Introduction

Excise taxes on certain unhealthy products have been successfully used to control the spread of diseases associated to their high intake. The classic case has been taxes on tobacco consumption, the benefits of which have been demonstrated through economic analysis.1 Despite these documented benefits, there are major differences among political actors in low- and middle-income countries (LMIC) regarding the need to impose taxes on sugar-sweetened beverages (SSB) in order to reduce their consumption.2,3 This debate becomes relevant due to the existence of an epidemic of non-communicable diseases (NCD) in LMIC associated to a high intake of SSB.

Mexico is going through two epidemics linked to the consumption of SSB: overweight/obesity and diabetes. According to a recent study, the combined prevalence of overweight and obesity in adults aged 20 years and older reached 75.2 percent, the highest among all OECD countries, while the prevalence of diabetes in this same age group reached almost 10 percent.4 In addition to its health impact, the estimated annual cost of diabetes in Mexico is 7.7 billion dollars.5

The association between these epidemics and a high consumption of SSB was well documented in the past decade.6 Mexico, in fact, has one of the highest consumptions of SSB in the world: 139.4 L per capita in 2013 (1.15 soft drink cans per capita per day).7,8

The high consumption of SSB and the high prevalence of NCD gave the Mexican government the rationale to propose a reform to the Law on Special Tax on Production and Services (IEPS, in Spanish)) to establish a one-peso tax on SSB.9 This tax would increase the average price of these beverages by 10 percent. This proposal was passed by Congress in October 2013 and enacted in January 2014.

The establishment of an excise tax on SSB was associated with a 6.3 percent reduction in the consumption of these beverages in 2014 in relation to the trends observed in the 2008-2012 period.10,11,12 These reductions were higher in low-income households, urban areas, and households with children. This decline was also associated with a 16.2 percent increase in the consumption of bottled wáter.

According to an article published in 2016, a 10 percent reduction in the consumption of SSB in Mexico would prevent 189 300 cases of diabetes, 20 400 cases of cerebrovascular disease and heart attack, and 18 900 deaths between 2013 and 2022, and would generate 983 million dollars in savings.13 Projections based on these and other studies suggest that an increase of the excise tax to 20 percent should double the impact of the current tax, reducing the prevalence of obesity by 6.8 percent by 2024 and preventing between 171 thousand and 267 thousand cases of diabetes by 2030.14

The objective of this study was to analyze the policy process and the position and power of the political actors involved in the discussion of a proposal to increase the current excise tax to SSB in Mexico from 10 to 20 percent.

The study was developed during 2018, the last year of the administration of president Peña Nieto (2012-2018). This means that in the present administration, headed by president López Obrador (2018-2024), the composition of the group of actors that could be involved in debate around a proposal to increase the tax on SSB will probably change. However, we believe that the information provided by this study remains relevant, given that more than half of the actors will still be involved in a new round of discussion of this policy proposal in the near future. In addition, the reasons provided by the different group of actors for supporting or opposing a change in the excise tax on SSB will still be useful for those involved in the implementation of this type of policy proposals elsewhere.

Materials and methods

In this analysis we refer to the policy process, defined as the procedure for identifying, defining and seeking solutions to public issues.15,16 A practical way to represent it is through the ‘policy cycle’, which describes how an issue moves from the recognition of a social problem to the design, adoption, implementation, and evaluation of a public policy that seeks to solve it.17,18 In this paper, we focus on the two initial stages of this cycle (agenda setting and policy formulation), which include the identification and framing of the issue, its incorporation into the national policy agenda, the design of a potential solution, and its debate in the legislature and other political circles.

Two types of analysis were used in this project: a context analysis and a stakeholder analysis. The context analysis was used to identify the epidemiological and political ‘enabling factors’ that place the problem of excessive consumption of SSB on the national policy agenda. We borrowed the notion of enabling factors from Andersen's behavioral model of families. According to this model, enabling factors are those forces that facilitate individual, collective, or environmental change based on their level of availability.19,20,21 In this paper we looked for factors in Mexico that facilitated the identification of excessive consumption of SSB as a major problem and the design of a policy to solve it.

However, enabling factors cannot by themselves guarantee the adoption of a public policy. Adoption requires certain ‘driving factors,’ which are defined as the forces that trigger change in an organization or system.22,23 In this particular case, the driving factors were identified through a stakeholder analysis of the deliberation procedures to increase the excise tax on SSB in Mexico from 10 to 20 percent. This analysis implies the identification of the actors involved in the discussion of this policy proposal, the position they hold in favor of or against it, and their level of power. The deliberation procedure is defined as the backand forth communication among parties that have interests that are shared and others that are opposed to a particular policy, with the purpose of reaching an agreement.24

To document the context analysis, we carried out a thematic literature review. We searched and reviewed newspapers, grey literature, scientific literature, and non-governmental organizations’ notes. For the grey literature and newspaper search we used the key words ‘SSB’, ‘taxes to SSB’ and ‘excise tax to SSB’. For the scientific literature search we used the key words ‘SSB’, ‘taxes to SSB’, ‘effect of price on SSB consumption’, and ‘stakeholder analysis’. The period for the search was 2014-2017.

In order to identify key stakeholders, we consulted three sources of information: government documents, newspaper articles, and scientific manuscripts. We also examined documents and minutes of the Mexican Congress (proposals, presentations, and reports) developed in the 2012-2014 period, during which the discussion on the tax on SSBs took place in Mexico, and identified the actors who participated in it, 35 in total. We then sent to all of them an invitation to participate in an interview to explore their thoughts about the current tax and their position regarding a possible tax increase. We received a positive response to this invitation from 18 of them. They all signed a letter of informed consent and agreed to have the session audio recorded, guaranteeing the confidentiality and ethical use of the information. The study protocol was approved by the Ethics in Research Committee of the National Institute of Public Health of Mexico. The interviews were done from March to July 2018.

We developed a semi-structured guide for the interviews to key informants. A total of 18 key actors were interviewed: three officials of the Ministry of Health (MoH) working in areas directly associated to the discussion on taxes on SSBs (Deputy Secretary Ministry of Health Promotion and Disease Prevention, and Federal Commission for Protection against Sanitary Risks [Comisión Federal para la Protección contra Riesgos Sanitarios, Cofepris]); one official of the Ministry of Finance; two congressmen from parties with opposing views regarding taxes on SSBs; one representative of a multilateral organization; two representatives of NGOs involved in issues related with overweight/obesity; five representatives of the industry, two involved in the production of SSBs and three involved in their commercialization, and, finally, four researchers involved in nutrition-related research related to nutrition.

We asked each informant to identify those actors in our inventory who, in their view, would support or oppose the increase to the tax on SSB, and to evaluate their level of power. We also asked them to add the names of any important actors that might been left out of the list, but no name was added. We also asked them to define their own position regarding a potential increase to the SSB tax and the reasons for their support or opposition.

For the analysis, we used the Policymaker software, a tool that helps conduct stakeholder analyses and design political strategies to support a policy.25Policymaker is based on five analytical steps: 1) policy content; 2) actors; 3) opportunities and barriers; 4) strategies, and 5) impacts of the strategies.

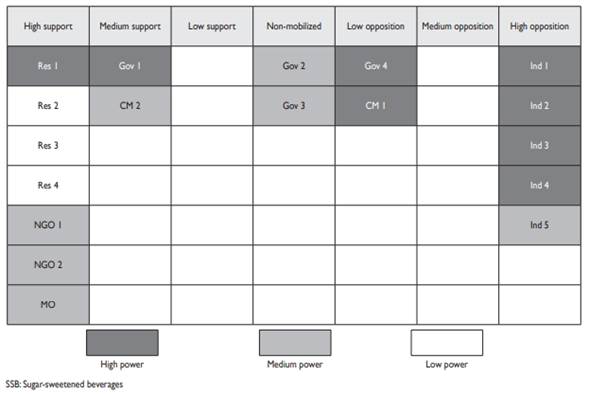

With the collected information, we built a “players position map”, using as reference the level of power of each actor and the level of support or opposition (or indifference) to the proposed policy. The actors’ power was established using a set of questions included in Policymaker. The answers to these questions provided information, for each actor, on access to financial, organizational, and symbolic resources to influence policies, as well as on easy and direct access to decision makers and to the media. Based on the answers, Policymaker rates the power of each actor as ‘high’, ‘medium’ or ‘low’.

Results

Context analysis

We analyzed two contextual factors which we believe have created a window of opportunity for the adoption of a policy to impose a higher excise tax on SSB in Mexico: i) the nutritional transition in Mexico and ii) the worldwide awareness about the impact of SSB on the increasing global prevalence of overweight/obesity and diabetes.

Awareness regarding the need to control the consumption of SSB through various policy measures, including taxation, first stemmed from the evidence on the nutrition transition experienced by middle-income countries in the past decades. This transition is characterized by a shift from a high prevalence of undernutrition to a high prevalence of overweight/obesity and nutrition-related NCD.26,27,28

In Mexico, the prevalence of stunting in children under five declined from 26.9 percent in 1988 to 13.6 percent in 2012, while the prevalence of overweight/ obesity in adults aged 20 years and older increased from 33.0 percent in 1988 to 75.2 percent in 2018.4,29,30

The evolution of overweight/obesity in Mexico has been documented through national surveys implemented in 2000, 2006, 2012, 2016, and 2018 (figure 1).4,31 The resulting measurements have been widely disseminated and have played a crucial role in the framing of the problem of overweight/obesity and its consequences, its discussion in policy circles, and its incorporation into the national health agenda.4,29,32,33,34,35,36,37

The other contextual factor that is creating a window of opportunity to increase the tax on SSB in Mexico is the international consensus around the possibility of reducing the consumption of these products through the use of, among other things, fiscal policies. The supporters of these measures refer to the success of tobacco taxes worldwide and to the initial documented positive effects of SSB taxes.38,39

The World Health Organization (WHO) had suggested for years a lower intake of sugar but had refrained from supporting taxes on SSB. However, in 2016, this agency published a report suggesting a 20 percent tax on SSB in order to reduce global overweigh/obesity, diabetes, and tooth decay.40 Globally, soda taxes have gained momentum as powerful interventions to discourage sugar consumption and thus reduce the growing burden of overweight/obesity. Available evidence shows that they discourage the consumption of SSBs, incentivize the purchase of healthier products, and generate revenue to support health promotion programs and curative services.12,13,14,41,42

Stakeholder analysis

The adoption of a policy requires certain ‘driving factors‘ to leverage the ‘enabling conditions’ in order to push this new policy measure. In this case, the driving factors or driving actors for an increase to the tax on SSB were identified through a stakeholder analysis.

The 18 key actors in our study were clustered in six groups: government officials (Gov), congressmen (CM), representatives of multilateral organizations (MO), representatives of non-governmental organizations (NGO), representatives of the industry (IND), and researchers (Res).

As illustrated in figure 2, seven actors strongly supported an increase to the excise tax on SSB to 20 percent: the four researchers, the two NGO representatives, and the representative of the multilateral organization. One of the researchers had high political power, while the two NGOs representatives and the representative of the multilateral organization had medium political power. One government official with high political power (Gov1) showed medium support to the increase in the tax. This was also the case of one congressman, who had medium political power (CM2).

As expected, the strongest opposition to the tax came from the representatives of the industry, four of whom had high political power. One government oficial (Gov4) and one legislator (CM1), both with high political power, showed low opposition to the proposed policy.

Figure 2 Position map of key actors in the negotiation of an increase to the excise tax on SSB to 20% in Mexico, 2018

Finally, the two government officials working at Cofepris (Gov 2 and 3) did not manifest support or opposition to the increase to the tax on SSB.

The general image of the map shows a balanced situation. However, a slightly higher number of actors supported the increase to the tax, but the actors opposing this policy measure had a greater political power. Those supporting the policy measure argued that scientific evidence has shown that high consumption of SSB is one of the main risk factors associated to overweight/obesity and diabetes. For these reasons, according to them, the government should design policy instruments, including taxes, to reduce the consumption of these products. They also argued that the higher the tax, the greater the reduction of their consumption and of the health damages generated by them.

Fiscal procedures, according to these same supporters, should be complemented with additional control measures, such as regulation of SSB advertisements, implementation of labelling procedures for these beverages, increasing accessibility to drinking water, and promotion of physical activity. These measures could be partly financed with resources gathered through a higher excise tax.

According to the representative of the multilateral organization, this policy proposal is consistent with WHO’s suggestions. A successful implementation of a higher tax on SSB, in addition, would have a major positive impact on the region, since more Latin American countries would be willing to follow this example.

NGO representatives argued that an additional benefit of consumers’ mobilization around this measure would be the empowerment of citizens, who would then be willing to participate more actively in support of other measures to improve their health.

The high government official who supported this policy measure stated that its promotion in Congress is the responsibility of the Ministry of Finance, the government area in charge of imposing taxes. The role of the MoH should be limited to providing evidence in support of this measure.

Several arguments were offered by those actors opposing an increase in the excise tax on SSB to 20 percent in Mexico, mainly the representatives of the industry. It is important to mention that most of these arguments were consistently presented by all members of this opposing group, a fact that expresses the existence of a common and coordinated strategy to confront this potential policy measure.

The main argument presented by this group is that the caloric input of SSB is not enough to produce the levels of overweight/obesity registered in Mexico and that these beverages are a key component of the Mexican diet, especially in poor households. They also argue that the tax on SSB did not modify the consumption patterns of these products or the caloric input of the Mexican population. According to them, the limited initial effects that have been registered will disappear as regular consumption patterns reestablish after a brief period of time. For these reasons, an increase in the excise tax would generate a major financial burden on the poorest households without producing health benefits.

The representatives of the industry also stated that the main purpose of a rise in the tax on SSB is to increase fiscal income. They argue that this measure would have a negative impact on economic activity, since it would particularly affect the retail sector, strongly dependent on SSB sales. In any case, the role of the government, they argued, should be limited to providing the consumers with information. Excessive intervention, according to them, restricts personal choice, a key component of well-performing markets and a right of citizens.

One government official stated that, given the fact that there is no consensus around the need to increase the excise tax on SSB, further research is needed to establish the appropriate level of the proposed tax.

According to government actors who refused to take a position regarding this issue, it is important to avoid conflicts with the industry, especially since there is a national pact among all economic actors to limit additional taxes. They also stated that non-coercive measures that impact the levels of overweight/obesity, such as the promotion of physical activity and nutritional advice, should be favored over compulsory actions.

The congressman who opposed the implementation of an increase in the excise tax argues that, given the enormous consequences of such a measure, a major agreement among all political parties should be reached.

Discussion

Fiscal policies are being used worldwide for public health purposes. In addition to discouraging the purchase of certain products (tobacco, SSB), they stimulate behavioral changes. This stakeholder analysis shows that certain key actors (academics, NGOs) support an increase to the excise tax to 20 percent, while others (industry representatives) strongly oppose it. Both sides use evidence to support their positions. The proponents of the increase to the excise tax invoke the evidence gathered from scientific journals, while those opposing this measure resort to evidence generated expressly by the SSB industry. The soda industry is also known for consistently hiding evidence that documents the harmful effects of sugar consumption, just as the tobacco industry did with cigarettes and other tobacco products.43

The main argument of those supporting an increase to the excise tax on SSB in Mexico is that there is evidence that demonstrates that fiscal measures to reduce the consumption of SSBs are very costeffective and can further reduce the consumption of these beverages and improve health conditions.44 They also argue that this fiscal measure should be complemented with measures to promote physical activity and a healthy diet, improve access to drinking water, and enforce detailed labelling of SSB. These complementary measures could be financed with the resources generated by the increased excise tax, although in Mexico financial authorities have opposed the earmarking of tax revenues.

Those opposing this measure argue that the tax on SSB did not modify the consumption patterns of these products or the caloric input of the Mexican population. For this reason, an increase in the tax would generate additional financial burdens on households without producing health benefits, as well as major problems to the convenience stores sector, which is strongly dependent on SSB sales. They insisted that the key to addressing the challenge of overweigh/obesity in Mexico is the promotion of healthy lifestyles.

Finally, the government representatives were divided. The area in charge of health promotion and disease prevention at the MoH showed a modest support to an increase to the tax on SSB, while the area in charge of the protection against sanitary risks stated that this topic lies outside its area of competence. Other representatives, concerned about the potential political consequences of a confrontation with the powerful SSB industry, avoided taking a position.

The stakeholder map shows a balanced distribution of actors. However, the soda industry seems to concentrate more political leverage, due to its access to huge financial resources to influence public opinion and government officials and key congressmen through the media and lobbying procedures.45 These measures are the core components of a soda industry’s strategy, designed years ago following the example of the tobacco industry in its fight against cigarette taxes.46 This strategy has been adapted to the present political circumstances of Mexico and enriched with information regarding its successful implementation in several states of the USA and various countries.47

Those in favor of increasing the tax on SSB have solid documentation on the overweight/obesity epidemic, scientific evidence of its effects on the consumption of these beverages, and proofs of the positive impact of this measure on the consumption patterns of SSB. They have also used in their promotion campaigns the experiences of other middle-income countries that have recently adopted major fiscal measures.48 The researchers and NGO representatives interviewed for this project believe that only a major coalition and an extended social mobilization to push this new tax forward could convince the Mexican government to support this policy.

In Mexico, the problem of overweight/obesity, and its impact on health has been well documented, and several proposals to address this problem have been designed and implemented.49 These proposals include an excise tax of 10 percent on SSB. Evidence has shown that higher taxes on these beverages could further reduce their consumption, generating additional health benefits. For this reason, the idea of increasing the excise tax on SSB to 20 percent has been recently discussed in various policy circles.

This stakeholder analysis shows that the leading supporters of an increase to the excise tax on SSB in Mexico are researchers and NGOs involved in the fight against overweight/obesity, holding scientific evidence as their chief asset. The main opponent is the soda industry, which has a solid opposing strategy and enormous financial resources to influence public opinion, government officials, and congressmen through the media and lobbying procedures. Finally, the government shows a cautious position towards increasing the excise tax, and would only support such a measure if its proponents are able to build a solid and large coalition and mobilize public opinion to push this policy forward in the Mexican congress.

There is an increasing consensus in academic, NGO, and global policy circles around the need to impose taxes on SSB. The available evidence shows that this measure reduces the consumption of these beverages, as well as obesity rates.31,42 For this reason, the WHO recommended imposing a 20 percent excise tax on these products. However, evidence and recommendations are not enough to guarantee the implementation of health policies: active promotion of these and other measures by powerful and influential actors is also required. In order to guarantee the implementation of a policy, it is necessary to: i) identify and document the problem that this policy intends to address; ii) design a solid proposal to address this problem, and iii) mobilize key actors to push this proposal forward in policy circles.

nueva página del texto (beta)

nueva página del texto (beta)