Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Similares en

SciELO

Similares en

SciELO

Compartir

Economía mexicana. Nueva época

versión impresa ISSN 1665-2045

Econ. mex. Nueva época vol.20 no.2 Ciudad de México ene. 2011

Artículos

Private and Pareto Efficient Public Transfers

Transferencias públicas Pareto eficientes y transferencias privadas

Ikuho Kochi and Raúl Alberto Ponce Rodríguez*

* Professors, Instituto de Ciencias Sociales y Administración, Universidad Autónoma de Ciudad Juárez. Ciudad Juárez, Chih. Mexico. ikuho.kochi@uacj.mx, rponce@uacj.mx

Fecha de recepción: 28 de octubre de 2009.

Fecha de aceptación: 18 de junio de 2010.

Abstract

Private transfers are a market mechanism that changes the inequality in the distribution of income. Should the government increase or reduce the size of Pareto efficient public transfers after observing an increase in inter vivos private transfers that reduces (increases) inequality in the distribution of income? In this paper we provide an answer to this question. Our analysis identifies conditions in which private transfers change income inequality and crowd out government's transfers in a targeted redistributive program, but increase the size of public transfers in a broad base redistributive program.

Keywords: redistribution, optimal taxation, personal income taxes, performance of government, remittances.

Resumen

Las transferencias privadas son un mecanismo de mercado que cambia la inequidad en la distribución del ingreso. Después de observar un incremento en las transferencias privadas entre individuos que reducen la inequidad en la distribución del ingreso, ¿debería el gobierno incrementar o reducir el tamaño de las transferencias Pareto eficientes del sector público? En este artículo damos respuesta a esta pregunta. Nuestro análisis identifica condiciones en las que las transferencias privadas entre individuos cambian la inequidad en la distribución del ingreso y reducen las transferencias del gobierno en un programa de redistribución focalizado, pero incrementan el tamaño de las transferencias públicas en un programa de redistribución universal.

Palabras clave: redistribución, impuestos óptimos, impuestos al ingreso individual, desempeño del gobierno, remesas.

JEL classification: H2, H21, H23, H24, F24.

Introduction

Recent empirical evidence indicates that private transfers, such as donations, remittances, etc., change inequality in the distribution of income. Knowles and Anker (1981) find that private transfers increase household income in the lowest quintile in Kenya and reduce inequality. Adams and Page (2005) find that a 10 per cent increase in per capita official international remittances will lead to a 3.5 per cent decline in the share of people living in poverty.

Stark et al. (1986, 1988) show empirical evidence of two different rural areas in Mexico. In one of the jurisdictions, the predominant beneficiaries of remittances are households at the upper end of the distribution of income, and therefore private transfers enhance inequality, while in the other jurisdiction recipients of remittances are households at the lower end of the distribution of income, which tends to reduce inequality. Acosta et al. (2007) also find cross country differences in the impact of remittances on inequality. In a sample of 59 industrial and developing countries, remittances tend to increase inequality for the average country in the sample, but also reduce inequality in Latin American countries.1

Since private transfers modify inequality in income distribution, then we could expect that private transfers also affect the role of government in redistributing income.2 Private transfers might affect the extent of public redistribution by modifying several aspects relevant to the design of fiscal policy. First, private transfers change the distribution of full income across the economy, and therefore households' tax burdens. Since modern public programs are financed primarily by taxation, then a change in the distribution of tax burdens is likely to change directly the extent of taxation and, indirectly, the size of public transfers. Second, private transfers also change the distribution of marginal utility of household income, which in turn modifies the welfare gains from public transfers.

It is not clear, however, what final effect a change in private transfers has on government's redistributive policy. The policy question related to the interaction between private and Pareto efficient public transfers is: should the government increase (reduce) the extent of public transfers in light of changes in the distribution of income explained by changes in private transfers? The purpose of this paper is to answer this question. Moreover, we analyze if private transfers have a differentiated effect on redistributive programs which are universal or targeted to the poor. The distinction between broad versus targeted benefits from public programs is at the core of public debate, is relevant for the design of public programs, and has received attention from the normative theory (Saez, 2006; Tresch, 2003) as well as from the positive theory of economics (Persson and Tabellini, 2005; Acemoglu and Robinson, 2001; Myerson, 1993).

In this paper we focus our analysis on a particular interaction between private and public transfers: the effect of remittances on both the distribution of income and the size of Pareto efficient public transfers. Remittances are playing an increasingly important role in explaining the distribution of income of many developing countries. According to the World Bank, the value of worldwide remittances reached 433 billion in 2008, of which 328 billion correspond to private transfers directed to developing countries.3 Moreover, as we mentioned above, there is evidence that remittances change the distribution of income and, therefore, we could expect a sizeable impact of remittances on government's redistributive policy.

We contribute to the analysis of public finance in several ways. First, to the best of our knowledge, we are the first in studying the impact of private transfers on the size of Pareto efficient public transfers. Second, we characterize conditions in which an increase in private transfers received by poor households affects positively both the welfare costs from taxation and the welfare gains from public transfers. Under the conditions identified in this paper, the welfare costs of the redistributive program outweigh its gains, and the optimal response from the government in a targeted redistributive program is to reduce the tax rate on full income and the per capita transfer. In this case, private transfers substitute, to some degree, the government's role in redistributing income.

We also characterize a class of equilibrium in which an increase in remittances received by the poor reduces inequality of income but, contrary to what intuition suggests, the optimal response from the government is to increase the per capita public transfer. In this case, the market mechanism for private redistribution and the government's targeted redistributive program complement each other.

We also identify conditions in which an increase in remittances received by resident households with lower (higher) than average earning abilities leads the government to increase (reduce) the optimal tax rate on full income and the per capita transfer in a universal redistributive program. Finally, our results also suggest that changes in private transfers are more likely to crowd out public redistribution when the government implements a universal, vis-à-vis, a targeted program of public transfers.

The rest of the paper is structured as follows: section I deals with the literature review. The preliminaries of the model are considered in section II. Section III includes the Pareto efficient public transfers. Section IV presents a discussion of possible extensions of our paper, and section V concludes.

I. Literature Review

Many economists have argued that public redistribution is one of the fundamental tasks of the government in a market economy. The rationales for public transfers include the notion that redistribution seeks to satisfy some norms of fairness in society. In this case, a benevolent government could use fiscal instruments, such as taxes and welfare programs, to carry out society's preferences for redistribution. For applications of the normative theory of redistribution see Tresch (2003) and Lambert (2001), among many others.

Buchanan and Tullock (1962) have pointed out that public redistribution can provide insurance when there is significant uncertainty about the state of the economy. For some papers along this line of thought see Sen (1973) and Lee (1998). Public redistribution might also be the result of political competition between parties that seek to win the election to form the government. See the applications of the Downsian model of electoral competition by Romer (1975), Roberts (1977), Meltzer and Richards (1981), and Hettich and Winer (1999).

Redistribution can also be a public good if individuals are altruistic (if individuals have social preferences). If altruistic households in a large economy only care about the well being of the poor, then private transfers arising in a market economy are not Pareto efficient, because altruistic families will not take into account how their transfers to the poor affect the well being of other altruistic individuals in the economy, and because donors have strong incentives to free-ride (see Andreoni, 1988). Therefore, a government can intervene by providing the size of public redistribution that can restore Pareto optimality conditions in the economy (see Hoch-man and Rodgers, 1969).

However, models of altruism have been concerned with the notion that government's redistributive policies might crowd out private transfers (Barro, 1974; Becker, 1974). This, in turn, puts into question the efficacy of the government's efforts to redistribute income (Roberts, 1984). The basic argument that public transfers might crowd out private transfers in altruistic models recognizes that a one dollar increase in the recipient's income due to a public transfer might decrease the size of private donations of altruistic individuals. For empirical evidence that public transfers reduce the size of private transfers, see Cox and Jiménez (1989, 1990), Cox and Jacubson (1995), Altonji et al. (1997), and Juárez (2009).

Several other papers have studied the type of fiscal policies that would arise in an economy with private transfers when individuals are altruistic. Hochman and Rodgers (1969) establish, based on efficiency grounds, the rationale for government redistribution in an economy with private (inter-vivos) transfers due to altruism. Johansson (1997) explores how different types of altruistic behavior affect Pigouvian taxes. Coate (1995) argues that altruism has implications for the form of public transfers and, based on efficiency grounds, he advocates for in-kind transfers of insurance. Finally, Kranich (2001) is concerned with the existence of majority rule equilibria that involves progressive taxation.

However, the hypothesis that private transfers might affect government's efforts to redistribute income has not received adequate attention in the literature. To the best of our knowledge, we don't know any paper addressing this issue. In this paper we contribute in filling this gap by analyzing the response of public transfers to changes in the distribution of income promoted by changes in the size of remittances.

Our paper is closest to the political economy analysis of Kranich (2001). However, our analysis is different from Kranich's since our interest is to study the government's response to private foreign transfers, while Kranich is interested in the existence of a majority rule equilibrium with progressive taxation. Moreover, in our analysis we characterize the disincentive effects of taxation in donors of private transfers and in recipients of private and public transfers.

Another contribution of our paper is that our analysis extends the literature by comparing the response of government's redistributive policies to an increase in remittances received by low income households when the government implements a universal and a targeted program of social transfers. The distinction between broad versus targeted benefits from public programs is at the core of the public debate; it is relevant for the design of public programs and it has received the attention from the normative theory (Saez, 2006; Tresch, 2003) as well as from the positive theory of economics (Persson and Tabellini, 2005; Acemoglu and Robinson, 2001; Myerson, 1993).

II. The Model

Consider an economy in which households established in a certain country have preferences given by μ(c,  ) = c -

) = c -  2/2, where c is consumption and

2/2, where c is consumption and  ∈[0, 1] is the supply of labor.4 In this economy households have heterogeneous labor earning abilities. Households' earning abilities (labor wages) are differentiated according to a given distribution h(n), where n is the individual's labor wage with n∈ [n0, nmax]. The opportunity choice set for resident consumers is c = (n

∈[0, 1] is the supply of labor.4 In this economy households have heterogeneous labor earning abilities. Households' earning abilities (labor wages) are differentiated according to a given distribution h(n), where n is the individual's labor wage with n∈ [n0, nmax]. The opportunity choice set for resident consumers is c = (n + R) (1 - t) + T, where consumption opportunities depend on the structure of the linear income tax system, constituted by a public transfer T and a tax t on full income, the wage income z = n

+ R) (1 - t) + T, where consumption opportunities depend on the structure of the linear income tax system, constituted by a public transfer T and a tax t on full income, the wage income z = n and remittances R.5

and remittances R.5

Since our interest is to study the impact of remittances on the government's redistributive policy, we need to rationalize why some households abroad send remittances to relatives (or other households) in their home country. To do so, we assume that the donors of remittances are altruistic and care about the well being of their families living in their home countries.6 Donors of private transfers have strict quasi-concave preferences given by μa (ca,  a, v(t, T, n)), where ca is consumption,

a, v(t, T, n)), where ca is consumption,  a∈ [0,1] is the supply of labor with ∂ μa / ∂

a∈ [0,1] is the supply of labor with ∂ μa / ∂  a< 0, and v(t,T,n) is the indirect utility (to be fully characterized in the next section) of the recipients of remittances with ∂μa/∂v > 0. The budget constraint for donors of private transfers is given by ca = na

a< 0, and v(t,T,n) is the indirect utility (to be fully characterized in the next section) of the recipients of remittances with ∂μa/∂v > 0. The budget constraint for donors of private transfers is given by ca = na  a-R, where na is the earning ability of households abroad with na ∈ [na0, namax].7 For simplicity and without loss of generality of our analysis, we ignore international taxes and transfers of donors.

a-R, where na is the earning ability of households abroad with na ∈ [na0, namax].7 For simplicity and without loss of generality of our analysis, we ignore international taxes and transfers of donors.

In this paper we also assume that households have no mobility. This assumption is made not because we consider the bi-causality role of migration and public policy to be non-important, but because of mathematical simplicity of the model. In future research we will consider the impact of redistribution and migration. For the time being, we take as given both the distribution of donors and the distribution of households established in the donor's home country.

II.1. Government's Policy

In this economy, the government's problem is to set the tax rate on full income, t, and the per capita transfer T to maximize a weighted nationwide social welfare of resident families subject to the government's budget constraint (see expression 1). Formally, the government's problem is:

Where ω(n) > 0 ∀n ∈ [n0, nmax] is the change in the welfare of society due to a change in the well being of household type n. Moreover, the government's tax revenue, β, depends on the full income of residents; then β = ∫∀n h(n) t {n (t, n) + R (t, na, n)} dn, where

(t, n) + R (t, na, n)} dn, where  (t, n) and R (t, na, n) correspond, respectively, to the optimal supply of labor of resident households and the optimal private transfers sent by individuals working abroad, type na, to a relative type n residing in the country. In (1), a resident household type n pays a tax t on wage income and on the received private transfers R (t, na, n).8

(t, n) and R (t, na, n) correspond, respectively, to the optimal supply of labor of resident households and the optimal private transfers sent by individuals working abroad, type na, to a relative type n residing in the country. In (1), a resident household type n pays a tax t on wage income and on the received private transfers R (t, na, n).8

The equilibrium of this economy involves the strategic interaction of government, resident households and donors of private transfers. The government designs its redistributive policy to maximize the well being of all residents in the economy, taking into account that resident households choose their consumption and labor supply to maximize their preferences subject to their budget constraint, and that households abroad (the remittances' donors) seek to maximize their well being by deciding their supply of labor and the size of private transfers, given their preferences and budget constraint, and the preferences and budget constraint of their families in their home country. Formally:

Definition. The economic equilibrium for this economy is characterized as follows:

a) The government selects a tax t* and a social transfer T*, so that:

b) Resident households with n∈ [n0, nmax] select their consumption and labor choices so that:

c) Donors of private transfers type na ∈ [ na0, namax] decide their labor supply  a (t, na, n), consumption ca (t, na, n), and the size of private transfers to a relative type n, R(t, na, n), to maximize the donor's utility so that:

a (t, na, n), consumption ca (t, na, n), and the size of private transfers to a relative type n, R(t, na, n), to maximize the donor's utility so that:

Our definition of economic equilibrium recognizes that a rational donor type na decides the size of remittances R(t, na, n) to a relative type n in the donor's home country taking into account the impact that public taxes and transfers have on the economic well being of their families living in the donor's home country. Proposition 1 (see below) characterizes conditions in which the best response of remittances [R(t, na, n) sent by a household type na from abroad] to taxes satisfies dR /dt < 0. This result shows that an increase in the optimal tax rate on full income reduces the size of remittances, because the donor's marginal benefit of sending transfers to their families living in their home country is lower. Formally:

Proposition 1. The best response of private transfers sent by households working abroad is given by R(t, na, n) satisfying d R / dt < 0.

Proof

By definition, donors of private transfers behave as follows:

Impose ca = na a - R into μa(ca,

a - R into μa(ca,  a, v (t, T, n)) and obtain the following first order conditions for households working abroad: 9,10

a, v (t, T, n)) and obtain the following first order conditions for households working abroad: 9,10

Differentiate the first order conditions in (6) and (7) totally with respect to d a, dR, and dt to show:

a, dR, and dt to show:

Where  . By assumption, μa (ca,

. By assumption, μa (ca,  a, v(t, T, n)) is a strict quasi-concave preference relation, which implies that H μa is a negative definite matrix; therefore ∂2μa/∂2

a, v(t, T, n)) is a strict quasi-concave preference relation, which implies that H μa is a negative definite matrix; therefore ∂2μa/∂2 a < 0 and |H μa| = {∂2μa/∂2

a < 0 and |H μa| = {∂2μa/∂2 a} {∂2μa/∂2R} - {∂2μa/∂

a} {∂2μa/∂2R} - {∂2μa/∂ a∂R}2 > 0. It follows that the best response of remittances to taxation is given by

a∂R}2 > 0. It follows that the best response of remittances to taxation is given by

Because |H μa| > 0,  and ∂2μa/∂2

and ∂2μa/∂2  a< 0; then, dR / dt < 0. The size of remittances falls or remains unchanged with increases in the optimal tax rate on full income.

a< 0; then, dR / dt < 0. The size of remittances falls or remains unchanged with increases in the optimal tax rate on full income.

The possibility that government's actions might crowd out monetary transfers among families (the result in proposition 1) has been first pointed out by Becker (1974) and Bernheim et al. (1985).11 Here, we just identify conditions that produce this result. Full crowding out of government's taxes on remittances occurs when the condition dμa/dR < 0 is satisfied for a given tax t, while some partial crowding out occurs when dμa/dR = 0, so that R (t, na, n)>0.

In our economy, the optimal redistributive government policy at the Nash equilibrium (to be characterized in the following section) takes into account the crowding out possibilities discussed above. For mathematical tractability, we consider only the case in which the marginal effect of taxes on private transfers, dR(t, na, n)/dt = χ < 0, satisfies d2R(t, na, n)/d2t = 0, and the elasticity of remittances and taxes given by εR-t = {dR(t, na, n) / dt} {t/R} = ε < 0 is constant.12

III. Pareto Efficient Public Transfers

In this section we analyze the equilibrium tax rate on full income and the optimal size of government transfers. We consider two types of redistributive programs that have received attention in the literature: on the normative theory of public economics, the analysis over targeted versus universal redistribution has been centered on the trade-off between equity and efficiency (Saez, 2006; Thresch, 2003). Targeted redistributive programs are considered to produce lower deadweight costs from taxation relative to those of universal programs, but tend to penalize more heavily the effort of low income families in the vicinity of poverty line, by creating high differentials in their taxes and public transfers.13

In a targeted program of transfers to the poor, only those individuals with earning abilities below a predetermined threshold wage receive transfers from the government. In our economy, ñ is the cutoff point that divides access and exclusion to public transfers. All individuals with n ≤ ñ are considered to be poor and eligible for public transfers in a targeted redistributive program, while individuals with earning abilities higher than n are not eligible for social transfers. We also analyze a universal public program in which all individuals in the economy receive transfers from the government.

On what follows, proposition 2 identifies the optimal labor supply of poor and non poor households under the different redistributive programs analyzed in this paper. This result is then used in Lemma 1, which contains the Pareto optimal taxes.

Proposition 2. In an economy in which a tax t is applied to full income of all resident households, and social transfers can be universal or targeted to the poor, the supply of labor of poor and non poor households are characterized by

Proof

The result is trivial; just solve the first order conditions of the household's problem to obtain condition (10).

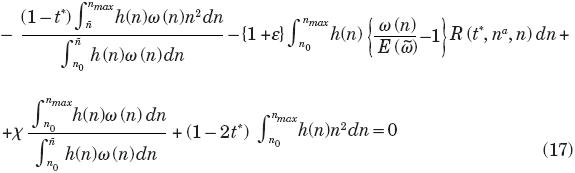

Lemma 1. The optimal tax rate on full income t* in a targeted redistributive program is given by:14

Proof

The first order condition for the government's redistributive policy with an interior solution t* > 0 satisfying  is equivalent to

is equivalent to

The distribution of the tax burden implied by the structure of the linear income tax means15

Where dv/ dT = α is the household's marginal utility of income. Use (12) to rewrite condition (11) as follows:

Use condition (10) of proposition 2 and our definitions for dR / dt* = χ < 0 and εR*-t* = {dR (t* na, n) / dt*} {t*/ R} = ε < 0 to re-express the first term of (13) as follows:

The government's budget constraint for an economy with a linear income tax system in which taxes on full income are applied to all households is given by

It follows that

Use (14), (15), (16), and α=∂ μ /∂c = 1 ∀ n ∈ [n0 ,nmax] in condition (13) and rearrange terms to obtain

Where  is the average social marginal utility of households with earning abilities below or equal to ñ.

is the average social marginal utility of households with earning abilities below or equal to ñ.

Use the condition  to show that

to show that

Use condition (18) and re-arrange terms in (17) to obtain

In (19),  is the average gross labor income of resident households, and

is the average gross labor income of resident households, and  is a weighted average of the gross labor income,

is a weighted average of the gross labor income,  in a targeted redistributive program, while in a universal transfer program θ = 1.

in a targeted redistributive program, while in a universal transfer program θ = 1.

III.1. Remittances Received by Households at the Upper and Lower Ends of Income Distribution, and Optimal Public Transfers in a Targeted Program

In this section we develop a comparative analysis to study the response of the government's redistributive policy to changes in the distribution of income in targeted (see proposition 3 below) and universal transfer programs (see proposition 4). In our analysis we consider the case in which the earning ability of some donor type  increases and leads to higher remittances sent by the donor to a resident household with some earning ability

increases and leads to higher remittances sent by the donor to a resident household with some earning ability  .16 Moreover, if households receiving more remittances have low (high) earning abilities, then the increase in remittances reduces (increases) inequality in the distribution of income and might induce the government to change its policy on redistribution.

.16 Moreover, if households receiving more remittances have low (high) earning abilities, then the increase in remittances reduces (increases) inequality in the distribution of income and might induce the government to change its policy on redistribution.

Proposition 3

I. For an economy with targeted redistribution, an increase in the earning ability of a donor type  a increases his private transfers to resident households with some earning ability

a increases his private transfers to resident households with some earning ability  and reduces the size of optimal public transfers if:

and reduces the size of optimal public transfers if:

3.1)

3.2) The remittance-tax elasticity εR-t* = ε is inelastic

where E[ ] is the average social marginal utility of full income of households with earning abilities below ñ, and λ is the inverse of the elasticity of government's tax rate t* to changes in the distribution of full income promoted by an increase in the size of remittances received by household type

] is the average social marginal utility of full income of households with earning abilities below ñ, and λ is the inverse of the elasticity of government's tax rate t* to changes in the distribution of full income promoted by an increase in the size of remittances received by household type  .

.

II. An increase in the earning ability of a donor type  a increases his private transfers to households with some earning ability

a increases his private transfers to households with some earning ability  , so that

, so that  >

>  ⇒ ω (

⇒ ω ( ) < E [

) < E [ ], and induces the government to increase the size of Pareto optimal public transfers.

], and induces the government to increase the size of Pareto optimal public transfers.

Proof

Case I: Households type  receiving higher remittances have

receiving higher remittances have  <

<  : ω(

: ω( ) > E [

) > E [ ] .

] .

The optimal tax rate is given by:

In this case, the increase in the earning ability of a donor type  a increases the size of remittances received by resident households with

a increases the size of remittances received by resident households with  <

<  , and changes the tax rate of equilibrium in the following way:

, and changes the tax rate of equilibrium in the following way:

By assumption t* > 0, h( ) ∈

) ∈  + and, at the political equilibrium, the marginal change in remittances sent by a donor type

+ and, at the political equilibrium, the marginal change in remittances sent by a donor type  a, due to a positive change in the donor's income, is ∂R (t*,

a, due to a positive change in the donor's income, is ∂R (t*,  a,

a,  ) / ∂

) / ∂  a > 0. Moreover, by assumptions (3.2) and (3.3) the following conditions must be satisfied: {1 + ε} > 0 and ω(

a > 0. Moreover, by assumptions (3.2) and (3.3) the following conditions must be satisfied: {1 + ε} > 0 and ω( ) > E(

) > E( ). Therefore, dt*/ d

). Therefore, dt*/ d a < 0 in condition (20). Use the expression in (15) to obtain dT*/ d

a < 0 in condition (20). Use the expression in (15) to obtain dT*/ d a:

a:

The first term in the right hand side of (21) is non positive, since dt*/d a < 0, and by (3.1) t * ∈ (0 , 1/2); therefore, (1-2t*) > 0. Moreover, from the second term in (21) it is simple to show that

a < 0, and by (3.1) t * ∈ (0 , 1/2); therefore, (1-2t*) > 0. Moreover, from the second term in (21) it is simple to show that  since by condition (3.4) λ ∈ (-1,0) h(

since by condition (3.4) λ ∈ (-1,0) h( ) ∈

) ∈  +, and ∂R (t*,

+, and ∂R (t*,  a,

a,  ) /∂

) /∂  a > 0. We conclude that under the conditions identified in this proposition, the optimal response from the government to an increase in the size of remittances received by households with earnings abilities below the threshold wage ñ is to reduce the government's social transfers.

a > 0. We conclude that under the conditions identified in this proposition, the optimal response from the government to an increase in the size of remittances received by households with earnings abilities below the threshold wage ñ is to reduce the government's social transfers.

Case II: Households type  receiving higher remittances have

receiving higher remittances have  >

>  : ω(

: ω( ) < E [

) < E [ ].

].

The effect of an increase in the earning ability of a donor type  a, that increases the size of remittances received by households with

a, that increases the size of remittances received by households with  :

:  >

>  ⇒ ω (

⇒ ω ( ) < E [

) < E [ ] , in the tax rate of equilibrium is given by (22):

] , in the tax rate of equilibrium is given by (22):

Use condition (15) to obtain dT* / d a:

a:

The first and second terms in the right hand side of (23) are positive; therefore, dT* /d a > 0. We conclude that the conditions identified in this proposition imply that an increase in the size of remittances received by families type

a > 0. We conclude that the conditions identified in this proposition imply that an increase in the size of remittances received by families type  , who have earning abilities above the threshold wage ñ, increases the Pareto optimal social transfers from the government.

, who have earning abilities above the threshold wage ñ, increases the Pareto optimal social transfers from the government.

As we mentioned before, private transfers might affect the extent of public redistribution by modifying several aspects relevant to the welfare calculus of policy makers: First, private transfers change the distribution of full income across the economy and households' tax burdens. Since modern public programs are financed primarily by taxation, then a change in the distribution of tax burdens are likely to change directly the extent of taxation and, indirectly, the size of public transfers.

Second, private transfers also change the distribution of social marginal utility of household income, which in turn modifies the welfare gains from redistributing income. Third, an increase in private transfers might induce a positive income effect on government's budget constraint, which tends to increase the size of public programs, including those related to redistribution.17

Although the final effect of changes in income distribution promoted by changes in the remittances received by residents over public redistribution is (in general) ambiguous, proposition 3 identifies a class of equilibrium for targeted redistributive programs, in which the optimal response from the government to a fall (increase) in income inequality resulting from higher private transfers to the poor (non poor) is to reduce (increase) the size of public transfers.

In particular, the interval t* ∈ (0,1 /2), along with the conditions that εR-t* is inelastic and that the government's tax response to changes in private transfers η = 1/λ is elastic (where λ is the condition identified in 3.2), represent sufficient conditions for a positive marginal tax revenue due to a change in t*. Hence, condition t* ∈  + : 0 < t* <

+ : 0 < t* <  recognizes that a sufficiently high tax on full income leads to significant deadweight costs of taxation. This might constrain the government's ability to raise higher tax revenues and transfers through tax increases, since the marginal tax revenue for changes in t* might become negative.18 For the interval identified in this condition, the marginal tax revenue due to changes in t* is positive.

recognizes that a sufficiently high tax on full income leads to significant deadweight costs of taxation. This might constrain the government's ability to raise higher tax revenues and transfers through tax increases, since the marginal tax revenue for changes in t* might become negative.18 For the interval identified in this condition, the marginal tax revenue due to changes in t* is positive.

The condition that ε R-t* = ε is inelastic is related to the crowding out effect of public redistribution on private transfers from individuals living abroad and, therefore, to the effectiveness of the government's efforts to redistribute income. As shown by proposition 1, dR/dt < 0; then, an increase in remittances received by a group of residents type  in the economy might lead to an increase in t*, which might cause a fall of private transfers sent by other donors of remittances. This, in turn, might change the distribution of income and make ineffective the government's efforts to redistribute income according to its social welfare function.

in the economy might lead to an increase in t*, which might cause a fall of private transfers sent by other donors of remittances. This, in turn, might change the distribution of income and make ineffective the government's efforts to redistribute income according to its social welfare function.

Condition (3.3) reflects the way policy makers aggregate the well being of net winners and losers from the public program. To see this, we need to recognize that in our economy pro low income redistribution is likely to occur when the marginal change in social welfare (due to a change in the household's income) is decreasing with full income. In this case, the marginal social welfare gains of redistributing $1 to the poor is likely to outweigh the social marginal costs of taking away income from those families which are net contributors to the government's redistributive program. This in turn might lead to pro low income redistributive policies.

As we mentioned before, the effect of private transfers on the size of public transfers T* depends on, first, dt* / d a

a  0, and second, a positive tax revenue effect of remittances. Condition dt* / d

0, and second, a positive tax revenue effect of remittances. Condition dt* / d a can be positive or negative depending, among other things, on whether the recipient family type

a can be positive or negative depending, among other things, on whether the recipient family type  has a high or low earning ability type. For the case dt* / d

has a high or low earning ability type. For the case dt* / d a > 0 an increase in private transfers received by households type ii leads to higher public transfers. For the case dt* / d

a > 0 an increase in private transfers received by households type ii leads to higher public transfers. For the case dt* / d a < 0, this effect tends to reduce per capita transfers, while the positive tax revenue effect of remittances tends to increase transfers. Condition (3.4) is a sufficient one so that dt* / d

a < 0, this effect tends to reduce per capita transfers, while the positive tax revenue effect of remittances tends to increase transfers. Condition (3.4) is a sufficient one so that dt* / d a < 0 implies a reduction of transfers from the government.

a < 0 implies a reduction of transfers from the government.

III.2. Private Trafsfers afi Ufiversal Public Trafsfers

Now consider an economy with a universal redistributive program. The main difference of this section with respect to our previous analysis relies in the eligibility requirement of resident households for receiving public transfers. Under a universal redistributive program, resident households pay a tax on full income t* and receive a public transfer from the government T* regardless of their earning ability. Our findings are the following:

Propositiof 4: If in a universal redistributive program with t* > 0:

4.1) t* ∈  + : 0 < t* <

+ : 0 < t* <

4.2) εR-t* = ε is inelastic

4.3) For  ∈ [n0, nmax]:

∈ [n0, nmax]:

E[n] and ω(

E[n] and ω( )

)  E[ω] =

E[ω] =  h(n)ω(n)dn

h(n)ω(n)dn

Where E [ω] is the average social marginal utility of all individuals in this economy.

Then an increase in the earning ability of a donor type  a increases his private transfers sent to households with some earning ability

a increases his private transfers sent to households with some earning ability  that is lower (higher) than the average earning ability of the economy, and leads to a reduction (increase) in the size of the government's redistributive transfers.

that is lower (higher) than the average earning ability of the economy, and leads to a reduction (increase) in the size of the government's redistributive transfers.

Proof

Case I: An increase in remittances received by households with lower than average income ability

We assume that households type  receiving higher remittances have lower than average earning abilities, and ω (

receiving higher remittances have lower than average earning abilities, and ω ( ) > E[ω], where E [&>], is the average income ability in the economy. From condition (11) rearrange terms to express the first order condition of Pareto optimal taxes as follows:

) > E[ω], where E [&>], is the average income ability in the economy. From condition (11) rearrange terms to express the first order condition of Pareto optimal taxes as follows:

In this case, the increase in the earning ability of a donor type  a increases the size of remittances received by resident households with

a increases the size of remittances received by resident households with  <

<  : ω(

: ω( ) > E[ω] and changes the tax rate of equilibrium as follows:

) > E[ω] and changes the tax rate of equilibrium as follows:

By condition (4.1 ) t*> 0, {2E[z] —Eω [z]} > 0, by (4.2) {1 + ε} > 0. Moreover, h( ) ∈

) ∈  +,

+,  > 0, and by (4.3)

> 0, and by (4.3)  > E[n] and ω(

> E[n] and ω( ) < E[ω]; hence, dt*/ d

) < E[ω]; hence, dt*/ d a <0. Use condition (15) to obtain dT*/ d

a <0. Use condition (15) to obtain dT*/ d a:

a:

The first term in the right hand side of (26) is negative, since dt* / d a < 0 and by (4.1) t* ∈ (0, 1/2); then, (1- 2t*) > 0. Also,

a < 0 and by (4.1) t* ∈ (0, 1/2); then, (1- 2t*) > 0. Also,  since by condition (4.2) λ ∈(-1,0). It follows that, under the conditions identified in this proposition, an increase in the size of remittances received by households with earning abilities below the average earning ability induces the government to reduce the size of the per capita social transfers.

since by condition (4.2) λ ∈(-1,0). It follows that, under the conditions identified in this proposition, an increase in the size of remittances received by households with earning abilities below the average earning ability induces the government to reduce the size of the per capita social transfers.

Case II: An increase in remittances received by households with higher than average income ability

By condition (25), dt* / d a

a  0 as E [ω]

0 as E [ω]  ω(

ω( ). By condition (4.3),

). By condition (4.3),  > E [n] and ω(

> E [n] and ω( ) < E [ω]; hence, dt* / d

) < E [ω]; hence, dt* / d a> 0. Moreover, condition (26) characterizes dT* / d

a> 0. Moreover, condition (26) characterizes dT* / d a. In this case, the first and second terms in the right hand side of (26) are positive; therefore, dT*/d

a. In this case, the first and second terms in the right hand side of (26) are positive; therefore, dT*/d a> 0. It follows that an increase in the size of remittances received by high income resident families increases government's social transfers.

a> 0. It follows that an increase in the size of remittances received by high income resident families increases government's social transfers.

For the conditions identified in proposition 4, an increase in remittances received by resident households with lower (higher) than average earning abilities leads to a distribution of private transfers that reduces (increases) inequality in the distribution of income. This, in turn, induces the government to reduce (increase) the tax rate on full income and the per capita transfer.

A simple comparison of our results in propositions 3 and 4 suggests that changes in private transfers are more likely to crowd out public redistribution when the government implements a universal, vis-à-vis, a targeted program of public transfers. The main difference in the government's response to private transfers is that in the targeted program there are conditions (see proposition 3) in which an increase in remittances received by households with earning abilities above the threshold wage (that defines beneficiaries from non beneficiaries) but below the average earning ability induces the government to increase the size of public transfers, while in the universal program an increase in remittances received by households with earning abilities below average crowds out public redistribution.

IV. Discussion

In this section we discuss some interesting extensions about the government's choice between targeted and universal transfer programs. First, it is relevant to point out that our model considers optimal tax and public transfers for a benevolent social planner with perfect information on the distribution of preferences and earning abilities of resident households. However, governments might have imperfect information. This, in turn, imposes some restrictions on the government's design of a targeted versus a universal redistributive program, since a targeted program creates incentives for some individuals to misrepresent their earning abilities as they seek to beneficiate from the government's program.19 This strategic behavior of households might create further deadweight costs from tax and public transfers (relative to those recognized in this paper), which could reduce the size of public transfers (if the program is adopted) in focalized redistribution.

Another interesting avenue to extend the analysis in this paper is to consider the role of preference aggregation in the design of public transfers throughout a political economy model, in which the formation of government is endogenous. In our model the process of preference aggregation is exogenous, since a benevolent social planner dictates the relative weights to be assigned to household preferences in the social welfare function. In a political economy model, the relative weights of households' preferences could be assigned by policy makers according to their political objectives.

For instance, parties might design redistributive policies to win elections and form the government (Downs, 1957). Under perfect information on the distribution of voters' preferences and earning abilities, a representative democracy with a two-party system, a uni-dimensional fiscal policy, etc., the median voter's preferences over redistribution are decisive (Meltzer and Richards, 1981).20 That is, electoral incentives might induce parties to produce middle of the road policies. Therefore, there could be a class of equilibria in which a universal, rather than a targeted redistributive program, is likely to capture the electoral support of a majority of voters if nmedian > ñ, where nmedian is the earning ability of the median voter.21,22 In contrast, if nmedian < ñ, then it is possible that the median voter actually prefers a targeted over a universal redistributive program, since the per capita transfers to the median voter are likely to be higher under targeted redistribution relative to that obtained in a universal program of redistribution.

It would be interesting to conduct a similar analysis in a political economy model, in which parties have imperfect information on the distribution of preferences (the probabilistic voting model). On top of the issues mentioned above about the incentives of voters to misrepresent their earning abilities, there are electoral incentives that might induce parties to select a targeted versus a redistributive program. If voting is probabilistic, parties aggregate the preferences of households according to their marginal probability to vote for a certain party. It is simple to show that parties produce the ideal redistributive policy of a weighted average voter. If nwa < ñ, where nwa is the earning ability of a weighted average voter, then parties might have electoral incentives to produce a targeted redistribution, and if nwa > ñ parties might choose to produce a universal program of redistribution.

V. Conclusions

A well established rationale for government intervention in the economy is public redistribution. Market mechanisms for the redistribution of income are said to be inefficient or non compatible with the incentives of self interested individuals. The evidence, however, shows that some individuals engage in altruistic transfers that change the distribution of income and, possibly, government's redistributive policy. In this setting, the public policy question that follows is relevant: What should the optimal level of public redistribution be for an economy in which there are private transfers?

In this paper we provide an answer to this question, by developing a comparative analysis in which we characterize the optimal government response to a change in the distribution of income, promoted by an increase in private transfers from donors working abroad. Moreover, we study whether private transfers have a differentiated effect in targeted versus universal transfer programs.

As any other program from the government, public redistribution creates welfare gains and costs. A change in private transfers modifies the distribution of welfare gains and costs from public redistribution. However, the final effect of private transfers on government's optimal redistributive policy is ambiguous. The main contribution of this paper is the characterization of a class of equilibrium, in which an increase in the size of private transfers received by the poor reduces inequality of income in the economy and diminishes the role of government in redistributing income in a targeted program, but increases public redistribution in a universal program of transfers.

References

Acemoglu, D. and J. Robinson (2001), "Inefficient Redistribution", The American Political Science Review, 95 (3), pp. 649-661. [ Links ]

Acosta, P., C. Calderón, P. Fajnzylber and H. López (2007), "What is the Impact of International Remittances on Poverty and Inequality in Latin America?" World Development, 36 (1), pp. 89-114. [ Links ]

Adams, R. H. Jr. (2009), "The Determinants of International Remittances in Developing Countries", World Development, 37, pp. 93-103. [ Links ]

Adams, R. and J. Page (2005), "Do International Migration and Remittances Reduce Poverty in Developing Countries?" World Development, 33 (10), pp. 1645-1669. [ Links ]

Altonji, J. G., F. Hayashi and L. Kotlikoff (1997), "Parental Altruism and Inter vivos Transfers: Theory and Evidence", Journal of Political Economy, 105 (6), pp. 1121-1166. [ Links ]

Andreoni, J. (1988), "Privately Provided Public Goods in a Large Economy: The Limits of Altruism", Journal of Public Economics, 35 (1), pp. 57-73. [ Links ]

Barro, R. J. (1974), "Are Government Bonds Net Wealth?" Journal of Political Economy, 82 (6), pp. 1095-1117. [ Links ]

Becker, G. S. (1974), "A Theory of Social Interactions", Journal of Political Economy, 82 (6), pp. 1063-1093. [ Links ]

Bernheim, B. D., A. Shleifer and L. H. Summers (1985), "The Strategic Bequest Motive", Journal of Political Economy, 93 (6), pp. 1045-1076. [ Links ]

Buchanan, J. M. and G. Tullock (1962), The Calculus of Consent, Ann Arbor, University of Michigan Press [ Links ]

Coate, S. (1995), "Altruism, the Samaritan's Dilemma and Government Transfer Policy", American Economic Review, 85 (1), pp. 46-57. [ Links ]

Cox, D. (1987), "Motives for Private Income Transfers", Journal of Political Economy, 95 (3), pp. 508-546. [ Links ]

Cox, D. and E. Jiménez (1989), "Private Transfers and Public Policy in Developing Countries: A Case Study for Peru", Policy, Planning and Research Working Paper 345, World Bank, Washington, D.C. Processed. [ Links ]

---------- (1990), "Achieving Social Transfers Through Private Transfers: A Review", The World Bank Research Observer, 5 (2), pp. 205-218. [ Links ]

Cox, D. and G. Jakubson (1995), "The Connection between Public Transfers and Private Interfamily Transfers", Journal of Public Economics 57 (1), pp. 129-167. [ Links ]

Downs, A., (1957), An Economic Theory of Democracy, Nueva York, Harper and Row. [ Links ]

Hettich, W. and S. L. Winer (1999), Democratic Choice and Taxation, Cambridge, Cambridge University Press. [ Links ]

Hochman, H. M. and J. D. Rodgers (1969), "Pareto Optimal Redistribution", American Economic Review, 59 (4), pp. 542-557. [ Links ]

Johansson, O. (1997), "Optimal Piguvian Taxes under Altruism", Land Economics, 73 (3), pp. 297-308. [ Links ]

Juárez, L. (2009), "Crowding Out of Private Support to the Elderly: Evidence from a Demogrant in Mexico", Journal of Public Economics, 93 (3-4), pp. 454-463. [ Links ]

Knowles, J. C. and R. Anker (1981), "An Analysis of Income Transfers in a Developing Country", Journal of Development Economics, 8 (2), pp. 205-226. [ Links ]

Kranich, L. (2001), "Altruism and the Political Economy of Income Taxation", Journal of Public Economic Theory, 3 (4), pp. 455-469. [ Links ]

Lambert, P. J. (2001), The Distribution and Redistribution of Income, Manchester, Manchester University Press. [ Links ]

Lee, K. (1998), "Uncertain Income and Redistribution in a Federal System", Journal of Public Economics, 69 (3), pp. 413-433. [ Links ]

Meltzer, A. H. and S. F. Richards (1981), "A Rational Theory of the Size of Government", Journal of Political Economy, 89 (5), pp. 914-927. [ Links ]

Mueller, D. C. (2003), Public Choice III, Cambridge University Press. [ Links ]

Myerson, R. B. (1993), "Incentives to Cultivate Minorities Under Alternative Electoral Systems", The American Political Science Review, 87 (4), pp. 856-869. [ Links ]

Persson, T. and G. Tabellini (2005), The Economic Effect of Constitutions, MIT Press. [ Links ]

Roberts, K. W. S. (1977), "Voting Over Income Tax Schedules", Journal of Public Economics, 8 (3), pp. 329-340. [ Links ]

Roberts, R. D. (1984), "A Positive Model of Private Charity and Public Transfers", Journal of Political Economy, 92 (1), pp. 136-148. [ Links ]

Romer, T. (1975), "Individual Welfare, Majority Voting and the Properties of a Linear Income Tax", Journal of Public Economics, 4 (2), pp. 1631-85. [ Links ]

Saez, E. (2006), "Redistribution toward Low income in Rich Countries", in A.V. Banerjee et al., Understanding Poverty, Oxford University Press. [ Links ]

Sen, A. K. (1973), "On Ignorance and Equal Distribution", American Economic Review, 63 (5), pp. 1022-1024. [ Links ]

Stark, O., E. Taylor and S. Yitzhaki (1986), "Remittances and Inequality", The Economic Journal, 96 (383), pp. 722-740. [ Links ]

---------- (1988), "Migration, Remittances and Inequality", Journal of Development Economics, 28 (3), pp. 309-322. [ Links ]

Tresch, R. W. (2003), Public Finance:A Normative Theory, Second Edition, Academic Press. [ Links ]

The authors would like to thank the comments of two anonymous reviewers, which significantly improved this paper.

1 For a review of the empirical analysis of private transfers and inequality see Cox and Jiménez (1990).

2 To see this, it is sufficient to recognize that policy makers might have incentives to use tax and spending policies to redistribute in favor of low income families. For instance, normative theory (Tresch, 2003) suggests that a benevolent planner might act on behalf of society's tastes for pro poor redistribution. Positive theory (Mueller, 2003; Hettich and Winer, 1999; Meltzer and Richards, 1981; Roberts, 1984) argues that policy makers might redistribute in favor of the poor to capture some political gains.

3 In several developing countries, such as Honduras, Jordan, Lebanon and Mexico, remittances reach a significant proportion of GDP.

4 The assumption of weakly separable preferences between consumption and leisure is just for the sake of simplicity in the mathematical analysis.

5 The budget constraint may vary depending on whether the household receives private transfers or not. In the latter case, the opportunity consumption function of the household would be c = (n  ) (1 - t) + T.

) (1 - t) + T.

6 The theoretical literature examines mainly altruism (Becker, 1974) and economic exchange (Bernheim et al., 1985) as rationales for private transfers among individuals. Our choice of rationalizing private transfers throughout altruism is based on two aspects: first, the phenomenon of altruism has received significant theoretical attention, and second, altruism has empirical support.

7 This characterization means that donors of private transfers seek to maximize their well being by deciding their supply of labor and the size of remittances, given their preferences and budget constraint, and the preferences and budget constraint of their families in their home countries. At this point we use a general characterization of the indirect utility function of the migrant's family living in the home country, because this function will change depending on whether the redistributive program is targeted or universal for households with different wage earning abilities.

8 The motivation for considering a tax on full income relies on the fact that many developing countries receiving significant remittances also rely heavily on consumption taxes in their tax structure. Therefore, remittances are taxed through the consumption pattern of resident households. Since a tax on full income is also equivalent to a broad tax on consumption, then we are able to capture this empirical fact.

9 To obtain the first order conditions use this coming equality

v (t, T, n) = μ ((n  (t, n) + R (t, n)) (1-t ) + T,

(t, n) + R (t, n)) (1-t ) + T,  (t, n))

(t, n))

to state the following:

μa(ca,  a, v (t, T, n)) - μa(na

a, v (t, T, n)) - μa(na  a-R,

a-R,  a, μ ((n

a, μ ((n (t, n) + R(t, n)) (1-t) + T,

(t, n) + R(t, n)) (1-t) + T,  (t, n))).

(t, n))).

From the expression above find dμa/ d a and dμa/dR.

a and dμa/dR.

10 From (6) and (7) we obtain  a(t, na, n) and R (t, na, n), while c a(t, na, n) is obtained by imposing

a(t, na, n) and R (t, na, n), while c a(t, na, n) is obtained by imposing  a(t, na, n) and R(t, na, n) in the budget constraint; that is, c a(t, na, n) = na

a(t, na, n) and R(t, na, n) in the budget constraint; that is, c a(t, na, n) = na a(t, na, n) -R (t, na, n).

a(t, na, n) -R (t, na, n).

11 There is also empirical evidence supporting the hypothesis that government's fiscal policies crowd out private transfers. For a survey on this issue see Cox and Jiménez (1990).

12 In the absence of this assumption there are some second order effects of taxes on remittances that complicate the interpretation of the comparative static analysis to be conducted in the following section.

13 The theory of political economy has also been interested in the comparative analysis of targeted versus universal public programs (Myerson, 1993; Persson and Tabellini, 2005; Acemoglu and Robinson, 2001).

14 Here, the characterization of the optimal tax is flexible enough to be applied to the optimal tax rate on a universal transfer program.

15 To obtain the results in (12) consider the following:

v (t, T, n) = Max {μ (c (t*, n),  (t*, n)) + α [(n

(t*, n)) + α [(n (t*, n) + R (t*, na, n)) (1- t*) + T - c (t*, n)]},

(t*, n) + R (t*, na, n)) (1- t*) + T - c (t*, n)]},

where c (t*, n) and  (t*, n) are the consumer's optimal consumption and supply of labor. Then,

(t*, n) are the consumer's optimal consumption and supply of labor. Then,

Use the first order conditions of the consumer's choice problem in the condition above to conclude:

dv / dt* = - α {n (t*, n) + R (t*, na, n) - (1 - t*) dR / dt* } ∀n ∈ [n0, nmax].

(t*, n) + R (t*, na, n) - (1 - t*) dR / dt* } ∀n ∈ [n0, nmax].

16 Models of altruism predict that an increase in the donors' income increases their private transfers, unless private transfers are inferior goods. For a formal analysis of this issue, see Cox (1987) and Becker (1974), and for empirical evidence of a positive relationship between the donors' income and private transfers, see Adams (2009). In our economy we assume that remittances increase with the earning ability of donors.

17 In this economy the government implements a tax on full income (see condition 1). Therefore, the higher the remittances received by resident families in the economy, the higher the government's tax revenue and the size of public transfers.

18 In this economy the deadweight costs of taxation arise from disincentive effects of taxes on the supply of labor of residents, and the crowding out effect of taxes on private transfers sent by households abroad.

19 We appreciate the comments of an anonymous reviewer who pointed out this issue.

20 For the complete set up of the median voter model, see Mueller (2003).

21 In the literature, it is common to distinguish the distribution of ideal preferences of voters over public policies throughout the differences of the earning abilities of voters. In this case, for any n0, n1: n0 < n1 then T0 > Tv where T0 and T1 are the corresponding ideal public transfers from voters with earning abilities n0 and n1.

22 To see this, recall that if nmedian > ñ and the program is targeted, then the median voter pays a tax on full income but receives a public transfer of zero. However, in a universal program the median voter pays the tax on full income, and the model of Meltzer and Richards (1981) predicts that the median voter receives a positive public transfer if the full income of the median voter is lower than the average full income of the economy.