Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Nova scientia

versión On-line ISSN 2007-0705

Nova scientia vol.6 no.11 León abr. 2014

Ciencias humanas y sociales

Oligopsonio-Oligopolio. La Perfecta Competencia Imperfecta

Oligopsony-Oligopoly. The perfect imperfect competition

Carlos Encinas-Ferrer1

1 Universidad De La Salle Bajío. E-mail: cencinas@delasalle.edu.mx.

Recepción: 17-10-2013

Aceptación: 22-11-2013

Resumen

El oligopolio y el oligopsonio han sido estudiados extensamente. Sin embargo, la figura dual del intermediario oligopsonista-oligopolista no lo ha sido. Esta doble personalidad tiene un impacto negativo sobre el mercado: por una parte, reduce la demanda a los productores y el precio de sus productos y, por la otra, al actuar como vendedor, reduce la oferta y de esta manera eleva los precios a los consumidores finales. Al actuar como comprador-vendedor sus beneficios se incrementan comprando barato y vendiendo caro, lo que afecta a la demanda efectiva de los consumidores y a la oferta efectiva del productor.

Palabras clave: Oligopsonio, oligopolio, competencia imperfecta.

Abstract

Oligopoly and oligopsony have been studied extensively. However, the dual figure of the oligopsonistic-oligopolistic intermediary has not been. This dual personality has a double negative impact on the market, on one hand reduces the demand to producers who face a competitive market, lowering prices as buyers, and on the other hand reducing its offer by raising the prices as sellers. In this way, their benefits are increased buying cheap and selling expensive, affecting effective demand of the consumer and the effective supply of the initial producer.

Keywords: Oligopsony, oligopoly, imperfect competition.

To the memory of Joan Robinson

The monopolists, by keeping the market constantly understocked by never fully supplying the

effectual demand, sell their commodities much above the natural price, and raise their

emoluments, whether they consist in wages or profit, greatly above their natural rate".

Adam Smith

The wealth of nations (1776)

The monopsonists, by keeping the market constantly overstocked by never fully demanding the

effectual supply, buy the commodities much below the natural price, and reduce their expenses

greatly below their natural rate.

Carlos Encinas Ferrer

Economic Theory (2003)

The development of the capitalist system of production with its extensive specialization and division of labor and the expansion of the labor market, turn our world in a producer of goods directed exclusively to market exchange. In this way the goods are converted to the producer in what Marx calls, non-use values coming to market to be exchanged for money by those who actually make them use values.

We must remember, however, that the market is designed in such a way and due to the division of labor and specialization rarely the original producer sells directly to consumers. On the contrary, it does it to tertiary sector intermediaries who, by buying at a lower price than the final effective demand would be willing to pay, infra-demand and subsequently under-supply the final consumer, increasing prices and appropriating benefits that were originated in the production process.

The original producer marginal costs cease to be determinants of the quantity offered, since they disappear in the middle of the commercial process. Thus, average or unitary costs become fundamental in accounting and decision-making processes and not marginal costs as claimed by the neoclassical school and teach today in most microeconomics classes virtually everywhere.

Both, the oligopoly and the oligopsony, have been studied extensively, but more the first than the second. However, the dual figure of the oligopsonistic-oligopolistic intermediary has not been. We should not confuse it with the bilateral monopoly where there are both, a single seller and a single buyer in the same market and at the same time (Hoffman, 1940).

Large trading companies of transnational character, especially in the area of self-service markets, are now spread throughout the world and its market power affects adversely both producers and consumers. The purpose of this paper is to show briefly some of the negative effects that this dual personality of buyer-seller presents.

The imperfect competition term was coined by the British economist Joan Robinson in 1933. In those years several authors devoted themselves to study the non-competitive markets, among them, along with Robinson, Edward Hastings Chamberlin and Piero Sraffa. Their contributions were instrumental to show the limitations of Say's Law and allowed John Maynard Keynes to develop his General Theory.

In another direction, several authors questioned the neoclassical theory of pricing and profit maximization. Among them we should mention Hall and Hitch who in 1939 investigated whether employers actually drove their pricing and production policies in the way neoclassical theory says. They used the method of the interview to find out.

The results were clearly negative. Almost all businessmen follow the rule they call "full cost pricing principle" to set prices, i.e., take the unitary or average cost as a base and add a percentage as profit or benefit. Paul M. Sweezy also conducted studies in this regard and Paolo Sylos Labini (1965) in his studies on the oligopoly was based on the results of their research and the experiences of those mentioned above. Meanwhile, Katalin Martinas (2002) has worked on this issue from the perspective of comparative analysis between microeconomics and thermo dynamics.

My own experiences in the real world of business have shown me that no employer knows what marginal cost is, much less has determined its curve and therefore the results of Hall and Hitch mentioned before are confirmed in the sense that is in the average total cost or unitary cost that their decisions are based.

I will address the subject of my paper using the graph instrumental of the dominant theory as it is the best known.

Perfect Competition

It is necessary, before continuing, to point out the characteristics of both, the perfect and imperfect competition, and thus having a clearer understanding of the effects of the oligopsony-oligopoly duality -which I call the perfect imperfect competition- on the economy.

To define perfect competition we start from the following assumptions:

a. Lots of producers (supply).

b. Lots of consumers (demand).

c. None of the sellers bid a part of the supply so big that allow him to determine the price.

d. None of the consumers consumes a part of the demand so great that allow him to control the price.

e. Goods produced are identical.

f. Free entry and exit from the market.

g. Both producers and consumers have perfect information on prices and market conditions.

It follows that the price will be the social expression of the agreement of thousands of producers and consumers on equal terms. Both producers and consumers will be what we know in economics as price takers. Both supply and demand will have to accept a price socially determined. The price will be, therefore, enough for the producer to cover economic costs expended in the production factors (land, labor and capital) which involves both the explicit and implicit costs (opportunity costs). There won't be, however, economic profits as he will sell at what Adam Smith called the natural price. I have to point out that if there is a natural price in perfect competition, there should be also a natural cost.

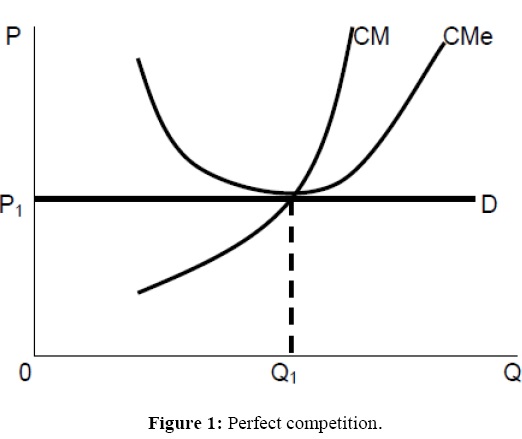

To understand this, let's see the known graphic of the average and marginal costs under perfect competition in the long term.

Under the assumptions of perfect competition the number of producers and consumers is so great and the proportion of the individual supply and demand is so small within the total, that the individual producer can sell any quantity that he will produce at the market price, the individual demand curve he faces is horizontal to the x-axis (Q), or what is the same, is perfectly elastic. Both, producers and consumers are price takers.

According with this theory, in the long term the price, due to high competition, free entrance and exit from the market and perfect information for buyers and sellers, will be fixed at that point where the producers will cover all their explicit and implicit costs.

Reality is quite different, even in the agricultural sector the perfect competition is only a very simplified model that omits many things but above all it fails to mention that it works under the assumption that producers sell directly to consumers. In a research made by me in some agricultural regions between the cities of Manuel Doblado and Romita, in Guanajuato in central Mexico, I found that between the producer and the final consumer there is not only the so called "middleman" (for a better knowledge of this figure read Rust and Hall, 2002) but three levels of intermediaries or middlemen: the first broker who buys and takes the product directly to the central supplier, the wholesale intermediary, that sells to the retailers who sell to the final consumer. The difference between the price received by the producer and the price paid by consumers may be higher than 1000%.

The reality is that the producer does not cover even the implicit costs and this is exacerbated -due to lack of antitrust regulations- when in this market appears the oligopsonistic-oligopolistic intermediary in the figure of big supermarket chains.

Imperfect Competition

By observing the assumptions of perfect competition we realize that most of them do not exist in the real world and only production in the primary sector and in some extractive sectors approach the perfect model. Even there, however, information is not perfect and there are, between producers and sellers, the middlemen and the oligopsonistic-oligopolistic intermediaries who control a significant portion of the quantities offered and demanded.

What happens in conditions of imperfect competition? There are sellers and buyers who have control over an important part of the market.

In the case of sellers, their individual curve of demand begins to have positive slope, which implies that reducing the quantity supplied to the market will increase prices respectively.

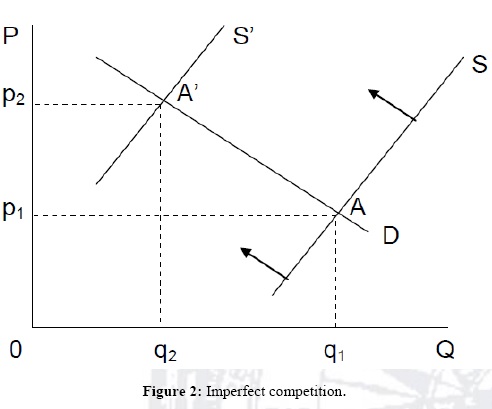

Let's look at the classical graph of reduced supply.

We note that in this example the offer is able to bring to market the quantity q1 at which, by the slope of the demand curve, correspond price p1 at the equilibrium point A. If the seller reduces the amount that is able to supply in the market from q1 to q2 (new supply curve S') then, by the slope of the demand curve, the equilibrium point would move to A' with a price p2, higher than the original. They are price makers or, in other words, they have market power.

Why is it so bad for the economy in general imperfect competition? Adam Smith's phrase at the beginning of this paper is clearer than any other explanation of the harmful aspects of imperfect competition. Let's see.

On the supply side:

a. It supplies the market with an amount less than that which can be made by productive forces;

b. Because of this the seller sells at a higher price than perfect competition, appearing therefore, the benefit greater than zero Adam Smith speaks of.

On the demand side, as my paraphrase emphasizes:

a. The amount purchased in the Market is less than the actual demand of the society;

b. Because of this, the equilibrium price is lower than the one the seller would get in a competitive market.

Imperfect competition occurs in varying degrees; depending on how concentrated in few hands supply and demand is. The best known are:

On the supply side:

a. Monopoly - There is only one supplier of the product.

b. Oligopoly - There are a few suppliers of the product.

c. Monopolistic Competition - Many producers selling products that are differentiated from one another.

On the demand side:

a. Monopsony - there is only one purchaser.

b. Oligopoly - there are few buyers of the product.

c. Monopsonistic competition – there are a large number of small buyers, they purchase similar but not identical inputs, have relative freedom of entry into and exit out of the industry, and possess extensive knowledge of prices and technology.

The question that readers will be asking is: how sellers determine how much to offer on the market? The answer is: at that point where they maximize their profit. In economics we have determined that point and to explain it we have to introduce a new concept: the marginal revenue. Marginal revenue is the additional revenue obtained by selling an additional unit of the commodity. Let's build a hypothetical table where we have the situation of a monopoly market.

In the next graphic we see that the maximum profit (230) is obtained by the monopoly selling the amount corresponding to the point where marginal cost equals marginal revenue (40). Let's see the graph that is derived from the above table.

The monopoly maximizes its total profit in this example selling 4 units at a price of 120 and an average cost of 62.5. It's total income is 480 (4 x 120), its total cost 250 (4 x 62.5) and total profit 230 (57.5 x 4). If positioned in the point where MC = ATC it will sell 5 units at a price of 100 and its profit will be only 200.

What would be the harm for society as a whole? Consumers would get fewer units of the good at a higher price, they would have less money for other needs and, therefore, effective demand for other sellers will be reduced. Thus the monopoly indirectly prevents the possibility that in other areas of production, new companies are established or existing ones have a wider market.

In some books on economics (Mankiw, 2009, Krugman & Wells, 2006, Lipsey, 1989, among others) it is stated that the monopoly has no supply curve. The reason for this is that the offer is not set at the point where the marginal cost equals the price, as in the neoclassical assumptions of perfect competition, but indirectly from the amount determined by the point where marginal cost equals marginal revenue, as we saw in the previous figure.

Let us fallow Lipsey (p. 223, Fig. 13.5): "When a firm faces a negatively sloped demand curve, there is no unique relation between the price it charges and the quantity that it sells." If this statement is valid for the monopoly so it would be for any imperfect competition -as oligopoly and monopolistic competition-. Under the maximizing profit assumption most companies will lack a supply curve as they have market power.

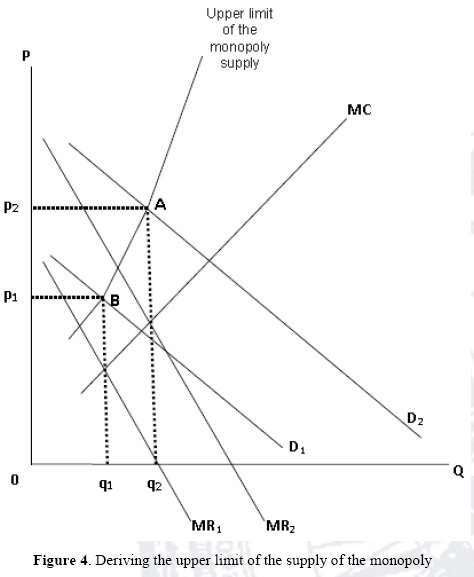

Since in imperfect competition the shape of the demand curve determines the shape of the marginal revenue (MR) curve -which has a steeper slope than the demand curve- and this, in turn, determines the amount of profit maximizing in the monopoly, oligopoly and monopolistic competition, I derived in the following graph what happens when you swift demand curve parallel, without a variation in the slope, and the subsequent movement in the marginal revenue curve.

Lipsey -in the quotation aforementioned- performed an analysis in which a firm with a given marginal cost curve, faces sudden changes in the slope of its demand. Changes like the ones in his example talk us of different companies with same marginal costs in very different markets, this is the reason I chose to shift demand in parallel.

In a previous article (Encinas, 2010) I concluded that in imperfect competition rather than a supply curve of successive points, what we had was the upper limit (profit maximizing) of a supply of diffuse character formed by alternative points which lower bound was the marginal cost curve.

I want to point out that the real shape of the upper limit derived is not a straight line; its real shape, as we develop more parallel demand curves with their marginal revenues, becomes more and more inelastic. This is due to the steeper slope of the marginal revenue compared with the demand curve. Imperfect competition not only reduces the quantity supplied in the market at a highest price, but makes its supply more inelastic than the curve of the marginal cost which means a greater market power.

Other forms of imperfect competition such as non-colluding oligopolies and monopolistic competition (Chamberlin, 1932) behave similarly and although they do not have full control of the market, they supply a smaller quantity of goods and services that its productive capacity allows.

Imperfect competition from demand view has been little studied. I will analyze it using a simple model. As monopoly understocks the market, in what way monopsonists and oligopsonists overstocks it? History has shown us that the production of raw materials and basic food, the so-called "commodities", has been controlled in the developing countries not only by local intermediaries but also by large corporations, which determine production volumes and distribution mechanisms completely detrimental to the interests of the society in which production takes place. Remember the United Fruit in Central America, the Anaconda Copper Company, and the "twelve oil sisters" before the creation of OPEC.

The intervention of intermediaries in the supply chain often distorts market flow. By demanding goods in many cases act as monopsony or oligopsony, and as sellers they supply goods acting as monopolists or oligopolists. This dual personality of an important part of the tertiary sector (Encinas, 2003) has been little studied and has double negative implications both for the production supply and to the final consumer.

Here is a diagram that shows their position in the market:

We see clearly the dual position of the intermediary in the market flow. The higher the portion of the flow of goods passing through their hands the greater its ability to act as oligopsonistic-oligopolistic and the greater the possibility of acting on prices and quantities supplied and demanded.

Its negative impact will be felt in a relevant way in the event that we are in front of basic consumption goods that already have an inelastic demand; the price changes will be very high accompanied by small reductions in the amounts negotiated. However, as intermediaries operate prices based in percentage discounts and charges, its market intervention reduces the elasticity of demand.

In the next diagram I show the traditional flow including intermediaries.

What follows is a graph in which we see the performance of the intermediary in his position of monopsonist or oligopsonist in a market of monopolistic competition.

Effective demand is represented by curve D. Intermediary intervention reduces price in percentage changes and therefore the demand curve D', decreasing the quantity demanded but also making it more elastic. By doing so, you get a lower price (p2) with a lower quantity demanded (q2).

We see that the producer loses some of its market power as his demand becomes more elastic. It is important to note that the greater elasticity of demand does not translate into benefits for the consumer but only to the broker.

We arrive to similar conclusion about the increased elasticity of the monopsony demand curve through the neoclassical instruments of analysis (Zamora, 1959; Williams, 2009).

Equilibrium under monopsony occurs at a lower quantity than equilibrium under perfect competition, q2 instead of q1; and at a lower price, pm instead of p1.

In the first part of this paper we saw what happens when the intermediary acts as monopoly or oligopoly and is interesting to note that if the monopoly and the oligopoly understocks the market below his productive capacity, making supply more inelastic, the monopsony and the oligopsony makes the demand curve more elastic, obtaining in both roles and increased market power.

The dual personality of the oligopsonist-oligopolist intermediary has, therefore, a double negative impact on the market, on the one hand reduces the demand to producers who face a competitive market, lowering prices as buyers, and on the other hand reducing its offer by raising the prices as sellers. In this way, their benefits are increased buying cheap and selling expensive, affecting effective demand of the consumer and the effective supply of the initial producer.

An additional negative effect is found in the case of local intermediaries in the agricultural sector of our emerging countries. Generally operate as exclusive introducers in central markets, acting as an oligopsony that producers can not break. This position allows them to buy at such low prices that they prevent the capitalization of small and medium-sized farmers and sell at a price so high that it reduces the final consumption. We all know the so large difference that exists between the prices to which our farmers sell their products to intermediaries and those who eventually pay consumers. The difference is so broad that not allows the capitalization of the agricultural sector and reduces the level of household consumption in general. As in this process they underdemand and undersupply the market, generate enormous waste that materializes in thousands of tons of decomposed food, daily pulled away by lack of investment in equipment and facilities that allow its conservation.

These negative effects are not unique in the agricultural sector; they strongly impact also the monopolistic competition, as we see in Figure 7.

Intermediaries play an important role when they do not act as oligopsonists-oligopolists. They facilitate the movement of goods, taking them to final consumption centers; reducing the costs of distribution and circulation of the producers and facilitating the consumer choice. However, the negative aspects are such that they merit measures of economic policy for its correction.

References

Chamberlin, Edward Hastings (1934), Teoría de la Competencia Monopólica, Fondo de Cultura Económica, Segunda Edición en Español, 1956, México. [ Links ]

Encinas Ferrer, Carlos (2003), Teoría Económica, Sistema Avanzado de Bachillerato y Educación Superior (SABES), segunda edición 2004. México. [ Links ]

- Monopsonio-Monopolio. La perfecta competencia imperfecta. Article provided by Grupo Eumed.net (Universidad de Málaga) in its journal TECSISTECATL.Volume (Year): (2010), Issue (Month): 9 (December), EUMED. [ Links ]

Hall, R.L. y C. J. Hitch, Price Theory and Business Behaviour, en «Oxford Economic Papers», 1939, reprinted by Oxford Studies in the Price Mecanism, T. Wilson y P. W. S. Andrews, Oxford 1951, pp. 106-38. [ Links ]

Hoffman, A.C. (1940), Large Scale Organization in the Food Industries, Monograph No. 35, US Temporary National Economic Committee, Washington, D.C. [ Links ]

Keynes, John Maynard (1936), Teoría General de la Ocupación el Interés y el Dinero, Fondo de Cultura Económica, sexta edición, 1963. México. [ Links ]

Krugman, Paul and Robin Wells (2006), Introducción a la Economía, Microeconomía, Editorial Reverte, Barcelona. [ Links ]

Lipsey, Richard G. (1989), Introduction to Positive Economics, Weidenfeld & Nicolson, 7th. Ed., p 223. London. [ Links ]

Mankiw, N. Gregory (2009), Principles of Economics, Cengage Learning, 5th Edición, USA. [ Links ]

Monopsonistic Competition, Amos WEB Encyclonomic WEB*pedia, http://www.AmosWEB.com, AmosWEB LLC, 2000-2013. [Accessed: April 5, 2013].

Martinás, Katalin (2002), "Is the Utility Maximization Principle Necessary?",Post-autistic economics review, Issue no. 12; 15 March 2002. http://www.paecon.net/PAEReview/wholeissues/issue12.htm. Acceed: November 29, 2010. [ Links ]

Robinson, Joan Violet (1933), The Economics of Imperfect Competition, Macmillan. 2d ed., 1969.Londres. [ Links ]

John Rust, George Hall, "Middlemen versus Market Makers: A Theory of Competitive Exchange", NBER Working Paper No. 8883, Issued in April 2002, NBER Program(s): IO. http://www.nber.org/papers/w8883. [ Links ]

Say, Jean Baptiste: A treatise on political economy; or the production distribution and consumption of wealth. Translated from the fourth edition of the French. Batoche Books Kitchener 2001, p. 57 Say's law, in honor of Juan Bautista Say, who said at the end of the eighteenth century that any offer, created its own demand, so the mismatch between supply and demand is quickly corrected. [ Links ]

Sylos Labini, Paolo, Oligopolio y progreso técnico, Barcelona, Oikos-Tau, 1965. [ Links ]

Smith, Adam (1776), An Inquiry into the Nature and Causes of the Wealth of Nations, Edwin Cannan (Editor), Randim House, Inc. Nueva York, 1904. [ Links ]

Sraffa, Piero (1926), "The Laws of Returns under Competitive Conditions", The Economic Journal, Vol. 36, No.144 (Dec. 1926), pp. 535 – 550, Blackwell Publishing, Royal Economic Society, UK. [ Links ]

Sweezy, Paul M., Demand Under Conditions of Oligopoly, en «Journal of Political Economy», 1939, reimpreso en Readings in Price Theory, Allen and Unwin, Londres 1953, pp. 404-9. [ Links ]

Williams, Michael Francis (2009), "Analysis of Monopsony", Cooleconomics.com. Consulted November 18, 2013. http://getyourecon.com/mana/mana-monopsony.pdf. [ Links ]

Zamora, Ricardo (1959), Tratado de Teoría Económica, Fondo de Cultura Económica, 4th. Edition, Mexico. [ Links ]