level of economic growth receive on average less FDI, measured as a percentage of GDP, and maintain a lower level of economic openness, measured as the sum of exports and imports, than the countries with the lowest level of economic growth. Meanwhile, the countries with the highest level of economic growth receive on average a higher level of domestic investment and maintain a higher level of economic openness than the countries with the lowest level of economic growth. In other words, countries with higher levels of economic growth do not always receive higher levels of FDI.

In the case of economic openness, only for countries with high levels of economic growth is it true that a higher rate of economic growth is related to a higher degree of economic openness, measured by the sum of exports and imports, given that countries with a medium level of economic growth maintain a lower level of openness than countries with low levels of economic growth.

On the other hand, when looking at the last column of Table 1 we find that only for countries with low and high levels of GDP growth can the positive correlation between economic growth, FDI and DEO be met, given that for the total sample and for countries with average levels of GDP growth this relation is not met, as only FDI is positively correlated with economic growth, but that is not the case for economic openness, which has a negative correlation with growth. Meanwhile, for countries with average economic growth only economic openness is positively related to economic growth, as FDI is negatively related to economic growth, with the latter likely to have a displacement effect.

Table 1 shows that endogenous growth models do not meet the requirements of the positive effect of FDI and DEO on economic growth, but rather that the impact of the FDI and DEO variables on economic growth is ambiguous. Furthermore, we cannot establish any causal relationship between these variables and we have no idea if the effects between the variables are persistent and for how long. So, it is necessary to integrate the dynamic interaction of economic growth, FDI, trade openness, and domestic investment, which is done in the following section through the estimation of the panel data VAR presented in the previous section to allows us to model, among other things, the causal relationships between the variables, the persistence and strength of the relationships, among others.

Results

The main objective of this study is to determine the relationship between Foreign Direct Investment (FDI), Trade Openness, and Economic Growth in 19 Latin American countries from 1996 to 2015. According to the evidence provided in applications of endogenous growth models, we expect that FDI and Trade Openness will positively impact the economic growth of countries (Romer,1993; Lucas, 1988; Borensztein, De Gregorio and Lee, 1998; Balasa, 1978; Lorenzi, 2016.

Due to the fact that we also include domestic investment as an endogenous variable in this model, we provide additional evidence to prove the existence of displacement effects between foreign direct investment and domestic investment. In this sense, the literature on this relationship is inconclusive, as seen in Nunnemkamp and Spatz (2003), Luiz R. de Mello, Jr. (1994), and Auxiliadora López and Aníbal Osorto (2016), thus the present study also contributes by providing evidence on the subject.

Table 1 below shows the estimated parameters of the first order panel data VAR using the Generalized Method of Moments. Four versions of the model (1) were estimated, which correspond to the case with the complete sample of countries in the first column (a) and the cases that distinguish the economic development of the countries in tertiles of growth-columns (b), (c) and (d), respectively. The table contains three panels that show the dynamic impact of the lags of each variable on itself and on other variables.8

All three cases show some statistically significant dynamic relationships that can be better explained in terms of impulse response functions (IRF). Graph 1 shows the IRFs for the whole sample (case a), while Graph 2 shows the IRFs for the case of Highly Developed countries. The dynamic relation between our study variables does not seem to respond in economies with low or medium levels of development, i.e., the IRFs do not show statistically significant effects in these two cases. However, we do find IRFs with statistically significant effects for the case of economies with high economic development.

Autoreplies

The dynamic impact of each variable on itself is shown in each case on the diagonal of the graph. Shocks from the Economic Openings have persistent positive effects on the long-term behavior of this variable, whose response is non-zero even after 10 years (see first diagonal graph). For their part, Foreign Direct Investment (FDI), Domestic Investment (DomInv), and GDP growth (gpib) respond positively to shocks that originate from each other, although in shorter periods of time-three years at most (see Graphs 2, 3, and 4 on the diagonal). Of these, the most sensitive, although slightly less persistent, is FDI. The behavior of self-responses is similar when analyzing the case of countries with high levels of development.

Dynamic openness of growth

The last column of graphs shows, in the first line, a positive response of the GDP growth to shocks from the opening equation of Latin American economies. This response is weak but significant at 90%. Conversely, shocks from the GDP Growth equation also have a positive impact on economic openness (level of exports plus imports) in Latin America in the short term.

Interestingly, for Latin American economies with High Economic Development, the response of GDP growth to shocks from the export plus imports equation (openness), although small, is negative and statistically significant in the short- and long-term (see Figures in Graph 2). Although the effect gradually diminishes, the response of GDP growth in this sub-sample of developed economies remains negative for up to 10 years. These results contrast with what the literature finds (Balasa, 1978; Edwards, 1997; Frankel and Romer, 1999; Irwin and Tervio, 2002). However, some authors such as Rodríguez and Rodrik (1999), Rodrik (1998) and Walde and Wood (2004), do find a negative impact of openness on GDP growth in the more developed economies.

In contrast, for these High Growth economies, the response of economic openness to shocks from GDP growth is positive and persists for more than six years before dissipating. This result, along with what was reported in the previous paragraph, suggests that the growth of the export sector can be effectively promoted through policies to stimulate domestic development, particularly in the case of highly developed economies. This result has also been suggested by Sachs and Warner (1995) for different French and English colonies and independent countries, and by Rodríguez and Rodrik (1999) for other cases.

Table 2 Dynamic Relations of Foreign Direct Investment, Domestic Investment, Economic Openness, and Economic Growth.a

| Entire Sample (a) | Low development (b) | Medium development (c) | High development (d) | |||||

|---|---|---|---|---|---|---|---|---|

| γij | Std. errorb | γij | Std. errorb | γij | Std. errorb | γij | Std. errorb | |

| Economic growth | ||||||||

| Growtht-1 | 004152 | 0.0793 | 0.5279 | 0.1323 | -0.2327 | 0.022 | 0.0669 | 0.0361 |

| FDIt-1 | -0.0261 | 0.0169 | -0.0472 | 0.0209 | -0.0019 | 0.0026 | -0.1564 | 0.0144 |

| DomInvt-1 | -0.3137 | 0.1522 | 0.2129 | 0.0939 | 0.0507 | 0.0294 | 0.2913 | 0.0802 |

| ExportImportt-1 | 0.0621 | 0.0289 | 0.3966 | 0.0468 | -0.0051 | 0.0053 | -0.2093 | 0.0161 |

| Foreign Direct Investment (FDI) | ||||||||

| Growtht-1 | 1.5783 | 0.3751 | -0.9857 | 0.3206 | 14.9512 | 1.1718 | 0.8704 | 0.1513 |

| FDIt-1 | 0.1381 | 0.1056 | 0.4546 | 0.073 | 0.6847 | 0.1536 | 0.166 | 0.0642 |

| DomInvt-1 | 1.7672 | 0.6285 | 2.6945 | 0.5346 | -0.0577 | 0.7964 | 1.2981 | 0.2452 |

| ExportImportt-1 | 0.0799 | 0.1359 | 0.601 | 0.1545 | -1.2131 | 0.2357 | -0.151 | 0.051 |

| Domestic Investment (DomInv) | ||||||||

| Growtht-1 | 0.5853 | 0.1328 | 0.0549 | 0.1347 | 2.7295 | 0.2064 | 0.2087 | 0.0344 |

| FDIt-1 | 0.0221 | 0.0202 | 0.2219 | 0.0301 | 0.0835 | 0.0244 | -0.0241 | 0.0081 |

| DomInvt-1 | 0.6859 | 0.1436 | 0.274 | 0.128 | 1.6562 | 0.1471 | 0.6613 | 0.0515 |

| ExportImportt-1 | 0.0273 | 0.0306 | 0.2858 | 0.0464 | -0.2621 | 0.0484 | 0.0401 | 0.0127 |

| Exports and Imports (ExportImport) | ||||||||

| Growtht-1 | 0.2917 | 0.0884 | 0.519 | 0.1405 | -0.4936 | 0.04339 | 0.0295 | 0.0407 |

| FDIt-1 | -0.03 | 0.0193 | -0.1104 | 0.0214 | -0.0332 | 0.0071 | -0.086 | 0.0106 |

| DomInvt-1 | -0.5158 | 0.1728 | 0.2069 | 0.123 | -0.0274 | 0.0737 | -0.1675 | 0.0787 |

| ExportImportt-1 | 1.0554 | 0.0322 | 1.3426 | 0.0459 | 0.9649 | 0.0233 | 0.7901 | 0.0204 |

a*,**, *** indicates significance at levels of 1%, 5%, and 10%. Panel VAR estimations through the Generalized Me thod of Moments (GMM). Variables transformed through the Helmert Method of Arellano and Bover (1995). Models identified according to Hansen J Statistic. b Standard errors adjusted for heteroscedasticity for each group (a-d)

Source: Own elaboration with data from the World Bank (2016) and the International Monetary Fund (2016).

FDI and growth dynamics

In its third line, the last column of graphs also shows the impact of shocks from the FDI equation on the dynamics of economic growth in Latin American countries. Graph 1 shows the estimates for the entire sample and shows that shocks from FDI have a negative and significant impact on GDP growth for just over three years before dissipating. The last graph in the third column shows that shocks from the GDP growth equation have a positive impact on foreign direct investment: a dynamic economy can attract FDI.

In turn, examining the case of Latin American economies with high growth dynamics confirms more clearly that FDI shocks have adverse effects on GDP growth dynamics, while GDP growth shocks have favorable effects on FDI attraction. These results are compared with those reported by Nunnenkamp and Spatz (2003), who find that the impact of US FDI on growth in countries in Africa, Latin America, and Asia is positive but negligible and still negative, as with the studies by Luiz R. de Mello, Jr. (1994) and Auxiliadora López and Aníbal Osorto (2016), who found the same for other cases.

Can FDI displace Domestic Investment?

Interestingly, in general, for the entire sample of Latin American countries-as with FDI-shocks from domestic investment have a negative impact on the growth dynamics of the DP, although the effect is small, barely significant, and reverses in the short term (see the second and third figures in Graph 1). Conversely, for the sub-sample of high developing countries, domestic investment has a positive and significant impact on GDP growth dynamics, while FDI shocks negatively affect GDP growth dynamics (see the second and third figures in Graph 2).

The differentiated effect of domestic investment and FDI on GDP dynamics could be caused by the displacement effects of FDI on domestic investment and vice versa. Our panel data VAR allows us to examine this possibility. The third figure in the second column of graphs shows that, for the entire sample of Latin American countries, shocks from the FDI equation positively impact domestic investment for a couple of years. In other words, the possibility of FDI strengthens domestic investment in Latin American economies. Similarly, domestic investment shocks foster FDI dynamics, albeit for a shorter period of time. This means that for the sample of all countries, we found no evidence to indicate the existence of a displacement effect of FDI on domestic investment or vice versa.

However, if we concentrate on the case of Latin American economies with High Development (see Graph 2, third figure in the second column of graphs), we observe a shift in FDI on domestic investment: shocks from the FDI equation have a negative impact on the temporal dynamics of domestic investment that can extend-according to the response of the domestic investment variable (DomInv)-for more than 5 years. It is perhaps through this means that the negative impact of FDI shocks on the growth dynamics of highly developed Latin American economies is based. In other words, foreign direct investment shocks that negatively impact GDP growth over time may be due to the displacement of FDI on domestic investment.

Variance decomposition

Table 3 presents the percentage change in GDP growth explained by the shocks from the equations of FDI, DomInv, and Openness accumulated in s=10 years for the four cases of analysis: full sample, and low, medium, and high developing countries. We focus on the case expose of the entire sample and the high developing countries.

Table 3 Growth, FDI, and Domestic Investment: variance decomposition (%).*

| Growth | FDI | DomInv | Openness | |

|---|---|---|---|---|

| Entire Sample | ||||

| Growth | 0.7977 | 0.0556 | 0.1419 | 0.0048 |

| FDI | 0.3691 | 0.4971 | 0.1132 | 0.0206 |

| DomInv | 0.5633 | 0.0666 | 0.3408 | 0.0293 |

| Openness | 0.1921 | 0.1227 | 0.3848 | 0.3004 |

| Low Development | ||||

| Growth | 0.8449 | 0.0132 | 0.0004 | 0.1415 |

| FDI | 0.8546 | 0.0046 | 0.0042 | 0.1366 |

| DomInv | 0.8553 | 0.0039 | 0.0022 | 0.1386 |

| Openness | 0.8408 | 0.0164 | 0.0007 | 0.1421 |

| Medium Development | ||||

| Growth | 0.0271 | 0.7144 | 0.2482 | 0.0103 |

| FDI | 0.0299 | 0.7227 | 0.2335 | 0.0139 |

| DomInv | 0.0269 | 0.7150 | 0.2476 | 0.0105 |

| Openness | 0.0330 | 0.7264 | 0.2210 | 0.0196 |

| High Development | ||||

| Growth | 0.6903 | 0.2605 | 0.0203 | 0.0289 |

| FDI | 0.0808 | 0.8306 | 0.0828 | 0.0058 |

| DomInv | 0.1275 | 0.0915 | 0.7788 | 0.0022 |

| Openness | 0.3524 | 0.0730 | 0.1203 | 0.4543 |

* Percentage variation in the variable of the line explained by the variable of the column. Ten periods are considered.

Source: Own elaboration with data from the World Bank (2016) and the International Monetary Fund (2016).

Mainly we observe that, for the case of the complete sample, 14.19% of the variation in the growth of Latin American economies over time is mainly explained by domestic investment, followed by foreign direct investment (5.56%), and finally openness with only 0.48%.

On its part, more than a third of the variation in FDI (36.91%) is explained by the dynamics of GDP growth: a dynamic economy is capable of attracting FDI. Similarly, domestic investment explains 11.32% of the variation in FDI and only 2.93% of the variation in this variable is explained by trade openness.

The variation of domestic investment is explained in more than half by the dynamics of GDP growth (56.33%), while FDI and Openness explain 6.67% and 2.93%, respectively. The variation of the Openness variable (exports) is explained in good measure by domestic investment (38.48%) and also, in a relevant manner, by the GDP growth (19.21%) and FDI (12.27%).

In contrast to the general sample, 26.05% of the variation in growth of the countries with higher economic growth is explained by FDI, while domestic investment and exports (openness) barely explain 2.03% and 2.89% of the productive dynamics. In these countries, the variation in FDI depends only 8.08% on the dynamics of growth and 8.28% on domestic investment. Openness has almost nothing to do with the variation in FDI, accounting for only 0.58% of FDI. In the same way, the variation of domestic investment is explained by the economic growth in 12.75%; by the FDI in 9.15%; and in just 0.22% by Openness. Finally, the variation of exports (openness) is mainly explained by GDP growth (35.24%), domestic investment (12.03%) and, to a lesser extent, FDI (7.30%).

Conclusions

Among the most important contributions of this work is the empirical evidence found on the relations between Foreign Direct Investment, Degree of Trade Openness, and Economic Growth for Latin American countries, about which we expected to find a positive impact of FDI and DEO on Economic Growth-according to endogenous growth models-but our results contribute to the existing ambiguity.

First, we found a dynamic relation between Economic Growth, Foreign Direct Investment, and the Degree of Economic Openness that does not appear in economies with low or medium growth levels but does in economies with high economic growth and in the entire sample of Latin American countries.

Regarding the relation between Economic Openness and Growth, we observe ambiguous results, since for the complete sample we find a positive response of GDP growth to shocks coming from openness. This is consistent with the results obtained in the studies of Balassa (1978); Sachs, J. D., et al. (1995); Levine and Renelt (1992); Irwin and Tervio (2002) and Emery (1967), although in our case the response is weak. However, for countries with high economic growth, we find a negative response from the dynamics of GDP growth in the face of shocks from openness that persist for up to 10 years, results that coincide with those obtained by Rodríguez and Rodrik (1999), Rodrik (1998), and Walde and Wood (2004); results that in our case persist for ten years.

On the other hand, for the entire sample, we observed a negative and significant impact of FDI on the dynamics of GDP growth for a little over three years before it dissipated, which is more clearly confirmed in the case of the Latin American countries with the highest economic growth. This could be explained by the negative effect found in this work of FDI on Domestic Investment, meaning that there is a shift of FDI on Domestic Investment. These results coincide with those found in the studies of Nunnenkamp and Spatz (2003), for countries in Africa, Latin America, and Asia, as well as those of Luiz R. de Mello, Jr. (1994) and Auxiliadora López and Aníbal Osorto (2016) for other cases; although they differ from those found by Rendón Obando and Ramírez Franco (2017), Álvarez, Barraza and Legato (2009), as well as Ruxanda and Muraru (2010), who found a positive impact of FDI on growth.

Another contribution of the article is the use of a novel econometric methodology, a dynamic panel estimated using the Vector Autoregressive approach with Panel Data based on the proposal of Holtz-Eakin et al. (1988), which makes it possible to analyze the temporal and transversal dimensions of the variables and overcomes some of the limitations of the standard panel data methodology by providing information on the dynamics of each variable with the impulses from the others, as well as on the persistence of each shock and the variance of the processes.

The article also contributes to the design of an FDI attraction policy, as we find positive effects of economic growth towards FDI both for the total sample and for countries with high economic growth; this means that a dynamic economy can attract FDI. Similarly, it can contribute to the design of a policy that considers the positive impact of domestic investment on FDI (i.e., the complementarity of both types of investment), as well as the negative impact of FDI on domestic investment for countries with higher growth (i.e., the presence of FDI displacement on domestic investment).

REFERENCES

Álvarez, A., Barraza, J.S. y Legato, A. M. (2009). Inversión Extranjera Directa y Crecimiento Económico en Latinoamérica, Información Tecnológica, Vol. 20(6), 115-124. https://doi.org/10.4067/s0718-07642009000600014 [ Links ]

Andrews, D. y B. Lu (2001). Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. Journal of Econometrics, vol. 101, número 1, 123-164. https://doi.org/10.1016/S0304-4076(00)00077-4 [ Links ]

Apergis, N, Lyroudi, K. y Vamvakidis, A. (2008). The relationship between foreign direct investment and economic growth: evidence from transition countries. World Transition Economy Research, Transition Studies Review, 15(1), pp. 37-51. https://doi.org/10.1007/s11300-008-0177-0 [ Links ]

Arellano, M. y O. Bover (1995). Another look at the instrumental variable estimation of error component models. Journal of Econometrics, 68, 29-51. https://doi.org/10.1016/0304-4076(94)01642-d [ Links ]

Balassa, B. (1978). Exports and economic growth. Further evidence. Journal of Development Economics, 5, pp. 181-189. https://doi.org/10.1016/0304-3878(78)90006-8 [ Links ]

Banco Mundial (2016). World Development Indicators. (Disponible en: http://databank.worldbank.org/ddp/home.do?Step=3&id=4 . (Consultado el 27/09/2017). [ Links ]

Barro, R. (1994). Democracy and Growth. NBER Working Paper Series. Working Paper No. 4909. National Bureau of Economic Research, October. (DOI): 10.3386/w4909. [ Links ]

Ben-David, D. (1993). Equalizing Exchange: Trade Liberalization and Income Convergence. The Quarterly Journal of Economics. 01 August. 108(3): 653-679. https://doi.org/10.2307/2118404 [ Links ]

Blomstörn, M., Lipsey, R. y Zejan, M. (1992). What explains developing country growth? Working Paper No. 4132, National Bureau of Economic Research, U.S.A. (DOI): 10.3386/w4132 [ Links ]

Borensztein, E., De Gregorio, J. y Lee, J.W. (1998). How does foreign direect investment affect economic growth?, Journal of International Economics 45 (1998), 115-135. https://doi.org/10.1016/S0022-1996(97)00033-0 [ Links ]

Chaowdhury, A. y Mavrotas G. (2005). FDI and Growth: A Causal Relationship, Research Paper No. 2005/25, World Institute for Development Economics Research. United Nations University, June. (Disponible en: https://econpapers.repec.org/paper/unuwpaper/rp2005-25.htm ), (Consultado: 25/10/2018). [ Links ]

De Mello, L. Jr. (1999). Foreign direct investment led growth: evidence from time series and panel data, Oxford Economic Papers, 51(1), pp. 133-51. https://doi.org/10.1093/oep/51.1.133 [ Links ]

Edwards, S. (1997). Openness, Productivity and Growth: What do We really Know?. NBER Working Paper Series No. 5978. Marzo. Document Object Identifier (DOI): 10.3386/w5978. [ Links ]

Elías, S., Fernández, M.R. y Ferrari, A. (2006). Inversión Extranjera Directa y Crecimiento Económico: un análisis empírico, Departamento de Economía, Universidad Nacional del Sur, Agosto. (Disponible en: http://www.aaep.org.ar/espa/anales/works06/Elias_Fernandez_Ferrari.pdf ), (Consultado: 25/10/2018). [ Links ]

Emery, R. F. (1967). The relation of exports and economic growth. Kyklos, 20, Issue 4, pp. 470-486, Noviembre. https://doi.org/10.1111/j.1467-6435.1967.tb00859.x [ Links ]

Fleming, J.M. y Mundell, R.A. (1964). “Official Intervention on the Forward Exchange Market: A Simplified Analysis”. Staff Papers-International Monetary Fund, 11(1), pp. 1-19. https://doi.org/10.2307/3866057 [ Links ]

Fondo Monetario Internacional (2016). World Economic Outlook Database 2009-2015. International Monetary Fund, July. (Disponible en https://www.imf.org/external/pubs/ft/weo/2016/01/weodata/index.aspx ), (Consultado: 28/09/2017). [ Links ]

Frankel, J. y Romer, D. (1999). Does Trade Cause Growth?. The American Economic Review. 89(3), pp. 379-399 https://doi.org/10.1257/aer.89.3.379 [ Links ]

Hallak, J.C. y Levinsohn, J. (2004). Fooling Ourselves: Evaluating the Globalization and Growth Debate. Research Seminar in International Economics. Discussion Paper No. 509. https://doi.org/10.3386/w10244 [ Links ]

Hansen, A. H. (1949). Monetary theory and fiscal policy. New York: McGraw-Hill. https://doi.org/10.2307/1069434 [ Links ]

Hicks, J.R. (1937). Mr. Keynes and the classics; a suggested interpretation. Econometrica: Journal of the Econometric Society, 5 (2), pp. 147-159. https://doi.org/10.2307/1907242 [ Links ]

Holtz-Eakin, D., Newey, W. y Rosen, H. (1988). Estimating Vector Autoregresion with Panel Data, Econometrica, 56, 1371-1395. https://doi.org/10.2307/1913103 [ Links ]

Hume, D. (1752). Political Discourses. Printed by R. Fleming, Edimburgh. https://doi.org/10.1093/acprof:oso/9780199243365.003.0020 [ Links ]

Irwin, D.A. y Tervio, M. (2000). Does Trade Raise Income? Evidence from the Twentieth Century. National Bureau of Economic Research. Working paper 7745. https://doi.org/10.3386/w7745 [ Links ]

Kaldor, N. (1966). Causes of the slow rate of economic growth of the United Kingdom: an inaugural lecture. Cambridge University Press. https://doi.org/10.1177/003231876601800210 [ Links ]

Levine, R. y Renelt, D. (1992). A Sensitivity Analysis of Cross-Coutry Growth Regressions. The American Economic Review, Vol. 82, Issue 4 (Sep. 1992), 942-963. (Disponible en: https://www.researchgate.net/publication/4901181_A_Sensitivity_Analysis_of_Cross-Country_Growth_Regressions ), (Consultado: 25/10/2018). [ Links ]

López, M.A. y T.A. Osorto (2015). IED en Centroamérica: su efecto en la Inversión Doméstica. Economía y Administración (E&A), Vol. 6, Núm. 1 (2015). https://doi.org/10.5377/eya.v6i1.2732 [ Links ]

Lorenzi, N.R. (2016). Efectos macroeconómicos de la inversión extranjera directa sobre la inversión en Uruguay 1990-2013. Análisis Económico, Núm. 76, vol. XXXI, primer cuatrimestre. (Disponible en:http://www.redalyc.org/pdf/413/41344590002.pdf ) y (Consultado: 25/10/2018). [ Links ]

Love, I. y L. Zicchino (2006). Financial development and dynamic investment behavior: Evidence from panel VAR. The Quarterly Review of Economics and Finance, Volume 46, Número 2, Mayo, pp. 190-210. https://doi.org/10.1016/j.qref.2005.11.007 [ Links ]

Lucas, R. E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22. https://doi.org/10.1016/0304-3932(88)90168-7 [ Links ]

Malthus, T. R. (1798). An Essay on the Principle of Population. London: Printed for J. Johnson, in St. Paul’s Church Yard. (Disponible en: http://www.esp.org/books/malthus/population/malthus.pdf ), (Consultado: 25/10/2018). [ Links ]

Mill, J. S. (1848). Principios de Economía Política con algunas de sus aplicaciones a la filosofía social. Fondo de Cultura Económica, México. (Disponible en: https://www.elfondoenlinea.com/Detalle.aspx?ctit=001090R ), (Consultado: 25/10/2018). [ Links ]

Mottaleb, A. (2007). Determinants of Foreign Direct Investment and Its Impact on Economic Growth in Developing Countries, Munich Personal RePEc Archive, MPRA Paper No. 9157, December. (Disponible en: https://mpra.ub.uni-muenchen.de/9457/ ), (Consultado 25/10/2018). [ Links ]

Nunnenkamp, P. y Spatz, J. (2003). Foreign Direct Investment and Economic Growth in Developing Countries: How Relevant Are Host-Country and Industry Characteristics?. Kiel Working Paper 1176. https://doi.org/10.2139/ssrn.425260 [ Links ]

Rendón Obando, H. y Ramírez Franco, L.D. (2017). Impacto de la inversión extranjera directa y del grado de apertura de la economía sobre el crecimiento económico para América Latina 1980-2010, Estudios de Economía Aplicada, Vol. 35-1, pp. 217-244. (Disponible en: http://www.redalyc.org/pdf/301/30149602011.pdf ), (Consultado: 25/10/2018). [ Links ]

Ricardo, D. (1817). On the Principles of Political Economy and Taxation. Vol. 1 of The Collected Works of David Ricardo, ed. P. Sraffa and M. Dobb, Cambridge University Press, Cambridge. (Disponible en: https://socialsciences.mcmaster.ca/econ/ugcm/3ll3/ricardo/Principles.pdf ), (Consultado: 25/10/2018). [ Links ]

Rodrick, D. (2002). After Neoliberalism, What?. In Remarks at the BNDES Seminar on New Paths of Development, Río de Janeiro, Septiembre 12-13. (Disponible en: http://www.new-rules.org/storage/documents/afterneolib/rodrik.pdf ), (Consultado: 25/10/2018). [ Links ]

Rodríguez, F. y Rodrik, D. (1999). Trade policy and economic growth: A skeptic’s guide to the cross-national evidence. National Bureau of Economic Research. Working Paper 7081. Abril. https://doi.org/10.3386/w7081 [ Links ]

Romer, E.M. (1986). Increasing returns and long run growth. The Journal of Political Economy, 94, pp. 1002-1037. https://doi.org/10.1086/261420 [ Links ]

Romer, P. (1993). Idea gaps and object gaps in economic development, Journal of Monetary Economics, 32(3), pp. 543-573. https://doi.org/10.1016/0304-3932(93)90029-f [ Links ]

Ruxanda, G. y Muraru, A. (2010). FDI and Economic Growth. Evidence from Simultaneous Equation Models, Romanian Journal of Economic Forecasting, 1, pp. 45-58. (Disponible en: http://www.ipe.ro/rjef/rjef1_10/rjef1_10_3.pdf ), (Consultado: 25/10/2018). [ Links ]

Sachs, J. y Warner, A. (1995). Economic Reform and the Process of Global Integration. Brooking Papers on Economic Activity, Vol. 1995, No. 1, 25th. Anniversary Issue (1999), pp. 1-118. (Disponible en: https://www.jstor.org/stable/pdf/2534573.pdf?refreqid=excelsior%3A97342f75d3e63fb6171735611fb27b55 ), (Consultado: 25/10/2018). [ Links ]

Sachs, J. D.; Aslund, A.W. y Fischer, S. (1995). Economic Reform and the Process of Global Integration. Brooking Papers on Economic Activity, Vol. 1995, No. 1, 25th. Anniversary Issue, pp. 1-118. https://doi.org/10.2307/2534573 [ Links ]

Smith, A. (1776, 1983). Investigaciones sobre la naturaleza y causas de la riqueza de las naciones. Barcelona: Orbis. (Disponible en: https://www.marxists.org/espanol/smith_adam/1776/riqueza/smith-tomo1.pdf ), (Consultado: 25/10/2018). [ Links ]

Solow, R. (1956). A Contribution to the Theory of Economic Growth, Quarterly Journal of Economics, 70, pp. 65-94. https://doi.org/10.2307/1884513 [ Links ]

Walde, K. y Wood, C. (2004). The empirics of trade and growth: where are the policy recommendations?. European Economy. December, Vol. 1, Issue 2-3, pp. 275-292. https://doi.org/10.1007/s10368-004-0016-7 [ Links ]

Yaghmanian, B. y R. Ghorashi (1995). Export Performance and economic growth: time series evidence from Latin America. Journal of International Trade and Economic Development, 3, pp. 121-30. https://doi.org/10.1177/056943459503900204 [ Links ]

Annex

Table A.1 Decisions criteria for the organization of the Panel Data VAR model

| Selection order criteria | No. de obs. = 84 | |||||

| Sample: 2007-2013 | No. de panels = 15 | |||||

| Ave. no. of T. = 5.60 | ||||||

| lag | CD | J | J pvalue | MBIC | MAIC | MQIC |

| 1 | 0.9999017 | 78.4132 | 0.5292812 | -276.0521 | -81.5869 | -159.7602 |

| 2 | 0.9999442 | 42.09343 | 0.9844091 | -241.4788 | -85.90657 | -148.4453 |

| 3 | 0.9999468 | 20.61265 | 0.9998141 | -192.0666 | -75.38735 | -122.2914 |

| 4 | 0.9988692 | 11.83012 | 0.9995619 | -129.956 | -52.16988 | -83.43925 |

Source: Own elaboration using the program STATA.

Tabla A.2 Condiciones de Estabilidad del Modelo VAR (1) estimado.

| Own value | ||

|---|---|---|

| Real | Imaginary | Modulus |

| 0.9690661 | 0 | 0.9690661 |

| 0.62681 | 0.4014941 | 0.7443711 |

| 0.62681 | -0.4014941 | 0.7443711 |

| 0.0718607 | 0 | 0.1718607 |

Source: Own elaboration using the program STATA.

Source: Own elaboration using data from the World Bank (2016) and the International Monetary Fund (2016).

Figure A.1 Own values and Unitary Circle, roots.

Source: Own elaboration with data from the World Bank (2016) and the International Monetary Fund (2016).

Figure 1 Growth, FDI, Domestic Investment, and Openness: Impulse Response Functions (IRFs) total sample.

Source: Own elaboration with data from the World Bank (2016) and the International Monetary Fund (2016).

Figure 2 growth, FDI, Domestic Investment, and Openness: Impulse Response Functions (IRFs), High Growth Countries.

1Absolute advantage: Each country will benefit from foreign trade by exporting the goods that it produces more efficiently, according to the natural advantages of each country, and importing the goods for which it does not have an absolute disadvantage (Smith 1776, 1983).

2Comparative advantage: A country must specialize in the production and export of goods whose relative cost with respect to other domestic goods is less than the same relative cost of the partner country, David Ricardo (1871).

3Theory of reciprocal demand: It determines the price relation according to which goods will be exchanged interna tionally. To this end, demand is added to supply (a unique factor of the classical model) and thus it is concluded that the equilibrium price on the international market would be given by the intersection of the quantity offered by a country and the quantity demanded by the trading partner (Mill, 1848).

4Theory of effective demand: It broadens the classical view by offering an interpretation of the role of demand, stating that international trade only occurs when effective demand is added to a comparative advantage of one country over another (increase in population followed by an increase in purchasing power) (Malthus, 1798).

5Unlike the first difference or simple deviation with regard to the mean, the Helmert procedure consists of obtaining the deviations from the mean of the future observations of each variable, which ensures that the lag values of the ex planatory variables remain valid instruments. This method ensures that the explanatory variables are orthogonal to the errors at all times t and that the independence from residues and residues squared is met (homoscedasticity).

6For more information on the panel data VAR theory, on identification, estimation and inferences problems, and use of the lag of zi,t as instrumental variables, the reader can refer to the contributions of Holtz-Eakin et al. (1988).

7Panel data VAR estimation based on the Stata program developed by Love and Ziccino (2006).

8The stationarity of each variable was ensured by using the Helmert procedure of Arellano and Bolver (1995). The stationarity of the variables was further verified using the Levin-Lin-Chu procedure for unit roots in panel data.

Received: October 31, 2016; Accepted: November 17, 2017

texto em

texto em